Here’s the top of Porter Stansberry’s latest order form:

“EXPOSED: The Big Secret Behind AI

“The most remarkable talent in financial publishing reveals how to correctly profit from the real winners of the AI revolution”

The “presentation” from Porter this time is similar to past presentations he has given — half “big picture” argument about why everyone else is wrong and trying to scam investors, and half tease about how he’s got the right approach, and has the better investments to recommend.

The “everyone’s wrong” part is an argument that what people are calling “artificial intelligence” isn’t real artificial intelligence, it’s just algorithms processing huge data sets and giving “enhanced intelligence” through tools like large language models (ChatGPT, etc.), which is what he calls an “Artificial Illusion.” He says that investors are obsessed with the shiny playthings and are throwing money at all the wrong “AI Startup” companies that don’t have real profits yet, or in many cases even real products. And it’s not just rubes like you and I, of course, it’s the big institutional investors, too — everyone’s chasing the AI story, including the venture capital funds who are daydreaming about the next big thing and shoveling billions of dollars into what they hope will be the next OpenAI/ChatGPT stories.

So Porter is essentially saying that he thinks the safer money to be made is in companies who are using some of these “enhanced intelligence” machine learning tools to improve their products and services, not by betting on the next big AI platform or chip or technology. That doesn’t sound terribly revolutionary, of course, but sure, compared to the risky AI startup ideas we’ve seen promoted all year, I guess it’s a little dash of sobriety. Either that, or it’s just a nice straw man marketing technique (“feel skeptical about those scammy-sounding tech startups in AI? Me, too, and you’re right, they’re not real! That’s not real artificial intelligence, it’s just a gradual improvement in computer science! Now that we’re in agreement that this is just an investing fad, check out my more reasonable investment ideas!”)

I just saved you half an hour, so you’re welcome.

What, then, does he say about his actual recommendations? He teases three picks to entice folks to subscribe to his Big Secret on Wall Street service ($1,000/yr, 30-day refund period w/10% cancellation fee), which is about a year and a half old now and has been focused on Porter’s long-time effort to find “world class businesses that you can buy and hold forever.” (Porter also recently returned to MarketWise (MKTW) as CEO and Chairman, that’s the company he built on top of Stansberry Research, his previous publishing firm, so his attention is certainly divided, but he says that his personal writing will continue to be through this Porter & Co. publication… even if I’d be surprised if MarketWise doesn’t end up buying Porter & Co. one of these days, too).

The basic logic behind Porter’s picks is usually pretty solid — his publishing companies have certainly had some over-the-top marketing, and some of his editors at Stansberry Research and MarketWise have been pretty far out there at the speculative end of the market, but the ideas he likes to write about personally are usually pretty staid — he likes to talk up capital-efficient companies that have strong brands, can generate free cash flow and compound that into growth of the business without much debt, and have some competitive advantages in their market. He often likes to call these “forever stocks” that are efficient and sustainable enough that you can hold them in perpetuity, even if maybe you have to wait until they’re a bit beaten down before you can safely buy them. His past teaser picks for this The Big Secret on Wall Street publication have been hit or miss so far — his biggest pushes have been for EQT and Tellurian as natural gas plays over the past 18 months or so, and those haven’t done well, but beyond that he’s had some pretty solid winners (BWX Technologies (BWXT) and Dream Finders Homes (DFH)) and a few stinkers (Annaly Capital (NLY) and Icahn Enterprises (IEP)) over the past year or so.

His teases this time out are for three “Special Reports” about companies that are trading at historically low valuations and have strong and sustainable businesses, but are also benefitting from AI and machine learning, even if it’s not “real AI.” We’ll feed them to the Thinkolator one at a time… he calls these “AI Railroad” stocks…

AI Railroad #1: The $1 Trillion Powerhouse

From the order form:

“In this report you’ll learn about a fintech firm that has been using machine learning to lock up 40% of the market and grow its sales every year despite any fluctuations in the market. This “forever stock” is one of the best investments you can own.”

He compares this one to Marqeta (MQ), which has quietly become a global payments powerhouse as they help huge brands process payments, though I’m not sure why he likes this one so much — they went public at a wild valuation in 2021 and have been clobbered since then, much like Adyen and many others in the payments space… but neither of those is the stock he’s picking today. More clues…

They’ve grown symbiotically through multiple acquisitions, buying 26 different businesses…. one of them grew payment volumes from virtually nothing in 2013 to $400 billion in 2022, another acquisition grew its customer base 3,000%, revenue 485% and valuation 2,975%.

