MAKE YOUR PORTFOLIO GREAT AGAIN !

This thread is a continuation of several threads posted previously by the author on gold and silver and hard asset investments. I am still a believer in hard assets. I also believe we are entering a period of inflation with continued dollar devaluation, higher interest rates, and a sluggish economy with chaotic dislocations. I believe there will be a lot of uncertainty and high volatility.

PURPOSE My intent is to find and discuss good mining and commodity ideas. Gold and silver remain a focus, but I want to achieve a more balanced approach still based on tangible commodities.

STEEL and IRON ORE…I believe Trump’s programs will benefit iron ore and steel. Stocks in this sector have been beaten down terribly but are rebounding. I am long VALE, a Brazilian company which is the world’s largest iron ore producer. I have been long Arcelor Mittal but do not have a position at the moment. Anybody know anything about cement and asphalt ?

COPPER, ZINC, PGM METALS…My very best conviction stock is Ivanhoe Mines IVPAF. I am completely comfortable with a large single position in IVPAF to cover these metals. However other investors may be uncomfortable with a small cap in sub-Saharan Africa. So I think it is beneficial to introduce other names even though I myself am not interested. Rio Tinto, Freeport-McMoran, Teck, Turquoise Hill, BHP and others come to mind. Travis, our host, is long Altius Minerals, and I have been also.

URANIUM…I’m bullish but the choices seem pretty limited. My top three investment-grade choices are Cameco first, then Cameco second, or my third pick would be Cameco. After that, you are speculating on small caps, or buying ETFS or funds comprised of Cameco and some small caps. At the moment, I am long Cameco and UEC.

LITHIUM…I am considering a long position in lithium. I have nothing to recommend at the moment, although I am strongly considering Galaxy, an Australian company. And I like Neometals, also an Australian, but it is difficult to get from my broker, who hates it when I want to buy obscure 50 cent companies on small foreign exchanges. If anybody’s got a great battery play, I am interested.

POTASH/FERTILIZER…very interested but they all seem pretty expensive. There has been consolidation but I have considered Agrium, Mosaic, and there is a German company whose name I forget at the moment (K&D? K&S?).

OIL AND GAS…I would like some very good conviction picks accompanied by strong reasons and decent research. This field is so big, we could get completely lost just tossing names around. I am somewhat worried about price weakness in the energy sector but feel that it is worthwhile to develop a point of view on a few companies. I have little experience although I made very good money in the past on XOM and CVX. Currently I would be interested in pipelines, LNG, or any other sector that someone knows something about. In natgas I like OGZPY.

SOLAR and WIND…really not too interested. The results depend too much on politics, the time frames seem too long. But I am not completely closed-minded on it if you have conviction on something.

COAL…same opinion as solar and wind, but the prices are low and depressed instead of hyped and high-flying. I am still stuck with some defaulted Arch Coal bonds that my financial advisor recommended. They went to ZERO. Now they are worth a Starbucks latte and a pastry. And no espresso shot in the latte, either.

AGRICULTURE…very interested. A large sector but really not too many choices if you rule out futures, like I do. I have a few obscure favorites, but no positions at present:

WHGPY (Chinese pork processor who bought Smithfield)

LAND (Gladstone Land, California farmland)

INCPY (Input Capital, a Canadian canola, streaming model).

Open to more conventional picks like ADM and DBA.

GOLD AND SILVER…my picks have been discussed at length previously. I follow these pretty closely. I am long royalty/streamers SAND, FNV, SLW, and OR; miners PVG, MAG; developers SA, CLASF, MRDCF, BALMF, KNTNF, and LXVMF; and I own PSLV and physical bullion. I swing trade big caps ABX and NEM.

****

DISCLOSURES. I am a retired executive and an amateur investor. I like both fundamental and technical analysis. I am a medium-term to long-term position player and prefer to discuss stock investment in that context. Please no minute-by-minute reports that oil is now 52.50 down 10 cents and the Iranians may suspend Ramadan next week so you are going long until the afternoon bell.

I am not an expert in any of the commodities discussed nor am I qualified to give advice.

Everyone makes mistakes and I make more than my share.Sometimes I change my mind.

When I post, I express my opinions and my positions. These are just that…they are my opinions and my positions. They are not advice or recommendations, which I remind you I am unqualified to make.

Opinions and positions are subject to change at any moment. That is quite unlike the pig-headed and foolish political convictions everybody carries around adamantly, and which change only rarely for unpredictable reasons that have nothing to do with logical thought or reasoned discussion.

Because of this, political developments can be introduced on this thread only when they have a clear bearing on the commodities or companies under discussion.

You are responsible for your decisions, and I am responsible for mine. Caveat emptor.

I would like to operate in a friendly, honest, and constructive atmosphere.

As thread moderator I reserve to myself the role of referee, censor, arbiter, and Grand Poobah, subject to the over-arching authority of Travis, who owns the site and who has on occasion exercised his right to ruthlessly censor and suppress my radical blatherings.

This is a discussion topic or guest posting submitted by a Stock Gumshoe reader. The content has not been edited or reviewed by Stock Gumshoe, and any opinions expressed are those of the author alone.

Gold and Silver and Hard Assets after Trump’s Inauguration…2017

Gold and Silver and Hard Assets after Trump’s Inauguration…2017

Well, my $SWC Stillwater Mining shares have been bought out by S African miner $SBGL Sibanye Gold Ltd at $18 each (bought at $15). (I think I’d rather have got stock in Sibanye, but they didn’t ask me.)

