[ed note: Michael Jorrin, a medical writer who we have dubbed “Doc Gumshoe” (he’s not a doctor), shares his thoughts with us once or twice a month — what follows is his latest missive, the words and opinions below are his alone.]

I didn’t plan it this way, but the timing of this Doc Gumshoe post couldn’t have been much better. As I was gathering material, news items from the American Diabetes Association’s 74th scientific meeting, which ran from the 13th to the 17th of June, kept popping up.

“Popping up” isn’t a bad way to describe what these news releases were doing. They were mostly modest pops, like back yard Fourth of July fireworks. Some of the news media covering this event did throw around the B word, but if any of the agents discussed at the meeting attain Blockbuster status, it will be because of the magnitude of the problem (and the opportunity!) posed by diabetes, and not because any of the drugs appear to have the capacity to work genuine miracles.

So, what’s the magnitude of the problem?

In Doc Gumshoe’s previous piece about diabetes (“The Why and the What of Diabetes Management”) there was a Tiny Addendum that noted that the Centers for Disease Control had upped their estimate of the number of persons in the US from about 26 million in 2011 to about 29 million today. That’s an increase of a million per year. Note that those figures include both Type 1 and Type 2 diabetes, and that somewhere between 25% and 30% of all diabetes is undiagnosed. Previously the ADA had stated that there were about 1.9 million newly diagnosed cases of diabetes in adults per year. Yes, those numbers are estimates, albeit careful estimates based on the best data.

And here’s another estimate from the CDC: 86 million people in the US have what is labelled “prediabetes,” i.e., insulin resistance or impaired glucose tolerance. The CDC projects that without intervention, about 30% of those persons would have Type 2 diabetes within 5 years.

That would up the total diabetic population of our fair land to somewhere in the neighborhood of 55 million individuals.

My bet is that we won’t reach that figure – that’s a worst-case scenario, and a lot of effort is being lavished on diabetes awareness, screening, healthy living, etc. Just because Mayor Michael Bloomberg’s proposed ban on half-gallon sugary drinks (or whatever size) didn’t go through doesn’t mean that Attention Isn’t Being Paid.

All the same, Doc Gumshoe wouldn’t be a bit surprised if we got to 35 – 40 million cases of frank diabetes by the year 2020.

Here’s something else: United Healthcare projects that the costs of diabetes treatment could reach $500 billion by 2020. I don’t know whether that’s meant to strike terror into the hearts of the citizenry, who would have to fork over that moolah, or to provide an incentive to the pharmaceutical industry to come up with drugs that could snaffle a chunk of that loot. However, as I write these words, the ghost of Miss Truesdell is looking over my shoulder and shaking her head. She doesn’t think that $500 billion number makes sense. The 2012 medical costs totaled $176 billion, and the $69 billion in lost productivity brings the total to $245 billion. I am skeptical about adding lost productivity to the costs of diabetes treatment, but even if we include lost productivity, I wonder whether the cost will really double to $500 billion in 8 years. Anyway, however we figure it, the whole pie is immense and Pharma wants its slice.

Big Pharma steps up to the plate

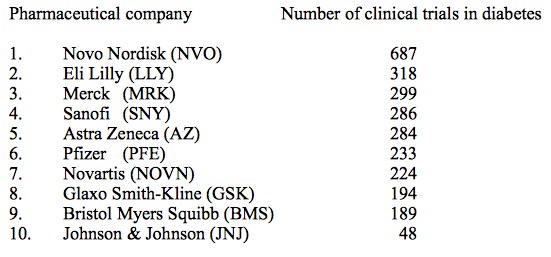

Despite the recommendation by McKinsey & Company a couple of years ago that big pharmaceutical outfits should ease back on R & D and concentrate their efforts on their “core competency,” that being sales and marketing, Big Pharma is lavishing lots of resources on R & D in the diabetes area. Here’s a quick list (by no means exhaustive) of the clinical trial activity of some of those outfits:

No surprise that Novo Nordisk (NVO) tops the list, since they are the long-established leader in diabetes treatment products, specifically a range of insulins, but also the incretin mimetic Victoza (liraglutide). Further down, we’ll be discussing the benefits vs potential risks of the entire class of drugs that relate to incretins and the rapid insulin response, as well as the duel between Victoza and Eli Lilly’s (LLY) dulaglutide.