They have 40 consecutive quarters of sales growth

Transaction volume was up 500% to $1,380 in 2022

Net income up “a staggering 800%” since 2012

They’ve captured 40% of their market, and are “on course to become a trillion-dollar business by 2040” (market cap? Revenues? He doesn’t say.)

So what is this company that he calls a “golden goose kind of business?”

This is PayPal (PYPL), which in many ways is the grandpappy of the “fintech” companies, and remains a very large player, with a market cap of about $60 billion. Paypal has had a number of challenges as we’ve come off of the instant and dramatic switch to online payments in 2020 and saw e-commerce explode around the world but they slow down a little, with some company-specific issues thrown in for good measure (including a CEO change).

How are they using machine learning/AI? Here’s what Porter says:

"reveal" emails? If not,

just click here...

“Speeding up product development…

“Improving authorization rates…

“Stopping fraud before it happens.”

And why is PayPal at a historically discounted 16X earnings?

Porter says that it’s trading at “one of its lowest valuations on record” because, after 8 years of consecutive revenue growth, the company’s sales slowed, just a little bit, in the last quarter. And that “We’re pretty sure this is only a temporary dip.”

Paypal’s share price has recovered a little bit from its six-year low in late October, but it’s still very cheap relative to where it has traded since it split off from Ebay back in 2015. The current trailing GAAP PE ratio is about 17, and analysts think earnings will pick up quite a bit next year, so the forward adjusted PE is only about 11 (the GAAP earnings include stock-based compensation, the adjusted earnings do not). And yes, earnings have come down from the heady days of 2021 — their GAAP earnings per share fell more than 50% in 2022 (adjusted earnings fell less), so even though that number did bounce back pretty nicely this year, it still seemed to scare investors and cause them to revalue the company. Most folks still ignore stock-based compensation, it appears, and on that basis PYPL is at a historic valuation low of 10-12X earnings.

The big “hidden asset” inside PayPal these days is probably Braintree, which in many ways performs a service similar to Adyen or Marqeta, doing online payment processing for larger companies — that’s the acquisition that he hints at, the one which recently hit $400 billion in transaction volume. The competition between Adyen and Braintree is probably hurting their profit margins this year, particularly in the US market, but those seem to be the two leading players these days.

Will PayPal recover? Probably. They certainly have some very powerful brands in PayPal, Venmo, Braintree, Honey and others, and they’ve been able to pretty steadily grow the business… even if it has gotten a big worse in the past couple years as the e-commerce boom slowed down. They are not without competition, but they have been around longer than anyone else, have a lot of businesses that are probably misunderstood by investors to some degree, and they are probably the cheapest “fintech” leader right now. They’re not growing very fast, and we can’t know if growth will accelerate from here, but at this kind of valuation you don’t really need high growth to justify an investment — you just need to have some confidence that their business is at least sustainable, and more likely to grow than to shrink. Analysts forecast that PYPL will get back to pretty solid earnings growth over the next five years, averaging 15-20% growth, and if that’s the case then buying now, at ~16X GAAP earnings, will very likely work out very well. Even if they just grow roughly as well as they did over the past five years, roughly 10-12% per year, this valuation is pretty easy to swallow.

