Jim Rickards, an economist and lawyer who has been peddling newsletters for Agora for a couple years, has a new ad out for his Strategic Intelligence newsletter that tries, as so many have for the past five years, to lather readers up into a panic about the imminent demise of the U.S. Dollar.

And, of course, it’s a newsletter ad — so there has to be a deadline. There’s no urgency to sign up unless they tell you that this huge opportunity will only last until a specific date… and without urgency, of course, we’re free to wander off and think about other things. Just like car salesmen frantically try to get you not to you leave the dealership by throwing their “best deal” at you and saying the car you like may be gone tomorrow, newsletter pitchmen are panicked that you might click away from their ad without buying. The customer who waits to think things over is much less likely to buy.

And the deadline this time is September 30 — and Rickards makes it seem even more imminent and “insider-y” by putting a time on it, too:

“This time, and on top of every other pressure our cash already has to face, there’s an exact deadline on the calendar . In a nutshell, it’s an event scheduled for Friday, September 30th.

“By my best estimate, what’s coming will go down around 4 pm.

“And when it does, you’ve got no idea yet how radically this could end up impacting your financial safety.

“Not only could this event gut the U.S. stock market… and cannibalize your retirement savings… but it could ultimately END what we’ve come to know as the American way of life.”

No soft-pedaling there, right? Soft pedaling doesn’t sell newsletters, strong opinions and urgency sell newsletters. Just ask Porter Stansberry about his “End of America” presentation from 2010 and 2011 that predicted riots in the street, food shortages and more as the dollar loses its “reserve currency” status.

As we’ve seen with most “doomsayer” pieces over the past 40 years (Porter’s “End of America” piece was the most aggressively marketed, but there were lots of other people saying much the same thing about the dollar’s demise not only in 2010, but for years before that… and from time to time over the past few years, too), these arguments usually have plenty of reasonable-sounding logic in them and there were and are real risks, not least because the general trend of all “fiat” currencies is to inflate the currency base and gradually erode the value of the currency over time.

But believing in the “fear” message or the specific predictive power of a particular pundit too strongly would have likely led to tremendous opportunity costs for investors who bunkered down and missed out on the big run in stocks, bonds and the US dollar over the past five years. People were already afraid of stocks after the 2008-2009 crash, they were ready to hear the message that “the end is nigh” and hide in the cellar, and that’s not so likely to have worked out well for most of them (depending, of course, on the specific pundit and spiel you’re talking about — but there were a lot of them from 2009-2012, at least, predicting Dollar “doom”… and that has continued in more recent years as well).

I tend to get too blathery when talking about the risks of believing in a compelling-sounding story coming from a reasonable-sounding “expert,” so I’ll try to be relatively brief in looking at what Rickards is actually talking about. Just remember: One of our great weaknesses (and gifts) as a species is our love of storytelling, and our tendency to build a narrative around events that makes us believe we can predict the future is ingrained and very strong.

So what is it that Rickards sees coming this time? Here’s a little more from the ad:

“… there is a new form of currency that’s about to flood the world economy. It’s not money for you. You’ll never get to withdraw it from an ATM, even if you travel overseas.

“This new form of money is strictly created for the financial elite.

“We call it ‘world money’ because of what it could ultimately do — and soon — which is replace U.S. dollar reserves around the world.

“That’s right — this is as close to the end of ‘king dollar’ as we’ve ever come.

“Now, what does that mean exactly? After all, what do you care if the people in Asia, Europe or the Middle East suddenly decide the dollar no longer gets #1 status around the world? ….

“Losing our #1 status means giving up a whole slew of benefits you never knew you had….”

He goes through some things that he thinks will happen “when central banks empty their vaults to make room for ‘world money'” … he notes that it “could push world stock markets off a cliff,” “gut your savings account,” “hike up prices you pay for everything” and “send U.S. tax rates soaring as D.C. scrambles for another source of cash.”

So that sounds pretty apocalyptic… but then, more from Rickards:

“Is this the monetary apocalypse? Not exactly.

“In fact, it’s not even the first time we’ve had a currency implosion like the one I’m warning you about now. It’s happened three times just in the last century — in 1914, 1939 and 1971.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“What I am telling you though is that you will want to take steps to get ready.

“In case you still doubt the accuracy of this September 30th date… or what’s about to replace the dollar… I’ve even got some smoking-gun proof.

“It’s an actual 42-page blueprint… buried deep on the website of the world’s most powerful financial institution. This document lays out exactly how “world money” works.

“Inside the document, it says…

“If there were political willingness to do so, these [“world money”] securities could constitute an embryo of global currency.”

Translation?

