Chris Wood is out with an attention-getting ad for Casey’s Extraordinary Technology newsletter ($1,497 “on sale!”), and readers are asking their favorite neighborhood Gumshoe… so let’s get you some answers.

The basic pitch is that there’s a kind of power that he calls “Bell Power,” and it’s growing like mad and could supply all our energy needs forever. Here’s a bit from the ad:

“If you add up every barrel of oil and all the natural gas drilled from the red sands of Texas in 2015… “Bell Power” still cranks out more energy in just 90 minutes than all of Texas produced last year.

“This is a massive leap forward for mankind, a new Industrial Revolution…

“I’m talking about free and unlimited energy.

“And, as you might imagine, this is the kind of breakthrough that could pay out billions in profits to early investors. In fact, by some projections, “Bell Power” – as we’re calling it – promises to expand 200-fold.”

Sounds familiar, right? Like most pitches for alternative energy stocks we’ve seen over the past decade, the promise is of free and unlimited energy… and that, naturally, creates rivers of cash that will go flowing straight into your wallet. More from the ad:

“If you invest in the unlimited power technologies I’m going to share with you today – in the specific way I’ll show you over the course of this presentation – you could easily see the chance to pocket a 100%+ gain in the next two years alone.

“And that’s just the start.

“Because when you account for the fact that, according to some projections, “Bell Power” could supply 100% of the world’s energy needs within the next 12 years…

“That would mean more than 16,566% growth!

“If that happens, there’s little doubt you’ll see the potential for gains MUCH bigger than a mere 100%.

“Of course, gains like these don’t happen every day… and I am by no means guaranteeing that “Bell Power” will make you a millionaire in the coming years…

“But it isn’t out of the question, either.”

So what is this “Bell Power?” Apparently all the cool companies are using it, but you’re still “early”…

“… it’s not too late, because the ‘smart money’ has just bought into ‘Bell Power’ in a big way…

“Silicon Valley’s biggest and most influential companies are pouring BILLIONS into ‘Bell Power'”

The words “sunlight” or “solar” or even “panel” don’t appear in the ad until you force yourself to sift halfway through the transcript (or, God forbid, actually listen to it for that long), but this is quite obviously a reference to solar power, specifically photovoltaic power collection through solar panels.

The words “sunlight” or “solar” or even “panel” don’t appear in the ad until you force yourself to sift halfway through the transcript (or, God forbid, actually listen to it for that long), but this is quite obviously a reference to solar power, specifically photovoltaic power collection through solar panels.

Which you’ve heard of, and you have probably even realized that solar panel costs have come down dramatically thanks to massive increases in production over the past few years — there aren’t many neighborhoods left in the US where there aren’t solar panels on at least one roof, and hordes of solar panel salesmen are going door to door in most states trying to show you what a great deal you can get with a solar home that sells its excess power into the grid (and they’re not necessarily lying — depending on the state, those net metering deals and other incentives can indeed make solar a “hard to lose” proposition for a lot of people).

And we get the magical name of Elon Musk invoked as well, of course…

“PayPal and Tesla founder Elon Musk recently invested over $2.6 billion into developing this new source of fuel.”

Well, sort of — Elon Musk recently decided to use $2.6 billion of Tesla shares to buy SolarCity, the solar installer run by his cousin in which he has a large personal stake. He is certainly an advocate for both solar power and battery storage.

"reveal" emails? If not,

just click here...

And we get some wild comparisons that really caught the eye of a lot of readers, like this:

“You could take all the oil and gas that flowed from the ground in Texas in 2015… add it all together… and you still wouldn’t have as much energy as ‘Bell Power’ cranks out in a mere 1.5 hours.

“‘Bell Power’ is growing so fast, it could meet 1,550% of the entire world’s energy needs within three decades.”

Exciting, right?

Brown tries to answer the question, “why is everyone going into ‘Bell Power’ right now?”…

“Two major reasons.

