This schedule shall be maintained by any IRR as a(n) event(s) occur(s) in the following format: $XYZ, Link/source,. Calculated columns/cells (TBD) may include: SP, %age SP change, Volume, MC, etc.; brief summary/comment including original comment(s)/thread(s)s/post#(s) . 125-150 characters (max), author. Schedule to exist on stockgumshoe.com/microblog utilizing google drive. This spreadsheet greatly reduce the biotech posts in currenty threads and consolidate information between threads. Perpetual Prosperity to ALL!-Benjamin

example: HEADER: Nasdaq.com US Market ClosedDec 12, 2014CAC 40 4108.93-116.93 ▼-2.77%NIKKEI 225 17371.58114.18 ▲0.66%FTSE100 6300.63-161.07 ▼-2.49%

Stock Market Activity

NASDAQ Composite Volume: 1,834,060,354

Index Value Change Net / %

NASDAQ 4653.60 -54.56 ▼1.16% NASDAQ-100 (NDX) 4199.28 -47.2 ▼1.11% Pre-Market (NDX) 4211.91 -34.57 ▼0.81% After Hours(NDX) 4200.08 0.8 ▲0.02%

DJIA 17280.83 -315.51 ▼1.79% S&P 500 2002.33 -33 ▼1.62%

Russell 2000 1152.45 -14.51 ▼1.24% Data as of Dec 12, 2014

View Major Indices 12:00 PM 3:00 PM 4660 4680 4700

Editor’s Picks

Closing Update: Stocks Finish Worst Week Since January With Steep Sell-Off; New Fall for Crude Oil Keeps Markets in Swoon

Daily Dividend Report: EIX, EMC, STT, RL, FMC, TRN, BWS

GE Boosts Dividend By 5% Latest Market News Headlines

3 Best Renewable Energy Stocks for 2015

How a Ford Pickup Became America’s Top Luxury…

How AT&T and Verizon’s Loss is Your Gain

A Breakdown of How Your Social Security Tax…

MARKET SNAPSHOT: Crashing Crude May Blow A $1.6…

The Biggest Risk for Apple Inc. Stock in 2015 and…

SpaceX Invents an X-Wing … Sort Of: Introducing…

This Tiny Biotech Worries Sanofi and Shire, and…

Believe it or Not, Amazon Isn’t the King of…

Aerojet Rocketdyne Propulsion Supported Mission…

More Market Headlines

Featured Story

3 Things Starbucks CEO Howard Schultz Wants Investors to Know

Get a glimpse into the future of the coffee chain

Featured Video

vew More Videos

SCHEDULE DATA:Stock Activity

Most Active Most Advanced Most Declined Dollar Volume Unusual Volume

Company Last Sale* Change Net / % Share Volume

Calithera Biosciences, Inc. (CALA) $29.85 6.65 ▲ 28.66% 1,167,588

ChemoCentryx, Inc. (CCXI) $5.60 1.11 ▲ 24.72% 7,777,656

Oncothyreon Inc. (ONTY) $2.02 0.31 ▲ 18.13% 7,735,300

Sangamo BioSciences, Inc. (SGMO) $16.53 2.46 ▲ 17.48% 2,530,356

Cerulean Pharma Inc. (CERU) $6 0.83 ▲ 16.05% 75,458

Read more: http://www.nasdaq.com/#ixzz3Lt0mWKHa

http://www.nasdaq.com/article/why-chemocentryx-incs-shares-shot-60-higher-today-cm422798 , calcs1,2,3,,, TLOGolgytes …

This is a discussion topic or guest posting submitted by a Stock Gumshoe reader. The content has not been edited or reviewed by Stock Gumshoe, and any opinions expressed are those of the author alone.

Timely Schedule of Biotechnology Equitys Gains and Losses

Timely Schedule of Biotechnology Equitys Gains and Losses

RE:Post 136 ABIO, CALA, PRTK, RGDX, SKBI, VBIV ALDR, DSCO, LJPC, TGTX

Post 139 KIte, 140, 142, AKAO, CTIX, 144 SPHS, 146 AGIO, 147 AGIO,CELG, 149 CLDN 150 SNWV 151 GILD, 152 GALE, 153 ABIO, CALA, PRTK, RGDX, SKBI, VBIV, 154 ISIS, AGIO, ARIA, ABBV, AGEN, AXLN, ATHN, AVNR, BLUE,FOLD 155 KITE, 157 NBY, 158 CALA, 159 FOMX, 160 CTIX, 161 NBY, 162 OPHT, 163 GIOLD ACHN, 164 AKBA, 165 BENITECH, 166 ACRX ECTE RNN ATHX 167 AKAO 168 SNWV 169 TRVN CALA 170 MORHOSYS 171, 172 NO-FLY BIO LIST etc,

all above regarding http://www.stockgumshoe.com/2014/12/microblog-dawn-of-the-planet-of-the-tloglodytes/ Best-Benjamin

204 NVS, NBY, PTLA, TRVN, ISIS…

If USA doesn’t take #STEM as seriously as #China the ranks of the most prosperous nations are going to change. We don’t have a day to lose…

