Turn down the football game and bring out the pies, it’s that time again!

Stock Gumshoe is mostly closed down for the holiday week, but we do have to continue our annual tradition of calling out our “Turkey of the Year” … so take a pause from arguing with your family and join us, won’t you?

What is this tradition, you ask?

Every year, as American families gather to give thanks, and perhaps to remind themselves of why they don’t gather more often, we take a moment to point out one of the truly dreadful stock picks that was teased by the newsletter promoters in the past twelve months.

It’s not a particularly scientific process — we usually have a good number of stocks to choose from that are down 70-90% or more from when they were touted, even during good “bull market” years, so we have to pick one from among a bunch of stinkers.

What makes a turkey stand out? Mostly, it’s the mismatch between promise and reality… or, sometimes, the surprising nature of the collapse. If you’re dealing with a one-drug biotech stock about to hit a big FDA decision date, you should be going into that knowing that the “thumbs down” could lead to a 90% collapse, that’s why those stocks have the potential to gain 500% when things go the other way… risk and reward are inexorably linked, but often those collapses are a genuine shock.

So the Turkey of the Year is ideally a stock that performed terribly, defying some wild optimism from the promotion. Sadly, that also doesn’t usually narrow it down to a single winner… so we have to go with the unscientific poll of one: I get to decide. Don’t worry, you’ll have your chance to argue for your own turkey in a moment.

Last year’s winner was the pick of Indivior (INDV.L, INVVY) from Chris Mayer, whose newsletter stopped publication not that long after (he’s still around and still writes an interesting blog, but as a money manager instead of a newsletter flack)… and that one serves as a reminder that turkeys don’t often learn to soar like eagles — as has happened many times with past Turkey of the Year winners, Indivior has lost another 2/3 of its value since winning the honor (thanks mostly to a fraud allegation and massive fine from the DOJ).

Who, then, are the candidates this time around? Who will win the 12th annual Turkey of the Year? To date, 2019 has been worse than average, we are still seeing the typical 1:2 ratio of winners to losers, almost every year it turns out that about one third of the teaser picks beat the S&P 500, but the overall performance looks a bit worse than usual because we don’t have a few huge winners skewing things to the upside (no 100% gains at this point in 2019, which is odd for a year when the market did well), and we have an unusually fruitful crop of stocks that are down more than 80%.

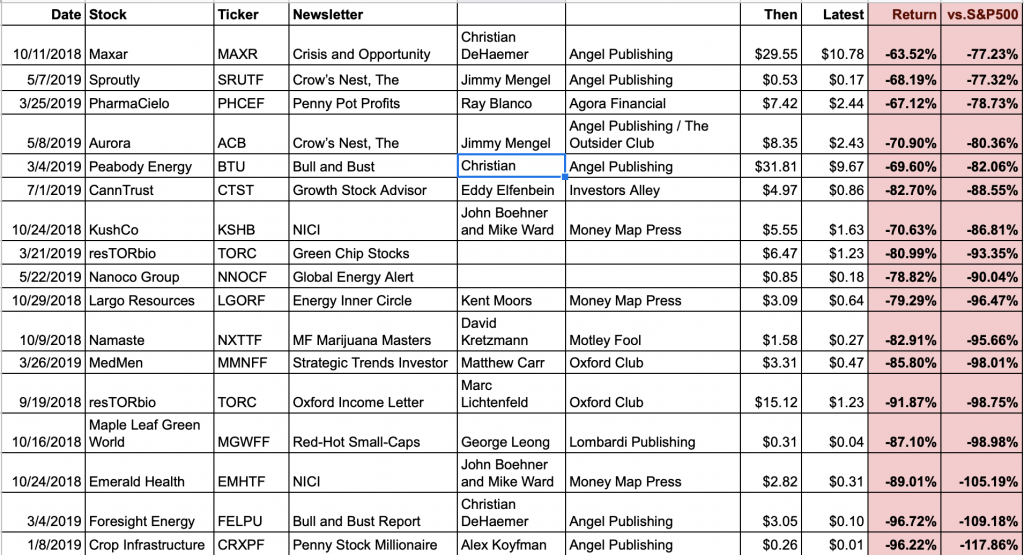

Most of the possibilities are in the beleaguered marijuana or mining sectors, perhaps because there weren’t many junior oil stocks teased this year, and, of course, there’s also at least one biotech. Here’s the list of the worst-performing teaser picks from the past year or so, the ones that have lost more than 75% relative to the S&P 500 (numbers from Tuesday):

