This article was originally published on June 5, 2023, when Eric Fry’s ads started rolling — he has a new push out with this same “Project Omega” theme now, with the headline about the “final phase” — here’s how he puts it:

“On August 23, a shocking turn of events will trigger a $3 trillion AI panic in the market. Act now before the panic starts.”

Presumably that’s a reference to the next NVIDIA (NVDA) conference call, since it was NVDA’s last quarterly report that poured gasoline on the stock market’s AI mania… and yes, NVIDIA will report their next quarter on August 23, after the market close (it’s their second quarter of the 2024 fiscal year, just FYI, they use an odd fiscal calendar).

Will that change the story? Maybe. It will probably be the most closely-watched earnings report this year, so lots of people will be interpreting every word that Jensen Huang utters, and they’ll have to do another big “beat and raise” to keep the AI mania burning, so we should at least expect volatility in all the AI-related stocks next week — and NVDA’s market cap could gain or lose $250 billion in five minutes next Wednesday evening, we just don’t know which.

But anyway, we don’t know what Fry will say in his August 16 “presentation”, since it hasn’t happened yet… but it will probably be quite similar to what he said in early June. What follows is what we wrote in reaction to his first “Project Omega” teaser pitch:

Published June 5, 2023, has not been updated or revised:

Everyone is fully aboard the Artificial Intelligence bandwagon these days, and every newsletter is trying to tantalize us with the idea that they’ve got the next great picks for AI… the one that’s getting our readers’ attention this week is Eric Fry’s pitch for his Fry’s Investment Report ($49 first year, renews at $199/yr).

This is how the ad gets started:

“America’s Top Trader – who predicted the dot.com bust, the rise of bitcoin and last year’s tech wreck exposes…

“Elon Musk’s ‘Project Omega’

“It could soon mint new millionaires, while plunging millions of unprepared Americans into poverty. Take these 3 steps to prepare….

“In Downtown San Fransisco a few years ago, Elon Musk and a couple of other billionaires launched what I’m calling ‘Project Omega’…

“A project that’s soon guaranteed to affect every aspect of your life.”

So that’s just a reference to OpenAI, the company behind the wildly popular breakthrough generative AI product called ChatGPT (Elon Musk was an initial funder of OpenAI, and was on the board for a few years, though is not involved with them now and has said separating from OpenAI was a blunder).

And he laces the ad with both fear and greed for us…

“I believe ‘Project Omega’ will turn the growing wealth gap in America…

“Into a black hole so large that if you’re on the wrong side…

“You’ll never be able to catch up.

“But if you take the 3 steps I’m going to cover here today…

“You could end up on the winning side of this $15.7 trillion economic shift….

“You’ll Have to Jump Onboard, or You’ll be Left Behind…”

The basic comparison is to the internet revolution in the 1990s, when companies who embraced the internet thrived and those that didn’t got left behind — including the often-covered saga of Netflix disrupting Blockbuster. And he calls the release of ChatGPT late last year the “Netscape Moment” for AI…

"reveal" emails? If not,

just click here...

“You see, before Netscape’s browser…

“The internet was mainly used by hardcore techies and researchers…

“People who had devoted hundreds of hours to understanding the web and all its complexities.

“Netscape changed all that.

“Its user-friendly interface…

“Ease of navigation…

“And ability to view web pages with multimedia content…

“Made it extremely easy for regular people to use the internet.

“As a result, it paved the way for its widespread adoption.

“The launch of ChatGPT is doing something similar with artificial intelligence….

“AI is now going mainstream just like the internet did in 1995.”

And we all know what happened to the internet stocks from 1995 to 2000, so Eric Fry throws in a few charts about that, showing the incredible rise of previously unknown companies like Qualcomm (QCOM) and Cisco Systems (CSCO), with 50-100X gains if you happened to hold for those five years and get out near the top. Those charts don’t extend into 2001 and 2002, incidentally, which is when many of those stocks lost 90% of their value… just a little reminder that bubbles eventually pop, even if we can’t usually predict when (or resist the temptation to try to ride them to the top).

