Casey’s “Why Are Trump Insiders Pouring Millions Into This Mysterious Energy?” Pitch

by Travis Johnson, Stock Gumshoe | March 13, 2017 3:02 pm

What's being teased for the next uranium bull market?

“Why Are Trump Insiders Pouring Millions Into This Mysterious Energy?

“One that history has shown could mint all-new millionaires.

“But NOT in fossil fuels or renewals. Instead, it’s an unusual kind of fuel that’s critical to his energy plans… his climate plan… even his foreign policy…

“This kind of fuel has boomed ONLY twice before – and both times, investors had the historic opportunity to turn every $1,000 invested into $1,044,000.”

That’s the intro we get for the latest pitch from Nick Giambruno[1] for Casey[2]’s Crisis Investing[3] newsletter ($1,999/year)… and, as you probably already realize, it’s about nuclear power and uranium[4].

More from the ad:

“… while nothing in the market is guaranteed, our research shows that this commodity is on the cusp of a new bull market. Simply put, it delivers immense value to its users, there’s no substitute, and production is falling while demand rises.

“Plus, this time, there’s an extra trigger turning the market around: Donald Trump[5].

“Trump loves this commodity. It fits right in with his ‘America First’ platform.

“This commodity is critical to an industry Trump says he’s ‘very in favor’ of. And it’s critical for securing the country’s energy independence.”

OK… so why buy now? Apparently Giambruno is calling the bottom… as several other newsletter pundits have done, somewhat disastrously, for uranium a few times since the Fukushima disaster six years ago. More from the ad:

“… stocks in ‘Trump’s favorite commodity’ spent much of last year ‘carving a bottom.’ This is when an asset class stops falling, trades sideways for a while, and then starts rising.

“Trump’s election signaled this commodity’s new bull market—which I think has the potential to deliver the same eye-popping investment returns as its previous bulls.”

The hook to this ad is that Donald Trump tweeted about this “mysterious fuel” on December 22, and that the stocks who peddle in this fuel went soaring as a result… and that this is just the beginning, because this industry has had two crazy bull markets (and collapses, we interject) over the past decade or so and is on its way, sez Casey and his editor Giambruno, to another.

The “secret fuel” is, of course uranium … and the promise of uranium riches is one that has been sold many, many times over the past three or four years. Lots of the newsletter folks were convinced that we had bottomed out on uranium prices a few months after the Fukushima disaster in 2011, or late in 2013 as the Russian “megatons to megawatts” recycling program ended, or during various political debates about nuclear energy in Germany, or restarting the reactor fleet in Japan[6], or about new reactor construction in India[7] and China[8].

And still, uranium has gone almost straight down over the past several years. Uranium is generally sold on long-term contracts, but even those are drifting down in price considerably… and as the prices have dropped we were told over and over again that most uranium producers couldn’t produce the stuff for $40, so production would be cut and that would produce higher prices because of the continuing baseline demand… and when that didn’t work we were told that these miners couldn’t profitably produce uranium for $30, or for $25, or $20.

So that is the biggest caveat: That all of these arguments make sense, there is not enough supply to fuel the current reactor fleet plus the new reactors being built (mostly in China), the costs of production are too high for miners to sustainably produce uranium at $20 a pound (or even, for some miners, twice that level) … but these arguments made pretty much exactly as much sense three years ago, too, and uranium has still continued to fall (it did bounce a little bit in the Summer of 2014, then started to fall yet again). Here’s the price chart for uranium over the past 20 years as reported by industry giant Cameco (like many industrial commodities it was pretty much flat before that for decades… at least in comparison):

[9]

[9]