“First, if you’re a company like Wal-Mart, you don’t have to pay to get started. Specialized companies come in, ‘install’ the technology for you, and you’re instantly saving money.

“Second, it saves them a ton of money on taxes.

“That’s because a Federal tax credit lets you slash 30% off your tax bill when you invest in ‘Bell Power.’ If you’re investing billions like Apple and Google, you wind up saving a LOT of money.

“But today, ‘Bell Power’ has gotten so cheap it’s taking hold even in less ‘tax-friendly’ parts of the country.

“In West Texas, for example, contractors are spending $1 billion on a new ‘Bell Power’ project the size of 900 football fields. What’s more, the state has announced plans to increase its total capacity 6,377% by 2029. An incredible amount – more capacity than the entire United States added this year.”

Texas is, as you know, a very large state — it accounts for just under 10% of US GDP. So why is the notion that Texas could in twelve years add more capacity than the whole US did this year so incredible? The way I think about it that’s just growing solar installations for twelve years at roughly the same rate that the US did as a whole this year, right in line with its share of the economy.

But yes, that’s a lot of solar power.

And we’re told that solar’s costs are coming down because of a version of “Moore’s law”

“In the tech world they call it Moore’s Law…

“But there’s a unique name for it in the world of solar. Industry insiders call it ‘Swanson’s Law’ after Richard Swanson, the founder of SunPower.

“According to Swanson’s Law, every time the amount of solar panel production doubles, the cost of these panels falls 20%.

“This explains why solar’s price has plummeted 99.9% in the last few decades…”

And then Brown goes through some examples of the huge gains that would have been possible in some solar energy companies in the past… these are a few of them:

- JA Solar rose 319% in a little more than a year…

- Daqo New Energy rose 1,271% in two short years…

- China Singyes Solar rose 1,554% in five years…

- JinkoSolar rose 1,593% in under two years…

- And Canadian Solar rose 2,010% in less than 18 months.

Though no particular mention, of course, is made of the many fortunes lost in solar power for those who participated in the back side of those gains, or failed to “sell at the top” (does anyone ever actually sell at the top? I certainly never seem to quite manage that).

Some examples are obvious, like SunEdison’s (SUNE) disastrous fall from grace and collapse into bankruptcy over the past year or so, but even much more successful companies that appear to have some good staying power have done the “boom and bust” routine over the past decade.

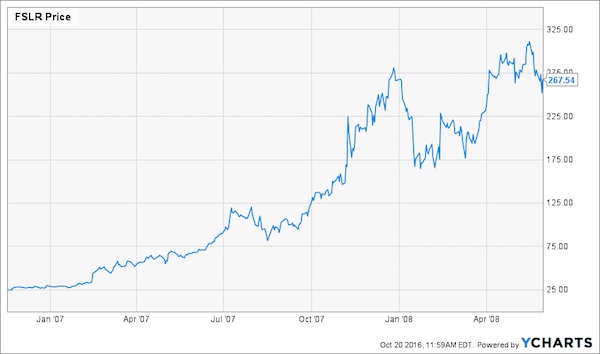

Just to give you some perspective, here is a chart of First Solar that’s similar to the one they include in the ad, from December 2007 to June 2008…

… and here’s the chart they don’t show, for the period from June 2008 to the present.

One major challenge for solar’s growth potential, of course, is storage — the sun doesn’t shine everywhere all the time, and it especially doesn’t shine at night… and that’s what they think is the big “last barrier” that has come crashing down:

“Without an effective, cheap way to store solar power…without a battery…you’re still out in the cold. You still have to pay for your electricity, even though your solar panels are capturing multiple times more than you need.

“And that’s where we have our opportunity.

“You see, this problem hasn’t gone unnoticed…

“In fact, in just the few years since 2014, the U.S. energy storage market has quietly grown over 243%.

“And within eight years, research company Frost & Sullivan projects revenues for this industry to reach $8.3 billion per year. That’s a 1,735% increase by 2024.”