Education will change forever with #VR – NingXia province China just opened the first @htcvive 50-student full-function VR classrooms. Epic!

https://twitter.com/CharlieFink/status/918718615758635010 ht @RickKing16

MGEN benefits from nusinerin, kynamro, patisiran, inclisiran – they give investors a way to visualize a path to market for oligotx. Though miRNA has vastly different MoA from antisense or RNAi, their success helps it. C 9.70 1/3, 4? up 😉 https://twitter.com/mikegoodma/status/948574149882019840 Thx Mike

#Charts:

Finviz Technical Analysis, Fundamental, Catalysts #News

https://finviz.com/chart.ashx?t=MGEN&ty=c&ta=1&p=d&s=l

https://finviz.com/quote.ashx?t=MGEN

#Invest #Chart: mgen

https://www.investing.com/equities/signal-genetics

Fix You https://www.youtube.com/watch?v=sTkQUL_MMLU

Over the #rainbow, #wonderful world

https://www.youtube.com/watch?v=Z26BvHOD_sg

https://www.ursa.fi/blogi/ice-crystal-halos/halo_display_from_upper_bavaria/

Christian - 史逸飞 #Follow

Rainbow – #360 Degree. Natural Phenomenon

It’s not a lens-reflection, nor a #photoshop-artwork. The Rainbow appeared on a “mixed-weather-day” during my stay in Mallorca. Quite a natural phenomenon…

https://www.flickr.com/photos/lostlaowai/5873115391 halo

b2a +

#DesignMarch https://designmarch.is/programme?date=&q=&related_events=

#f/k = x > Screener https://pro.moneymappress.com/p/TMPBK39LFSN4/LTMPU307/Full?

D R Barton. The 10-Minute Millionaire Pro newsletter at $299/yr.

#Screener Schwab image > Screeners at Schwab By Randy Frederick ?

?

https://www.schwab.com/active-trader/insights/content/options-screeners-at-schwab

#J_Hook Screener > More to come… #b2a

So my wife inherited an account several months ago. Although I don’t consider the account huge, it was managed by a South Florida high-wealth asset management firm. I’ve found it instructive to see how they allocated the assets, and Ben thought it might be worth sharing.

Broadly speaking, there are three broad categories of assets in this portfolio: Individual stocks, mutual funds, and fixed income (there was also an annuity we cashed out, which I’ll ignore). I suspect that the owner of the portfolio advised the wealth management firm how conservative to be with her assets, and they adjusted the relative proportions accordingly. Knowing this individual pretty well, and looking at the allocations, it seems as though she requested that they be pretty conservative and focus more on wealth preservation than growth.

This first e-mail will focus only on fixed income. I’ll discuss the other two categories later.

The fixed income investments were as follows:

Intermediate Bonds: 35% of the total fixed income category

High Yield Corporate Bonds: 12% of fixed income

Municipal Bonds: 24% of fixed income

World Bonds: 16% of fixed income

“Non-traditional” Bonds: 9% of total

Emerging Markets Bonds: 3.3% of total

There may be a rounding error in there.

A couple of notes:

(1) There are a number of corporate bond funds. The ones chosen for this account were: TIHYX, AHITX, and SHYAX (I sold SHYAX because the fees were higher than normal, but will likely keep the others). The yield on these funds aren’t as high as available elsewhere—I think they must not use any leverage to boost returns as others do, but make the funds more risky.

(2) There seems to be quite a bit of overlap in the countries represented in the World Bond Funds and the Emerging Markets Fund, so I don’t know how those Morningstar classifications are determined. At any rate, the world funds were SEFIX and TTRZX, and the emerging markets bond fund was SITEX.

(3) There are dozens and dozens of municipal bond funds available. While the ones in this portfolio were ETFs, I prefer CEFs (close-ended funds), which trade like stocks and generally have higher yields. I’ve been making the switch to some of the better CEFs.

(4) What the heck are non-traditional Bonds? Beats me; that’s the classification given by Morningstar, but it looks like it is mostly made up of secured loans (such as packages of mortgages) and corporate loans. That ticker is DFLEX, which is a DoubleLine fund.

Here’s my final thought. This portfolio had something like 30-35% allocated to fixed income. For me that’s too high; I prefer something down around 15-20%, but I’m still a young’un. Anyway, my recommendation would be that, regardless of what proportion of your portfolio you decide to put in fixed income, you then should consider allocating that amount among intermediate bonds/munis/corporate/world bonds, etc. in approximately the percentages listed above. At least it seems like a reasonable place to start.

Quick post on the second category, mutual funds. To be honest, this is something I just don’t get; I think there should have been no mutual funds in this portfolio because the holdings could have been easily replicated through individual stock purchases at a lower cost (you’ll understand why when I get to the post about individual stock holdings). Actually, I’m overreaching a little. I could see holding funds of stocks that are hard to replicate, such as baskets of emerging market companies or small/mid caps.

Anyway, there were a ridiculously high number of stock funds in this portfolio–I think 14 in total, not including the bond funds already discussed–some of which are repetitive (and some of which, as I stated above, have relatively high annual expense ratios).

