The folks at Money Map Press are following in the footsteps of a few other advisories by trying to not just pitch publicly traded stocks, but to pitch the idea that they can get you access to a specific private investment deal that you can’t find elsewhere.

That’s probably true in some cases — there are private placements all the time, particularly in the junior resource sector where it makes sense for companies to raise money in fairly small amounts, and they aren’t open to all comers so there are often groups of friends or fellow travelers who get the allocations. In those cases, the newsletters themselves won’t be getting the private placement shares for you directly but would really just be pointing you to the company or the company’s agent to request a piece of the deal. It’s a little murky, since little of it happens in the public eye despite the fact that these are public companies, but I know that Frank Curzio had a similar project where he tried to get some of his high-end subscribers into particular private placements that were spearheaded or shared by the Katusa/Casey/Sprott folks and other “connected” resource investors.

But this is the first time I’ve seen the access to a private placement advertised so widely, and that’s probably a big dangerous… so let’s see what stock it is they’re talking about, and see what else might jump out from the ad.

The pitch is from Mike Ward at Money Map, and he’s advertising the Money Map Project, which is one of those high end (or “back end”, as the publishers would call it) services that they sell to their “best” subscribers. Usually such services are priced in the $2,000-5,000 neighborhood, and this one’s right in the middle at $4,000. I haven’t seen mention of this Money Map Project before that I can remember, so perhaps this is their first deal.

Here’s some of the lead-in:

“First Time Ever! An Exclusive Private Offering in What Could Be the Next…

“Multi-Billion Dollar Gold Venture

“You could have a rare chance to partner with an investment legend who’s already built two billion-dollar mining companies from the ground up.

“Independent analysis suggests every stake you own could turn into $595,000”

That list of “investment legends” who’ve already built billion-dollar companies is pretty short, so I expect many of us already know what the stock is… but let’s check a few more details to be sure:

“Today, for the first time ever, I’m thrilled to tell you about an exclusive private investment offering that’s open ONLY to Money Map Project Members…

“It’s a deal that gives you direct ownership in a company that, for the past two years…

“Has been aggressively acquiring dozens of huge, high-quality gold assets across Canada, Mexico, and the United States…

“At historically LOW prices….

“The gentleman you could “partner” with already built two multi-billion dollar mining companies from the ground up – making total gains as high as 17,900% for investors who got in at the beginning of both….

“The private offering I’m recommending to you today is unlike anything you’ve seen before.

“It comes with perks and sweeteners typically given to venture capitalists, investment firms, and billion-dollar investors like Warren Buffett…

“Including an immediate ‘private investor discount’ that’s worth thousands of dollars.”

OK, so we can at least get you the easy answer: This is indeed First Mining Finance they’re talking about, and the “investment legend” who founded the company is Keith Neumeyer, who has indeed created two billion-dollar companies (First Quantum and First Majestic Silver). First Mining Finance is a “mineral bank” created out of some of the low-priority projects owned by First Majestic, and they have spent the last year or two using their shares (and Keith’s reputation and connections) to buy up small gold miners to accumulate “ounces in the ground” that, the argument goes, will become more valuable in a bull market.

The strategy, eventually, will be to partner or sell these projects to miners in exchange for royalties or some similar upside participation, effectively creating a “bank” that buys undeveloped assets when they’re cheap and “monetizes” them when there’s more demand (ie, when the big miners are looking for acquisitions to replace their reserves, or when there’s more greed in the gold mining market and folks are throwing money at development projects).

I like the strategy, I own the stock and suggested it to the Irregulars almost exactly a year ago (along with a much-less successful “bank” that’s doing non-mining royalties). And they’ve been busy — back then they had just announced their first acquisition, of Coastal Gold, and they had about 100,000 shares outstanding and roughly a million ounces of potential “in the ground” resources (including measured, indicated and inferred resources) — now, they’ve acquired (or at least announced the acquisition of) seven companies, they have almost 500,000 shares outstanding, and the “resources” number, using gold equivalent (some of the mines have more silver or copper) is now about 10 million ounces.

This is really a financial and arbitrage exercise, though the eventual success will depend on gold prices — what they’re doing now is essentially creating value by moving one asset from a junior miner without a lot of investor interest into a “mineral bank” that’s heavily promoted and run by a well-known and investor-savvy Chairman in Neumeyer.

"reveal" emails? If not,

just click here...

