Today, we take you back to 2012… The Motley Fool is promoting it’s “$2.2 Trillion War for your Living Room” stocks again, and the ad is almost identical to the version that first started circulating in the Fall of 2012.

That’s not all that shocking, of course — once a newsletter publisher finds an ad that catches the eye of potential subscribers, they have every incentive to make sure everyone with an email address sees that same ad at least a few times a week. But this one got some folks curious because it’s being released as “A MOTLEY FOOL INVESTIGATIVE REPORT — MARCH 25, 2016”

Which it sort of is, in that there are a few comments about the fact that these picks were made a couple years ago… but they continue to keep those older picks “secret” in the ad and encourage you to sign up to get your full “Golden Age of TV” research report and a subscription to Motley Fool Stock Advisor to learn more. They also indicate that those three stocks have done spectacularly well, though they use the time period from 2012 to 2014 to illustrate that success, regardless of the fact that we’ve had another 18 months since then that could have been included, had the “Investigative report” really been done on March 25.

So… since they’re going to re-mail the same ad with minor updating, we’ll do the same thing. What follows is the identical article I published on October 15, 2012 identifying the three stocks the Fool was picking… and then stick through to the end, and we’ll see what their performance has been like and check the current valuations. I’ve also left all the original comments appended in case you want to see what other readers think.

—from 10/15/2012—

The folks at the Motley Fool have pitched a lot of “big change” stock ideas over the years, from the “end of ‘Made in China'” (3D printing) to the “Death of Microsoft” (cloud computing), and these email campaigns always get a lot of attention from Gumshoe readers … both because they’re well pitched and because the big trends they describe often do, at least in broad terms, seem well-grounded in reality.

So it caught our attention when the floodgates opened over the weekend and thousands of readers (OK, dozens — but still) wrote in asking about the latest pitch from them, called “Television 2.0”.

It’s a long ad, as they always are, and it’s signed by one of the tech folks at the Fool because he tells a personal story about taking his daughter to school and having her throw the epiphany in his face that yes, teenagers don’t need traditional cable TV anymore … but it’s really an ad for Tom and Dave Gardner’s Stock Advisor newsletter, the flagship publication of the Motley Fool, and it’s about how content creators will be the winners of the “war for your living room.”

Here are a few excerpts from the ad about the big picture — which is basically just that more people are getting their video in untraditional ways and video and cable providers are losing leverage:

“Because the percentage of households with a cable or satellite subscription is now declining for the first time in the history of television.

“3 million Americans have already cut the cord, including 425,000 in the past 3 months alone.

“And according to Credit Suisse analyst Stefan Anninger, those ‘cord-cutters’ are joined by a new group … the “cord-nevers.” A full 83.1% of new households are choosing to live without pay-TV.

“No wonder Business Insider reports that the cable/satellite industry is ‘starting to collapse’…”

And this about “how we got here,” including comparisons to old monopoly businesses like the music labels, phone company, etc….

“We started paying more and more good money to get less and less good programming.

“And we put up with it for too long.

“I mean, millions of Americans dropped newspapers, long-distance telephone service, bookstores, traditional stockbrokers, record companies, travel agents, and department stores, even though they were actually quite happy with those businesses.

“It’s just that something better came along.

“But here we are still clinging to this outmoded television delivery technology that we’re all really unhappy with.

“And now that something better has come along for this too, it’s time to act.“Not just as consumers, but also as investors.”

And then he preemptively covers that concern that’s probably popping up in your head right now: In most cases, the fastest internet service you can get is from … your cable company (or another hated monopolist with bad customer service, your local phone company), and won’t they find a way to shut down those pipes if you stop paying for the content they sell through their cable box?

“… another big problem had occurred to me.

“Even if I quit cable, won’t I still be paying those same #$!&(&*$ for my internet service?

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“You can use your imagination to figure out the actual word I said.

“But it turns out that Tom has been researching this same puzzle for months. And he’s already found the solution….

“Google Fiber. And it could be just as revolutionary as Google’s search engine was when it debuted…

“Making our internet connections 100 times faster (fast enough to watch TV and record 8 other “streaming” shows in high-definition all at once, with no herky jerky download delays). And all for the same price most of us pay our cable companies for internet right now.

“In other words, it will completely break down the wall between television and the Internet. And put the cable companies out to pasture.

“CNN Money is calling Google Fiber an ‘audacious bet.’

“But Tom says it just makes sense. (And he should know…he recommended Google in Stock Advisor on July 20 when he found out about the Fiber project, and has already made a 18% gain.)”

What is Google Fiber, as we go off on this tangent? It’s Google’s effort to push for better data service by buying up unused fiber optic cable and offering up a test bundle of tv/data/phone at a set price — it’s very much a test, here’s how the ad describes it:

“… other companies … tried to build a fiber-optic information superhighway over the years (including the cable companies) [and] left a lot of unused wiring. It’s called ‘dark fiber,’ and Google is quietly buying it for pennies on the dollar.

“Meanwhile, they’re plotting their next move — now that Google Fiber reaches more than 90% of Kansas City, they’re cutting deals with ESPN, CNN, TBS, Cartoon Network, plus (you guessed it) the NFL Network. And placing help-wanted ads for national sales representatives on their company website.

“Which is leading some technology watchers to conclude that the Google Fiber experiment in Kansas City ‘is not a test’ but rather ‘a takeover plan.'”