There are subtle differences among them so I don’t know the best way to organize them here. For instance, thre are six that consist of large companies, either “growth”-oriented, “value”-oriented, or a “blend” of both, and with their holdings consisting of between 75%-90% US stocks and the remainder International stocks.

In addition, there are:

Two large US stock-only mutual funds (consisting of around 40% of the mutual fund category)

a small/midcap US stock fund (consisting of just 4% of the total mutual fund category)

Two large foreign-stock only funds, one focused on “growth” and one focused on a “blend” (consisting of approximately 12% of the value of all the mutual funds)

Three emerging markets stock funds (consisting of around 20% of the value of all the mutual funds)

One “world allocation” fund consisting of 1/3 large US stocks, 1/3 large international stocks, and 1/3 bonds (just 4% of the mutual fund category).

Note that the percentages listed above don’t include the funds that have both a US and foreign stock component, so it would be inaccurate to say that 12% of the holdings here were in non-emerging market foreign stocks. If you divide up the components of the funds that included both US and foreign stocks, and add them in, it’s more than that.

I’ll also note that I am generally very skeptical about the distinction between “value” and “growth” companies. There is a ton of overlap in the holdings of these funds, For instance, I think every single non-foreign fund in this portfolio has Microsoft as a top ten holding (The top holdings of each fund are listed on Morningstar’s site for easy perusal). Is it growth or value? Who cares?

I kind of understand how it happened: There seems to have been a manager for the “US growth stocks,” a separate manager for “US value stocks,” a different manager for “small US stocks,” foreign stocks, etc., and each manager included both stocks and funds in their portion of the portfolio, without any regard for what the other managers were doing. The portfolio was not looked at holistically–that is, a complete whole. Which is why there seems to be so much overlap, even though the value of each mutual fund holding was relatively small. This is a great lesson on why we all need to look at our holdings as one portfolio even if there are different accounts within in (such as both a taxable and tax-deferred account).

I have since sold all the US-based mutual funds, and the foreign funds that had high fees.

I think that’s it for the funds.

All right. We are now reaching the meat of this professionally-managed inherited portfolio, which consists of the stock holdings. There’s a lot of information that can be gleaned from these holdings. I’ll try to be concise, and limit discussion to what I think is most relevant, but please ask questions if there’s anything more you’d like to know here.

I think it’s important to reiterate here that multiple asset managers worked on this account. As I understand it, this portion of the portfolio (which includes some of the mutual funds discussed previously, BTW), was split into several “baskets” with differing style: Large-Cap Growth, Large-Cap Core (whatever that is), Large-Cap Value, Small-Cap Growth, and International Developed Markets. The “baskets” were split as follows:

Large-Cap Growth: 23% of value of all stock holdings

Large-Cap Core: 13% of value of all stock holdings

Large-Cap Value: 23% of value of all stock holdings

Small-Cap Growth: 13% of value of all stock holdings

International: 27% of value of all stock holdings

So, another way to look at it is: 60% large-cap domestic, 27% international (large, mid, and small cap), and 13% small-cap domestic.

What is the difference between Large-Cap Growth, Large-Cap Core, and Large-Cap Value? Here’s a list of five holdings from each category, chosen at random:

Large-Cap Growth: Abbott, Adobe Systems, Google, ADP, Blackrock.

Large-Cap Core: 3M, Apple, Dollar General, Honeywell, Johnson & Johnson

Large-Cap Value: AT&T, CVS, Merck, Pepsi, Proctor & Gamble.

There are also some stocks that are given OTHER classifications: Mid-cap growth, small-cap value, small-cap core, emerging markets, etc., and it is likely that the same manager handled all small-and mid-cap domestic, and the same manager handled both foreign developed and emerging markets, even though that doesn’t completely mesh with the description of the five managed accounts.

Anyway, that’s all background.

There are about 210 different stocks in this portfolio, which is WAAAAYYYYYY overkill, especially in light of the size of many of these holdings. What I suspect was going on here is that each individual manager puts the same stocks in the same proportion in all the client accounts he or she manages, and the number of shares is simply determined by the size of the account. So I am guessing that the stocks in this account, in the same proportion, was exactly the same as accounts ten, twenty, even thirty times larger. (note: the sheer number of different stocks in this account, many of which being ridiculously small in size, makes me really question why there were any large-cap domestic mutual funds, as alluded to in the earlier post).

I can’t list all 210 stocks, so what I am going to do is simply give you the first 50 or so. To give you a sense of size, the largest stock holding was approximately 4 times the size of the last one I am giving you. CVS, at # 14, is twice the size of the stock at the bottom. Only the top nine stocks are more than 2.5 times the last on the list—so it is pretty top-heavy. The top nine stocks. combined, constitute around 17.5% of the value of all the stocks (through Google/Alphabet).

Let me note also that there are no REITs, no MLPs, and maybe only one or two electric utilities. The other sectors seem to be evenly represented.