As a strategy others have mentioned, my biotech & mining positions are in the higher risk area of my account. Now I have some cash in hand to use elsewhere – a nice feeling – but the choices are so many, sigh.

Penny

https://ceo.ca/@marketwired/colorado-earns-initial-51-in-ksp-and-allocates-4m

May 11, 2017 12:12 ET

Long C$CXO

https://www.ivanhoemines.com/news/2017/ivanhoe-mines-issues-financial-results-and-review-of-operations-for-the-first-quarter-of-2017/

The hard figures – “The company expects to spend $50 million on further development at the Platreef Project; $26 million at the Kipushi Project; $4 million on regional exploration in the DRC; and $11 million on corporate overheads for the remainder of 2017 – as well as its proportionate funding of the Kamoa-Kakula Project, expected to be $35 million for the remainder of 2017”

Long C$IVN

Ivanhoe net expenditures…seems like a lot but they get 41 million from Zijin as an installment payment on the copper deal. Nothing to worry about, these guy should have it together.

Looks like outrageous good fortune gathering in the wings for $CLASF Colorado Resources. Achieved 51% buyin on SeaBridge Parsnips & headed for potential 80/20 partnership w $SA on what could hold 9 more mineralization hot zones. Am I missing the downside to this deal?Long Colorado

Thanks scotty. Looked like a nice entry point – new long on CLASF with small position.

$CLASF…there will be insane leverage if they find something, market cap is under $20 million

hn knows all about the Seabridge option. Got into this ages ago. Current SP is good buy point IMO. I’m in higher by a bit.

Awaiting to hear from hn on this further. It’s a very big piece if land. To quote hn, it’s like a small country.

Long C$CXO

Colorado – Grand Canyon

Speaking of Colorado (the state) and gold, listen to this from Bix Weir:

https://www.youtube.com/watch?v=xB4_b23dNvE&feature=youtu.be

COLORADO RESOURCES Here is my take. This tiny company has an option on a large and promising Seabridge property. Seabridge gave them the option because Seabridge is intent on developing the KSM property and they do not have the resources to explore it while working on KSM, their #1 project.

By spending money exploring and drilling, Colorado at their sole discretion they can increase their ownership up first to 50% and then to 80%. They have shown in the announcement they intend to do this.

They do not have to do it. Colorado has other places to drill and explore. So we can assume they believe there is something important there, and it should not surprise anyone because the area is full of old mine sites and promising targets and is near Brucejack, and the famous Barrick mine, and the Seabridge KSM property. Heart of the Golden Triangle.

As a value proposition, Colorado is outrageous even as a speculation. The market cap is so small and the potential value is so large it is hard to see how it can miss….granted that they will need money and they might not find anything.

It is a speculation, but one that I like very much. Rick Rule likes it too but you won’t hear from him til he is looking to sell some of his position, which he got very cheap.

Long $CLASF

Colorado…small country in a great spot…near the Pretium Kingdom and the Seabridge

Empire. Fills in the area nicely.

Top 10 Gold And Silver Mining Stock Optionality Plays

Author: Don Durrett…

https://seekingalpha.com/article/4071570-top-10-gold-silver-mining-stock-optionality-plays?app=1&uprof=45&isDirectRoadblock=true

Nothing against Durrett but I believe my picks are superior. We agree on Bear Creek but there are not a lot of stocks In common. Why he excludes Seabridge is beyond me.

Arizona ends income taxation on gold and silver…

https://www.soundmoneydefense.org/news/2017/05/10/arizona-ends-gold-taxation-000152?utm_source=170511-MMX-PN&keycode=170511-MMX-PN&utm_medium=email&utm_campaign=content&AID=3818

They are saying gold and silver are money. What a concept. Firther comment below.

TED BUTLER – A Secret and Illegal Agreement –

Posted on April 27, 2017 by The Doc

He tells it like it is! Excellent article re silver price manipulation.

http://www.silverdoctors.com/silver/silver-news/a-secret-and-illegal-agreement-ted-butler/

NetworkNewsWire – Kipushi – Ivanhoe Mines

Long C$IVN

With Zinc Prices and Global Deficit on the Rise, Savvy Mining Companies are Poised to Profit – Thursday May 11, 2017 by PR Newswire

Increasing global demand countered by a worldwide shortage has made zinc a red-hot commodity, and mining companies are racing to cash-in on the shortage. Companies like Kootenay Zinc Corporation (OTC:KTNNF) (CSE:ZNK.CN) (Kootenay ZincProfile), Nevsun Resources Ltd. (NYSE: NSU), Ivanhoe Mines LTD. (OTC: IVPAF), Teck Resources Limited (NYSE: TECK) and Hudbay Minerals Inc. (NYSE: HBM) are working to address the world’s current zinc shortage and take advantage of the subsequent rise in zinc prices.

