I thought long and hard about this title……tacky as it is, this seems as good as any. My contention is that Bio is a gamblers game, where most investors have zippo idea of the science, and the science takes soooo long to bear fruit that watching paint dry seems like a knee jerk reaction. Many gamblers just trade the news. The consequence is that, win or lose, they overract to news!!

The aim here is to exploit that over-reaction for in-out profit. Its a different form of gambling, so dont bet more than you can afford to lose without a wry smile.

Bets are like boy/girlfriends…..you have some fun while it lasts, but its best to never look back. I aim to snaffle 10%….(so when did you last get 10% per month from bank interest? ) You ’could hang on for a 100% win/lose if you like (see $sphs since dec 14 2014) But Im setting 10% as the benchmark. The plan is to monitor/buy/short stocks that have hit a catalyst, on the basis that the sp always (?) overracts. So, as catalysts happen, we will trade the opposite direction. Having made or lost roughly 10%, we’ll be out.

DONT SET A MECHANICAL STOP LOSS…..Guaranteed the whipsaw will take you out for a loss. You have to monitor end of day prices, then exit for good or bad. If you’re keen, you can always re-enter lower or hang in there…..thats your call, so dont blame me.

Have fun with a play account or, if you’re convinced, bet some minor dosh…..but never more than you can afford to wave goodbye to.

Let the fun begin.

This is a discussion topic or guest posting submitted by a Stock Gumshoe reader. The content has not been edited or reviewed by Stock Gumshoe, and any opinions expressed are those of the author alone.

Alan’s Trading game

Alan’s Trading game

Not a huge catalyst, but TRVN hit a wall today 17 may 2016. Im V defo not getting involved with the science merits here….just sp movement. Its been in the $11 plus for a while….its now $6.56 and been $6.36 on the news. Im guessing theres 10% to be had. Im also guessing theres little downside, so a minus 10% seems unlikely. But never marry a stock. Get in, get out.

Isn’t the idea to buy it right after the crash, which was down to 4.00 yesterday pre-market? With nimbleness one might have gotten in near 5.00. I hemmed and hawed a bit and added pre-market at 5.5. This is now, on that tranche, about an 18% return. Buying the gaps down when there is a negative catalyst is the strategy in a nutshell, is it not? But then maybe not everyone can trade during the extended sessions. And I guess I am disobeying your maxim of get in and get out, by trying to strengthen a position — I did not have the choice of a blank slate.

Its not just ‘ Buying the gaps down when there is a negative catalyst is the strategy in a nutshell’ It works just as well by shorting the winning pops. In a nutshell, its reverse trading the markets overreaction. Trading AH wasnt my intention (maybe its a good idea, we’ll see), but AH trading is usually more expensive to trade. My idea was to trade v shortly after the bell when the retail trade (over) reacts.

As said, we have no need to know anything about the stock/science. The Calendar tells us daily which stock is due a catalyst…….so whatever it is, thats the stock on our radar. For all I know, the same strategy applies to other sectors….. I havent checked.

But I must apologise…..my timing for starting this game is rotten coz Im off on holiday till 27th. Ill pick up then. BFN

Vacy? lucky U, alanh. I have not had a vacation in 8+ years as I am a #caregiver and investor; or maybe I have been on vacy since 2001?

While you are on vacy here is a tread to discuss and share rockets: http://www.stockgumshoe.com/2016/05/microblog-ztne-rktz/

A system I have been learning from MM, SW, JAB and others involves laddering, utilizing… Leonardo Fibonacci was an Italian mathematician born in the 12th century. He is known to have discovered the “Fibonacci numbers,” which are a sequence of … (May bore some of you – but it fascinates me. – Boxing News

http://www.saddoboxing.comIt does for me; the fact that the golden means closest thing (the fibonocci) mathmatics of 1+1=2 2+1=3 3+2=5 1,2,3,5,8,13,21,34,55, so on for … ), MACD and L2. #AwesomeEternity – >>>–Jammin—>

Looking for $RLYP on May 26. If ZS-Pharma gets approved it should go to 9 which is the shorts target. Shorts have to cover, company cannot be worth zero regardless. Alan be nimble Steve be quick! Here is my best near future pick.

The last calendar entry was KMPH adcom on 5/5/16. It fell to $6.91 then rose to $7.75. Its now back down to $5.87, but we would have been out for the 10% target.

#Tool – Keshif @keshifme 26s26 seconds ago

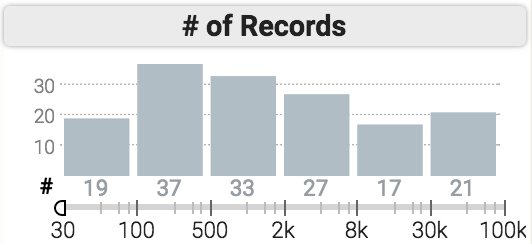

How do you know bins are created on log-scale without even reading numbers? The small ticks | || in between bars

Mystery Man Retweeted Radio Silent @RadioSilentplay

$SPOM .0016 look for the “W”pattern continuation

Write it down: https://twitter.com/scienmag/status/751740188255199232

https://twitter.com/KSSMDPhD

Here is link of and about picture in this link from awards show Stockgumshoe awards Jan/2015. Trying to hide something here is link with article in full– https://www.stockgumshoe.com/2015/01/the-2015-stock-gumshoe-biotechnology-awards-show/#