Now that we’re closing in on the end of the year, and the redoubtable Lynn Clark (Queen of all detailed things that I forget to do) has managed to get our tracking spreadsheets much improved and up to date, with relative performance included for the first time this year, I thought I’d check in on how the teasermeisters are doing so far in 2014. After all, we’ve got the unveiling of our “Turkey of the Year” to come in a few weeks, so we’ve got to start thinking a bit about the candidates.

So let’s look and see what had happened if you had bought a bunch of those teased stocks on or near the day they were teased… would you in fact have turned your $5,000 into $13,000 or $112,000 or $1 million, as so many of them hint at?

Uh, no.

Now, to be fair, we knew that already. And some of these stock ideas that were pitched by newsletters were clearly shorter-term trades, while some were long-term investments that they expect to play out over years, not months. And the market was hit badly in recent months, as I think everyone realizes (though thanks to that quick bounceback rally, the broad market is now back to near 52-week highs, up 9% on the year so far).

But going by the teasers that we’ve tracked all year, which includes every one that I’ve written about that pitched a specific stock or fund as an investment, 147 in all so far this year as of the first week of October, we’ve seen 32 stocks that did better than the S&P (and none that have hit a “double” on the year), and 115 that have done worse than the S&P (so far, none have gone bankrupt or gone to zero this year, but plenty are down by 50% or more).

And you know what, even though the market has taken a hit recently, if you had bought a small slug of the S&P 500 (using the SPY ETF as a benchmark for this) on each day when a teaser stock was uncovered, every single one of those slugs of money would be in the green as of today.

It won’t surprise you to hear that most of the “most winning” stocks are in biotech or tech, nor that the bottom of the pile is littered with energy and mining stocks (and a few failed biotechs and techs, too). Biotech has been the most consistent growth stock and “story stock” sector this year, with big spurts from strong news, and some areas of tech have been pretty strong… and, as many of us are all-too-aware, basic materials have been crushed.

There’s only one mining or energy stock that has outdone the S&P this year out of our teaser solutions, and that’s the decidedly atypical Canadian diamond miner Dominion Diamond (DDC). When it comes to profiting from falling commodity prices, only one teased pick has made a big surge and that’s Louis Navellier’s tout of Spirit Airlines (SAVE) about six months ago.

Has one teaser-spinner outperformed the others? Not dramatically, at least according to my browsing of the data — some are less likely to have 70% losses given their focus on larger stocks, and the letters that focus less on energy or materials stocks, like the Motley Fool or Navellier often do, have perhaps tended to do a bit better this year… but pretty much everyone has some big stinkers (like POWR from Navellier, or TCS from the Fool, for example).

And, of course, I also own more stocks that are in the bottom of this list than are in the top personally, so I’m not claiming to be fantastically more prescient than the newsletter pundits — and, to be fair, these are the picks and stories that newsletters are using to get your attention and urge you to subscribe, they are not likely to be all that representative of the performance of any of these newsletters overall (especially given our limited sample size — we rarely look at teasers from the same letter more than a half-dozen times in a year, so these are the ones they might think will be their best stocks, or just their best “stories” to get your attention, but most of them recommend one or two new picks each month).

But I do find it useful to look at these spreadsheets every now and then as a reminder that it’s worth being patient, being a cynic, and taking the time to look carefully at the companies that are sold to us as fantastic growth stories (or, indeed, at any company that’s being “sold” to you). And if this year is any guide, every time you think you’ve found the next hot stock you should slow down, count to ten, then, if you’ve convinced yourself that this is one of the 32 out of 147 that’s a real winner in the near future, still put at least half that money into a broad index fund and do your wagering with smaller amounts.