One of the slides in their current investor presentation points this out, noting essentially that the market values an ounce of resources at somewhere in the $5-10 range when it’s held by the distressed junior miners First Mining has acquired, and the market values First Mining at more like $20 per ounce of resources…. so just by swapping shares, the juniors, on average, get almost a 100% bump in per-ounce valuation.

I imagine that’s a big part of the reason why companies are willing to be acquired for First Mining shares, though it’s also true that a lot of companies don’t really (or didn’t until this year, at least) have much choice given the lack of financing available in the sector (First Mining doesn’t generally use cash for acquisitions — in fact, most of their cash has come in because of the cash on the books of the companies they’ve acquired, so sometimes the acquisitions improve their balance sheet).

So that’s the way the company works — and they probably would have been better off, frankly, if the slump in gold miners had gone on for another year or two and given desperation a chance to really set in for more of the junior miners who have appealing assets. It might start to get a little tougher to acquire mines if gold prices continue their bullishness — CEOs in the mining sector are way too optimistic as a general rule, so if they are fed some reason for optimism by the market they’re less likely to sell their companies at a steep discount to the amount of capital they’ve expended in acquiring and exploring their properties. Neumeyer’s assertion is that “normally” gold in the ground trades for between $50-150 an ounce, and right now First Mining is valued at about $18-20 per “resource” ounce in USD (I assume that he means US dollars, but in Canadian terms it would be C$22 or 23 for the current valuation).

The biggest property they’ve acquired so far is Springpole, which they got when they acquired Gold Canyon last September when gold was around $1,100 an ounce — the cost to First Mining in shares was roughly C$60 million at the time (now C$120 million for Gold Canyon shareholders who held, since First Mining has doubled since then), but Springpole has a PEA that indicates the value is well over C$500 million with gold at $1,300 an ounce, and it’s in a very active mining area in Ontario… I would assume that’s probably the first asset of First Mining’s that’s likely to get a development deal with a major miner, since it’s big and well-defined and near lots of existing infrastructure, but you never know. Neumeyer has indicated that other properties in the portfolio have some potential to have similar-size (several million ounce) resources, but they’re not yet booked or are historic and don’t meet current reporting standards. I don’t know if there’s some kind of skeleton in the closet at Springpole, I haven’t researched it at all, but if you’re bullish on that project and on gold prices, then First Mining is an easy buy at anywhere near the current price.

Is First Mining a “value” here? I’m not completely sure, but it’s a substantial position for me and I expect it to be quite levered to gold if gold rises sharply and dealmaking begins to take off again. I sold a portion of my First Mining shares after the first surge in gold miners at the beginning of April, and bought most of that position back at close to the same price a little while ago, so I have a decent allocation to First Mining as one of my more levered and speculative gold mining investments… it’s a smaller position than I hold in Sandstorm Gold (SAND), which is a cash-flowing royalty firm, or the gold mining ETFs (mostly SGDM), but it’s much larger than the little speculations I sometimes put on in micro-sized junior warrants and options that are too small to write about to a large audience (and which are, probably, fundamentally stupid investments because of high risk).

My uncertainty about First Mining stems largely from the fact that it’s so promotional and so loved by so many different pundits and newsletter guys — that’s a good thing in that it helps them have higher-priced shares that are good to use for acquisitions, but it’s a bad thing if the market turns and the promotional stuff no longer works, and investors sell it down to those bedrock “price per ounce” valuations that so many junior miners suffer under when the market is distressed. In that way, you can think of it as somewhat of a leveraged junior — though that’s also partly offset by the fact that they now own a lot of potential mines, not just one or two like most junior miners.

But if you can stomach that risk, that if junior miners fall 50% and things get ugly again then First Mining could conceivably fall even harder, I do like the model and the “optionality” they have to sell and partner a large variety of properties IF the market goes in their favor over the long run, and I like Keith Neumeyers track record… I just try not to drink too much of the Kool-Ade or make it too big a position, even though I’m sometimes tempted to because of the appeal of the “story.”

But what’s this story about a private placement? Does Money Map Report really have a private placement lined up at 67 cents, with warrants, as they tease?

Well, probably that’s at least generally true — though I don’t know how large it is, or if it will end up feeling like a bait and switch if investors sign up and aren’t able to get the allocation they want (or aren’t eligible — you do still have to be an “accredited investor” for these private placements, which usually means you have to have income over $200,000 or investable assets over a million dollars).

