This percolated up to the “most asked about” teaser pitch over the weekend, and it’s easy to see why — everyone loves royalties (or as the newsletters like to call it, “getting money for free without doing any hard work”), and Sid Riggs is saying that “you can get super rich in a matter of months” thanks to the “up to 20% Royalties” on big blockbuster drugs.

And I’m certainly not immune to the allure — I loves me some royalties, too. The idea of skimming a little off the top thanks to your invention, or discovery, or whatever is profoundly appealing. Collecting 2% of the gold form a producing mine is a lot easier to model than trying to figure out what the mine construction costs will be, whether there will be a labor strike, or how much you’ll have to bribe the local officials (kidding! No company would ever bribe anyone, of course).

So what’s Sid Riggs talking about? Well, here’s a bit of the lead-in for you:

“Thanks to a group of doctors and financiers (including one of the most successful investors in America), there is a new way for you – an everyday investor – to profit from royalties now being paid on some of the biggest BLOCKBUSTER drugs in America.

“Specifically, eight breakthrough medications now used to treat a wide range of illnesses, half of which have no current treatments available.

“It’s a single investment – one I like to refer to as the “Drug Royalty Program” – and it offers a way for you to benefit from drug royalties and much more.

“Sales for these eight drugs are rising FAST.

“Last year, their sales were up 30%. By next year they’re set to go up 118%.

“And when it comes to profiting off royalties all you have to remember is one thing…

“The higher the sales, the bigger the money.”

What’s not to like?

So, assuming that you don’t want to subscribe to Small-Cap Rocket Alert to get his full “Drug Royalties Prospectus” for $1,950, I’m going to sift through the clues for you and see if we can identify this “Drug Royalties” investment for you.

Then, of course, you can go subscribe to his letter if you want to — maybe it’s fantastic, I don’t know… but give yourself a chance to think about the investment idea first. That generally gives folks better odds of being able to think about an investment rationally — paying $1,950 for something predisposes you to love it… if you don’t like the investment idea, you’d have to admit to yourself that you got snookered. Most people don’t come to that conclusion willingly, even in their subconscience, so they convince themselves to adore whatever they just paid to learn about.

Don’t worry, I’m sure Mr. Riggs can wait a moment for you to think first.

So what’s this idea he’s pitching? Well, we already learned that it’s a single investment that gives you access to eight drug royalties. Then the order form handily sums up some of the clues for us:

“Just a few weeks ago, on March 23, 2016, the U.S. Food and Drug Administration (FDA) approved a new prescription medication that will treat the second most common blood disease in America.

“Sales of this drug could reach $100 million in the next 12 months.

“And now, through this single DRUG ROYALTY investment, I can tap into this wealth, too.

“In fact, with this breakthrough drug now selling on the market, I can profit from a huge 20% royalty on its sales.

“That means for every $100 in sales, a royalty of $20 will be paid out, with the money piling up every time a new prescription is sold.”

Ah, so that’s actually plenty to feed into the Thinkolator — but I don’t want to rush things, let’s check the other clues as well:

“I can tap into a large pipeline of 140 drugs now being developed by some of the largest pharmaceutical companies in America, known for developing innovative, life-saving treatments. Companies like Merck, Baxter, Pfizer, and Lilly….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“In 2016, I expect four new drugs will be added to this DRUG ROYALTY program.

- Drug #1: The first drug was just approved by the FDA in March 2016. I can expect to profit from a nearly $20 million payout.

- Drug #2: The second drug is set to enter a market worth an estimated $800 million. It could easily payout $22 million in royalties.

- Drug #3: The third drug is under review by the FDA. At a royalty rate of up to 10%, it could end up paying $100 million in royalties per year.

- Drug #4: The fourth drug is currently completing Phase III trials. With a royalty of 2.5%, it could pay a $95 million royalty per year going forward.”

And apparently it’s not just royalties… Riggs says there’s a “Full Pipeline of 140 Royalty-Paying Drugs”….