Fry does think this bubble is inflating faster than the tech bubble of the 1990s, in part because the adoption of ChatGPT has been so much faster than past technologies like Facebook or Netflix (“ChatGPT is already being adopted 42 times faster than the internet”), so maybe that means we’ll peak faster, too? I certainly don’t know, though it does feel like the world moves a lot faster now than it did 25 years ago.

So, what should we do to get rich here? Well, after the “fear” bit, which is essentially the fact that AI is going to come for all of our jobs, and lead to mass layoffs in white collar jobs that mimic the layoffs that automation and factory robotics brought to the blue collar world, which will lead to even more income inequality and perhaps the adoption of a Universal Basic Income policy, he also says that “the few who take advantage of this revolution could come out of this shift wealthier than ever.”

Basically, then, it’s an argument that inequality will get worse… but you can buy the right stuff now to be on the happy side of the “unequal” distribution of wealth.

And that’s certainly been the case so far this year, any stock that investors can reasonably connect to AI has been soaring, which you’ve no doubt already noticed (NVIDIA, C3.ai, etc.)… but they’ve already come so far, so fast, what does Eric Fry think we should actually buy at this point?

He does finally get there, and he begins to hint about the specific recommendations he’s making, so let’s see what we can ID for you…

We get very limited clues about the three stocks in his “The Top 3 Stocks for the AI Revolution…” report, but this is what he dangles as bait:

“Step #1: Buy Shares of These 3 AI Dominators….

“AI is now going mainstream, just like the internet did in 1995.

“That means you have another shot at those kinds of explosive gains.

“I’ve already identified 3 companies that I believe will be the biggest winners of this AI revolution.

“And I put all the details inside a special report called The Top 3 Stocks for the AI Revolution….

“One of these companies I’m recommending recently started using AI to predict the onset of diseases…

“Allowing doctors to address health problems before they even occur.

“Another company I’m recommending is building the infrastructure that AI is built on.

“Investing in it could be like investing in steel during the construction of railroads.

“You’ll also learn about a company that I believe will help take AI robots mainstream.”

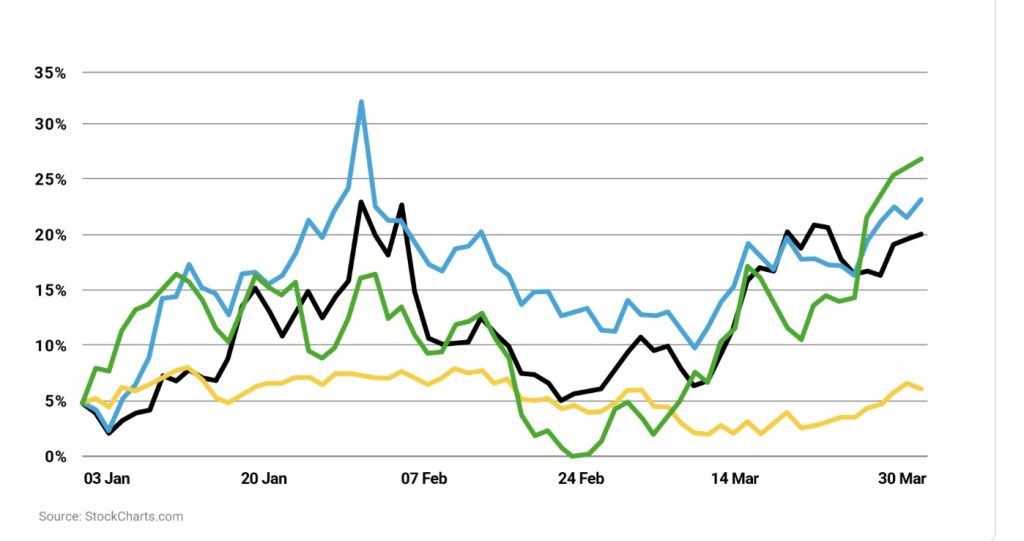

And that’s it… though thankfully, we do get a little chart of those three stocks, which as of the end of March were all beating the market (the S&P 500 is that yellow line), so we can use that to confirm any possible matches.