It’s hard for me to imagine Google pouring trillions of dollars into wiring the entire country, my assumption would be that this is all part of an attempt to push other people (the telcos and cable companies, mostly) to improve connection speeds by giving them a little frightening taste of competition, but that’s just my guess. Right now it doesn’t cost Google that much because it is literally only available in a few “fiberhoods” of two cities, and those two cities are Kansas City, Missouri and Kansas City, Kansas. Still, I must admit that if they had this service available in my town I’d be tempted to jump on it — resentment of incumbent providers runs high, though unfortunately it’s pretty much in inner cities where there’s enough population density and “dark fiber” to make new startup services feasible on the cheap.

More from the ad:

“I was starting to think that Google would be my big winning investment in ‘Television 2.0.’

“But David’s research has now convinced me otherwise….

“You see, Google Fiber isn’t the biggest immediate threat to the cable companies. Because it might take a few years to complete its nationwide roll-out.

“What would really make me sweat if I was the CEO of Comcast, Time Warner, or DirecTV, is a tiny detail buried on page 555 of Steve Jobs, the best-selling official biography of the Apple CEO written by Walter Isaacson.

“(David’s been watching Apple closely for years — he pointed Stock Advisor members to the company in 2008, right when the iPhone was gathering steam. And they’ve made a fantastic 336.9% return on that investment already.)

“This is the key quotation, from Steve Jobs himself:

‘I’d like to create an integrated television set that is completely easy to use. It will have the simplest user interface you could imagine. I finally cracked it.’

…

“So while some say Apple’s announcement next month will introduce a smaller version of the iPad… the truth is, Apple needs a bigger splash than that to justify the sky-high stock price that comes with being the most valuable company in the history of the world.

“That’s why Barron’s calls the announcement ‘an event well worth watching.’

“Why Computer World thinks that Apple is preparing a ‘sneak attack’ on the TV market. And why The Atlantic says ‘Apple wants to be in your living room. And it doesn’t want to settle for being the screen in your lap while you watch TV. Apple wants to be the TV.’

“It’s also why you may need to act NOW if you want to position yourself for maximum profit in the ‘holy war’ for control of television that will be waged in 2013 and 2014.”

Which, as you read through, might make you think he’s recommending Apple again — but that’s not the case either. He lays out the competitive landscape for TV viewership:

“There’s the cable and satellite companies clawing to hold onto their trillion dollar revenue stream.

“Meanwhile, there’s Google attacking through its fiber optic wires underneath the street.

“And now Apple opening a new battlefield in the living room.

“Not to mention other industry heavyweights that already offer popular ‘Television 2.0’ services with a far greater toe-hold than Google Fiber or Apple TV.

“Like Amazon, which has more than 10 million video on-demand subscribers in its Prime service.

“Or Netflix, which has more than 27 million subscribers watching movies and TV shows through its interface.”

And then gets to his “content is king” realization:

“David and Tom sorted it all out for me with something they called ‘The Cheerios Test.’

“And sent me running to my online brokerage…NOT to buy Google, or Apple, or Amazon, or Netflix…but to buy two stocks I had never heard of before, and a third one I would have never even considered…

“You see, with the brilliant strategy they gave me, it doesn’t matter which corporate giant gains a decisive advantage in this war…or when.

“Because as long as you know how to invest in these 3 stocks, you’re in good position for any outcome.”

So what the heck is the “Cheerios Test?” Here’s what he says on that:

“I love Cheerios. (Better than Raisin Bran or Froot Loops.) I eat Cheerios. (Every morning!) But I don’t really care that much about who I buy them from or what kind of package they come in; I just care about convenience and price.

“That’s when it hit me.

“They were saying that TV was basically the same.

“What we really love are TV shows. Right?

“My daughter likes Glee. My son likes Family Guy. My wife likes Top Chef. And I like football.

“It doesn’t really matter what screen we watch them on, or what time of day…or what network, cable company, satellite dish, website, app, or gadget delivers them to us.

“Our shows are our shows!

“A recent Forbes magazine article agrees. It starts with an alarming headline: ‘The Death of Television’!

“But it goes on to explain that rather than dying, TV is about to be reborn.

“And in the world of TV 2.0, we’re in control.”

So yes, it’s about who owns TV shows and can get them to you. This has been a matter for investor debate for many years, and you’ve probably heard the “content is king” argument before, though it’s held a bit stronger for video content than it has for newspapers, magazines and songs so far.

They give a rundown of some of the major content showdowns between content owners and distributors in recent years, many of which have led to better payouts for content owners:

- “Like the AMC channel (home of Breaking Bad and Mad Men) staring down the Dish satellite network.

- Fox playing chicken with Cablevision and almost blacking out a 2010 World Series game.

- Viacom (which makes The Daily Show, Jersey Shore, and Spongebob Squarepants) strong-arming DirecTV.

- The Starz movie network pulling out of Netflix.

- And the Madison Square Garden channel taking its New York Knicks games away from Time Warner cable during the height of “Linsanity” this spring.”

And there are plenty of other examples — this is a flip from where things where 10 or 20 years ago, when upstarts like ESPN or Fox News were paying cable companies or providing free or very cheap content just to get distribution. Now that content is often what drives cable and satellite subscribers to renew, so the fees content providers are charging are climbing dramatically, and cable companies are chafing… but the loss of the cable monopoly is hurting them, since so much of this content can also be accessed online and the providers of genuine hits have leverage both to get better deals for those hit shows and networks, and to force more “bundling” of their weaker offerings that are trying to gain traction.

So that’s a long bit of chatter to get through as we finally start to get some hints about which companies they’re picking:

“Why you need these 3 stocks NOW

“We’ve seen that on-demand direct distribution to the customer changes everything.