… and that this investment profits even when drugs don’t end up getting approved, because they collect milestone payments along the way. Including a potential for $10 million in milestone payments in 2017.

“But wait,” says the salesman, “that’s not all!”

“In addition to this pipeline of drugs, I will also be able to profit from a proprietary compound now being used inside six FDA-approved drugs sold in 60 countries… as well as to 40 other drugs currently in development.

“The folks who run this DRUG ROYALTY program own this compound and have exclusive patent rights on it until 2033. With sales projected to grow 48% this year, I’ll be able to profit from the rising sales of this compound for years to come.”

So what is this investment that Sid Riggs’ ad says is “the most promising opportunity in Money Morning history?”

I’m afraid it won’t be a surprise to most of you… this is a stock I’ve written about many times, Ligand Pharmaceuticals (LGND).

Ligand is basically a drug developer from the mid-1990s that was mired in financial disappointment and turned itself into a royalty company thanks to a turnaround accelerated by some activist investors in the mid-2000s.

They had a core set of royalties coming in, eventually including what is still their largest revenue driver, Promacta (developed in partnership with GlaxoSmithKline, now owned by Novartis and still paying a high royalty), and they’ve been generating some cash for most of that time. For many years, like most biotech/R&D companies, they spent the cash on what turned out to be unprofitable R&D programs — the current CEO, John Higgins, was put in office back in 2007 under pressure from Dan Loeb and other investors, and he took the opportunity to accelerate the turnaround to an “R&D lite” model (my words, not theirs).

The timing was pretty nice for Higgins and Ligand. They had sold off several valuable assets and had a solid balance sheet, so during the financial crisis and recovery Ligand was able to invest in more potential royalties by acquiring faltering companies with good partners and good assets that were overshadowed by heavy spending on other programs. Then back in 2013, they finally became profitable — and after a couple quarters of profitability, with some rapid revenue growth, I felt comfortable enough with the company to profile it for the Irregulars back in June, 2013 and, a little while later, to buy shares in my own account.

I still own the stock today, though I did lighten up a bit along the way because it’s a wilder ride than I expected (it went from $35 to $80, then back to $45 on a short-seller attack in 2014, then up to $100 on more revenue growth… it has bumped up over $100 three times in the past year and is now right around $115, a 10-year high).

There aren’t a lot of “royalty” investments out there in the pharmaceutical space — some smaller companies make up a significant amount of their cash flow from royalties or partnership deals with big pharma, but those are mostly “one drug” deals. Other than the private funds (of with Royalty Pharma is by far the largest) there isn’t any “pure play” on pharmaceutical royalties that I’m aware of, Ligand is as close as we get (I’d love to see Royalty Pharma come public, but that’s unlikely unless the tax code changes to let them be a tax pass-through or something like that).

First, why is it a match?

That “proprietary compound” talked about in the tease is Captisol, which Ligand got when they acquired CyDex in 2009. That’s basically a solubility and deliverability technology, I think they mostly use it to convert oral drugs into injectable drugs, and when they make a partnership deal with a drug company that wants to use the technology they end up selling more of their proprietary Captisol and typically getting a royalty (usually a small one) on the gross revenue. That’s an oversimplification, but it’s essentially the business model of that segment of the company. They have other technologies that they’ve acquired as well and are essentially licensing out for drug discovery and development, including the recent acquisition of Open Monoclonal Antibody (OMT) — all of those technology platforms and drug development partnerships are designed to increase the number of partner-funded drugs in the pipeline that could eventually pay royalties.

And yes, they do receive milestone payments from their partners — the basic business model is to acquire or develop drug programs, then, as soon as those programs have reached any kind of viability at all, to partner them off to another company in exchange for milestone payments if the drug makes it through development, and royalties if it is approved. Using $6.1 million for that number for 2015 is reasonable, that’s what they reported for “License fees, milestones, and other revenues.” That number varies widely — they’ve received at least $6 million so far in 2016 as well, since that’s what they were paid when Spectrum got FDA approval for CE-melphalan last month, a drug that will now be called Evomela. (CE stands for Captisol-Enabled.)

