The folks at Money Map Press are following in the footsteps of a few other advisories by trying to not just pitch publicly traded stocks, but to pitch the idea that they can get you access to a specific private investment deal that you can’t find elsewhere.

That’s probably true in some cases — there are private placements all the time, particularly in the junior resource sector where it makes sense for companies to raise money in fairly small amounts, and they aren’t open to all comers so there are often groups of friends or fellow travelers who get the allocations. In those cases, the newsletters themselves won’t be getting the private placement shares for you directly but would really just be pointing you to the company or the company’s agent to request a piece of the deal. It’s a little murky, since little of it happens in the public eye despite the fact that these are public companies, but I know that Frank Curzio had a similar project where he tried to get some of his high-end subscribers into particular private placements that were spearheaded or shared by the Katusa/Casey/Sprott folks and other “connected” resource investors.

But this is the first time I’ve seen the access to a private placement advertised so widely, and that’s probably a big dangerous… so let’s see what stock it is they’re talking about, and see what else might jump out from the ad.

The pitch is from Mike Ward at Money Map, and he’s advertising the Money Map Project, which is one of those high end (or “back end”, as the publishers would call it) services that they sell to their “best” subscribers. Usually such services are priced in the $2,000-5,000 neighborhood, and this one’s right in the middle at $4,000. I haven’t seen mention of this Money Map Project before that I can remember, so perhaps this is their first deal.

Here’s some of the lead-in:

“First Time Ever! An Exclusive Private Offering in What Could Be the Next…

“Multi-Billion Dollar Gold Venture

“You could have a rare chance to partner with an investment legend who’s already built two billion-dollar mining companies from the ground up.

“Independent analysis suggests every stake you own could turn into $595,000”

That list of “investment legends” who’ve already built billion-dollar companies is pretty short, so I expect many of us already know what the stock is… but let’s check a few more details to be sure:

“Today, for the first time ever, I’m thrilled to tell you about an exclusive private investment offering that’s open ONLY to Money Map Project Members…

“It’s a deal that gives you direct ownership in a company that, for the past two years…

“Has been aggressively acquiring dozens of huge, high-quality gold assets across Canada, Mexico, and the United States…

“At historically LOW prices….

“The gentleman you could “partner” with already built two multi-billion dollar mining companies from the ground up – making total gains as high as 17,900% for investors who got in at the beginning of both….

“The private offering I’m recommending to you today is unlike anything you’ve seen before.

“It comes with perks and sweeteners typically given to venture capitalists, investment firms, and billion-dollar investors like Warren Buffett…

“Including an immediate ‘private investor discount’ that’s worth thousands of dollars.”

OK, so we can at least get you the easy answer: This is indeed First Mining Finance they’re talking about, and the “investment legend” who founded the company is Keith Neumeyer, who has indeed created two billion-dollar companies (First Quantum and First Majestic Silver). First Mining Finance is a “mineral bank” created out of some of the low-priority projects owned by First Majestic, and they have spent the last year or two using their shares (and Keith’s reputation and connections) to buy up small gold miners to accumulate “ounces in the ground” that, the argument goes, will become more valuable in a bull market.

The strategy, eventually, will be to partner or sell these projects to miners in exchange for royalties or some similar upside participation, effectively creating a “bank” that buys undeveloped assets when they’re cheap and “monetizes” them when there’s more demand (ie, when the big miners are looking for acquisitions to replace their reserves, or when there’s more greed in the gold mining market and folks are throwing money at development projects).

I like the strategy, I own the stock and suggested it to the Irregulars almost exactly a year ago (along with a much-less successful “bank” that’s doing non-mining royalties). And they’ve been busy — back then they had just announced their first acquisition, of Coastal Gold, and they had about 100,000 shares outstanding and roughly a million ounces of potential “in the ground” resources (including measured, indicated and inferred resources) — now, they’ve acquired (or at least announced the acquisition of) seven companies, they have almost 500,000 shares outstanding, and the “resources” number, using gold equivalent (some of the mines have more silver or copper) is now about 10 million ounces.

This is really a financial and arbitrage exercise, though the eventual success will depend on gold prices — what they’re doing now is essentially creating value by moving one asset from a junior miner without a lot of investor interest into a “mineral bank” that’s heavily promoted and run by a well-known and investor-savvy Chairman in Neumeyer.