The private placement they’re talking about is at a price below the current market price, they say it’s at 67 cents (which is where the stock was about a week ago, immediately prior to the Brexit vote — it’s around 73 cents now), so that’s perhaps interesting even though that might not be cheap enough to be compelling enough to tie yourself to a private placement, which often comes with other strings attached (minimum holding periods, etc.) What is more compelling is that they indicate that their private placement also includes a “free” warrant — and warrants are where early-stage resource investors really get their big upside potential.

A warrant is essentially just like a call option, though they’re not as standardized and they don’t always trade on the market (some are listed, many are not) — a warrant gives you the right to buy a stock at a set price (the “strike” price) anytime before the warrant expires, sometimes with additional conditions or rules for exercising the warrant.

As a quick aside, if you do own warrants pay close attention to them when expiration comes closer — unlike with options positions, your broker is unlikely to act on the warrant on your behalf or notice that it exists, and even an “in the money” warrant can expire worthless if you don’t take action. Even if the stock is above the exercise price and the warrant is very valuable, if you don’t proactively sell the warrant or exercise it that valuable warrant can become worthless on the day after expiration.

Ward says that the private placement is being made in 20,000 share installments (so about $13,000, which is roughly $10,000 US), and that they’re being offered out-of-the-money warrants at the same time. So those in this Money Map-arranged private placement will get three-year warrants with a strike price of 95 cents, and you get a half-warrant for each share you buy (so a tranche of 20,000 shares would come with 10,000 warrants).

First Mining does not have any warrants trading today that I’m aware of, so I don’t know if this probably small tranche of warrants will end up getting listed — which means that getting your value back from them might require actually exercising the warrants at some point in the next three years instead of just selling them on the open market. And I generally love warrants, particularly long-term warrants, because, as you can easily figure in your head, they provide huge leverage — if you have warrants at 95 cents and the stock goes to $2, the warrant is suddenly worth $1.05 and you didn’t pay anything for it.

Is getting in on this warrant worth subscribing to Money Map Project for $4,000? Well, that depends not just on whether First Mining ends up doing well over the next few years (which depends on both their execution and on the gold price… and if gold doesn’t rise for a couple years and they make a lot more deals and issue more shares they could easily see their share price stagnate or drop), but also on the size of the allocation you might be able to get to this private placement. Money Map is really just making the introduction for you, they’re not guaranteeing that you’d be able to buy 20,000 units or 100,000 or whatever of the private placement, and as far as I can tell we’re not told how large the placement is going to be. There are no refunds for Money Map Project, so you can’t sign up and see if you can get in and then cancel if you fail to get some of the private placement, or don’t get the allocation you want.

So we can do some quick calculating to give some perspective, if you like. First Mining Finance is currently at 73 cents, so the value of getting in at 67 cents is six cents per share today. For that discount to make it worth subscribing just for this private placement deal, you’d have to buy 80,000 shares in the private placement (an investment of C$53,600, or about US$41,000). So maybe if you can get that allocation it’s reasonable… assuming that First Mining isn’t available in the open market for 67 cents, like it was a week ago.

I’d calculate that the three-year warrant is worth a minimum of 20 cents, according to a basic Black-Scholes valuation model that assumes 25% volatility, but that’s pretty much as valuable as interpreting smoke signals or tea dregs — it’s worth what you can exercise it for, or what someone will pay for it. If it were going to be a listed warrant, I wouldn’t be surprised to see it trade at twice that level given the current interest in the stock. If we assume that the value is somewhere in the middle of that, perhaps 30 cents per warrant, then that’s 15 cents per share (it takes two shares of the private placement to get a warrant). So to get $4,000 of value out of the subscription, based on just the warrants, would mean you’d need to buy only 25-30,000 shares (well, I guess you’d need to buy 40,000 since they’re selling in 20,000 share tranches).

So if you love the stock and would be willing to commit to it for some period of time, and were going to spend at least $10-20,000 on acquiring First Mining Finance shares anyway, and would find the leverage of warrants to be valuable, it’s possible that the $4,000 subscription would be worthwhile to you IF you could be assured of getting a minimum of something like 40,000 units of the private placement, depending on your own assessment of the value of the warrants. But even if you don’t get any units of the private placement, you’re still out the $4,000 — so that’s the major risk.