NSRGY NESTLE S A SPNSD ADR REPSTING REG SHS

ADBE ADOBE SYSTEMS INC DELAWARE

MSFT MICROSOFT CORP

DG DOLLAR GENERAL CORP NEW

ADP AUTOMATIC DATA PROCESSING INC

CAJ CANON INC SPON ADR

ACN ACCENTURE PLC IRELAND CLASS A NEW

V VISA INC CLASS A

GOOG ALPHABET INC CL C

UNH UNITEDHEALTH GROUP INC

NKE NIKE INC CL B

MMC MARSH & MCLENNAN COS INC

LOW LOWES COMPANIES INC

CVS CVS HEALTH CORP

NICE NICE LTD SPONS ADR

ALPMY ASTELLAS PHARMA INC ADR

ZTS ZOETIS INC CL A

ORCL ORACLE CORP

KT KT CORP SPONSORED ADR

CEO CNOOC LTD SPONS ADR

SNN SMITH & NEPHEW PLC NEW SPONS ADR

ALGN ALIGN TECHNOLOGY INC

SBUX STARBUCKS CORP

IHG INTERCONTINENTAL HOTELS GROUP PLC NEW SPONS ADR 2017

AMGN AMGEN INC

ORLY O REILLY AUTOMOTIVE INC NEW

SJM SMUCKER JM COMPANY NEW

PM PHILIP MORRIS INTL INC

FB FACEBOOK INC CL A

GWW GRAINGER W W INC

JNJ JOHNSON & JOHNSON

STT STATE STREET CORP

ABT ABBOTT LABORATORIES

CVX CHEVRON CORP

ABC AMERISOURCEBERGEN CORP

MCHP MICROCHIP TECHNOLOGY INC

IT GARTNER INC

MLCO MELCO RESORTS & ENTERTAIMENT LTD ADR

KR KROGER COMPANY

OXY OCCIDENTAL PETROLEUM CORP

SNE SONY CORP ADR NEW 7/74

OMC OMNICOM GROUP INC

GOOGL ALPHABET INC CL A

BKNG BOOKING HOLDINGS INC

ITW ILLINOIS TOOL WORKS INC

MRK MERCK & COMPANY INC NEW

REGN REGENERON PHARMACEUTICALS INC

DBSDY DBS GROUP HLDGS LTD SPONS ADR

WNS WNS HOLDINGS LTD SPONSORED ADR

RDS/A ROYAL DUTCH SHELL PLC SPONSORED ADR REPSTG A SHARES

MA MASTERCARD INC CL A

Also, just for giggles, here are the bottom 30 in size, which combined have the same value as Nestle, the #1. Most, I believe, are small- and mid-cap international stocks:

WWW WOLVERINE WORLD WIDE INC

SONC SONIC CORP

AKO/B EMBOTELLADORA ANDINA S A SPONSORED ADR REPRESENTING SERIES B

MIELY MITSUBISHI ELEC CORP ADR

SSB SOUTH STATE CORP

TMICY TREND MICRO INC SPONSORED ADR NEW

SCSC SCANSOURCE INC

SKM SK TELECOM LTD SPONS ADR

DRQ DRIL-QUIP INC

HURN HURON CONSULTING GROUP INC

UHT UNIVERSAL HEALTH REALTY* INCOME TRUST SHARES BENEFICIAL INTEREST

PDCO PATTERSON COMPANIES INC

ADRNY KONINKLIJKE AHOLD DELHAIZE N V SPONS ADR NEW

ADDYY ADIDAS AG SPONS ADR

DSDVY DSV AS ADR

DLAKY DEUTSCHE LUFTHANSA AG SPONS ADR

KMTUY KOMATSU LTD SPONS ADR NEW

SMFKY SMURFIT KAPPA GRP PLC ADR

PCRFY PANASONIC CORP ADR

EBKDY ERSTE GROUP BANK AG SPONSORED ADR REPSENTING 1/2 SH

AVDL AVADEL PHARMACEUTICALS PLC SPONS ADR

HTHIY HITACHI LTD ADR 10 COM

CCU COMPANIA CERVECEIAS UNIDAS S A SPONSORED ADR

CMCM CHEETAH MOBILE INC ADR

ORKLY ORKLA ASA SPON ADR

HENOY HENKEL AG & COMPANY KGAA SPONSORED ADR REPSTG PFD SHS

SWRAY SWIRE PACIFIC LIMITED SPONSORED ADR REPRESENTING 1 CLASS A

VCO VINA CONCHA Y TORO S A SPONSORED ADR

SHI SINOPEC SHANGHAI PETRO SPONS ADR REPSTG CL H

PBSFY PROSIEBENSAT 1 MEDIA AG ADR

I think that’s it. Let me know if you’d like me to parse this any other way. Hopefully the formatting looks OK.

#inherited portfolio

Wow, savethemanatee – 140 in just stocks! And there are/were other holdings too! No wonder you want to sell off the chaff, if you only had time to work out what is actually chaff.

Of the bottom thirty, I’d want to entertain keeping only Mitsubishi Electric and Komatsu, maybe Hitachi, as their products are familiar to me through my husband’s work, but I think that they’re in cyclical industries. I’d keep them just to put them aside for later analysis. And of course I could be all wrong here since I’ve never heard of most of the lower 30!

IMHO it’s a matter of how much time you have to investigate their vitals. Expediency says to sell and say, “Thank you, dear Auntie Em (or whomever)” as the proceeds come in.

