Louis Navellier and other pundits have used the “master key” metaphor for their favorite stocks for a long time, so I guess it’s no surprise that they’re again trotting it out today to pitch the “Master Key for A.I.,” not least because A.I. is all most investors want to hear about today.

So what is it? Well, in concept it’s basically the same as saying that he has a “picks and shovels” play on A.I. — a “master key” gets you exposure to all (or most) of the A.I. projects without having to pick one that will “win,” and the older metaphor of being the guy who sells picks and shovels to the miners is similarly a business that is exposed to a hot trend, but not dependent on identifying the leading company.

And the company? Well, he does drop a few clues in his teasing, so we can probably get a name for you. Just give me a moment.

The ad from Navellier is a promo for Louis Navellier’s Growth Investor ($49/yr), which is one of the entry-level newsletters at Investorplace, one of the publishers in the now-vast MarketWise family (Stansberry, Empire Financial, Brownstone, Palm Beach, etc.). MarketWise is great at upselling people, so the primary goal of their free newsletters and $49-99 newsletters is to get people in the door, creating a marketing funnel where they can be pushed into a “lifetime” subscription or one of the premium-priced letters ($2,000-5,000/yr, generally).

That doesn’t mean the expensive letters are necessarily better in any objective way, and in fact people are often happier with a $49 subscription that recommends mainstream stocks than with a $5,000 subscription that recommends complex trading systems or options or smaller companies, but that’s how it works from the publisher’s point of view: The most valuable person to a newsletter publisher is the investor who has just pulled out their credit card for the first time and paid for an entry level subscription, signaling that they’re willing to pay something for investment commentary and research — so if you sign up for one of these entry-level letters, be prepared for a full inbox in the months ahead, you will instantly become the most appealing prospect for their high-end “upgrade” letters.

But anyway, back to the business of identifying stocks and answering your questions. What does Louis Navellier tell us about this “Master Key” company for A.I.? Here’s where he hooks the bait:

“… my latest discovery – the ‘perfect AI investment.’

“It’s called the AI ‘Master Key’…

“A way to potentially unlock the AI industry’s biggest, fastest gains… but with nowhere near the amount of risk of buying small, unproven stocks.

“How does it work?

“Well, you probably know that a Master Key is a single key that can be used to unlock any door in a building.

“Imagine a 1,000-room luxury New York high-rise. For privacy and security, each room has its own unique key, which lets residents access their assigned room, but no one else’s.

“But here’s the thing…

“The entire building also has a Master Key — a single key that can gain access to any room.

“Whoever holds this Master Key has the power to unlock ANY door…

“And that is essentially what I’ve uncovered in the AI markets — a way to unlock the biggest gains — and potentially NONE of the losers.”

And apparently it’s been around for a long time…

“Believe it or not, it has been around for decades.

“And it could have already multiplied your money many times over.

“In fact, I told my readers to get in on this simple investment as early as May 2016.

“Everyone who listened to my advice and held through recent highs had the chance to pocket as much as 2,877%.

“But this was only the beginning.

"reveal" emails? If not,

just click here...

“The AI ‘Master Key’ is set to deliver even bigger gains much faster.”

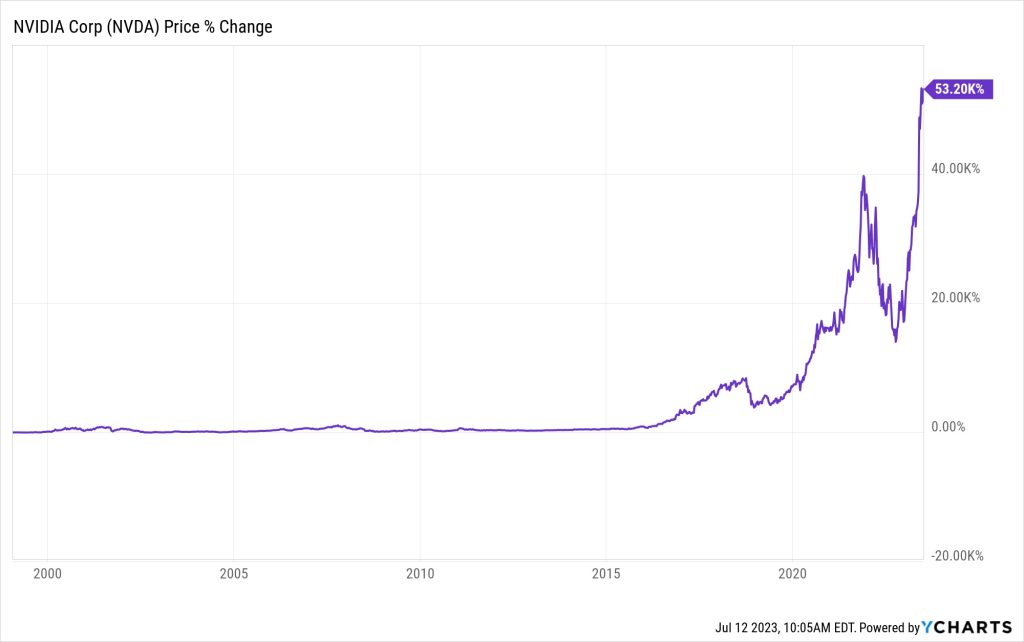

OK, so Navellier says he recommended it about seven years ago and it’s up 2,877% since then… and also includes a chart of the ludicrous returns since the late 1990s for this stock… I grabbed a copy of his chart, just because it’s an important clue.

