This teaser solution and discussion was shared with the Irregulars in the Friday File a few weeks ago, but questions are continuing to come in, particularly as Melvin pitches this as a “Buffett v. Biden” story, and there has been some more news from the company, so we’re re-posting and updating our solution for everyone today.

The ad is a pitch from Tim Melvin’s 20% Letter ($79 first year, renews at $99)… Melvin’s ads were more aggressively circulating earlier in the year, when he was still promoting TFS Financial as his “perfect dividend stock” and touting a bunch of smaller dividend payers — and while they’re mostly down a bit, those stocks have, as a group, actually held up better than I thought they would, particularly TFSL through the bank collapse this year (it’s only down 20% or so since he pitched it in January, and that’s quite a victory in the small bank space — though I suppose we should also mention that Territorial Bancorp (TBNK), another bank he promoted in similar ads a year ago, is down 60% or so).

This is the latest lead-in email ad for this teaser pitch:

“Warren Buffett just made a $40 Billion bet against President Biden, and nobody seems to have noticed.

“So I looked into it…

“Why is the Oracle of Omaha so certain about Biden’s Trillion Dollar plan going south?

“And what I found might shock you…

“Because it looks like Buffett’s big bet could trigger a stock market event that hasn’t happened since 1984…

“A tidal wave of stock gains in ‘America’s Most Hated Sector.'”

What does that mean? Well, really just that Warren Buffet has been buying oil stocks, particularly building up large positions in Occidental Petroleum (OXY) and Chevron (CVX) in recent years. I’d say it’s not particularly a “bet against Biden,” it’s just typical Buffett logic — we’re going to continue to need roughly similar amounts of oil for another couple decades, at a bare minimum (we might need more, for longer, depending on how the rest of the world industrializes), so it makes sense to buy the best cash-earning oil companies who will profit from that, at a time when most investors think oil is dying or reject the sector for other reasons. Berkshire started buying those positions before Biden was elected, incidentally.

Buffett’s Berkshire Hathaway has made other energy investments as well, of course — Berkshire Hathaway Energy owns some of the biggest wind farms in the United States, and also owns lots of oil and gas infrastructure and pipelines and some regional utility businesses, including control of the only LNG export facility on the east coast. Maybe that totals up to about $40 billion, I guess that’s a reasonable ballpark number for the capital Berkshire has committed to the energy sector in the past few years (as of today, Berkshire’s shares in OXY and CVX total up to about $31 billion).