Please tell me that you now have this portfolio in a brokerage that won’t charge you more than it’s worth to sell the small holdings, especially those foreign stocks.

Thanks for posting!

Penny

Part of me wants to sell off all the stocks whose value are below a certain ridiculously low threshold (i.e., the cost of a single night out with my family). But I agree, this is a neat opportunity to learn something about companies I know little or nothing about–after all, there’s a reason a professional chose these particular stocks.

The first, immediate step was to identify and sell the holdings that my wife and I are prohibited from holding (we’re both federal government employees, and ethics rules still apply to rank-and-file civil servants, even if it doesn’t seem to for political appointees). Then, as mentioned, I sold the US-based mutual funds with the intention of reinvesting it in individual stocks. Now it’s a matter of executing the hard part. The ones I keep, I will add to. The small and mid-cap foreign stocks are the most interesting to me, to be honest.

Thankfully, my brokerage (Schwab) gives me free transactions, a gift for switching from Scottrade last year!

wow, Savethemanatee, absolutely fabulously awesome thanks for sharing! so much to learn here!

yours, Finn

OK–You asked. Sorry for the delay; I was out all weekend.

Here’s the complete managed portfolio (just the stocks), in order from highest value of each holding to lowest. It’s a little overwhelming. Just to clarify something: I think I originally mentioned that some of the confusion with this portfolio was that there were several different individual managers–one for international stocks, one for growth stocks, one for value stocks, etc. So, it’s entirely possible that several stocks were purchased by more than one “manager”, and that is why they appear very high on the list (Dollar General, I’m looking at you).