"reveal" emails? If not,

just click here...

One of the slides in their current investor presentation points this out, noting essentially that the market values an ounce of resources at somewhere in the $5-10 range when it’s held by the distressed junior miners First Mining has acquired, and the market values First Mining at more like $20 per ounce of resources…. so just by swapping shares, the juniors, on average, get almost a 100% bump in per-ounce valuation.

I imagine that’s a big part of the reason why companies are willing to be acquired for First Mining shares, though it’s also true that a lot of companies don’t really (or didn’t until this year, at least) have much choice given the lack of financing available in the sector (First Mining doesn’t generally use cash for acquisitions — in fact, most of their cash has come in because of the cash on the books of the companies they’ve acquired, so sometimes the acquisitions improve their balance sheet).

So that’s the way the company works — and they probably would have been better off, frankly, if the slump in gold miners had gone on for another year or two and given desperation a chance to really set in for more of the junior miners who have appealing assets. It might start to get a little tougher to acquire mines if gold prices continue their bullishness — CEOs in the mining sector are way too optimistic as a general rule, so if they are fed some reason for optimism by the market they’re less likely to sell their companies at a steep discount to the amount of capital they’ve expended in acquiring and exploring their properties. Neumeyer’s assertion is that “normally” gold in the ground trades for between $50-150 an ounce, and right now First Mining is valued at about $18-20 per “resource” ounce in USD (I assume that he means US dollars, but in Canadian terms it would be C$22 or 23 for the current valuation).

The biggest property they’ve acquired so far is Springpole, which they got when they acquired Gold Canyon last September when gold was around $1,100 an ounce — the cost to First Mining in shares was roughly C$60 million at the time (now C$120 million for Gold Canyon shareholders who held, since First Mining has doubled since then), but Springpole has a PEA that indicates the value is well over C$500 million with gold at $1,300 an ounce, and it’s in a very active mining area in Ontario… I would assume that’s probably the first asset of First Mining’s that’s likely to get a development deal with a major miner, since it’s big and well-defined and near lots of existing infrastructure, but you never know. Neumeyer has indicated that other properties in the portfolio have some potential to have similar-size (several million ounce) resources, but they’re not yet booked or are historic and don’t meet current reporting standards. I don’t know if there’s some kind of skeleton in the closet at Springpole, I haven’t researched it at all, but if you’re bullish on that project and on gold prices, then First Mining is an easy buy at anywhere near the current price.

Is First Mining a “value” here? I’m not completely sure, but it’s a substantial position for me and I expect it to be quite levered to gold if gold rises sharply and dealmaking begins to take off again. I sold a portion of my First Mining shares after the first surge in gold miners at the beginning of April, and bought most of that position back at close to the same price a little while ago, so I have a decent allocation to First Mining as one of my more levered and speculative gold mining investments… it’s a smaller position than I hold in Sandstorm Gold (SAND), which is a cash-flowing royalty firm, or the gold mining ETFs (mostly SGDM), but it’s much larger than the little speculations I sometimes put on in micro-sized junior warrants and options that are too small to write about to a large audience (and which are, probably, fundamentally stupid investments because of high risk).

My uncertainty about First Mining stems largely from the fact that it’s so promotional and so loved by so many different pundits and newsletter guys — that’s a good thing in that it helps them have higher-priced shares that are good to use for acquisitions, but it’s a bad thing if the market turns and the promotional stuff no longer works, and investors sell it down to those bedrock “price per ounce” valuations that so many junior miners suffer under when the market is distressed. In that way, you can think of it as somewhat of a leveraged junior — though that’s also partly offset by the fact that they now own a lot of potential mines, not just one or two like most junior miners.

But if you can stomach that risk, that if junior miners fall 50% and things get ugly again then First Mining could conceivably fall even harder, I do like the model and the “optionality” they have to sell and partner a large variety of properties IF the market goes in their favor over the long run, and I like Keith Neumeyers track record… I just try not to drink too much of the Kool-Ade or make it too big a position, even though I’m sometimes tempted to because of the appeal of the “story.”

But what’s this story about a private placement? Does Money Map Report really have a private placement lined up at 67 cents, with warrants, as they tease?

