This article originally appeared as part of the Friday File for the Stock Gumshoe Irregulars on October 27th, and now that they’ve had a few weeks with it we’re opening it up to everyone, to help answer ongoing questions from readers. The story has not changed in any meaningful way in the past few weeks, though the market’s recovery has meant that the two stocks teased here have outperformed a bit and are now slightly more expensive… I’ll share a brief update at the end…

So what’s this Altucher “A.I. Crown Jewel” ad all about? Gumshoe readers are asking about it because of the exciting-sounding email that’s going around, here’s an excerpt:

“A.I. investors… get ready:

“Because this little-known supplier just received a GIGANTIC order from Nvidia.

“In short:

“This supplier is planning to pump out 2,000,000 units of a critical piece of tech which I call…

“‘The A.I. Crown Jewel'”

And once you click through to the “presentation”, which turns out to be from James Altucher in an ad for his Altucher’s Investment Network ($79/yr), which is one of the “entry level” newsletters at Paradigm Press, we get this excitement about riding NVDIA’s coattails…

“Nvidia is a company that one analyst says has, “monopolized the economics of A.I.”

“That explains why they’re making an estimated 1,000% profit on every single Crown Jewel sold.

“It’s an absolute cash cow.

“But here’s the twist:

“Nvidia doesn’t actually make this device….

“Every single ‘Crown Jewel’ – the one you see from the manufacturing clip on your screen right now — is supplied by one, single, mysterious company…

“And NO ONE else.

“Meaning…

“Nvidia’s little-known supplier currently has a monopoly on The Crown Jewel.

“It’s the only company in the world that makes this technology.”

Yeah, you probably can guess the answer already. Sorry about that, but let’s get a little more of Altucher’s hype first…

“Investors who own the supplier behind this world-changing technology could see a massive windfall.

“That’s why I believe this little-known ‘crown jewel’ supplier is the #1 investment for the A.I. revolution.

“But as I said…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“You don’t have much time to act.

“The Crown Jewel is ramping up into mass production, right now.

“In fact…

“This supplier is on track to ship out more than a half-million ‘Crown Jewels’ this year…

“And they’re slated up to pump out nearly 2 million ‘Crown Jewels’ next year….

“I predict this little-known supplier could even become the next trillion-dollar stock.”

So yes, for those of you who were hoping for some new and exciting little supplier, this is a bit of, well, a kick in the family jewels… Altucher is just teasing Taiwan Semiconductor (TSM), the world’s largest semiconductor manufacturer, and the company that makes all of NVIDIA’s chips (and most of the chips for almost everyone else, too, including Apple, AMD, etc.).

Taiwan Semiconductor had a “beat and raise” report last week, and told investors to expect “healthy growth” in 2024, but the booming business of making high-end GPUs for NVIDIA is not their only business, so not everything is doubling and tripling every time you blink your eyes… they’ve also seen declining sales of smart phones and laptops cut into demand for the chips that go into those products, which are still larger businesses for them than the highest-end GPU products, and there is also some general trepidation about softness in the semiconductor space, particularly following Texas Instruments (TXN) report this week that told us demand is pretty weak for a lot of industrial chip users. Taiwan Semiconductor is so massive, and touches almost every kind of chip, that they’re not really a “pure play” on AI excitement, even though, yes, they do make essentially all of the in-demand AI processing chips that everyone’s thirsting for right now. And even though they’re likely to ramp up production of those chips considerably next year.

Teeka Tiwari also teased Taiwan Semiconductor last month, here’s what I said about them at that time:

TSM does have high orders from NVIDIA right now, though they’re still suffering a bit because orders from other major customers, like Apple, are much lower than they’ve been in the past (Apple is by far their biggest customer), as many chips are still in a down cycle of falling demand right now. TSM is reasonably valued, and could perhaps demand somewhat higher margins in the future if they try to pressure Apple and others to pay more… but given their size and their huge customer base they will probably follow the chip sector’s up and down cycles in the future, too….

The challenge of slowdowns in other areas of semiconductors is real for Taiwan Semi, so despite the fact that it’s the global leader and is certainly a great company, with excellent profitability, it’s almost certainly going to earn a lot less this year than it did last year (estimates for this year are currently at $4.94 in earnings per share, they earned $6.57 last year)… but analysts do think that growth will kick back in again in 2024 ($6.06) and 2025 ($7.62). That’s not anything like NVIDIA’s wild earnings growth this year, but it’s still nice growth for a monstrously huge manufacturing company. At that valuation, TSM is trading at about 15X next year’s estimated earnings and pays a dividend of about 2%. Perfectly reasonable…. maybe even cheap… but not likely to be a nosebleed growth story even if AI continues to be a hot trend.