So what are the companies that are going to make us some money, per this pitch from Chris Wood at Casey’s Extraordinary Technology newsletter?

One is apparently a company that has developed a better inverter — the device that takes direct current (DC) from the solar panel and turns it into alternating current (AC) so you can plug your hair dryer or toaster oven in and have it actually work.

Wood says that “traditionally, rooftop arrays use … a string inverter” that gets rid of problems like shade on a single panel cutting overall output drastically, or the system failing just because one panel breaks (and, apparently, these string inverter systems can also cause fires). And apparently this “one small company” he’s teasing has fixed that problem. Here are some hints:

“… one small company – which I’m recommending today – has come up with a technology that demolishes all these problems. In fact, the benefits the company claims are pretty astounding:

- They’re high efficiency

- They’re safe

- There’s no single point of failure

- Shade can’t drag down the whole system

- They last twice as long as the traditional inverter

“And if one of your panels does fail, this company’s product can tell you exactly which one it is, saving you expensive repair time.”

OK, I don’t really know anything about solar power… but that sounds good, right?

And we get a few clues about what the business has been doing…

“The company recently inked a deal with PG&E, one of the country’s biggest utility companies, to integrate their technology into the grid and throughout homes in California.

“They’ve expanded to Canada, Australia, New Zealand, France, the U.K., Switzerland, the Netherlands, and Nigeria.

“Bottom line: In the short term, I’ve never seen a safer, easier opportunity to quickly double your money on a small-cap company…”

What Wood’s referring to are what’s usually called “microinverters” — essentially, instead of pulling all the DC from all the panels down to one big inverter, each panel has a microinverter underneath it that converts the power to AC immediately and also allows for more discrete control and monitoring of the system (being able to tell when one panel has a problem, for example, or monitoring the production from all panels).

And the bad news is that this means it could be a lot of companies — microinverters are not a new invention, and many big electronics firms make them (I have no idea whose might be best, that’s way outside my wheelhouse)… but the Thinkolator says they’re almost certainly teasing a little company called Enphase Energy (ENPH).

Enphase is in a deal to roll out their microinverters to PG&E customers on at least a test basis, particularly in combination with energy storage systems (it’s OK with me if you call them “batteries”) as PG&E tries to bring “smart storage” into the grid in a larger way. The press release about that is here, and a greentech media story about it is here.

The basic characteristics of microinverters, that they prevent the “single point of failure” and may be more efficient when solar arrays have panels pointing in more than one direction, or when there’s a meaningful problem with shading the panels, are common to the whole concept… the idea of converting at the panel instead of in a central location is not “owned” by Enphase.

Enphase’s claim is that their energy management system is better and smarter, coordinating the power generation from each panel and microinverter and integrating it with the storage system. These may not be that likely to be used in big solar farms or large “flat roof” commercial rooftop installations, I imagine, since it’s more expensive and the value added doesn’t seem all that huge for installations where there isn’t shade (and where the panels can all face the same direction), and there are certainly costs and complications involved with microinverters — they are little electronic devices, some of them are going to fail (perhaps more likely if you subject them to intense heat on a rooftop under a solar panel), and then you have to tear out the solar panel to replace the microinverter.

Solar technology changes all the time, of course, and I’m not at all up on the state of the art in the industry — but I do want to point out that Enphase does not own the “microinverter” design or concept… whether theirs is better than the microinverters or power management systems from Siemens or ABB or whoever else, you’ll have to make that call on your own.

On the financial side, Enphase looks pretty ugly. The stock price was in the high teens two years ago, and now it’s scraping down around $1 a share. Does that mean it’s a bargain now? Or that it was a ridiculous hype-stock two years ago? What happened?

