This is from the order form for a recent Charles Mizrahi ad for his Alpha Investor ($47 first year, renews at $79)…

“I’d like for you to imagine getting a second chance to invest in…

“Nvidia in 2017 before it debuted its first AI chip (+1,858%)

“Tesla’s 2010 IPO (+13,869%)

“Google’s in 2004 (+5,317%)

“Amazon when they went public in 1997 (+177,500%)“Or how about this. What if you could get in a time machine and invest in Microsoft when it was a small startup in 1981?

“I’ve spent months investigating this powerful AI Guardian breakthrough and the little-known firm that invented it. Everything I’ve uncovered leads me to one undeniable conclusion.

“This is the one investment in artificial intelligence that could single-handedly reward you with generational wealth. And I want to make sure you don’t miss out.”

Tempting, right? This ad has both the fear and greed pretty well maxed out — the “presentation” by Charles Mizrahi with hired infommercial host John Daly (who is described as an “investigative reporter”), leads with lots of fear about “Rogue AI” taking on a life of its own and creating chemical weapons or acquiring nuclear weapons, or manipulating financial markets, but then the “greed” angle kicks in with a promise that the company they call the “AI Guardian” will prevent all this stuff… here’s a little excerpt:

“But I’m not here to spread fear.

“We eliminate rogue AI — it’s the positive side of our Oppenheimer Moment.

“Artificial intelligence will cure dangerous diseases like cancer and Alzheimer’s. We will have driverless cars.

“Unlimited sources of energy.

“But for the folks watching — if they remember one thing — remember this…

“In Elon Musk’s own words … AI could allow us all to enjoy ‘an age of abundance’…

“He meant an abundance of wealth.

“$22.1 trillion a year. It will transform the lives of millions of Americans.”

And who is this “AI Guardian” company? The details start to leak out in hints…

“You won’t find a lot of press on this little-known firm. Especially the two billionaires behind it. They aren’t famous.

“For four years they self-funded their work. No venture capital money to exert influence over them.

“The CEO of Intel described one of them as a genius ‘like Michelangelo.’

“He was a childhood prodigy. At 16, he designed a high-powered microprocessor for computers.

“He would go on to co-found Sun Microsystems. That sold for $7.4 billion.

“The other founder sold his Ethernet startup to Cisco. Then became one of Google’s first angel investors.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Google’s valuation has since shot up over 15.4 million percent from its startup days to over $1.7 trillion.”

And a bit more about the history of the company…

“In the early days, the founders wanted to test the limits of Version 1.0 of their tech.

“They turned to 50 Wall Street firms, where speed is king.

“The company behind this AI Guardian generated those 50 firms $1 million a day in profits.”

Well, that happens to be enough, actually — this is a company I’m already familiar with — but we’ll go through a bit more of the ad so we can understand why Mizrahi likes them, and calls them the “AI Guardian”….

“Building this AI wasn’t a business to them.

“It was a mission….

“… this team set out to build a new form of AI that was, as they described: “self-defending.”

“When they pulled back the curtain, they revealed they had invented a powerful suite of hardware and software.

“Combined it creates the world’s first AI security and threat elimination system….

“I’m confident this AI Guardian — can help protect companies from their own AI applications going rogue….

“And it’s universally compatible with every form of AI. So every company and government can use it — no matter what type of AI application they’re building.”

And a little hint about the size of the company…

“Compared to the tech titans, the firm that invented this AI Guardian is tiny.

“Its size wouldn’t even register a speck on their radar.

“Yet, you believe its valuation could jump 2,500% over the next five years.

“But — you can buy into it right now for $5.”

He also drops some hints about deals they’ve signed with the military…

“… there has been a rush to embrace this AI Guardian firm.

…. a nine-figure contract from the Pentagon…. The details were sparse. Just the bare minimum they had to legally disclose.

“Then I found the AI Guardian referenced in NSA documentation.

“And documentation with the U.S. Naval department that oversees our fleet of submarines….

“… it was being relied on by Lockheed Martin…. General Dynamics…..

“I even discovered the AI Guardian firm was helping protect the fifth largest nuclear arsenal in the world…. the Atomic Weapons Establishment in Berkshire, England.”

And some other current customers that make it clear this is not just an AI company, and is probably not all that new…

“I found it inside a network of 6 hospitals and 75 outpatient facilities across Florida.

“And an Ohio lab that’s utilizing CRISPR technology to edit human DNA….

“A chain of 28 banks in the southern United States are using it, where $2.5 billion is being stored for 175,000 Americans.

