I’ve been getting more questions about this “Billionaire’s Portfolio” service lately, so we’ll get you a quick answer to one of their teaser pitches today.

The newsletter itself is essentially one in a long line of “whale watcher” services — those who follow big investors, mostly through SEC filings, and try to either mimic their portfolios or hand-pick their best ideas. They try to focus on the “best of the best” in institutional and hedge fund managers.

There are obvious concerns about the strategy. It’s hard to mimic the portfolio of even a pretty open and slow-moving hedge fund (like Bill Ackman’s Pershing Square, for example, which typically owns less than a dozen stocks and doesn’t trade much), partly because they generally have to file their portfolios only once a quarter, with a 45-day lag, and we don’t generally know exactly when or why they bought or what price they paid, and partly because they only have to disclose US-traded positions.

And it’s also questionable whether anyone can look at a hundred different institutional portfolios and somehow do as well as (or better than) those portfolio managers by just picking the “best” ideas from those funds. That means you’re dealing with not just the risk that one manager could make bad choices (as most of them do, more than half the time), but with the additional risk that the person selecting the “best of” from those managers could make bad selections.

That’s not to say it’s not worth checking out the portfolios of successful investors — we all do it, and it’s an interesting way both to learn about new ways to think about your investments and to identify promising investments that you might want to consider. But don’t gloss over the fact that active stock investing is hard to do well, and that picking the “best of the best” is probably even harder.

Here’s how Billionaire’s Portfolio describes their service:

“We make things very simple. Our customers pay us a quarterly subscription fee, and we give them open access to see our carefully designed portfolio of stocks that are owned by the world’s best billionaire investors and hedge funds – plus a lot more.

“Our premium research service, The Billionaire’s Portfolio, is a hand picked portfolio of the 20 best ideas from the world’s best hedge funds and billionaire investors. We follow the world’s best investors. You follow us.”

So with a little bit of buzzkill firmly under our belts, what’s being teased today by Billionaire’s Portfolio? Here are our clues:

“… we will send you the name of the beaten-down commodity stock that one of the best, most seasoned activist investors in the world has gone ‘ALL-IN’ on.

“We currently hold this stock in our Billionaire’s Portfolio and it has all of the trappings to be the next billionaire-maker. Consider this: This pioneer activist investor has 100% of his fund in this stock, he controls 100% of the board, he has his hand-picked CEO running the company, and he has a price target on the stock that is 1700% higher than current prices.

“The CEO he has put in place has cleaned house and has the company running, in the words of this investor, like a ‘perfectly well run humming machine.'”

OK, so I know we’ve already lost some of you because of that bad word in there (“commodity”) — but is this a beaten-down diamond in the rough? Or iron ore pellet in the rough?

A little more inducement from the ad:

“The last time this CEO was put in place to turn around a metals company, he produced 20x return for shareholders.

“Given the beaten down prices of commodities over the past year, and the nascent recovery, it’s not unlikely to see some of these commodity stocks move 20% to 30% in a day, or 50% in a week.”

So … hoodat?

This is, hold your nose, Cliffs Natural Resources (CLF), the big iron ore miner (formerly known as Cleveland Cliffs).

And yes, it is firmly in the hands of an activist investing hedge fund (well, former hedge fund) — which is losing money hand over fist on the deal.

The activist investor they’re following here is Casablanca Capital, run by Donald Drapkin — who does have a long history, including some with dealmaker Ron Perelman, but, as far as I can tell, has never been a widely-followed activist investor. Casablanca is apparently (at least, according to the interview in this installment of Activist Insights last year) no longer a hedge fund, but is an investment management company that takes on investments on a case-by-case basis. Whatever that means.

They do still file 13Fs when required, as with their ownership of a bit over 5% of Cliffs, but though CLF is the only stock in their 13F filings that doesn’t mean it’s 100% of anyone’s portfolio — most of the portfolio of Casablanca, if you can consider them as having a portfolio, is not in US-listed equities that require 13F disclosure, from what I’ve seen CLF is now probably between 5-10% of the money managed by Drapkin et al. They have really moved, it appears, from managing a portfolio that they might use to buy lots of stuff to calling around to investors when they do have an idea (like CLF) to raise a lot of capital for a “one off” campaign. I can’t imagine how hard it’s going to be for them to raise that kind of money again for an activist stake, given the abject failure, at least so far, of the CLF investment.

That same interview indicated that Casablanca raised $200 million for the investment in about 5% of Cliffs, which was followed by a (successful) proxy battle that ended with Casablanca replacing the board and installing a new CEO. I don’t know exactly what Casablanca paid, but it doesn’t look like they’ve sold any over the last year and a half, they still own a bit over 5% and those 7.9 million shares they own are now worth about $24 million. They’ve seen paper losses, now, of probably at least 75% and perhaps as much as 90%, depending on exactly how much they actually paid (the stock was already moving down while they were building their position, the Activist Insight article notes that they estimate Casablanca paid about $25 a share).

