This pitch from Keith Schaefer started running several months ago, but we’ve had questions pop up every now and then about it… and just recently, he has jumped on November 12 as the key date to urge investors to action (both buying the stock and, naturally, subscribing to his Oil & Gas Investments Bulletin).

So we’re re-releasing this teaser solution piece, and it happens to be a stock I bought some of at the time. The ad spiel is similarly worded to the one we saw back in July, so what follows has not been updated. Since I own the stock personally and I’m also interested to see what they say on November 12 (that is indeed when they release their next earnings), I’ll add some updated thoughts to the end of the article. We’ve also left the original comments from July attached below so you can see if our readers had other useful notes for your consideration.

—from 7/21/2015—

Keith Schaefer is mostly an oil and gas guy — and his latest ads say that he’s putting 1/5th of his own personal wealth, $400,000, into a single stock.

So, naturally, our readers (including Gumshoe columnist Myron Martin) have been asking me “who is it?” Let’s put the Thinkolator to the test and see if we can name it, shall we?

The promise is pretty compelling — the basic pitch is that this is an energy marketing company that is about to get access to Comcast’s customer list to pitch a “bundle” that includes not only HBO and broadband but also your natural gas or electricity service (possibly including solar). Sounds kinda interesting… and it also pays a high dividend, which means that, like many of Keith’s picks, it’s probably Canadian.

But let’s get some of this in Schaefer’s words…

“Comcast…. may now be my second-favorite company.

“That’s because they’ve just created a new ‘energy loophole’ –

“By partnering with my #1 new company.

“And this loophole is so powerful and compelling — I’ve invested a full 1/5th of my portfolio into the trade.

“That’s more than $400,000 of my Personal Portfolio, in this single play – green-lighted by the biggest cable company in America.

“So, if my investment thesis works — and it’s off to a great start so far — it’s going to benefit both of us in a big way….

“I haven’t even mentioned the big cash payouts I’m getting from the double digit yield.

“It’s just over 10%, and I expect these big payouts to increase—a lot.”

Mouthwatering, right? Well, let’s see if we can sift a few more details from the pitch. Here’s how the deal with Comcast works:

“… the entire strategy involves a highly unusual partnership between two companies at complete opposite ends of the stock spectrum.

“One is very very BIG (that’s Comcast), and the other is tiny… a micro-cap hand-picked by Comcast…..

“[customers] get cable, internet and phone – all in one bill, if they want.

“Now they can get their energy bill, too, from Comcast.

“… it could be a guaranteed lower energy bill… and a free gift, like 3 complimentary months of Showtime, HBO and Starz…

“It’s a WIN-WIN-WIN for everyone….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Customers can actually see their monthly energy bills shrink, like clockwork….

“While Comcast gets easy incremental revenue, and my #1 energy pick gets a new customer.”

If you’re not in one of the states where utilities are partially deregulated, this may sound a bit odd — but in about half the states you are able to buy your gas or your electricity from a variety of different suppliers who might offer different deals (prepay discounts, lower prices, “smoothed” bills, etc.), so you still end up paying your traditional utility for the delivery service, but the actual energy might be supplied by any of several providers. All of whom, if my experience in Massachusetts is any indication, will advertise as AT&T and Verizon to win new customers.

So it sounds like Schaefer’s talking about one of these companies, an energy retailer that works through a variety of partnerships to get customers, apparently including “bundle” customers with Comcast or other utility or telecom providers. I’ll confess that I’m not much of an expert in how these companies work, I don’t know what typical margins are — though I imagine it depends a lot on their ability to control and hedge for changing prices for wholesale natural gas and electricity.

More from the pitch:

“And here’s the thing about my loophole company…

“They make crazy offers!

“Basically they are saying – We want you to pay less on your monthly energy bills…

“But you must accept these FREE Premium TV Channels, and other perks first.

“These offers give such immediate rewards, it makes customers forget about ‘things that happened at the old Comcast.’….

“If only 3% of Comcast’s customers take them up on this (that’s WAY less than what Management and Comcast both expect)…

“My loophole company – with its Comcast Connection – will more than DOUBLE its customer base.

“And that means a lot more than doubling earnings and cash flow.”