NSRGY NESTLE S A SPNSD ADR REPSTING REG SHS

ADBE ADOBE SYSTEMS INC DELAWARE

MSFT MICROSOFT CORP

DG DOLLAR GENERAL CORP NEW

ADP AUTOMATIC DATA PROCESSING INC

CAJ CANON INC SPON ADR

ACN ACCENTURE PLC IRELAND CLASS A NEW

V VISA INC CLASS A

GOOG ALPHABET INC CL C

UNH UNITEDHEALTH GROUP INC

NKE NIKE INC CL B

MMC MARSH & MCLENNAN COS INC

LOW LOWES COMPANIES INC

CVS CVS HEALTH CORP

NICE NICE LTD SPONS ADR

ALPMY ASTELLAS PHARMA INC ADR

ZTS ZOETIS INC CL A

ORCL ORACLE CORP

KT KT CORP SPONSORED ADR

CEO CNOOC LTD SPONS ADR

SNN SMITH & NEPHEW PLC NEW SPONS ADR

ALGN ALIGN TECHNOLOGY INC

SBUX STARBUCKS CORP

IHG INTERCONTINENTAL HOTELS GROUP PLC NEW SPONS ADR 2017

AMGN AMGEN INC

ORLY O REILLY AUTOMOTIVE INC NEW

SJM SMUCKER JM COMPANY NEW

PM PHILIP MORRIS INTL INC

FB FACEBOOK INC CL A

GWW GRAINGER W W INC

JNJ JOHNSON & JOHNSON

STT STATE STREET CORP

ABT ABBOTT LABORATORIES

CVX CHEVRON CORP

ABC AMERISOURCEBERGEN CORP

MCHP MICROCHIP TECHNOLOGY INC

IT GARTNER INC

MLCO MELCO RESORTS & ENTERTAIMENT LTD ADR

KR KROGER COMPANY

OXY OCCIDENTAL PETROLEUM CORP

SNE SONY CORP ADR NEW 7/74

OMC OMNICOM GROUP INC

GOOGL ALPHABET INC CL A

BKNG BOOKING HOLDINGS INC

ITW ILLINOIS TOOL WORKS INC

MRK MERCK & COMPANY INC NEW

REGN REGENERON PHARMACEUTICALS INC

DBSDY DBS GROUP HLDGS LTD SPONS ADR

WNS WNS HOLDINGS LTD SPONSORED ADR

RDS/A ROYAL DUTCH SHELL PLC SPONSORED ADR REPSTG A SHARES

MA MASTERCARD INC CL A

MT ARCELORMITTAL SA LUXEMBOURG NY REGISTRY SHARES NEW

WEX WEX INC

AAPL APPLE INC

UOVEY UNITED OVERSEAS BK LTD SPONS ADR

ROST ROSS STORES INC

CAG CONAGRA BRANDS INC

MMM 3M COMPANY

FMS FRESENIUS MEDICAL CARE AG & CO KGAA SPONSORED ADR REPSTG SHS

MO ALTRIA GROUP INC

BLKB BLACKBAUD INC

AFL AFLAC INC

MANH MANHATTAN ASSOCIATES INC

BHKLY BOC HONG KONG HOLDINGS LTD SPON ADR

FPAFY FIRST PAC LTD SPONS ADR

CLGX CORELOGIC INC

CSCO CISCO SYSTEMS INC

CHH CHOICE HOTELS INTL NEW INC

SSEZY SSE PLC SPON ADR

PSX PHILLIPS 66

PG PROCTER & GAMBLE COMPANY

ATR APTARGROUP INC

DWAHY DAIWA HOUSE IND LIMITED ADR

FICO FAIR ISAAC CORP

FIS FIDELITY NATIONAL INFORMATION SERVICES INC

EXPO EXPONENT INC

DCM NTT DOCOMO INC SPONSORED ADR

COLM COLUMBIA SPORTSWEAR COMPANY

MORN MORNINGSTAR INC

NEE NEXTERA ENERGY INC

IX ORIX CORP SPONSORED ADR

JPM JPMORGAN CHASE & COMPANY

STO STATOIL ASA SPONSORED ADR

UNP UNION PACIFIC CORP

TKPYY TAKEDA PHARMACEUTICAL COMPANY LTD SPONSORED ADR

BDX BECTON DICKINSON & COMPANY

JMHLY JARDINE MATHESON HOLDINGS LIMITED ADR

WFC WELLS FARGO & CO NEW

KEX KIRBY CORP

TECH BIO TECHNE CORP

HON HONEYWELL INTL INC

PKG PACKAGING CORP OF AMERICA

LMT LOCKHEED MARTIN CORP

NTTYY NIPPON TELEG & TEL CORP SPON ADR

PFE PFIZER INC

SEOAY STORA ENSO CORP SPONSORED ADR REPSTG SHARES R

STM STMICROELECTRONICS N V NY REGISTRY

CMCSA COMCAST CORP CL A NEW

STBFY SUNTORY BEVERAGE & FOOD LTD ADS

MDT MEDTRONIC PLC

IPAR INTER PARFUMS INC

AEG AEGON N V NY REGISTRY SHS

CASY CASEYS GENL STORES INC

MOG/A MOOG INC CLASS A

PEP PEPSICO INC

YY YY INC ADS REPSTG CL A

POOL POOL CORP

T AT&T INC

HLUYY H LUNDBECK A/S SPONSORED ADR LEVEL 1

CB CHUBB LTD

AHEXY ADECCO GROUP AG ADR

ABBV ABBVIE INC

IR INGERSOLL RAND PLC

LSTR LANDSTAR SYSTEM INC

NATI NATIONAL INSTRUMENTS CORP

UNF UNIFIRST CORP

NAVG NAVIGATORS GROUP INC

WEC WEC ENERGY GROUP INC

KNBWY KIRIN HOLDINGS COMPANY LIMITED SPONS ADR

PX PRAXAIR INC

PB PROSPERITY BANCSHARES INC

SOUHY SOUTH32 LTD SPONS ADR

STBZ STATE BANK FINL CORP

ARGX ARGENX SE ADS RESPSTG ORD SHARES

MON MONSANTO COMPANY NEW

DIS WALT DISNEY CO

MDLZ MONDELEZ INTERNATIONAL INC CL A

WHGLY WH GROUP LTD SPONSORED ADR

KCRPY KAO CORP SPONSORED ADR REPSTG 10 SHS COM

CL COLGATE-PALMOLIVE COMPANY

BECN BEACON ROOFING SUPPLY INC

UMC UNITED MICROELECTRONICS CORP SPONSORED ADR NEW

OTSKY OTSUKA HOLDINGS COMPANY LTD ADR

JJSF J & J SNACK FOODS CORP

CRTO CRITEO SA ADS

IART INTEGRA LIFESCIENCES HLDGS CORP

AGN ALLERGAN PLC

DORM DORMAN PRODUCTS INC

FWRD FORWARD AIR CORP

TXN TEXAS INSTRUMENTS INC

PTR PETROCHINA COMPANY LIMITED SPONSORED ADR

WHR WHIRLPOOL CORP

BFAM BRIGHT HORIZONS FAMILY SOLUTIONS INC

TLK PERUSAHAN PERSEROAN PERSERO ADR PORT TELEKMUNIKIASI INDONESIA

PKX POSCO SPONSORED ADR

SLB SCHLUMBERGER LTD

WABC WESTAMERICA BANCORPORATION