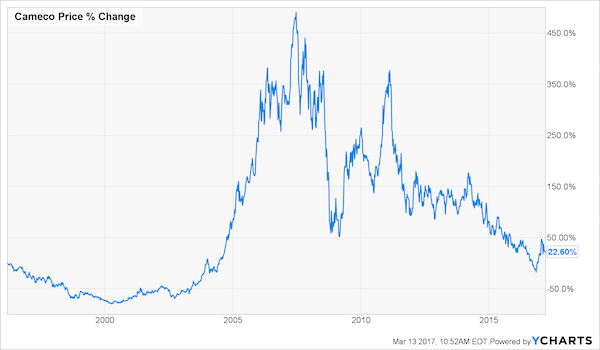

So you can see those two modern-era spikes in the uranium price, in 2007 and 2011, and those did indeed create some tremendous wealth for those who were fortunate enough to be speculators at the right time. Even the big players enjoyed some boom periods during those years when uranium prices spiked, as you can see from the chart of Cameco (CCJ)[10], which is really the proxy for uranium among institutional investors:

[11]

[11]

But you can also see the disastrous results you’d be sitting on now if you had bought into the uranium recovery story in 2013, or 2014, or 2015… even this strongest of the uranium stocks has been falling for years.

I’ve gotten ahead of myself, though — first, we need to ID the stock for you. The ad makes clear that they’re looking at highly-levered companies, which probably means junior miners — here’s a little more of the pitch:

"reveal" emails? If not,

just click here...

“Thanks to Doug’s connections in the mining space, he also identifies the most lucrative plays that are leveraged to these resources.

“Miners that have the potential to soar 10x, 50x, even 100x more than the actual price of the metal itself.

“And he recommends them while they’re ‘hated’ and incredibly cheap – BEFORE they take off.”

So what are the stocks? Let’s get right to the clues:

“2017 Uranium Supercycle Play #1: One Tiny 85-Cent Stock Is Positioned for

Historic Gains on the Trump Nuclear Boom“This explorer may be tiny, but its mine isn’t.

“It’s proven to have a whopping 106 million pounds.

“And it’s positioned right in the heart of Canada[12]’s famous Athabascan district.”

That’s Fission Uranium (FCU.TO, FCUUF OTC in the US). That is an explorer with a large deposit in the prime North American uranium district, near Cameco’s mines, and it did enjoy a nice spike as uranium recovered from $19 to $23 and animal spirits came back to the mining space after the election. It’s still exploring its PLS uranium project, which looks like it might be very large and low-cost, but I have no idea what the timeline might be for actually getting to mine development. You can see their latest investor presentation here[13] if you’d like some more of the basic details — it’s already a $400 million company, so it’s clearly an exploration junior but it’s not exactly teensy.

And… that’s about it, they don’t hint at any other nuclear stocks they might like, the rest is all about the inevitability of uranium prices rising.

There’s also a big “insiders are buying” argument being made — not for this company specifically, but for uranium and nuclear in general… and, particularly, that “Trump Advisors” are buying into the sector:

“Peter Thiel[14], billionaire co-founder of PayPal, seed investor in Facebook, and Trump advisor…

“Put down $1,250,000 into Trump’s campaign when nobody thought he would win.

“He has also put down $2 million into this energy, calling it ‘necessary to replace fossil fuels’.

“Billionaire Robert Mercer, Renaissance Technologies CEO and the Trump campaign’s biggest donor… is also in on these ‘fuel stocks’.

“In fact, his total investment amounts to over $5 million!

“It’s not just Trump insiders though…

“Microsoft co-founder, billionaire Paul Allen, has helped raise as much as $200 million for this energy.

“Not to be outdone, Microsoft’s Bill Gates[15] put down an undisclosed amount, but the Financial Times reports it’s in the ‘hundreds of millions.’

“Even billionaires who don’t care much for Trump are in on this fuel.

“Amazon’s Jeff Bezos, the most anti-Trump CEO in Silicon Valley, invested $19.5 million.”

So yes, I’m sure all those folks have invested something into uranium stocks or nuclear power — Bill Gates has been pretty vocal about his support for nuclear power, including sustained support for the private company TerraPower that he founded more than a decade ago (TerraPower is trying to advance the Traveling Wave Reactor)… and Peter Thiel has invested more than $2 million, through his venture fund, in a nuclear startup (Transatomic Power[16], which is trying to advance a new variation of the molten salt reactor design for safer nuclear power).