Angel Publishing leads the way this year, with about a third of that list from its newsletters… next is Money Map Press, thanks largely to their “National Institute of Cannabis Investors,” but there’s plenty of infamy to spread around among the various stock touters for this year, Angel mostly stands out just because they don’t have a single teaser pick in the green for 2019 (though, to be fair, they do have a couple late-2018 teases that have done very well in Ballard Power (BLDP) and Aerojet RocketDyne (AJRD)).

So… before we name our winner, do any of these possible turkeys have lessons to teach us?

Christian DeHaemer’s pick of Maxar (MAXR) for its satellite business (63% loss) might be a “don’t catch a falling knife” lesson, since it had gotten clobbered even before he picked it, though it did also recover some after it bottomed out a few months later in January, and his repeated pick of Peabody Energy (BTU) a few times over the past year as a “coal contract” income play (72% loss) might be a lesson about the dangers of chasing dividends in declining businesses… and one of the other coal dividend stocks he teased in those same ads, Foresight Energy (FELP, now FELPU) has done even worse, losing about 90%.

Chasing a bad commodity trend is a lesson others can teach us, too — if we go back into the later months of 2018, where picks are also eligible for the Turkey treatment, we see Kent Moors popping up his head with his pick of Vanadium miner Largo Resources (LGO.TO, LGORF), down almost 80% (and also, sadly, in my portfolio).

The “betting on a continuation of a bubble” ideas almost always lead our tracking spreadsheets at both the top and the bottom, as well — so a year ago the marijuana picks would have been plentiful at the top of our list of best performers, and this year they’re about half of the Turkey candidates.

And this year, as happens from time to time, there’s also a duplicate on the list — resTORbio (TORC) was touted by Oxford Club’s Marc Lichtenfeld back in September of 2018 as having 4,000% potential thanks to its “fountain of youth” drug, and then again was pitched half a dozen different times by Jeff Siegel’s Green Chip Stocks starting in March, with his “Day Zero” pitch about the news coming from them that would make for “the most profitable day in the history of mankind.”

And that came pretty close to being the final winner, frankly, partly because Siegel was so relentless in promoting this “Day Zero” silliness even when the company didn’t have any meaningful “catalyst” news expected until at least the first quarter. Surprising everyone (except perhaps Siegel), that meaningful news appeared early — but instead of it being positive (it never had a chance of being “most profitable day ever” positive, but it could have been good if there was early success in their clinical trial), the news took the form of a cancellation of their most advanced drug trials because of “failure to meet endpoints.” The Phase 3 trial results we were expecting to roll in sometime in the first quarter were instead announced a couple weeks ago, with the news that the placebo actually did better at preventing respiratory illness than their RTB101 drug and the trials had therefore been halted for that indication, causing the stock to drop about 85%.

But in the end, on my judgement call, TORC ends up a whisker behind the winner in second place… because I couldn’t resist the perfection of the almost-as-frequently-teased winner that had been touted for much of the year as a “perfect $1 stock” and is now at a penny.

It’s hard to single out one particular pot-related turkey that was worse than any of the others, but that’s where we find our Turkey of the Year for 2019 — Alex Kofyman’s teased recommendation Crop Infrastructure (CROP.CX, CRXPF).

Crop Infrastructure was pitched originally as the “McDonald’s of Cannabis” because of the fact that it was trying to build a business based on marijuana real estate — owning property and equipment, leasing it out to operators and joint venture partners, and getting repaid from the profits.

"reveal" emails? If not,

just click here...