“Just like it did for online airplane and hotel bookings with Priceline.com, and online purchases of books (and just about anything else) on Amazon.com….

“Which gives content providers the upper hand — regardless of whether they’re going through traditional carriers like Cablevision or Time Warner, or new challengers like Google, Apple, and Netflix….

“Tom and David think these three winners are about to go on the kind of epic run we only see once every 10 years or so.

“And it’s hard to disagree. Because as you’ve seen in this report so far, the next revolution in television has only just begun.

“Once more people find out about Google Fiber and the new Apple TV set over the coming days and weeks…the war for the living room will be what everyone’s talking about.

“And that means even the Wall Street skeptics will finally come around…

“Which gives you a short buying window. Fortunately, there’s still time to join those Stock Advisor members and cash in — but you may need to act NOW.

“I wish I could tell you the name and ticker symbol of these 3 uniquely positioned stocks. And if it were up to me I’d probably just spill the beans.

“But my friends in the Motley Fool customer service department tell me I can’t, out of respect to the members who are already paying for our Stock Advisor service.”

Which is where your friendly neighborhood Stock Gumshoe jumps in, of course — I can’t give you their full report on these stocks or tell you exactly what advice they might be giving, but I can at least sniff through their clues and tell you the stocks and the tickers and give a little basic info so you can go forth and researchify on your own.

So let’s get to it, shall we? First!

“Company A is an $89 billion powerhouse that owns more than 100 global television networks, plus 7 movie studios, 4 video game companies, and hundreds of websites. Not to mention a little-known research laboratory that’s developing the next generation of TV technology. (Like a new system that lets you use any object in your house — including your couch, your coffee table, even a glass of water — as a remote control). In fact, this company’s growth potential is so strong that legendary hedge fund investor George Soros just snapped up a million shares.”

Well, probably no surprise to you there but this one is clearly Disney (DIS) — and yes, you probably also know that it’s an entertainment and content powerhouse as well as a travel and technology company, owning huge content-spewing brands like ABC and ESPN as well as the eponymous studios and cable networks and relatively recent acquisitions Marvel and Pixar, among many others. They’ve gotten so big now that it’s hard to pick just one “crown jewel” from their assets, but ESPN has probably been the single most powerful content provider in the cable/content wars, with what seems like almost unlimited power to raise per-subscriber fees — after all, ESPN gets both huge live viewership (sports is watched live, mostly) and a strong “young guys” demographic that brings in huge advertising dollars from the film studios and beer and car companies (among others).

And yes, it’s hard to argue with an investment in Disney — it’s got a fortress balance sheet, it’s a blue chip company that’s incredibly profitable, it has become a dividend growth company over the past decade, and it’s reasonably priced even after the stock has gone up about 50% in the past year. I guess the only real argument against building a position in Disney at times like these is that it’s also a tourism driven and hit-driven company, so there have tended to be opportunities to buy the stock cheaper in years when theme park visitors are down, or when they have a big flop year with their movies — though it can be hard to nimbly watch and take advantage of those things. The John Carter film was a huge flop for Disney relative to expectations over the winter, but even the announcement that they would book a $200 million loss on the film in the Spring failed to keep the stock down for very long, largely because that news came right around the time they announced that mega-hit The Avengers made over $200 million in ticket sales on its opening weekend.

I’m sure no one will get fired for recommending Disney, but this is one that, were I to buy it as a long-term hold, I’d probably nibble now but try to scale into it over a couple years and hope for a couple bad tourist seasons or a lousy Christmas movie slate to bring dips in the stock. I did own Marvel Entertainment years ago, which was a hugely successful recommendation of David Gardner’s back when they were on the verge of bankruptcy and the first Spider Man movie had yet to be released (and years before Iron Man and The Avengers made the Marvel stable of characters look like such a no-brainer goldmine), but I don’t think I’ve ever owned Disney.

Still, if you feel like there will be a full-fledged “war for your living room” with several companies vying to provide live TV, it’s hard to picture a company having more leverage in this than Disney, since they bring with them ESPN, ABC and their own Disney Studios content, and there isn’t a single cable provider in the country that could sell their service effectively if they cut ESPN. That leverage might not impact a $90 billion company that much on an earnings per share basis, particularly as this “war for your living room” will likely be waged over many years and through many test locations, but it’s still leverage.

Oh, and yes, they do have a research division that came up with a crazy cool technology that could turn your houseplant (or other stuff, I guess) into a remote control — there’s a story on that here if you’re curious. It’s not going to be financially significant in the next few years, I would bet, but it is cool.

Next?

“Company B rose from the ashes of a declining newspaper empire. Now it’s cultivating a niche TV audience that’s especially attractive to advertisers. Allowing this company to generate more than $2 billion in revenue from just 1.7 million viewers…At $1,290 ‘revenue per viewer,’ that makes its programming 76% more profitable than the average television network.

“According to Investor’s Business Daily, even though the entertainment industry is extremely lucrative, it actually has ‘a puny number of high quality stocks.’ And those are two of them.”