And what does the Thinkolator say?

The black line? That’s Alphabet (GOOG, GOOGL).

And they could probably match any of those clues, actually — they bought DeepMind about a decade ago, and that’s been used over the years to fuel the work of their Verily health subsidiary to predict kidney disease from a patient’s health records, and heart disease from the results of eye scans. Among other things.

Nobody really knows, but my guess would be that Alphabet has probably spent more on AI R&D than anyone else over the past 20 years, and artificial intelligence has played a growing role in their core products (search, ads) forever, though the perception earlier this year was that they were falling behind Microsoft and OpenAI in generative AI because of the Bing/ChatGPT partnership that looked a lot more polised than Google’s hastily released Bard product.

They are also building a lot of the infrastructure for AI, with their Tensor chips available on Google Cloud, and, though they’ve shelved a lot of their robotics “other bets” over the years, they’re certainly still active in robotics in general… including the large Waymo autonomous driving division. I’d guess Fry’s reference is to their disease prediction work, but that’s just a guess.

The green one, believe it or not, is Intel (INTC)… which I guess would have to be Fry’s “building the infrastructure that AI is built on” company, just by process of elimination. Yes, they are investing heavily into foundries to expand their chip production, they’re trying like mad to catch up with Taiwan Semiconductor (TSM) so they can take on more of the work of building the most advanced chips (NVIDIA did mention that they’d be willing to contract with Intel, eventually).

And they’re not at all a market darling, as you’ve probably heard, since revenue has dropped pretty dramatically after many years of somewhat tepid but steady growth. Many people perceive Intel to be so far behind leaders like Samsung and Taiwan Semiconductor that they’ll never catch up… but maybe they will, particularly as they benefit from the huge push to “reshore” semiconductor manufacturing back to the US. If they can get back to their past levels of profitability, and begin to compete better for the data center acceleration and AI processing business that NVIDIA so quickly grew to dominate in recent years, the stock is probably too cheap… but that’s a big “if,” investors often bought Intel over the past decade because although the growth was slow, they were at least very profitable and paid a nice dividend. Today, they’re not profitable as they race to invest in growing the business again (or rescuing the business, if you’re a bit more cynical), and they slashed the dividend. The share price is back to the range it mostly traded in from 2003 to 2013 or so, well off the highs of the 2000 dot-com boom and the 2019-2021 “everyone wants more servers and laptops” boom.

So what’s the third one, that blue line? Well, it won’t surprise you to hear that this is yet another tech giant — that’s Amazon (AMZN), so presumably Fry is slotting them in as the “company that I believe will help take AI robots mainstream.”

I don’t disagree that the tech giants are likely to be the double-dip winner here — they won the internet explosion, they won the work from home surge in e-commerce and cloud usage, and they will probably win the AI race, too… nobody is going to be able to outspend Google and Microsoft and Amazon, nor will they have access to the decades of valuable data that feed the AI work those companies are doing. I own Alphabet and Amazon, personally, and I think AI is a bigger opportunity for them than it is a risk… but we’ll see.

