I thought this was going to be another pitch for what’s lately been teased very aggressively as invisible “770 Account” participating whole life insurance by the Palm Beach Folks… so I almost tossed the email (there are only so many times you can run through that story).

But this is a little bit different — the tease is from a different publisher, and it’s a different product (though there are some similarities). So what’s the deal? Well, the ad is from Ryan Cole and it’s a pitch for his Unconventional Wealth newsletter… and this is how he introduces it…

“Did you know that one of America’s most beloved founding fathers left behind an account that grows your money tax-free… pays a lifetime income of up to 61 times more than savings accounts… and in some cases, offers stock-market-like returns with no risk to your principal?

“And here’s the best part…

“Regular Americans are already cashing in on a modern version of this account…”

Oooh, intriguing! Whatever could it be?

Here’s a bit more from the tantalizing tale…

“On June 23, 1789, 10 months before his death, Benjamin Franklin decided to add an addendum to his will.

“In this text, he left an obscure account to his personal heirs and to his native city of Boston.

“This specific Boston account turned $4,400 into $5.5 million… never lost money in any single year… and paid income for 200 straight years, until the local government decided to close the account and cash out.

“And over the past few years, this account has taken on a life of its own and evolved into something new — what I call Franklin IRAs…

“It’s a little-known retirement account that…

- Gives you exposure to the growth in the stock market, without its downside risk

- Pays up to 61 times MORE than the average savings account

- Grows your money tax-free, saving you thousands of dollars over time

- Offers guaranteed growing income for life

- Has a guaranteed minimum return in some cases that can be as high as 6–8%

- Has no management fees.”

Who wouldn’t want that, right? But it does sound like one of those structured products that, like whole life insurance, is sold on commission and has lots of hidden costs and is very non-standardized and difficult to compare. Still, we should check it out, right?

And apparently it has also gotten a bit of an endorsement, at least, from academics — here’s some more from the ad:

“I came across a study from professor David B., from the widely respected Wharton School of University of Pennsylvania.

“Like myself, he was skeptical at first.

“Which is why he decided to launch a two-year, in-depth study to verify if the benefits of these accounts were real.

“He and a team of five other Ph.D. financial economists looked at real returns, not just hypothetical gains, from 1997–2010.

“They actually collected copies of real customer statements from 172 different accounts.

“After analyzing the most comprehensive data ever assembled for real returns of what I call “Franklin IRAs,” they reached a shocking conclusion…

“‘Franklin IRAs’ Managed to Beat CDs, Bonds and Stocks”

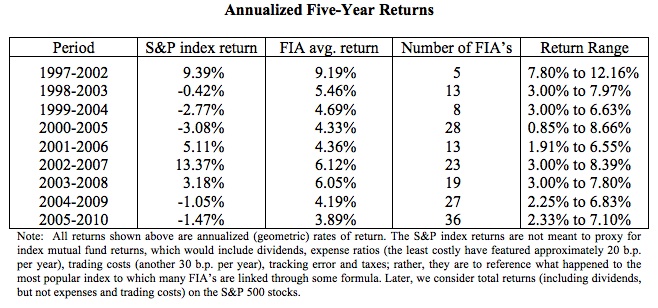

OK, that’s true. And it means that what Cole is teasing here is a form of annuity — an insurance contract that, in exchange for up-front payment that’s either surrendered to the insurance company or tied up for an extended period of time, provides a promised return. In this case, the study he cites is from Jack Marrion, Geoffrey VanderPal, and David F. Babbel and is called “Real World Index Annuity Returns” — you can download it here if you like… it’s quite readable and brief, not academic gibberish. And that study was specifically about index annuities, which do offer a guarantee against market losses and some market participation, so that’s presumably what Cole is teasing.

"reveal" emails? If not,

just click here...