This one is a company I don’t know well at all, other than being quite familiar with the fact that they’re responsible for the celebrification of the interior design, real estate brokerage, and cooking industries — this is Scripps Networks Interactive (SNI), which owns the Food Network, HGTV, the Travel Channel, etc. Scripps did indeed start as a newspaper company, and was one of the dominant newspaper publishers in the world for the second half of the 20th Century (you know, back when newspapers made money), as well as a major local media company through a network of local TV stations and cable companies, but about 20 years ago they started spitting some of that prodigious newspaper cash flow into content creation, building and buying those now-well-known niche cable brands, starting with HGTV. Four years ago they split the company, so the original E.W. Scripps (SSP) still owns the 20 or so TV stations (mostly ABC affiliates, coincidentally) and 13 mid-market newspapers around the country and is a stagnant, barely profitable $600 million company, and Scripps Networks Interactive owns the five cable channels and is a rapidly growing, highly profitable $10 billion entertainment force. Or farce, if you’re feeling cynical about our desperate desire to watch other people saute onions and declutter their mud rooms.

You can certainly argue that Food Network and HGTV are strong enough, with loyal enough viewers, that they should command premium and growing fees from cable and satellite providers — if you’d asked me, I would have thought that this celebrity chef fascination was a flash in the pan when Emeril Lagasse was the standard-bearer five years ago, but even though he has moved on there are still dozens of stars being made like Guy Fieri and Paula Deen (who are, in turn, turning themselves into chain restaurant brands). So I’m the last person to suggest that I can tell where this trend goes, but these cable networks seem to have a pretty good thing going — they have low-cost content, they build celebrities who must, I presume, work cheap as they build their personal brands, and when those fizzle or the stars demand more (a la Emeril, I suspect), they move on and build the next star. It looks like it’s working pretty well — they did quickly end disputes with AT&T and Cablevision when they were briefly shut out of those networks for a few days during contract renewal talks a year or two ago, and I presume that it was pressure from subscribers that led to those resolutions, so this does seem to be a content provider that has a fair amount of leverage over the distributors — and, of course, a solid web presence.

I’ve never looked closely at SNI, but I did skim through the last quarterly report and note that while they are growing revenue pretty nicely, they’re expecting to grow expenses more quickly this year — I don’t know if that’s a sustained trend, but it’s an indication that their programming costs might rise faster than their advertising revenue and subscriber fees, which obviously would be a huge weight for the business to carry since they’re already carrying a premium valuation (about 20X trailing earnings). That could well be a temporary thing, I don’t know, but it’s something to keep an eye on — we’re certainly moving into an era of more distributed programming, with more online video … but my impression is that advertisers still tend to pay substantially more for targeted, timely mass attention through hit shows than they do for online advertisements, so that transition is closely watched by both advertisers and content owners. There’s also a competitive aspect to this space, since HGTV and Food Network have to maintain their brand positioning against plenty of other niche cable channels as well as against upstart online brands in their space, but they are clearly a leader in that competition now so they do have at least some advantage.

Next?

“Company C didn’t make IBD’s list…because it isn’t really an entertainment company. In fact, even though it operates some of the most popular channels on TV (reaching more than 1.5 billion viewers in 180 countries), its business model is completely different. Its most important customers are actually elementary and high schools. And now it’s entering another $25 billion education market with a breakthrough product that’s half of the price of the traditional choice. So you can see why this company has been able to grow its quarterly earnings per share by a fantastic 22.5% in the past year.”

Well, I don’t know if I agree with that summary of the company — but we fed it through the Thinkolator and this is pretty clearly Discovery Communications (DISCA and others, more on that in a moment), the other big cable network company that gets a fair amount of investor attention. Like SNI, they enjoy the benefits of all of the original “reality” shows — low production costs and niche marketability. They call themselves “The World’s #1 Nonfiction Media Company” and produce a bewildering array of programming for their popular channels, including Animal Planet, Discovery Channel, TLC, The Oprah Network, etc. And they are taking advantage of international distribution in a big way, partly because their documentary, reality and educational content is very easy and inexpensive (compared to fiction, at least) to translate to different languages and cultures.

But I don’t know that I agree that schools are its most important customers — or that their “breakthrough” will really turn out to be such in the “another $25 billion market.” They do have a strong educational offering, with streaming content that’s available in about half the schools in this country (replacing the beloved filmstrips of my youth on those days when the teacher has a migraine, he says cynically), and they are moving into “interactive textbooks” in an attempt to help shake up the $25 billion textbook industry, but when it comes to financial performance it’s all about subscriber fees for their networks from cable companies, and advertising revenue. In the US, they’re close to 50/50 ads and subscriber fees, and internationally subscriber fees are a stronger revenue generator at the moment — “education” is a rounding error when it comes to revenues and earnings at Discovery, though it’s certainly possible that they use that division to drive earnings or cover expenses in some other way. Their textbook initiative, called “techbook,” is yet another way for them to leverage their content into the education sphere — using the educational content they already produce to build interactive textbooks for schools, but I wouldn’t put too much weight on that. Education is a small part of Discovery’s income statement, and it’s not as though folks like McGraw-Hill or Pearson, dominant textbook publishers, have failed to notice that there are opportunities in technology-enhanced publishing for students… it may end up working well for Discovery, but I can’t see it being a major part of the business in the next five years, my guess is that in 2018 we’ll still care more about Bigfoot, River Monsters and custom choppers than we do about Discovery’s “techbook” business.

Discovery is also one of those multiple-class stocks — DISCA is the A shares, which get one vote per share, DISCB, B shares, gets 10 votes per share, and DISCK, C shares, gets no voting power. DISCK trades at a bit of a discount since it doesn’t get the voting power, which might be interesting for small investors who understand that they don’t get any corporate voting power anyway, though you can imagine a proxy fight or activist investor situation when voting shares should trade at a substantial premium, too, so those things are always a tough call — and really, though I hold shares in companies that have “lower class” non-voting or fewer-votes shares (like Berkshire Hathaway and Google), I don’t like to encourage that activity. The B shares are very illiquid, but currently priced about the same as the A shares.