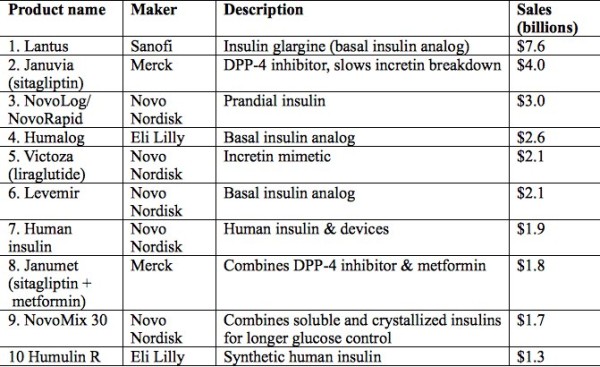

And here’s a list of the top 10 diabetes drugs in terms of sales:

As you see, seven of the ten are insulin products in one of several forms, and five are Novo Nordisk products. This may come as a surprise, since the great majority of persons with diabetes have Type 2 diabetes (T2DM), which is, at least initially, usually treated with non-insulin agents. Several factors contribute to the global dominance of insulin:

- One, eventually almost all persons with T2DM wind up needing supplementary insulin, as their pancreatic beta cells quit functioning after long years of battling against systemic insulin resistance. (We discussed this at greater length in the previous blog.)

- Two, many persons with T2DM, particularly in less-developed regions of the world, have advanced disease at the time of diagnosis, likely beyond the stage where merely increasing the sensitivity of insulin receptors does much good. Exogenous insulin is the quick answer, and mostly does the trick.

Metformin, which is a usual first-line drug for treating T2DM, is also huge seller globally, but it’s relatively cheap. If the sales of generic metformin plus branded formulations such as Glucophage (Bristol Myers Squibb (BMY)) are added, the total dollar amount only hits somewhere between $1.5 billion and $2.0 billion.

However, another trend worthy of our notice: all three of the top sellers that are not insulin products are drugs that target first-phase insulin release through the incretin response. And many of the drugs discussed at the ADA meeting, particularly the ones that attracted the most attention, also address the first-phase insulin response. Why is this?

A bit more about incretins and the first-phase insulin response

In a non-diabetic person, the pancreatic beta cells are secreting insulin all the time, because every cell in our bodies requires insulin to enable the process of converting glucose into energy. Even when we’re sound asleep, our hearts pump, our lungs suck in air, and our brains have dreams or nightmares, as the case may be. We don’t turn off.

This constant insulin release is called the basal insulin response. It accounts for about half the total. The other half, called the first-phase, or sometimes prandial insulin response, is in direct response to food intake. When nutrients of any kind get into the digestive system, a couple of different peptides are released from the gut, mostly from the small intestine, although some are also released from the colon. These peptides are designated GLP-1 and GIP and are generally termed incretins.

What they do is send a message to the beta cells that it’s time to step up insulin secretion, because a load of glucose is being dumped into the bloodstream. In addition, they send a message to the liver that it’s time to stop breaking down glycogen into glucose and releasing that glucose into the bloodstream – it’s okay for the liver to do that when there’s no food in the digestive system, but we don’t need that extra glucose right after a meal.

Incretin release starts quite soon – about 15 minutes after any nutrients pass into the small intestine – and continues for up to 2 hours. The response of the beta cells to this signal is actually more rapid than their response to the presence of glucose in the blood. This has been demonstrated by studies timing insulin response to intravenous glucose injections compared with insulin response to food in the gut. Food in the gut triggers a quicker response.

However, the half-lives of these two peptides are very short – GLP-1 about 2 minutes, and GIP about 5 to 7 minutes. That’s because incretins are broken down by an enzyme labelled DPP-4. The release of incretins and their breakdown by DPP-4 is clearly a homeostatic process – the organism only requires a robust first-phase insulin release during digestion (while glucose is being sent to the bloodstream) but not after.

But in persons with diabetes, the incretin response is not sufficient to trigger the release of enough insulin to bring the blood glucose to normal levels. This may result in that adverse feedback loop, in which high blood glucose brings about increased insulin release, which in turn leads to resistance at the insulin receptors and continued high blood glucose.

Two classes of drugs attempt to remedy this defect. One class consists of the inhibitors of DPP-4 (the breakdown enzyme), thus prolonging the life of the incretins. DPP-4 inhibitors are called “gliptins.” Merck’s (MRK) Januvia (sitagliptin), second on the list of best-selling diabetes drugs, is one of these.