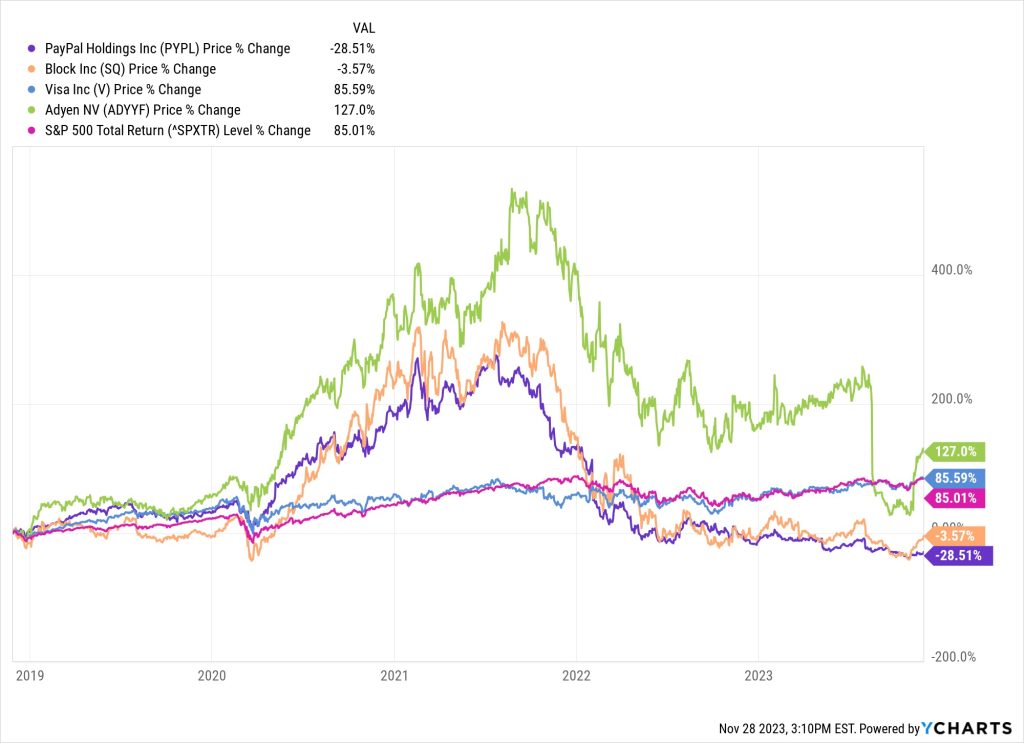

Here’s what PayPal has looked like over the past five years, compared to some related businesses… that’s Adyen in green, Block in orange, and the much steadier oligopoly Visa in blue… Visa has pretty much tracked the S&P 500, but the rest went through pretty similar boom and bust periods…

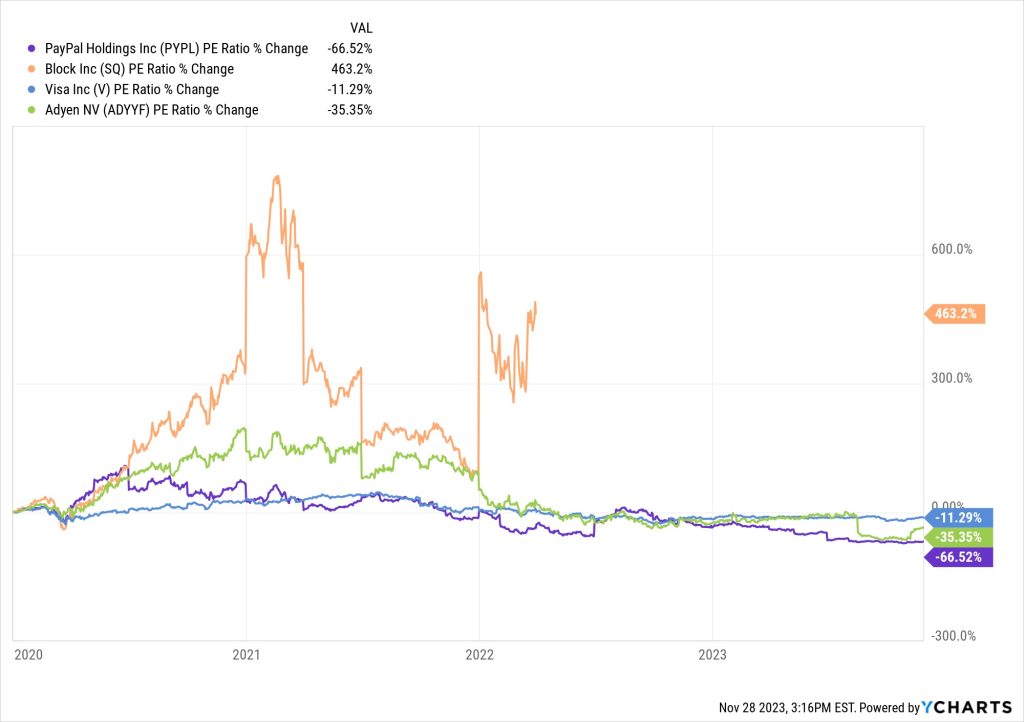

But the earnings growth, sales growth and free cash flow have been relatively solid for those companies, changing far less dramatically than the share price, so what’s really been changing is that investors got too excited in 2020 and 2021, and probably got too pessimistic in 2022 and 2023… here’s how the PE ratio changed for those four companies, which is one way of saying that what made PYPL one of the worst investments in this space wasn’t an operational shortfall, it was a sentiment shortfall, probably mostly because of the 2022 earnings “reset” that Porter believes is a temporary issue.