Discovery is extremely profitable and growing nicely — their growth in the last quarter was not as strong as SNI’s, but they’re more than twice as big and have profit margins that are a bit stronger, and they are really the leaders when it comes to leveraging content internationally and across platforms, which helps to significantly increase profitability when they get their content right. I have more confidence in Discovery than I do in Scripps, though that may just be because they have a broader array of channels and hits and niches they can play to beyond Scripps’ core niches of travel, cooking, and home improvement… or it could just be a reflexive response to the fact that Vanilla Ice hosts a real estate show for Scripps on their DIY network, and I have a hard time believing in a world where that’s possible.

This is clearly an interesting time of transition for television and video entertainment — I don’t know if we’ll end up “giving up” on cable TV en masse in a surprisingly fast transition as happened with CD players and is happening a bit more slowly with printed newspapers, but there is a move to more online and streaming content and there are plenty of companies who are working to further that transition with hardware, software, and streaming libraries, including Netflix and Google and Apple and Amazon and hundreds of smaller players, but it’s also quite possible that the transition will be a lot slower, and there’s still a lot of power in the hands of the TV networks and the cable and satellite distributors … even if it’s not as much power as they had ten years ago. There are, for example, plenty of places to watch shows online — and even lots of increased investment in professionally produced “channels” online through Amazon, Google, Netflix and the like, all of whom are funding content development as well as trying to expand their distribution businesses … but traditional TV still has a very strong position with the people who care the most: advertisers. Online video ads are a very fast-growing market, but reports I’ve seen indicate that they’re only about 5% of the size of the traditional television ad market, and the strength of television has always been it’s power to create a mass market and homogenize society, urging essentially every single American, over the space of two or three days, to see the same movie or visit the same store at the mall that coming weekend.

It’ll be an interesting thing to watch, seeing if the increasing niche-ification of media and the distributed content continues to erode that mass market, but I have my doubts that it will happen all that quickly — car dealers and movie producers really want to be able to reach everyone, all at once, and they’ll pay a premium for it … with some exceptions it strikes me that it’s been the advertisers, not the viewers, who are willing to consistently pay for hit content.

But that’s just my squishy impression of the speed of the big picture transition, and it probably doesn’t mean anything. What we get from this teaser are three strong content-dominated companies, each of whom is very profitable and trading at a premium to the market, and each of which has shown enough growth and stability to (arguably, depending on what you think the future holds) deserve such a premium. Think Scripps Networks, Discovery Communications or Disney are right for your portfolio, or the best play on the revolution in video delivery? Let us know with a comment below.

—–and back to 2016—–

Well, the story today is pretty similar to 2012 in some ways, at least as long as you’re using a broad brush to paint the disputes between content owners and content distributors… though Facebook, Google’s YouTube and others have dramatically increased the power and profitability of video advertising on the internet in the last few years.

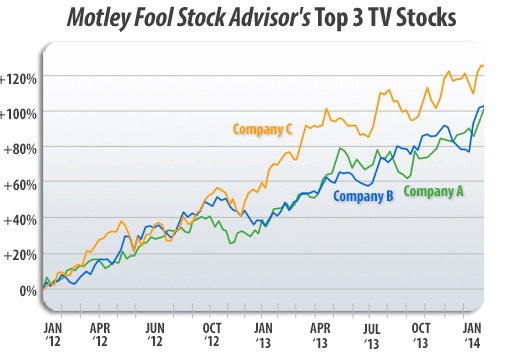

The latest version of this ad includes a chart of the performance of those three stocks from 2012 until the last time they probably really updated the ad, in early 2014. Here’s a screen grab of that:

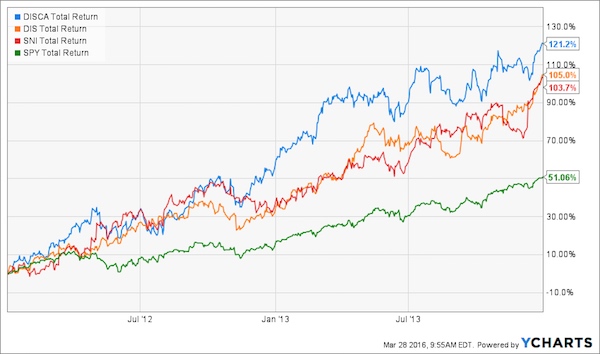

And here’s my version of the same chart, all I really did was add in the S&P 500 as a comparison (that’s the green line on the bottom) — this is a ‘total return’ chart, so it includes dividends:

You can see that the ad isn’t lying about that 2012-2014 performance — all the picks did essentially twice as well as the market. But why are they re-promoting this idea now, more than two years after the end of the chart? Are the stocks still outperforming the market, or are they appealing bargains now? Here’s what the chart looks like if you bring it up to the present:

The S&P 500 is still that green line, now with a total return since 2012 of about 74%… but now that’s a lot better than the total return of Scripps Interactive and Discovery Communications, each of which lost roughly half its value over the last two years. Disney is the only one that has continued to beat the market, despite the fact that it’s by far the largest of the bunch (and despite the fact that it took two serious tumbles over the past year).

I never ended up owning Discovery or Scripps, but I do own Disney now — I bought when it collapsed this year, a dip in the shares that I felt like I had been waiting years to see. What do the valuations look like for these stocks now?