Strong competition for Januvia

One current challenger is Galvus (vildagliptin). Novartis (NVS) is putting the pedal to the metal on this one. Currently 139 clinical trials with vildagliptin are at various stages. Galvus has not received FDA approval, even though Novartis has been knocking at the door since 2007, the reason being that there were hints that, along with other incretin-based drugs, there might be an association with pancreatic cancer. Note, there was no evidence that vildagliptin itself ever led to pancreatic cancer in a patient, and the FDA and the European Medicines Association (EMA) have reviewed huge amounts of evidence regarding sitagliptin (Januvia) and exenatide (Byetta), an incretin mimetic, and found no evidence of increased incidence of pancreatic cancer. The FDA/EMA statement and a summary of the evidence was published in the New England Journal of Medicine in February of this year (N Engl J Med 2014; 370:794).

"reveal" emails? If not,

just click here...

My guess is that as the results are announced of the many safety studies with Galvus, FDA approval for this drug will be forthcoming. Galvus has performed very well in clinical studies; for example, reducing mean HbA1C levels in older patients to essentially normal levels, and also minimizing some of the adverse effects (i.e., hypoglycemia) associated with some other antidiabetic drugs. A competitive disadvantage versus Januvia is that Galvus needs to be taken twice daily, whereas Januvia can be taken once daily. Galvus is likely to be a big boost for Novartis.

The duel between Victoza (liraglutide) and Eli Lilly’s dulaglutide

Both of those drugs are incretin mimetics. Incretin mimetics are not synthetic insulins. Instead, they are entirely different molecules that nonetheless closely mimic the activity of incretins, which is to say that they tell the pancreatic beta cells to release insulin, and they tell also slow the process of converting stored fat (glycogen) to glucose. They do this by activating the GLP-1 receptors on the surface of pancreatic beta cells, but only when there are excessive levels of glucose in the blood. When glucose returns to normal levels, insulin secretion also returns to normal or basal levels – that is, the prandial insulin phase peters out.

Incretin mimetics work in tandem with native incretin secretion from the gut. However, an important difference is that the incretin mimetics are not degraded by DPP-4. While native incretins have a very short half-life, mostly less than 10 minutes, incretin mimetics have a much longer half life; therefore it is feasible for these agents to be dosed as drugs.

Lilly began a series of Phase 3 clinical trials with dulaglutide in 2010, comparing their new agent with a wide range of antidiabetic drugs, including insulin glargine and insulin lispro, metformin, the sulfonylurea glimepride (Amaryl), the DPP-4 inhibitor Januvia (sitagliptin), which is the 2nd-biggest diabetes seller, and the incretin mimetic Byetta (exenatide), as well as in patients with kidney disease, hepatic impairment, patients taking digoxin, and women on oral contraceptives. Trials to date have been uniformly successful; for example, dulaglutide achieved greater reductions in HbA1C than either insulin glargine alone or a combination of insulins glargine and lispro, and also bested Januvia and Byetta.

A greater challenge for Lilly has been the head-to-head comparison with Novo-Nordisk’s Victoza (liraglutide), the top-selling incretin mimetic, and the number 5 seller in the diabetes sweepstakes. In the AWARD-6 trial, dulaglutide lowered HbA1C slightly more than Victoza, by 1.42 percentage points from baseline, compared with 1.36 for Victoza. This means that for many patients who present with HbA1C levels in the neighborhood of 8%, dulaglutide alone could be enough to bring them within acceptable limits, even though it is not likely that this new agent will be approved as monotherapy for newly diagnosed patients.

The very small difference in favor of dulaglutide will not be enough to change the prescribing practices of most physicians. However, there is a major difference. Whereas Victoza is given by injection every day, dulaglutide is given, also by injection, once a week. When dulaglutide receives FDA approval in the US, it will be marketed under the name Trulicity.

Victoza did perform better than dulaglutide/Trulicity in one respect. Patients on Victoza in the AWARD-6 trial lost a bit more weight than those on dulaglutide – 3.6 kg versus 2.9 kg. That result has prompted Novo Nordisk to study Victoza as an obesity drug, perhaps to compensate for their anticipated lost sales when dulaglutide hits the market.

As I have said before, I’m reluctant to use the B-word when talking about a drug’s prospects, but if there’s one where that word might be appropriate, it’s dulaglutide/Trulicity. This couldn’t come at a better time for Lilly, which, as some of you have likely noticed, needs something to wipe the egg off its face after recent flubs with Alzheimer’s and cancer drugs. Dulaglutide will very likely bring substantial rewards for Lilly.

… and now for something new and trendy?