Other clues? Keith says that they blew out estimates in the first quarter this year, and that there has been insider buying.

And it apparently has fewer than 20 million shares outstanding, with “little debt” — a little surprising for a high yielder, since very often companies that pay 10% yields have to use debt leverage to generate that amount of distributable cash.

We’re also told that there are a couple catalysts coming…

“The first catalyst is Texas.

“In regulated states, you buy energy directly from the utility. They – or the government – set the price.

“But in states where energy is de-regulated, consumers have a choice in where they purchase that energy.

“That means energy suppliers can compete with each other in selling directly to customers.

“And in Texas, consumers can now buy from my #1 stock pick.

“They just bought one of the largest energy retailers in the Lone Star State.

“That gives my fast-growing junior company an active presence in 20 states now, plus Washington, DC.”

And the second catalyst?

“It’s where customers can get guaranteed lower energy bills. And it’s insanely profitable.

“It’s another partnership they’ve signed – a major one, just like Comcast.

“This second catalyst has just started raking in the cash for my biggest investment ever.

“It will generate years of super-high margin revenue—and recurring revenue, with basically ZERO risk….

“They’re in partnership with one of the industry leaders in solar energy — providing roof-top solar power systems.

“Not only does their solar deal give them an incredibly high 50% margin business…

“Even better – they get a recurring revenue stream: residual commissions for every customer they sign up—for 15 full years….

“… they’ve only been in the solar market for a little over a year, and already it represents 10% of company cash flow….

“… the deal is such that this energy retailer has ZERO cost exposure to the solar business… so their risk is zero.

“It’s all pure upside: commissions and ongoing royalties.”

OK, so that sounds fairly impressive. Enough detail to name the “secret” stock for you?

Indeed, the Thinkolator is up to the task — this is Crius Energy Trust (KWH-UN in Toronto, CRIUF OTC in the US), which did indeed go public in 2012 as a 28% owner of Crius Energy, which was a relatively small energy marketer under brand names Viridian and Public Power, mostly in the northeastern US.

They’ve expanded their brands since then, adding a couple partnerships with telecom companies (Cincinnati Bell and Fairpoint) and buying a couple companies along the way, including TriEagle a few months ago (that’s the one that got them into Texas, though in a small way so far)… and just a few weeks ago they did a follow-on offering at C$6.80 that helped them increase their ownership in Crius to 43%, which they think will help liquidity.

There should now be about 17 million shares in Crius Energy Trust, and the shares are right at C$8, so the market cap is about C$130 million or so — though this is also a little misleading, since the only thing the trust owns is 43% of Crius Energy (which is not separately traded), so the whole company presumably has a value of something just under C$300 million… not that this means anything when it comes to the share price, that’s just a way of saying that the operating business is bigger than the stock — so when it comes to operations, they’re a bit bigger than the tiny market cap might imply. That makes me feel somewhat better about the risk on this one, though you certainly do still have the risk that a non-public entity owns more than half of the business and controls it.

The dividend is high, though it’s not double-digits anymore — the stock has come up a little bit, it might be that Schaefer bought in the secondary offering (it would take a while to buy up $400,000 worth otherwise), and if so his yield would be over 10% (the current yield is 70 cents a year and the secondary offering was at C$6.80, a discount to the then-market price of C$7.50. (All these numbers are Canadian, I’m trying not to confuse matters by doing any conversions but the current price of C$8 should be about US$6.18.)

You can see the company’s success and failure by just glancing at the chart — they went public at $10, then collapsed in a couple of sharp moves down to around $3.50 at the bottom in early 2014 when they finally capitulated and cut the dividend (to the current level, 70 cents a year payable monthly), but have come back pretty strong from then as revenue, EBITDA and the number of customers all rose. Schaefer says the problem was their hedging losses, particularly on natural gas when that market was struggling, and that they’ve fixed that with an improved hedging business (and new management of that part of the business).

The deal with Comcast is a pretty new one, launched just recently in their first few markets (Illinois and Pennsylvania, according to this article), and it’s not guaranteed to succeed. Comcast has tried similar marketing plans to “bundle” energy offerings before, most recently a test with NRG Energy (that’s the deal that was canceled, by mutual agreement, before the Crius trial was started), and they will probably move pretty slowly. Crius says the deal is for three years, and that other states will be added in the second half of this year — three years probably isn’t even enough to roll it out to all Comcast subscribers in deregulated states, but it will certainly give some idea.