“This AI Guardian firm is being trusted by Wells Fargo and Citizens Bank.

“And our telecommunications network, John.

“AT&T is using it.

“The oil industry — BP has used it.

“Our financial markets and over 9,000 companies and government agencies too….”

And the “next Microsoft” bit that comes up again and again is all about this being a universal solution to the problems of all the big cloud companies and other AI innovators….

“This is the next Microsoft….

“Today, AI is in its Wild Wild West stage.

“To bring order to all of this chaos from rogue AI — the world needs a universal operating system for artificial intelligence.

“The AI Guardian is that universal operating system.

“Microsoft was the very first cloud provider to become a client of this firm.

“Microsoft may have to pay them $1 billion a year. They need it to fully harness ChatGPT.

“After Microsoft turned to them — Amazon and Google followed suit. This firm’s tech was integrated into Nvidia’s tech.

“IBM, Facebook, Oracle…

“This firm’s tech has been integrated into Apple’s technology too.”

So what does this company do? From the ad, it sounds like it speeds up and protects data.

“The life force of AI is data.

“If it can’t access the data it needs fast enough, or it can’t find the data — or it gets bad or malicious data — it can go rogue.

“And if an AI application can’t navigate its way through this network of clouds and data centers at light speed — it can go rogue….

“Generative AI can require as much as 100 times the amount of data and can consume 10 to 15 times the amount of energy as older forms of AI….

“AI’s increasing demands on this outdated infrastructure have us tap dancing on landmines.

“There’s been a surge in crashes….

“What happens when they’re all bombarding these ancient data centers and incompatible clouds with AI applications that are 1 million times more powerful than before?”

And a few more specifics about the company…

“The AI Guardian packs an incredible one-two punch through a suite of cutting-edge, patented hardware and software.

“All powered by its own proprietary AI.

“It can instantly upgrade all these ancient data centers. It could solve the incompatibility problems between the clouds.

“And it’s also the world’s first AI security and threat elimination system….

“They’ve already been awarded 823 patents for their full suite of technology….

“The AI Guardian can make data move up to 57,400% faster inside a data center than was previously possible.

“Can upgrade from 800gbs to 460tbs.”

He goes into some more detail about the products this company provides, including a “data transfer accelerator” that can plug and play into a data center, helping to prioritize and move data and avoid bottlenecks, and a software platform that makes all of the big cloud systems compatible with each other, that “universal operating system”

And the cyberattack prevention stuff…

“The AI Guardian’s own artificial intelligence is trained with an advanced knowledge base of all types of cyberattacks.

“And it constantly self-upgrades with the latest intel.

“It can detect a threat down to the microsecond.

“A millionth of a second.

“But it doesn’t wait for the bad guys to strike. It strikes first.

“The firm calls this ‘Threat Hunting.'”

He sums it up again on the order form:

“A Silicon Valley Dream Team — You’ll meet the brilliant billionaires who founded this firm and the fast-rising executive from Cisco they recruited to be their CEO. I’ll walk you through the 823 patents they’ve been awarded. They serve as an impervious moat, protecting their world-changing innovations.

“We’ll explore the cutting-edge R&D they’re undertaking at their California headquarters. I’ll review their expanding operations in Canada, India, Ireland, Germany, and England.

“And you’ll see the bold plan they’ve deployed that took them from zero to landing more than 9,000 total clients. But with the AI revolution speeding up, they could become mission-critical to millions of companies….

“Own a Piece of ‘The Next Microsoft’ — This could be your “millionaire maker.” I’ll present undeniable facts and projections that prove this firm’s valuation could soar 2,500% over the next five years and 5,000% after ten years. From there, it could go parabolic, just like the ‘original Microsoft.'”

So… hoodat? Well, it is indeed much smaller than Microsoft and the other tech titans, some of whom are their largest customers… but it ain’t exactly small. This is another recommendation to buy Arista Networks (ANET), which we’ve seen touted many times over the years, most aggressively by the Motley Fool.

And yes, Arista has a fascinating origin story… it was founded by Andy Bechtolsheim, who was one of the co-founders of Sun Microsystems, Ken Duda, who led the development of Arista’s EOS operating system, and David Cheriton, who is sometimes called “Professor Billionaire” because he wrote a check to two of his Stanford students, Larry Page and Sergey Brin, to help them kick-start Google. They recruited Jayshree Ullal as Arista’s CEO back in 2008, and she had been instrumental in building Cisco’s data center switching business over the previous 15 years… they got early orders from some big tech companies thanks to their newer architecture and operating system, and that led to Arista going public in 2014. And yes, they have applied for 823 patents, though as of the last data I saw “only” 526 had been granted (number of patents is not that big a deal, of course, it’s having important ones that matters).