“The financial elites are saying this could be the “money” that replaces the dollar in central bank vaults the world over.”

And the panic sets in:

“If you’ve got even a nickel in dollar-denominated wealth, you need to pay attention.

“Because, make no mistake, the day ‘world money’ fills that role… the value of the dollars in your bank account will plunge in value, virtually overnight.”

So what’s he talking about? As best I can tell this is, once again, a hullabaloo about the fact that the IMF is going to change the makeup of its special drawing rights (SDR) calculation for reserve currencies on October 1.

The move is well-known and well-telegraphed, and it’s really about China more than it is about the US dollar (unless, of course, you’re reading between the lines and predicting that this is a first step in the IMF taking over global currencies — which is a conspiracy theory line of thinking. Conspiracy theories are not necessarily wrong every time, but they rarely make for good investment strategies).

The SDR is a derivative reserve currency created by the IMF to try to diversify global reserve currencies, and to some degree that’s intended to lessen the reliance on the US dollar as the single reserve currency — though it’s not new. The SDR has been around since the late 1960s, and was originally based on gold and the US dollar (since major currency exchange rates were still fixed back then, under the Bretton Woods postwar system that collapsed a couple years later). Now, I’d describe the SDR as an attempt to have a global reserve currency that’s more representative of global trade flow and economic power — it exists as a currency, sort of, in that countries can exchange it and it’s occasionally used in some exchange rate calculations, but the most widespread use has been the 2009 attempts to bolster some economies whose balance sheets were in trouble, and I think the only real value of the SDR is that it can be exchanged for the currencies that make it up.

Currently, the SDR is made up of the U.S. dollar (41.9%), euro (37.4%), Japanese yen (9.4%), and pound sterling (11.3%). As of October 1, in a move that was announced last November but delayed a bit to allow more time for the Chinese Yuan to become more freely tradable, the makeup will be: U.S. dollar relatively unchanged at (41.73%), and weightings for the euro (30.93%), yen (8.33%) and pound (8.09%) fall to make room for a 10.92% slot for the Chinese currency.

Similar words of panic about the fall of the dollar were distributed by a number of pundits last year, leading up to the decision to include the Chinese currency in the SDR basket and therefore acknowledge China’s importance as a global financial player, and the fear then was also largely that the US dollar would fall because suddenly all this money would flock into “SDRs”.

Which, of course, didn’t happen. There are precious few SDRs in existence (a few hundred billion, I think — there are roughly 10 trillion US dollars in the global money supply), and as a non-economist myself it seems like more of a political, foreign aid, and bookkeeping tool than anything else (I’m sure Rickards knows a lot more about the use of the SDR than I do, but it seems quite limited to me). SDRs are made of money, and the only reason they haven’t been completely obliterated in value over the past couple years is that the US$ and Japanese Yen make up half of the SDR — the other components have been getting clobbered, even before the Brexit drop.

And if the worry is that there’s a new global currency that’s going to replace the current system, which is dominated by the dollar but also includes huge flows of cash between every major currency every day in a fairly seamless dance, I can’t help but think that ship has sailed. If there’s anything we’ve learned about global politics over the past few years, it’s that countries are now suddenly aware that giving up control of their own currency creates the potential for economic disaster. Controlling your currency, either by deflation or inflation or by actual curbs on trade or on money flow, is one of the key capabilities of any nation — and those who give it up often find (hello, Greece) that their partners (hi, Germany) have different priorities when it comes to currency values and stability.

So… could the US dollar lose its status as the preeminent “reserve currency” for the globe? Sure. That’s sort of been happening, to some gradual degree, for years — the euro (until the last year or so, at least) was starting to take a piece of that role to some degree, and central banks that are cash-rich, like China, have spent the past decade talking about diversifying their reserves.

But from what I can see, this is moving very, very slowly. Certainly no one is really dumping the dollar, because they’re all too aggressively trying to dump their own currencies to try to create local inflation and raise exports to keep their citizens happy. This has been going on for several years, central bank reserves seem to be getting a little less dollar-centric, and other currencies (mostly the Yuan) are rising in global importance… but the only major currency that has been going up in value versus other currencies is the US dollar. Old habits die hard.