Discovery (DISCA/DISCB/DISCK) is expected to grow earnings at about a 10% rate over the next few years, and is trading at 18X trailing earnings. The stock has collapsed because growth dramatically disappointed over the past few years — you’ll note that the old clue above was that “you can see why this company has been able to grow its quarterly earnings per share by a fantastic 22.5% in the past year”… in the new version they did update the clues a little bit, and Discovery is hinted at with the sentence “So you can see why this company has been able to grow its earnings per share by an annualized 5.2% during the past five years.”

Growing earnings per share at 5% over the past five years is not impressive. Not for a stock that has always been talked about as a “growth” stock, paid its CEO $150 million a year or so ago, and had an average PE ratio in the low-20s for much of that time. To make matters worse, for most of 2013 the stock traded at 40X earnings. A lot of that investor disappointment has come because costs have risen for the content developer, for some of the same reasons that folks have worried about Disney (like the sports rights fees issues — Discovery bought EuroSport a while back and spent heavily on getting the Olympics rights in Europe), and because they depend very heavily on overseas growth and the strong US$ has really weakened those international results. They still have a lot of hits in the “unscripted” TV arena that they helped to popularize, and their partnership with Oprah appears to maybe not be as much of a disaster as it looked like a few years ago, so who knows, maybe they will return to growth, especially if the dollar weakens a bit against other major currencies.

Scripps Network Interactive (SNI), the owner of HGTV and Food Network, is much cheaper than Discovery these days and trades at what appears to be a more reasonable forward PE of 12… though the stock has been in the doldrums because earnings aren’t really growing. Earnings per share are expected to grow only 2% this year and slightly more in 2017, but analyst somehow expect them to reignite to average 10% earnings growth out into the future after that. I don’t understand why, and I’m always suspicious when big earnings growth numbers are based on huge numbers three or four years out instead of growth in the current year (just because the current year growth might be forecastable within some degree of error, but the other stuff is extremely unlikely to be accurate)… so it’s not too expensive to consider, but neither do I find it terribly appealing. But then again, I don’t like the Food Network or HGTV or understand the obsession with watching cooking competitions (though presumably it’s a problem for Scripps that the biggest cooking star around, Gordon Ramsay, doesn’t work for the Food Network). This still seems a thin bet for me on a few channels that I don’t think are likely to be as valuable or as high-growing as the analysts expect — but they do know a lot more than me, that’s just my opinion.

Interestingly, the old “moribund” parent, EW Scripps (SSP), has done much better than the spun-out Scripps Networks since 2012 — the old newspaper and TV station owner has doubled, while SNI is only up about 50%.

And Disney (DIS), which I do own now, is in a different league — it’s ten times larger than either Scripps or Discovery (yes, the clues above said “$89 billion powerhouse” in 2012 and that’s been updated to “$194 billion powerhouse”) and obviously has huge businesses outside of television content. And though I didn’t own it back in 2012, and thought it might be worth scaling into over time, it took me a long time — I bought into the stock last year because the stock got too cheap in the panic over ESPN’s possible problems from the “cord cutter” generation, and it’s still a pretty small personal position. ESPN is by far the most valuable cable television franchise, with dramatically higher fees than any other network and a huge advertising business, and it’s more than 40% of Disney’s earnings, so their future is obviously a big deal for Disney. I personally think the impact of cord cutting is overstated, partly because the trend is gradual and partly because I think ESPN is far likelier to be viable as either a standalone “over the top” channel sold without a cable subscription than most cable channels…. or a core part of new “skinny bundles” that are being talked about as a compromise for folks who want to get rid of $100 cable bills.

But I do acknowledge that DIS may face headwinds at ESPN, partly because of astronomical content costs (buying sports rights), and I don’t count on ESPN being the primary driver for Disney earnings in the future — I just think the market is failing to appreciate the fact that Disney is the world’s best marketer and brand expander, and it so happens that Star Wars and Pixar and Marvel and Frozen and now Zootopia are continuing to bolster the argument that Disney has again institutionalized, after a weak period a decade or so ago, their ability to create hugely valuable content that continually generates blockbuster results. Disney is huge and pretty expensive at about 16X next year’s earnings and will also probably grow earnings in the 10% neighborhood, analysts say, but it’s also, I think, the one real “blue chip” in entertainment, and the one that can work those brands across different businesses better than others (theme parks, cruises, movies, TV shows, merchandise, etc.).

You can see my bias there, of course — I own Disney and like it, and I’m a bit more skeptical of the growth of the other two… but Discovery and Scripps are certainly smaller and less tightly scrutinized than Disney, so there’s a better chance that some “hidden” value could emerge from those smaller shares that, unlike Disney, are still small enough that a big new hit show, or at least a new hit network, would have a meaningful impact on their shares.

That’s all for our trip down memory lane to 2012, and our current look at the same stocks that the Motley Fool continues to tease for potential Stock Advisor subscribers… have a thought about cord cutting, or these kinds of content companies? Other winners or losers in the shifting sands of entertainment? Let us know with a comment below.

Disclosure: I own shares of Google, Apple, Facebook and Disney among the companies featured above, and call options on DIS. I do not own stock in the other firms mentioned, and will not trade in any stock covered for at least three days.