And this is a case where the business plan sounds compelling and it seems like a great idea, until the actual business tries to operate. So let that be a lesson to us, buying a business plan is different from buying a business — as Mike Tyson so famously said about the strategy of one of his boxing opponents, “everyone has a plan until they get punched in the mouth.”

Crop Infrastructure’s punches in the mouth may not have been Tyson-worthy, but they have come pretty hard and fast of late — the specifics of their leases and joint venture deals never seemed very compelling beyond the headlines, but it was when they got into actual operations that everything seemed to unravel and the daylight shone through enough to let investors realize just how un-interesting those deals were — with the final bell tolling when they looked to rescue themselves by selling off their most valuable asset this past summer, their hemp farm in Nevada and associated licenses, for $24 million… only to find that the crop was so infested by weeds and ravaged by antelopes that the buyer lost interest. You can’t make this stuff up… farming, it turns out, is hard, even if you’re growing what you think of as a golden fleece.

That disaster in Nevada led to Crop realizing that they couldn’t make it on their own any longer, they didn’t have the capital to invest in their joint ventures or repay their debts, so they turned to a partner — and the news now is that they have agreed to be acquired by MYM Nutraceuticals (MYM.CX, MYMMF) in an all-stock deal (CROP shareholders each get 0.0952 MYM shares). That deal isn’t closed yet and could fall apart, I imagine, but if it goes through and MYM is still valued at about C$0.16 at the close, that would mean each Crop Infrastructure share is worth about 1.1 cents (in US$). And it’s hard to imagine Crop shareholders sticking around, since MYM itself isn’t exactly in great shape either — I haven’t dug into their business at all, but it looks like MYM is just a little $15 million company burning through cash, not unlike lots of other marijuana hopefuls. It kind of looks like Crop is being rescued from a shipwreck by a leaking rowboat… with no sign of land on the horizon.

Sorry, that got darker than I intended — speculative manias always solve themselves, but we usually need only to look in the mirror to find the real turkeys. Marijuana is obviously an ugly sector for pretty much everyone these days, as hindsight tells us quite clearly that the business plans have run full-speed into the reality that the legal pot business is not going to be immediately as big or as profitable as everyone expected, and everyone who dreamed about riches from pot stocks is part of the reason that they soared to such bubblicious valuations… and created so many turkeys for us to consider this year.

Crop Infrastructure happened to be the absolute worst performer that we covered over the past year, which is really why it gets the edge over TORC, and it stuck in my mind because we had to cover it so many times as the promotion push was relentless, but with another move of a few pennies either way we could be talking instead about MedMen or KushCo or Emerald Heath or any of dozens of others. That’s the bargain with speculative penny stocks, you go in swinging for the fences and hoping for 1,000% gains, and you know (or you should know) that the probabilities are much higher that you’ll be saddled with a 100% loss.

So in the final reckoning, I decree that the Turkey of the Year for 2019 is Crop Infrastructure (CROP.CX, CRXPF), which also just happens to be the worst-performing stock on our tracking spreadsheets over the past year or so. And if you want an honorary mention or second place finisher, well, look no further than the biotech hopeful resTORbio (TORC).

The good news? If you bet on Crop Infrastructure and kept your position at just one or two percent of your portfolio… your portfolio is only down one or two percent. And it was a pretty good year, so if you put 99% of your portfolio in the S&P 500 and 1% into Crop Infrastructure when Kofyman first pitched the stock in January, you could have still turned $10,000 into $12,056… not quite as good as the $12,174 you would have had if you just put it all into the broad market, but diversification can indeed provide some comfort even if you wager a little on what turns out to be a real stinker.

Foresight Energy, Crop Infrastructure and Emerald Health, just as a point of interest, are the only three stocks in the past year whose performance has been worse than -100% versus the S&P 500 — meaning that although the stock was bad, with a 96% loss in Crop’s case, that’s exacerbated by the fact that the market did pretty well during that period… this basically incorporates the idea of “opportunity cost” in stock picking, so if the choice was between buying that stock and buying the S&P 500, you’ve lost more than just 96% of the money you invested… you lost 114% of the money you would have had if you had just “bought the market” instead.