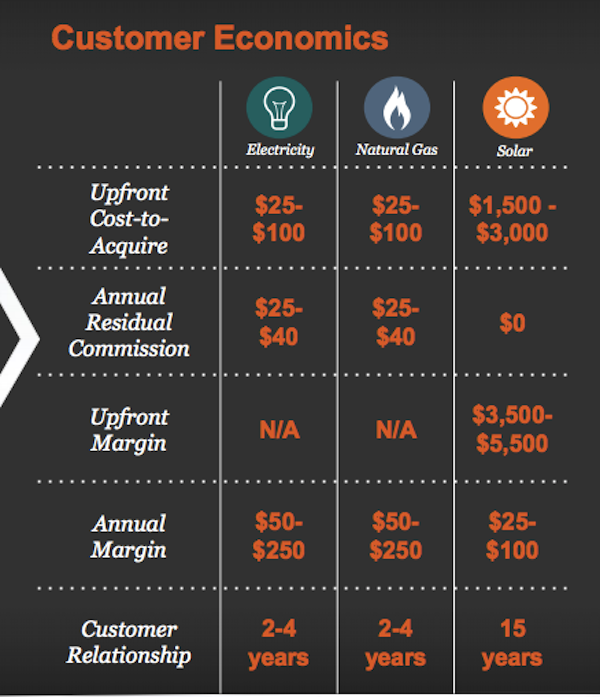

What really caught my eye was their description of the underlying economics of their customer relationships, as expressed in this slide from a recent investor presentation (whole presentation is here):

That’s a snapshot of a pretty strong underlying business — the investments they make in acquiring customers are paid off almost immediately… so if they can keep that up as they make new partnership deals, grow the customer numbers, and cross-sell solar to more of their traditional energy customers, there’s definitely some potential for upside. Particularly if solar subsidies stay solid and price competition under deregulation doesn’t get crazier. And there was a swath of insider buying back in April, so that’s always good to see.

They do also have a marketing deal with Solarcity to sell rooftop solar services to Crius customers — which could eventually include some Comcast customers, I suppose, though I don’t know how flexible the deal with Comcast is or how quickly it might ramp up if it’s successful. They have their own solar brand as well, Citra, that they’re trying to ramp up (giving them a bigger piece of the pie, contracting with local installers, but also presumably more of a cost risk than the SolarCity commissions).

So what’s the deal? Well, in the end what we have is a company that appears to me to have a pretty decent revenue growth trend because of several new partnerships, and the business is more scalable than most energy businesses — they’re really just doing the marketing and the customer retention and the partnership deals, and then managing the energy delivery as a financial obligation (hedging, buying power or gas and reselling it). They don’t own power plants or electric lines, so there’s not a capital investment required for each new customer — just a customer relations investment… so as the customer base grows, the margins should improve (assuming they don’t screw up the hedging, or face more aggressive competition).

It’s obviously risky to some degree — public shareholders in the trust don’t control the company, it is traded as an income investment (like almost all trusts) so, as we’ve seen, if the distribution gets cut for any reason the share price will almost certainly fall. And while it probably looks a little better for Canadian investors right now, since they will see all the revenue come in in US$ and get translated into (currently much less valuable) Canadian Loonies, they do also incur their costs mostly in US dollars… and those of us who have to translate our brokerage statements back into US dollars will be slightly less impressed.

I like the marketing focus of the company, and it’s a little unusual to see such a growth focus from a company that is both small and high-yielding (the current yield is about 8.75%, still quite high even though it’s not Schaefer’s 10%+), so I decided to express my interest by taking on a small personal position today, as I’m finishing up this note (no, I’m not buying anywhere near $400,000 worth). That will force me to follow it more closely and see how their partnerships develop — I’ll let you know if my thoughts on it change. And I won’t sell my shares for at least a month, to give you some confidence that I’m not trying to drive the share price up after buying a little piece (I might buy more after my required three-day waiting period, if I continue to like what I see, but I won’t sell).