Tom Conner had a new pick he just emailed today

Something about an energy hog in everyone’s house

They’re trading in for a less expensive one. I’m

Guessing Ac/heat. And what is this whole google stock about? Anyone

Have the ticket symbols ?

with the advantage of hindsight, you can clearly see that all 3 of those companies have done well… doubled and more over last few years (dont forget to factor in that DISC A,B and K split at or near 2 for 1)

but what the authors of the vid, and most other seem to be missing is, no matter whether any of the 3 companies take off like a rocket, or remain flat, it really doesn’t matter… it’s pretty much common sense that “on demand” type content is sure to only gain in popularity (and it also follows that traditional type tv programming is sure to stagnate some) … but regardless of how quickly any of it happens, and regardless of what content providers end up the big winners… it’s 100% guaranteed that the the big cable companies will always win… cox, comcast, verizon etc all OWN the coax and fiber that all that content will be streaming through, and they will surely get their tolls for every bit and byte that travels their unregulated, non-public utility designated fiber and coax… at&t and even more so, verizon are particularly well positioned at they not only own hardwired coax and fiber lines, but also dominate the wireless infrastructure… so they will be getting paid for data usage whether you’re getting through your phone, tablet, or at your home

no matter how great any companies content is, and no matter how cheaply they can offer it, the only way to get it to you is through the gatekeepers…. as the percentage of end users purchasing their content from the cable/fiber/wireless owners, diminishes, those companies are 100% guaranteed to begin to throttle speeds and charge per unit data fees on everything… just look at current smart phone pricing plans, and see the future of anything you try to do online, every GB, MB etc used will have a price… all that “content” that everyone wants to see is high data usage video, and as everything keeps going higher definition, higher quality, the amount of bits, bytes, GBs, MBs used to transmit content continually grows….

verizon, at&t, comcast etc are all in far better position to be profitable than any entertainment company… no matter how great the content is and how cheaply it can be produced, you still need a way to get it to the end user, the gatekeepers are always going to get paid

I’d love to see Apple develop a system (and negotiate for space), relying on “broadcasting” from WiFi towers …. NO MORE CABLE COMPANIES! Apple could contract with some of the largest cable tower oner networks to have hardware mounted to cell towers, and “beam” TV/movie content over WiFi for a small basic subscription fee, and then you could “pick and choose” your add-on packages (i.e.: HBO, Netflix, Sports, Movie, etc.).

No more cable lines needed to watch your TV device …. and your account could follow you almost world-wide for viewing!

If Comcast and TimeWarner, and the like don’t want to “play ball” with Apple (or Google), I say screw ’em, and let’s see Apple change the TV/Home Movie environment, just like they did with iTunes for Music.

Go get ’em Tim!

Apple? Like they would provide anything at a low cost…oh never mind your post is dated on April Fool’s day, you were only joking, sorry for being slow to catch that.

Hello.

You will made a Cut Cable TV easy:

1.- Download IPTV.apk from market

2.-In Google browser search for files with .m3u extencion

3.- Download the file in your CPU/phone/Android/Cloud storage (take note of the path)

4.- open IPTV apk and go to settings

5.-In the Local file option put your File with .m3u extention.

6.Back to main screen in IPTV aplication.

7.- Enjoy…!!!. Your cut your cable…! and your have TV.!

for more list, looking for cacmoflixTV lists, area free !!!!

Thanks for the tip!

Give me one stock I should look at for doubling over the next year anyone.

Research this technology and for pennies you can buy stock in this new technology that revolutionizes silk making. On the brink of commercializing spider silk for protective clothing for firefighters and military personnel. Spider silk is stronger than steel and Kevlar!!! Do your due diligence and then decide if this is right for you!

What is this stock Rose-Marie. What is the ticker?

check out symbol ntek. they are cutting edge technology with 4K movies streaming into your Ultra HD 4K state of the art television. yes, they are a penny stock and yes they are downloading 100 Paramount pictures for the viewers to purchase. they have turned down buy outs. the company announced they have embedded their technology,STB’s, into 90 percent of the Ultra HD 4K televisions. they have other movie deals to be announced for conversion to streaming . the share count is high on account of gaining movie deals and adding content. they are adding more and more content. get sum if you believe in them.

Good Lord sir,

NTEK is amongst the highest profile scams of the last several years, their CEO (formerly) David Foley is currently serving time at Taft for his actions at NTEK, not his only rodeo and probably not his last. A recidivist of the first order.

You can not have done even a modicum of DD, anything can double as the stock and co. are pure imagination and promo, but to recommend this leaves me speechless.

Tsk tsk.

DAVID RUSSELL FOLEY

Register Number: 13141-111

Age: 49

Race: White

Sex: Male

Located at: Taft CI

Release Date: 03/14/2017

http://www.bop.gov/inmates/custody_and_care/docs/RDAP_locations.pdf

Good Lord Sir: I have no arguments on Mr. Foley and his past mistake. I am not condemning him for that. He is serving his time. Well, look on the new 4K TV’s in the Best Buy show room, they have UltraFlix embedded in them. That is the product of Nanotech Entertainment. Scam you say, well I gather time will tell. I think they are moving forward. Struggles of course. If you are speechless then I hope you are breathing. Go to Costco and Walmart and such. Ultraflix is one of the 3 or 4 software providers streaming the 4K entertainment.

ok

Gui in this race to have streaming TV and movies come into my android phone and 4K tv who or what do you suggest??