Some industry insiders are calling it a “bionic pancreas.” Here’s how it works. First, for comparison, the standard insulin pump, used by millions of persons with diabetes, mostly Type 1, requires the patient to monitor his or her blood glucose levels by the standard finger-stick method, calculate how much insulin he/she needs at that moment, and instruct the pump to deliver that amount of insulin. It was a huge advance over the old way of getting insulin, which consisted of several daily self-administered subcutaneous injections. The insulin pump is more accurate and can deliver insulin more gradually than the insulin injection. The user can tinker with the way the pump delivers insulin, ranging from a bigger dose initially followed by a trickle, perhaps mimicking the prandial / basal insulin responses, to a more even release throughout the 24 hours. Nonetheless, it’s far from perfect, and some insulin pump users continue to experience potentially dangerous episodes of low blood glucose, and also insufficiently controlled elevated blood glucose.

The so-called bionic pancreas tries to eliminate these issues. The patient has two subcutaneous needle-like devices implanted. One delivers insulin, and monitors blood glucose levels. The other delivers glucagon, the hormone that signals the liver to turn stored glycogen into glucose. The implanted needles also monitor the body fluids for insulin and glucagon respectively, so that these two agents are released into the body as needed. The devices are connected to externally-worn insulin and glucagon pumps.

What controls the whole system is that the information from the implanted devices is transmitted to a smartphone, which does the calculations and instructs the pumps as to how much insulin or glucagon to deliver.

A pilot version of this system was tested by Mass General Hospital in 20 adults and 32 young people. In the pilot version, the patients still used the finger-stick method to monitor their levels, but then input that data to their smartphones. The results strongly favored the experimental system over the insulin pump, lowering blood glucose, in the words of the chief investigator, Steven Russell, MD of Mass General, “to levels that have been shown to dramatically reduce the risk of diabetic complications.”

Perhaps more important, it reduced the incidence of hypoglycemic episodes by 37% in the adults and by 50% in the young people. Although in the long run, complications are what destroy the lives of people with diabetes, on a day-to-day basis what patients and health-care providers most have to watch out for are the low blood glucose episodes – so called “insulin reactions” – which can cause fainting, shock, or coma.

If my instincts are correct, this is a development that will have enormous impact on the lives of persons with diabetes, both in the short and long-term. The likely first market for these devices will be younger persons with Type 1 diabetes. But the Type 2 diabetic who can no longer control the disease with non-insulin agents will also certainly benefit and likely jump aboard..

The next time you see a person looking intently at a device, it might not be a device-addict checking for tweets, but a diabetic controlling his/her condition “on the go!”

As for which medical device outfit will jump on this to make and market the “bionic pancreas,” Doc Gumshoe will keep his ear to the ground.

Salsalate lowers blood glucose in Type 2 diabetes

Salsalate is an NSAID (non-steroidal anti-inflammatory drug) in the salicylate family, related to aspirin, which is used to treat osteoarthritis. There were suggestions that it might be effective in treating diabetes as long ago as the 19th century, but these were based on anecdotal evidence and not seriously pursued once insulin deficiency was identified as the underlying pathology in diabetes. However, it has long been thought that inflammation had a role in the pathogenesis of diabetes, and this has now been confirmed in well-conducted clinical studies.

A shorter study, 14 weeks, evaluating the effectiveness of salsalate was published in 2010. This has now been followed by a 48 week study in 286 subjects with T2DM, comparing salsalate with placebo. HbA1C levels in subjects taking salsalate were 37% lower than in those taking placebo.

And patients in the salsalate group needed fewer additional medications to control their diabetes. In addition to its beneficial effects on blood glucose, salsalate demonstrated some benefit in reducing some markers of cardiovascular disease, although the salsalate cohort experienced small increases in LDL cholesterol.

More than propelling salsalate into the front line of agents used to manage diabetes, it provides clinicians with an additional mechanism of action through which to reduce blood glucose levels. The salsalate research was conducted by the Joslin Diabetes Center, which will continue to investigate this drug’s usefulness in the entire spectrum of cardiovascular disease, including diabetes. However, I think we can anticipate research initiatives into managing diabetes through the anti-inflammatory pathway. A likely avenue would be an oral formulation combining an agent that maximizes native insulin utilization with an anti-inflammatory agent with optimum glucose-lowering effectiveness as well as cardiovascular benefits. This would have multiple advantages. It would help with patient compliance, since the fewer pills the patient has to remember to take, the better. It would address two distinct disease mechanisms – insulin deficiency and inflammation. And it would minimize adverse effects, particularly hypoglycemia. Doc Gumshoe predicts that we won’t have to wait long for such a combination to be developed and marketed, and that it will be a bonanza for the pharma outfit that gets there first.