They do have a pipeline of 140 “future payments” from royalty-paying drugs — most of those, one assumes, will not make it through the FDA approval process, and many of them will not even get close, but it is a large pool from which future winners might emerge. Ligand calls these their “shots on goal” — the base case for investing in Ligand is that some of these drugs will work and be lucrative eventually, replacing older royalties in the decade to come as patents come close to expiration… and that, since the majority of these are fully-funded partnered programs, Ligand can be passive and doesn’t have to spend anything. They just wait and see if their ship comes in.

Ligand’s revenue for this year is expected to “cash in” at about $112 million (a bit higher, depending on which analyst you check), and most of that is from royalties — last year was about $72 million, so you can see the growth rate that is getting investors excited, but it’s also a company with a market cap of $2.5 billion, so they count on that huge-margin royalty revenue to drive the company. They have only 21 employees, and only a third of those are involved in R&D — this is really more of a financial company that manages a portfolio of assets (with those assets being those 140+ drug compounds and their relationships with pharmaceutical firms).

And the “Eight Royalty-Paying Drugs Now Being Sold Nationwide” is, of course, a match as well. They list eight marketed drugs on their website — though technically, two of those are not paying royalties (they just pay for Captisol materials).

The drug Riggs highlights as the “March 23” approval for “a new prescription medication that will treat the second most common blood disease in America” and “reach $100 million in the next 12 months” must be Evomela, which was actually approved on March 15. That is part of a multiple myeloma treatment, and myeloma is the second most common blood cancer, if not the second most common blood disorder. Evomela could have a meaningful impact on revenues because the royalty rate is extremely high at 20%, so even though the sales volume could be limited there is some expectation that they could hit $100 million in sales and get a $20 million royalty to Ligand ($20 million would be material for Ligand, that’s more than a quarter of 2015’s revenue).

The average weighted royalty rate for Ligand currently is about 4%, with smaller sellers like Evomela having higher royalties and blockbusters like Kyprolis usually having lower rates.

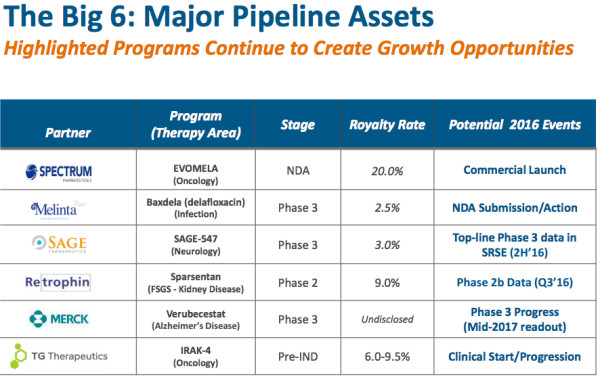

But the two drugs that really make or break Ligand today are Promacta and Kyprolis — none of their other royalties come very close yet, though perhaps Evomela will if it hits $100+ million in sales (it was just approved three weeks ago, so we won’t know for a while). They do have other appealing royalty possibilities in the pipeline, including the “Big Six” — that group includes approved or nearly approved “smaller” drugs like Evomela that will hit the income statement soon, as well as other relatively high-potential drugs like the orphan Sparsentan from Retrophin, the antibiotic Baxdela from Melinta that has completed some Phase III trials and is awaiting data, and some dramatically larger products that are further off but of substantial interest, like Merck’s Alzheimer’s Disease drug Verubecestat (that just recently got a name — it’s in Phase 2/3 trials and used to be called MK-8931).

So there is some potential for meaningfully diversifying beyond Promacta and Kyprolis eventually (there’s also a “Next 12” that Ligand things are emerging to be the next group with big revenue potential), but other than some expectation that Evomela will boost revenue this year it’s not there yet — and as of December 2015, there were only about a dozen drugs in their portfolio that were either awaiting FDA response or in Phase III trials.