Well, I don’t really know and I haven’t read through all the filings over the last couple years, but it looks like they had a nice ramp-up in sales after their IPO and from 2014 into 2015, and that helped them to improve their profit margins and to almost get to profitability… but then when their revenues started drifting downward a year or so ago the costs stayed pretty stubbornly high and they lost the premium valuation that comes with growth expectations at the same time that their actual reported numbers were getting worse and they were bleeding more cash. That’s the story that the financial statements tell me, though I’m sure there would be more nuance if you looked through all of the quarterly filings and the commentary from management.

They do not have a big debt problem, which is good — it’s a tiny company now, with a market cap of about $50 million, and they only have a few million in net debt right now after paying it down over the past year… but unless there’s a big turnaround of some sort in their operations (like a spike in revenue) they need more cash.

And they’re aiming to get that cash, it appears, with an announced public offering of stock, biting the bullet despite the low share price, and beginning a pretty substantial reorganization that includes layoffs and cost cutting. According to that press release, They anticipate that revenue for the second half of this year will be similar to the second half of last year, with perhaps a small amount of growth, but they don’t seem to expect margins to improve anytime soon.

The most interesting positive news for Enphase, I think, is that Dan Loeb’s Third Point has a large position in the stock — Third Point is the only meaningful institutional investor in what is now a penny stock, and they own about 6.3 million shares as of the end of September. That’s not something you’d necessarily want to overweight dramatically in your mind, since Third Point could see their ~$10 million ENPH position go to zero without being more than a rounding error in their $17 billion portfolio, and Third Point owned shares months ago and is currently underwater on its position… but it’s still interesting whenever you see a big billion-dollar fund manager start to dabble in a microcap stock. (For what it’s worth, Third Point also owned a meaningful stake in ENPH a couple years ago when it was far more expensive, I haven’t checked to see to what degree Loeb traded in or out over the years.)

I have a hard time getting excited about Enphase, mostly just because it looks to me like they’re a middleman supplier to a cost-conscious industry… and their falling revenues during a time of record solar installations indicate to me that maybe their products are not seen as particularly unique or valuable by the big solar installers and other buyers in the market. Maybe I’m missing something cool, but a company that stopped growing revenue at a time when most of the solar companies I’ve looked at were continuing to have booming revenue growth over the past year (profitable or not, lots of the installers were booking revenue growth of 50-100%) is sending out at least one little red flag. Sometimes if you can look past that with great insight you can find a bargain, but I haven’t looked past it yet — if you decide to, please let us know what you find.

We were also teased about a second stock, which is also an electrical equipment supplier to the solar industry that’s trying to sell a better storage system…

“Even if you bought the best solar panels… without a battery, you’d still be pumping your extra electricity back into the grid… only to buy it back to keep your lights on after the sun goes down.

“But today that technology exists and it’s booming. The energy storage market is on track to grow tenfold in the next eight years.

“This one tiny company sits right in the middle of it all. And it’s just swooped into the market with a breakthrough patented technology that’s transforming the storage industry.

“The company I’m recommending today has figured out how to cut down the weight of traditional systems by 92%.”

And we get a few other clues:

“The company recently signed a deal giving it access to 80,000 new customers and 500 distribution centers across the globe.

“In Texas, this company is partnering with one of the state’s biggest utilities on a $4.3 million project to deliver solar to businesses throughout the region.

“But one of its biggest markets – microgrids – is expected to hit $35 billion in total sales over the next four years.”

And we get a few other clues… but we don’t need to go any further, because they also show a photo of this company’s 30kw converger next to a much larger “convetional” (sic.) converter, and it’s pretty easy to recognize the company name and match the design to one of their products. So this is clearly Ideal Power (IPWR).

Here’s what Ideal Power says about itself:

“Ideal Power Inc. (NASDAQ: IPWR) has developed a novel, patented power conversion technology called Power Packet Switching Architecture™ (PPSA). PPSA improves the size, cost, efficiency, flexibility and reliability of electronic power converters. PPSA can scale across several large and growing markets, including solar photovoltaic generation, electrified vehicle charging, and commercial grid storage. Ideal Power also has a licensing-based, capital-efficient business model that can enable it to address these markets simultaneously. Ideal Power has won multiple grants for its PPSA technology, including a $2.5 million grant from the Department of Energy’s Advanced Research Projects Agency – Energy program, and market leading customers are incorporating PPSA as a key component of their systems.”