If you want to be a real contrarian, maybe looking at the bottom half of the spreadsheets to see if any gems have been thrown out with the slurry. Let us know if you find anything surprising or fantastic in perusing the lists — you can see the whole sheet from our tracking page (which also has links to the spreadsheets from past years), but here are the top and bottom ten at the moment:

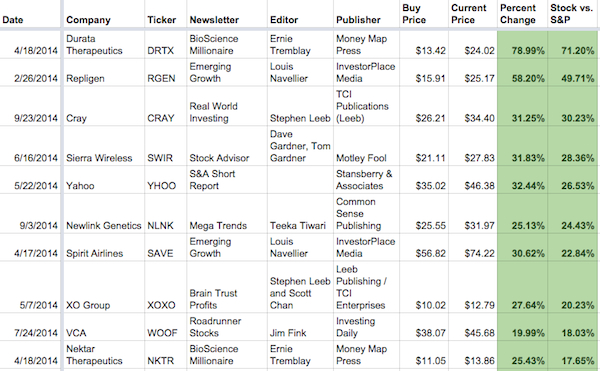

Top Ten vs. the S&P 500 so far in 2014:

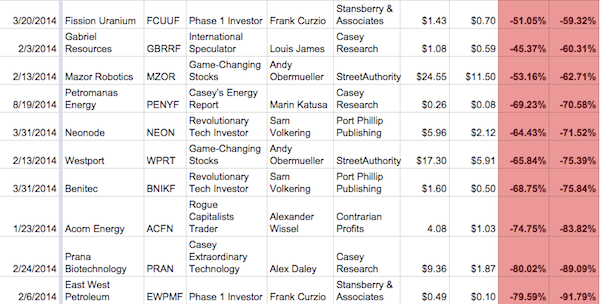

Bottom Ten vs. the S&P 500 so far in 2014:

(For live prices, and much more detail, go to the tracking page or the public version of the 2014 spreadsheet — these are just screen shots taken midday on Monday, November 3).

So what do you think? Anything interesting hiding in the rubble of this year’s teaser tracking spreadsheets, or any winners who you think will continue to thrive? Any other trends or insights you’d like to share? Let us know with a comment below.

"reveal" emails? If not,

just click here...

East West looking attractive now. in addition, they are buying back their shares heavily now. https://www.insidertracking.com/node/7?ticker=EW*CA

I still own it. Quite a waiting game while we wonder what will come of the gas drilling in Romania, though the NZ stuff seems to be closer to break-even than the real boon folks hoped for, at least so far. At least NZ is by some interpretations paying for itself, with cash flow from the wells (if it keeps up at this rate) covering much of the drilling commitments.

you do not have the new ticker symbol for Benitec, now no longer confined to Down Under as BLT (bacon lettuce & tomato) or as BNIKF here, but also with a sponsored ADR as BTEBY. The company and its depositary, BNY-Mellon, paid to allow the transfer to be made without charge by American shareholders.

True enough, the ADR either didn’t exist when the tease was spun or was more illiquid than the non-ADR, don’t remember which. The prices track close enough to make the point either way. (BTEBY represents five shares in Australia, BNIKF represents one — for anyone who’s keeping track or might be confused.)

It seems I am breaking even on the list with 3 in the green and 3 in the red. Percentage wise, I am slightly more in the green due to better entry than shown above. Mainly due to my BNIKF/BTEBY average price being at $0.68 vs $1.6.

Some beatings…. I hope they have stop loss.

I noticed that 5 of the 10 in the bottom 10 had an F on the end of the symbol. Does that tell you anything?

Yep… though, to be fair, that’s partly because we can’t use Canadian ticker symbols in these sheets.

SDRL or NADL or ? Of the Drillers which is the investment?

Best-Ben

CESX

Dear SmallCap Network Members,

Good morning, fellow small cap stock enthusiasts. No, you’re not crazy – we ARE sending today’s edition of the newsletter before the market opens instead of our typical post-close delivery. There’s a very good reason for the switch. There are two reasons, actually. One of them is, we couldn’t wait to tell you what we’re about to tell you! The other reason is, we wanted to give our loyal newsletter readers a sneak peak of a new opportunity we won’t be officially unveiling at the website until after the close today. It’s a big deal because, as you know, time is money.

Just to set the stage a little, imagine an $18 billion industry with high barriers to entry and government regulations that essentially mandate the industry’s success. If you’re not only already in the game but have established yourself as a qualified service provider (maybe even an approved service provider to the government), it’s a position most other companies can only dream of being in.