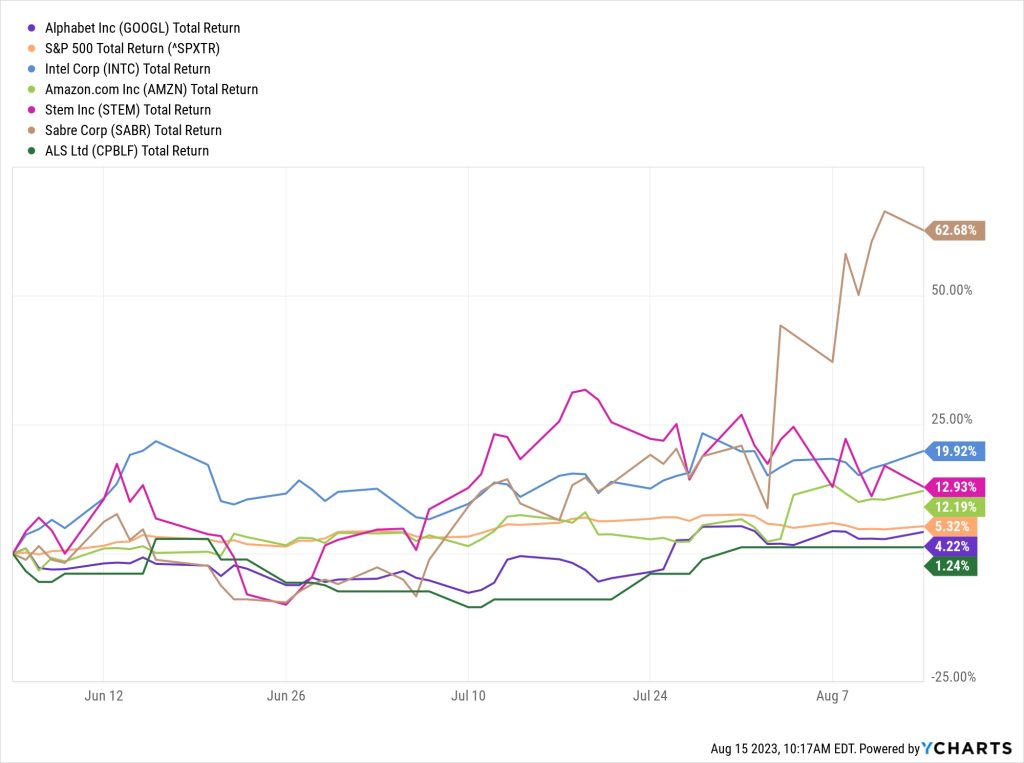

The chart that Fry uses in his tease cuts off at the beginning of April, which is when all three companies were up in the 15-25% neighborhood for the year to date — since then, as you see here, Alphabet and Amazon have kept soaring, largely because they’ve shaken off the brief panic earlier in the year that they might be “AI losers,” and Intel has been a bit weaker:

That’s not all, though… Fry also teases some “moonshot” ideas for AI

“If you missed those massive gains in internet stocks…

“You now have a second chance with what I’m calling ‘The AI Moonshots.’

“I already selected the three with the most upside potential….

“A tiny company that’s using the power of AI to revolutionize the energy sector. (I’ll give you a hint: They’ve already partnered with a slew of Fortune 500 companies across the U.S., including Amazon and Walmart.)

“The $5 stock that’s at the forefront of the AI revolution in the airline space.

“And an AI company that can find gold and other metals underground without any drilling. With gold making new all-time highs recently, shares could skyrocket soon.”

No confirmatory chart for this one, sadly, so we’re left to be a bit more “guess-y” ….

I’d guess that the “tiny company using the power of AI to revolutionize the energy sector” is likely Stem Energy (STEM), mostly because I know Eric Fry has pitched that stock in the past. They are an energy storage company, their basic product is a battery system and energy management that times flows to and from the grid to benefit from higher and lower energy prices at different times of the day, and to incorporate solar panels when available. And they’re certainly talking up their use of AI recently (everybody is, they now call themselves “a Global Leader in AI-driven Clean Energy Solutions and Services”), and they have worked with both Amazon and Walmart. I own a little STEM, though in the same space I also own and prefer Fluence (FLNC), which has been better at building the supply chain for its energy storage products, and has some stronger partners.

For the “AI revolution in the airline space,” the most interesting thing I’ve come across in recent months is Air Space Intelligence, which sells an AI platform for airlines called Flyways… but they’re still a private, venture-funded company, so definitely not a “$5 stock” we can buy today. Other candidates?