Well, probably that’s at least generally true — though I don’t know how large it is, or if it will end up feeling like a bait and switch if investors sign up and aren’t able to get the allocation they want (or aren’t eligible — you do still have to be an “accredited investor” for these private placements, which usually means you have to have income over $200,000 or investable assets over a million dollars).

The private placement they’re talking about is at a price below the current market price, they say it’s at 67 cents (which is where the stock was about a week ago, immediately prior to the Brexit vote — it’s around 73 cents now), so that’s perhaps interesting even though that might not be cheap enough to be compelling enough to tie yourself to a private placement, which often comes with other strings attached (minimum holding periods, etc.) What is more compelling is that they indicate that their private placement also includes a “free” warrant — and warrants are where early-stage resource investors really get their big upside potential.

A warrant is essentially just like a call option, though they’re not as standardized and they don’t always trade on the market (some are listed, many are not) — a warrant gives you the right to buy a stock at a set price (the “strike” price) anytime before the warrant expires, sometimes with additional conditions or rules for exercising the warrant.

As a quick aside, if you do own warrants pay close attention to them when expiration comes closer — unlike with options positions, your broker is unlikely to act on the warrant on your behalf or notice that it exists, and even an “in the money” warrant can expire worthless if you don’t take action. Even if the stock is above the exercise price and the warrant is very valuable, if you don’t proactively sell the warrant or exercise it that valuable warrant can become worthless on the day after expiration.

Ward says that the private placement is being made in 20,000 share installments (so about $13,000, which is roughly $10,000 US), and that they’re being offered out-of-the-money warrants at the same time. So those in this Money Map-arranged private placement will get three-year warrants with a strike price of 95 cents, and you get a half-warrant for each share you buy (so a tranche of 20,000 shares would come with 10,000 warrants).

First Mining does not have any warrants trading today that I’m aware of, so I don’t know if this probably small tranche of warrants will end up getting listed — which means that getting your value back from them might require actually exercising the warrants at some point in the next three years instead of just selling them on the open market. And I generally love warrants, particularly long-term warrants, because, as you can easily figure in your head, they provide huge leverage — if you have warrants at 95 cents and the stock goes to $2, the warrant is suddenly worth $1.05 and you didn’t pay anything for it.

Is getting in on this warrant worth subscribing to Money Map Project for $4,000? Well, that depends not just on whether First Mining ends up doing well over the next few years (which depends on both their execution and on the gold price… and if gold doesn’t rise for a couple years and they make a lot more deals and issue more shares they could easily see their share price stagnate or drop), but also on the size of the allocation you might be able to get to this private placement. Money Map is really just making the introduction for you, they’re not guaranteeing that you’d be able to buy 20,000 units or 100,000 or whatever of the private placement, and as far as I can tell we’re not told how large the placement is going to be. There are no refunds for Money Map Project, so you can’t sign up and see if you can get in and then cancel if you fail to get some of the private placement, or don’t get the allocation you want.

So we can do some quick calculating to give some perspective, if you like. First Mining Finance is currently at 73 cents, so the value of getting in at 67 cents is six cents per share today. For that discount to make it worth subscribing just for this private placement deal, you’d have to buy 80,000 shares in the private placement (an investment of C$53,600, or about US$41,000). So maybe if you can get that allocation it’s reasonable… assuming that First Mining isn’t available in the open market for 67 cents, like it was a week ago.

I’d calculate that the three-year warrant is worth a minimum of 20 cents, according to a basic Black-Scholes valuation model that assumes 25% volatility, but that’s pretty much as valuable as interpreting smoke signals or tea dregs — it’s worth what you can exercise it for, or what someone will pay for it. If it were going to be a listed warrant, I wouldn’t be surprised to see it trade at twice that level given the current interest in the stock. If we assume that the value is somewhere in the middle of that, perhaps 30 cents per warrant, then that’s 15 cents per share (it takes two shares of the private placement to get a warrant). So to get $4,000 of value out of the subscription, based on just the warrants, would mean you’d need to buy only 25-30,000 shares (well, I guess you’d need to buy 40,000 since they’re selling in 20,000 share tranches).