Why does that chart matter? Because we can use it to confirm that, yes, Louis Navellier is again pitching NVIDIA (NVDA). Here’s my version of that chart, so you can see how perfectly it matches up… and we know that Navellier has called out NVIDIA for being a “master key” before — first as a “master key” for cryptocurrencies in 2016 and 2017, and then as the “master key for AI” starting in 2019 or so. This is the chart for NVIDIA through today, and the stock has hit all-time highs again in recent months, so we can also tell you that Navellier pulled his data for this ad in about March of this year, despite the fact that it’s dated “July 2023″…

So… sorry, it’s not some exciting and unknown little tech stock, it’s the largest semiconductor company in the world, and one that has been in the headlines for six months as it has just about tripled in value so far in 2023. NVIDIA now has a trillion-dollar market capitalization, joining only Apple, Microsoft, Amazon and Alphabet in that club today, so it’s meaningfully larger than other hot stocks like Tesla, Meta Platforms and Berkshire Hathaway (though NVDA’s revenue is a fraction of all of those other companies… and the only one in that group with lower net income over the past year is Amazon).

NVDA is a hot stock now, of course, but it’s been a hot stock for about six years, teased by a lot of pundits from 2016-2019 as a hot play on bitcoin or on artificial intelligence or on self-driving cars or on video gaming or on virtual reality. They’ve had an almost perfect record at riding each “hot” wave of excitement in the tech world. The challenge hasn’t been finding the hot, momentum driven stock in these trends, we’ve all known that was NVIDIA for the past 5+ years… the challenge has been in believing that they can keep finding new trends to ride, and in holding onto the stock once you own it, because NVIDIA has been a dramatic mover, sometimes becoming wildly expensive but also sometimes falling more than 50% in a matter of months when the business hits a speed bump and the analysts begin to believe that the growth is over. I’ve managed my NVDA position pretty badly, in retrospect getting overly caught up in the slowdown periods and taking profits along the way instead of just holding on to fully reap the fantastical gains we’ve seen this year, and yet it’s still been a hugely successful investment for me.

So… what to do with NVIDIA now? I wrote a long piece for the Irregulars in a Friday File about six weeks ago, after NVIDIA’s shocking earnings report (they told investors to expect 60% more revenue in the current quarter than analysts had been forecasting, an almost unheard-of “raise” for a very large company), and that’s my most recent update of big picture thinking and valuation assessment for this most unusual stock… I’ll just share that commentary with all of you here, a little “taste” of that Friday File, with a few updates thrown in since some of the estimates have changed since late May [I’ve covered some of those updated analyst expectations in italics]:

*****

Excerpt — May 27 Friday File: W.T.F., NVIDIA?

NVIDIA (NVDA) is now the most extreme story I’ve seen among large company stocks in at least 20 years, with the possible exception of Tesla (TSLA). I’m going to dig into this for a long time today, so if you can’t tolerate any more NVDA blather you might want to scroll down a bit…

Yes, there has been wild trading since COVID in all kinds of stocks, and insane valuations sometimes hit for those “story” stocks and “meme” stocks that really catch the attention of day traders (EVs, LiDAR, you name it…), but almost never have we seen a megacap company, one of the largest companies in the history of the world, trade at a valuation like this… or make a move like NVIDIA made on Thursday morning.

There have been huge surprises that got fairly close, like with Google (now Alphabet (GOOG)) in its first quarter or two after going public, when we collectively began to realize just how much money they could make with the brilliant scalability of their search ads… or with Facebook (now Meta (META)), when they figured out their mobile app about a decade ago… or, yes, Tesla, when they started to actually deliver cars and make a little money to pour rocket fuel onto what was already a “saving the world” conviction stock for many.

But we’ve never seen anything quite this dramatic, at this size, in this short period of time.

In just a few moments of commentary on their conference call on Wednesday evening, NVIDIA shocked investors of all stripes by doing far more than confirm what everyone knew, that the surge in AI interest among companies was leading to strong demand for its data center chipsets. That emerging growth in AI chip demand was essentially the story that caused NVDA shares to more than double in the first several months of 2023, before this earnings update.