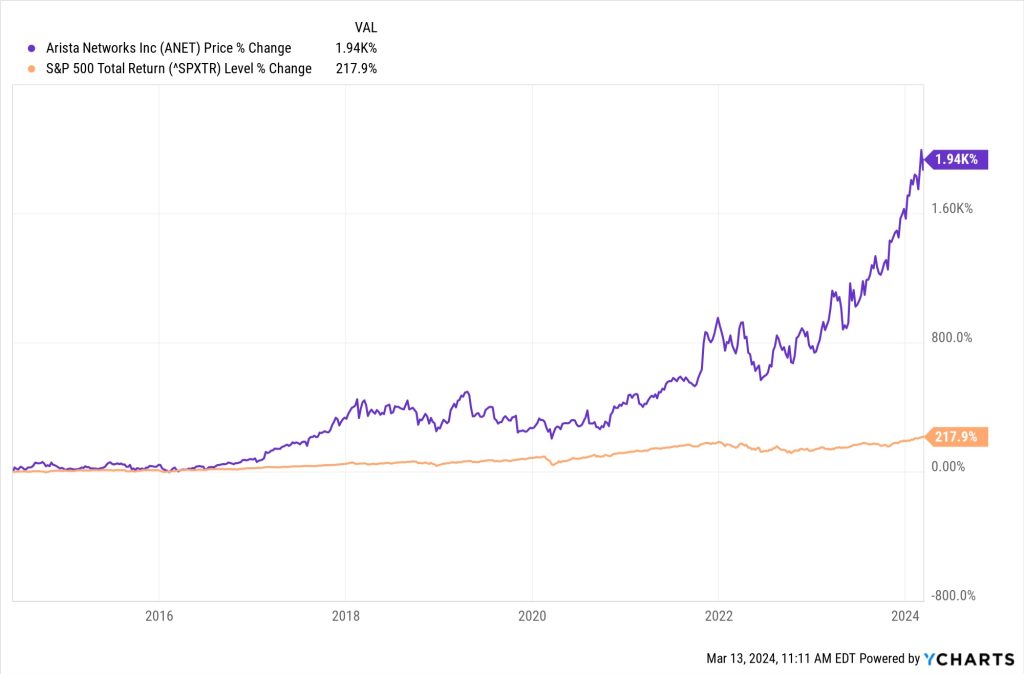

The stock has been phenomenally successful since going public, though it has also been a bumpy ride, with some long periods of weak stock performance (mostly driven by slowing capital spending by a few of the big “cloud titan” companies who have always been their major customers).

Things really took off for Arista once the fears about big tech cutting its capital expenditures (in 2022) were erased by the enthusiasm for building up data center capacity for AI (in 2023), and the revenue and earnings growth have picked up nicely, driving ANET to trade at a dramatically higher multiple as investor enthusiasm washed over the shares.

It’s now an $87 billion company, so yes, it’s small compared to NVIDIA (NVDA) and Microsoft (MSFT), and it is currently growing faster than most of the rest of “big tech” (with NVIDIA, of course, a notable exception), but it’s not exactly tiny. It is currently trading at about 35-40X earnings, and has been growing earnings at close to 40% and revenue by 20% per year over the past five years, so it may require a strong stomach to pay that kind of valuation or buy near all-time highs, which is always hard to do… but they’ve certainly earned it at this point, and have at least a reasonable chance of keeping it up. That depends in large part on their two largest customers, Microsoft and Meta Platforms (META), and whether they continue to spend heavily on building and upgrading data centers, and, more generally, on whether the wave of spending to modernize and upgrade data centers, and build new ones, continues to move rapidly — that seems to be the consensus, and the rising tide will list Arista more than its competitors because they’ve been pretty consistently taking market share for years in the switching business… though things can change quickly on that front. I don’t really think of Arista as a “cybersecurity” company, but it’s true that protecting networks and managing traffic are inherently part of offering the hardware and software for switching within data centers, and security is probably becoming a bigger focus for Arista (as it is for all the other networking hardware/software companies, including Cisco). Whether or not Mizrahi’s claims about their ability to “handle” Rogue AI are particularly unique to Arista, or are a specific reason to own the stock, I have no idea.

