I’ll open today by saying that I don’t know if the euro will rise or fall against the dollar over the next two years. And neither does anyone else. Global currency markets are vast and complex and driven by trader sentiment and economic growth and interest rates and unpredictable crises and lots of other influences.

But, of course, that doesn’t stop investors and pundits from trying to predict them, or from having opinions — and they’re strong opinions sometimes, and well-backed by evidence, and they sound compelling and true. Just like the predictions that the US dollar would collapse four years ago sounded compelling and obviously true to many people (the dollar, in case you didn’t notice, has been incredibly strong for years despite the perceived overabundance of liquidity from the Fed, lapping essentially all other major currencies… and helping to keep our inflation rates and commodity costs low, among other things).

So that’s the intro from me — I share that just to remind you that Larry Edelson’s predictions about this next “supercycle” move in the Euro, though they sound compelling and evidence-based, are not necessarily going to come true. We all have a tendency to believe logical arguments, that doesn’t mean the cleanest logic wins in the end when you’re talking about the real world. It doesn’t even mean that people who were right about the strong dollar a few years ago (I wasn’t one of them, to be clear) will be right about what happens in the next few years.

But lots of folks are asking, so what is Edelson’s prediction… and how does he suggest that you can play this prediction to make some money? He drops some hints as he’s teasing us about his money-making idea in the latest ads for his Supercycle Trader ($5,794 for five years in the current “sale”), so let’s see what the Thinkolator can help to extrapolate from the marketing ooze… we’ll start with a little excerpt from Mr. Edelson to get you in the mood…

“I’ve been trying to prepare you for this for many months now.

“I’ve told you repeatedly that the euro currency would be one of the first victims of the supercycle that formed in October.

“I told you that the toxic brew of massive, unpayable debts, a weakening economy and soaring government costs due to the refugee crisis would drive the EU to its knees.

“I’ve begged you, even pleaded with you to invest in things that soar when the euro sinks.

“Now, as if all the crises converging on Europe aren’t enough, the International Monetary Fund itself is pulling the rug out from under the euro.”

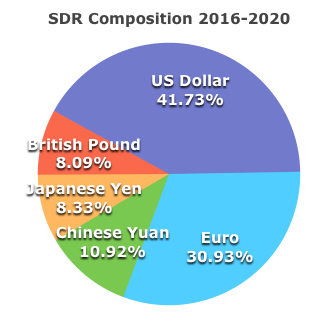

That’s a reference to the IMF “certifying” the Chinese Yuan as a reserve currency, and including it in the Special Drawing Rights (SDR) basket starting next Fall, which is indeed happening — and though many folks have been wringing their hands and fearmongering about what it means for the dollar, there’s no particular reason for it to impact the dollar in a big way — the US dollar’s (dominant) share of the reserve basket stays the same, the Yuan is mostly taking away from the Euro… and the SDR is more a reflection of global trends than it is a determining factor for economic behavior. This addition of the Yuan is much more important symbolically and as an indicator of China’s opening economy than it is a real driver of demand for the currency for economic activity or for sovereign reserves.

Here’s how the SDR will be calculated starting next October:

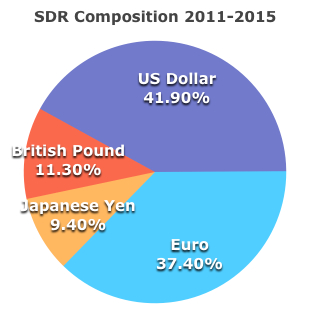

And here’s how it’s calculated today:

So really, though the Euro is losing some presence in the SDR the biggest impact, as a percentage, is in cutting the Pound’s role in the SDR. Not that the British people should panic, either. This doesn’t mean that suddenly 25% of the Pounds in circulation are going to be turned in for Yuan, collapsing the value of the British currency.

Edelson says in the ad that “to make room in banks’ reserves for the yuan, the IMF just REDUCED the amount of euros banks must hold by a full 16%,” and I’d say that’s an extremely aggressive interpretation of what the SDR recalculation means.

In my view, there’s no immediate impact from the SDR change other than in changing the way that some countries exchange a very small portion of their reserves (the vast majority of reserves are in actual currencies in the proportion chosen by each central bank or government, not in SDRs), in some loan programs to developing countries from the IMF, and in the way the IMF keeps its books. There’s no particular reason why this specific move should change exchange rates, as the volume of SDRs is dwarfed by the volume of actual global trade (which is what currencies are really for in the first place) — though exchange rates have been so volatile over this past decade that you’re probably better off assuming that almost anything can happen. Of far bigger impact, I think, would be if China opened up enough that foreign investors began to hold meaningful amounts of Chinese sovereign and corporate debt — and that will probably happen too, probably also very gradually.

But back to our point, the search for an investment that Larry Edelson is hinting at.