Whether the investments by those folks ends up changing the market price of uranium, I dunno — it’s a slow-moving industry, both because of public fears about new reactors and the challenge of changing an established and heavily-regulated business, and because of the massive, massive investment required to build a new reactor.

What drives uranium pricing is some combination of the cost to mine, availability of mined production for strategic reasons (Kazakhstan dominates uranium production globally and is strategically subject to Russian influence, most of the rest comes from Canada, Australia[17], and Niger and Namibia[18] in Africa[19]), the willingness of governments to sell their strategic stockpiles, and the demand from power plants.

Demand is driven both by refueling, which happens every few years for all existing reactors, and by new reactors joining the global active fleet who will need to fully fuel-up for the first time…. and there is no real “spot market” in uranium, though there are quotes for spot pricing that are followed by investors — most uranium is bought on long-term supply contracts between reactor operators and miners/refiners (that chart from Cameco above includes both the spot price and the contract price trends).

And uranium, despite a little perk up recently, is still a very contrarian investment. From what I can tell, most participants in the market are pretty depressed and no one is looking for demand to spark right back up anytime soon — Cameco and their peers talk a lot about high inventories for uranium, largely caused by the shutdown of all of Japan’s reactors post-Fukushima (TEPCO just recently canceled a supply contract with Cameco[20], for example, despite the fact that they haven’t operated most of their reactors for more than five years… so their inventories must be ridiculously high).

And as a result of that additional contract cancellation, Cameco may even be cutting back further on production… after announcing job and production cuts earlier this year[21]. Part of the problem, as you’ve probably already surmised, is that long-term contracts that are expiring now are not going to roll over at the $60, $70 or $100 per pound prices that were seen near the 2007 and 2011 peaks — Cameco produced 31.5 million pounds of uranium last year, at an average price of about $55 a pound, and since current spot prices and long-term prices are both far below that level their average realized price might well continue falling for several more years if long-term contract prices don’t perk up considerably (current spot prices are in the low $20s, long-term prices are reportedly in the low-$30s).

The short term has seen a bump up for uranium, so there is at least a little bit of optimism among traders again — and since we’re talking about junior miners, even a sliver of optimism can be enough to send their prices soaring. Never underestimate the power of speculators who are daydreaming about catching lightning in a bottle — those who bought the teensy junior explorers in 2006 could have ridden them to 1,000%+ gains, and that kind of potential can be irresistible.

And yes, there is that oft-touted 100,000% gain that Doug Casey[22] earned on a uranium speculation — that’s a reference to Paladin Energy (PDN.TO, PDN.AX, PALAY), which was a huge winner during the 2007 uranium boom (or “bubble,” if you prefer). Paladin was also a “career maker” for Rick Rule[23], among others — that went from pennies a share to about $10 at the peak… and, despite the fact that it’s been a producing miner pretty much the whole time, it is now back down to 11 cents a share (their two mines started up in 2007 and 2009, perfectly timed to excite and entice, though only one is currently operating — the other is on “care and maintenance” waiting for better prices).

Incidentally, Paladin was also the source of much of the cash that built the current Altius Minerals (ALS.TO, ATUSF), my largest personal commodity investment — Altius spun out and then sold the Central Mineral Belt uranium deposit near the peak in 2007 for gains of something like $200 million, and the resulting spun-out company (Aurora Energy) was eventually bought by Paladin a couple years later (I’m not claiming any prescience on that, to be clear, I didn’t start buying Altius until 2009 — though they were still sitting on a huge pile of that cash at the time).

So that’s the idea — that if you get lucky, as people do from time to time, you can get gains that turn $1,000 or $10,000 into a million dollars if you catch the right stock on the cusp of the right speculative bubble (and, of course, if you’re smart and lucky enough to sell near the peak — taking profits at a 100% or 200% gain means you can say good-bye to the 100,000% return dream, but it also means you don’t have to watch your portfolio inflate and then deflate if you’re paralyzed by indecision about selling… selling is always harder than buying). That speculative fervor is also what drives most marijuana[24] stocks now, of course, and you’ll hear the drumbeat of a different hoped-for bubble a couple times a year… not all of them really capture the imagination and inflate into craziness, of course, but sometimes it happens.