It’s somewhat spurious to say that these annuities have “no management fees,” because they’re sold differently than mutual funds or other “managed” investments. The fees in annuities are related to the risks they’re insuring (stock market loss, particularly, or mortality risk for some annuities) and to the commissions or salaries paid to their salespeople (annuities are not generally sold direct to individuals, they go through brokers or agents), and they are not necessarily taken off the top of the contract like they are for Whole Life insurance, so they’re not obvious… in many cases, even if there isn’t a specific annual fee or management fee, the “fees” by some other name are earned from the spread between what the insurance company can make on the money you give it, and what the insurance company pays you. That makes comparing annuities, which are insurance products, to investment products difficult at best — and because rates and returns and specific terms (which greatly impact long-term results) can be different for each provider, it’s exceedingly difficult to comparison shop.

That’s not true of all annuities — fixed income annuities that you’re using to generate a fixed income that you can plan on, whether immediate or deferred, are different, and far more popular and “accepted” by mainstream financial folks, than annuities which are used to build and compound a nest egg. People often use income annuities to effectively turn a chunk of cash into a lifetime monthly “pension” check when they’re either retired or are looking at retiring within a pretty brief time period, like ten years or so… or as “longevity insurance” to make sure that they don’t run out of money if they happen to live into their 90s (for example).

Here are the quick basics on fixed income annuities, which are really not what Cole is talking about, though most annuities are designed to go through an accumulation phase and then an income-paying phase — for a lot of income annuities, the “accumulation” phase is just “roll over your 401(k) into an annuity contract to turn it into an income stream:

You buy an annuity contract with a lump sum payment, and in turn you receive a fixed monthly payment until you die. That’s the basic idea. There are variations based on whether the annuity covers two people (ie, if you die but your husband survives for a decade you can buy one annuity that covers both your lives, sometimes with a different payment after one person passes away), or that are designed to offer guarantees against dying “too soon” before you get much income from the annuity.

An immediate fixed income annuity means you buy the annuity contract now, send the lump of cash to the insurance company now, and the income starts now. A deferred fixed income annuity, which is much cheaper, means you buy the annuity contract now, send the cash to the company now, and you start to receive the income at a set date in the future (ie, you could buy at 55 to make sure you have a set monthly income starting at 65, or you could buy at 65 when you retire in order to make sure you have a minimum income level from age 85 on if you’re worried that your other savings might run out). Deferred annuities seem very common for folks who are in the final stretch of retirement planning, modeling out how their golden years might go and taking, for example, half of their 401(k) balance ten years before retirement and buying a deferred annuity with it to lock in some level of future income.

The payment terms are all spelled out in advance, and guaranteed by the claims paying ability of the insurance company you deal with, and — as you might expect — terms look kind of lousy right now because interest rates are so low. Insurance companies can’t create money out of nothing, your annuity income is from a combination of pooled insurance (ie, the people who die before they get back their premiums in the form of annuity income) and investment income that the insurer can make on the cash they hold. Insurance companies diversify broadly and invest in all kinds of things, including stocks and alternative investments, but a huge proportion of their investments are in high quality fixed income (bonds), because they are making strong promises about the future availability of that money and have to limit their risks… so when interest rates are low, they offer low returns on annuities. Plus, it’s what the market will bear and the market is generally determined by interest rates — if a five-year CD or municipal bond offered you 5% annual income plus guaranteed return of principal after those five years, you might not have much interest in an annuity that promised 5% annual income for life but no return of principal (that’s roughly what an immediate annuity for a 60-year-old man would get you now).

Annuity rates offered at any given time change as interest rates change, and as life expectancy or other underwriting calculations change, but for the most part they are also fixed (you can buy annuities with CPI-based inflation protection — but, as you would guess, they’re more expensive and give lower income now)… and there are also lots of different kinds of annuities, with various promised return minimums (you can guarantee five years of payments, or 10 or 20, to your heirs if you die before the annuity begins paying, you can get a higher return but for a fixed period of time with no “lifetime” benefit, etc.). When you go back over time you’ll see times when immediate annuities provided much more dramatic returns, but that was likely when interest rates were very high and life expectancy was lower — if an insurance company can get 10% on a 30-year bond, like they could in 1985, then they’d probably be quite happy offering a lifetime payout of 12-15% or more a year to a 65-year old (that’s just an example, I haven’t checked what rates might have been and I’m not an actuary)…. but with 30-year bonds at the super-depressed rate of 2.5% right now, it’s no big surprise that the immediate annuity rate for that same 65-year-old is more like 6%.