—and now some updates, as of October 26—

Crius today trades at a dividend yield of about 7.5% (70 cent annual dividend expected, paid monthly, divided by the C$9 share price), so, including dividends, I’m sitting on a gain of about 15-20% on the shares I bought back in July when Schaefer’s pitch got me intrigued me with this stock’s potential.

This is going to trade like an income stock to a large degree, assuming that they don’t announce terrible or exciting news that changes perceptions of the business more broadly, and the fourth quarter’s dividends have already been announced — steady as she goes on that front. So what has happened since?

Well, they did announce the second quarter earnings back in late August, which were similar to the first quarter — no earthshaking news. Kind of makes me think that the November 12 “I’m going to get rich” excitement is a bit overblown… which, sadly, wouldn’t be the first time a newsletter pundit got people needlessly excited about an earnings report. Newsletter advertising is catalyst-driven — if you don’t think something sexy is going to happen to a stock in the next couple weeks, you’ll sit on hour hands and not pull out your credit card, copywriters have to build up your greed and give you a sense of urgency when they’re looking for new subscribers.

And, frankly, we probably shouldn’t expect this to be a fast-changing business. They are energy retailers, for the most part — they put together deals to market energy, often in combination with other basic services and in competition with other providers. They don’t install solar systems, they don’t produce natural gas, they don’t generate electricity — they just buy in bulk and resell to individual customers or, in some cases, work on commission (like with solar panel installations). What they own is a marketing relationship, a list of customers, some wholesale trading/brokerage operations, and a marketing channel — part of that is their joint venture with Comcast to test cross-selling their energy offerings as part of the Comcast “bundle”, but they have a bunch of such relationships.

So you need to look at their ability to grow the customer base, to make acquisitions that give them access to customers at a good price, and to keep their customers happy enough and their deals reasonable enough that they can minimize the costly “churn” of having to replace an expiring customer with a new one. That’s most of the business, though they do also have to use financing to effectively buy in bulk, and they do have to manage commodity price costs to some degree (if they’re selling fixed-price natural gas or electricity to a customer for a year, for example, they need to account for fluctuating costs of acquiring that gas or power).

So far, it seems, well, OK. This is a competitive business, as anyone who lives in a state with unregulated (or lightly regulated) electricity can tell you — I get mailings every day from folks who want us to buy electricity from a different producer or to “lock in” prices for our propane or other services. None of them are likely to make huge margins without taking substantial chances, I would imagine.

Crius is primarily an electricity re-seller, gas and solar are much smaller parts of their business so far. Most of their customers are in Texas, New England and the Midatlantic states, and they are now more weighted than they’ve been in the past to commercial customers (as opposed to residential), and to fixed-price contracts (ie, you agree to a fixed fee for your electricity generation for a year).

The selling proposition is essentially that you can offer something the stodgy old utility company can’t — whether that’s bundling of some sort, like with Comcast (you get HBO for free if you buy your electricity through us, too!) or more flexibility than your utility will offer (like the fixed price, longer-term, or variable rate contracts you might prefer for your business). The utility still delivers the electricity and still earns its distribution fee, but it doesn’t actually generate the electricity for you — it uses electricity provided to it by Crius, bought on the wholesale market (even, quite possibly, from the same generation plant that the utility uses). It’s a strange idea to get your head around, but it basically works because electricity is fungible (one kilowatt hour in a given location is the same as the next) and is traded all the time on the wholesale level, and because it has evolved that there are really three entities involved in bringing you electricity: the producer of the electricity, the owner of the transmission/distribution system, and the marketer who signs you up as a customer. It used to be that those were all done by one company, and for many people they still are, but in some areas there are a dozen marketers competing to structure a deal with you even if there’s only one transmission system owner who can deliver the electricity, and even if all the marketers are likely to get similar prices from the regional wholesale power producers.

Right now, Crius is growing slowly, and mostly from acquisitions — the big jumps in customer numbers have come from buying other companies, the organic growth is far, far slower, and the churn is quite high (last quarter they added 88,000 customers and lost 79,000 customers, for a net organic gain of 9,000 customers… they also bought 200,000 new customers when they acquired TriEagle, but that doesn’t count as “organic growth.” As you see from that chart at the top, which is still similar to what’s being used by Crius in the materials, the payoff for an electricity customer is pretty quick, but margins improve substantially after the first couple years — if they don’t stick with you into year three, your chances of making a substantial profit from that customer are diminished.