And you don’t need me to tell you this, but speculating is fine. Most of us have to indulge our speculative streak every now and then, and sometimes it even works out… just don’t bet the college fund or your retirement[25] on it, and be honest with yourself about the risk you’re taking. I like to think of these kinds of speculations as being more like a bet on the roulette wheel. Betting on red or black probably has roughly 50% odds of paying off, that’s like shares in a uranium blue chip like Cameco, and you’ve got maybe a coin flip’s chance to see your investment double or better… betting on an individual junior mining stock in the sector is like betting on one of the individual numbers on the wheel, you’ve got a 1 in 30 (or whatever) chance of making anything at all, but if you do happen to hit the returns are at least several hundred percent and possibly into the thousands.

The ad cites three catalysts that they see for uranium…

First, that President Trump is “pro nuclear” and is going to ease regulations that are keeping companies from investing in nuclear power or uranium mining. That seems like hokum to me — if you wanted to build a nuclear plant in the US today, even if it’s just an additional reactor at an existing site or a remote reactor with few neighbors that doesn’t face political opposition, you’d have a hard time getting the billion-dollar financing with natural gas[26] prices so low. The best justification for pushing nuclear is not economic, it’s environmental, since nuclear power offers huge advantages in fighting carbon emissions and climate change — and Donald Trump has made clear that he doesn’t believe that we should be investing in reducing carbon emissions.

Few companies seem to be itching to build new nuclear power plants in the US right now, and, indeed, most of the applications for new reactors that were on file with the NRC have been withdrawn by the applicants over the past couple years. I wouldn’t expect that to change, given the massive natural gas supplies now available the US is unlikely to have a renaissance in nuclear power unless we decide to focus on emissions control. The December Tweet from Trump that gets cited[27] over and over again is about nuclear weapons, not nuclear power, though there has been plenty of chatter about trying to protect the nuclear power plants from natural gas competition, and about how oil[28]/us-election-2016/trump-nuclear-power-nei-ceo">industry insiders are hopeful that the Trump administration will be good for nuclear power in general, but that’s presumably pretty far down the list in terms of political priorities.

Second, that Kazakhstan cut 10% of its mines (Kazakhstan is the only uranium producer larger than the Saskatchewan uranium mines), reportedly because prices are too low for profitable export. Cameco’s cutting too, as folks have noted. That’s perhaps part of the eventual solution, since the old saying remains true that “the cure for low prices is low prices,” but that doesn’t mean a turn is imminent.

And Third, that China is investing massively into nuclear power — with 60 plants under construction. India also has plans for 100 reactors, and we’re told in the ad, again, that Japan will have no choice but to restart their reactors (both to meet climate change goals, and to cut the high cost of liquefied natural gas imports). From what I can tell from the official sources (like the IEA[29]), China has only 20 reactors under construction — which, going just by simple math, probably wouldn’t be enough to make up for the 45 that have been shut down in Germany and Japan, let alone the gradual retirement of 1960s-era reactors that are nearing obsolescence or the end of their safe operating lives in the US and elsewhere (there are about 450 operating reactors in the world, to give some perspective — 160 have been permanently shut down over the years, and there are 60 reactors under construction now, including China along with 5 in India, 4 in the US, 7 in Russia, etc.).

So that’s my quick look at some uranium and nuclear perspective — I share this not because I’m sure uranium prices won’t spike again, but because I’m not sure when that might happen. I agree that there’s a likelihood of another uranium bull market… but I agreed to that notion back in 2014 when most of the newsletters were peddling it as well, and in 2015, and 2016, so it’s clear that I’m missing something. And what I think I’m missing is that the stockpile of unused uranium remains large, particularly because of the Japanese and German reactors being shut down, and the number of mines that are on standby, ready to produce if prices improve, probably means that the next speculative spike in uranium prices has less of an opportunity to turn the next wave of junior explorers into miners and producers. That doesn’t mean their share prices won’t spike of uranium goes back to $60 or $100, though, so feel free to go seeking that speculative high if you’re interested.