And keep in mind, this is not an investment you can get back at some point — this is an income stream you’re buying, so at 6% the first 16 years are effectively just you getting your cash back… after that, you’re benefitting from the fact that lots of folks died earlier than you did and you’re getting their income. There’s a reason that insurance companies have done so well over time: people fear risk, and selling risk protection is a great business because the risk taken is far less dangerous to the insurance company than it feels to the insurance buyer. Peace of mind is very valuable to individuals, but doesn’t cost much (as long as you have a huge actuarial pool) for institutions to provide. That doesn’t mean insurance is a scam, and fixed annuities make sense for lots of people who need or want stability, but be aware that you’re being sold something that makes them a lot of money; they’re not doing you a favor.

But I digress… that’s really the annuity income phase, which is the end game for most annuities when you turn that lump sum you’ve accumulated into income. Cole is not talking about immediate or planned income from immediate or deferred fixed annuities, and as far as I can tell from his hints and promises he’s not even talking about fixed or variable annuities as an asset accumulation/savings vehicle (some retirement plans offer annuities, either fixed or variable — I have money with TIAA/CREF from my days as an academic, for example, and what I think of as their low-cost funds for investment are really mostly low-cost variable annuities… though they also do have a core fixed annuity option that’s guaranteed to return 3% a year).

He’s talking, I think, about that still-relatively-new hybrid that is effectively sold as a “safer” IRA-type investment: The Equity Index Annuity. This is much more of a savings vehicle than it is an income vehicle, it’s for that “accumulation” phase, though many people plan on using them to build a next egg that then becomes an income annuity (sometimes this is even in the original terms of the annuity, as a rider) so it’s supposed to grow in value.

The basic premise of an index annuity is that you invest a set amount — and you can set it up so that you invest each month or each year, like an IRA, sometimes people use these when they’ve maxed out their other tax-advantaged investment options — and that money increases, tax-deferred, over time and you’re not allowed to take it out before the term expires (without surrendering some of the principal).

More or less like variable annuities, which will invest in stuff like mutual funds, they are supposed to go up with the market over time… but unlike variable annuities, index annuities typically have a strict no-loss guarantee for any given year and have very low limits on the amount of gain you can make in a given year. The increases in the amount are based on some kind of index, tied to some kind of cap, so you effectively are going up when the market goes up… to an extent… and not going down when the market goes down.

So, for example, the index they use might be the S&P 500 and there might be a cap of 5%. That means, in years when the S&P loses money you don’t lose money… and in years when the S&P 500 goes up your account value also goes up, but only up to a maximum of 5% (sometimes it’s a percentage of the gain up to the cap, too — so perhaps you get 75% of the S&P 500 return with a cap of 5% in any given year). So you can see the obvious smoothing impact that this would have — in years when the S&P loses 40%, as it has a couple times in history, you don’t lose anything. In years when the S&P 500 goes up by 15% or more, your account goes up by 5%. The odds may or may not work out in your favor, depending on what the next 20-30 years do, but over the past 50 years the S&P has had 10 down years (counting dividends) and 25 years when it returned more than 15%. The insurance contract promises that you will not lose money, and that’s really what excites people (most of these contracts are not adjusted for inflation, though they can be for a fee).