So if you love the stock and would be willing to commit to it for some period of time, and were going to spend at least $10-20,000 on acquiring First Mining Finance shares anyway, and would find the leverage of warrants to be valuable, it’s possible that the $4,000 subscription would be worthwhile to you IF you could be assured of getting a minimum of something like 40,000 units of the private placement, depending on your own assessment of the value of the warrants. But even if you don’t get any units of the private placement, you’re still out the $4,000 — so that’s the major risk.

I don’t know what Money Map Project‘s track record is at identifying “private” investments — they tried to do something similar with direct investments in oil wells that were recommended by Dr. Kent Moors a couple years ago, and that has presumably been a disaster given the fall in oil prices (I’m just guessing, I haven’t heard what the results were from anyone). Previously they also have run ads indicating that they could get you “pre public” shares or special access to investments, and those ads were much more misleading than this one — so I guess that’s positive (those were the ads from Michael Robinson for getting in “privately” on Stellar Biotechnologies, and getting some special access to the SharesPost 100 Fund).

Whether there will be any deals from Money Map beyond this private placement that have any value, or whether you personally could get access to the private placement, I have no idea… but the placement itself, going by the description in the ad (I’m not a member, obviously, and haven’t seen the terms of the private placement), seems to have some potential if you’re interested in owning First Mining shares. And if you own First Mining already, I wouldn’t worry about this being dilutive — I would guess that the private placement would be quite small, perhaps just a couple million dollars or even less… and First Mining is going to keep issuing tons of shares to acquire more companies if things work out as they expect anyway.

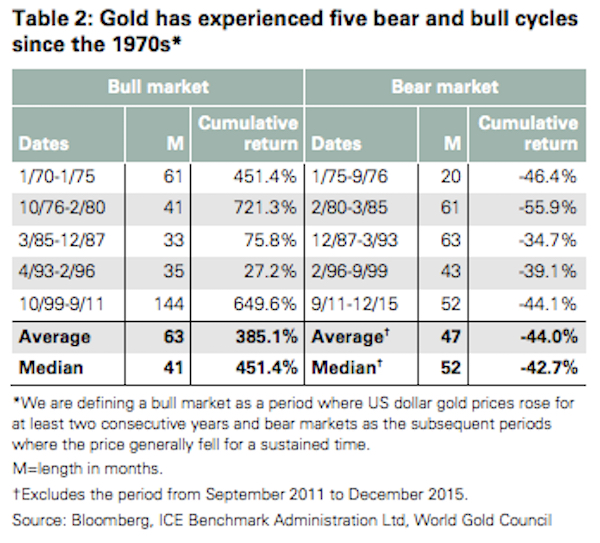

Big picture? The ad cites several arguments for investing in gold, though the one that they keep harping on is the cyclicality — with the tendency of bear markets in gold to create average declines of 44% and bull markets to generate gains of 450%… and, not coincidentally, the current bear market in gold, as of a couple months ago, was down 44.1% from the September 2011 high. Here’s the table that Money Map borrowed from to make that point:

(That chart is in the World Gold Council’s first quarter report, which you can see here.)

And beyond that, well, you can make your own call.

My biggest fear for this particular offer, assuming you do find the actual investment in First Mining to be worth your money, would be the potential for either intentional or accidental “bait and switch” — that too many people might sign up and want access to this private placement, and that there won’t be enough private placement units to go around… or that unaccredited investors, for whom this private placement would be worthless, would sign up for an expensive newsletter that offers no refunds, and that might never have a deal that you find as appealing as this particular one. Any comment beyond that from me would be guessing, but if you’ve got an opinion on this, or any experience with private placements engineered by Money Map or other newsletters in the past, feel free to share it with a comment below.

Once again, well done Travis!

Sold FFM today at .5775. A dime less.

If you mean First Mining, that’s presumably the FFMGF US$ shares — the references above for 67 and 73 cents are to the Canadian shares in C$.

maw toronto

mwsnf over the counter

I am in yes

Curious that Sprott Thoughts released an interview with FF’s prez Patrick Donnelly yesterday! Must be getting ready to sell more stock!

I am a holder of First Majestic and looked at First Mining after they bought Gold Canyon. In order for this mine to be built, they need to build a long road, put in a power line and drain a lake. How will the environmentalists or the First Nations ever let that happen? It isn’t permitted and has no feasibility study. It will cost well in excess of half a billion dollars and be many many years (and dilutions) before this ever becomes a mine. Yet all the newsletters pushing First Mining make it sound like most of their projects are shovel ready.