A few caveats:

- We’re just working from ads and promotions — we don’t know what the specific advice was from any of these newsletters. Maybe they doubled down on the stock when it dropped, maybe they stopped out or changed their minds the day after we covered the tease (sometimes newsletters have even sold a stock before they tease it to recruit new subscribers), we don’t subscribe so we don’t know. We set our tracking to just assume that you bought the stock on the day the newsletter teased it and held it forever.

- And as a corollary to that, this is not necessarily a reflection on the newsletter pundit who promoted the Turkey — yes, we should use this moment to remind ourselves that the marketing pablum skews our perception and has to be actively ignored, but sometimes the newsletter editors don’t even really have much to do with the teaser pitches their publisher uses in their name… and the overall performance of a newsletter’s portfolio is presumably often different from the performance of their most actively touted “teaser” stocks.

- I am far from perfect, of course. I make dumb decisions and choose bad investments sometimes, too (though I at least don’t promise anyone they’ll get 5,000% gains by following my ideas), and this is not meant as a criticism of those particular newsletters — I think of the annual Turkey Award as being a bit more light-hearted than that, since we all do dumb things sometimes, but also as a reminder. Sometimes it’s just important to remind ourselves that these promises of grandiose gains are marketing gibberish, and the best way to do that is by looking at a stock that seemed so enticing when it was promoted as a life-changing company a few months ago, and now looks, without that glare of heated marketing hype, like the boring old also-ran that it probably was all along, if we had had the patience to think it through.

And, of course, I need to be fair and look in the mirror at the same time that I call out these turkeys… I always have a few stinkers in my portfolio to comment on as well.

In recent years that has mostly been a few commodity-related stocks that I’ve held on to stubbornly despite hitting stop losses, so I can also remind you that being stubborn is a risk and creates a real opportunity cost if you stick with stocks that persistently decline, something that happens quite a bit in high-risk sectors or in commodity industries… particularly if you’re wrong about the demand or pricing trend in the marketplace.

So you can take your pick from my three “persistent stinker” positions that still linger in the Real Money Portfolio, Clean TeQ and Largo Resources and U.S. Gold Corp… but I’ll call my personal turkey Clean TeQ Holdings, since that was the largest position of the three for me and, at the moment, is down the most. My overall portfolio return would be at least 0.5% higher if I had sold each of those at a stop loss to preserve more of the capital.

Lesson for me? Well, for Largo I think it’s mostly just “China trade war bad,” really, since their customers are primarily steelmakers, and I’m still pretty stubborn about their unique situation in vanadium (I know, stubborn is bad, I didn’t say I learned all these lessons)… but for the other two I’m going to conclude that it’s “don’t let a non-cash-flowing company pass a stop loss”… the possible outcomes when a company doesn’t have any revenue coming in, including the likely need for raising more capital, really push toward a high probability of negative returns if the stock gets into a downtrend.

That’s mostly an issue for very young companies or for commodity or biotech stocks, since those are the sectors where you’re likely to have a company without any real sales (Largo, to be fair, has real production and real sales and has sometimes been profitable, Clean TeQ and US Gold do not), but it’s worth remembering. If your hope for a company relies solely on a future that, if you’re being honest, you were more certain of than you should have been… let that stop loss preserve some of your capital, wash the ugly red line out of your portfolio, and free your mind and your money to go hunting for the next great idea.

And the worst part? Clean TeQ was also my personal “turkey” last year, and it has lost another 50% or so since then. Like I said, sometimes I don’t learn the lesson… but maybe you will. And perhaps there’s hope for me still.

So let me close by wishing my US readers a wonderful Thanksgiving holiday, I hope you spend it with friends or family and have many thanks to give this year. I’m thankful for you, dear reader, for sharing a little bit of your time with me this year… and I’ll be back to impose on you again on Monday, so you might also give thanks for a brief respite from my blatherations. Happy Thanksgiving!