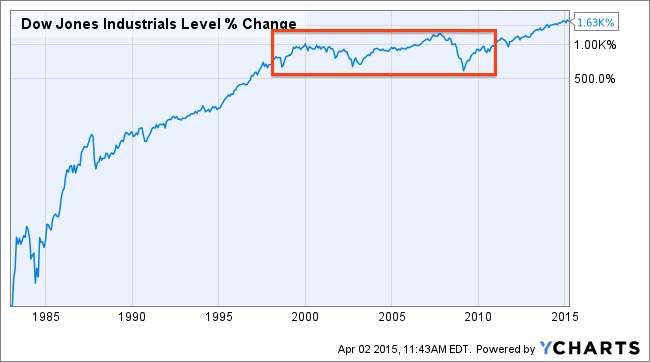

There are a few important things to note: First, the study Cole cites is fairly recent and was pretty well-received and seemed relatively unbiased to me, but it also covered a dozen years during which there were two historically huge stock market declines. That wasn’t by design, it just happens to be the time period with available data on index annuities (which were really introduced in the mid-1990s), but that means it missed many years of steady stock market increases before and after that period — here’s a chart of the Dow (I didn’t have S&P 500 data going back that far) that shows the period they’re studying, just FYI.

And here are the average index annuity returns they found:

Second, there are dozens of studies of annuities — but they don’t generally study real-world results from annuity contracts, they have typically used assumptions based on the author’s assessment of how annuities work and back-tested those assumptions, and most of them seem to have an axe to grind. That can produce results that don’t necessarily tell us anything about what returns might be into the future. So you will definitely find lots of articles that tell you how terrible annuities are (all kinds of annuities, not just index annuities).

Really, these index annuities are a wishy washy offering that intuitively appeals to a lot of people — they are designed to give you a portion of the stock market returns, though often a very small portion of those returns (and they apparently don’t include dividends in their equity return calculations, usually, which can be a big deal), and, perhaps more importantly for investors in their 40s and 50s who have seen two huge market declines in their working lives, they promise to protect your principal.

Protecting principal is pretty expensive, because you’re going past the financial planner’s model of “this will probably generate these returns and this kind of retirement income, with a reasonable degree of certainty, on average and based on historical returns” and you’re instead dealing with the far more solid, “we promise to provide these returns, and you will definitely not lose principal” Whether or not you want to pay for those kinds of promises in exchange for giving up the upside that you might, on average, be expected to see from a diversified portfolio is really the question — these are insurance products, insuring you against stock market collapses and loss of principal, and insurance is not necessarily cheap.

If you do decide to look into index annuities, which are pretty clearly what Cole is pitching as “Franklin IRAs”, do be careful to understand the fine print. They do offer tax-deferred returns, they do usually offer a guarantee of return of principal/premium (the amount you put in) and sometimes a guaranteed minimum return, and they do offer some portion of index participation.

A few things that keep that index participation low are: caps (a maximum amount your account can rise in a given month or year); participation rates (sometimes they discount the index return, so your return could, for example, be calculated on 80% of the underlying index instead of 100%); spreads or margin or asset fees, which they take off the top of returns and which can be several percent a year; and riders (which you might opt into to provide deferred income guarantees, for example, in the future, and which cost money). You can also get bonuses, so the insurance company could effectively sell you a $105,000 index annuity for $100,000, for example… and you would also, in every case I’ve seen, have stiff surrender fees, so you’d lose 10% or more of your principal/premium if you take it out before the term is up (ten years, 20 years, whatever the annuity contract is that you agree to). It doesn’t feel like fees, since you don’t have to pay them and they don’t come out of your premium amount that’s guaranteed, but you effectively pay pretty steep fees for the insurance in depressed returns relative to the underlying index that they’re loosely tracking… but, as that study indicated, there are definitely time periods during which index annuities have been competitive.

The major quibble that I usually see with variable or indexed annuities is that they do worse than the market, either because of annual fees in the case of most variable annuities or because of caps and other restrictions on growth in the case of index annuities. That’s true if you’re comparing it with an S&P 500 Index fund, for sure, any kind of annuity is going to cost a lot more and return a lot less than the broad market most of the time, but that’s not really the point of these annuities. They seem to be designed for, and they probably appeal to, folks who are afraid their nest egg will get crushed by the market at just the worst time, in the last few years before they retire or in their early years of retirement. The examples I’ve seen put a pretty high cost on protecting from possible future crashes, but, as the study cited indicates, in years when the market has really, really bad returns or averages a negative return for five years (as it did for a lot of five-year periods in the 1997-2010 study period), then the index annuities can provide a much better return simply because of the lack of “drawdowns” (ie, years when your portfolio loses money and your account declines in value).