Disclosure: I can’t resist the siren song of speculation, either, and I do speculate on uranium from time to time — over the past three years, all of those speculations have led to losses. My current position is in Cameco 2019 LEAP[30] Options. I don’t own any other investment noted above, and will not trade in any covered stocks for at least three days per Stock Gumshoe’s trading rules.

- Nick Giambruno: https://www.stockgumshoe.com/tag/nick-giambruno/

- Casey: https://www.stockgumshoe.com/tag/casey/

- Crisis Investing: https://www.stockgumshoe.com/tag/crisis-investing/

- uranium: https://www.stockgumshoe.com/tag/uranium/

- Donald Trump: https://www.stockgumshoe.com/tag/donald-trump/

- Japan: https://www.stockgumshoe.com/tag/japan/

- India: https://www.stockgumshoe.com/tag/india/

- China: https://www.stockgumshoe.com/tag/china/

- [Image]: http://www.stockgumshoe.com/wp-content/uploads/2017/03/Uranium19972017.jpeg

- Cameco (CCJ): https://www.stockgumshoe.com/tag/ccj/

- [Image]: http://www.stockgumshoe.com/wp-content/uploads/2017/03/CCJ_chart.jpg

- Canada: https://www.stockgumshoe.com/tag/canada/

- see their latest investor presentation here: http://www.fissionuranium.com/_resources/presentations/FCU_Phenom_Mar_2017_v4.pdf

- Peter Thiel: https://www.stockgumshoe.com/tag/peter-thiel/

- Bill Gates: https://www.stockgumshoe.com/tag/bill-gates/

- Transatomic Power: http://www.bizjournals.com/boston/blog/startups/2015/02/peter-thiels-founders-fund-helps-fuel-cambridge.html

- Australia: https://www.stockgumshoe.com/tag/australia/

- Namibia: https://www.stockgumshoe.com/tag/namibia/

- Africa: https://www.stockgumshoe.com/tag/africa/

- TEPCO just recently canceled a supply contract with Cameco: http://www.cnbc.com/2017/02/01/reuters-america-tepco-scraps-uranium-supply-contract-with-canadas-cameco.html

- announcing job and production cuts earlier this year: http://globalnews.ca/news/3187697/cameco-announces-job-cuts-at-cigar-lake-mcarthur-river-and-key-lake-operations/

- Doug Casey: https://www.stockgumshoe.com/tag/doug-casey/

- Rick Rule: https://www.stockgumshoe.com/tag/rick-rule/

- marijuana: https://www.stockgumshoe.com/tag/marijuana/

- retirement: https://www.stockgumshoe.com/tag/retirement/

- natural gas: https://www.stockgumshoe.com/tag/natural-gas/

- December Tweet from Trump that gets cited: https://twitter.com/realDonaldTrump/status/811977223326625792

- oil: http://www.platts.com/news-feature/2017/a%20href=

- like the IEA: https://www.iaea.org/PRIS/WorldStatistics/UnderConstructionReactorsByCountry.aspx

- LEAP: https://www.stockgumshoe.com/tag/leap/

Source URL: https://www.stockgumshoe.com/reviews/crisis-investing/caseys-why-are-trump-insiders-pouring-millions-into-this-mysterious-energy-pitch/

No wonder that there are no new H.C.Andersens writing fairytales. They are being grabbed up by Agora & Co!

GGG Australia

GDLNF US over the counter

Yes I own some

That is all

Preference from Casey re: uranium is well documented to be UEC.

Certainly Marin Katusa (who manages some of Casey’s money in a hedge fund, and used to write a newsletter for Casey) is in love with UEC, and Casey may own shares — but that’s not the stock being pitched here. UEC is an “in situ recovery” company, their argument is that when uranium prices rise again they’ll be able to ramp up production fairly quickly — as opposed to the hard rock miners, who have much larger reserves and higher grades but will take much longer to permit and build a mine.