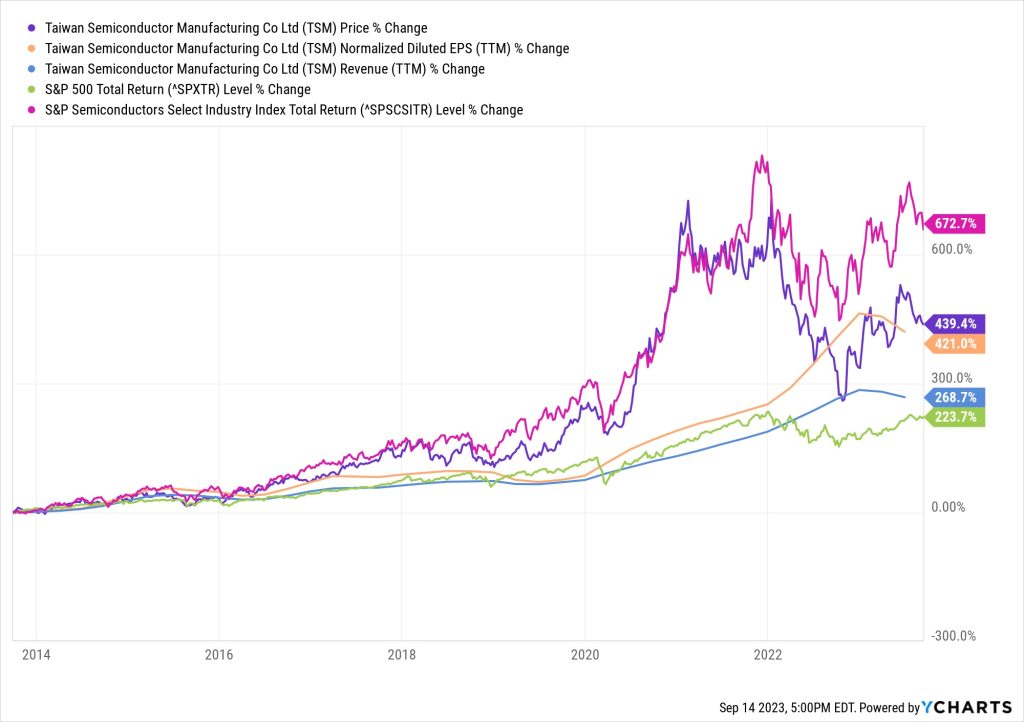

TSM has been the leading chipmaker for lots of hot trends over the years, and that has served them well, but they’re also so huge that they ride the cycles of the semiconductor business down during weaker periods, too. Here’s what their performance has been like over the past ten years, just to give a little perspective — it was the biggest foundry and arguably the technological leader ten years ago, too (Intel is the only one who might argue, really, that was right around when they started to lose the race)… thats the total return for TSM in purple, driven by their earnings growth (orange) and revenue growth (blue) over the years, compared to the S&P 500 (green) and the S&P Semiconductor Index (pink) (NVDA is up about 10,000% during that time period, which had a huge impact on the chip stock index):

So TSM has done well, and it’s not just multiple expansion — their earnings have grown, and the stock has kept up with that. There aren’t many more important companies in the world right now, so if you can accept that the biggest gains are likely to go to the companies who design hot products, not those who manufacture them, it’s probably a fine landing place for your money.

It’s just not doing great right this second. Making those high-end GPU chips for NVIDIA is a relatively small part of Taiwan Semiconductor’s business, and slowing demand elsewhere has clearly had a bigger impact on their factory utilization and revenue than NVIDIA’s rising demand. At least so far. The latest worry came out from reports over the weekend that TSM is asking suppliers to delay deliveries, because of slowing demand, but TSM management had already warned investors that the boom in AI chips was not going to be enough to offset the clear slowdown in the industry right now.

That can all change, of course. If it weren’t for the massive geopolitical risk as China continues to eye the absorption of its “renegade province” and Taiwan continues to arm itself for a Ukraine-like surprise invasion, I would probably own Taiwan Semiconductor today, I’ve looked at it many times but haven’t ever bought shares.

