Dylan Jovine has been pitching a few different defense-related stocks for several years now, including some A.I. companies tied to the war in Ukraine as well as some aerospace and missile companies… but I haven’t covered one of those in a while, and we’ve got a new take on the spiel from his Behind the Markets newsletter that a lot of readers are asking about this week, so it’s time to dig in again and get some answers.

Most of these ads have a “hook”, of course, to get your attention by connecting to the news of the day — so it could be the war in Ukraine, the fear about China invading Taiwan, or, more recently, the renewed cycle of violence in the Middle East after Hamas’ large-scale terrorist attack on Israel back in October. This time the ad is introduced mostly with the “Israel” connection… here’s part of the latest email I received:

“Subject: Israel’s brand new weapon…

“The US has co-developed the most advanced weapon in the world – in a multi billion dollar deal with Israel.

“Sending billions of dollars worth of weapons to Israel to fight Hamas.

“Including a brand new weapon the New York Times says is, “impossible to defend against”….

“The soaring demand for these weapons will undoubtedly have a major impact on this defense contractor’s stock price.”

“Undoubtedly a major impact,” eh? That sounds like a reason for temptation. So what’s the story?

Well, that email focused on Israel actually leads into a pitch called “Project Overmatch”… and it’s mostly about China. The ad is for Jovine’s Behind the Markets ($99/yr), and here’s the intro:

“Pentagon Unveils New Plan to Counter China –

“Project Overmatch”

“New Military Plan Will Replace 20th Century Weapons with Weapons that Could Win Wars in the 21st Century

“Early Investors Could See 35,960% Returns With Small Defense Contractor Who Won this Groundbreaking Contract”

That “Overmatch” bit is about the seeral reports of war games and scenario projections that have the US facing huge losses if we get involved in a battle with China over Taiwan… that “Project Overmatch” is specifically an initiative by the Navy to improve their “operational architecture” and enable ships and warfighters to communicate and organize more effectively, including the use of drones and similar systems, but I guess it’s part of the ongoing efforts to modernize all aspects of the military, especially the communications, command and control systems (the Air Force has “Advanced Battle Management,” Army has “Project Convergence,” etc).

But as we drift through the ad “presentation” a bit more, this becomes much more specifically about a particular weapons program, hypersonic missiles… which is something Jovine has been touting and teasing for almost four years. Is he still pitching the same company? Let’s check out the clues…

“At the center of all this spending is one new weapon that’s straight out of a SCI-FI movie.

“CBS News Reports: ‘It’s an entirely new type of weapon.’

“The NY Times Reports: “No existing defense can stop it.”

“And the U.S. Army said, “We’re going to make a lot of them very quickly.”

“I’m going to tell you about the small defense contractor that beat out big firms like Lockheed Martin and Boeing to make it for the military.

“A small contractor that reminds me of General Dynamics, which soared 8,990% after inventing the Tomahawk Missile for the Navy.”

And that’s where Jovine gets the oddly precise (and massive) return promise he dangles to tempt us…

"reveal" emails? If not,

just click here...

“But investors in this small company could make four times as much, or 35,960% on their money.

“That’s because this new weapon won’t just be adopted by the US Navy.

“It’s being adopted by all four branches of the military – the Army, Navy/Marines, Air Force and the Space Force.”

OK, so… General Dynamics had a 8,990% gain over about 30 years… and because this new missile might have four times the customer base, since they’re selling to all four branches of the military, it’s going to post 4X that return, or 35,960%?

I hope you can tell intuitively that this is a ridiculous forecast. Erase those 36,000% returns from your mind. And yes, Jovine made exactly the same prediction, with that same 35,960% gain for investors, in the first version of this teaser pitch, which we saw for the first time in July of 2020 — back then he was calling this hypersonic missile the “first 5G weapon” and the “5G Arrow.”

But otherwise, the tale here is essentially identical to what we covered back then… at least up to this point, though the latest version of this ad is peppered with some more updated info, like the frightening results of the “War Games” that they staged on Meet the Press back in the Summer of 2022 (which led to China attacking Hawaii, Alaska and San Diego), but then we just get some reworded hype about this “small defense contractor” ….

“We have to begin developing these weapons.

“That’s why the military has said it’s their “#1 Priority.” They’ve already budgeted billions of dollars to these weapons.

“And in a moment, I’m going to tell you about the small company that won the rights to be the first to manufacture them.