URG is also in situ and cheaper than UEC.

I am a subs of Crisis. Nick first promote CCJ on Nov 2016, then promote UEC later.

One of the reason that Nick love UEC is UEC is an “in situ recovery” company, and they do not need to burn cash when uranium price is low.

Very interesting reading however this commodity overall is a tough call always seems to be something in the way, interesting to note that dividend miners are not easy to find so Cameco must be doing something right http://eqibeat.com/top-20-global-mining-stocks-by-dividend-yield/

Perhaps a better Trump “nuke” play might be microwave ovens with spy cameras. A GE/Go-Pro joint venture, maybe?

You realize they were talking about transistors within the microwave that could be used to hack into phones, TV’s etc. Not the actual microwave. WIKI leaks data dump is revealing a lot. Some of which we already new like Samsung TV’s ability to be taped into to spy on owners. This was in the mainstream media years ago with press conferences etc…. of course most people don’t get watched but it can be done.

Thanks Travis. Thorough as usual.

Thanks, Travis for sleuthing this one down to FCUUF. As the world’s largest producer, Kazakhstan is cutting down because of a supply glut: http://www.world-nuclear-news.org/UF-Oversupply-prompts-Kazakh-uranium-production-cut-1001177.html

Quoting the article: “These strategic Kazakh mineral assets are far more valuable to our shareholders and stakeholders being left in the ground for the time being, rather than adding to the current oversupply situation. Their greater value will instead be realised when produced into improved markets in the coming years.” Hope your CCJ 2019 LEAP works out.

Thanks Travis for an article on Uranium. I bought into Paladin a few years ago at $0.33, then averaged down when they hit $0.20, again at $0.14, and the last one when they hit $0.03, now $0.11. I am holding for the long term or next big bull market (which will probably be one in the same. Are any Kazakhstan miners on any stock exchange or are they owned by the Kazak government, would appreciate if anyone knows.

Is PALAF still in business? @ .08 cents i can not go wrong on 1000 shares.

I also own some GGG Australia and am happy with so far

I don’t know why people are not talking about Ur-Energy Inc. they are making money

I agree URG is making money when uranium is @ a low cost now. They use a new system to mine called IN-SITU or solution mining. Google them, they are over-performers using new technology and are a JUNIOR AMERICAN COMPANY like UUUU. Meaning they are owned by Canadian Corporations but operate in USA.

If Trump goes Nuculear he will buy from miners working in America. URG, UUUU, UEC and so on. AMERICA FIRST!

The same thing applies in other countries. Normally a stock at this level would appear under my “Stocks Under A Dollar” banner but because this is an existing thread I just want to make the point that a company does not have to be in production to be a potentially profitable investment, Discovery and development is sometimes more profitable than when a company actually develops a mine to the production stage. Most years I DOUBLE my money on speculative stocks at early stages.

There is always a bull market somewhere is a popular saying among astute investors and when it comes to uranium, prices have been improving lately but are still far from a level that would induce major producers to ramp up production and generate profits. There are however potential niche markets where discovery and development of local resources could be profitable no matter what the sector in general does.

I have one in my portfolio, a Canadian company with assets in Argentina which has several reactors and several more under construction and naturally they would rather have a domestic resource than have to import it, this gives Blue Ky Uranium BSK-V / BKUCF a decisive edge to supply a local market and it has moved up nicely with the recent increase in the U308 price.

With only about 41,000 shares out, currently @ .38c Canadian I consider this a great speculation in this sector. Start your investigation with these recent press releases:

http://reply.investingnews.com/dm?id=13F56DD0D6B455BE53F62F47686CBD2C307E8380E19CCF0B

http://investingnews.com/company-profiles/blue-sky-uranium-nuclear-energy-argentina/

Iknow CCJ is the king of uranium mining but… what’s wrong with DNN, URG, UUUU. Iknow they don’t give dividends. But Uranium is uranium. I would rather have 15 shares than 1 share of CCJ. Advise please.