I also hear First Mining being mentioned on almost every gold news site. Stansberry has been pumping it for many months and now they are doing another large dilution. Where do the new buyers come from?

I think the only thing they are mining at FM are investors.

Anyway, the end result of all of this is I have lost a lot of confidence in Keith Neumeyer. He is a smart guy and has done a great job with First Majestic but I think he spends too much time with First Mining now. I won’t trust him any more with a large position. So I sold half of my position in First Majestic and switched it to Fortuna. Cheers.

Good perspective that’s certainly worth considering, thanks! To some extent they are designed to be “bailed out” by the next speculative fervor — they certainly don’t want to build or operate mines like First Majestic does, and there is a reasonable argument that the properties they’re buying “cheap” are cheap for what might turn out to be very good reasons.

Agree, if these properties were so undervalued they would have already had interest for acquisitions or joint ventures, etc. to develop them. Shovel ready? Sure, they are shoveling as much of this crap onto investors as fast as they can. 🙂 Many of them likely have fatal flaws that mean they are unlikely to be economic at almost any conceivable price. Therefore a constant pump required to keep this propped up. The best experts in the industry are not putting their money in First Mining. If you want to speculate on leverage jr. plays, look for ones with quality properties like Canasil, Mirasol, Orex, Mariana, Millrock, Hummingbird, Midland Resources, Sarama, Kootenay, Alexco, Cornerstone Capital, Colorado Resources, Azure, for example. Disclosure: I do own positions in all of these as well as numerous other mining stocks.

DRAMARBURGER lists some interesting juniors that I also own but he comes across as if he was a better stock picker than the millionaires (multiple) that invested in First Mining. He also by implication is saying that he is smarter than Keith Neumyer who has build two BILLION dollar companies and is highly regarded and respected as a leading executive in the industry. Of course he could also just be implying that was only a fluke and he has now turned rogue and is playing the millionaires and billionaires he came to know in the industry as SUCKERS even investing his own money ti lure them in when he “KNOWS” the projects he is buying are really worthless. Since he looked at over a hundred and only bought ten he must not know what he is doing, hows that for a stretch?

How many stocks “D: listed have proven resources of 1oM oz in the ground?

I am really getting weary of MMP and all the other newsletters companies offering the latest greatest at extra subscription prices.

Just bought a certain gold stock investment sub. Failed postionss. No refund. The expert says wait while it is quite obvious to all the gold investors horse is out of the barn. Can’t cancel. My opinion is these advisors are not worth what they cost. Many examples. Buy calls in CTL, so many many others. I am a fool investor to trust any of these advisors as you may be.

Any of them call Brexit and its impact on calls and puts- no- not one.

Failures I am getting out of.

If you are going to buy a newsletter for mining stocks, I suggest you look at Brent Cook’s Exploration Insights. He is a highly respected economic geologist and only recommends stocks he puts his own money into. He was bearish on the mining stocks for several years until about the middle of last year. I only know him by reputation and have never subscribed to his (probably be richer if I had) or anyone else’s mining newsletters.

I bought some first mining after I figured out who It was that Ward was talking about. I like Neumyer’s track record in mining. The company appears to be on solid ground. Naturally as soon as I bought it it went down 5 percent. I exited the market and placed my capital into a new Haas Avacado Plantation. Now I am looking for ,small home nearby. This is in Panamam. I hope to move there. I am tired of our politics and do not see a decent choice forthcoming in November. So as the saying goes “If you don’t like the heat g e t out of The kitchen. Off I go. Back to First Mineral, I hope gold soars and Neumeyer makes FF his t hired billion dollar success story. I could sure use a sky rocketing stock.

I wouldn’t put any importance on little 10-20% moves in stocks like this — either they’ll fail much more dramatically than that, or they’ll have the potential for huge returns.

Echo that, anyone who gets out of a tiny stock like FF on a 5% down move is not going to very successful in the junior mining sector.