The imbalanced market, in part, is fueled by the 2016 shutdown of various zinc mines in China (which is both the world’s biggest zinc producer and its biggest zinc consumer) and the dwindling ore supply of major zinc mines. While zinc prices sagged in 2015, the base metal was a top performer out of the 22 raw materials tracked by the Bloomberg Commodity Index. Goldman Sachs the following year called zinc “the bullish exception in the metals space,” and predicted that a deeper shortage would send zinc prices as high as $2,500 per metric ton in 2017. Zinc outpaced expectations, however, and as of May 2017, the price of the mineral reached $2,628 per metric ton. It’s obvious to see why Jeff Currie, Head of Commodities Research at Goldman Sachs Global, in a Bloomberg interview(1) said zinc is his No. 1 commodities pick for 2017.

So, what does this mean for zinc mining companies throughout the world? It means an opportunity to profit in a huge way, particularly for companies that can find the best zinc deposits with the shortest ramp-up time, or those with the ability to expand their existing zinc reserves.

Among these frontrunners is Kootenay ZincCorporation (OTCQB: KTNNF)(CSE:ZNK),a mineral exploration and development company based in Vancouver, BC. Kootenay Zinc is engaged in discovering large-scale sedimentary-exhalative (SEDEX) zinc deposits and is currently focused on its Sully Property which is located just 18 miles from the historic Sullivan Mine. The Sullivan Mine was in operation for approximately 100 years and was one of the world’s biggest SEDEX silver, zinc and lead deposits, boasting production that, at today’s prices, would be valued at US $49 billion. An exciting factor for Kootenay Zinc is that its Sully Project could be, subject to positive drill data, of similar size to the Legendary Sullivan-an exciting prospect, indeed.

The Sully Project shares geologic features with the Sullivan Mine and the sedimentary rocks hosting the Sullivan Mine are also present at Sully, representing different environments of the same basin. Geological data thus far suggests Kootenay Zinc’s Sully Project share the same stratigraphic level at which the Sullivan Mine was deposited and appears to coincide with the Sully Project’s East gravity anomaly. A subtle lead-zinc soil anomaly may reflect leakage up faults and dispersion through thick till and alluvium from a deposit that is entirely buried, and a Cominco airborne geophysical survey has shown two N-S trending magnetic anomalies underground that are up to nearly 2 miles long (1.86) and about 0.62 of a mile apart at the Sully Project. They are near-coincident with the gravity anomalies.

Drilling at the Sully Project, to date has been a near miss which means a strike could be close at hand. Initial surveying at Sully indicated a shallow mass was only narrowly missed by drilling in 2004, and work performed since that time indicated the target was deep. Downhole temperature and magnetic field readings in 2014 indicated the target may have been missed by as little as 100 meters. Geochemical data shows anomalous zinc and lead in the soil which is possible leakage on structures related to the East mass. New gravity data have confirmed and better defined the mass. The next step for Kootenay Zinc is to target this East mass and the company has commenced a drilling program.

Diverse activities being pursued by Nevsun Resources (NYSE: NSU) also include zinc mining operations, with production coming from its Bisha copper-zinc mine in Eritrea. The Bisha Mine is a high-grade open pit mine with nine years of reserve life, and it generates revenues from both zinc and copper concentrates. In the middle portion of 2016, Nevsun Resources expanded its flotation capacity to produce zinc concentrates in addition to copper concentrates from primary ore.

Nevsun Resources earlier this week named Peter G. Kukielski as its new CEO, effective May 12, replacing the retiring Cliff Davis. According to the press release, Kukielski has more than 30 years of diverse international experience in the mining industry which will support the company’s strategies to advance its projects.

Ivanhoe Mines (OTC: IVPAF) is also chasing zinc and has been at work – modernizing and upgrading its Kipushi Mine located in the Central African Copperbelt in preparation to restart commercial production there. Between 1924 and 1993, the Kipushi Project produced about 60 million tonnes grading 11 percent zinc and 7 percent copper. The company is in the midst of a projected two-year construction period with a relatively fast ramp-up to a projected steady-state production of 530,000 tonnes per year of zinc concentrate. A preliminary economic assessment was conducted in May 2016, and a pre-feasibility study is underway to refine the PEA’s findings and to optimize the redevelopment schedule of the mine. Both the PEA and PFS are focused on the mining of Kipushi’s Big Zinc Deposit which has approximately 10.2 million tonnes of Measured and Indicated Mineral Resources grading 34.9 percent zinc-more than twice the Measured and Indicated Mineral Resources of the world’s next-highest-grade zinc project.

Another company positioned to capitalize on the current world zinc shortage is Teck Resources (NYSE: TECK). Teck is the third-largest producer of mined zinc on earth and operates one of the largest fully integrated zinc and lead smelting and refining facilities in the world. The company produces zinc and zinc alloys in slab and jumbo form and is capable of producing about 295,000 tonnes of refined zinc annually. Teck also produces zinc concentrate from its Red Dog Operations, located in Alaska, and from its Pend Oreille Operations, located in Washington State, marketing its zinc concentrate throughout the world. Additionally, the company’s concentrate team buys concentrate from other mines which are then processed at Teck’s Trail Operations metallurgical complex in British Columbia.

Hudbay Minerals (NYSE: HBM) is also cashing in on the global zinc shortage with output from its 777 Mine and its Lalor Mine. The company operates a zinc plant, located in Flin Flon, Manitoba which produces special high-grade metal from zinc concentrate in three cast shapes. This plant is one of six chief zinc producers in North America and the plant’s capacity is expected to be fully utilized by domestic concentrates produced by the 777 and Lalor mines. In the first quarter of 2017, Hudbay said that higher copper and zinc prices enabled the company to increase growth profit over the previous quarter. Its Manitoba operations produced 30,6000 tonnes of zinc as a result of higher zinc grades at 777 and Lalor, as well as higher zinc recoveries.