But they’ve clearly been doing reasonably well as a cash business — they generate enough cash to pay a substantial dividend, and the payout ratio for those cash earnings is right around 50% so the dividend shouldn’t be in any imminent danger. It’s not at all guaranteed for future years, they have to keep getting new customers every year to replace the large number who drop off, which is why I have trouble thinking of this as being a safe and secure type of business… but that’s why the yield is high. I’m a little tempted to sell my shares, since they’re getting to be more reasonably valued right now, but I’ll hold on for now and keep a tight leash on this stock in my personal portfolio. And yes, I’ll be curious to see what the company says in their next earnings announcement — but I don’t expect it to be monumentally positive or negative.

The business is steady enough that we know what their dividend will be for October, November and December (5.83 cents a month per share, Canadian), and we know that in order to grow dramatically they’re going to have to either have huge uptake in customers from their existing relationships, such as if the Comcast agreement, still in its early days, generates a lot of new customers, or they’re going to have to buy more customers. Absent something really crazy, like a major new acquisition or a huge sell-through of high-margin SolarCity installs that generates a lot of commission (perhaps unlikely, since it seems they can’t even get their current installs done on time), then November 12 shouldn’t be that big a deal as far as I can see. If it falls back toward $8 on November 13 as they’re having their conference call in the morning, I’ll probably sell on a stop-loss if I have the opportunity to do so… if it climbs following earnings, I’ll re-evaluate then. If it doesn’t do much, which strikes me as the most likely scenario, then I won’t do much, either. They seem like a good marketer, with good relationships and some growth potential… but there is no magic or secret sauce, and the business is competitive so I won’t expect much more than the 7.5% yield I’m currently earning, and if it appears that yield is coming with more risk than I expected, I’ll sell. We’ll see in a couple weeks whether the next quarter changes any of that, but I’ll be pretty surprised if it does.

What do you think? Am I crazy to own a little piece of this one? Is Keith going too far by putting 1/5 of his money into it? See any prospects for this energy retailer? Let us know with a comment below.

Travis,

When you buy a stock like this do you buy it OTC or on the .TO exchange? and why one over the other?

Thanks,

Mike

My preference is to buy on the home exchange, but it usually depends on which account I have funds in — some brokers I can trade direct, some have to be OTC. With Canadian stocks it doesn’t matter that much unless liquidity is extremely low and you have to sell in a hurry, the buying can almost always be done at a fair price OTC in the U.S.

Careful with tax considerations, too, Canada usually withholds tax on dividends for

U.S. Investors, and you can’t claim a credit for that if your stock is in a tax-sheltered account. Not sure what the current state of the tax treaty is, but intend to keep foreign high-dividend stocks in my taxable accounts.

I now stick with Canadian exchanges exclusively after having discovered years ago the agonies of trying to sort out U.S. dollar transactions from Canadian dollar transactions at tax time in order to calculate my annual contribution to Her Majesty’s treasury.

ISn’t it sick we all have to hand over to either a queen or in America’s case the king

I prefer to make these trades on the Toronto exchange.

The US dollar is stronger now than it has been at any time since the middle of 2004. Several times in that period it cost more than $1 USD to buy a Canadian dollar; it cost more than $.90 to buy a Canadian dollar from mid-2009 until the Fall of 2014.

Today, including the exchange fee, I can buy a Canadian dollar for less than $.77.

If I hold this stock for three years, and if the stock remains completely flat, but the dollar weakens back to $.90, I will still make 17% on the currency exchange.

(On the other hand, if the dollar strengthens further, say to $.65 to the Canadian dollar, I will lose another 15% before it starts to turn around. This will be influenced by when natural resources, among Canada’s most lucrative assets, begin to turn around.)

In the meantime, with interest rates near zero, I have moved large amounts of cash into Canadian dollars, where I hope, over the next three years, to make 6%+ a year just on the currency exchange.

CDN $ vs. $ USD exchange rate mainly.