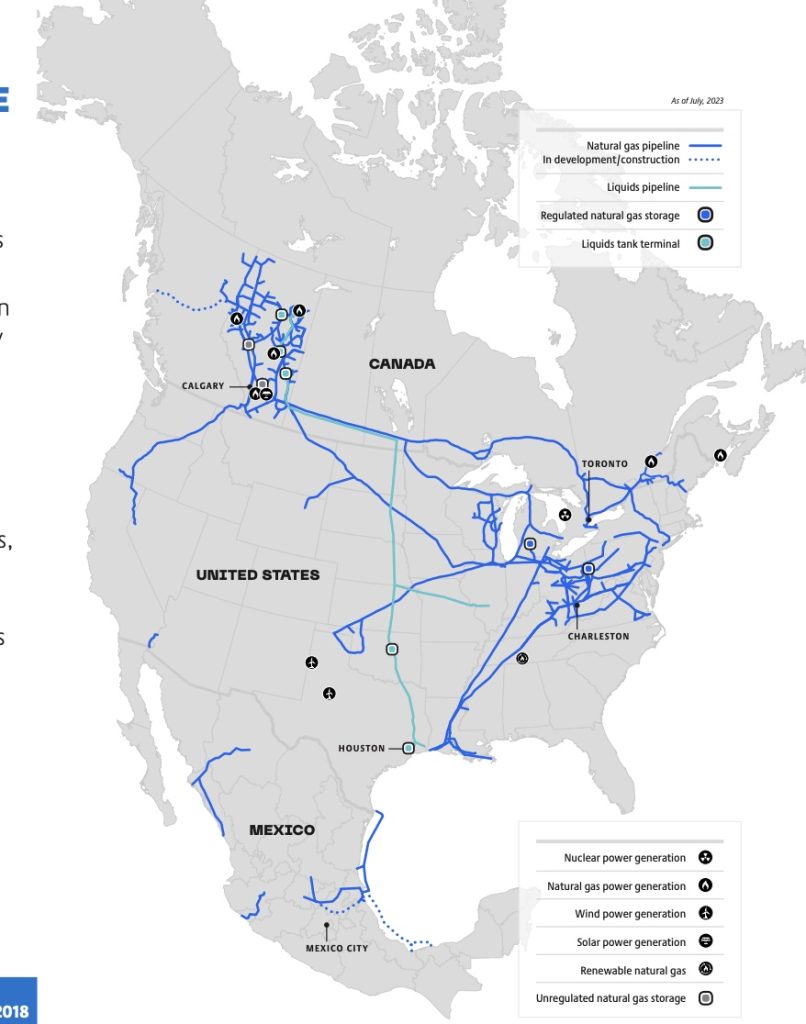

What does that mean for Tim Melvin and his “energy map?” Here’s a bit of the ad:

“This Map Holds the Key to a $4.5 Trillion Energy Revolution…

“Those blue lines are owned by America’s most HATED stock with full control of Biden’s $4.5 trillion energy revolution…

“ONE controversial energy stock just entered a “quick income window” for the first time since 1984…

“You MUST get in by November 8th for the best chance at growing a $91,761 per year income stream”

OK, so it really must be an oil pipeline company, and we get the basic spiel — we can shorten it as, “Biden hates oil and gas, grrrr, we hate Biden like you do, but we’re going to turn over his apple cart because hahahaha we still need oil and gas for the next few decades and oil has made lots of people rich and you’re next! (for the low low price of $79)”

And I guess you can’t really blame them for this marketing technique — investment newsletters tend to appeal to conservative voters, and doubling down on politics often is a salesman’s shortcut for “you and I are on the same side, so you should feel comfortable giving me money.” The newsletter marketers have used this as a money-making strategy for decades, and the more divisiveness and easy hatred there is for a particular politician, the more effective the strategy.

As with every other time politics is the headline in an investing story, we’re better off skipping the politics and heading right to the investment — the more politics you add, the more likely you are to make an emotional decision, and emotion tends to be the enemy of investors. Unless you’re Warren Buffett.

What else does he say about this company? It’s a high-yielder, but it’s also a “special situation” investment, there’s some kind of spinoff involved…

“Going off their targets…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“You’re locking in 7% annual dividend growth…

“Looking at the stock as it sits today…

“We’re going to be getting an 8.1% dividend. It’s a very high-yielding stock, and we will collect that into 2024 when the spinoff is accomplished.

“We expect the stock’s price to dip on the announcement…

“Giving us a unique “discount window” to buy in before it takes off, as often happens with spinoffs, and that’s what we’re taking full advantage of….

“I believe this is your best chance to fund your dream lifestyle with just ONE stock….

“… it trades for less than $40 as I write this!”

So… who’s that? This is the Canadian company TC Energy (TRP), which I wrote a little bit about when Brad Thomas was pitching the same stock back in August.

And yes, I guess that to some degree you could say this has been a “most hated” stock for some activists, since one of their major assets is the Keystone Pipeline which runs from Western Canada to the Gulf Coast, and they would have been the builder and operator of the Keystone XL pipeline extension if that hadn’t been rejected by President Biden… though since they changed their name from “TransCanada” to “TC Energy” a few years ago, maybe nobody knows them well enough to hate them. (And forecasts and plans and high-profile projects are rarely as simple and predictable as investors would like to think — TRP stock jumped 20% higher in the month or so following President Biden’s effective cancellation of the Keystone XL project, in January of 2021.)

And the “must get in by November 8?” That’s the day they’ll release their next quarterly earnings report, and will likely declare their fourth quarterly dividend for the year — it’s not likely to be a surprise, it will probably be the same as the last dividend payment, if you’re looking for the dividend growth trajectory continuing we likely won’t know that for a few months, the next dividend increase is expected in February. Given all the news of the spinoff and restructuring work they’re doing to “recycle” assets, it could be that more meaningful news will come out of the earnings report, but I don’t know whether that news will be taken as good or bad by investors.

TC Energy is more diversified than US MLPs, this is a midstream energy business that also owns some electric power plants, but the stock tends to be treated similarly to its US MLP cousins, and is owned mostly for the high yield (about 8%, though the dividend growth for US investors in TRP hasn’t been quite as steady as most of the MLPs, partly because of the Canadian dollar’s weakness and partly because in part it’s a slower growth utility business).