"reveal" emails? If not,

just click here...

Drapkin reportedly said last year that a “competent CEO” could drive the shares of CLF back to $50 (they were somewhere in the teens at that point), and he got his experienced CEO (Laurenco Goncalves, who had turned around a steel company for Apollo and sold it to India’s Reliance a year or two prior), who is still running CLF. The shares are at $3, and the original activist proposals from Casablanca weren’t really followed — whether because circumstances changed or because they changed their mind, I don’t know. The original idea was to spin off all the aggressive international expansion Cliffs had done, revert to their Great Lakes iron ore focus, and convert their long-lived, steady iron ore mines into a Master Limited Partnership (MLP) that could churn out a high yield for investors and get everyone excited again.

Not terribly shocking in the world of activist investing — the idea, to probably oversimplify, is to take something that investors don’t like and shake it up somehow so that investors will like it again — in this case, getting rid of expensive expansion projects and paying a big dividend.

But it turned out that iron ore wasn’t just in a soft patch, the problem wasn’t just that management had overextended themselves or failed to structure the company properly… iron ore was in a full-blown crash, and no one knows where the price will go from here. There is so much capacity now, and so little growth expected in steel demand in China, that it’s hard to see the big supply/demand imbalance shifting away from oversupply anytime soon — though, as you’ll often hear stated, “the cure for low prices is low prices” (because low prices stop mine development and slow production but also, usually, spur demand).

With the recent spikes in iron ore starting about ten years ago, all really spurred by massive increases in steel demand in China, it’s easy to forget that iron ore traded at $25-30 a ton for a good 20 years before that. The $55/ton prices we’re seeing now seem shockingly low for those who saw the spikes in 2008 and 2011 (or who invested aggressively in expansion while those prices were spiking, like Cliffs and all the major miners did), but we may still be on our way down to a “new normal” in lower prices — particularly because of the massive capacity that was added to the system by big players like Rio Tinto, Vale and BHP Billiton who developed huge new mines while prices were climbing.

Though, to be fair, I should account for inflation — that might make you a little more optimistic. Iron ore was at $28 a ton in January, 1980, and it’s at $55/ton today. But a dollar in 1980 went a lot further than it goes today — if we adjust the price just for inflation, using the CPI, then that $28 in 1980 would actually be about $81 today. So if iron ore had simply kept up with consumer price inflation, it would be 50% higher today. That’s your little taste of hope, but it doesn’t necessarily mean iron should be at $81 today — there’s certainly no sign of a shortage of the stuff either in stockpiles or in the ground, and Rio Tinto (RIO), for example, is still increasing production at their Pilbara mines in Australia and can turn a profit eve with iron ore below $50 (so can Brazil’s Vale). The big hope is that low prices force shutdowns of Chinese mines, which are much more expensive, and help to drive prices higher… but most scenarios I’ve seen predict a continued surplus for seaborne iron ore (stuff that can feasibly be sold to China) going out at least two more years (not that those predictions are accurate, necessarily — but, unlike me, they’re at least doing more than guessing).

This is the problem with activist investing in commodity companies — even if you do clean up management, or create a better corporate structure, or rationalize capital allocation within the business… there’s a huge amount that is completely outside your control, since no amount of activism will change the price of iron ore on global markets. Drapkin isn’t the first hedgie to face this problem, obviously (David Einhorn’s fund has been clobbered this year partly because of his bets on Canadian oil, coal, and gold)… and this commodity exposure isn’t a problem that’s limited to a few hedge funds either, of course… I’ve certainly had some periods of very bad performance in my personal portfolio that can be traced back, at least in part, to oil, gold and, yes, iron ore.

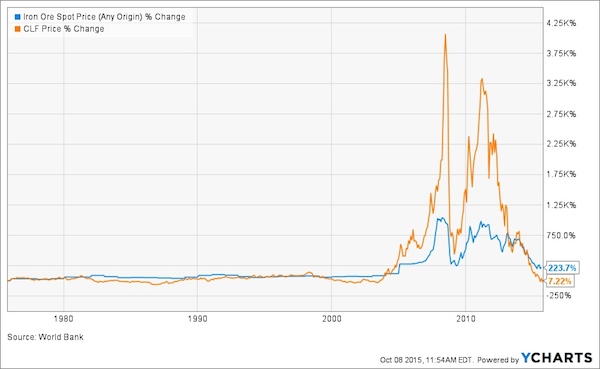

Here’s a chart of iron ore plotted against a chart of CLF over the last ten years, just to give you an idea of what the relationship is:

And here’s a chart of iron ore and CLF since January of 2014, starting roughly when Casablanca announced their position and started their activist campaign:

So it’s not necessarily the fault of management, or of Donald Drapkin, or anyone else — iron ore collapses, CLF collapses… there’s no management magic that can really counter that kind of swing in the market.