I subscribe to Schaefer’s newsletter so I bought some CRIUS also. I like the marketing synergies and especially the recent success with solar. Solar finally seems to be on the verge of challenging utility companies on a cost basis and certainly should be considered by consumers in the South and Southwest for long term savings and partial independence from their local utility. New financing schemes make it much more palatable to consumers and CRIUS wins whether the consumer buys it outright or finances the solar panels.

Here in TX we have about a million “mom and pop” energy servicers. Some have great deals for promotion, particularly in terms of low-usage/energy conservation. If you read any bad reviews about any of them, it’s always billing issues. Once a company messes up the billing, they are dropped like a bad habit and subsequently smeared on Yelp, etc. Last month our electric bill was $17 (for 840 kwh) due to a rebate promo (which ended). Now we are up to 9 cents/kwh averaging in carrier fees and taxes. So Comcast jumping on this should be an easy deal. I mean, it’s just remotely reading meters and billing. Any problems with outages they tell you to call someone else. On the flip side, we have also experienced good and bad results with “bundling”. Our experience with AT&T/Directv was pretty smooth. Our experience with Centurylink was, less so, much less so. So it seems to me from our own experience, it’s going to be all about the service/competitive pricing/ease of transition, as to whether this relationship is a winner. Obvious statement of the year I suppose.

Todd, how would you like to get rid of your cable bill all together, yet get more. I am a distributor for Legend Direct. We sell a streaming box that delivers a ton of programming to your TV. Over 600 channels, all movies, all sports including NFL network, all ppv events, lots of international programs, kids movies and programs and much more. All it takes is a small charge for the box, which is yours to keep and there is no annual or monthly charges. Contact me if you or any of your Texas friends are interested. You can go to the web site or email me at mrkirchner@hotmail.com or phone me at 262 752-0000. Thanks

Strange, I cant trade either US or Canada on Interactive brokers ?

I bought my shares on IB, don’t know if the rules would be different for you. I don’t think IB uses the -un ticker for trusts like yahoo finance and many websites do.

check your permissions for penny stocks for otcbb … I had to get that straightened out with them. some weird problems when trying to buy a Canadian stock

Travis,

I like what I read, just to let you know, as you put it, “to nibble on it” I will jump into it and take a taste. (although, my jump can be compared to that of an ant, that’s my level of affordability). Thanks for the sleuthing.

Keith Schaefer is a nice and very bright guy who does a ton of homework. But that said, his last big idea was Poseidon with whom he lost $400K in his wife’s retirement fund he told it. Poseidon rented basically big above ground swimming pools to oil companies who had to store fracking fluids. I lost on it also, I now look back and see what a flimsy business Poseidon really was – this Cirius sound as lame for any major investment. Ugh. Keith Keith Keith, hope your timing is better this time. Ugh.

Poseidon what a crap that was. I escaped this one just on time. I like Schaefer but unless your whole portfolio is geared towards energy or you’ve a lot of money to invest, he is difficult to follow. So you end up stock picking the stock picker. Furthermore, he doesn’t apply stop loss and doubles down when the stock is down. It takes nerves. I cancelled but bought some of this before. Glad to see it followed in Stock Gumshoe.

The Poseidon concept really took off in some areas. The failure there was the execution of the plan rather than the plan being useless. The stock, on the other hand, I did not follow. I just know from experience that the Posieden-styles of tanks are quite common nowadays in the oilfield.

The story is good, the chart, beside being ultra low volume appease to be setting up a head and shoulders pattern.

Like to see that resolved first.

Could somebody who knows comment on the ways to trade this company.

I have accounts with Sharebuilder( now CapitalOne) and Robinhood App( free trades always; check it out). However neither one of them allows me to trade “Crius Energy Trust”…

Which brokerage firm you’re using?

Those aren’t “real” stock brokers, they’re free or low-cost stock accumulation platforms that cut costs by not doing anything tricky. Great for accumulating shares of companies that are in the S&P 500, or even in the Wilshire 5000, but usually don’t touch OTC stocks or stocks that trade on foreign exchanges where the trade usually requires a little bit of handling or processing, sometimes even by an actual person. For that most of the “real” brokers, even the discount ones like TDAmeritrade, Etrade, TradeKing, Scottrade, Schwab, Vanguard, Fidelity, etc. will do fine. Each broker has different policies for trading OTC stocks — sometimes, for the smaller ones, they require you to call… or sometimes, for OTC tickers that represent foreign stocks, they’ll charge a foreign stock fee. I use Fidelity and TD Ameritrade frequently, and can usually trade any OTC stock using them, and I also use Interactive Brokers when I want to trade directly on a foreign exchange (Canada, London, Paris, Hong Kong, Australia, etc.)