Here’s the slide from Ligand’s latest presentation about their “Big Six”…

For 2016, though, it’s still going to be mostly a Promacta and Kyprolis story, with a side dish of Evomela and “steady as she goes” for their older, very small royalty producers. That’s somewhat of a disapointment for Ligand storytellers, because Duavee, the hot flash drug approved a couple years ago, was expected to at least make some dent and probably only sold maybe $25 million worth of prescriptions last year (at a 2-3% royalty, that ain’t much), but the beauty is that although “flop” drugs might inflate expectations and cause disappointment, they don’t actually cost Ligand any cash — they’re not the ones putting a billion dollars into getting the drug through to approval.

Both Promacta and Kyprolis are still growing, and expected to keep growing, so that level of concentration is not necessarily a reason to panic… it’s just a reason to think of the stock as a bit riskier than the idea of “diversified royalty investment” might otherwise convey. If something terrible happens to one of those drugs, either because of regulatory action or some shocking new side effect, Ligand’s stock could get crushed and none of their other royalties is likely to be able to make up that revenue in the near term. That, in the end, was why I lightened up on my position a while back, to control that risk a little better — now it’s a midsize holding for me, maybe 2-3 percent of my individual equity portfolio or so (bumping up into the bottom of my top ten holdings sometimes, depending on the day), and I’m happy to watch it grow without too much concern about that potential risk.

To be clear, Ligand is still very optimistic about both Kyprolis and Promacta — they see Promacta, their largest revenue source, growing at more than 10% a year out several years, and Kyprolis they see more than doubling sales by 2020 (probably mostly because Amgen is trying to move that up to get a first-line multiple myeloma approval for the drug). Those assessments are based on the analyst reports from Novartis and Amgen, for the most part.

That’s the big driver for the expectation that Ligand will have adjusted earnings of $3.40 this year and about $5 next year, off of revenue growth of 60% in 2016 and 35% or so in 2017. It’s worth noting that there are a LOT of adjustments in those numbers, as the short attack complained back in 2014 (GAAP earnings are about half that much), though they’re mostly “non cash” items (employee stock options, which are huge considering the small number of employees, losses of their spun-out subsidiary Viking Therapeutics, acquisition costs, etc.).

So even on an adjusted basis, it’s expensive — perhaps not overwhelmingly so, since that’s about 33X this year’s earnings and 23X next year’s earnings, which can be justifiable for a high-margin business with high growth… but still, being expensive means that your stock can fall very, very quickly if that growth fails to materialize for even one quarter, and Ligand’s shares are indeed volatile. The short seller attention on Ligand has faded somewhat, and the high-profile hedge fund manager who was shorting the stock a couple years ago and publishing negative reports has come under some criticism (and responded, to be fair), but there is still a 30% short position in LGND. That’s both fuel for an upside move, if Ligand surprises or has great clinical news and those shorts have to cover, and a reason to worry, because a big short position usually has some logic on its side.

Even if the “short” logic is primarily a concern about overvaluation and egregious executive compensation, and even if you think the shorts are misunderstanding the business strategy, implying fraud that you don’t see, or overestimating the risk, you should always give the short argument a fair hearing — short investors are taking more risk than long investors, even more so if they reveal their short positions publicly, and they are usually careful researchers. Emmanuel Lemelson’s original short analysis, which I think has some serious flaws but is worth looking at at least as it pertains to their lack of diversification and their very high executive compensation, is here (it’s from almost two years ago, but Lemelson is still short and has not posted much new analysis on the stock since 2014).