Here’s a chart for the past five years — I used the currency surrogates that are easiest for small investors to trade, the CurrencyShares ETFs (Blue FXY is Yen, red FXB is Pound, green FXCH Yuan Renminbi, orange FXE Euro) and the Dollar Index (purple AMEX). You can see that the Japanese Yen has had a bit of a recovery in the past year or so, but otherwise the only trend of the past five years has been “sell everything else, buy more dollars.” (This isn’t a completely fair representation of those currencies, but it’s pretty close)

That’s the past, of course, not the future — but it’s important to note that 2014 and 2015 saw several waves of very similar “the dollar is dying because the SDR basket is changing” arguments from newsletters and other pundits (as well as the “FT-900 shift” that was fretted about as a “dollar killer” back in 2014). They’ve all been very wrong so far, other than the fact that most of those folks have urged investment in higher-quality gold mining or gold royalty investments which have now finally gotten some traction. That doesn’t mean they’ll be wrong forever, or that their insight into trends might not be worth considering, but when they promise a change that’s going to happen on a specific date we should be very skeptical.

So what does Rickards think you should do to avoid this “disaster” that will be coming “around 4pm” on September 30?

More from the ad:

“The first shows you how to hedge your wealth against an immediate backslide in the dollar. At minimum, it’s a way to halt your savings from going to zero. At the outer reaches, there’s the potential for an extraordinary eight-to-one return.

“Then I’ll show you how to avoid another 2008-level wipeout in the stock market. My risk models exposed the last bust over two years in advance. This time, they’re signaling an even bigger fall. But that doesn’t mean you have to hang on for the ride.

“I’ll show you specific, household-name stocks that look especially toxic for the coming collapse. I can also show you how to make money even as Wall Street comes undone. In my own career, I’ve made gains on falling shares as high as 3,000%.

“Finally, I can show you how to own a stake in ‘new money’ itself, before it replaces the dollar and takes over the #1 slot as a world financial reserve. This would normally NOT be possible for most regular investors. However, I’ve found a completely original way for you to do it.”

OK, so that last one is easy — if you want to own a stake in this SDR “new money,” just buy the currencies that make up the SDR. It’s not rocket science (though it is, unfortunately, a little bit of math). I don’t even see any reason to be precise, frankly — if you round things a bit you get to 40% US dollar, 30% euro, and 10% each of Yuan, Pound and Yen. You can buy all of those either through a foreign currency-denominated bank account (probably Everbank makes this easier than most, though many big banks can provide accounts in foreign currencies and I don’t know if they’re necessarily the best), or using those same CurrencyShares ETFs in your regular brokerage account. And, frankly, if you live in the U.S, you’ve already probably got lots of dollar exposure, so you could just split your “mimic the SDR” allocation up among the others — half in euros, half split roughly evenly among the other three. Easy enough. (This is not a recommendation, of course, and I’m not doing this, I’m just trying to approximate what a “buy the SDR” decision would look like for an individual investor.)

I assume that his “potential for an extraordinary eight-to-one return” pitch is related to much of what he says in the remainder of the ad (and in his book, The New Case for Gold) is about investing in gold — that gold mining stocks have the potential to provide highly levered returns. Which is true, and in an era of competitive currency devaluation it’s logical to me that gold should do well… or, at least, should help to protect against any really dramatic loss of value in a particular currency.

The “avoid another 2008-level wipeout in the stock market” is presumably a reference to hedging — which is fairly expensive, as a general rule. You can bet against the broad market either using options (like buying put options on the S&P 500 through the SPY ETF or one of the many other broad-market ETFs), or by using inverse ETFs that use futures contracts to move up when the market they’re tracking moves down. Both will work if you’re reasonably accurate about time frame, but both also have substantial time decay if you’re wrong — which is a fancy way of saying that holding those levered bearish positions costs money, so if you don’t end up needing the hedge (because the market doesn’t go down) you will have wasted quite a bit of cash. Sort of like insurance, though compared to most kinds of insurance contracts these bets against the market are much more expensive.

The cheaper solution would just be to short the market, or to short particular stocks that you think will fall particularly hard — that doesn’t carry as much cost, other than whatever it costs you to borrow the shares that you’re selling short, but it carries a larger risk (shorted positions can theoretically post infinite losses, since a stock could go up forever) and it doesn’t provide any additional leverage like an option or a 2X or 3X inverse ETF will… so you may need to hold a big short position to make up for the risks you think you have in the rest of your portfolio.

Personally, I’m a long-term investor and a long-term optimist about the future of the stock market, so my preference during times of uncertainty (which I’ll agree we seem to find ourselves in) is to do any hedging in active investments (like buying gold miners, which can hedge against some adverse markets or currency changes but not, of course, against everything bad that could happen) and, perhaps more importantly, to be mindful of individual company risk, think in advance about whether I want to use stop losses for particular holdings, and to keep more cash than is usual in my brokerage accounts. That last one is a position I’ve been trying to adhere to most of the time for the past couple years, with more cash than is usual for me… and that extra cash has hurt performance in my portfolio, though not, of course, as much as an active bet against the market would have.