And there are plenty of other endorsements for this stock — Tiwari noted some famous investors who have bought TSM, and the list is even longer than that, though for most of them, of course, it’s a relatively small portion of their portfolio, and some of them have since sold down their positions (Bridgewater, for example, sold about 2/3 of its TSM position a quarter ago — but it was a trivial position for them even before that, well below 1%). Warren Buffett was probably the highest-profile investor in TSM in 2022, since he bought shares last year… but then he quickly sold them, with his rethinking of the geopolitical risk as the primary reason for selling all of Berkshire’s TSM shares within a couple quarters of buying.

I’ve admired Taiwan Semiconductor for years, and it’s hard to really imagine that China will take Taiwan by force and destroy or sequester the most advanced manufacturing facilities in the process… but the simmering standoff between the US and China, with Taiwan often in the middle, certainly increases the range of possible outcomes.

Most likely, though, the real risk is what we’re facing right now — that when Apple sells fewer iPhones, Taiwan Semiconductor sees lower demand and falling revenue. Apple accounts for something between 20-25% of TSM’s revenue in any given year and has been its largest customer for a long time (NVIDIA is probably ~6-8% of revenue, maybe a little more this year, they’re usually in the top five customers), but the roster of large customers for Taiwan Semiconductor is a who’s who of the chip and electronics world — Qualcomm, AMD, Broadcom, NVIDIA, MediaTek, Intel, Marvell, Sony, Amazon, STMicro, Infineon, and many more. TSM may build the future, but not all of their customers have strong demand growth every year.

With one more quarter under their belt, things haven’t changed much — the earnings estimates for this year have now grown to $5.13 per share, about 5% higher than they were before the latest report, but future expectations are largely the same… the stock is close to where it was when Teeka touted it, so TSM is now trading at about 14X 2024 earnings estimates (17X likely 2023 earnings), with a dividend yield of about 2%. Still rational, still not a super-fast growth story, particularly with NVIDIA a little off its highs as we wait for their next earnings report in a few weeks, and for key customer Apple’s report next week… but who knows whether enthusiasm for AI will pick up again.

That’s now shifted a bit — the earnings estimates haven’t changed, nothing dramatic is different about the business, but the stock has risen since we first posted this article, so TSM is now valued at about 16X forward earnings.

Altucher had a second tease in this pitch, too:

“Step #2: Buy The Secret Technology Behind The A.I. Crown Jewel….

“The Crown Jewel is made with the earth’s purest metals…

“It’s produced with the world’s most expensive machines…

“It requires fifteen HUNDRED carefully planned steps…

“Each one executed with pinpoint precision.

“And there’s one piece of computer engineering equipment that’s absolutely VITAL to making this A.I. chip.

“Chip experts even believe this is the most important technology in the entire A.I. supply chain.

“And the best part?

“There’s only one company in the whole world that makes this special piece of computer engineering equipment.”

Well, that’s not a super-specific tease… but given the “one company in the whole world” bit, the best guess is that Altucher is pitching the Dutch lithography giant ASML (ASML), which has drifted back down to a more reasonable valuation recently, probably mostly because of the export restrictions that are preventing them from selling their most advanced chipmaking machines to China.

I last covered ASML when the Motley Fool was calling it the “most important company in the world,” and it’s one of the few real monopolies in the semiconductor capital equipment space, though I don’t know how technology is moving forward or if the need for their equipment will continue to be huge forever. If you don’t know the company, you can get a great background quickly by listening to the ASML episode of Business Breakdowns from a few months ago.

The big change recently, and the reason the stock has dipped back down to a more normal-sounding valuation, a place where it rarely resides, is that the company issued shockingly weak guidance last week in their earnings report — they still think 2023 will end up being a 20-30% growth year in revenue, but that 2024 will be flat, thanks to a dramatic slowdown in demand for semiconductor capital equipment as their customers pull back in a weaker market for chips, before growth picks up again in 2025. And they’re not just speculating that things look weak, their bookings have fallen apart in the past couple quarters (they had almost $10 billion in bookings in the third quarter a year ago, and that’s now fallen to about $3 billion).

As happens so often in this space, bust turned to boom, and then busted again. There’s a longstanding pattern in semiconductors — demand soars because of hot products or economic growth, companies build up capacity to supply chips for that demand, which sometimes takes years, that huge increase in capacity keeps prices down, and then we eventually get to “oversupply”, usually because demand falls, and profit margins collapse.

What’s clouding that picture a little is the global effort to reduce reliance on both Taiwan and China for chips and related manufacturing capacity, so the US and Europe and Japan and countries in Southeast Asia are all pushing to build semiconductor factories… which means a lot of them will need ASML equipment, but maybe not as soon as next year. And it means there will be a lot more capacity in the future… but maybe also a more divided world, with shorter and more constrained supply chains, which will have an unpredictable impact on chip pricing.