So Larry’s argument is that this combination of factors, the SDR change and the rise of the Yuan and the refugee crisis and the faltering economies in Europe, will bring the euro down further. Here’s a bit more from the ad:

“The way I see it, a crashing euro is now virtually guaranteed by not just one, but by four major forces:

- FORCE #1: The massive unpayable debts EU members have run up …

- FORCE #2: Four million Syrian refugees demanding free food … free housing … free medical care … and more …

- FORCE #3: The slow-motion collapse of the EU economy and inevitable decline in government revenues needed to service their exploding debts …

- FORCE #4: This vicious attack on the euro currency by the IMF.

“Urgent recommendation available NOW: 488% gains possible!”

So what is this recommendation? Here are the specifics he drops in the ad:

“It’s a highly leveraged position that strictly limits your risk but NOT your profit potential.

“What’s more, you don’t need a lot of money to begin. You could invest as little as $210 if you like.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“And the best part is, you’ll have up to two years to make your money:

- If the euro falls only ONE-FOURTH as much as I think it will, you could walk away with nearly DOUBLE YOUR MONEY …

- If it falls ONE-HALF as much as I think it will, you could nearly TRIPLE YOUR MONEY, and …

- If the euro plunges to my price target of $0.80 against the dollar, you could make as much as 488%.

“That’s enough to turn every $10,000 you invest into $58,800!”

OK, so “highly leveraged position that limits risk but not profit potential” is code for “options” — buying options contracts is the easiest way to get exposure to the movement (either up or down) in some underlying stock or fund while risking relatively little capital and strictly defining your risk (if you’re selling options the risk exposure is a bit different — but your success rate generally goes way up, too).

But can you trade options on currencies? Yes, you could actually trade futures options on currencies directly using forex options trading through specialized foreign exchange brokers — but without getting into that somewhat different world of trading, you can also trade options on currency ETFs using a regular brokerage account… so, since this Supercycle Trader service is generally focused on using ETFs, I suspect it’s options on these currency ETFs that Edelson is probably recommending, that’s a much more comfortable thing for most US retail investors than is direct forex trading.

Are there options on ETFs that would give you this kind of exposure? Yes. There are eight euro currency ETFs that are designed to track the euro either short or long, some of which are leveraged ETFs that try to double the daily move in the underlying currency. And of those, there are three I’m aware of that have options trading available — FXE, which is the big CurrencyShares ETF that’s probably the easiest one to understand quickly (because one share of the ETF is very close to representing 100 euros in US$ terms); ULE, which is the ProShares version of a “double euro” fund; and EUO, which is the ProShares “double short euro” fund.

You can bet against the Euro using any of those — if you want to bet against the euro you could either short the long euro funds (FXE or ULE) or buy the short euro fund (EUO), and if you want to leverage that bet much further you could do the same with options (buy puts on the long euro funds, or buy calls on the short euro fund).

And yes, we’re just about to the end of 2015 — so the 2018 LEAPs are trading for stocks and funds that have long term options and you could have “up to two years” to make your money using those long-term options (2018 LEAPs trade just like regular call and put options, but have a longer time period to expiration so generally should trade with a higher time premium — LEAPs all have January expirations, so for these three ETFs there are both January 2017 and January 2018 LEAP options available in addition to a regular menu of options expiry dates over the next several quarters).

How do we get to a 488% return, assuming that Larry is right about the euro falling to 80 cents by January 2018?

I’ll run through a couiple examples (I’m not recommending any of these specific trades, of course, just trying to provide some scenarios so you can perhaps think about it more clearly):

You could buy the FXE January 2018 $90 puts. FXE is at $107 today with the Euro/USD exchange rate at about $1.10. That would cost you about $1.35 per share ($135 per contract, each options contract represents 100 shares), so you would need FXE to fall to at least $88.65 by late January 2018 for you to break even.

If FXE falls to $80, which would be fairly close to the euro being worth US$0.80, then your put contract would entitle you to sell 100 shares at $90, so you earn $10 per share… or $1,000 per contract. A nice return of 640% or so in two years ($135 turns into $1,000). If the Euro is still near US$0.90 or so and FXE is above $90, even at $90.05 at expiration, then any options contract held to expiration for that $90 strike price would expire worthless (though options contracts can be opened or sold at the market price anytime… so it might be that if the euro falls that far well before 2018 you could sell it several months before expiration for a profit if folks are anticipating more drop, that’s largely unpredictable).

Similarly, if we want to try to mimic the “invest as little as $210” suggestion from Edelson, you could move up the strike price a bit to give yourself some more room for profit if the euro moves down less than 25% or so by 2018 (a drop from $1.10 to $0.80 would be a 27% drop, FYI) — the $95 FXE put contract would cost you about $210 today ($2.10 per share), and if FXE is at $80 at expiration (euro near 80 cents) then the contract could be worth $1,500 — so about a 615% gain there, similar to the move in the $90 puts. If the Euro just drops to 90 cents, however, and FXE is at $90, then your $95 puts are worth $500 (a gain of 140%) while your $90 puts would be worthless.