Gold stocks are being overbought. Brexit? If one follows politics like I do this will turn out good in the long run. GB is so tangeled in that they can only leave by going down the drain. (it will take at least ?10 years to get rid of the common market laws). On the other side EU will have serious problems if they let them go. A compromise will be found. (1-2 years)

Could be, and gold going back down is certainly the big risk with any gold stocks — they’ve mostly at least doubled on a ~20% move in gold, so guess what happens if gold goes down by 20% (or worse)? I think gold has the potential for a meaningful move higher over the next couple years as currencies keep trying to compete themselves lower, but the dollar is staying awfully firm and US bonds are still relatively attractive for big money. I try to think of gold stocks as a leveraged bit of insurance in my portfolio — if they’re doing well, probably the rest of my portfolio will be doing pretty lousy, and vice versa. I like the leverage of mining stocks and royalties because I don’t want to buy all that much insurance and commit a lot of capital to that insurance, and I only want to insure against really bad stuff. Gold equities exposure is something near 10% of my stock portfolio these days, which is on the high end of my typical exposure mostly because the mining stocks have gone up so much.

Travis, I completely agree with you. It is possible gold could go down but I don’t think it will go down very much. July is normally a great seasonal time to buy. India looks like they are going to have a good monsoon so that will put money into their pockets. They don’t trust banks and normally buy gold. I think if gold holds above $1270 through July we are off to the races. I am going to buy on any dip.

I prefer gold producers and royalty companies. I keep a very small position in speculative juniors. I think you could make a huge amount of money over the next few years but you need to be very selective and not believe anything your read by the newsletter writers…especially the ones involved in private placements being mentioned by newsletter after newsletter. This is why I will avoid First Mining.

You do us all a great service by helping us figure this out. Thank you.

Worth considering here: The US subsidiary of First Mining Finance, a Nevada corporation, could issue a private placement under Regulation A, to US investors, for up to $50 million, and could legally include non-accredited investors among the buyers, under the recently-revised Regulation A that was mandated by Congress in the JOBS Act. There is a lifetime limit to how many times the subsidiary can do that, under Regulation A, but still, $50 million is $50 million.

The advantage for First Mining would be to use a single large Regulation A raise, to amass enough shareholders, to be able to re-list their ADR on the NASDAQ.

Intriguing possibilities, these new laws make.

After carefully reading through the Money Map Press sales pitch, the Accredited Investors Only language appears, but only after multiple pages of gobbledy-gook. This is probably going to alienate some readers, because they won’t want to waste their time, reading what looks like bibble-babble from pathological narcissists in an institution somewhere, for pages and pages, just to learn that they’re prohibited by law from taking the deal. It may attract others…readers who know an accredited investor and hope to distill down these pitches and deliver them for a finder’s fee of some sort. which will make it interesting to see if Money Map Press is still in existence in 2020.

Their target are likely the “mass affluent” — the newsletter world’s favorite customers, dentists and lawyers who have high salaries but no time or inclination to analyze investments. I suspect the private placement is largely promotional from First Mining’s perspective, they already pay stock promoters so offering up some shares through a well-publicized placement through an extremely promotional newsletter publisher helps to raise the company profile with other investors as well. My suspicion is that the placement is extremely small, though that’s just a guess.

Indeed, targeting the mass affluent and greed-induced financially ignorant.

Does this include a free drink?? If this is that involved and it takes pages of disclosure, etc. it probably won’t end well for investors. Self dealing anyone?

I have no interest in this MMPress deal, but I have noticed that another publisher, Weiss, Inc., has also been pushing more esoteric investments, the latest being Larry Edelson’s “Gold Mining Millionaire” which he claims will specialize in junior mining warrants. They have been selling option services in the last couple of years, too, as a way of amplifying the appeal to greed.

I don’t get it. If you look at cumulative returns your money should be in gold because the gains in bull markets are much greater than the looses in bear markets, what am I missing here?

The main thing missing is that this is history. Gold has gone up dramatically since 1970 when the dollar was decoupled from gold… but that doesn’t mean the past will necessarily repeat, and the two big monetary changes for gold in the US in the 1930s and early 1970s certainly had a big impact on the price in dollars.

And gold is still well off of the highs of the early 1980s if you use inflation-adjusted dollars… so the other major thing missing is inflation — gold has also risen in inflation-adjusted terms, but the impact has been less dramatic. There’s an interesting inflation-adjusted gold price chart here that helps to provide some perspective.