“In other words, we know the military is spending billions of dollars on these weapons and we know the name of the small company making them!

“That gives early investors the opportunity to earn 35,000% returns on the small defense contractor making them.”

Sorry about that, now you have to erase the “35,000% returns” from your brain again, otherwise it would be almost impossible to evaluate the investment rationally. But what’s our company?

It is, indeed, the same as it was back in 2020 — Jovine is again teasing Leidos (LDOS), a major government contractor, because they own Dynetics, which is the prime contractor for the manufacture of the glide bodies for the Army and Navy hypersonic program.

The challenge, though, is that this is still a very small part of Leidos — the latest contract was a $428 million four-year deal to build prototypes for this Common Hypersonic Glide Body, awarded back in July, so we’re not exactly dealing with a mass production item just yet, and that ~$100 million/year pretty quickly gets swallowed up by Leidos’ gigantic government (and civil) contracts that are generally much more focused on IT services — many of these contracts are very long (7-10 years), but Leidos booked $7.9 billion of new contracts just last quarter, and their backlog is currently $38 billion ($9 billion of which they say is actually funded, and therefore more likely to be secure). Leidos is a $15 billion company that also has annual revenue of about $15 billion, so hypersonics are not particularly close to “moving the needle” when it comes to their financial performance.

But who knows, maybe someday.