Block doesn’t have a PE ratio anymore, since they’re not GAAP profitable, but this chart shows that Adyen’s PE valuation has fallen by about a third in five years, while PayPal’s has fallen by about 2/3. It makes a lot more sense to buy a stock after the multiple has compressed like this than before, of course, even though it’s human nature to avoid stocks that are “on sale” in the stock market… and, we’ll restate the obvious, nobody knows what the future holds, buying at a low valuation gives you more room to be wrong, on average, but the valuation could stay low if PayPal isn’t able to get back to growing its earnings.

What’s next?

AI Railroad #2: The Prettiest Stock on Wall Street

This one is about a retailer…

“Physical retail never died, and certain sectors were never in that much danger to begin with — and beauty products are probably the most obvious

“Besides 2020, the cosmetics market has grown every single year…. No matter what happens, women are always going to buy cosmetics.

“And AI is having a big impact on the industry

“One company has figured out how to leverage machine learning to corner the beauty market and dominate its competition.”

And we get some specific numbers, too, so the Thinkolator will appreciate that…

“Since 2010, this company’s net income has shot up 4,000%”

“Earnings per share up 3,600%

“Free cash flow up 1,000%

“ROE up over 400%

“Customers spend an average of $28 per month on their products, over $300 a year

“One of the greatest retail businesses that has ever been built”

Porter says that this company benefits from brand loyalty, has $630 million in cash and no debt, and earns a 40% gross margin, which is pretty spectacular for a retailer. What else?

Growth is still pretty good — in 2023, he says sales were up 18%, gross profits 10%, and earnings per share up 7.5%… though you may have already noticed the problem in those numbers, if earnings were growing slower than sales and gross profit, then they were getting less efficient, which investors generally hate to see.

And indeed, that’s what Porter said the problem was that brought on the good valuation he sees today — he says the stock is “grossly undervalued” with a PE ratio of 16, and that it’s only this cheap because the operating margins “narrowed slightly” by 1.5 percentage points… but that we should be able to ignore that, because they’ve doubled their earnings in five years and he thinks they’ll keep that up. He calls this a a “Forever Company” that could deliver 15% compounded returns.

So what’s this one? That is, you may have guessed, Ulta Beauty (ULTA). This is a company I owned for a while, and should have held, but I got spooked out of the shares during the early days of the pandemic in 2020 and haven’t looked into the shares recently. It looks like the challenge is a bit of an earnings growth slowdown of late, with earnings per share only likely to grow at a ~7%/year pace over the next few years, if analysts are correct, so that would be a meaningful slowdown from the 15-20% pace of recent years (other than the COVID year), and more like 30-40% when they were just building out their store footprint in the decade before that. This is a powerful brand and store base, particularly now that so many traditional department stores are faltering and losing that coveted cosmetics business, and their return on equity is remarkable for a retailer, particularly one that doesn’t carry debt (though they do have meaningful lease obligations, which are kind of like debt).

Seems pretty reasonable — I don’t know anything about how they’re using machine learning, but they survived COVID very well, women are still spending on cosmetics (and men are spending more, too), and they seem to have proven themselves as an industry leader. You could probably convince me to get interested in Ulta again as the valuation drops into the reasonable range here, it is at roughly 16X earnings still, and it’s a well-run company that does not rely on stuff like stock-based compensation, so those earnings are a bit more “real” than some… though it may well require some patience if they aren’t able to surprise analysts with some growth acceleration again. If they’re stuck at ~7% earnings growth, then it’s easier to pay a little less, I’d find it easier to be attracted to this one at 14X earnings, for a PEG ratio of 2.0, but I imagine that part of the argument here is that ULTA should surprise analysts with their growth over the next decade (14X earnings right now would be a bit over $350, just FYI).

And one more…

AI Railroad #3: “Apple of Agriculture”

This is an argument that we need to use AI to feed the world…

“Global food production needs to increase by 70% to feed the expected growing population by 2050, and with 50% less farm labor and less arable land.