As of Aug 2018 nTRK is worthless

As of Aug 2018 NTEK is worthless

I do know this is old…And maybe I’ll be the last to comment, but the video is still up. So I wanted to comment on motley fool (Or MF as I call them because they are MFers). The only word I consistently come up with is Assholes! They offer some good stock tips, but if the stocks go down they say “Long Term”; Everything is long term, but it’s not that. Just look at that video. The guy claims he’ll tell you the 3 stocks, but he Does NOT. He says it will take 3 minutes; 35 minutes later you’re turning it off in disgust. And that my friends is exactly what it’s like to be a member. I was one and just gave up and asked for a refund, because whatever tips they have; it seems to me their main business is in Spamming you with emails (much like that presentation) trying to get you to buy more stuff from them. It’s maddening and you will hate them. At least I did.

almost 3 and a half years since this report

DIS has done so well, but SNI and Disck not so much

TMF and David Gardner likes to pride themselves in being right 60% of the time in this report that’s not the case.

Where can we find a comprehensive listing of all of the major content companies that trade as public stocks?

pone67 welcome to the Gummunity. 🙂 Here is one of many free stock screeners: http://stockoodles.com/#page/screener/screener.php Best2You-Ben

Thanks for the welcome. I did not find a way to do the specific search I am asking for with that tool. I was hoping someone would guide me to an article that might list the top 20 or so in this category. I love the theme but these companies have already realized tremendous value and I question significant upside.

10 Best Media Stocks for 2016 according to The Street:

http://www.thestreet.com/topic/21501/top-rated-equity-media-companies.html

Media stocks another source: http://www.bullsector.com/media.html

I think those are both wrong focus links in terms of the type of media company. We do not want distribution companies. We want pure content producers, ideally companies with very low production costs. Movie production companies fail this test because 90% of the profit in these businesses end up going to movie stars, not the shareholders. What makes companies like Discovery interesting is their ability generate high profit content at low costs. The whole point of this article is that the Internet is going to give them “free” distribution, so the underlying business becomes even more profitable and gets even more demand that translates to potentially higher pricing. None of the categories in the two articles you linked focus on these kinds of companies.

Are you guys/gals entirely sure your coming at this from the right direction? Seems to me there are only 24hrs in a day. Of those, youve prob only got 4 watching hours (if you work and sleep too). I would guess that 1 hr is spent trying to work out what to watch….another hour wasted in starting to watch something that quickly proves to be junk. So you watch 2 hrs of decent TV per day but paying for 24hrs.

Whats needed is a REALLY good ‘like minded’ review site that tells you what was on yesterday that was quality, so that you dont waste precious time on the junk….then gives you access to just that prog for a pay as you go fee. If someone did this and provided day after access rights, Id subscribe AND invest. But I see 1000’s of available channels with no idea which to choose, and generally I find it 10mins after it started.

Once upon a time, here in the UK, we had just 4 stations. Everyone knew what was on and what was worth watching…..and it was free! More choice has just led to more junk. They are trying hard to destroy the BBC which has brought us junk like Monty Python, Life on Earth, Tinker Tailor, Sherlock Holmes + a grillion others, till the latest; Night Manager…..and no adverts!

I still can’t figure out what percentage of the Motley Fool is frenzied self-promoting marketing machine and how much is really good beyond the horizon insight. I cannot fully trust the analyses of a company that spends so much effort marketing itself–the Fool doth promote too much.

The fools have Bill Mann, who runs their Independence Fund. This is a great fund. All the rest is garbage.

Mann used to work on a few of the newsletters, too, I had a little contact with him years ago and he seemed a decent sort — the three Fool newsletters are pretty expensive and largely underwhelming, and Mann’s on the management team of all of them, though Independence (FOOLX) is the one that has beaten its benchmark. It looks like it has beaten that benchmark, which is essentially the total global market index, because its foreign picks have been better than foreign markets overall, though FOOLX trails well behind the S&P 500 (as all international markets have trailed the US for several years). Seems to be a decent fund, though the expense ratio is higher than most folks would prefer (that’s at least partly because the fund is too small to be really efficient, I don’t know if they’ll cut the expense ratio if the fund grows in size).

Just abandoned DirecTV and went back to local cable here in Sioux City, Iowa area. Tired of DTV signal going out whenever it rained or snowed more than a fraction of an inch. Getting MORE of the channels I like for LESS MONEY than DTV. Also only one or two channels selling stuff versus DOZENS from DTV. Local cable provider installing fiber optics to its customers. How will those MF touted content providers get the programming to my 55 inch HDTV? Is it over the internet? How fast does my internet need to be for proper reception? Will I need the fastest internet available? What will it cost? $100 per month more? $200 per month more? My current triple play–Internet, Cable (1080p HD) & telephone is about $135.

My TV 58 inch 4K 1080i HDTV, for internet TV you need 40 mbps. I have a lifetime deal for 29.99 a month from many years back so I do not know what it goes for now. Added HuluPlus for 8.55 a month, suspend and restart anytime you like without charge, great for busy summer months. HDTV antennas (2) installed for $300.00 one time for local channels and you are done. But this is not so great in bad weather or a very windy day. Roku one time$100. Been disappointed by multiple content providers.

Hey BJI

Heelan High 1967!

Does anyone know how many paid subscribers Motley Fool has ?

Thanks

I bought those three stocks and only Disney went anywhere. Although it could be fair to say that MF recommends a stock for the long haul (like 5 years) while I wanted

to see gain in a month.

For the new investor, my best advice is to get all the free advice you can, which can include watching CNBC or Bloomberg TV, Make note of what stocks are mentioned often in various places. Luckily MF gave me 2 years for $49 each but then started pitching all their other services for more money. As does everyone else. Especially Money Map Press.

What company did David Gardner say will become 23 times bigger than Netflix?

TTD

What are warrants and are they ok? How do you find and trade them. I am not paying 1750.00 to find out.