The broader portrait is that due to the closure of a number of big mines, zinc had hit a record shortage in 2016, with inventories shrinking to 286,000 metric tons, according to the International Lead and Zinc Study Group(2) . As the deficit continues to widen, zinc is trading at its highest level in more than eight years and is forecast to continue its climb. As the value of zinc continues to increase, investors should take a closer look at the companies racing to advance their projects to meet rising demand.

Editorial Sources:

(1) Bloomberg: http://nnw.fm/IYc53

(2) MetalMiner: http://nnw.fm/Ysa29

For more information on Kootenay Zinc visit: Kootenay Zinc (CSE:ZNK) (OTCQB:KTNNF)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides to users (1) access to our news aggregation and syndication servers, (2) enhanced press release services, and (3) a full array of social communication solutions. As a multifaceted financial news and content distribution company with an extensive team of contributing journalists and writers, NNW is uniquely positioned to best serve private and public companies that desire to reach a wide audience of investors, consumers, journalists and the general public. NNW has an ever-growing distribution network of more than 5,000 key syndication outlets across the country. By cutting through the overload of information in today’s market, NNW brings its clients unparalleled visibility, recognition and brand awareness. NNW is where news, content and information converge.

I have read and reread all that has been posted here and still a little slow-well it is Friday and all. I have several of the miners on that GDJX delete list. Will they soon be taking a major hit in SP and then rebound? Time to sell and then rebuy?? Mining 101 but I’m learning!

Drykoff…sorry I have no opinion on the ETFs

Since I do not follow them, i only scan their component s to find tickers of interest.

$CNRIF Condor Resources…good day for one of my far-out micro caps. Condor Resources is a Peruvian project generator.

They released very good sample results. One of them quoted 10,000 grams per ton AG…the real number is higher and unknown, because the test they used cuts off values over 10,000 grams per ton.

Anyway the samples are from surface… the vein is actually exposed, it’s been tracked for over a kilometer. They can see the width and the vein is just lying there exposed on the surface. Drilling will test the depth of the good stuff. At least we know for sure it is there, it is just a question of how big it is.

They have several good target projects and they are in the the sights of Nolan Watson and company. A great SPECULATION, but one with a lot of questions a lot of important questions already answered.

HN

Another one that I followed you in on. Thanks for sharing all these concepts with us. I hope someday it would be possible to meet.

Dinner and drinks on me…..

Let’s do it. We can brainstorm and organize a conference of the like-minded.

I have a lot of respect for your approach and the ideas you have contributed.

Thanks Nuzzles! Although sp took a 20% loss hit Friday, recovered more than half by closing. I’m up 40%, and pleased. Too bad I hear the overall climate for buyouts isn’t too good right now. Not expected to improve with rising interest rates on the horizon and gold prices slumping. Do you see this one as an exception?

sidenote: are you on twitter?

eemajin – ” Although sp took a 20% loss hit Friday,”

Could I ask, which stock are you referring to ?

Thanks,

Statement by Ted Butler (From David Schectman section in the Miles Franklin free newsletter dated 12May2017):

“While the biggest single change in the composition of the concentrated COMEX short position has been the defection of JP Morgan to becoming net long by virtue of its physical metal accumulation, there are some other more subtle changes, including the complete absence of any economic legitimacy to the current short position. In essence, there are no legitimate shorts on the COMEX, in terms of miners hedging future production or those hedging against existing physical inventory. The big shorts, apart from JP Morgan, appear to be mostly foreign banks according to CFTC data and definitely not miners from the earnings statements from public mining companies. The speculating foreign banks are precisely the type of short sellers most likely to panic when silver prices start to rally and it begins to take hold on them that JP Morgan is no longer the shorts’ protector and short seller of last resort.”

“I have been studying the silver manipulation for more than 30 years — and over that time I have seen it spread to other commodities, certainly to gold, copper, crude oil and just about every market where the technical funds have risen as a potent market force to be manipulated and harvested. But no market has been as manipulated as has COMEX silver, thanks to the level of concentrated short selling compared to real world supplies. The recent selloff has affected many commodities and I do expect a vigorous turn up in gold, copper, crude oil, platinum and other markets once the technical fund selling is complete, but the rally to come in silver should far outdistance any other commodity rally.” — Silver analyst Ted Butler

May 12 article from Ted Butler (“Expecting the Unexpected”), “I am convinced that silver will soon explode in price in a manner of unprecedented proportions, … I mean that the move can commence at any time, but more likely before many weeks or months have gone by

http://silverseek.com/print/16585

Re following silver is leveraged against paper at double gold leverage. I do not understand bitcoin being involved in silver except as ratio to Dollar. Such leverage ratio cannot be covered by silver at any price or infinite,,, so what happens when it all crashes?

http://silverseek.com/commentary/paper-vs-physical-amazing-amount-leverage-silver-market-16597

Silver squeeze will be brutal as mining production has dropped;

http://silverseek.com/commentary/global-silver-mining-industry-productivity-falls-lowest-history-16521

$Sand $mrldf combination…it appears to me that a proxy will be approved, a positive vote on the Mariana side is a pretty sure bet.

