While the talking heads in the financial media scream about Netflix and Disney…one billionaire CEO has placed a huge bet to lead the way for the Next Generation of entertainment, and he isn’t stopping anytime soon.

Learn More

Urgent Alert!

________________________________________

Japanese Billionaire’s Prediction Will Give You Goosebumps

He built his $138 billion fortune through a series of bold investments. And now he’s preparing to invest an enormous stake into a new technology that has the world’s other billionaires buzzing…

Learn more

Motley Fool Gives Rare ”Total Conviction” Buy Sign

Over 17 years of guiding investors, Tom and David Gardner have only ever formally agreed on recommending 21 stocks. And when they have, the results have been spectacular. Click below to learn why we want investors to get in on this promising young company before it’s too late.

Learn more

This is a discussion topic or guest posting submitted by a Stock Gumshoe reader. The content has not been edited or reviewed by Stock Gumshoe, and any opinions expressed are those of the author alone.

motley fool 46-Year-Old CEO Bets $44.2 Billion on One Stock

motley fool 46-Year-Old CEO Bets $44.2 Billion on One Stock

So what is the stock and the new technology, pray tell, Gumshoers…..

What theanseer here?

The “Japanese billionaire” can only refer to Son Masayoshi.

His biggest investments are listed here: https://www.recode.net/2018/2/5/16974032/this-is-where-chart-softbank-vision-fund-masayoshi-son-venture-capital

Most of those companies are not publicly traded. The exceptions (please tell me if I’m wrong) are NVIDIA (NVDA) and ZhongAn, an insurer.

So it could be NVDA. NVDA is just the type of company that The Motley Fool can get excited about. On the other hand, NVDA has been around for such a long time, and it’s not clear to me why you would have to associate it specifically with Son Masayoshi…

Any opinions?

Son bought ARM, a British microchip company and took it private. NVDA provides its products to ARM. This is all I found.

Interesting.

lobbyTV (https://lobbyTV.co) is betting on AI assisted TV delivery with complete personalization.

Whatever it is, it’s a streaming platform that also incorporates social networking, gaming etc. I just wish I could find out what it is without paying for it…lol

Tencent

Great!…um, which one? There are two “Tencent”s …

The parent, this was teased before the IPO of Tencent Music. TCEHY and TCTZF are both tickers used for shares of Tencent on US exchanges, TCEHY is the ADR and TCTZF is a second OTC ticker designating a “foreign” stock.

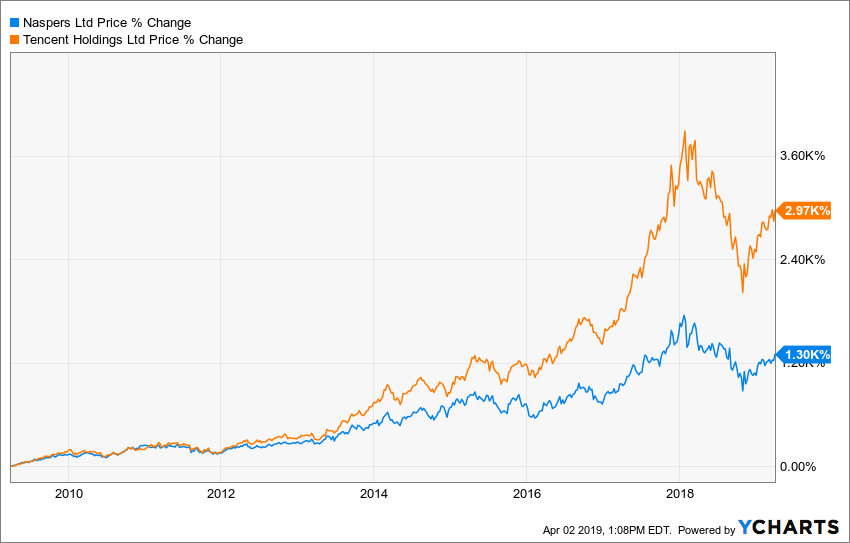

When buying OTC tickers for overseas stocks, I always suggest buying the most liquid one — that’s likely to provide the fairest price and the best chance of selling if you ever need to sell in a hurry. TCEHY is far more liquid than TCTZF. I don’t own either and don’t know where Tencent is going in the near term, but if I wanted to buy Tencent directly I’d buy TCEHY. If I wanted discounted exposure to Tencent (with some additional risk and reward), I’d buy shares of Naspers (NPSNY), which is Tencent’s largest shareholder (I owned Naspers for a while, but stopped out this year).

With NASPERS moving out of the So. African exchange over to Europe do you see this as an opportunity for NASPERS growth and investors profit?

Yes, I expect it will probably help to finally close the discount to Tencent… though the fundamental driver will still be Tencent, so if that declines all bets are off. Long Naspers (NPSNY) with a partial hedge of going short Tencent (TCEHY) has some logical appeal, though I haven’t looked at the numbers.

The discount took a few years to build, it probably won’t disappear overnight, but I think it should shrink. Here’s the 10-year comparison of the two:

And the one year, indicating that there has been a slight change as Naspers has outperformed a little but, but no big change in the size of the discount has taken hold yet:

Any follow up on this? Motley Fool has a new ad out “world’s smartest billionaire all in on this one stock”