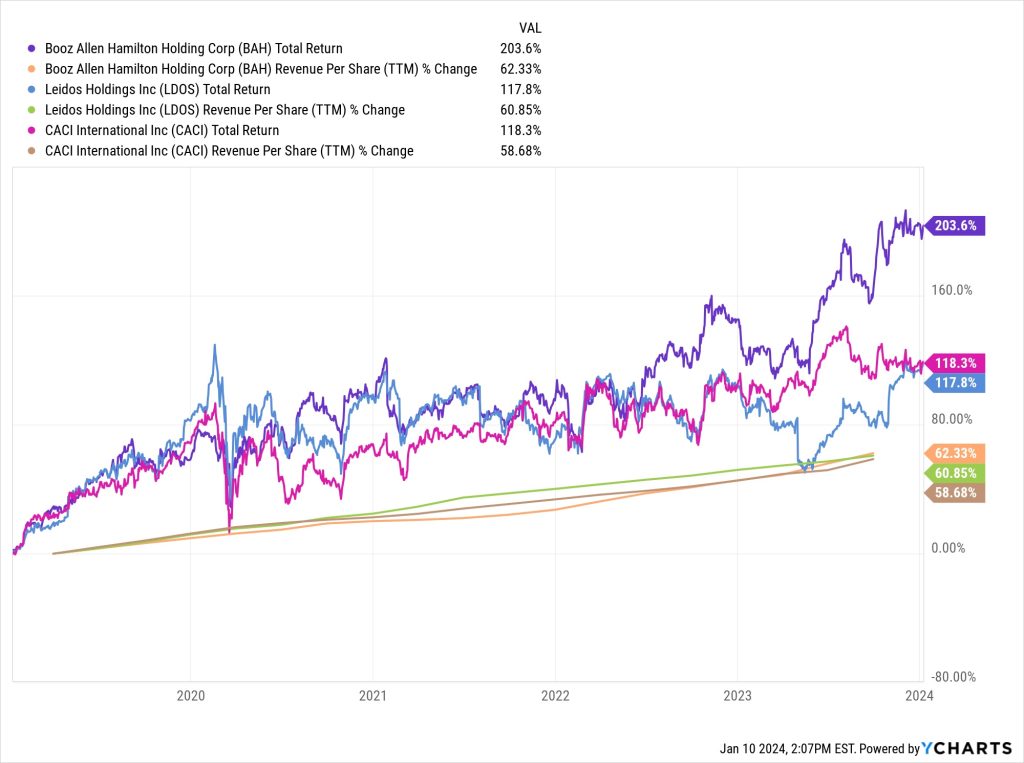

How does Leidos look now? Pretty decent, as long as you get that “35,000%” idea out of your head. They are reasonably valued, at about 15X current-year earnings, with earnings likely to grow somewhere in the 5-10% range each year, on average. They are a little cheaper than big weapons systems contractors like Lockheed Martin (LMT) or General Dynamics (GD), which are not currently growing quite as fast but are expected to benefit from increased defense spending in general… LDOS trades at a similar valuation to Huntington Ingalls Industries (HII), with also a pretty similar likely growth trajectory — HII is the only defense contractor I currently own, though none of these weapons system contractors are really good comparisons for Leidos, which is much more of a people-driven IT contractor than a product-driven weapons manufacturer, and which ought to be more “asset light” in nature. Probably a better comparison, despite that little hypersonics business hiding inside Leidos’ Dynetics subsidiary, is CACI International (CACI), which similarly provides IT services to the government… or perhaps Booz Allen Hamilton (BAH), the big technology consulting and management consulting firm which primarily provides services to the government (not just defense, but including defense). BAH is much more profitable, and has generally had better growth, but it also trades at a much richer valuation, CACI is a closer match to LDOS when it comes to growth and profitability… here’s what the three have looked like over the past five years, they’ve all had roughly the same level of revenue growth, but Booz Allen has had by far the best stock market performance:

So that’s not especially new, but it’s still a reasonable company with a pretty steady business and a rational valuation. It hasn’t done much in the years since Jovine started pitching the stock — this is the performance of LDOS (in purple) since the first version of this ad I could find, back in July 11, 2020, compared to the Invesco Aerospace & Defense ETF (PPA, orange):

What comes next? Well, I’m afraid I am somewhat fearful that defense spending around the globe is likely to rise substantially over the next few years, with all the threats we can all see on the horizon, and that’s probably at least a small boost for Leidos. Doesn’t seem likely to make them outpace the sexier companies that actually make the tanks, aircraft carriers, bombers and missiles that are in demand today, but there’s probably some possibility that they could turn their Dynetics subsidiary into something far larger if they can really get a handle on this hypersonic missile business, though at this early prototyping stage, with many failed hypersonic tests by various US defense contractors over the past few years, I wouldn’t be heavily on that outcome.

And Jovine also includes some other “new age” defense companies in his tease, so let’s see what we’ve got on that front…

“Weapons Stock Pick #2:

“Identify & Target: The $7 AI Stock that Will Target Incoming Threats”

“In the battlefield of the future, success is going to come down to how quickly our soldiers detect and target incoming threats.

“Our second stock pick is a small software company the Pentagon has hired to do just that…and it’s only trading at $7 a share.”

That’s almost certainly a pitch for Palantir (PLTR)< though that "$7 a share" clue tells you how long it's been since Jovine updated this part of the ad -- PLTR was at that level before the AI mania got fired up back in May of 2023, and Jovine was also teasing the stock at that time in his Ukraine-focused teaser ads, but PLTR shares are currently closer to $17. And growing not really because of the government, but because they’re piling up new corporate contracts surprisingly quickly. It’s a tough sell whether Palantir can grow quickly enough to justify the current valuation, which is roughly 60X adjusted 2023 earnings (their stock-based compensation is massive, so it’s more like 200X GAAP earnings), but they are at least growing, and it’s a popular stock idea again these days.

Next…

“Weapons Stock Pick #3:

“Eliminate: The Small Cap Laser Stock that Will Shoot Down Incoming Threats”

“The AI stock I just told you about is going to help our soldiers identify and target incoming threats.

“But in the battlefield of the future, we’re also going to need to be able to shoot down incoming drones and missiles in an instant.

“A laser is more precise than a bullet and travels 50,000 times faster than an ICBM can. At a cost of only $1 per shot, you can see why our armed forces are adding them as quickly as possible.

“Our 3rd stock pick is a small cap defense contractor that’s fast becoming one of the top laser firms on earth.”

Not a lot of clues there, but I suspect Jovine is probably pitching the Israeli defense contractor Elbit Systems (ESLT), which works on a lot of different programs, including the various missile defense systems under the “Iron Dome” and “David’s Sling” programs as well as some laser weapons (counter-weapons, really). They’re profitable, and have grown revenue at about a 10% annual rate over the past five years, but they haven’t really become more efficient or profitable over time. There’s not much analyst coverage, but the expectation is that earnings will be in the $6-7 range this year and over the next couple years, so there’s not an obvious high growth story to go along with the premium valuation (30X earnings). That’s about all I know about this one.

And one more…

“Weapons Stock Pick #4:

“Attack: The Small Cap Drone Stock Poised for the Counter-Attack”

“The $7 AI stock I just mentioned will help our soldiers identify and target incoming threats.

“And the small cap laser stock I just mentioned will help our soldiers shoot down those incoming threats.

“But the fourth stock in our special report does helps us hit back. And it does this by supplying our Army drone swarms.”