I don’t know what Money Map Project‘s track record is at identifying “private” investments — they tried to do something similar with direct investments in oil wells that were recommended by Dr. Kent Moors a couple years ago, and that has presumably been a disaster given the fall in oil prices (I’m just guessing, I haven’t heard what the results were from anyone). Previously they also have run ads indicating that they could get you “pre public” shares or special access to investments, and those ads were much more misleading than this one — so I guess that’s positive (those were the ads from Michael Robinson for getting in “privately” on Stellar Biotechnologies, and getting some special access to the SharesPost 100 Fund).

Whether there will be any deals from Money Map beyond this private placement that have any value, or whether you personally could get access to the private placement, I have no idea… but the placement itself, going by the description in the ad (I’m not a member, obviously, and haven’t seen the terms of the private placement), seems to have some potential if you’re interested in owning First Mining shares. And if you own First Mining already, I wouldn’t worry about this being dilutive — I would guess that the private placement would be quite small, perhaps just a couple million dollars or even less… and First Mining is going to keep issuing tons of shares to acquire more companies if things work out as they expect anyway.

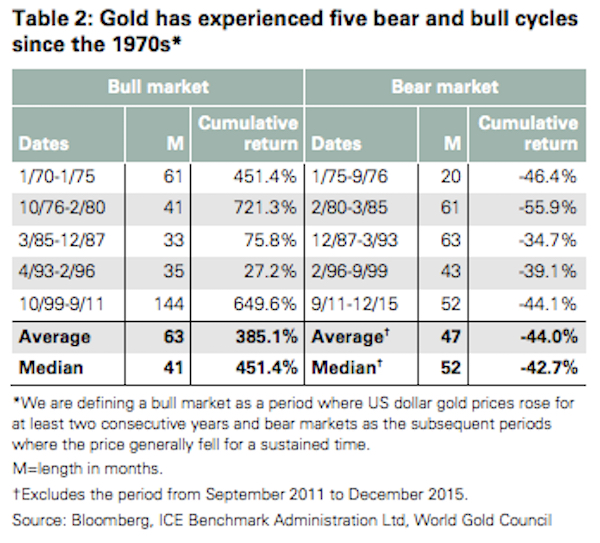

Big picture? The ad cites several arguments for investing in gold, though the one that they keep harping on is the cyclicality — with the tendency of bear markets in gold to create average declines of 44% and bull markets to generate gains of 450%… and, not coincidentally, the current bear market in gold, as of a couple months ago, was down 44.1% from the September 2011 high. Here’s the table that Money Map borrowed from to make that point:

(That chart is in the World Gold Council’s first quarter report, which you can see here.)

And beyond that, well, you can make your own call.

My biggest fear for this particular offer, assuming you do find the actual investment in First Mining to be worth your money, would be the potential for either intentional or accidental “bait and switch” — that too many people might sign up and want access to this private placement, and that there won’t be enough private placement units to go around… or that unaccredited investors, for whom this private placement would be worthless, would sign up for an expensive newsletter that offers no refunds, and that might never have a deal that you find as appealing as this particular one. Any comment beyond that from me would be guessing, but if you’ve got an opinion on this, or any experience with private placements engineered by Money Map or other newsletters in the past, feel free to share it with a comment below.

Myron

I have wasted entirely too much time debunking various deceptive production from MMP to ever give them the benefit of the doubt that “sometimes they might be right” or to believe anything they say without verifying it first.

There are two issues here. The sensibility of the underlying investment and the use of this placement to make such investment.

As for the second, I would stay a hundred miles away from any investment process which includes MMP. Go directly to some of the knowledgeable broker folks you spoke about and work through them.

As for the first topic – I’ve no clue whether its a good investment or not … but i will share with you that to the extent your post is meant to imply that all those you name would recommend purchasing the stock at the current time and price – said implication is incorrect.

Reasonable points — those who got in early on First Mining aren’t necessarily in favor of buying at these prices (though some of the folks in the Casey/Katusa crowd talk it up every chance they get). I was a little surprised that Neumeyer offered this private placement to Money Map instead of to folks like Marin Katusa or Frank Curzio who have high end subscriber “clubs” of private placement enthusiasts, but I don’t know the details of any of those relationships or what might have been offered to who, or whether those terms would have enticed others. And I can see why investors who’ve been burned by the promotional tactics of a newsletter wouldn’t want to be involved in any deal that publisher is facilitating.

My goal is always to look at the ads, try to get a clearer picture, and help people think rationally about the actual investment without quite so much of the “must buy it now” greed that the copywriters are so good at generating in our brains. I don’t put much weight on the source of the investment idea most of the time, other than the fact that experience tells me that some newsletter analysts seem typically to be a lot more rigorous than others in looking at the books or being cautious about valuation.