My worry with insurance being pitched as a magical investment resource, in most flavors, is not necessarily that it’s a bad idea to have some allocation to an insured return like this, particularly during low-return times when interest rates offer little in the way of guaranteed returns and the stock market seems expensive and scary, but that insurance is so opaque and poorly understood by most investors that it has to be sold through salespeople, and on terms that can differ widely from customer to customer. That means it’s not just hard to understand the built-in costs and limitations of these kinds of contracts but it’s also hard to compare different offerings across different insurance companies.

There’s not one index annuity contract that you can say is definitively bad or good, since this isn’t an academic exercise where you can compare it to some theoretically superior portfolio — individuals buy insurance because they want a guarantee, and a superior portfolio provides a likelihood of much better returns but certainly not a guarantee of no losses. You can say that annuities, particularly variable and index annuities, are complicated and hard to compare… and it makes me a little squirmy when something is sold by an agent who might not necessarily be comparing across all the available options with your best option in mind, and when there are stiff surrender fees that make it hard to get out of these contracts if an agent talks you into a bad one.

I don’t mean to imply that all agents selling annuities are going to sell you junk, no more than I’d tell you that all commissioned brokers will sell you the mutual fund with the highest load regardless of performance… but I bet some of them do. Incentives matter, and products like this that are sold by brokers and agents are usually more expensive, and more prone to hidden costs that we don’t think about, than products that are bought by consumers from a variety of openly described options.

So there you have it — “Franklin IRAs” are depressingly non-magical Indexed Annuities. They are usually guaranteed not to lose money as long as you don’t take your money out before the term ends, and they provide returns that are loosely connected to equity index returns up to a (usually pretty low) maximum annual return… sort of a middle ground between fixed annuities that pay a set rate, and variable annuities that are often derided for weak returns and high fees. Beyond that, it gets a lot more complicated.

I found this Fidelity article to be one of the better general ones about the basics of index annuities, there’s a good overview of all the kinds of annuities and some of the terms at Investopedia here, and there’s a more broadly skeptical piece on index annuities from Kiplinger’s here from a few years ago.

I don’t see anything that’s a viable investment for anyone in any age bracket.

Either you’re too old….like me….and won’t live to see an ROI….or you’re too young with nothing to invest and conditions are too unstable to hope for a return in a reasonable time frame.

Looks to me like a better bet would be to build steel framed geodesic dome homes on

20 acres of land with its own water well, its own solar panel array for electricity, and

enclosed, protected gardens to grow your own food……and do it for less than $100K….something an old couple could pull out of a 401K…..and hand the ‘farm’ down to their children and grandchildren operated as a family enterprise in perpetuity.

ol’ Lawrence in west Texas

Please remember the “Guarantees” are only as good as the company promising them. There is no recovery if the company goes out of business.

I find these annuities offer lower returns, and higher risk than investing in NYSE stocks.

Amazed at some of the product these touts pitch? Lifetime annuity could be a good thing and I am all for secure return but I wouldnt tie up much into one. First up that up to 61x avg savings (basic savings) is about 6% but it is not compounded so its really like 2%. Ti two plans aare working a gauranteed 6% of principal and portfolio rerurn. Once you start taking lifetime payments which are 5%. You lose the option of taking the portfolio return. Depending on how long you build the 6% to take the 5 could take 10 years from the time you iniate payments for principal to roll out and profits arise

Where is the irregulars’ “side bar” box ??

Oops, forgot to add it to this article. Good eye!

Great work explaining how these work Travis! One thing you really have to watch is that they set a criteria to set their caps on the upside and then they back test their formula to get the best “past results” possible. Then they reserve the right to change how they valuate the caps each and every year. These are very attractive in a low interest rate environment as is whole life insurance. To me the returns the article states are over hyped, in my opinion I think you can see a 3-5 % return in these over the long term which in these days can be a great place to park some fixed low risk money if you don’t need to access it anytime soon. I am no expert but I have looked at a few of these before.