According to UxC, global uranium inventories are currently sitting at 1.4 billion pounds. Global annual uranium demand is about 173 million pounds per year, which means that there is enough uranium available for years of consumption. For prices to ascent, new nuclear capacity is essential.

Hard to say what the future holds. EV’s will be the biggest reason for more electricity. And at the pace it’s moving I will be surprised if I will be alive or very old in retirement. The way lithium battery’s keep catching fire makes one wonder how safe this technology is. I’m keeping a eye on it but am way off for now from investing investing in it. To much cheer leading going on now. I invest with facts not my emotions.

Very astute observation, it is easy to let ones emotions dominate critical thinking and plenty of investors do not do enough due diligence to separate out FACT from hype and a compelling story spun by promoters. As usual Travis has done a good job at posting a factual look at an industry sector and it is true that nobody can know with certainty the WHEN of the uranium market turning positive, but history indicates it WILL likely happen in time, and this is where “intelligent speculation” as Doug Casey would call it comes. in. Where I would differ from the assessment by Travis is in primarily looking too Cameco as the bell-weather indicator for the sector. WHY, because when demand is down major producers suffer the most because they have huge infrastructure to support while their sales are declining. By contrast, most of the money made in commodities are on DISCOVERY, and then secondarily on takeovers by larger companies looking to replace reserves. For the sake of illustration to support my argument, suppose we are 5 years away from a major price spike in uranium, then a speculator needs to ask 2 basic questions.

1) What producers are well positioned financially to survive the drought in sales and buy while stock prices are low, but just a small initial stake to better track the sector!

2) What exploration stage companies have the best track record of successful discovery and current reserves with growth potential? Point being there is lots of money to be made on discovery in anticipation of a better future market. Case in point, I have small positions in Energy Fuels, UEC and a few other near term producers that have done well for me that can quickly ramp up production WHEN the market actually turns positive, I will only ADD to my positions in leading companies WHEN I see solid evidence of a positive market uptrend.

My best return in the sector has been from a smaller less well known explorer with a very capable technical team in the Athabaska Basin. I am referring too SKYHARBOUR Resources who continue to expand their resource, acquire more land and are able to raise money for exploration with no problem. There are others with near term production capabilities I will write about in a future column when I am convinced the sector is ready to move higher.

In the meantime I am considering another uranium focused company I had never previously looked at in-depth, which not only has enormous land holdings in the Basin, but also Nunavut. I spoke at length with the CEO at the recent PDAC show in Toronto and was very favourably impressed with their approach as they do not have the typical “one trick pony” mentality.

They are finding other resources on their vast tracts of land and are well financed to develop other assets such as diamonds, ZINC and copper that are hot sectors right now. That company is CAN-Alaska Uranium Ltd, CVVUF & CVV-V .43 with only 27,000 shares issued. which has not yet got the attention of the press like Forum and a few others. I like finding what I call “hidden Gems” the market in general has not yet discovered. Well worth a look, more detail in my stocks under a dollar service initial list.

How does a investor know what else a uranium mining company finds: cooper, zinc, diamonds, etc.,. and does that count towards the profit? CCJ only allows uranium to count as profit I think. Advise.

My point on CanAlaska was that while they have excellent and abundant uranium resources, they are not just “standing still” waiting for the uranium market situation to improve enough to justify production, they are keeping their people busy developing other resources found on their vast land holdings. The market has not yet priced in the value of those resources, but that is where intelligent speculation comes in. As those additional resources are developed the market will re-rate the stock higher.

You are speaking to my point of a lot of investors not doing sufficient “due diligence” personally. There is simply no substitute for speaking directly to management of a given company to assess their goals, how they think, how they manage their funds etc. In other words, don’t even think about investing in any company just because some newsletter promoter recommends it, you need to check out the companies website and and most recent press releases and SUBSCRIBE if you are at all interested in the company, that way you can track the companies progress if you are at all uncertain.