Bingo! Travis, you described the land “bank” perfectly. It coincides with Sprott this week. He was writing about the whole situation a couple of times. I think you are right about the “private” placement, it’s probably like KLH. Same wording as KLH last year. You will recall that it was waiting to get on the Nasdaq.(How is that a private placement?) It did happen eventually. It hit $10 a share. That was about a year later. I think they are crossing some legal line saying that KLH and this “bank” stock are PP’S. I think they are baiting people to pay a ridiculous price to join the “Premium- Ripo** oops Service. I think this stock is good just with Mr. Neumeyer owning a lot of shares as he was very successful in the last two ventures to say the least. I’m interested what people think about Money Map doing this; baiting people with some Private Placement which I think is wrong, but who am I to judge 3 or 4 Gurus at MM? I never did find out what they really had with the KLH Private Pl. did anyone hear about it? I think something stinks in Baltimore and it is not the fish. Anyway The New Site looks great Travis, and your writing is Purlitzer Prize worthy. Thank you again for some great articles. Timothy

The ad actually includes quotes from Neumeyer about the private placement terms, so I suspect it really is a private placement (unlike KLH)… that doesn’t mean it’s great, or that the terms are good or enough is available to satisfy MMP subscribers who want “in” (I don’t know the terms or the size of the deal), but I expect it’s really a private placement this time.

In response to SB: What part of “each situation must be judged on its own merits” did you not understand? I could care less whether Money Map Press jumps on the bandwagon on something on which I have already done my due diligence and made up my own mind, in fact I have seriously considered unsubscribing from MMP and notified them if they don’t stop spamming me with 3 copies daily from different analysts ,(one of which I used to like)I will unsubscribe. Should it not be obvious that I DO rely on the numerous people already mentioned for guidance as to whether it is worth my time to do my own due diligence on a stock I learn about from whatever source? My entire premise in writing my columns is based on following already proven successful management teams. I am all for healthy skepticism, but in this case MMP has nothing to do with my confidence in the potential success of Keith Neumeyer in building a THIRD Billion dollar company given his proven track record and the number of equally successful millionaires he has attracted to his latest project. While there is no guarantee of success in any such project. I think the odds are pretty well stacked in his favour. and while I might wish Keith had chosen a more creditable organization to make his offer to raise more funds to invest at a time when acquiring assets are “ON SALE” at historically low prices, it is what it is and makes no difference to me as a non-accredited investor how he raises the money to implement what seems to me like a good business plan that has worked for him twice before. I am along for the ride and will give it a reasonable time for success.

I am interested in Mr. Martin’s thoughts on Fortune Minerals, and Formation Minerals as early stage Cobalt companies to fill the gap for Lithium batteries?

Each has about 10% of the world supply in the ground. Formation has their stuff in Idaho, but they are both about the closest supply to one GIGAfactory.

Timothy I

had a position in $FMETF up to last year, I’m not familiar with Fortune Minerals. I looked at my spreadsheet of Myron’s stocks and I don’t see Fortune or Formation on the list. I did go to Formations web site to sign up for their newsletters again. While there I notice that they are saying Hedge funds are buying Cobalt I’ll have to look into that some more. I got out of Formation because their new mine for Cobalt was not going to be opened at was then the Cobalt metal price. Now might be the time to reconsider, the price is up for the year is up 3.3% and for the week down 2.1%. Do you know if the cobalt in lithium batteries is being used in the anode and cathode?

Myron

really? that’s where you want to go? questioning my ability to read?

Ugh

1) While I am all in favor of judging a case on its merits, in this case one has to spend $4,000 to examine the actual merits of the placement in hand. And similar materials in the past requiring such payment have been at best blatantly deceptive and at worst fraudulent in so far as being descriptive of the ultimate placement documents.

My suggestion was to contact Sprott, for example, or any of the others experts you mentioned directly for their current advice on the stock – (rather than rely on your advising what any expert’s initial position was, or MMP’s $4000 special offer promo, or me.)

2) I am also all in favor of doing one’s own due diligence and have made no claim to have done so in this case nor to have any clue as to the value of the underlying investment.

You, however, paraded out a list of “experts” and “successful millionaires” (and have made reference to them again now) as if they were current backers of the company and its stock. You then said in essence “I’m with them”. This is not a “do your own due diligence” argument.