There are other interesting AI-related projects for airline traffic control, like the Aimee system from Searidge Technologies, but they’re now owned by public-private partnership groups NAV Canada and NATS in the UK, providers of air traffic control services that are owned either by the government or by consortia of airlines and airports, so you can’t really invest in those.

And there are some companies that talk up AI in the airlines space, including FLYHT Aerospace Solutions (FLY.V, FLYLF) and training/simulator company CAE (CAE), but neither of those has been anywhere near $5 this year.

If I had to pick a company that’s most likely to be at the AI forefront in the airline space and has traded around $5 this year, I’d probably go with Sabre (SABR)… though they’ve been having a bad year, perhaps in part because they’re probably also perceived as being disrupted by AI to some degree. Sabre was the pioneer of automating airline reservations and pricing, it was the go-to technology for travel agencies in the pre-internet age and provided the backbone for some of the early online travel agencies, and it remains a key technology provider for travel companies. They have partnered with Google and others to develop AI technologies, including Sabre Travel AI, but they have not really gotten the investor buzz when it comes to their AI work… and they don’t often even mention AI in their quarterly results press releases. They are in the midst of a turnaround, though, and they’ve been a foundational tech supplier to the travel industry for a long time, so perhaps it will all work out — analysts think they’ll become proftiable next year and will grow nicely from that point, so if those analysts are correct then Sabre, at about $3.50 today, is trading at only about 4X expected 2025 earnings.

Not bad for a company that, although it’s not currently profitable, has strongly growing revenue and can easily handle its cash burn at the moment, thanks to still about $700 million in cash on their books — the biggest challenge, outside of the competitive challenge of keeping their customers and remaining at the front edge of AI use for airlines and other travel companies, is probably their balance sheet. They carry about $5 billion in long-term debt, and they’ve been active in extending their maturities in recent years, so they are trying to work through that, but it is a challenge — their interest expense last year was almost $300 million, so that’s a big chunk of their gross profit ($400 million), and some of their debt is adjustable rate so that cost will almost certainly be growing. In order for this to work out, Sabre probably has to outgrow their interest costs pretty aggressively in the next few years — analysts think they will, but I can’t say that I have any great insight on that. As usual, cheap is cheap for a reason — and it looks like the reason here is “debt.”

And for our last “moonshot?” There are plenty of companies that say they’re using AI in mining, generally by “learning” from geological data and from satellite imagery to identify gold targets, or using it to improve existing operations (including big players — BHP hired Microsoft to try to improve copper recovery at Escondida using AI, for example).

A lot of these are private and very small, like Earth AI in Australia, or just way too tiny to consider for investment, like Windfall Geotek (WIN.V, WINKF). If I were to make a wild guess about what stock a fairly mainstream newsletter might pitch in this space, it would be the industrial services company ALS Limited (ALQ in Australia, CPBLF OTC in the US), which does a lot of work for mining companies and bought the Goldspot Discoveries business from what is now called Earthlabs back in December. Here’s how they described that deal:

“Founded in 2016, GoldSpot Discoveries Corp. is a Canadian company recognised as a global leader in artificial intelligence and data science who are using AI to transform the mineral discovery process. Staffed by Geoscience and Data Science experts, GoldSpot provides geological consulting services and software augmented by AI.

“The acquisition of GoldSpot also includes its specialised data acquisition and consulting groups including Geotic Inc. that provides drill core logging and modelling solutions, and Ridgeline Exploration Services that delivers support for the full exploration cycle. These teams round out the multidisciplinary experts of GoldSpot by providing high quality fit-for-purpose data to service the next generation of industry needs.”

Hard to see that being transformative in the very near future, ALS is a pretty big company (about $4 billion market cap), but it is a fairly steady services business that is exposed to some industries that are less cyclical than mining, too, and it has grown nicely over the years. Currently trades at a fairly reasonable valuation, roughly 20X earnings, and with a dividend of about 3%.