Here’s one more bit of the scary scenario laid out by Rickards:

“After September 30, bank vaults worldwide could opt to swap dollars for “world money.”

“This could send a tidal wave of cash back to the U.S.

“And you know what happens when there’s too much of anything.

“It makes everything that’s there worth less.

“Imagine paying twice what you pay now to buy a car, an iPhone, or gasoline. Companies that do business overseas could see every cost advantage vaporize. Will that bring jobs back home too?

“Don’t count on it.

“Because weaker dollars will make costs soar here too. You could see mass layoffs. Some companies will just shut their doors forever. They won’t have any other option.

“Of course that will slam the stock market.

“As global investors flee, you could see stocks crash 50%… 60%… or more.”

That “too much money makes it less valuable” argument should work, but it hasn’t really, not yet — we’ve been churning out more and more dollars by cutting interest rates and doing quantitative easing, and most other major currencies have also been churning out more and more and easing monetary conditions as well, so all currencies should be falling. And they are, in relation to asset prices — that easy money is why real estate is again going up in the US and in many other places, and it’s a big part of the reason why the stock market is going up (which is why everyone’s panicked about what happens if interest rates really start to go up, which could also begin in September… though the betting on that is decidedly mixed). And it’s probably why gold has finally been rising this year, though that rise has been widely anticipated by lots of newsletter guys for at least a couple years.

Does that mean we’ll see a crash? Or that October 1 will bring a sea change in the global economy? I really doubt it. Not that the market won’t go down — the market is pretty expensive and obviously jittery, and it wouldn’t take much in the way of bad news to cause a correction in the stock market — but I don’t think it will have a lot to do with the change in the SDR or the possible continuing transition to having less dollar-centric reserves around the world (global reserves are roughly 60% in US$, from what I’ve read, and the IMF SDR basket is 40% US$… but do you see a lot of central bankers making big bets on the euro or yuan right now? I don’t, I expect change in that world to continue to be gradual and political and not all that meaningful to most long-term investors. I could be wrong, of course, and I’ll agree that the “free ride” the US has gotten on our massive debt and overspending should slow down… but I don’t see much profit to be made in trying to predict the month when that will happen.

And then Rickards leaves us with a couple more hints about specific things he thinks we should do to protect ourselves:

“I tell anybody who listens to take 10% of whatever they’ve got set aside, whether that’s $5,000 or $5 million. And then put that in physical gold. That’s enough to build a foundation.

“And how to lock in gold and silver ownership for tomorrow at a low fixed price. It’s like getting a special ‘call option’ on the rising price of gold and sliver. With a long-haul expiration date.

“Plus, income streams with a built in hedge against a crashing dollar. As cash unravels, these income streams should go up. You can own a percentage stake as they do.”

That’s essentially all commodities-based — owning some physical gold, and 10% of savings or 10% of a portfolio seems like a rational number to me; “locking in” gold and silver at a low fixed price is likely a reference to either streaming or royalty companies, who do just that, or even, more conceptually, to “gold bank” companies who buy up projects that have gold in the ground but don’t have plans to actually mine it themselves.

And income streams that hedge against the dollar could also be most any dividend-paying commodity stock, at least in theory, though I imagine he’s probably still talking about streaming and royalty companies. A few years ago a similar argument might have extolled the value of oil royalty companies, but most folks are a little too timid to recommend those after the beating they’ve taken since the oil price collapsed starting two years ago.

Finally, we get one “must buy” investment from Rickards:

“… you’ll want to own the one must-buy I name in the same report.

“It gives you a claim on special ‘streaming contracts’ to buy gold for as little as $400 an ounce… and silver as low as $4 an ounce. These deals are already locked into place. Which could send these shares skyrocketing as metals price start to soar.”

If that’s a reference to a single investment, then it’s most likely a reference to Silver Wheaton (SLW), which is by far the biggest of the big royalty/streaming companies (and, despite the name, has branched out to include gold in recent years).

There are now a decent handful of cash-flowing royalty and streaming stocks, but clearly Silver Wheaton, Franco-Nevada (FNV), and Royal Gold (RGLD) stand above the rest, and, honestly, any of them would be a decent core holding for someone who wants precious metal exposure without a lot of risk tied to one specific mine — though they’re all quite expensive based on current fundamentals. There are smaller players in the space, too, including Sandstorm Gold (SAND), which has been my favorite for many years (though it has done worse than the others until this year) and Osisko Gold Royalties (OR), and there are a lot of little companies who own royalties on specific projects.