Since I have accounts with some of these names, and your claim seemed at odds with a recent market conversation regarding another “land bank” stock that is no longer in my portfolio as a result of that conversation – I called them for an opinion.

At least one of the names you mentioned not only would not recommend buying the stock at current levels, but would be more inclined to sell. Moreover, it was the opinion where I called that the company has not been able to execute its very good business plan – and has been overpaying for lesser quality assets rather than buying great assets on sale.

So, ignoring for the moment whether calling on your list of experts who agreed with you was a coercive argument or not – the list was inaccurate.

Hmm?….Im sure there must be less abbrasive ways of saying this. Let me consult Google…..

Marin Katusa and Casey were deadly for my portfolio. I subscribed to their energy newsletter and did exactly what they said. I never had any solid success and could never get in or out at their price targets. I felt I was being used by them. It took me a long time to figure out how they operate. Casey was absorbed by Stansberry but Katusa still lives on has his people who have already bought into the PPs like Curzio helping him out. The whole thing is far too much like a Ponzi scheme. The first ones in make money, they take profits and then they do a new PP and move on to the next pump. After my experience, I wouldn’t touch anything Katusa is talking about with a ten foot pole.

Google IKN and Katusa together for further explanation and illustrations about how they work..

Katusa is an interesting guy who has had some huge wins over the years — so much of junior resource investing is about those private placements and “getting in early” on a lot of deals with experienced hands, since so many of them fail even when commodity prices are moving their way. It’s a business where the best folks will tell you their good returns come from one 10,000% winner next to a few 100% losers and a couple “meh” stocks. And they don’t know, of course, which of their ten highest conviction buys will be that huge winner and which few will go to zero.

It is hard to parse the opinions these folks share,

Both publicly and on their newsletters, when they’re also in at the venture stage on these same companies and have far lower cost basis. Katusa split off when Stansberry bought out Casey, and I suspect a big part of the reason is that Stansberry analysts can’t own a stock before they write about it.

I do like the InkaKolaNews guy, he gets into a good righteous anger about the Casey folks in particular.

Consider platinum mining stocks. Less hype than gold with room for growth.

If you like Gold IMHO go with these 3 stocks: HL , ABX and AUY .

I am with you on 2 of them and while there is no question Barrick is a #1 gold producer (ABX) they have far to much DEBT for my risk tolerance and management has made too many mistakes. In fact I feel they are far more interested in feathering their own nests then they are in rewarding shareholders. I see them as having an “entitlement mentality” ever since they gave an $11. MILLION signing bonus on hiring a new executive which I consider ludicrous, in short I simply don’t trust them. I might consider options in a rising bull market like we have now because it is a darling of institutions (hedge funds etc.) but buy the stock as a small retail investor, NOT A CHANCE!

Not sure what SB is so upset about, my comments re the MMP backed Private investment was never about the merits of the deal being offered, only about Neumeyer’s potential success with his new venture.

Sure people change their mind all the time, take early profits or change their priorities if they think they have found something better. If SB actually did get one of the millionaires on the phone or an answer to an E-mail then would it not have been appropriate for him to say I talked with ? ? and he said either he has sold his stake or would not buy more at to-days prices? Fair dinkum as an Aussie would say, but it does not change my perspective that I got in at a good price and am prepared to stick with it for a year or so to see how things develop and either buy even more if results warrant, or book a profit or loss as appropriate.

I response to Timothy’s question, yes I have Formation Metals in my portfolio because I too believe cobalt demand will increase with greater demand for lithium ion batteries and I have looked at Fortune a few times but is not currently in my portfolio. I can’t buy everything I might be interested in or read about and neither can I write about every interesting stock that may come to my attention. I only write about stocks I believe have a near term catalyst for market attention or great longer term prospects. It is a rare month that I don’t have at least one speculative stock I have been holding for some time that dosen’t get picked up by a larger better financed company anxious to add to their reserves and willing to pay a 40% to 50% premium over market.

I am a Lifetime Passport Member of MMP and I have personally made it known to Mike Ward That I really dont like the fact that Money Map Project and Micro

Energy are not included in my so called All Inclusive Membership. Every time that they come up with a new idea, and create a new subsscription, this just dilutes the actual value of my membership. I am stii working on this with MMP to provide me with an actual all inclusve Membership.