Insurance companies are the only investment-product providers who CAN, in some circumstances, use the word “GUARANTEE.” Just make sure that you read all of the fine print, and ask pertinent questions after you study promotional materials very carefully. ((I am a retired investment professional on the sales side. You could NOT pay me to buy a so-called “index” annuity. I find listening to their advertisements to be painful; just my humble opinion.))

Joan White, I trust your judgement in this matter a great deal more than I could trust Ryan Cole. I will also NOT buy an Index Annuity.

In theory, the indexed annuity should be safe because the insurer is supposed to cover the liability, or the return of your capital, with high grade bond purchases. Just buy an annuity from a company that is A-rated or better, they say. One of the earlier investments of this type was a product called “Principal Protected Notes” or PPNs. The issuer? Lehman Brothers, who before their collapse had a AA rating, I believe. (The justification for that, according to the credit rating agencies in later testimony, was that the government would certainly bail them out, ala Bear Stearns.) We know how that turned out. I assume the PPNs tanked along with everything else that was Lehman. I find it amusing that these things would be labeled as “Franklin IRAs” as though they were good as ol’ Ben’s word. A perusal of his “Poor Richard’s Almanac” reveals the item “Lost Time is never found again.” I’d like to add that the same is true of lost money.

“Theory and reality are only theoretically related.” — Robert Grossblatt

I, too, have worked for years as an investment professional and absolutely agree with Joan White. If you need insurance, buy an insurance policy, but if you want to invest with an insurance company, then do it by buying (and/or trading) shares in their stock.

For every nickel I’ve in invested in Insurance I’ve received $1000 and growing. How about those returns?

Please don’t crow, just tell us how so we can research it as a possible investment. That’s what irregulars do. Thanks

I was not crowing Alan but stating fact. By the way I am not an irregular although I’ve tried to join, but Travis’s system won’t let me. In the 80’s I was a Chemical Engineering Consultant. I was divorced with three kids and their support and higher education was my responsibility. The only way I could insure that outcome was with Life & Disability Insurance. I secured a $150K Regular Life and $450K Term Policy. I also added a Disability Rider to the policies. The Disability Policy I secured you cannot get today, as it was Job Specific with an age 65 term. I also added an Inflation Rider to that policy. At age 49 I suffered a major stroke in my Left Parietal Lobe. I was declared permanently disabled by several physicians. For the next sixteen years I proceeded to collect benefits of 70% ( tax free ) of my best salary year for the prior three years. My Life & Term premiums are paid continuously to Age 90 because of the disability rider. I will be 72 in May. My CPA says I hit the Insurance Lottery. I would have preferred to have my health rather than the 20+ years wondering though Medical Wonderland.

Wow, Carbon. So much for the argument I’ve heard too often, that insurance is always a waste of money. Not when it’s needed, it isn’t. Sorry for what you’ve been through though, yes having one’s health and the ability to keep working is far preferable to any disability situation.

Carbon,

I agree with you. I am so happy for you, except I pray that good health will return. I had a disability policy, paid a good bit in premiums yet never needed it. I don’t regret having had it. I’m your age now and if my premiums helped keep you afloat, then it was worth it. Insurance is always a gamble and they cannot bring back health or life, but I still believe in it.

Prayers and Blessings,

jbinsc

That sounds like the returns of an arsonist who “invests” in fire insurance 🙂

Travis LOL Three men sitting on beach in Tahiti. First says I bought big policy on my uncle when he died I retired here. 2nd says I bought fire insurance on my business when it burned I retired here . Third says I bought flood insurance and when Katrina wiped out my building I retired here.. 2nd thought a moment and asks 3rd say how do you start a hurricane?

Any investment where the seller can collect a fee of 8% or better up front is going to be sold hard. People selling annuities just make too much money to not promise everything possible to get you to sign on the bottom line.

A much better play would be to buy Berkshire Hathaway .

This is one of the best articles I have ever read on this site and the best discussion of index annuities I have seen on the net. Thanks!! Tony Robbins discussed annuities in his new book so I was interested in them but I agree with your conclusion that it is a steep price to pay for “safety”.