The basic difference, if you’re looking into these kinds of investments, is that “streaming” means you have a contract to buy a certain portion of a mine’s output at a fixed price, while “royalty” usually means you more passively receive a percentage of the value of the metal (or whatever) that comes out of the smelter. The general rule is that streaming deals have been done mostly on projects that are closer to production or on secondary products of a mine, and royalties are often bought (or awarded) based on much earlier-stage exploration projects (often a junior miner or landowner, for example, will sell a project very early on and receive a royalty as part of that compensation), though there are lots of variations.

Royalty companies and streaming companies are clearly levered to commodity prices, both because the mines are more likely to be built and production maximized if prices are good (and they don’t get anything from mines that aren’t producing) and because they have upside to higher prices without having any additional cost as prices rise (so if Silver Wheaton’s deal is to buy silver at $4 an ounce from a mine, for example, their profit doubles as silver goes from $8 to $12). They don’t have any protection, really, if commodity prices fall — mines can get shut down and make their royalties at least temporarily worthless — but they are generally at least without obligation. They don’t have to put any money into the mines after they’ve bought their streaming deal or royalty (though sometimes they do, particularly if they’re trying to “rescue” their partner and help the mine get built).

So I’d reckon that Rickards is probably recommending Silver Wheaton (SLW), which is likely to be a nicely levered play on both gold and silver — though it’s important to note that it’s also involved in a very active tax dispute with the Canadian government, and the outcome of that could have huge implications for Silver Wheaton’s income (hundreds of millions of dollars in unpaid taxes). It’s probably not a “company killer” of a tax ruling if they lose, since they have huge assets and a $12 billion valuation, but it could easily cause the company to get revalued much lower and I don’t know if it would impact the anticipated earnings in the future (perhaps they’ve changed their structure to route less income through the Caymans for tax avoidance, I don’t know). I can’t claim to have any particular expertise on this, but the filings and reports I’ve read (there’s a good Globe and Mail article here, for example) indicate that Silver Wheaton has been more aggressive about this tax shelter activity than the others (yes, even more than Sandstorm Gold, which was founded by Silver Wheaton’s old CFO).

I’d say that Silver Wheaton is the cheapest of the streaming and royalty firms, but is cheap at least partly because of the risk (and probably because they get about 60% of their revenue from silver, which doesn’t get as much love as gold) — Franco-Nevada is the oldest company in the space and probably the safest bet, and Sandstorm Gold is my personal favorite largely because it’s small and has more rapid growth potential.

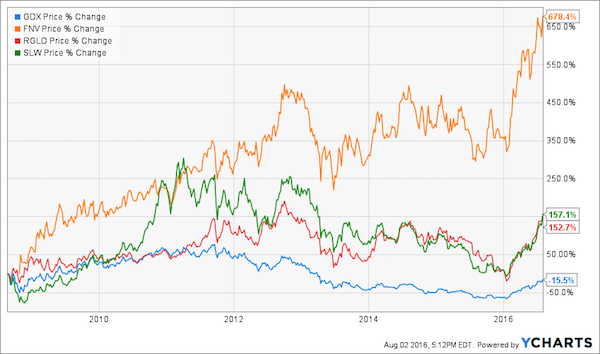

But they’ll all probably do quite well if precious metals prices keep rising, so to some degree you’re splitting hairs — if you don’t want to pick individual stocks, my favorite gold mining ETF is Sprott Gold Miners (SGDM), which, unlike the more popular Van Eck Gold Miners ETF (GDX) does not have a substantial weighting in Franco-Nevada or Silver Wheaton… but which does include both Sandstorm Gold and Royal Gold among the actual miners in its portfolio. And as you’ll notice on this chart, royalty companies don’t have as much upside as the average miner when there’s an ebullient market like we’ve had so far this year:

That’s a year to date chart, and it shows that the two big ETFs have done far better than most of the royalty/streaming firms, the two outliers who have done worse have been Franco Nevada and Osisko — the former probably because it started rising before the miners and would have been by far the better performer if we went out two years, the latter probably because it’s not yet very diversified. You do get a reduction in mine-specific risk from a royalty company, and you do arguably get an easier “one purchase” bit of leverage and diversification… but you also get that from a good ETF, so you don’t necessarily have to make things all that complicated while you’re in a bull market. Over the long term it makes a difference, partly because royalty companies can compound their earnings, so Franco Nevada and Royal Gold have clobbered the GDX ETF over the past decade… as in this chart:

… but if you’re just thinking about what will happen if gold goes up by 20% in the next year, the difference is likely to be less substantial.

I can’t claim any great prescience about the speed with which economies adjust… but I certainly did put substantially more into gold investments early this year and have added to some of those (particularly SGDM) and taken profits on some others, my gold exposure is now a little bit more than 10% of my portfolio, particularly if you include Altius Minerals (ALS.TO, ATUSF) which is only slightly exposed to gold (that’s more of a copper, potash, coal royalty play).