JJ

Your experience is not surprising, they pretty well all do it. They make promises they don’t keep when circumstances change from their viewpoint. I have a lifetime membership with Agora and they pulled the same trick on me using the excuse that a particular new newsletter was too exclusive to have thousands of readers because the stocks covered were too small. When I persisted they finally offered me a one year complimentary subscription too shut me up. a partial victory, but it still does not honour their pledge of “everything we publish for life.”

It is like moving the goal posts when the ball seems headed for the goal.

Being a small-time investor, I find plays such as this quite dubious. I put my full faith in the Money Map Organization (Robinson & Moors), and got burned both times. Just because you pay a hefty price for their subscriptions doesn’t mean squat. It just means they are better scammers. To think that they were above doing the “pump & dump” routine was my error. The Stellar Bio-technologies scheme should have won some kind of Oscar. The literature I received had to cost them dearly, however the “pump” worked – for me. That was a tough lesson regarding my finances.

I truly enjoy your articles Travis.

Tom — North Carolina

FFMGF looks like to me that debt is greater than cash on hand which is just over $1 mil. would be a warning sign for a stock that hasn’t been around that long.

I’m wondering how much this applies to a new company that buys assets/inventory to resell and at the end of of a Bear market going into a Bull. How would you tell if they are over extended for the current market. Something definitely to keep and eye on.

Apparently the terms of that private placement changed — I’d be pissed if I had signed up for the letter, no refunds allowed, and had the terms change on me — this is per another Money

Map person at http://suremoneyinvestor.com/2016/07/why-im-withdrawing-my-recommendation-of-first-mining-finance/

Got an email couple hours ago that money map is pulling its recommendation on First Mining Finance they said that at the last minute First Mining changed the terms on the whole deal has anyone else gotten this e mail? Thx Joe

Thanks so much for this made over 20% so far in less than 2 weeks, thought you would enjoy their cancelling rec and why!

Dear Sure Money Investor,

One of the most important things I’ve learned in my three decades as an investor is that you have to have the ability to change your mind when the facts change.

Recently, I recommended a private placement investment in First Mining Finance (FF.V), based not only in my belief that gold is going to rise sharply in price in the next few years, but also based on the favorable terms of the deal and the excellent reputation and track record of Keith Neumeyer, founder and chairman of First Mining, and Patrick Donnelly, president.

Then we got the rug pulled out from under us.

Over the weekend, Neumeyer and Donnelly decided to change the terms of the offering and raise the price paid by investors from the agreed-upon CAD 67 cents per share and 95 cent warrant price to 80 cents per share and $1.10 warrant price. Why? Because FF.V’s stock price had increased.

This came as a surprise and a disappointment to me and to Money Map Press, which brought this deal to my attention (and is the publisher for Sure Money).

When I make a recommendation of any kind to you, I have your best interests in mind and nothing else. If a company acts this way today, what is to stop it from doing something in the future that hurts investors? I will not recommend doing business with them or have my name associated with them.

Accordingly I am withdrawing my recommendation of First Mining Finance at this new offering price. I respect Money Map Press’ decision to do the same.

Sincerely,

Michael Lewitt

I’m curious about whether a private placement will still be done, or if the Money Map folks were the only ones involved in trying to market the private placement and it will be gone now. The terms are now public, First Mining posted the details in a press release on Monday:

That’s a decent-size offering, and it’s certainly valuable now with First Mining having shot higher again (it’s at C$1.16 at the moment, so well above both the unit offering price and the warrant strike price, so that three year warrant could be worth quite a bit if the shares continue to rise). No indication as to whether they intend to list the warrants for trading or if they’ll remain unlisted… as, of course, there’s no indication whether they’ll actually go through with the private placement, or what the terms might otherwise be (i.e., will the units have to be held for a particular period of time, etc).

I received an email from Michael Lewitts of Sure Money Withdrawing his recommendation to invest in First Mining Finance:

“….

Over the weekend, Neumeyer and Donnelly decided to change the terms of the offering and raise the price paid by investors from the agreed-upon CAD 67 cents per share and 95 cent warrant price to 80 cents per share and $1.10 warrant price. Why? Because FF.V’s stock price had increased…..”

thats really poor taste to do that. in any event there looks to be multiple opportunities of multi bag potential junior miners still out there. a favorite is aurvista that incidentally moved a great deal the other day. still like Northisle for the mining side and noka resources on the lithium side. key is management and asset and all 3 have them. good hunting

Is there anything current on this? Last posts were in mid-July 2016…..