Nothing is ever as easy or as certain as the “gold must rise from here, and forever” arguments that many folks make. I expect the odds are pretty good that gold will rise over time in dollar terms, mostly because I think the dollar is likely to shrink in value over time as it always has (that’s inflation, money gradually becomes worth less… which encourages people to spend or invest it instead of just sitting on it, and that need to use money instead of holding it helps provide some impetus to keep the economy chugging along). But that doesn’t mean I’m at all certain about what gold might do next year, or for the next ten years, I’m just expecting that they’ll have some solid resemblance to the last 50 years — and it’s important to always keep in the back of your mind that they might not.

Thus the necessity to diversify away from yourself, and don’t let the logic that seems impeccable to you kill your portfolio if the world fails to follow your logical path. That’s what kills many investors, the absolute certainty that gold will rise or will fall, or that X will be the next big thing… there’s always room for each of us to be quite wrong about the future.

Stay far away from “Money Map” products…they are snakes and fraudsters!

I purchased Money Map Project 2 years ago when oil was over $100 per barrel. Kent Moors made it sound so good that I couldn’t get my money in soon enough. Well, that would have been awesome when oil was $120 a barrel. When it is below $50 (or in the $20’s and $30’s like it was recently), my $67,500 investment has returned only $4300 so far. I think it will improve as oil prices rise but I am not holding my breath! I think gold is on a better track so I may try this one to even the score a bit!

Thanks for the update, I was wondering what had happened with those wells Moors was selling.

I don’t understand: my e-mail from Money Map Report said, “The private gold play that only you can access”, so how did Travis find out about it?

I read the same ad you did, they didn’t try very hard to obscure the name of the stock (they even used Keith Neumeyer’s name) — I just tried to explain what they’re likely doing with the private placement. I don’t know the PP terms or any qualifications or restrictions on the new placement units, those specifics are indeed still “private” and you can likely only get them from Money Map or from First Mining.

I don’t know whether Travis invested in First Mining because of my original write-up. but you cam check the archives to see when I first mentioned it. For me as a non accredited investor who got in early at a low price paying $4000. to save 6c on a stock even with the warrants would simply make no sense. Stocks like this can be very volatile so simply adding to my stake on any price dips is the way to go as long as its progress remains positive and the precious metals sector remains the place to be as it has been so far this year.

Even as an accredited investor I like your advice

Posted this before – Money Map Project One was Always going to be a disaster for participants, regardless of oil price ……

Money Map Project One violated ALL TEN of the Mr. Moors’ purported 10 requirements for investing. The pap in his marketing nowhere is backed up in the PP documents.

The documents, if you bother to actually read them are very transparent. It is quite clear that if you invest, they will take all your money and might some day give some of it back to you. To start with they will take 25% of your money and put it in their pocket as a direct unaccountable payment. Then they will take another 12.5% of your money to pay themselves $850/acre for land they bought at $500/acre for a previous project that went bust. Oh and Wells 16-25 of the wells you were buying? Well they aren’t covered by your initial investment – those wells are going to be paid for by the revenues from the first 15 wells (if all goes well). And by the way – everyone else involved (Silver Tusk) is shouldering no risk whatsoever because the risk is all on you the investor, with whose money everyone else first and foremost is being kept 100% whole. This program could drill nothing but dry holes and the Managing Partner and its affiliates would walk away with $9 million, plus reimbursement for all management costs, plus $4.5 million for leases they currently own for a failed property leftover from a prior failed project, plus all costs and profit for drilling nothing but dry holes. Historically they on average have returned approx 15% if invested capital back to investors (Not Profit but invested capital) – and have run at just under a 50% dry hole rate. This is all in the documents. Moreover – it is explicitly stated in the documents that any investment made is based only on the basis of those documents and that they were responsible for no other representations made about the investment. Oh and by the way, their geologist’s report is not to be relied on by you for investment purposes – you should hire your own independent geologist before investing, etc. etc. etc. Silver Tusk et al are bulletproof. They told you exactly what was going to happen – in writing – and if you invested you signed off on it. Moors and MoneyMap are the only ones on the hook for false representation. There was no way in hell the project was EVER going to perform as they represented. You might be able to get your $5,000 back, but as to your actual investment, if you invested you signed off that you had read the prospectus and the reality of the investment was laid out chapter and verse in that document. The operators have only managed to repay capitalization costs on two wells – EVER and both of those wells were drilled prior to to 2009. To repeat – Their total repayment on all of their projects as presented in their own documents is about 15%. That’s not profit – that’s repayment of invested capital total over the life of all their projects.