And really, I’ve written similar things about diversification and being wary of predictions of doom for quite a while — so I’ll leave you with these words that I wrote in a Friday File back in the Spring of 2014, when people were also worried (they always are, particularly when making people worried is a good business):

We’ve written some in these parts about the many, many predictions of a US dollar collapse and an associated economic and societal collapse — recent newsletter pitches that spin this “doom” story have come fast and furious from Porter Stansberry and several others, and they are a pretty popular stock in trade in the world of investment newsletter marketing … though Porter did raise the bar considerably with his huge (and probably extremely successful) marketing investment in the “End of America” video promotions that he started to run several years ago.

That doesn’t mean that the predictions of doom are wrong… just that we’re well reminded that they are marketing. They are selling the fear of what might happen, and the fear of being unprepared or missing out. These pundits may well actually believe that the worst will happen, or that the trend for the US economy is bad enough that something very bad is very likely to happen, and they might even be right… but the wording and the emotional drama of the ads are simple advertising. And it works. I get worried when I read these ads or listen to the presentations.

I don’t sell all my stocks and put my IRA into gold and buy a citizenship in St. Kitts and Nevis or an estate in Nicaragua or Argentina because I fear the US will descend into chaos… but I do worry.

And there are very reasonable, mainstream things that people do every day to protect their savings against confiscatory governments or future inflation or currency devaluation… and, of course, reasonable things that every family can do to protect themselves from disasters both natural and man-made.

And really, if you subscribe to most of these newsletters I expect that’s going to be the advice that you will actually receive… be prepared, but don’t sink all your money into gold or guns or cans of beans in the basement and don’t stop thinking about ways to grow your net worth in the stock market. The disaster prognosis sells books and tries to kick-start some “outside the box” thinking, and there’s probably nothing wrong with that unless you get overwhelmed by the fear-based marketing, but meanwhile the newsletters these folks write and sell continue to recommend various types of real, mainstream investments that you can trade on the stock market.

So sure, as far as I’m concerned I think folks should feel free to buy an air horn to protect yourself from burglars, or buy a little farmland in the country if that’s feasible for you and you think you’ll need to plant beans to survive, keep an emergency kit and some supplies like most folks started doing after 9/11… and heck, if you suffer from the greatest fear of the wealthy, that your savings will be confiscated and you’ll be in the same boat as everyone else, feel free to buy that yacht to get you out of the country, and that home in Panama, and that overseas bank account (make sure to report it to the IRS). But most people can’t afford those things, or would be pretty minimally protected by having $10,000 of their savings in a bank in Canada or Panama.

It is very easy to go beyond reasonable preparation and bring yourself to the edge of panic — particularly if you’re also angry at the stock market, or at big business or the banks, or at the government or our elected leaders. Panicked people don’t make smart or well-timed choices very often, but they do buy newsletters and freeze-dried beef stroganoff and, apparently, collectible silver coins if the ads I’m seeing are any indication. I think there’s plenty of reason to worry that people might be shocked by some future economic downturn, whatever the cause, but I also think people who spent hours and huge amounts of psychic energy worrying about how to get some money out of the US would have been better off figuring out how to save more money and focusing on diversification. Better, I think, to deal with the crisis we know we have, a population of people who, on average, expect 30 or 40 “golden years” of retirement but haven’t saved nearly enough to live that retirement. Panic a little less, diversify, and save a lot more.

I love diversification. I like diversifying so that my stock portfolio isn’t dependent solely on the US economy and includes a large weighting in companies who operate elsewhere or globally and own “real” hard assets or valuable and irreplaceable businesses (though to some degree that diversification has been a drag on my portfolio in recent years), I like diversifying so that my savings is not solely in US dollar bank accounts (largely with physical precious metals and with foreign currencies, though I don’t currently hold any foreign currency CDs as I often have in the past)… but I don’t fool myself into thinking that I will know when the stock market is going to have its next crash, or when the dollar will reverse course and lose value against hard assets or other currencies.

I do think the US$ will lose value over time, but that’s like saying that water will run downhill — the dollar has almost always lost value over time, though often very slowly. That’s why people invest their money instead of sitting on it. Recent blowouts in the amount of government debt, and expected weakness in the US economy as we hit the demographic morass of the Baby Boomer retirement, are obviously frightening and largely unprecedented… and it is especially difficult to calculate the impact US debt and unfunded obligations might have on the currency because the world has never been as interconnected and interdependent as it is today.