Analysts are predicting a pretty stable future for them, and you can get a pretty good idea of their breadth and strategy from the latest quarterly investor presentation… but the biggest news for TC Energy lately is probably really their plan to split into two businesses, spinning off their oil pipelines into a separate entity (so TC Energy, which is the much larger part of the business, will be more like a natural gas pipeline and distribution and storage company, with a little side business in power generation, while the new Liquids Pipelines business will own Keystone and their other oil infrastructure and be a pure-play oil pipeline operator — most likely, TC Energy will have a lower yield and higher dividend growth, Liquid Pipelines will have a higher yield and slower dividend growth).

You can see the presentation of the deal here, it’s not likely to be completed until sometime in late 2024. Seems like a rational spinoff to me, and the whole operation right now has a relatively high dividend yield compared to other natural gas/electricity utility companies who have meaningful “low emissions” power generation capacity, so it might create some opportunities.

They see their average cash flow for the whole growing by about 5% per year, supporting dividend growth of 3-5% as they stabilize their payout ratios and pay down some debt, so the base assumption should probably be for an 8% yield that grows about 4% per year — which is pretty good, but not necessarily life-changing, and they have had some down years in the past. Analysts and investors were generally not excited about the spinoff announcement a few weeks ago, which is why the shares have been down this year… but that actually makes me more interested in the shares, given the lower valuation, and there was also a nice insider buy by the Board Chair when the price dipped, so there’s at least one little spark of optimism.

There has been some more news of late, too — they did finalize the sale of their non-controlling interest in the Columbia pipelines, freeing up $5.2 billion to pay down debt, and they do think their cash flow this year will be 5-7% higher than last year and they “target 7% long-term comparable EBITDA growth” for the remaining parent (which will still be called TC Energy) after the spinoff, while the new spun-out Liquids Pipelines company will target growth of 2-3%. In a victory for financial engineering, they expect that the company they believed would be able to grow at 6% before they announced the planned separation, will now be able to grow at 6-7% if the two are separate. Though they’re telling investors to expect only 3-5% dividend growth for TC Energy and 2-3% for Liquids Pipeline after the deal is done in 2024. For US shareholders, the average dividend growth has been about 6% per year over the past four or five years, and that doesn’t look like it’s going to accelerate or change dramatically (unless the Canadian dollar turns around, perhaps, though that would also bring down the share price in US$, all else being equal).

And there’s more — TC Energy did get approval to expand a California pipeline, which could become a positive over time, but in bigger news, the leaping cost of debt clearly has companies everywhere spooked, and TC Energy is no exception, so Bloomberg reported late last week that they’re going beyond that Columbia pipelines sale and are “exploring asset sales” that could amount to a total of about $10 billion. That adds up to a lot of “portfolio refresh” for a $34 billion company, and is probably more than they need to push through this restructuring and reorganization and get down to their target leverage (though with interest costs going up much faster than they would have expected a year ago, it’s also quite possible that the target will move).

So again, an interesting idea — it’s not a MLP, so you don’t have the hassle of the K-1 partnership reporting at tax time, if that matters to you… and the dividend is both a little better than the US non-MLP pipeline owners like Kinder Morgan (KM) and Oneok (OKE), and also growing a little faster. I do like spinoffs, so I’m interested to see what happens as they get closer to finalizing that spin, maybe we’ll see one or the other sides of the company trade down to a meaningful discount as a result, but that won’t be until probably late next year. And the impact might be minimal — after all, the liquids pipelines business, which basically just owns some oil pipelines that transport western Canada oil to the US, is a small portion of the business (about 15%). The big comparable there is probably Pembina (PBA), which also only yields about 6.5%.

I do find TC Energy somewhat tempting because of the spinoff dynamics and decent income profile, particularly if they manage to find buyers who are willing to pay a premium price for these assets they’re trying to sell (that’s an open question, since rising interest rates have reduced the value of almost everything), but I’ll stick with my high-yield pipeline exposure being through the Alerian MLP ETF (AMLP), it’s just easier.

It’s not going to fund your dream lifestyle overnight, but a high dividend that grows at all can indeed compound very nicely, if you give it enough time. We can’t know for sure what TRP will do in the months and years ahead, but the simple math says that if you put down $10,000 today (just pulling that number out of my hat), and get an 8% dividend yield, you only need the dividend to be increased by 5% per year, with shares keeping up with that (so, the stock price also goes up 5% per year, so that future buyers are also buying with an 8% dividend expectation), to more than triple your money in a decade. If you do that, and reinvest those dividends into more shares, your $10,000 turns into about $34,600 ten years from now… and, again assuming that this business remains steady and valuable and has similar returns a decade into the future, your annual dividends from that point, on your initial $10,000 cost, would be about $2,900.