I concur, this is an excellent article. The author takes a relatively confusing and somewhat complex area and puts forth the more important features. I am going to disagree with a few of the conclusions of the author and some of the comments above.

First, I consider myself a relatively sophisticated financial professional but an unsophisticated investment professional. In 2008 I found myself 4 years from retirement and my portfolio just dropped by a third. Most concerning however was that my safe AAA rated muni-bonds dropped by 25%. I now realized that I had to become, if not a sophisticated investment professional, a much more educated investor,

I had 4 years of earning power left, if I was going to retire as planned, so I wanted to see how I could insure a portion of my retirement portfolio would not again suffer such a decline as above.

To make a long journey short I did explore a number of investment vehicles similar to fixed and variable annuity contracts and life insurance contracts. I worked with an advisor who was very knowledgeable in the area that worked for a fee, not commission. We found a number of investment vehicles (annuity and life insurance contracts) that would protect my downside but still allow me to reap some upside, albeit only a % of the upside but at rates higher than the author states e.g. maxed at 80% of index up to 13%).

I put about 20% of my net worth in these vehicles and have funded them since 2008. I now look back at how these investments have performed and quite frankly with the benefit of hindsight I would have invested more.

I fully realize investment decisions are dependent on individual needs. From my perspective what occurred in 2008 (market crash) really concerned me. I realized that if such a crash occurred in retirement I would be severely harmed financially.

I’d like to know more about the “investment vehicles” you use. Already retired and need to make some decisions. thanks, barb”

I used 2 different vehicles from 4 companies. I used 4 different companies just for diversification purposes, as the products were similar.

I used a Indexed Universal Life product and a fixed and variable annuity product.

I will add that a key for me in making these 2 economical was to reduce commissions (especially on the life insurance product) to bear minimums and you may have a problem doing that.

I have an engineering background (EE) and have been an investment advisor for about 12 years. Index Annuities have their place, but only when sold for what they are – a savings vehicle, NOT an investment vehicle. The fact that their upside is often linked to an equity index leads people to believe they are in some way invested in the stock market and they should expect returns comparable to those of the stock market. Index Annuities are savings (safe money) tools, the security of which is provided by bonds. The upside is provided by using options linked to the market – not direct investment. The ability to capture returns derives from options pricing models. The worst environment for those models is low prevailing interest rates and high stock market volatility. That makes options expensive and the money with which to buy them only minimal, so the linkage to the markets is also minimal.

Index Annuities can take the place of cash, money market, and bonds in a portfolio as long as sufficient liquidity is maintained (this is very important). With the inevitable end of the 1983 – 2015 bond bull market, index annuities may be a wise alternative to bonds for the fixed component of a portfolio. The income options are also very valuable assurances against longevity risk. Electing to turn on an income option is not the same as annuitizing, so the corpus of money is not forfeit if death occurs with a remaining cash value to the policy.

Bottom line, Index Annuities will never provide returns comparable to any equity market. They were not designed to do that. Expect 3% – 5% over the long haul. Most problems investors have with annuities can be squarely laid at the feet of overly-aggressive salesmen, (the same problem with Cash Value Life abuse and all the Smart Money Millionaire or Bank on Yourself scams). I have heard insurance salesmen refer to an Index Annuity with a monthly upside cap of 2.5% as one way the client could potentially get 30% return in a year. That’s absurd… but unfortunately it seems to sell product.

One potential solution is to only work with a Registered Investment Advisory firm that provides planning and is able to show you how each part of the portfolio works. Asset class diversification, risk diversification (and parity modeling), and income diversification should help keep any one component from being too heavily weighted.

In encourage clients to ask (in writing) several questions of any salesman: 1) What percentage of the salesman’s income comes from any one product type (like index annuities);? 2) what percentage of that income category comes from any one company?; 3) is there a product that would provide comparable returns to the client with better terms (shorter surrender periods, lower surrender costs, etc) and potentially lower commissions for the salesman. Just asking these questions and requesting answers in writing is a heck of a truth serum.