If it falls apart, at least we can assume that Sandstorms will recover the price drop from the knee-jerk dilution reaction, and we know that they offered nominally a value of about

$1.38 per share of Mariana. (37 cents cash and a quarter share SAND which was about $1 at the time of offer). Presumably Sandstorm feels the value is higher.

I like both ends And would not be afraid to add either although the short term risk is higher with Mariana because it will drop back to 80 cents if the deal is not completed.

But we now know that a qualified buyer will pay $1.28, give or take.

THe drop in Sandstorm Is silly in my

Opinion because the dilution is adding an asset worth at least the amount offered,

And the debt incurred is quite low from the standpoint of cash outlay.

Marin Katusa sees junior miners at fire sale prices this summer. Says to keep cash ready to buy. Very interesting article:

https://katusaresearch.com/junior-gold-stock-etf-poised-create-fire-sale-opportunity-gold-stocks/

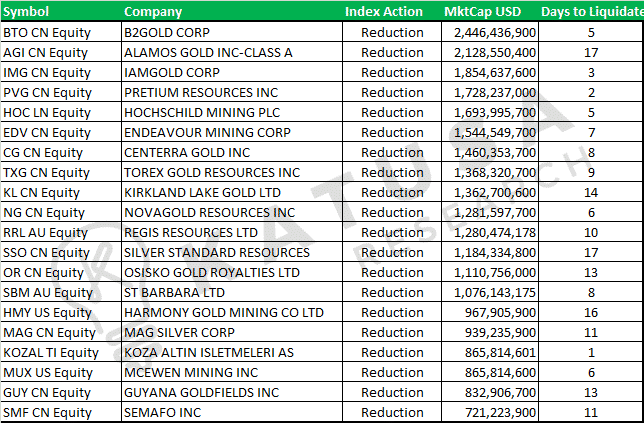

Katusa’s prediction on small cap stock liquidation….interesting and plausible. Don’t have a strong opinion on it. What I think I will do is go over the holdings of the VanEck GDXJ

and zero in on what I think are the best companies, then think about his recommended

course of action.

Marin Katusa’s prediction of small cap gold sell-off in June:

I lost my original recap while editing, here is a synopsis.

****

As I understand the article posted by Leslie, Katusa is predicting a sell-off of junior gold stocks to reconfigure the holdings of the GDXJ towards more mid-tier stocks.

I understand Katusa’s logic, but do not follow it as it relates to the list of stocks cited. 16 of the 20 stocks are already over or near $1 billion in market cap. But there are several other stocks listed in the GDXJ index that are not listed in Katusa’s article that conform more to his scenario.

I have a lot of respect for Katusa but no planned course of action yet based on this article, and I am not qualified to present a case for every stock in the GDXJ, so I will restrict my comments to stocks I hold, and a few others that I am interested in.

My longs:

$PVG Pretium Resources…already a mid-cap at $1.7 billion and the mine is about to announce first production any day. I cannot understand why any public investor would go short at this time, and PVG is already a mid-tier producer and will conform to the new Van Eck guidelines. I just do not believe Van Eck will dump PVG to conform to an arbitrary company profile. The short interest is only 2 days of trading. I am not at all worried about this one unless the first production is a total bust or a comet falls out of the sky and lands on the mill.

$MAG Mag Silver…there is a fairly large 11 day days-to-liquidate short interest. But if MAG suffers a drop in price I would tend to want to accumulate more, or sell puts at lower strikes. Also the market cap is near $1 billion, it is almost out of the micro-cap range. Van Eck must feel pretty strongly about MAG because it is really a silver miner, not a gold miner, but they have elected to take a large position.

$SAND Sandstorm Gold…Not on published list, but a holding of GDXJ. Sandstorm has a small market cap, only about 600 million or 750 million if you add in Mariana Resources. It is already at bargain prices and if it goes lower, I am a buyer. No way I am selling.

$SA Seabridge Gold…another one not on the published list but in the GDXJ. This one gives pause for thought because it has a large short interest of 19%. This also happens to be the self-imposed GDXJ limit on company position size, Katusa notes that GDXJ avoids having a 20% position in any single company. The thought occurs that perhaps Van Eck is planning a reduction, since the market cap of SA is well under $1 billion, and Van Eck can protect their investment with puts.

Will have to think this one over. Why would there be a 19% short interest on what I consider a first-class developer ?

OTHER STOCKS IN THE GDXJ OF INTEREST…no position

KIRKLAND LAKE…over $1 billion market cap but there is a large short position equal to 14 days trading.

NOVAGOLD… Over 1.2 billion MC but only a 6 day short position outstanding.

OSISKO ROYALTIES…this one puzzles me a little. I like it but do not understand why it has a market cap twice the size of Sandstorm. The short position is 13 days. A severe drop in price would make me sit up and take notice, maybe do a little bottom fishing.

SSRI Silver Standard…over $1 billion MC, 17 day short overhang. Could be one of the hedge candidates. Silver Standard is largely a gold company and has ties to Pretium. No interest personally, prefer straight gold or straight silver investments.

MCEWEN…MC is 865 million, but only a six day short overhang. Maybe GDXJ is hedging a little here.

GUYANA GOLDFIELDS…not a prime target of mine, but the company has an $832 million market cap and a large short interest of 13 days. HARMONY gold is similar…under $1 billion MC and a 16 day short overhang.