And one more tiny addendum

Yes, stuff keeps popping up. About a week ago (as I was writing this), a paper was published in the Journal of the American Medical Association (JAMA. 2014 Jun 11;311(22):2288-96) comparing two groups of persons with T2DM who were not attaining acceptable HbA1C levels with metformin alone and required intensification of their drug regimen. This was not a controlled clinical trial, but a large observational study. There were two cohorts, one which added insulin to metformin, and a second which added a sulfonylurea. The main outcome measures were cardiovascular events and all-cause death. While there were no statistical differences in cardiovascular events, all-cause death was about 44% higher in the subjects taking insulin than in those taking a sulfonylurea. The possible causes of this large, significant difference need further investigation, and they could range from baseline differences in the subjects (i.e., the patients who got insulin were sicker to start with), to patients’ problems with managing their insulin dosage, which might be improved with the “bionic pancreas” we discussed earlier. At this point, it’s a red flag. We’ll keep watching.

* * * * * * *

Do please keep the comments coming! They are very important to me, since it lets me know if I’m on the right track sending you stuff that you’re interested in. Right now, I’m planning my next piece – I’m thinking about the placebo effect, which has gotten some attention lately in elevated circles. The question is, is it real? And beyond that, can it be put to use? We’ll see!

Why is it that citizens of what is billed as the leading western economy, the most advanced country in the world supposedly, has such grossly unhealthy citizens? Millions of them.

Why do these citizens persist in the idea that a synthetically created chemical substance that humans would NEVER have encountered in a natural environment and that interferes with a human bodily function will ‘somehow’ cure a health problem?

Why do these same citizens who should have access to the best and healthiest foods with the highest nutrient content consume some of the worst chemically polluted and artificially manufactured ‘plastic foods’ with seriously deficient nutrient content in the world?

Add in all the other toxins pumped hourly into the living environment that the human body must assimilate, neutralize and if at all possible discharge and it is no surprise we have the health profile we westerners do. No surprise either that the majority of companies supplying the drugs and high tech medical procedures are from the major western economies and make most of their sales there.

Decades ago the then head of the Kentucky State Medical department was reported as saying that 75% or more of ALL diabetes in the US would be blood sugar normal in 1 – 3 months with a change of diet. Maybe stretching it a bit but I do not think he was talking bullshit. Remember, most patients know more about diet than the doctor they visit does which unfortunately does not say much considering the appalling diets of most US citizens.

We westerners kill ourselves with our knife and fork and the crap we shovel in with them.

Oh really? Then why is Western longevity at an all time high and rising?

What you say a Kentucky medical official said is untrue, irrational, and completely unsupportable by any data. I suggest you read “Mass Listeria,” by Theodore Dalrymple. I am concerned you are afflicted with it.

You make the common lapse of agency argument that diet belief system adherents all do: impugn the diet for making one fat (excess nutrients), and then impugn the diet for lacking nutrients. Which is completely illogical. Diet believers believe in magic, that special alchemical pixie dust lurks in “healthy foods” (whatever those are). They can never define what those are. But this sort of chimerical allegation that people are being simultaneously overfed and underfed is the company such believers keep. Rather like arguing someone is fat and skinny at the same time. It makes me think of infomercials hawking moisturizers for women with “oily but dry” skin. People seduced by this belief system usually then declare that I am claiming that Twinkies and beer are just as healthy as broccoli and spinach.

The US as the most advanced country? Really? Got some data to back that up? I avidly doubt we are even in the top 10.

Here Here, couldn’t have said it better

‘Billed as’ and ‘supposedly’ were the qualifiers I used regarding the leading status of what I regularly call The United States of Amnesia. I wish no insult to the citizens of that country but on so many fronts that society appears determined to learn lessons so clearly already learnt by much older societies.

And I did not blast away with a diatribe of insults directed pointedly at any individual or group as you Dr KSS do. If there is delusion blowing around I think you might look at what you produce yourself first, the very definition of delusion is the simply that “I delude myself”.

I will look at the book/piece you recommend and I will not waste my effort suggesting any book or whatever to you except to say first do your homework before emoting loudly. The very nature of you writing makes clear where the limits of you comprehension lie.

You might check a few stats however, seeing as you quote what you call a statistic, and note that the major cause, the number one cause of death in the US of A is not old age, but modern technical medicine which at least one authoritive study suggests kills more than 3000 Americans a month. Quite a lot more than died on 9,11,2001 in a one off event.

The WHO many decades ago funded the standardization and collection of health statistics from around the world in a major international study and the advanced western societies did NOT look good on so many health statistics it was a rude awakening shock. Instead of one misleading figure like life expectancy you claim as increasing, look at the quality of life parameters across a range.