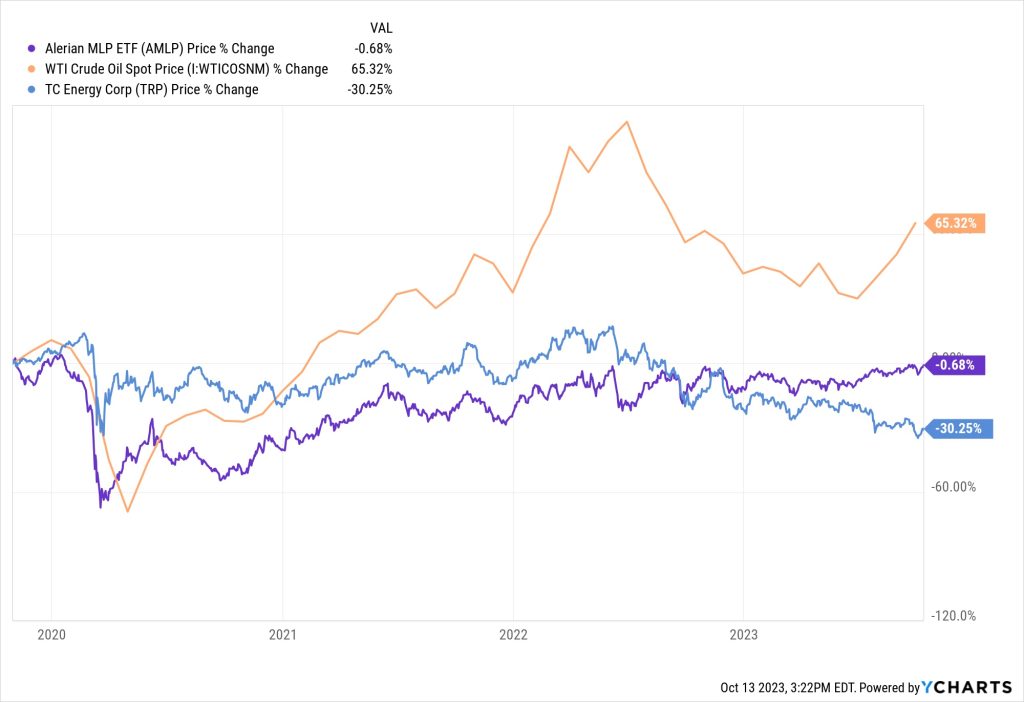

The problem, of course, is that there’s regularly a “hiccup” to that math in the commodities world, whether it’s the 2014 crash in oil prices that crushed all the pipeline owners, or the 2020 collapse of oil prices. Oil pipelines are good investments, with high cash income (and sometimes some nice tax advantages, if you buy the MLPs), and they’re theoretically somewhat commodity-price agnostic, since they’re really toll operators… but despite that, they get clobbered every time the oil business falls apart, even though they don’t necessarily surge higher at times when prices are climbing. Sometimes it’s best to make your big purchases, if you’re trying to be opportunistic, at a time when these kinds of assets are hated, not at times like today, when they’re more widely celebrated…. this is the relative performance of TC Energy and AMLP for the past four years, just for some context, which incorporates both the COVID collapse and the Russian invasion of Ukraine — that’s TRP shares in blue, AMLP shares in purple, crude oil prices in orange:

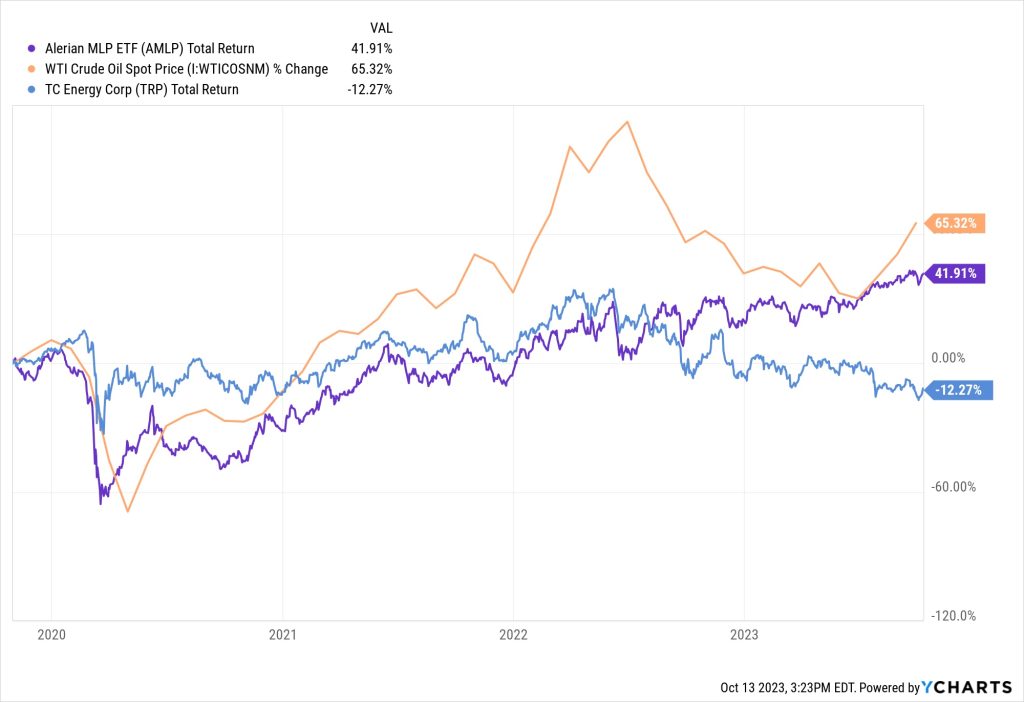

But, of course, nobody buys these for the capital gains — you buy for the dividend, so here’s the total return, including dividends:

They do compound pretty nicely, but they rarely shoot higher in a hurry… so it helps to be a little opportunistic with your entry price, particularly if you’re going to be patient through weaker periods and just let your dividends compound. Who knows, maybe that’s what we’re getting here with TC Energy, which has been written off a bit this year (or maybe it’s just because they’re predominantly a natural gas business, and gas, unlike crude oil, has been in a downward spiral since the brief spike of LNG enthusiasm after Europe was cut off from the Russian pipelines).

Still, though, there’s no magic solution — to get that “$91,761 per year income stream” today, as Melvin teases, you’d have to start with an investment in TC Energy of about $1.2 million. You might get there without quite that huge an up-front investment, of course, but it would take a long time — if you use the same assumptions I did in that math exercise above, which turned $10,000 into $34,600 in ten years, then you can make this work with a $100,000 investment. Invest $100,000 today, at an 8% dividend yield, and as long as the dividend gets increased 5% per year, and the share price keeps up with those dividend increases, then after 20 years your $100,000 would turn into $1.1 million… and at that point, you would indeed be earning $92,185 in annual dividend income. But, again, a lot can happen in 20 years, and a few meaningful hiccups along the way can change the end of the story quite a bit.

So there’s one income idea, which turns out to be one we’ve talked about before — sometimes it’s a good sign when two different newsletters start to believe that a downtrodden stock is a fashionable idea.

Sound like your cup of tea (or texas tea, I suppose)? Think TRP at a discount to some of its more stable peers is an opportunity at a growing 8% dividend yield, or do you not feel like living through whatever volatility their ongoing restructuring brings? Let us know with a comment below.

Disclosure: Of the investments mentioned above, I own shares of Berkshire Hathaway and the Alerian MLP ETF. I will not trade in any covered investment for at least three days after publication, per Stock Gumshoe’s trading rules.

Yahoo says the TRP dividend payout ratio is 406.67%, which sounds pretty bad.

Yep, that’s awfully high. A lot of these asset-heavy companies pay out more than they earn in GAAP income, which is usually what the payout ratio is based on, but that’s very high even in that context. I expect part of it’s because their income has had some huge adjustments recently — they say their “normalized income” is about $3.3 billion/year these days, but “net income” is only at $801 million at the moment. They currently are on pace to pay over $2 billion/year in dividends, which seems reasonable if there’s any justification for that “normalized” number but terrible compared to current GAAP income. Most of the adjustment beyond the $2 billion or so in depreciation that they record in a given year has been “asset impairment,” so the cash picture looks a lot better than the income picture, but it’s clearly still an unsettled situation as they sell assets and try to buy other assets and reduce their debt burden.

Thanks for the clarification. Pretty complicated deal.