The largest holdings in Katusa’s list of the GDXJ are B2Gold, Alamos, Iamgold, Hochschild, Endeavor, Centerra, and Torex. I am not so familiar with them but their size is large enough that they would be excluded from Katusa’s list as small-cap players to be liquidated.

Summary: I have no specific plans to act on Katusa’s thesis. The one position I will consider hedging is Seabridge Gold. Severe drops in SAND, MAG, and PVG I would consider as opportunities.

In regards to Katusa’s thesis, Ososko Royalties, Harmony, Guyana Goldfields, and Semafo appear to fit the best, since they have fairly large short positions held against them which might be a result of planned divestitures by Van Eck.

Small cap stocks in the GDXJ that might be of interest to me at bargain prices, after more DD, would be Osisko, Koza Altin, ALIAF, Silvercorp, and Asanko.

I’ve reduced my gold/silver stock holdings somewhat these last few months but this summer I’ll start building up my positions again. I think precious metal prices probably won’t start rising again until late summer or this fall. The Fed is still in tightening mode, inflation is in check, and real rates are still somewhat high. If Marin Katusa’s prediction does come true then early summer will be a good time to get some stocks at a discount.

HN, thanks for the list of stocks you like. I’m trying to build my cash position so I can take advantage of this dip in prices. I also want to add to my CleanTeq holdings as I think this is a great long term play.

From Eric Muschinski Free version of Gold Investment Letter:

” the big GDXJ rebalancing which will happen TODAY starting the last 30 minutes of the session. If possible, you want to be at your screen the last half hour of the session to go shopping or put in “stink bids” on some names of interest in case they get flushed out. It’s possible Van Eck has buyers lined up on some stocks ….” “Most of GDXJ’s orders will hit as “market at close” order, which literally is the last minute, so be aware things could change right at the bell.”

Where a lot of Ivanhoe’s copper will end up…..

World’s biggest building project aims to make China great again

https://www.theguardian.com/world/2017/may/12/chinese-president-belt-and-road-initiative?CMP=Share_AndroidApp_Copy_to_clipboard

C$IVN.

Colorado Resources $CLASF…here is a link to the claim map to the major portion of the BC Golden Triangle. Note the size and relationship of the Colorado claims and options to key Seabridge and Pretium deposits.

http://www.coloradoresources.com/s/KSP.asp?ReportID=725526&_Type=KSP-Property&_Title=Maps-Sections

$CLASF…claim map…additional comments…the Seabridge area of focus is the brown area next to the pink Pretium deposit with Brucejack on the western edge. Altogether this Seabridge holding is called the KSM deposit project. The blue areas to the northwest are the Colorado claims and options on Seabridge properties, the KSP projects.

There are a few other claims, from Skeena, Teuton and Metallis, the Esskay mine of Barrick is alos shown. However for my purposes I feel that I am well covered with Pretium, Seabridge, and Colorado, although Skeena may have an important holding. Esskay is held by Barrick, a big cap; Teuton is private; and I know nothing about Metallis.

The link opens to a page with maps, the map I refer to is the middle map in the top row.

What does one consider an OW or FP? I see the terms referred to quite often. Here is how I interpret FP vs OW. 7% of my portfolio is available for trading. Within that account I consider anything over 10% OW and anything between 5% and 10% a FP. Given that: Way OW $AUPH, $SHOP, $ARTH; FP $ZFGN,$AFMD,$APTO,$ESPR, $BIOC,$AXSM; Way UW Cash.

apologies – Posted in wrong discussion group. Weekend libations getting the better part of me.

$CLASF Colorado Resources…edited copy from this week’s news release:

May 11, 2017

Colorado Earns Initial 51% in KSP and Allocates $4M to Expand Inel Zone and Achieve 80% Ownership

COLORADO RESOURCES LTD. (TSX-V: CXO) announces it has made the final cash payment of $150,000 and completed the initial exploration expenditures of $6,000,000 at KSP; more than 6 months ahead of schedule. This will satisfy its agreement with SnipGold Corp. (a wholly owned subsidiary of Seabridge Gold Inc.) to earn its initial 51% interest in the KSP Property.

Colorado has also completed its detailed review of the 2016 exploration drill results in the context of updated geological, geochemical and geophysical data. As a result the Board has approved a 2017 exploration budget of $4,000,000 to complete approximately 7,500 m of drilling, which is expected to commence in early July. This exploration program is anticipated to satisfy the $4,000,000 in exploration expenditures required to earn an additional 29% (the “29% Additional Interest”), bringing Colorado’s interest to 80% in KSP.

A review of the 2016 geochemical data when referenced to last year’s drill program has shown that there are at least 10 soil geochemical anomalies of similar size and strength in the Inel –Khyber area (see News Release dated December 19, 2016 and Table 1) of which only one was tested by our 2016 drill program to shallow depths of approximately 125 m.

Reviews of geological and geochemical data along with new geophysical Induced Polarization (I.P.) and Magnetic data have recently been completed and are showing some very compelling targets at depth and along strike of our 2016 drilling (see Figures 1 & 2). A three dimensional plot of simplified geology and gold in soil anomalies on surface underlain by the I.P. chargeability model shows the spatial relationships and good correlation between gold intercepts in drilling and the currently interpreted chargeable areas*.