I continue to hold Ligand because Kyprolis and Promacta are continuing to grow sales (Promacta was in a dip when Lemelson shorted, but it seems to have recovered, thanks in part to some new indications), and because there is potential for those to be supplemented by other drugs over the coming years… with some potentially significant catalysts for more dramatic stock price appreciation if their Phase 1 diabetes drug looks exciting and they can get it partnered or sold before spending much more on it, or if Merck show’s great success with their Alzheimer’s Disease drug that could have an overwhelmingly large market (did you notice the commonality between those two? Yes, it’s that both diabetes and Alzheimer’s are massive, massive markets — those are low-probability catalysts, but high magnitude if they hit). The risk is high, because of the concentration of revenue in those two drugs and because of the very high valuation, and I can see some logic in taking profits here — but because Kyprolis and Promacta have apparently not yet stopped growing revenues, and because there are still substantial possible rewards if some of their “Big 6” come through, I’m still holding.

P.S. Dr. KSS, who writes and leads discussions about biotech stocks for the Irregulars (our paid members) here at Stock Gumshoe, has not been a fan of Ligand — I hold it, he doesn’t, and he is unimpressed with both Promacta and Kyprolis. He commented about the two back in 2014 when the short attack was fresh if you’d like that perspective.

P.P.S. I forgot to check in on that “180%” number — yes, Ligand shares have risen by roughly 1,000% in the past five years. Depending on the exact dates in 2011 and 2016 that you use it could be 900%, which is, if you simply divide by 5, 180% per year. That’s not how you usually calculate annualized returns, but it is more or less accurate by that simple math.

Thanks Travis,

I found this when it traded $54. Accuses me that I have not pulled the trigger, yet

Maybe because I’m in PDLI. And that was a hell of a ride.

It’s nice to get background on a company, but what about the $2.00 company, that was being touted in Sid Riggs advertisement. Please advise.

Mahalo & Aloha,

Ray Gallant

Haven’t seen Sid RIggs tout a $2 company recently, but all of the Money Map folks have been pretty aggressively re-circulating the Ernie Tremblay $2 “End Surgery Forever” stock for quite a while (that was TRXC, it’s not at $2 anymore).

Nah, this is the ‘brains’ (chip) behind the super-soldier exoskeleton gizmo the USArmy is supposedly developing. They could have saved themselves some money and subcontracted whatever they needed done to the Marines…Semper Fi, do or die!

-nemisis-

thanks for the review i have been in befor higgins made the other goup walk the plank also had a reverse split or was it a buy out in part anywayits along time and ive aged a geat deal w// a failing memory

TRXC is , the one for I bought. Saw the presentationn, went to GOOGLE. Then found them, that’s how I found Gum.[you guys] Hey, free country. He made the mistake and called the idea by correct name.The dummy LOL

LGND for almost 8 points so far from 115 to 123 although it has basically just beat the IBB by a few percent.

I took the “Bait” and subscribed to Riggs’ “Small Cap Rocket” newsletter, but only because it came with a grantee that if LGND didn’t triple in one year, I could get my subscription fee back. So far the stock is up about eight points, and I’ll likely end up getting my money back.

Thanks for this. So, knowing the names of the 8 stocks themselves doesn’t really matter. Now is there anyone who did join the program Riggs is pitching who can confirm LGND. After all I have confirmed some of the other actual pitched products from Money Map Press like SUNE (SunEdison last fall…grains of sand will make OPEC obsolete if we all use Sun Edison products…)

I could also tell you the 4 x-pattern stocks Mr. Hyphenated-Name recommended last fall, that did briefly peak after the X pattern, until my ultra-short trial subscription expired.

Not 8 stocks, 8 drugs. As to whether it’s LGND, there’s no room for doubt given those clues: either he’s recommending Ligand, or the clues are lies. There aren’t really even any companies that are particularly similar to LGND, frankly, though perhaps there will be in the future as the royalty model finds an enthusiastic investor base.

Travis,

is PDLI not in the same Royalty playfield?

What about the part of the pitch below? Is it simply a lie?

“But that’s what makes this investment opportunity so powerful.

[GRAPH HERE showing $10,000 in 2011 growing to $1.38 million by 2016]

In fact, a $10,000 investment in DRUG ROYALTIES going back to 2011 – with reinvested earnings – would now be worth $1.38 million.