TX TERNIUM SA SPONSORED ADR

PNFP PINNACLE FINANCIAL PARTNERS INC

SPKKY SPARK NEW ZEALAND LTD SPONSORED ADR

FUJIY FUJIFILM HOLDINGS CORP ADR

IBKC IBERIABANK CORP

SBH SALLY BEAUTY HOLDINGS INC

CABGY CARLSBERG AS SPONSORED ADR

NLSN NIELSEN HLDGS PLC SHS EUR

BLK BLACKROCK INC

AVH AVIANCA HOLDINGS SA ADR

ATHM AUTOHOME INC SPONS ADR REPSTG CL A

MNRO MONRO INC

UMPQ UMPQUA HOLDINGS CORP

CONE CYRUSONE INC

ICUI ICU MEDICAL INC

RLI R L I CORP

AAON AAON INC NEW

POWI POWER INTEGRATIONS INC

LANC LANCASTER COLONY CORP

ECOL U S ECOLOGY INC

KNSL KINSALE CAPITAL GROUP INC

APAM ARTISAN PARTNERS ASSET MGMT INC CL A

ENV ENVESTNET INC

TTNDY TECHTRONIC INDUSTRIES LIMITED SPONSORED ADR

RHHBY ROCHE HOLDING LIMITED SPONSORED ADR

ABB ABB LIMITED SPONSORED ADR

CASS CASS INFORMATION SYSTEMS INC

SCL STEPAN CO

AUO AU OPTRONICS CORP SPONSORED ADR

SXT SENSIENT TECHNOLOGIES CORP

LPL LG DISPLAY COMPANY LTD SPONSORED ADR REPRESENTING COMMON

BCPC BALCHEM CORP

PSO PEARSON PLC SPONSORED ADR

HKXCY HONG KONG EXCHANGES & CLEARING LIMITED ADR

RAVN RAVEN INDUSTRIES INC

AEXAY ATOS ORIGIN SA ADR

PLUS EPLUS INC

WWW WOLVERINE WORLD WIDE INC

SONC SONIC CORP

AKO/B EMBOTELLADORA ANDINA S A SPONSORED ADR REPRESENTING SERIES B

MIELY MITSUBISHI ELEC CORP ADR

SSB SOUTH STATE CORP

TMICY TREND MICRO INC SPONSORED ADR NEW

SCSC SCANSOURCE INC

SKM SK TELECOM LTD SPONS ADR

DRQ DRIL-QUIP INC

HURN HURON CONSULTING GROUP INC

UHT UNIVERSAL HEALTH REALTY* INCOME TRUST SHARES BENEFICIAL INTEREST

PDCO PATTERSON COMPANIES INC

ADRNY KONINKLIJKE AHOLD DELHAIZE N V SPONS ADR NEW

ADDYY ADIDAS AG SPONS ADR

DSDVY DSV AS ADR

DLAKY DEUTSCHE LUFTHANSA AG SPONS ADR

KMTUY KOMATSU LTD SPONS ADR NEW

SMFKY SMURFIT KAPPA GRP PLC ADR

PCRFY PANASONIC CORP ADR

EBKDY ERSTE GROUP BANK AG SPONSORED ADR REPSENTING 1/2 SH

AVDL AVADEL PHARMACEUTICALS PLC SPONS ADR

HTHIY HITACHI LTD ADR 10 COM

CCU COMPANIA CERVECEIAS UNIDAS S A SPONSORED ADR

CMCM CHEETAH MOBILE INC ADR

ORKLY ORKLA ASA SPON ADR

HENOY HENKEL AG & COMPANY KGAA SPONSORED ADR REPSTG PFD SHS

SWRAY SWIRE PACIFIC LIMITED SPONSORED ADR REPRESENTING 1 CLASS A

VCO VINA CONCHA Y TORO S A SPONSORED ADR

SHI SINOPEC SHANGHAI PETRO SPONS ADR REPSTG CL H

PBSFY PROSIEBENSAT 1 MEDIA AG ADR

BONUS:

Between December 31 and when this account was transferred to heirs in April, several stocks were sold in their entirety. These were almost all in the “international” basket and were:

Celgene Corp Pharmaceuticals CELG

Royal Philips NV ADR Medical Supplies PHG

Novo Nordisk A/S Pharmaceuticals NVO

The Interpublic Group of Companies Advertising IPG

Yirendai Ltd Financial YRD

Marine Harvest ASA Fish Harvesting MHGVY

51Job Inc Business Services JOBS

Imperial Brands Plc ADR Tobacco IMBBY

Tata Motors Ltd Vehicles TTM

Gol Linhas Aereas Inteligentes SA Airlines GOL

58.Com Inc Consumer Services WUBA

China Telecom Corp. Telecommunications CHA

Kasikornbank Public Co. Bank KPCPY

Wow! What a list. Thank you SaveTheManatee. 🙂 #Best2YOU! 🙂

$NP; WOW, we thought we were diversified. Following that list of investments would take 30 hours per day! Thanks for sharing the list.

Regards,

Frank

Hmmm, just scrolled thru for the 2nd time, and can confirm, not one entry from my portfolio. But I’m still nearly 125 years away from the 200 years $IPA.V holds out for me…

v4trn4, My #cush, 4 #generations 2 come is #wow $CWBR; as a result of #KASH, #fff #SGS #Gummunity and #DD, #BestAlwayz!

Gr8Full! With you on $COB.U, $KASH and #SGS/Gummunity! Best Backatchya…

#cush ??

$AUP and $CTEQF

$NVS np > “My favorite slide from my talk today at Free energy/kinetics workshop at Novartis. My talk was themed why kinetics matters for free energies, and how it can be incorporated using stat mech/AI ! The full talk is on youtube: ”

Pratyush Tiwary – Workshop on Free Energy, Kinetics, & MSM in Drug Design 2018

https://www.youtube.com/watch?v=EnkCuajMyeg

#Last? #comment 15May18 ht ty Maiccol https://twitter.com/tiwarylab/status/996509967145414656

NEW on #ASBMB’s Engage blog: Mark Howarth, a molecular biologist at Oxford University, has curated a collection of beautiful protein structures, each corresponding to a letter in the Roman alphabet. ht ty Maicol https://twitter.com/ASBMB/status/1004853214422986752 #Best2ALL!