****

If you look at the maps I think you will be impressed with the size and potential of the claim. This company has a tiny market cap under $20 million and has very large holdings in a very promising district. With Pretium, Seabridge, and Colorado you are essentially buying a district. If you look at the location of the Seabridge claims in the KSM (Kerr-Sulpherets-Mitchell) that are southwest of the Colorado KSP project, you will understand why I think a JV between Pretium and Seabridge will eventually come to pass.

Long $PVG, $CLASF, $SA.

$CLASF…correction, the Seabridge KSM district is to the southEAST of the Colorado/Seabridge KSP district.

LONG, but INTERESTING…re PM prices. “The Most Unbelievable Bullish Setup I Have Seen In 45 Years!” PLUS memorandum written in March 1974 regarding US efforts to suppress gold prices.

From David Schectman newsletter:

Here is an essay by Michael Ballenger. His views are similar to Ted Butler’s. This is a must read article…

The Most Unbelievable Bullish Setup I Have Seen In 45 Years!

“At the heart of the unprecedented move higher in the price of silver is the manner in which it will occur. It will be a price move like no other. It will be the greatest short covering rally in history. That’s guaranteed because the COMEX silver short position is the largest and most concentrated short position in history. There is no buying force in the financial markets more powerful than panicky buying by those forced to cover short positions.” … Ted Butler

GO GATA!

What is occurring in the silver market is beyond worth a special MIDAS commentary to put out there in front of so many valued Café members who have been so disappointed with silver’s performance these past many years. And the reason is to emphasize that what is occurring RIGHT NOW in the silver is TRULY historic. Never seen anything like it over the last 45 years of being involved in the futures markets.

Why is that?

*The last time the silver price tanked to $16, the silver open interest dropped to 158,000 contracts. This time it only fell to a little less than 190,000, which is not much below its all-time highs prior to last year.

*The specs did NOT go short the last time JPM raided the market, which is somewhat unusual. Consequently, the JPM crooks felt comfortable stalling out the last silver rally at $18.50 with the most aggressive selling pressure ever seen in that market.

*Recently, and especially in the last three days, the silver open interest has exploded. Meanwhile, the COT report (as of Tuesday) over the last two weeks has revealed a stunning shift showing the commercials (Gold Cartel) covering their shorts while the specs are going more short.

*UNREAL! This is a direct result of the most orchestrated, draining bearish price action (from $18.50 on down), thanks to JP Morgan, as any of us veteran traders have ever seen.

*And, as you know via recent commentary, it has been my theme that this drip selling, day after day after day, was orchestrated to demolish bullish sentiment and encourage the specs to GO SHORT So THEY could cover their own shorts.

*That is just what is happening.

*As you also know, the theme in this commentary of late has made mention of the worst bullish sentiment to come my way in our sector in 18 years. And that is at a time when the bullish fundamentals are as bullish as can be.

Then, just when you think the situation can’t get more bullish, it does. The preliminary silver open interest on Friday rose another 7,462 contracts to 214,229. Yes, the final number will be a bit lower, but still, this leaves the silver open interest only around 20,000 contracts off of its all-time high set recently … and that is with the silver price close to the cost of production in many cases, and below it in other cases.

This is beyond abnormal. The norm is for open interest to soar sharply higher when commodity prices soar too, not on lowly ones … because specs go long as prices take off, while producers lock in profits with future sales. However, the silver price has gotten so convoluted by what the JPM crowd has orchestrated, all the norms have been thrown out the window.

In comparison, the gold open interest only rose 1,636 contracts to 436,108 contracts, leaving it around 230,000 contracts from its all-time high and only around 40,000 contracts from multi-year lows. The contrast between the two is astounding.

So, the net of it all:

*This really is a historic situation, as all the recent technical evidence suggests it is the specs getting mega short down at these lowly price levels.

*We have been waiting for years for the JPM crowd to run of out enough physical silver to keep silver prices down and the manipulation scheme going. We just finally might be there, which is why JPM orchestrated the price lower as they did as part of an exit strategy.

*Yes, JPM shows a lot of silver on their Comex books, but no one knows if is for their own account. And no one really knows if their strategy is different than their cartel colleagues who have made fortunes shorting the market the last six years.

*Perhaps JPM WILL be the cabal member to get long on the coming historic move coming. That remains to be seen.

*What we know for sure is that once the silver price really begins to take off, the spec shorts will cover and go long for the zillionth time. The question then becomes, “who do they buy from, or who sells?”

*IF the jig is finally up, sellers will be few and far between and the upside price action will be violent. This will be mostly true once the $21 price level is breached, as that will signal the game has finally changed for the perennial cabal short sellers.

*This time easily could be different, but it is important to keep in my mind that when silver rose to $50 in 2011, the open interest averaged 133,000 contracts all the way up. JPM let the price go, or was forced to let it go.

*Disappointment has been unending for us silver bulls over the last six years. What appears to be staring us in the face suggests that that perennial disappointment will soon come to an abrupt conclusion in the near future. IF that is the case, the long delayed move higher towards $100 an ounce ought to be one of the most violent ever seen.

Michael Ballanger, whom CP and I had so much fun with at our Monday GATA dinner in Toronto…

The COT Report May 9th

Gold: $1227.80 up $3.80

Silver: $16.46 up $19.5

GTSR: 74.59 (?)