We paid the $5,000, read the docs, and sent him a letter saying they must have sent us the exemplar for what not to invest in by mistake and asked that they either send us the documents for the project that actually meets all 10 of his stated criteria, or in the alternative send us back the $5,000. They sent us our money back.

Thanks, good perspective!

Travis:You are owed a great deal of gratitude for your in depth analysis of this

MMP private placement offering. Best advice I ever got was from an antique dealer trying to sell me an expensive item “when in doubt,DON’T”

A grateful GS subscriber

Bill

The cynicism here is so thick you could cut it with a knife. I admit I don’t have a lot of faith in Money Map Press, but that dosen’t mean that anything they say is automatically bad, each situation has to be judged on its merits.

Keith Neumeyer has one of the best track records in the precious metals business and when other multi-millionaires like Doug Casey, Eric Sprott, Rick Rule, and Marin Katusa make major investments in a new project he undertakes with a big commitment of his personal money. and when he has already built BILLION dollar companies twice, whats not to like? To say nothing of other highly successful entreprenuers like Robt. Friedland, Ross Beaty and more using the same business model of land banking, the RISK level is pretty low in my books. Yes the price of gold COULD go down, but given the world level of DEBT through unrestricted money printing it is highly unlikely except for brief and manipulated dips engineered by the powers that be. There is a WAR going on between the Central Bankers that created the Federal Reserve Act Ponzi scheme in 1913 to create a monopoly in creating what amounts to counterfeit currency with no intrinsic value.

Only gold and silver are real money, anything else is just CREDIT created out of thin air circulating as currency. If you don’t understand the difference between currency and real money then educate yourself by googling Mike Maloney and listening to his excellent video’s on the history of money, and/or read the book The Creature From Jekyll Island by G, Edward Griffin.

In the face of hyperbole and marketing promises, cynicism (or at least skepticism) is the most valuable tool for the individual investor.

Excellent points . I agree this stock has pretty impressive backers deserves some personal investigation despite the dubious people at Money M. They and Agora and Stansbury Research have pretty close ties and over the years they have become a little more fast and loose with the facts. The best one I came across was Chris Mayer. He was too good in fac t; the founder of some of these letters, Mr. Bonner pulled him away from his letter which was what I thought a good investment letter should be, (100x baggers), in less than a year after he started it. I am going to look up his book on that subject, (C. Mayer) because he is now the proud author of a $2,,000 letter. Mr. Bonner admits he doesn’t know much about investing but years ago he saw a lucrative opportunity in “helping” people to make decisions about stocks. So he hired a bunch of talented sales people, and I think that he put more and more pressure on them to produce, because I noticed that the cheap letters gave useless tips and they reserved the best tips for the well moneyed people. Can you imagine paying $4000 sorry $2000 with the discount? Sorry I am getting long winded. But I noticed he paid good money to pick up people that actually had credentials, like Kent Moors, Robison, and C Mayer and just recently Tom Gentile on Options for the $2000 range right off the bat. He is actually someone I would trust and listen to on options, because he has written for Technical analysis of Stocks and Commodities for a few years. Two other high priced “talent” guys are Efrig, not sure of the spelling but he has good credentials and Althucker ? who already made a fortune he says in getting in early on tips from inside investors in startups . If I was rich it would be my dream to push and write a newsletter for fun, wouldn’t anybody? How much are they getting paid to bother doing that, leaving a life unrestricted from money worries, and write a investment newsletter. I guess my long-winded point is that these letters are just sales vehicles, and my feeling is that they are coming close to a legal line when they say or hint that they have some private placement. As I said below they as far as I could see did not have that with KLH, they were just waiting for it to migrate to the Nasdaq from the TSX Venture exchange which they said was not a real exchange but more like OTC but it isn’t. Anyway I really like the feedback on your site Travis, it is one of the best on the web in my opinion. Sorry for being long-winded. Chris Mayer and Tom Gentile are the real deal I think. Timothy