Does that make you want to buy in because of this activist investor?

Here’s a comment from Donald Drapkin in a Wall Street Week story from a couple weeks ago (and yes, that quoted “perfectly well-run humming machine” part from the ad is from this interview):

“Cliffs is a perfectly well-run humming machine. [Goncalves] got rid of the $6 billion noose around their neck. He’s reduced debt. He’s reduced expenses. He’s reduced lifting costs. And he’s okay for a couple of years. But when the price of iron ore goes from $140 a ton, and you get BHP [Billiton] and other producers that can produce down at the $45 level, you’re a commodities business. There is just nothing you can do about it. Now, will anything bad long-term happen to Cliffs? I don’t believe so. But you have to ride out the commodity cycle, and I wish I knew how long that was going to be.”

Me, too.

I don’t have any problem with making little bets on a turn in the “commodity cycle” — but do keep in mind that we don’t have any idea whether the “cycle” will turn for iron ore. It’s not necessarily a “when” — it might be “if,” or it might take so long that all the stock market speculators forget all about iron ore for ten or twenty years.

I don’t think that’s the most likely outcome, since I expect industrialization and urbanization will probably go through more phases of rapid growth either in China or in other large countries to consume iron to build skyscrapers and bridges, but it’s certainly possible. As you make bets on a recovery in commodities (if you make such bets), whether iron ore or anything else, I’d urge you not to be too “last decade centric” in your thinking — the abrupt cycles in commodity prices of the last ten years might not continue, the future could look far different from the recent past.

I’ve said this before, but diversification means more than just owning different sectors or different companies — it also means accepting that the strongly held certainties you might hold in your head, such as the notion that the commodities supercycle must rise again, might just be… well, wrong. You can bet on those notions, you can be contrarian, think deeply, try to predict the future — that’s what speculating on individual stocks is all about. But don’t bet your whole portfolio on a single strategy or world view or mindset even if, from your perspective, that strategy is impeccable and self-evidently brilliant. I call this “diversifying away from yourself,” and I think it’s a valuable thing to do whether you do it with index funds or with actively-managed funds that aren’t run the way you’d run a fund, or in some other way. Our brains can do terrible things in convincing us of the certainty of our thinking — don’t let your brain ruin your portfolio.

OK, I’ll stop ranting now. That doesn’t have anything in particular to do with this Casablanca position in Cliffs or with the utility of Billionaire’s Portfolio as an investment resource — I think I just got a bit off track with this notion that Casablanca put “100% of their fund” into Cliffs, and it scares me what a novice investor might do with that kind of technically accurate but perhaps misleading information.

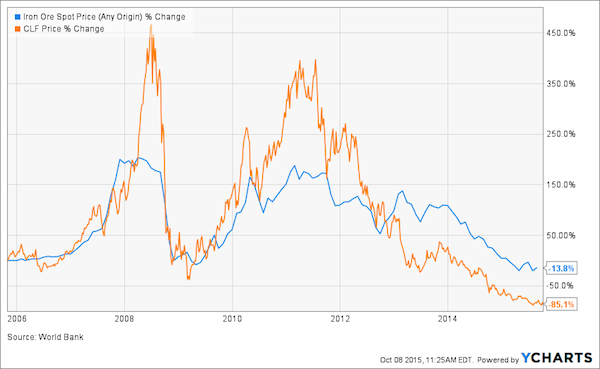

Here’s the iron ore and CLF price chart going out 40 years, just to put that perspective into a picture for you:

In the big picture, the movement of that blue line (iron ore prices) is going to have a lot more to do with the movement of the orange line (the CLF share price) than anything any activist or CEO can do to clean up or reorganize the corporation. And, of course, the fact that CLF has battened down the hatches and cut back on expansion and closed mines and sold assets means that if the iron ore price does go bonkers again, like in 2008 or 2010 (no one’s predicting that it will, as far as I know), CLF may not rise as much as it did in those years because it’s not quite as aggressively levered to rising ore prices anymore.

But that’s enough blather from me — it’s your money, so what do you think? Let us know where you think iron ore, or Cliffs, or anything else that’s been riding that “supercycle” for the past decade will go from here… just share your opinions with a comment in the friendly little box below.

P.S. That 1,700% price target in the headline? Yes, that’s just about what the gains would be in CLF if it recovers from the current $3 share price and hits the $53 price that Casablanca noted back when they started their activist campaign. I have not seen anything since then from Drapkin or Casablanca about what they have in mind as a price target now — if the stock ever recovers even to the price that Casablanca paid for the shares, that would be a gain of more than 700%.