The evidence is there if your eyes will acknowledge it that clearly demonstrates that the US of A is a society in a health crisis. Just look at the reality. Western longevity at an all time high and rising? Oh yeah! You might be surprised if you look behind the banner at why. Sanitation, not modern medicine, has done vastly more to improve life expectancy than almost everyone realizes yet we constantly hear the blurb of patent bulldust from the snake oil salesmen that we must bow down at the feet of modern medical genius and be eternally thankful.

I do NOT impune the diet in whatever way you suggest, NOR am I some sort of Diet nut as you try to paint me instead of making cogent argument. There is a very good bunch of reasons for the ‘Fat to Obese’ status of the majority of Americans that does NOT afflict the rest of the world until they adopt a lifestyle similar to the US one. Go study the difference Dr KSS.

Nice rhetoric. Let’s look at it a bit more closely.

I, like you, do not know what rank the USA has in health matters, nor do I much care. However, your remark about the increasing life-expectancy cannot possibly be directed at the great swathes of the earth where humanity has seen no increase whatsoever in this marker. This is because they have not had, do not have, and probably will not have, anything of worth with which to pay Big Pharma to improve their lot. We are talking about profiteering here, not philanthropy.

So, let’s continue to call a spade a spade. There are some ways where the medical industry has increased life expectancy, including:

1. It has developed different ways of replacing worn-out parts of the body.

Sounds good, doesn’t it? Well, for the person it might be, although the first hundred thousand or so are just guinea pigs. For humanity, it is a catastrophe. People who should have died off before they can multiply, haven’t. Does that sound hard? Well, it might, but it is 100% the truth.

2. It has fought a war against other living beings, whose desire to cling on to life for as long as possible is just as great as ours (viruses and bacteria).

On the surface, it seems we have been successful, but nothing is further from the truth. These have been disasters waiting to happen. Our foes have found ways of adapting, so as to render our weapons useless. “Superbugs” have arrived. Polio is back with a vengeance. So is tuberculosis, elephantiasis, cholera, leprosy. Even the bubonic plague, and malaria, despite trying to kill off every female anophelene mosquito on the planet. However, as long as they stay out of the western, civilised world, we can forget about them, can’t we? But not others, which have come to visit us, like AIDS, for example. No stone is left unturned, no cent left in the pocket of those affected, until the medical industry has bled them dry of as much cash as possible.

So, why has our attempts not worked? Well, we use one which is in direct opposition to that we use for ourselves, as in point one. Those with faulty gene stock are encouraged to flourish and propagate (providing those looking after them have the cash to pay with), so we are in fact diluting our gene pool further. So now we have even less resistance to these bugs. I will not even start here to talk about gene manipulation. More pride before falls.

And for the point about healthy eating habits made by Peter Tomkinson.

Soft living, lack of self-control (in part because the medical industry has set up it’s snake oil stand to solve everything), non-existent self-discipline, and so on, has led to sugar and fats being consumed in unreasonable proportions.

And before we blow the self-righteous horn of the medical industry, please consider this: there were some people who lived for a century or more before the advent of modern medicine. You can’t lay claim to them, now, can you?

So please keep to the script. Recommendations of longs and shorts in shares is all fine and good, but it’s money we are talking about, not charity. People (non-diabetics), if they are honest with themselves, don’t really care about diabetes further than the ability to make money out of it.

Paul: Ah, I get it. Eugenics is your thing. Good of you to declare that.

You are being prolapsarian in your argument about diet and longevity. The subject was the western diet, not the global diet, as the diet ranters are invariably indicting western eating habits. And western longevity is at its peak and rising. An odd centenarian or two a century ago is utterly specious, and attests to nothing. Centenarians were very very uncommon. Not so, anymore, Paul Jessup.

Meanwhile, I do know precisely where the US ranks in all facets medically, Only one country on earth has poorer outcomes per unit of currency spent than us: Russia, truly the most abominable system on earth.

Your asserting that non-diabetics care about diabetes only as a means for profit is an affront to all reasonable people everywhere Paul, and a boorish incendiary indictment of my profession and my life, in which I given hours days nights weekends to salvage lives. But you wouldn’t get that, wouldn’t grasp, having the world rolled up into a tiny ball.

As I see it, Ralph Waldo Emerson had you nailed when he said “Petty consistency is the hobgoblin of little minds.” Your remarks about genetic unfitness are obscene, criminal, and offensive to me, to Jews, to Cambodians, to Hutus and Tutsis, to gypsies, and to all Chinese women unlucky enough to be firstborns.