The US must logically be nearing the end of the currency “free ride” that we’ve enjoyed by lending people money in a currency that loses value over time, and that we control the issuance of, but demand is still extraordinarily high for the dollar and for US assets and, yes, for US debt. It is ridiculous that people are willing to lend money to our very broke government at less than the average historic rate of inflation… but it has been ridiculous for a long time. The original “End of America” video from Porter came out in the Fall of 2010, if memory serves, suggesting farmland, gold and silver coins and foreign bank accounts among his protection ideas as the US dollar loses its status as the global reserve currency, more or less the same kinds of “escape from the dollar” things he and other pundits have typically suggested more recently.

Those are not necessarily crazy ideas, in moderation, nor is there any reason to avoid diversification, but there is a substantial opportunity cost when you go beyond diversification and let panic send you “all in” on your “escape from the dollar” plan. If you had put all your savings into gold in late 2010, for example (not what Porter was suggesting, to be clear), you would have lost about 10% on that position to today… not so bad as a hedge… but you would have also missed out on the opportunity to have made a 20% gain by holding long term government bonds during that time, or 50% by holding a broad basket of stocks like the S&P 500.

So that’s what I said back in May of 2014, in response to a different teaser pitch (that one was from the Weiss folks)… and I still think it makes sense now. And I still think I’d likely find those words to be sensible if I look back on them five years from now. Don’t panic, don’t bet the farm that the dollar will crash on October 1, but the dollar probably will go down over time and it makes sense to be diversified enough that your portfolio can handle that. Beyond that, well, I don’t know what will happen this Fall — and worrying about what the world will do in a few months or a few years takes me away from stuff I might be able to understand, like the analysis of a particular company.

It’s your money, though, so what matters is what you think — are you panicked about the adjustment to the SDR? Anticipating a collapse in the dollar and an end to our way of life here in the currency-charmed US? How would you prepare? Let us know with a comment below…

Disclosure: among the investments noted above I have personal positions through either common stock, options or warrants in Sandstorm Gold and in the ETFs SGDM and GDX, and own physical gold and silver (mostly bullion coins). I will not trade in any covered stock for at least three days following publication per Stock Gumshoe’s trading rules.

I had a chance to read this, I really enjoy what Jim Rickards says. Personally, I don’t think the dollar will die until after the elections, just my opinion.

Larry Ellison, who toils for another newsletter publisher (Weiss), had a somewhat-veiled response to Rickards in one of his free articles recently too — you can see it here, but this is an excerpt:

I don’t know if Ellison is consistently right any more than Rickards is, to be fair, but I do always like to see newsletter pundits argue with each other or call out specious arguments that their competitors are peddling.

After listening in on two or Rickards calls over the past few weeks, I don’t believe he is saying we are going see much of anything happening on Sept. 30th. His point is this will be the point when the decline of the dollar starts and will take years to fully decline. We will not see any less dollars in any of our accounts the dollar will just won’t buy as much. If you heard something different I would like to know what it is.

The ads are far more hype-filled than his interviews and regular articles. The ads very much say September 30 is “D-Day” and imply, without stating directly, that he thinks things will happen fast after that.

That’s not really different from most pundits — the ads are always much more hyperbolic than the actual analysis, because you get a lot more subscribers when you emphasize a near-term and urgent catalyst.

The bank of Hawaii has 170,000 tones of gold. Check it out. Karen Hudes a whistle blower said originally the gold was to be used to back all currencys, but it will also lower price of gold. WHAT IS UP WITH ALL THAT GOLD?

That’s very unlikely to be true, though I’ve seen that person’s conspiracy theories mentioned before. US gold reserves are about 8,000 tonnes and 170,000 tonnes is roughly what is usually reported as the estimate for the total amount of gold ever mined (some folks think the number is much higher, of course, particularly because the amount mined before the 19th century is a fairly wild guess). World production has been in the 2,000-3,000 tonne/year range recently. The notion of almost all the gold every mined being in a secret vault on a volcanic island in the middle of the Pacific sounds more like a James Bond movie.

I have been following Karen Hudes also. She believes there is a way to transition to a reformed monetary system. Current currency system will collapse. Oh and she addresses the topic and argument regarding the 170,000 tones of gold. She believes there is a lot of gold, more than stated publicly and for this reason it might not as strong an investment as goldbugs might think.

https://www.youtube.com/watch?v=8JR4IAOEpgM

Are people seeing what’s taking place in major US cities? Are they looking at the militarizing of local police forces and martial law drills black hawk helicopter troops are conducting in these cities under cover of darkness? Are people looking at the executive orders Obama is signing pertaining to powers the government will have in the event of national crises? Are they looking at preparations major banks are making for crises? If the answer is no to any of these points I’ve mentioned, then maybe you need to start doing your research and ask yourself, why are all of these preparations being made? The answers would seem to foretell that our fearless leaders know something cataclysmic is on the horizon.