“AI could boost production and reduce waste.

“My team has identified the one company that we’re certain is going to play the critical role in this convergence of AI and farming. They are already using machine learning to help farmers…

“Distinguish weeds from crops, reducing chemical use by 80%

“Analyze the quality of grain on the harvesters and make adjustments, reducing food waste”

Clues about the company?

Since 2004, their dividends have grown by 1,000%

Since 2017, operating margins have grown 80%

Since 2018, net sales up 210%

Since 2019, cash flows up 100%“In the last quarter alone, this company’s revenues soared by more than 30%” (Q2, that is)

And Porter says they…

“have the most loyal user base in the entire industry, 77% of farmers are brand loyal.

“That’s why they’ve been called the “Apple of Agriculture,” they make both hardware and software, have long customer engagements, and are leveraging big data and their dealership network.”

More? We’re told that 11 of the world’s best portfolio managers currently invest in this company… and that it’s currently valued at just over 11x earnings, an extremely low price — Porter says it typically trades between 15-30x earnings

Why? Porter says it’s because “Farming is cyclical.” And he says “every investor in the world should own this stock.”

So hoodat? Thinkolator sez he’s teasing Deere (DE) again here, a company he touted as his favorite “AI stock” and “ultimate forever stock” back in early September.

What’s happened since then? Not so much — the stock has come down about $50, to roughly $360 now, mostly because the estimates for 2024 earnings were reduced by about 10% after the last earnings update. The big picture is that analysts are still expecting earnings to be pretty flat for the next few years, at something close to $30 per share, so it’s trading at about 12X earnings these days, so all that’s really changed is that analysts had expected 2-3% earnings growth from 2024-2026, and now they expect 0% growth, which changes the models and estimates but doesn’t really have much impact on the longer-term potential (and, of course, analysts can’t predict the farm economy to that level of precision — they can’t see what commodity prices or interest rates will be in 2024 or 2025 any more clearly than you or I can, even though their job means they have to guess). Here’s what I wrote about Deere back in September, my thinking hasn’t really changed:

“This is a pitch for Deere as a reasonably valued play on the increasing use of technology in agriculture… particularly the increasingly automated and autonomous “precision agriculture” push that increases yields and reduces labor (and requires more expensive equipment). Deere is a very high quality company that has become much more shareholder-focused in the past 15 years or so, and has led the way over smaller competitors and compares favorably with Caterpillar (CAT) in the places where they overlap… and it is widely seen as being the industry leader when it comes to technology, and the most valuable brand, so it’s probably a pretty decent bet here at 12X earnings, even if the analysts are right in forecasting that earnings will flatten out here for a few years (after several years of very strong growth, fueled by good commodity prices, new products, and easy money for equipment upgrades). They have built up a strong stream of recurring revenue as they sell software and service on top of the equipment, and enjoyed great pricing (not unlike the auto makers) in recent years, though there seems to be a widely-held belief that the gravy train is slowing, at least for a little bit, probably mostly because of the impact of higher interest rates on the farm economy and on capital equipment sales. I confess to being a little more tempted by AGCO (AGCO), one of the smaller tractor companies that is at a much lower valuation and could get better growth out of a recovering Ukraine (someday), but that’s mostly just the temptation of cheapness — in truth, it’s often wiser to buy the clear leader at a fair valuation than to buy the weaker competitor at a cheap valuation.”

So… interested in Porter’s “forever” stocks that profit from “enhanced intelligence?” Prefer to look for more direct plays on AI technology that are a bit lustier these days? Have other reasonably valued favorites to suggest? Let us know with a comment below… and thanks for reading!

Love your analysis. Wish you would start a fund.

You’re too kind, thanks!

He has, it’s called the real money portfolio.

Morningstar thinks PYPL is “deeply undervalued” while conceding that the 4Q results will be uninspiring. They don’t mention anything about AI as a boost to future earnings. Perhaps they are betting on PayPal’s new CEO and CFO to figure it out. Maybe they should also hire a CFE (chief financial engineer).

It is an interesting story, I really recommend the Business Breakdowns podcast on PayPal if anyone would like some more background on how they got to this point and how the business works.

Re your Quick-Take comment that Stansberry’s premise ‘sounds like a debate for a computer science class’ — Count me in!

I’d actually agree with him for once. But if U parse his sentence too closely – there’s a double negative. He says AI is an “Artificial Illusion.” No, I think it’s a REAL one!