This shows you just how powerful this investment opportunity is…”

Thank you for the presentation regarding Ligand. What is the company, that is being touted at $2.00 per share by Sid Riggs? Mahalo & Aloha, Ray Gallant

TRXC, Ray I decidedto google the sugical robot and there it was, a small company with some very dedicated people working for them andare invested. I got sold very quickly. The technology falls in the same catagory as intuitive surgical, which is close to 600 per share. As far as the royalty program, the sales pitch is just that. A bit exagerated, but that’s how they turn it into an ” impulsive buy “. They make thier money that way. I don’t know how they come up with their figures. I’m scared of stuff like that. It’s a fantastic idea. Residuals; what a dreamer huh? If you buy that ,i’ll be glad to sell you some Oncothyreon I’ve been stuck with like, forever ! A big fat LOL on that one,

Thank you for all you do!

Alpha Cells? What is this about?

“Alpha cells” covered here: http://www.stockgumshoe.com/reviews/smart-tech-investor/one-little-shot-to-kill-cancer-dead-from-smart-tech-investor/

I picked up TRXC this morning pre-market at $1.48. Thanks for the heads-up, Wild Bill.

After being strongly burned by following Dr Kent moors impressive recommandation on SunEdison I decided not to take any more chance with the money map hypes on TRXC and fortunately got off the train at $ 5.25….! From now on I will always validate their miraculous investment opportunities with Stock Gumshoe first before making any move. Many thanks Travis for your regular in depth analysis and wise advices. Keep on the excellent work.

John asked: What about the part of the pitch below? Is it simply a lie?

Well, golly gee whiz, John? Lie? Those Money Map people wouldn’t do something as debased as that….Never, never, never. Those $2 stocks are mana from heaven for those shysters in selling subscriptions to unwary investors. Believe me ’cause I was recently a passenger on the turnip truck. Hell, I subscribed to almost everything out there hoping to learn something about stock trading. And learn I did! I learned about X’s, Crosses, squiggly lines on charts that were supposed to mean something, etc., etc.. Then, after discovering that most of it was hogwash and horseshit, I cancelled those that were refundable and kicked myself in the butt for being so damned gullible. Shortly thereafter, however, I subscribed to one other. Yup…Stock Gumshoe. Best investment I could ever hope to find too! And so, John: Hell yes they lie because it’s quite profitable and, apparently, not illegal. They have all found a so-called expert to tout, from ex-government, CIA, Oil companies, Wall Street, and even weather forecasting. Makes ’em appear to know what they’re talking (lying) about don’t ‘ya know.

“Most people look at you and just smile. I look at you and laugh.” (Art O)

I sure appreciate having the Stock Gumshoe to bring a reality check to my financial undertakings. I got a flyer on the Canadian Retirement thing and thought “that’s just too out there to be real”. Sure enough, you nailed it. I figured it was just a different way to sell another investment magazine. Money map is driving me crazy and they are on my to do list for tomorrow to cancel. I will just stick with you for my reality basis, financially speaking. Thanks for all that you do.

Hi Mr Mike M

I would like to pick some TRXC stoc? Kindly advise.

thanks

Leela, TRXC is the subject of the current biotechnology article and may be found here: http://www.stockgumshoe.com/2016/05/the-bedlam-in-young-goliath/ Best2u4U-Benjamin

Could you possibly shed some light on the claim, in the ad, that “if you made a $10,000 investment in 2011 and reinvested every earning back into the investment, that it would be worth $1.38 million in 2016? It doesn’t seem possible that this is accurate, unless you were fortunate enough to be a part of the stock during it’s significant rise to its currect price level. Which begs the question, what is the likelihood that this statement, if it is true, would have any baring on future performance.

Can anyone tell me why Sid Riggs’ little company with the cure for Zika keeps going down in the stocks. purchased stock in Aug @ 7.62 now its about half. Would appreciate any feedback as soon as you can. I am afraid they might go belly belly.