You seem to have a gamut of people to quote from, and put anyone (well, at least Peter and myself so far) into pigeon holes which you think fit the bill. A medical training doesn’t guarantee infallibility, you know, but obviously limits replies to quoting from sources.

However, why you should imagine that my remarks are directed against members of some superstitious sect, people with another skin colour or a different lifestyle, I have no idea. Should I put you in a pigeon hole for the supercilious self-righteous, with a persecution complex? You are the one who does not include these folk in the dietary discussion, presumably because they don’t have much of a culinary choice when compared to those in the West, who can stuff themselves stupid on doughnuts and chocolate, only to expect drugs to put them right, because they have no self-control.

Russia, by the way, has some of the longest living human beings on earth. And all that, despite your assertion, nay judgement, that their system stinks. Perhaps there is something else here. I am sure you will know what. Who am I to argue with you, with your unswerving desire to help all and sundry, without sleep for months on end, no doubt? Very laudable.

Messing about with things just because one can, doesn’t mean one should. Ask the Australians about the plagues of non-indigenous species which they introduces into their country, without thought for the big picture. Some are so busy looking through microscopes that they forget there is Mother Nature at all levels.

One last point. The longer one lives, the more chance one has of dying from something else other than old age. It’s not the length of life that counts, but the quality.

One other point to make to readers who happen by is that in fact there is a sort of third type of diabetes physiology that goes underappreciated. It is type II diabetes complicated by islet cell burnout. These are patients who are insulin resistant, but who also become insulin deficient as a consequence of years of overdrive in DM-II (high pancreas insulin output).

Perhaps a third of 75 year olds are diabetic. But perhaps half of 85 year olds are. And the accrued difference may owe to islet cell burnout. People with new diagnoses of apparent type II diabetes really need to have insulin levels (or C peptide levels) determined to confirm that they are making excess insulin. Type I is where the pancreas makes none. Type II is excess insulin. What I would propose as “type III” is the elderly person with established insulin resistance whose pancreas function is fading and who aren’t making enough insulin (though they make some) to keep up with glucose.

We discuss biotech, including DM-II, on the subscriber only forums, and frequently cover investing in companies that treat diabetes. Readers are encouraged to subscribe. You will be glad you did.

This is very relevant to this discussion. So the incidence of diabetes per 100,000 is in fact increasing.

This is not to promote Ketogenic diets, just something to think about and follow future research.

http://eatingacademy.com/nutrition/success-versus-failure-stark-juxtaposition

Dr Kss, what is your view of this Cholesterol series by the way if you have time?

http://eatingacademy.com/nutrition/the-straight-dope-on-cholesterol-part-vii

Steven: on the face of it, that cholesterol info series in the link is quite accurate and balanced. I agree with all the author’s main points. Among the most important of these is how little diet can affect things. Cholesterol is made, on-board, and changing one’s diet to influence it is totally futile. He casts doubt on the relationship between pathogenicity and particle size for LDL, which I like.

To Paul Jessup: Russian male life expectancy stands at 65, among the worst in the non-third world. And, having been a guest of the Russian government on a diplomatic visa to teach in its health system, I have gotten a sustained view of it that almost no Westerner ever gets. It is genuinely appalling, a place where no patient has a right of informed consent, where no patient can request DNR, where basic commodities lack, and where patients are treated with regimens that frequently smack of voodoo and superstition. I therefore can vouch, with buckets of proof, that it is a genuinely horrible system that torments patients. The Russian government recently announced plans to place all prisoners with TB into hospice care and not treat them, to let them die of the disease, that they do not deserve treatment. You are standing up for a human-rights-violating regime that loathes gays, lesbians, gypsies, and the infirm. Your guns have melted. I am concerned given your disdain for “those who shouldn’t be allowed to reproduce,” as you said, and your sweeping pigeonholing of Americans as people who eat themselves into oblivion with doughnuts, which is most unfair, that you may be one of the far right types that actually admires and condones Putin, and wishes we could be more like Russia. Be careful what you wish for, Paul Jessup.

Russia’s attitude to homosexuality is a whole other subject. I will debate this with you if you like.

I do not remember standing up for anyone except the members of the human race that you ignored in your “Then why is Western longevity at an all time high and rising?” remark. If that included Russians, then so be it. Does that sound far right to you?

I am a little skeptical of your statement about Russians leaving TB patients to die in hospices. It’s a bit vague, sweeping, and perhaps biased. There is an epidemic in Russia, that’s true, but in my experience, Russians are not monsters, even if the American government would like you to believe this. However, the Americans put many of their prisoners in electric chairs, or inject them with poisons. So, not much difference then.