P.S. Yes, I know that you probably have a personal “Turkey” for 2019… and I’d be delighted to hear it, so far I got a list from a reader that suggested Bayer (BAYRY), Chesapeake Energy (CHK), the now-in-bankruptcy Dean Foods (DFODQ), Pharma disaster Mallinckrodt (MNK), McDermott International (MDR), Occidental Petroleum (OXY) and bankrupt Weatherford International (WFTIQ) and in the oil patch, and past highflier (and teaser stock) Velocys (OXFCF)… but I’m sure there are others that might be stuck in your craw, just drop your nominations in the little comment box below. Maybe we’ll learn something from your experience, and acknowledging a turkey of a stock pick that you lost money on can give you the strength to erase it from your portfolio to ease your mind, letting us all move on fresh with grand ideas for 2020.

P.P.S. And in case you’re wondering, here are the past “winners” — Potash North (Andrew Mickey, 2008); Raser Technologies (Oxford Club and others, 2009); SuperMedia (Hilary Kramer, 2010); Tengion (2011, Steve Christ); GasFrac (2012, multiple publishers); HRT Participacoes (2013, Byron King); Solazyme (2014, Motley Fool and Jimmy Mengel); CT Partners (2015, Louis Navellier); SunEdison (2016, Dr. Kent Moors); AquaMetals (2017, Cabot Small-Cap Confidential)… most of those newsletters and editors are still around, but we can’t say the same about most of the Turkeys.

Disclosure: Of the stocks mentioned above I have long positions (shares or call options) in Occidental Petroleum, Largo Resources, Clean TeQ, KushCo and U.S. Gold Corp. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

HAPPY TURKEY DAY ALL! I’m afraid to ask, BUT HERE GOES BEING A BIG GIRL! I have HEXO,AUXLEY,CRONOS…………..please break it to me gently…….. 🙂 Your input very appreciated.

It comes down to this legal growers have a hard time competing with black market/illegal due to all the regulations and taxes. California has received about half of the tax revenue they thought they were going to get. So their answer raise the taxes on marijuana even higher.

My biggest turkey, percentage wise, is Virgin Galactic (SPCE) down 24.54% since I bought it. This is one of my ‘lottery’ stocks. Either it pays off big at some point or I lose it all.

Another great article Travis! I have a lot to be thankful for this Thanksgiving. I really didn’t have a personal turkey this year. Thanks in part to the Gumshoe articles. As of this morning my account is up 94% YTD. And that’s with mostly options. I did buy, and still own, 15 contracts of the MDR Jan, $1.50 Calls. This will be a loser! But it’s really not much money. As far Crop Infrastructure, I don’t like any of the pot stocks. I won’t bore you with my stock buying criteria but they just don’t fit into it. Fist of all, pot is not legal all over the country. That’s enough for me to stay away. I know OXY is a good candidate for “turkey” of the year but I think it’s time to get in. I’ll probably buy some LEAPS this week. Because of my great year I might lay low for December and start fresh in January. Last December hurt my 2018 results. I’ll be using your site to help me plan my January. Thanks again for all your investigative work.

You can pretty much pick any marijuana stock and put the whole industry in that category

Yes I bought cgc and loosing value and bought acreage holdings as well all downside

Amen to what others have said about the pot industry laying eggs, and all of them turning into turkeys. All 8 of my Canadian pot stocks have gone the turkey route, led by the Major Domo Turkey, Aurora Cannibis. So many of us bought that in the $6 to $8 range or so and last I dared take a peek it was about $2.50. This dollar coaster ride has taken me from $5K up to $4K in the red, so like the limbo, how low can you go? Where are all those potheads when we need them?

There had to be a clue in the nickname “weed”. It grows like one and the business is populated with experienced people who were in it when it was illegal. Very little chance of establishing barriers to entry which would enable a company to make high profits.

Virgin Galactic – a “space” company. There is a lot of space, most of it empty, and unsaleable to a mass market. Another one where the clues were given.

So with regard to your – excellent – choice for Turkey of the Year $EMHTF … not even made better with an after-holiday Moistener and cranberry sauce … think it’s definitely a sell for tax loss – if in a taxable account – or is it worth holding on to? Anyone think this has a chance of recovery/a viable business and, if so, why? Thanks and Good Holidays to all! ADBL