That’s a long way of saying I don’t know how this will work out, but ASML, assuming you believe that the world will keep building more chip production capacity, and that demand for semiconductors will normalize over time but generally keep rising, is priced more reasonably now than it was for most of the year. Still, it ain’t cheap — ASML analysts now forecast that they’ll earn about $20 per share both this year and next year, then will grow again to about $29 per share in 2025, so that still averages out to about 20% per year. ASML is currently valued at about 28X earnings, which is firmly in the “reasonable” camp for that kind of growth rate, particularly for a high-margin company that has always been very profitable, continues to not have any strong competition in their core business, and doesn’t have any egregious caution flags like extreme stock-based compensation (their “adjusted” earnings and GAAP earnings are just about identical). Not a bad idea, in my book, though I don’t own the stock, but the bifurcation of China and the rest of the world is certainly bad news for them in the short term, even if it perhaps ends up being good news in the end by creating a larger (and more diversified) customer base.

And yes, these two stocks are tightly intertwined — Taiwan Semiconductor is usually ASML’s largest customer, so to some degree they’ll rise or fall together. As with Taiwan Semiconductor, ASML has not seen any changes to its earnings estimates or growth forecasts, and there’s been no big news out of the company, but the rise in the share price has bumped the valuation up a bit — ASML is now trading at about 33X earnings, at $680 a share… which is still reasonable if they can really grow at 20% per year over time, but it makes that growth more important.

So… nothing brand new here for you today from Altucher, but that’s another vote that two of the largest companies in the semiconductor space will continue to be beneficiaries of the surge in A.I. enthusiasm and chip demand… and yes, it might be that eventually Taiwan Semiconductor joins NVIDIA in the trillion-dollar club, but it wouldn’t be all that dramatic, they’re already more than halfway there with a market cap above $500 billion.

Your kind of stocks? No thank you? Do let us know with a comment below… thanks for reading Stock Gumshoe!

P.S. What’s been happening since October 27? Well, a little thaw with China and some resurgent confidence in tech stocks, thanks in part to inflation coming down, have helped these shares bounce back a bit from their October lull… here’s what they’ve done over the past few weeks, you can see that they’re essentially trading in lockstep and are outperforming the market (that’s the S&P 500 in orange):

Disclosure: Of the companies mentioned above, I own NVIIDA. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thanks again, Travis!

“the geopolitical risk” Will probably hammer many items soon. Good assessments

Could be, but lots of folks are also saying hopeful things following the Xi/Biden meeting yesterday. Talking is better than Taiwan flyovers, at least.

TSM is correct. Up over 15% since he recommended on 9/21/23. Other September recommendations INTC up 14%, MSFT up 13%, PATH up 12%.

I followed this author several years ago and lost money. He is trying to attract a new audience using other people’s ideas and research. APhone?!

Travis do you know what this is? Google is about to launch a new AI project that’s 5X better than ChatGPT. And I’ve found a way for you to profit from it.

Google paid me over $1.5 million in 2022 (click here to see the 1099 tax form that proves it).

And through my knowledge of Google, I’ve discovered a company that’s supplying a key piece of technology that makes Google’s new AI project possible.

I’m confident anyone who gets shares in this Google supplier today could see massive gains.

Who’s it from? Doesn’t ring a bell, but I can check out the ad.

Hi Travis:

I have the subscription, and I can confirm that Colin Tedards is recommending Broadcom (AVGO), as the #1 AI Stock (Google’s secret supplier).

Kaz

Hi Ladylothar:

I have the subscription, and I can confirm that Colin Tedards is recommending Broadcom (AVGO), as the #1 AI Stock (Google’s secret supplier).

Kaz

ASML is a long term investors Dream Stock! They have a Monopoly on high end equipment to point they can charge whatever they want for it. Customers want machines before they can even be fully tested & place orders for high end even before they’re fully designed much less built!

Their moat looks more like an ocean!! Look at EPS!!

It’s starting to happen! Intel (Intc) is the play. They will equal or surpass TSMC with the execution of the 5 nodes in 4 years strategy manufactured in US Fabs. Gelsinger has the company on track and Wall Street has begun to notice

And who is making the machines Intel is gonna use?

Check who has orders in for ASML machines not even being built yet!