Oh, and did I mention this particular company is already profitable, on the verge of a major expansion, and en route to a listing on a major exchange?

Honestly, it would be unusual to be able to say any of those things about most small cap and/or OTC stocks, so when you can say all three about one particular name, you make a point of learning more. Why? Because it’s a window of opportunity that won’t likely be open for very long.

Enough fanfare. The company we’re putting on the table today as an attractive investment idea is CES Synergies (CESX), though you may also know it as Cross Environmental Services.

In simplest terms, CES Synergies – through its subsidiary Cross Environmental Services (CES) – is a specialty environmental services company providing quality environmental contracting solutions, demolition and remediation services to commercial and industrial customers, as well as federal, state and municipal entities. Some of its customers include NASA, the U.S. Air Force, the U.S. Army Corps of Engineers, the State of Florida, and a whole slew of private sector organizations.

While a little obscure, it’s a reliable and surprisingly large industry. It’s getting bigger all the time too. We weren’t kidding above when we said the remediation and demolition industry was worth $18 billion per year in the United States. More important to us right now, it’s an industry that’s growing… rapidly.

It’s no big secret the housing construction market is on the mend. What’s largely been unrecognized over the past couple of years, though, is how rapidly the commercial and heavy construction market is growing too. Industry consulting group FMI published a report at the end of September explaining its forecast for growth in office space for this year is 8%, with a still-solid 7% growth rate expected next year. Manufacturing-based construction is on pace to grow 6% this year and 8% next year. The numbers jive with those gathered by statistics and data website Statista, which suggests heavy engineering construction spending in the U.S. should grow 5.6% this year, and grow another 7.4% next year.

Great, but what’s this got to do with CESX? A huge chunk of any new industrial, institutional, or commercial construction first requires the removal and abatement of existing structures. And when it comes to cleaning up dangerous, EPA-regulated construction messes, CES Synergies has proven itself as one of the best.

Though the company only became a publicly-traded entity a year ago, it’s been up and running since 1988. It’s also profitable, which is almost unheard of within the small cap space. Then again, after 26 years we can’t be entirely surprised the veteran management team knows how to bear fruit.

Just to paint the picture with numbers, the company generated $15.5 million in revenue last year. It’s driven a top line of $8.5 million for the first half of 2014, so it’s already on pace to exceed 2013’s total. (See the revenue chart below.) Yet, that figure may understate the growth actually at hand. Gross margins swelled from 16% in the second quarter of 2013 to 28% in the second quarter of 2014 on the heels of a 38% increase in y-o-y revenue growth for Q2. The swing back to a net profit last quarter underscores the company’s growing strength. More of the same kind of growth is likely in its foreseeable future too, as the company expands to meets its growing demand.

Now, we could probably stop right there and get to some concluding thoughts on CESX and you’d be more than interested enough to take on a position. There are a handful of additional details worth exploring, however, that could make CES Synergies an absolute must-have.

1. First and foremost, CES Synergies is a GSA-approved service provider.

Without getting too deep into the technicals, being a GSA-approved contractor means any federal government agency already has the green light to go ahead and hire CES Synergies at a pre-determined rate. It doesn’t have to compete or bid for business under the GSA schedule, nor do agencies need to work through an entire procurement process in order to hire the company to do cleanup work.

2. Second, management is eating its own cooking. In fact, management has made a huge bet on the future growth of the the company and the upside of its stock.

For perspective, while there may be 46.5 million outstanding shares of CESX, the total float is only 4.8 million shares. Who’s sitting on the rest? Management. CEO Clyde Alan Biston alone owned about 2/3 of the outstanding shares as of the last look, so he’s clearly sitting on the same side of the table as the average shareholder.

3. Third, it’s practically impossible for new competition to step in and compete with CES Synergies.

CES has an extensive late-model fleet of service trucks, box trucks, vans, excavators, loaders, dump trucks, semi-tractors, and roll-off trucks that can be deployed to any project. In addition to the large rolling stock and excavators, CES has an extensive inventory of specialty equipment designed to provide demolition and abatement services inside a structure. This equipment includes (but is not limited to) skid steer loaders equipped with exhaust scrubbers, mini-excavators equipped with hydraulic hammers, automated tile removing machines, airless sprayers, and innumerable handheld power tools designed for material removal.