Again, not so many clues here… but if you’re looking for an established and profitable pure play on drones, particularly military drones, then you’re probably looking at Aerovironment (AVAV), which has been the leader in that space for a very long time. This is now a $3 billion company, trading at about 44X adjusted earnings and with strong bounce-back growth this year that will probably lead, according to the few analysts who cover the stock, to earnings growth in the 15-20% range going forward, so they’re right around the top end of a “growth at a reasonable price” valuation, at least in my book (I like to see a PEG ratio below 2.0, which means a PE ratio that’s less than half the expected earnings growth rate). It’s been a volatile story, with lots of ups and downs over the years, but they would certainly like to be the key player for those future “drone swarms”.

And I’ll leave it there, dear friends — an ongoing pitch for Leidos because of its (relatively small) role in the early phases of developing hypersonic missiles, plus pitches for Palantir (PLTR) and (probably) Elbit (ESLT) and Aerovironment (AVAV). Not crazy ideas, and all are tied in to some degree with what one might guess the future defense spending trends might be — but there’s also always the option of a broad-based defense ETF, too, with the biggest distinction among those being “more Boeing” (iShares Aerospace & Defense (ITA), with almost 20% of the ETF allocated to Boeing shares, or “less Boeing” (Invesco Aerospace & Devense (PPA), with a 6% allocation, or S&P Aerospace & Defense (XAR), which is ~4% Boeing.

Have a favorite from this group of four stocks, or elsewhere in the defense space? Prefer to avoid defense stocks? Let us know with a comment below… thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of Huntington Ingalls Industries. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Good coverage, especially less Boeing?

I’ve been a long-time investor in Leidos (LDOS) and its predecessor SAIC since the latter’s IPO in October 2006. It’s been a bumpy but net profitable investment. However, if I were a first-time investor or putting new money into the aerospace/defense sector, I would buy an ETF, for broad diversification and less risk and volatility. This industry is funded largely by governments around the world, so its revenues and profits are largely political. Politicians like to spread the wealth around to many contractors at multiple locations and levels (e.g., prime, sub, sub sub, etc.). ETFs provide more exposure to lots of contractors along the myriad complex supply chains than individual stocks.

Private equity firms such as The Carlyle Group (CG) have also been active players in the A/D industry, so that’s another way to invest in the A/D industry.

I recently ponied up $49 to subscribe to J’s newsletter. (apparently 1/2 off)

His 3 AI defense stocks are: AI, PLTR, SPLK.

J also has a “First UFO weapon” report, that lists 4 more:

SPR, NOC, LMT, and LDOS.

No mention of ESLT or AVAV.

SPR, Spirit Aerosystems, is the smallish company with the biggish hypersonic potential. Because the Army, Navy, Air Force, & Marines will ALL want these weapons!

Plus, he makes the case that this tech came from reverse engineering Actual Recovered UFOs! They can go fast & suddenly change direction, like UFOs.

Furthermore, the testing thereof accounts for the recent huge? increase in UFO sightings over New Mexico!

SO, with all that in mind, I think I’m just going to buy one of those ETF’s you mentioned.

If the ETF is, say, 5% Boeing, then one could buy 20 shares of the fund, and short 1 share of Boeing to deBoeingify it. Or, why bother?! Boeing has (since 1/1) gone from 267 to 217, a 19% $3 B trim. Fixing this latest stupid problem with the MAX will be much simpler than the previous antistall system firmware debacle. Assuming nothing ELSE will go wrong with the MAX…

CS

Just follow Nancy Pelosi’s holdings and you will do fine.

99 Stocks Political Insiders Are Buying Before the Election

https://thefreeportsociety.com/2024/03/04/99-stocks-political-insiders-are-buying-before-the-election/?utm_source=fpng&utm_medium=eletter&utm_campaign=&utm_content=03-04-2024

Just how long has Dylan Jovine been recommending Leidos? Was it after the Wright Brothers took off from Kitty Hawk?

Ha! About 3-1/2 years, from what I can tell.

Hypersonic systems have been around for a long time. I believe the only reason they are in the news today is because the Russians and the Chinese have managed to steal the technology and the media is hyping it up.

There is probably an unknown company already producing some form of hypersonic missile if not a type of UFO along with defensive controls but it is good business to get other entities involved as if it were a new idea and to continue the parade of deception. Standard procedure ( for national security of course)

Still, investing in the right companies in this area can be profitable. Appreciate the thorough research.