Hi Travis,

Would you kindly share your thoughts about how/why all the liquidity has been forced to OTC? Where all the liquidity has gone? Markets are close all time high? Is this the as calm as in 1987 or early 2T or 07?

Kind Regards

Hupitate

All the liquidity forced to OTC? I don’t think I understand the question. I do think that individual investors are better off not thinking too much about the big picture — that’s not nearly as knowable as we’d like to think it is, and our individual instincts about the future direction of the market are almost certainly going to be wrong most of the time. Far wiser, I think, to spend the time thinking about something that can be controllable, like your understanding of an individual company and the prospects it might have in different market conditions, and whether they can grow their business and justify the current price being asked for the shares.

Easier said than done, of course, and I’m guilty about working within the biases of my world view and my expectations for the markets — my personal feeling is that we’re in a swing state between recovery and return to recession and I have no idea which way we’ll swing, and I think money will probably be cheap for a long time so I’m keeping a healthy exposure to income investments (REITs and such) and trying to use put-selling to generate some income with the extra cash I’m keeping in my portfolio.

I wish I could help you, I tried yesterday to get in the action but my trader does not handle it either. I got a reject window “orders cannot be accepted for this symbol” so what I’ll do is to get over it and keep digesting something else from the thinkolator. Good luck

Thanks Travis!

I opened an account with above mentioned firms because they had the lowest fees, but your answer clarifies some things.

On the same topic: “Robinhood” App – love using it, because of free trades; and recommend if someone is interested. They don’t have a lot of features, just basic stuff, but very intuitive and smooth. Not affiliated with them in any way…

Merrill Edge had something a while back about 30-100 free trades *per month*, depending on certain other conditions (like maybe other services [credit card…] and account balance). Called Fidelity to ask how they compete. They pointed me to their guaranteed execution. There is an industry-wide standard that has to be met, but they state that they pretty routinely beat that standard by about 0.01c/share, so on 1,000 shares, save $10 c/w other brokers’ execution. You can call Fidelity and they’ll point you to their execution guarantee. Theoretically, you can see online in the trade statement for a few days after each execution by how much you beat the industry standard. So, low fee doesn’t mean you necessarily saved. If you are a good enough customer, other brokerages will also give you free trades. When I called to ask about Merrill’s offer, Fidelity gave me 100 trades commission good for 1 year.

Where is the value added? I pay 0.07240/Kwh for Generation and Transmission in Berks County PA. Met-Ed is the Transmission Agent while PP&L is my power Generator. I own 500 shares of PP&L which pays $187.00 dividend currently. Buying another 500 shares would almost pay our electric bill for the year. Now that’s value added.

In my experience Comcast couldn’t provide reasonable service in cable. Last thing I want is them involved in my electric service.

Why are the OTC shares so much lower than the Canadian? Is it because of the 20% withholding on Canadian dividends?

Because the Canadian dollar is currently worth approx. 76 cents US.

I like Keith , but agree with frequent criticisms mentioned. I certainly would not gamble 25% of my net worth on any stock, so indeed when Keith is right he makes out like a bandit, but he also tends to lose big when he is wrong. Good work Travis, should probably buy a small position since it is Canadian, but based on current a few comments I suspect that a lot of American investors are not taking into account the 24% currency differential in their favour. This holds particularly true for Canadian miners whose expenses are mostly contracted in Canadian dollars while sales are mostly in U.S. dollars, an advantage that could soon reach 25% profit all by itself.

My technicals say this could be topping out – downside target below $2.50Cdn. -for what its worth.

I use RBC Direct broker, can buy US OTC stocks with CAD account. Why cannot I sell those stocks online electronically? Travis or any other folks will have some insights please.

Dr. Altaf, https://www.interactivebrokers.com/en/home.php offers online trading to most markets worldwide. Best2You-Ben

Ben, Thanks.