Copper: $2.5137 up $.0064

Zinc: $1.1510 down $.0190

GDXJ: $32.54 up $.45

JNUG: $18.48 up $.83

SRC.V: $.33 down $.02

CDA.V: $.48 down $.02

GI.V: $.035 down $.01

WUC: $1.55 up $.05

“Every stock market bull out there whether in New York or London or Mumbai or Beijing is in a drunken myopia of elevated expectations and deviated denial scrambling and scratching and pleading for assurances that it is truly different this time.”

I will have a more in-depth commentary on the silver situation tomorrow but I am now ALL-IN silver for the first time since 2009 and am leveraged by way of the USLV (3 x’s leveraged silver futures ETF) and by way of my margin account. It took large cajones and ample helpings of Benadryl and Cognac to pull the trigger but pull the trigger I did notwithstanding the fact that I can’t find my car keys and there is a heavily-damaged police car in the driveway.

Now where is that damned dog?

MJB

Do you still have any doubts about gold and silver manipulation? You shouldn’t. Free markets do not operate this way.

How about a “smoking gun” to help validate this viewpoint. Here is one for you…

State Dept. memo explains U.S. policy to drive gold out of financial system

Submitted by cpowell on 02:13PM ET Saturday, May 13, 2017. Section: Daily Dispatches

10:33a ET Saturday, May 13, 2017

Dear Friend of GATA and Gold:

A long memorandum written in March 1974 by a U.S. State Department official for Secretary of State Henry Kissinger and copied to future Federal Reserve Chairman Paul Volcker, then the Treasury Department’s undersecretary for monetary affairs, describes the desire of the United States and its options to prevent European countries from increasing the use of gold in the international financial system.

The memo, titled “Gold and the Monetary System: Potential U.S.-E.C. Conflict,” was recently discovered in the State Department archive by GoldMoney Vice President John Butler and brought to GATA’s attention this week by GoldMoney research chief Alasdair Macleod. It emphasizes the longstanding U.S. government policy of subverting gold as a reserve currency in favor of the Special Drawing Rights issued by the International Monetary Fund, an agency then and now largely controlled by the United States.

The memo’s author, Sidney Weintraub, deputy assistant secretary of state for international finance and development, wrote:

“To encourage and facilitate the eventual demonetization of gold, our position is to keep the present gold price, maintain the present Bretton Woods agreement ban against official gold purchases at above the official price, and encourage the gradual disposition of monetary gold through sales in the private market.

“An alternative route to demonetization could involve a substitution of SDRs for gold with the IMF, with the latter selling the gold gradually on the private market, and allocating the profits on such sales either to the original gold holders or by other agreement.”

Weintraub copied his memo to Volcker just a month before Secretary Kissinger met with his assistant undersecretary of state for economic and business affairs, Thomas O. Enders, to hear a similar argument. Whichever nation or group of nations controls the most gold, Enders explained to Kissinger, can control the currency markets by changing gold’s value periodically. Thus, Enders said, replacing gold as an international reserve with SDRs was in the interest of the United States.

GATA often has called attention to a transcript of Kissinger’s conversation with Enders, which remains in the State Department’s archives:

http://www.gata.org/node/13310

As GATA always pleads, if vainly, none of this stuff is mere “conspiracy theory.” It is extensively documented U.S. government policy based on the most obvious national interest that endures to the present, even if it can’t be discussed in polite company, in financial journalism, or even in the monetary metals mining industry, whose crippling it ensures.

Control of the currency markets long has been and remains the primary mechanism of imperialism.

Weintraub’s memo is posted at the State Department archive here —

https://history.state.gov/historicaldocuments/frus1969- 76v31/d61

— and in PDF format at GATA’s internet site here:

http://www.gata.org/files/WeintraubMemo-03- 06-1974.pdf

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

GATA BE IN IT TO WIN IT!

And there is more on this most-important subject. Read the article by Sprott, titled The Traitors Abetting The Deep State’s Dirty, Dying War on Gold in David’s Favorite Articles section below…

Ed Steer ((When JP Morgan et al are lying in wait, it matters not what the currencies are doing.) (Three year to date charts that show what has been happening) (We are seeing no selling of physical gold or silver) (Central Banks are engaged on a desperate battle on two fronts)

Sprott Money (The Traitors Abetting The Deep State’s Dirty, Dying War on Gold)

Jim Sinclair (The Great Shadow Unwind: Chinese Entrusted Loans Post First Decline In 10 Years)

$GDXJ reconfiguration…the topic was introduced by Leslie7 from an article by Marin Katusa. A more detailed add/delete likely list is available on the link to Tyler Durden’s Zero Hedge site below:

https://twitter.com/TimRunsHisMouth/status/864320973469777920?ref_src=twsrc%5Etfw&ref_url=http%3A%2F%2Fwww.washingtonsblog.com%2F

Katusa’s article stresses the stocks likely to be sold; Durden’s list names the stocks likely to be added.

FYI – Top 5 Lithium Miners To Buy

by Matt Bohlsen @sa

Summary

An update on lithium supply and demand.

My top five lithium miners discussed.

Five other lithium miners to consider.

Note: This article was first published on my SA Marketplace service on March 17, 2017 – so stock prices and stock data listed in the article are as of that date.

https://seekingalpha.com/article/4073613-top-5-lithium-miners-buy?app=1&uprof=46&isDirectRoadblock=true

xpost