I wrote that Russia has some of the longest living humans. I did not write that the life expectancy of all Russians is high. It appears to be between 68-69. I also did not write that some people should not be able to reproduce. I wrote that those with gene defects are encouraged to reproduce, subject to funding availability. I know medics are renown for bad handwriting, but I didn’t know that they have trouble reading computer-generated text.

Superstition exists in all walks of life. Crossing fingers, religion, and so on. The Russians do not have exclusivity in this matter.

And sweeping pigeon-holing is your forte, not mine. I only use your language in my replies, so that you understand me.

Anyway, I suppose that you will be calling me Hitler next.

I would question renaming the stage of Type 2 diabetes (which I refer to as T2DM and Dr KSS as D2), when the beta cells finally fail and quit secreting insulin as “Type 3 diabetes,” as Dr KSS suggests. The distinction between Type 1 and Type 2 diabetes is fundamental, based on entirely different pathophysiology, Type 1 being insulin deficiency from the very start, while Type 2 is insulin resistance. Persons with T2DM go through a phase where they have both very high blood glucose levels and exceedingly high insulin levels, but the insulin doesn’t help them to metabolize the blood glucose because of resistance at the insulin receptors. This eventually leads to beta-cell failure, which is a fairly normal part of the progression of T2DM. The beta cells are simply exhausted. Many persons with T2DM wind up needing exogenous insulin, but unlike the T1DM patients, for whom insulin shots by themselves do the trick, T2DM patients must still manage the insulin resistance which is an intrinsic part of their condition, so insulin is given in combination with drugs that address insulin resistance. For this reason I believe that the distinction between Type 1 and Type 2 is valid and should not be confused by adding another designation.

How about Type 2a and Type 2B or some such?

Liken you to Hitler, Paul Jessup? Don’t flatter yourself. Deranged, mad, but he did have aims and goals, rotten though they were. Your sole goal is arguing, worming, churning, haggling, being oppositional. You have no purpose, no agenda, no insight, no meta-message. Try as I might, I don’t see that you’ve come close to making a single point. I have a communique issued by the Russian government about TB prisoners being put in hospice. You’re an agitprop, a malcontent, a gratuitous defiant who just wants to disagree. Are you running for something? Running from something, perhaps? Why does Herr Jessup run amok?

“Try as I might, I don’t see that you’ve come close to making a single point.”

As I wrote before, you don’t concentrate on reading the subject matter, if it varies from your view.

笨蛋

Petit chinois as usual.

Hi: it very much is a third type of physiology as most DM-II patients do not burn out their islet cells. DM-1 depends on insulin. DM-II in some cases requires insulin for good control, but is never dependent on insulin. In my perception, a type III would recognize that you can have insulin resistance physiology but also be insulin-dependent.

And there is a functional type IV diabetes physiology: cirrhotic diabetes. Many people who were not diabetic previously become diabetic after they develop cirrhosis, because of the cirrhosis. It is complex to explain, but results from portosystemic shunting, altered gluconeogenesis. It is not fully understood yet, but has been recognized since ancient times, it seems. It is sometimes called hepatogenous diabetes, a term I don’t like (I’d prefer diabetogenous hepatosis). TIPS shunting ameliorates it.

Granted that many/most T2DM patients don’t progress to the insulin-dependent stage, but the physiologic differences between T1 & T2 are present ab initio. Also, some physicians prescribe supplementary prandial insulin before the islet cells are wasted. MannKind’s new inhaled insulin would likely be used at that stage (if it catches on at all – we remember what happened with Exubera!) Seems clumsy to rename the condition in midstream. But this is surely a quibble. Yes, diabetes secondary to cirrhosis is a separate disease & no doubt deserves a distinct name.

Exubera failed because of the nonlinear relationship between mg of powder and number of insulin units. This is a non-issue with Afrezza, but the doses as metered are far more typical for type 1 DM R-insulin doses, not DM-II. Afrezza is a complete nonstarter because it obviates injectable insulin in no one, and because state of the art DM-1 management is pump-based. Meanwhile, with proper use of max dose metformin followed by max dose pioglitazone followed by max dose GLP-1 RA (which mediates insulin release only in response to meals, rather than tonically/chronically as sulfonylureas do), it is possible for most DM-II patients to avoid islet failure. It has been eons since I have used insulin in any DM-II patient as I view it as the kiss of death. As studies with the degu demonstrate, a monumental portion of DM-II pathophysiology owes to hyperinsulinemia, not hyperglycemia.

Another topic:

What is the significance of the allergic reactions announced by Regado?

I have discussed it in extraordinary depth in the thread following my 2 July column on Biotie.