I have followed Porter Stansberry and his generally 3 stars out of 5 star possible pitches. Every so often he gets it right. This time DE, in hindsight, looks like a very wise choice. Trouble is, according to the farmers I know who use Deere products and services, the past growth cycle is pretty much over until interest rates come down like before 2019.

Porter is a masterful pitchman and is almost believable until you look under the facade of his rhetoric. Travis has done this brilliantly, again, and saved us all $1,000 in the process. Well done, Travis; keep an eagle eye on this high flying fast talking Porter Air Line stuff!

Adobe owns the copyright on all its AI generated stuff and so designers are indemnified against AI copyright infringement lawsuits, a very big deal for corporate and private ad agencies and content creators. Since Amazon now requires all publishers to disclose AI generated usage, it looks like a great lock has been put on using Adobe software vs. Open Sores and other publishing software…

Adobe is trying to stake out that “safe” zone for AI-generated images, covering copyright infringement claims for users of their Firefly system (because they can promise that no copyrighted images went into “training” their generative AI)… but this is a brand new area of law, it’s going to be a while before a strong set of guidelines emerges and people really understand the rules…. and there’s a lot of generative AI work right now that was clearly trained on copyrighted text and images and videos, given the general Silicon Valley ethos of “move fast and break things” that’s fueling all the startups. Heck, the internet and social media are still awash with plain old copyright infringement of both images and text after 30 years of trying to tamp that down, so I don’t know if the law will be much of a deterrent once you get past the big corporations.

I wish my wife had told me about ULTA back in 2020! I honestly don’t pay any attention to cosmetics but she and both my daughters shop there all the time and it is crazy expensive and so is the share price!

Deere has the same issue as CAT right now. High interest is going to keep their sales growth down for a while. I’m glad the Gumshoe could save me $1000 on this nothingburger newsletter.

ULTA doesn’t look expensive to me — it trades at about twice the valuation of the big department stores like Dillards and Macy’s, but it’s also been consistently growing revenue at 10%+/year, while those other retailers have had flat revenue over the past five years. It’s at about the same valuation as Target, but with much better growth and profitability and a better balance sheet… and on a PE basis, it’s trading at a 5-10% discount to the S&P 500.

If you have trouble with the $400 per share price feeling expensive, just imagine that they split the stock 10:1 — the company wouldn’t be any different, but then it would be trading at $40 with earnings per share of $2.50 and likely growing to about $3 in the next couple years. Sometimes high per-share prices deter people, but with the easy access to partial-share trading we should be able to look past the per-share price, which we tend to fixate on at first glance even though it might as well be a random number (since every company has a different number of shares outstanding), and just think about valuation and market cap.

High share prices used to be fairly shocking, back in the days when everyone repeatedly split their shares to keep the price consistently in the $30-100 range for years, so that reaction tends to be hard-wired in for a lot of people, but over time the companies who don’t often split their shares, and have let their share prices drift into the $500-1,000 range or higher, have done just fine. The extreme example, of course, is Berkshire Hathaway — you could have bought an A share in the 1980s for about $400, and it was one of the highest-priced stocks on the market back then… today the A shares are well over $500,000 each. Booking.com (BKNG), formerly known as Priceline, was a high-priced stock running through the hundreds a decade ago, it was at about $400 in 2011… and today it’s well over $3,000 per share.

Not that ULTA is destined to work out as well as BRK.A or BKNG, of course… that seems optimistic for a brick and mortar retailer, even a very good one. I just don’t agree that it’s crazy expensive.

Sorry for the rant, and I don’t even know if it was the $400+ share price that made you feel it was expensive, maybe you just think it should trade at a single-digit PE like some of the stodgier beauty-focused retailers, so please don’t take offense — that just gave me a chance to dig into a pet peeve 🙂

Any idea on what happened to investors’ funds in ABST on it’s acquisition by Crosspoint?

That deal closed back in July, I think — it was a cash deal, so according to Absolute’s press releases, investors should have gotten $11.50 in cash for each share they owned.

Thanks, but did they receive the payments?

I assume so, it’s the broker’s job to distribute that cash to shareholders, but I wasn’t a shareholder.

I think i got my $11.50 for ABST. It was a small position, i’d have to go dig out the records to be sure.

If memory serves, that was substantially less than i put into it…