You get the idea. There aren’t too many organizations with the financial wherewithal or the established name able to step into the market and compete with Cross Environmental Services.

While all these details are compelling, the best part of the CESX story is the part you can’t quite put your finger on, but can sense… CES Synergies is knocking on the door of a major growth phase.

Last quarter’s revenue numbers and swing back to profitability hint at it, as does the growing utilization of the company’s status as a GSA-approved service provider. Less obvious but even more indicative of rapidly-brewing growth is how CES Synergies has been awarded ten abatement and cleanup projects this year already, with seven of them being won just since June. Most of them were for undisclosed amounts, but a couple of the disclosed revenue totals were seven figure contracts. And again, we’re talking high-profile clients like the U.S. Air Force and the Florida Department of Transportation. Those organizations don’t dole out serious contract work to companies that haven’t proven themselves.

It’s just a guess for now (though an educated one), but a top line near $20 million for 2014 and a revenue total in the high $20 millions for next year seem realistic to us. That’s fantastic for a $41.1 million company already turning a net profit. We’ll have a better idea about the future once last quarter’s numbers are reported, which should be sometime in the first half of this month.

As bullish as those factors are, there are three clear reasons why an investor would want to make a point of getting into CESX soon… as in today.

As was mentioned above, the SmallCap Network will officially begin coverage of the company beginning this evening. As people go to the website they’re going to find this and other analysis of the stock, and for the obvious reasons they’re apt to like it. In trading, it’s better to be in front of a crowd than behind it.

Regardless of our coverage, other media sources and more investors are going to pick up on CES Synergies in the very near future. The growth story is just too compelling to ignore. And, once the upcoming earnings news is posted, the growth potential should become clear to everyone. (Frankly, we’re surprised more people and media outlets haven’t jumped on it already… not that we’re complaining. If they had, we wouldn’t be able to get in at $0.88 today, versus a price of $1.20 just a couple of months ago. Once the rest of the market does take notice of CESX though, look out above.)

The up-listing to a senior exchange like the NASDAQ has been on the radar for a while, but we think it could happen sooner than most people realize. While such a graduation will be catalytic for the stock, even just the official beginning of the uplisting process could put some serious bullish pressure on the stock’s value.

Bottom line? We can’t stress enough how incredible it is to see a profitable small cap stock established in an industry with high barriers to entry. Better still, it’s growing because of ever-expanding government regulations. CESX is one of those one-in-a-thousand cases, and you can pick it up at bargain prices today.

Warmest regards,

SmallCap Network

Ben,

CESX closed at 0.58 today. Still a buy?

Thanks, Shailesh

CESX-I want to apologize to all for that post from SmallCap Network-

I have since determined to read and follow Travis and the IRR’s discussions

and I am currently in the process of eliminating “junk” from my portfolio.

I have a tendendancy of being over exhuberant at times which is another

“flaw” I am attempting to surpress. Please gummies if I am get annoying let me

know…I am far from perfect and appreciate constructive critisism.

I am honored to be a memeber of such an elite group.

Best-Ben

The ten best performers all started with prices over $10. Only two of the worst ten performers did.

Good point. I suspect that’s likely true of the top third and the bottom third, though I haven’t checked for this year and that’s certainly not always the case (it will be swayed a lot by whether or not little mining and energy stocks have a good year, since they’re often the sub-$10 — or even sub-$1 — stocks.)

BBRY-Ingram Micro Mobility and BlackBerry Announce Distribution Agreement in Canada to Serve Unlocked Smartphone Market

9:17a ET November 4, 2014 (Market Wire) Print

Ingram Micro Mobility, a business unit of Ingram Micro Canada and subsidiary of Ingram Micro Inc. (NYSE: IM), is providing unlocked BlackBerry(R) 10 smartphones throughout Canada as part of a new agreement between the two companies. The agreement equips BlackBerry(R) (NASDAQ: BBRY) (TSX: BB) with broader distribution of its products and services throughout Canada by leveraging Ingram Micro Mobility’s supply chain expertise, extensive infrastructure and unique channel reach to value-added resellers (VARs), system integrators, mobile carriers, retailers and other service providers.