And like I said, that one is pretty much a wild guess. There are a lot of small firms and people working in this area over the past 20 years, partly inspired by big pushes like the Goldcorp Challenge back in 2000 and the more recent Integra Gold Rush Challenge. It could easily be someone else that I haven’t looked at.

Fry’s “Step 3” for being on the right side of the wealth divided as AI grows is just “avoid the AI losers,” and he doesn’t drop any clues as to who he thinks those will be. Plenty of businesses have the potential to be disrupted by AI as it grows more powerful, I imagine, and there will also be AI-focused companies that lose out to better products or processes. Here’s a little excerpt from a Bloomberg story a couple weeks ago about the hunt for those “losers”:

“One of the first companies to show how rapidly fortunes can shift in the age of AI was Chegg Inc. The education-technology company saw its stock drop by nearly 50% in a single day after saying that ChatGPT is threatening the growth of its homework-help services….

“BofA’s at-risk basket includes software makers like Gitlab Inc. and Upwork Inc., as well as online travel agents, advertisers and staffing firms. Jefferies analyst Brent Thill has a similar list that includes Chegg, along with software providers Dropbox Inc. and Five9 Inc.

“In a sign of how quickly fortunes and sentiment shift, BofA’s basket also includes Alphabet Inc. While the Google parent initially faced concerns that it was falling behind Microsoft in the AI race, recent updates and developments have eased those fears….”

If you’ve got a favorite “AI Loser” to discuss, well, feel free to throw it on the pile with a comment below.

And likewise, of course, if you’ve got better matches for any of those “AI Moonshots” we’ve guessed about, or an opinion on whether you believe his top three AI picks that we identified will be worthwhile investments, well, we’re all ears — the happy little comment box below awaits your sage words. Thanks for reading!

P.S. If you’ve ever subscribed to Fry’s Investment Report, your fellow investors want to know what you think — worth it? Not so much? Somewhere in between? Our reviews page for Fry’s Investment Report awaits your input… thanks!

P.P.S. As of August 14, here’s the chart of the stocks teased above since the original early June release of the “Project Omega” teaser — they’ve done fairly well, as a whole, with most of them beating the 5% two-month return of the S&P 500 — Sabre in particular has boomed after a better-than-expected report in early August:

Disclosure: of the stocks mentioned above, I own shares of Alphabet, Amazon, Stem, Fluence and NVIDIA. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I didn’t see the first thing about Elon.

With all due respect to those here investing in the stock market, the best investment I ever made was not in the stock market, but an outside asset property management company. No artificial intelligence in this property management company, real knowledgable down to earth people. I get paid each month and the value of my shares has doubled. I am not stressed out daily by checking how it is doing.

You didn’t name the company!

Hi Gerald, would you kindly agree to share information about your investment outside of the stock market. I need to create passive income for my adult son who struggles with major depression and has no income. When I pass he will not have anyone to depend on. I am 72 and not withdrawing from what I have in the market, so he can inherit it. Unfortunately I lost a lot of money (for me) in the last year in the market. I need to find investment for him that yields 10-15% a year, paid to him monthly. Thank you in advance, and best regards,

rachelskrespin@gmail.com OR iltrus@yahoo.com

https://www.stockgumshoe.com/reviews/frys-investment-report/answers-picks-from-elon-musks-project-omega-tease/comment-page-2/#comment-5058133

Nice write-up, Travis – ‘though I didn’t see Elon’s influence anywhere.

I agree with you that FLNC is probably a better bet vs STEM.

GOOG, MSFT, and NVDA seem like the most obvious play in the AI space.

ASML, TSM, and (even) AMD make more sense to me than INTC…but surprises are always possible.

I like AMZN – but, it’s expensive!

INTC is already building a manufacturing facility in Ohio. https://www.ai.gov/ This is the link to the US Governments AI Winners Act, look it up…it’s ALOT of reading. Also, TSM is building in Arizona.

I bought the report of which you speak….and the 3rd “moonshot” is “Ivanhoe Electric” for $17.00 or less.