But you already know most of that, since we’ve written about Arista so many times… here’s the Quick Take I shared with the Irregulars the last time the Motley Fool touted ANET as their “AI Phase 2 Stock” that runs “AI’s Invisible Goldmines,” just a few weeks ago — the stock is within 1% of where it traded back then, and there’s been no real news from the company:

Yes, this is yet another Motley Fool tease of Arista, a stock they’ve been pushing hard since 2017 — but this is the first time they’ve really touted it as an “AI” stock, with the argument that the rapid expansion of hyperscale data centers (those “AI Invisible Goldmines”) to meet the demand for AI processing will lead to more demand for Arista’s switching and routing equipment and software. Which is true, though it’s been difficult in the past to predict the waxing and waning cycles of capital investment in data center expansion, and that has led to some down years for Arista, mostly because they are very dependent on the order flow from Microsoft and Meta, which together accounted for 39% of Arista’s revenue in 2023 (and 42% in 2022), which makes a pause in orders if those companies re-prioritize in a given quarter or year a big deal for ANET shares. Today, buying ANET means making a judgement call about future growth — which is essentially true for any of the popular AI or AI-adjacent stocks these days — and investors seem to be more optimistic than analysts. They have plenty of surplus cash to survive whatever slowdown might come, and they’ve only been diluting shareholders by about 1% per year through stock-based compensation, with adjusted earnings now not too wildly far away from real GAAP earnings, and with real operating cash flow also pretty close to earnings (they’re valued at a little over 40X trailing free cash flow, and also 40X trailing adjusted earnings). They’re in fine shape, but probably too expensive if they’re only going to grow their earnings and cash flow at less than 10% in 2024, even if that growth picks up to 10-15% in the next few years (that’s the current analyst forecast)… and probably an easy buy if they’re going to continue growing earnings at even half of the 55-60% growth rate they’ve had over the past two years. If you think the analysts who follow NVIDIA and Arista are going to be accurate — which, to be fair, is very unlikely, NVDA analysts in particular have never gotten the “turn” even close to right when growth has collapsed or accelerated in the past — then ANET is actually more expensive than NVIDIA, growing more slowly, and more reliant on its largest couple of customers… but I’d be marginally more likely to buy ANET at this valuation than NVDA, even though I own the latter, mostly because I think Arista is likely to have more stable margins and less competition risk in any kind of growth “reset” over the next few years (and yes, that’s also a judgement call, and I could be quite wrong).

The clues are very specifically pointing at Arista here, so there’s no doubt on that front, though Mizrahi does throw in that “you can buy a piece for just $5” as a bit of a red herring… this is not a “$5 stock,” of course, Arista Networks is trading around $275 at the moment, but the fact is that the nominal share price doesn’t mean much anymore — almost all brokers will let you buy partial shares of any stock, so yes, you can buy $5 worth of Arista Networks if you like. Even if saying that is perhaps a bit misleading, and even if we do all tend to get a little psychologically hung up on share prices (what matters is how much you think the company should be worth overall, and whether you want to buy a piece of that, with the critical thing being the amount you want to invest, not the number of shares you would own… the number of shares is what creates the share price, and that’s very different from company to company, so it’s almost a random number and can change almost on a whim if the company issues shares or does a stock split).

It’s your money, as always, so you get to make the call — ready to bet on Arista Networks continuing its remarkable run? Scared off by the all-time highs and the investor enthusiasm? Let us know with a comment below… thanks for reading!

P.S. We don’t have a lot of recent reviews from Mizrahi’s Alpha Investor, and Gumshoe readers always want to know how real subscribers feel about their newsletters… so if you’ve ever subscribed to Alpha Investor, please click here to visit our Reviews page and let us all know what you think. Thanks!

Disclosure: Of the companies mentioned above, I own shares of Alphabet, Amazon and NVIDIA. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thanks Travis. I’ve owned ANET for years (thanks to Motley Fool), and it’s done very well, so it is pleasant to read your article and find that it is still being recommended.

Me, too. ANET is one of the few Motley Fool recommendations that have worked out for me. I’m glad that I don’t have to buy it at the current price, but also don’t have to sell it because it’s still rationally priced.

ANET’s a great hold for those prescient enough to have bought before the AI wave. As for buying, like its brethren, it looks to be about 50% overpriced. Maybe AI also stands for “Always Inflated”.

How can this be ARISTA when he keeps touting it as a $3 stock?

“Analysts predict a whopping 7,500% gain on this tiny $3 AI stock, get the ticker.” How can this be ANET , currently selling in the $275 range?