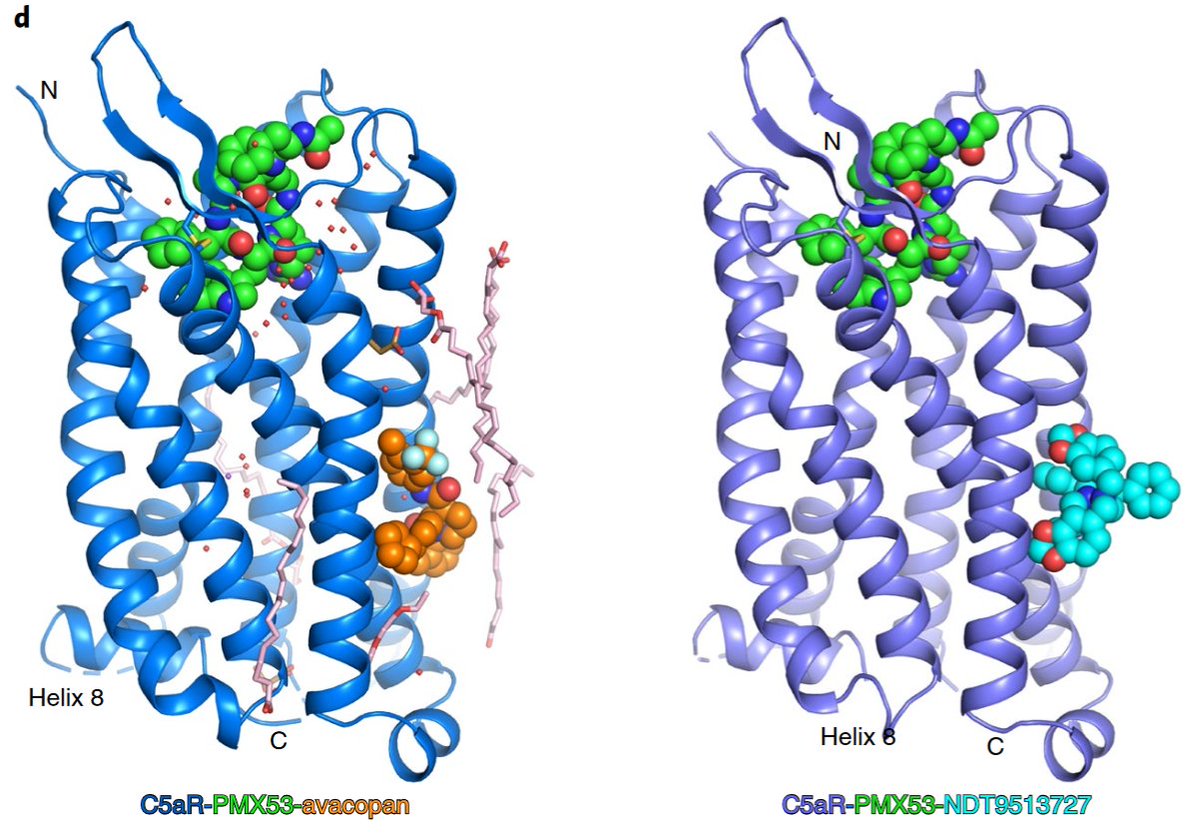

Orthosteric and allosteric action of the C5a receptor antagonists

Heng Liu, Hee Ryung Kim, R. N. V. Krishna Deepak, Lei Wang, Ka Young Chung, Hao Fan, Zhiyi Wei & Cheng Zhang

https://www.nature.com/articles/s41594-018-0067-z?

New ways of tickling anti-inflammatory C5a #GPCR

ht thx https://twitter.com/reducentropy/status/1005582865176899584

$NVDA, GOOG, $IBM etc,,,

Anybody up for #DFT and much more?

Combining chemistry, physics, mathematics…

#BioChem #AI #Computational #Chemistry #VR #NanoTech

https://soundcloud.com/theoreticallyspeaking

What is theoretical chemistry?

Density Functional Theory

Quantum Computing

Reaction Dynamics and Virtual Reality

Molecular Simulation and DNA Origami

Informatics

Simulating Biomolecules

About an hour and 1/2 of audio videos.

Comments, R&D https://www.stockgumshoe.com/2014/12/microblog-timely-schedule-of-biotechnology-equitys-gains-and-losses/

Theoretically Speaking @TheoryPod

🙂 Fascinating 🙂 Peace! 🙂

$CWBR related wow > The protein folding problem: a major conundrum of science: Ken Dill at TEDxSBU https://www.youtube.com/watch?v=zm-3kovWpNQ 16:30

#FoldIt https://www.youtube.com/watch?v=lGYJyur4FUA

An Introduction to Foldit https://www.youtube.com/watch?v=bo99JjnfdA8

Fold.it

“Sadly, the world is losing #CharlesKrauthammer -a giant of rational thought and uncommonly good common sense. We’re all the better for having heard and read you, Dr. K. You will be sorely missed and fondly, gratefully remembered. Thank you.” ~ Hal Marston

https://twitter.com/BirdBrayn/status/1005434402770505728 #86Cancer