“Ingram Micro Mobility is a valued partner for BlackBerry throughout the world,” said Matt Reaves, head of global distribution at BlackBerry, “This partnership will make it easier and more convenient for customers across Canada who value productivity and security to find the BlackBerry 10 smartphone that suits their needs.”

“We are excited to be working with BlackBerry to bring their extensive BlackBerry 10 smartphone portfolio to more Canadian retailers,” said Steve Roberts, executive director, Ingram Micro Mobility Canada. “Our distribution channel will allow a number of new partners to sell unlocked BlackBerry devices, offering greater choice for customers.”

Unlocked BlackBerry 10 smartphones will be available at retail locations online and in-stores as well as through value added resellers in the future. For more information on where to buy visit http://www.BlackBerry.com.

About BlackBerry A global leader in mobile communications, BlackBerry(R) revolutionized the mobile industry when it was introduced in 1999. Today, BlackBerry aims to inspire the success of our millions of customers around the world by continuously pushing the boundaries of mobile experiences. Founded in 1984 and based in Waterloo, Ontario, BlackBerry operates offices in North America, Europe, Asia Pacific and Latin America. The Company trades under the ticker symbols “BB” on the Toronto Stock Exchange and “BBRY” on the NASDAQ. For more information, visit blackberry.com.

About Ingram Micro Inc. Ingram Micro helps businesses realize the promise of technology. It delivers a full spectrum of global technology and supply chain services to businesses around the world. Deep expertise in technology solutions, mobility, cloud, and supply chain solutions enables its business partners to operate efficiently and successfully in the markets they serve. Unrivaled agility, deep market insights and the trust and dependability that come from decades of proven relationships, set Ingram Micro apart and ahead. Discover how Ingram Micro can help you realize the promise of technology. More at ingrammicro.com.

Ingram Micro Mobility delivers supply chain, distribution and recovery solutions across all aspects of the mobility device lifecycle, through responsiveness and focused execution. The Mobility business unit helps boost accessibility of connected and mobile devices, wearables, machine-to-machine technologies and accessories in the marketplace by solving customers’ complex logistical challenges. Ingram Micro Mobility’s device lifecycle services include capabilities such as warehousing, software loading, e-commerce, advanced planning, order management, accounts receivable and credit management, end-user fulfillment, and reverse logistics, including wireless device repair, triaging, refurbishment and recycling services. Visit ingrammicro.com/mobility.

Long BBRY

Best-Ben

It took awhile for me to realize that most of these teasers are really the scraps from the big boys. They got in early, made their gains, then are looking to get out. They leave a little juice on the bone (who wants to buy a stock on its way down), but not much. They have such large positions that they need publicity to reach enough dumb money to cover the sale.

You can verify this by looking at the slow stochastic, weekly slow stochastic, and relative strength index; they’ll almost always show a stock in an overbought condition, just not yet turning down.

Very interesting that 3 of the newsletter guys are in the top 10 twice and not in the bottom 10, plus two of the newsletter guys are in the bottom 10 twice and not in the top 10. Seems to help identify which newsletters might have more credibility. Of course since this is a snapshot, is it possible to look back at previous snapshots and see if this is typical or not?

All of the data for 7+ years is on the tracking page, but we do not save snapshots of particular periods in time — performance numbers are all “to date” for everything, which might be accurate for some of the “buy and hold” type letters but probably doesn’t represent the traders or strict stop-loss folks very well.

The Fools just jumped to #2 spot, SWIR up 26.6% today on earnings.

It just goes to prove GS is the best value.

No surprise that the penny stocks and foreign stocks are the worse performers…….These newsletter writers are the kings of pump and dump. Thirty years of investing and I started making money when I began ignoring junk stocks.