Sounds like what Iron ore needs is our Political Minions to get serious about an infrastructure rebuilding program. There is enough Roads, Bridges, Dams, to repair to spike the economy after 3-4 years planning. 8-[

Seems like Cliffs Natural Resources (CLF) has a very apt ticker…as it could stand for Cash Lost Forever. I can hardly wait for the MLP…more losses pending.

I believe it’s been shown (by economist J. Simon among others) that over the long term commodity prices tend to go down and even more certainly don’t keep pace with inflation. They can fluctuate based on cyclical supply/demand curves. This feels like one of those “swing for the fences” investments – not a nice “fat pitch.”

There have been pretty long cycles in many commodities even before the last decade’s “supercycle” — there’s an interesting Economist article here on that debate over long-term commodity pricing. Simon’s assertion, in part, is that price increases beget supply and innovation and switching, which has certainly been the case with Iron ore in the last few years.

Iam starting to “catch on” that these charlatans are really more interested in selling worthless subscriptions than actually picking good stocks. Really sad world we live in anymore.

I just wanted to make a “general comment” in regard to your articles.

They are “GREAT” and very informative for us small investors! Keep the

articles and data coming!!

Thanks Jack!

Like watching Roadrunner go off past the cliff. The bottom is down there somewhere. What’s left when it hits?

I agree with Chuck and the other nice folks who commented. Most of the stock hucksters survive by bilking you out of your money with unsubstantiated claims and promises of astronomical profits which mysteriously never come to pass. I spent thousands of dollars chasing their pots of gold and all I got was broken promises or lists of stocks that would break out if I had the patience to wait five to ten years. I am amazed by how many snake oil salesmen claim to be investment gurus who have the solution to my financial woes for only $ 1,995 and up for an annual subscription. My advice is to save your money and just become a Stock Gumshoe Irregular. You can’t beat the price and you can’t beat the advice. It have saved me a ton of money by not chasing after another left monkey wrench.

Thanks josgeezer! We all make mistakes, but hopefully some critical thinking can help us keep our mistakes small.

Fantastic article. Thank you for your insight and comments to be cautious.

You rock josgeezer. Most investors are like donkeys following behind a

bouncing carrot on the end of a stick. If you can just get that lucky

bounce! If you take just one more step, maybe you’ll get it and all

your dreams will come true! And it’s so close, not only can you see

it there dangling in front of you, but you can almost taste. Boy,

can’t that King Tantalus almost drink the water, and almost taste

those succulent grapes, just barely above his head? I think there’s

a Greek myth about this that I’ve now completely forgotten. Fortu-

nately, this is the American Dream, upon whose fate, the future of

the country, and the future of the world rests.

Iron ore! One blip in 40 years and that’s their recommendation? Anyone who resorts to using “Billionaire” in their name isn’t likely worth an ounce of iron ore.

Well… to be fair, it’s really two blips 😉

Ironic oar in a sinking ship……

These newsletters remind me of those cable TV shows searching for Bigfoot, UFOs, etc where NOTHING is ever found!

I don’t want to see another anything from motley

Fool. Now they’ve resorted to the same advertising tactics as those other ones. I’m sock of it. I gave them my name to get a report and

Then I watched that Buffett video.

I finally got off and much to my surprise is my free

Article. It’s the video I just watched on Buffett.

I thought those guys weren’t so bad but they’re so

Cheap their pencils speak!

As has been pointed out before, stock price vs corp value are separate entities. There are many short of CLF and when a squeeze comes that may be a catalyst to recover some of the losses those of us suffered on the way down. Is all the smart money in the bonds? I personally have made my dissatisfaction with current management known, but I trust they will figure out an exit strategy that will include a stock price much higher. I think casa thought this would be a much quicker hit.

The changes they pushed for did happen pretty quick, it’s really that it didn’t matter because the bottom was falling out of the ore market. Unless iron comes back to at least some degree, rising 20 percent or more, CLF is probably treading water.

Unfortunately greed and fear are super effective at getting people to take action. These newsletter teases always tap into these factors. It’s always either a “get rich quick” or “avoid certain disaster” message if you don’t subscribe. The best ones combine the two in a cliché of “take advantage of the coming disaster in XYZ and profit hugely!”

Telling people to do be diversified, conservative, work hard and save money over the long term is a boring and does nothing to sell newspapers! or subscriptions…

Thank you Stock Gunshoe! You are the un-newsletter!

Once again thanks for your candor and thoroughness. The Forbes Billionaire Portfolio ad was enticing, but aren’t they all!

Are there any newsletters or other investing services you recommend?