One item seemingly glossed over with this week’s Biden-Xi summit was our reassertion of the “One China” policy, which was probably a prerequisite for the meeting taking place. This is one potential problem that won’t go away by ignoring it. Buffet likely was right to exit his position in TSM. One way to take advantage of the AI/semi hype and mitigate the risk is to buy the VanEck Semiconductor ETF SMH, which at the moment is approximately 19% NVDA, 13% TSM, and 6% ASML among the other giants that no one ever heard of. The 10-year total return is 23.5%. Who needs Altucher ?

A1 Crown Juwel? If the Chinese economy collapses, the question is: will they pull the nationalist card and invade Taiwan, Too risky for Me. I invested heavily in Lithium, rare earth, etc and it cost a lot of money. Salea in EVs has dropped a lot in China, so the price of Lithium has fallen drastically..

I cringe when I hear investing heavily in anything. I thought it was a good idea also and bought a small position .50% size in LTHM.. im only down 50%

Its very dicey use caution here

Does anyone know what the AI stock/crypto that is patent pending that Teeka is recommending?

Great question on Teeka’s secret patent pending crypto?

As Usual, Great Job, Travis. I am a subscriber to this rather bombastic newsletter, that currently has about as many losing positions as gainers. Yes, they want. you to think they are your source for AI, but WEISS & NAVELLIER and others will tell you they have the Magic KEY for AI Stocks.

What seems to be the common denominator are the MEGA CAP stocks like NVDA, MSFT, and even TSLA.

The rest of the list is the “who’s who” of tech stocks like ASML, AVGO, LRCX, TSM, AAPL, PANW, ANET and many more. In other sectors, we find ISRG, CCJ, MDT, ALB, AI&BKR in Oil, and many more.

Here is a straight up AI list, to answer the tease question here:

MSFT, TSM, PATH, AMZN, DT, INTC, NVDA, ASML, ROK, SOUN, NRDY, FSLY, IONQ, VRNT.

Some people have been making money shorting the last 5 entries. Buyer Beware, any of these companies could be bought out or morphed into some other entity. Check out SVB and CHATGPT.

If you are correct, and I have a lot of confidence you are! He owes an apology to the people he sucked in. I have almost no belief in any of the pitches that are 10 minutes or longer. Someone said they make it so long is that way the people are more apt to buy! NEXT!

If they don’t offer a transcript, I am gone!

No, after watching a presentation that long you say to yourself, I’ve already wasted that time, that I’ll never get back so you buy a subscription cause it doesn’t seem that much more than the time watching it

I’m leary about these picks, is Altucher the only one who sees this?

Hi, Does anyone know what Altucher’s pitch about “The new AI 2.0 wealth window” is about? He’s saying it’s 10X bigger than crypto. He’s saying the wealth window is now through January 9th, 2024…. Bizarre it’s such a short window…. Anyone have insight? Thank you!

Funny, Altucher’s same pitch on YouTube dated March 3rd 2024 (The News Flash: Window of opportunity closes March 8th 2024) I guess AI 2.0 had been extended from your January window of opportunity! I wonder if all these solicitor’s M.F and others who are vying to milk the cow meet to discuss the price of milk?

What say you regarding teeka’s “Opt out of digital currency”

Mostly that it’s fear-marketing poppycock… but we have covered that pitch a few times (it’s been running since July, with minor updates): https://www.stockgumshoe.com/reviews/palm-beach-letter/whats-up-with-fednow-fedcoin-and-the-us-dollar-recall/

check out Wistron Corp (3231.TW). interesting player in information technology market.

Thanks… what makes them interesting?

Global exposure and perhaps an under the radar play.

//www.wistron.com

check it out Mr. T and give us your thoughts.

Salud Amigo!

AI stocks I thinkolate are POET RGTIW, RBOT. QTIW, QUBT

You guys do an amazing job!!!!!

Why is anybody even talking about any of this 2-3x nonsense when we are in a predictable cycle right before the Crypto facemelting boom of a lifetime. Quit stocks, wall street is worthless til they are forced onto Blockchain and have transparency. Dark pools make me sick, and don’t get me started on the FTD graveyard.. WAKE UP! Web 3 is the people fighting back for our money and our futures… Join the movement and make insane cash, then I will gladly return to the real actual earning businesses with the rest of the smart money. But while the casino is open and the cycle is on the upswing, all these overpriced stocks are a waste of time… Just saying ALTUCHER wrote two of my favorite books, he’s a legend, and I guarantee he’s in crypto right now! Don’t miss out yall

Hope the cycle turns out to be predictable for you!