All recent executive orders are published here, which ones are you worried about?

The militarization of the police is a significant problem, I think, though it’s a trend that has been pretty steady for 25 years, ever since the military surplus from the first Iraq war buildup started making its way to the streets of Sheboygan and Poughkeepsie.

I hope that banks and the government are preparing for crisis. That’s what they’re supposed to do. That’s not the same as predicting that there will be a crisis. I don’t buy insurance because I know that my house is going to burn down, I buy it because I worry that it might burn down… and the insurance company makes a lot of money because most of the time, the stuff you’re worried about doesn’t happen.

“Be prepared” is different from “be certain that cataclysm is coming.” I agree in some ways that things feel riskier right now than they did last year, but I don’t think my feelings are a very good barometer for what will happen to the country over the next five years.

Being so late to this party, I have not had the time to read all 167 comments to date so I apologize upfront if I repeat anyone’s comments.

Be careful with Jimbo, and Agora as a whole. Their hype far exceeds their results. I got in the Impact/currency newsletter (1750!) and found out a secret to the game. Recommend long–2018—options that will not show success until waaaay after your one-year subscription has expired. Call it currency but only 3 out of 20+ recommendations I have seen have anything to do,with currencies.

As far as physical gold and silver goes, and I am not saying yea or new, but keep in mind that most banks do not allow storage in a safety deposit box of any currency to include gold and silver. If you feel secure enough to store under your bed, go for it. Next, how liquid will gold and silver be that is outside the assay chain? I have bought and then sold US Silver dollars at a local coin store but the spreads were not what I expected.

Finally, I too was an Inteligence Officer (just like Byron claims and Jimbo asserts he gets the inside poop from) except I had, and still have real, foreign sources of information and they are saying China is quite close to implosion. I don’t take China’s world position too seriously.

What does this have to do with the article? Do your own homework, get second and third opinions, don’t fall victim to the fear tactics and keep reading gumshoe for the most unbiased reports that I have seen.

P.s. agora has bought out so many newsletters over the last year that I get 5-6 newsletters daily that say the same thing. Agora had an original self-licking ice cream because if so many folks are saying the same thing it must be true right? Except they are all owned by Agora.

So in this case, he is a liar or spruiker for Agora Financial ?

It is Larry Edelson, by the way from Weiss Research, not the way you spelt it and his track record is very good on gold and saved me a lot of money years ago, so I suggest that you look at his Real Wealth Report!

Gumshoe is terrific as well, by the way!

He only has a few hours to prove himself right!! However all his marketing nonsense is basically just try to get you to sign up their impact system.

It’s septmber 30, 2016 and nothing, zip nada, all hot air!

Who is this Richards, seems to me another scam artisr

Sept. 30, 2016 closed all up DOW 165, NASDAQ 43, and S&P 500 17. Sky didn’t fall Jim R.

After listening in on two or Rickards calls over the past few weeks, I don’t believe he is saying we are going see much of anything happening on Sept. 30th. His point is this will be the point when the decline of the dollar starts and will take years to fully decline. We will not see any less dollars in any of our accounts the dollar will just won’t buy as much. If you heard something different I would like to know what it is.

Jim it is now Oct 20, what happened?

Since rickards, once again, missed his latest guaranteed predicted Sep 30 crash, he is now saying the new crash will be Dec 31, 2016.

He is also once again pushing $10,000.00 gold like he did back in 2010. He also predicted a 3300 Dow at that same time. He could not have been more wrong. Yet he still stays in business.

How can someone is so wrong on so many things still have any following? It appears his only fans are those who read his books for confirmation of their beliefs.

test

Does anyone have more examples of Rickard’s predictions, and the results? My guess is that he’s been wrong at least nineteen out of twenty.

This should be a no brainer. Anyone who believes our stock market is going up should not gamble on companies, 50% and greater of which are upside down between their cash and revenue vs debt, unless one likes to play Russian roulette. Speaking of Russia, one of the top performers of 2016 was Rsx – VanEck Vetors Russia ETF which was up well over 50%. But for those who like our American stock exchanges, unless you are a guru and can pick like Motley Fool or others who claim large percentage gains, SSO, or Proshares Ultra S&P 500 will outperform most companies, including Berkshire Hathaway. And for those who agree with Jim Rickards and others who see a redo of 2008-2009, the stock for you is SDS – Proshares Short S&P 500, which rises when our markets fall.

Jim Rickards has been peddling this for 8 years now.

My best investment strategy is to read what JR writes and do the opposite. The sky isn’t falling, and he’s been screaming like chicken little for years.