Those examples both assume that FXE is trading at exactly 100 euros, which isn’t precisely correct — but it’s close enough to give an idea of the impact of a put option on FXE given any anticipated move in the euro that you might imagine. None of those 2018 options has a huge enough open interest that I’d assume it’s a big recommendation made by a substantial newsletter, but it’s possible — as you might expect, 2017 LEAP options trade in much higher volume and have much larger open interest… partly because 2018 LEAP options have only been created over the last month or two.

How about if we want to put on more leverage? That’s where the leveraged ETFs come into play — these ETFs aim to double the daily move in the underlying index (or currency, in this case), so if the euro falls 5% today they’re supposed to either fall 10% or rise 10% (depending on whether they’re “double short” or “double long”). They do this using derivatives like futures and options themselves to mimic these moves, and it generally works pretty well on a daily basis — but for a variety of reasons the tracking for these leveraged funds tends to lose that connection over the long term. EUO, for example, should be up 40% over the last two years because the euro has fallen 20% against the dollar in that time, but it’s actually up 48%. It’s not a problem if you happen to own EUO as a bet against the euro, of course, but it’s a reminder that you can’t count on the exact double inverse relationship holding firm over longer periods of time.

So if you wanted to “bet” roughly $210 on a fall in the euro, you could buy call options on the double short euro ETF (EUO). EUO is at $25 or so today, and the January 2018 call options that are near $2.10 per share are the $29 strike price — there’s very low volume in these options, so I’m sure they’re not the core recommendation from Edelson, but we’ll look at the example anyway (the 2017 EUO LEAPS might be recommended by a newsletter, some of those have huge open interest and high trading volume).

So if you bought the January 2018 $29 LEAPs on EUO at $2.10, your breakeven becomes $31.10. That would be a $6.10 move from today’s price, so that’s an increase of about 24% in the price of EUO over two years… which should mean that the euro has fallen another 12% against the dollar by January 2018, which would mean a euro exchange rate of about US$0.96 (though the specific tracking is not that perfect, as I mentioned). If the euro drops to $0.80 by 2018, then EUO should be at $38.50 if it tracks the euro perfectly, and in that case the $29 option that you paid $2.10 ($210 per contract) for would be worth $9.50 ($950 per contract), for a gain of about 350%.

Those are just some ideas for you to consider if you’re looking for a way to use the leverage of options to make a longer-term bet on the further fall of the Euro — I can’t tell you exactly which options contract Edelson might be suggesting, he wasn’t that specific in his hints, but if you’re intent on buying exposure all the way to January 2018 then I think the only real options are FXE puts, EUO calls, or ULE puts.

The nice thing about betting with options contracts like that, by buying puts or calls, is that you know up front what you might lose — you might lose 100% of your investment, but no more. If you actually short the ETFs or short the currency and it moves quickly against you, you could lose far more.

On the other hand, if you’re wrong about the extent to which the euro might move or the timing, your chances of a 100% loss are much higher with options than they are with unleveraged bets (like shorting FXE, or buying EUO shares outright) — options means you have to be much more accurate with timing and pricing, because being off a bit means that you lose the whole “bet.”

Even if you generally had the right idea about the euro falling over the next two years, you’d have to pick the right strike price to maximize profit from that fall… if you focused on that 80 cent number and were determined that the euro would fall that far, and noticed that betting on 80 cents is a lot cheaper than betting on 95 cents, then you might forget that if the euro falls to “only” 82 cents your options “bet” loses 100% of its value…. likewise, if you just want to bet that it will fall, not necessarily that you’re sure it will fall by more than 25%, well, a put options contract to sell euro shares for $1.05 in 2018 costs a LOT more than the contract to sell for 80 cents ($5 versus 50 cents, in the case of FXE 2018 puts at $1.05 and at $0.80), so you lose a lot of your potential leverage.

So… will the euro fall another 25%+ over the next two years against the dollar? Think any of these kinds of trades have appeal either as a way to hedge your portfolio or to place leveraged bets on the future? I don’t necessarily disagree with Edelson about the broad trend in the currency, I expect he’s better informed on that than I am, but I’d just caution you that being specifically right on these trades is harder than it might look from a “logically, the euro should drop” perspective. Throw your thoughts on the pile with a comment below.

The true story about the convicted felon Martin Armstrong who was a friend of Larry Edelson is quite intriguing. Martin Armstrong still has an inner circle, a club, whose members not surprisingly show in his scandalous propaganda movie “The Forecaster”. Larry Edelson is one of them. Also Erwin Pletsch who made his Socrates training video. And Abbas Carmody (World Economic Conference WEC Organizer) and Michael Campbell (from Michael Campbell’s Money Talks) who is another long time shill. I am quoting Martin Armstrong:

“I have hundreds of people working for me creating YouTube accounts and other social media accounts posting positive reviews and feedback.

I STILL GET fresh victims daily”

and

“Maybe you should come work for me? We could really use you around here. We have many aspects to our Ponzi scheme and you will be first in line and be a part of our inner circle purely based on the influence you have online and the threat you present against my business. We always pay our people the best and keep paying them for life just so they don’t talk too much and God forbid tell the authorities…

MA”