The following is the most thorough analysis of the prospects for uranium I have found from one of the most famous and successful resource investors, “http://secure.campaigner.com/csb/Public/show/f9bjo–bx628-5l3srhm2

Rick Rule makes many excellent points in his thorough essay but what I would label an irrational response by novice or inexperienced investors would be, since Rick Rule as a serially successful investor who made a small fortune in the previous uranium run-up with Paladin Energy I am going to invest $5000. in Paladin and hit a home run when the market turns positive again! Mistake #1), That was a unique situation, this time around it might be some other company that is best positioned to benefit from price increases.

Mistake #2), Committing that much money to an unknowable future event, that is not intelligent speculation. Rick mentions 5-6 leading companies out of the myriad of companies in the sector that are most likely to do well. and I agree with that. My current picks are NEXTGEN Energy, ENERGY FUELS, UEC, FORUM, Skyharbour Resources, and a few others I am considering and will write-up in the future. Buying a 100 shares of each will cost you less than a few thousand dollars, but allow you to TRACK progress of the market as a whole and ADD to the positions that are showing the best response and probably make some money on the way up as the various companies add to their resources. As noted by Rick, the recent increase in uranium prices already boosted the stock prices of a number of juniors, more so than the major producers but one thing I would point out that has not been mentioned, some of these companies have existing contracts they are supplying at prices well above the current spot prices, and production costs in situ well below the cited production cost for major producers. Some are even making small profits even at the still low prices, so the picture may not be quite as stark as traditionally portrayed by the media.

There is another factor that will likely limit huge return in the future re Uranium. There are HUGE supplies of spent fuel rods waiting reclaiming. Only a tiny bit of the Uranium is actually used up before rods must be pulled due to “poisoning” from daughter products of fission. If properly reclaimed the usable is again available for use and only a very small bit will need storage, which problem is holding back new plants until storage problem is solved. The $Billions spent to build the Nevada facility is wasted as it sits empty, blocked by a Senator.

If breeder reactors were built no uranium would need mined for perhaps a 1000 years. IMO

I got into Uranium with three different risk scale/size producers and I am up on all of them. Some things that could make Cameco Corp pop……1) court case they are currently subject to goes their way or settles….pop…..goes badly against them….temporarily down….for buying opportunity. 2)Japanese plants do start coming online in greater numbers as predicted for end of this year and into spring of 2018….pop.

Sustained growth/gains at higher share prices won’t really come until around 2020 at the earliest when stock piles are decreased….despite some big short terms pops in the mean time…..Despite stock piles and some shuttered mines there does appear to be a big supply and demand situation building because very few mines are actually being developed (actually being shuttered). Many old plants are also being revived instead of shut down in USA etc. recent announcements made on this.

People are waiting on ANY positive news with this which creates pops……got 45% gain and 33% gain and cashed out on some of it. More of this to come I would say…worth paying attention to.

Just one more unfortunate accident kills uranium growth. If that isn’t dangerous to your bank acct., then go for it.

What stock is Dr. ken Moors pitching: Zero Energy Ready Home Program. That’s also a defense contractor company?

t’s a set of standards that would move 60% of new construction to a hybrid, off-the-grid power system.

Exactly the kind of accomplishment that only technology like the Nano-Grid can accomplish.

And the market for this application is immense.

In the U.S., construction is one of our biggest industries.

We spend $48.8 billion each year just installing electric systems alone in new buildings.

If this Nano-Grid simply replaces the electrical systems in the 60% of new construction that will have to meet this standard… the rest of Dr. Ken Moors info on the tiny company that will provide energy to homes indepedantly and to the military. ARTX or KTOS?

Overall, a very nice job of sleuthing.

Once Thorium Energy is proven in China via investments from Bill Gates and others, this U.S. invented technology will grow.

The problem for Uranium is that the U.S. Government and others have massive supplies of Thorium fuel that they have been storing as nuclear waste. That is the necessary fuel is essentially FREE. Demand for Uranium thus goes to ZERO.

Open pit. Under a lake. Geez Casey.