I don’t know much else about them, I’m afraid — they do book a few hundred thousand dollars in sales each quarter, but in reality this is a “pre revenue” company that’s trying to create a business from essentially nothing… so you have to really analyze it based on the contracts they might win for “microgrid” projects or other fairly large-scale orders. The “80,000 new customers” hint is about their deal to get into Wesco’s distribution system, which is good in that it gives them more access to customers, but it’s just a deal to get stocked in warehouses and available through a distribution system — they still have to convince people to buy their equipment. It’s not bad news, but how good it is will be probably an open question for a while.

So there you have it… I can’t give you an in-depth analysis, but my two cents is that Enphase looks like a company struggling to compete in a competitive market, and seeing sales lag or plateau, while Ideal Power is trying to sell something that seems to be technologically different in power management (I don’t know if it’s really unique or not), and they haven’t really gotten off the ground as a commercial enterprise yet so that’s their major challenge… but I have no idea the extent to which they might be “on track”.

I’m out of time, so I’ll send you off to researchify these one on your own and report back to the group. Hopefully that’s enough to get you started, or to give you an idea of whether this tack by Casey’s Extraordinary Technology appeals to you. Nothing lights up my eyes with greed about these two stocks on my first pass through their numbers, but that doesn’t mean there aren’t opportunities in these or other solar and storage suppliers.

Sound electrifying to you? Let us know with a comment below.

What about SOLAREDGE ?

Oil and natural gas aren’t going away any time soon so if you are green and want effective pollution control for the old tech look at $CLIR (ClearSign Combustion) that has a technology that makes large burners both more efficient and much less polluting in terms of NOx and CO. In fact, hot off the presses today, they resurrected a mothballed refinery heater in Bakersfield CA for Tricor and made this dirty old unused burner (had to be shut down 30 years ago because too polluting for CA standards) into one of the cleanest refinery heaters in CA!! It’s a small refinery heater at a small company, but the implications are tremendous. Here is the press release: https://trading.scottrade.com/quotesresearch/ScottradeResearch.aspx?page=%2fqnr%2fStocks%2fArticle%3fdockey%3d1-SN20161024005245-3FV2E47H9ELKCUTAF9VHIDKR20%26symbol%3dCLIR%26ref%3dstocks%2fsnapshot

Try this link instead for today’s $CLIR news: http://ir.clearsign.com/2016-10-24-ClearSign-Announces-Successful-Completion-of-Tricor-Refinery-Heater-Project

At a price/sales ratio of 1100+, I’ll wait to see if they land some contracts!

I think that a good analogy is an emerging biotech company with its first approved drug that looks like a blockbuster geneh. CLIR is just ramping up with orders and revenue. It will snowball in 2017.

http://eelegal.org/2016/07/25/press-release-ee-legal-investigatory-report-details-how-billionaire-steyer-seeks-to-stifle-climate-change-debate-to-protect-his-solar-investments/

SEE WHAT I FOUND

Just picked up 500 shares of ipwr @ 2.36. They report next thursday and insiders have been buying. Wish me luck!

Just picked up some $enph, Company is looking stronger with new management.

$Enph – Enphase still looking good.

$ENPH Travis looks like a 5 bagger since you wrote this article. Would you mind taking another look at Enphase Energy, Thanks!

It’s a long time later, and now it looks like Enphase is beginning a comeback. They just bought another inverter maker, and their business numbers are finally improving. Share price is currently around $6. I recently bought maybe $1500 worth at about $4.50 a share.

$Enph – Share price is currently around $7, looking good.

$Enph – Share price is currently around $7, looking good.

What about BEEM?