One last thing, all of this discussion revolves around whether any particular product is in the best interest of a client or not. That is the definition of a Fiduciary. Most financial “professionals” are not Fiduciaries as determined by their licensure. Raise the ante – provide the salesman with a one-page Fiduciary Pledge Agreement by which they sign and attest that they are observing a Fiduciary Standard in their dealings with you. If they are part of a firm and under supervision of someone else, add a signature line for their supervisor. Think about it: Shouldn’t the salesman and his supervisor be willing to attest that they are acting in your best interest?

Happy Investing

A good article and the comments attest to the conclusion that there is no ‘one size fits all’ solution and annuity types are different in contractual functionality, even within the same type. The ‘salespeople’ who listen to the client’s desired objective(s), deferral period, and factor in age, while taking into account the tax consequences, will design and factual explain the products and contractual differences based upon the client specific parameters. Further, the ‘salesperson’ who typically are registered investment advisors also, and must adhere to the fiduciary standard of that professional registration, are operating with the best interests of the client. The current distribution system for annuities makes the most efficient use of the client’s time by having a guide, typically with decades of experience, who doesn’t make nearly the money per placed annuity as people think. If there was huge profitability in these products, common sense would indicate banks and brokerage houses would offer them. Right? There is a misplaced focus on index annuities for accumulation in this article. I have witnessed over my 28 years of experience, the overwhelming majority of individuals choose index annuities for the guaranteed income generation. As most retirees would agree, cash flow in retirement is key to financial success, while net worth is secondary. The most efficient method of cash flow generation, using the least money to provide the most income, is most important. Similar to creating a pension, as 86% of people do not currently have that luxury, an individual can essentially ‘pension-ize’ the necessary amount to fulfill the budgeted income needs, with a guaranteed result even when put in place several years prior to retirement, relieving the stress associated with a risk based approach using market equities. The newer annuities are the new pension for those 86%, with an all-in average cost of 1%, to guarantee the consistent, pension-like income even if the principal balance erodes due to age based withdrawals of 6-7%, and uncapped gains of 4-6% (as the principal is not stagnant and will take advantage of any future interest increases), all while the principal is insulated from market downturns and accessible to the owner. Imagine 6-7% withdrawal rate versus a 4%, some research would indicate a 2.8% ‘reasonable rate of withdrawal’ from a managed strategic portfolio. The additional assets not required for income generation may be invested based upon individual risk tolerance providing an inflationary income increase or occasional withdrawals, but only when the market equity positions are up rather than down to avoid reverse dollar cost averaging. This requires a paradigm shift, as well as overcoming erroneous and unfortunately bias information against annuities.

For example, there is a dollar for dollar reserve based upon premium, and each state requires insurance companies licensed to sell their products in the state to participate in a ‘state guaranty association’ which is funded by insurance companies and is not a state based agency. In the unfortunate event of insolvency of a company, the consumer is protected whether by the movement of the contract to another company or subject to limits based upon the regulations per state typically $250,000-$300,000. Ironically, informing the consumer of the ‘state guaranty association’ is not allowed when used as a ‘sales feature’. Other examples of misinformation include exaggerated fee structure, not informing consumers of uncapped allocations which make participation rate and caps both mute points. There are several types of annuities which confuses most financial advisors.

Contact the experts and take the initiative to discover through due diligence the mathematical, academic reasons, and practical reasons individuals may benefit from an annuity. Richard Zaehringer, AnnuityFYI.com 800.281.6510

So what about the alleged tie to Ben Franklin? Just an attention getter, with not even a tenuous connection?

Sorry for not clarifying that — Ben Franklin is often cited as an early user of annuities, particularly by folks who are trying to sell annuities. He did make bequests in his will for funds that would be given to the cities of Boston and Philadelphia, and managed in a particular way to grow and generate annual income for those cities. I do not know if they were otherwise similar to annuities that people buy today, and he didn’t pop down to his local insurance agent to buy these “annuities,” but there’s at least some structural similarity and his name and visage are often used by annuity companies.