But instead of just confirming that yes, growth is good in their data center business, and better than was expected last quarter, they provided guidance for the next quarter (the one they’re halfway through right now) that completely blew away the analyst forecasts.

Everyone saw demand growing for AI investment and projects, that’s why people have been buying NVDA up to nutty valuations all year… but it turns out we were also all sleepwalking through the speed of the explosion in demand for AI processing hardware, as data centers and cloud providers rushed to build up their capacity to meet the new demand surge from all the ChatGPT-inspired products and projects.

I thought it would grow, you thought it would grow, analysts thought it would grow… but not anywhere near this abruptly. Analysts were predicting that NVIDIA would start out this year pretty flat, with revenue and earnings continuing their recovery from last year’s big step down but remaining on the relatively slow growth path they’ve been on for the past couple quarters.

And there’s no other way to say it, but the forecast from the company turned all those assumptions into trash — NVDA did “beat” on revenue and earnings in the quarter they just reported, with $7.2 billion in revenue (only $6.5 billion was expected) and $1.09 in adjusted earnings per share ($0.91 was expected), so that was solid, and we should have expected at least that much, given the huge surge in the share price this year. The big driver was the data center business, of course, with revenue of $4.3 billion this quarter — 60% of their revenue this quarter came from supplying a variety of high-end chips for acceleration, machine learning and other tasks to data centers. When you ask a question of ChatGPT, it’s probably a NVDA chipset in a data center somewhere handling the extreme computing task of answering that question with a reasonably literate and logical plain-language answer (even if it sometimes lies, with a straight face, that still requires a lot of processing). The driver is that AI processes require heavy use of cloud “thinking,” and that means we need more and better chips in more data centers, attached to faster networks, in order to make those AI-generated answers faster and more accurate. NVIDIA has clearly found its next growth driver, and it’s a business they’ve been building up, as the leader in AI hardware, for almost a decade.

But the real shock was the forecast for NVDA’s second quarter of this fiscal year (we’re in their 2024FY, their year starts on Feb. 1) — NVDA told investors to expect $11 billion in revenue in this current quarter, which is more than 60% higher than the $7 billion that had been forecast, and far higher than NVDA’s best-ever quarter (that was $8.3 billion, in the same quarter in 2022). That massively higher number runs through to earnings, too, of course, and the first quarter forecast for NVDA’s net income moved almost instantly from $1 per share to $2 per share, roughly speaking.

So… what do we have now? A stock that’s another 25-30% higher, depending on the moment, and therefore has now hit new all-time highs, with dramatically altered future revenue and earnings expectations.

But that means, in the conventional way that most of Wall Street thinks, that NVDA, despite jumping 25% yesterday and 160% so far this year, is actually cheaper than it was not just back in January, but on Tuesday.

On January 31, NVDA shares were at about $200, and the consensus estimate of this year’s earnings per share was $4.35, so the stock traded at a forward PE of about 46.

On Tuesday this week, that consensus estimate for earnings was largely unchanged, at $4.54 (a great failure of analyst forecasting, we’ll get to that in a minute), so NVDA at $305 had a forward PE of 67.

Today, at $375 and with expected earnings this fiscal year of $7.76 per share, NVDA trades at a forward PE of about 48. Or, if we want to give a fairer comparison, since we’re now a quarter further along, the projected earnings for the next four quarters now sits at about $8.70, which means NVDA really has a forward PE of 43, the lowest that valuation has been all year. Despite the nuttiness, we can argue that NVDA is an easier buy today than it was at $200 back in January. [As of July, the estimate for the year is now $7.80… but the stock is up to $437 today, so that’s a forward PE of about 56]

I’ve always been optimistic about NVIDIA, even though I’ve often been shocked by the valuation, and even though I think it’s overvalued today. I believe that they will be able to grow revenues and earnings at roughly a 20% average annual rate into the future, and have held to that belief even when analysts were penciling in flat years, and that has kept me holding on to some of my position… but that sentiment can move in big waves for this company in any given quarter or year.

Roughly a year ago, analysts had expected that NVDA’s FY2024 earnings (we’re in the second quarter of FY24 now) would be about $6.75 per share… but investors got out ahead of analysts on the downside, too, and telegraphed that they expected that estimate to fall, and it did, by about a third. That investor expectation of lower future eanrings led NVDA shares to drop from about $300 at their (previous) peak to about $120 at the bottom in mid-2022, and as we headed into January the expectation for FY24 was still at that new “30% lower” level, down to about $4.25 in earnings per share this year. Now, it has climbed to $7.76 (it fluctuates almost every day, but roughly that), with the estimates again following the share price higher, not leading the share price.

That’s the pattern for NVDA in recent years — the stock tells you what’s going to happen first, then the analyst estimates catch up with that, both on the upside and the downside. Here’s the chart of those FY24 earnings estimates matched up with NVDA’s share price over the past two years — that’s the share price in orange, clearly leading the analyst estimates in purple (that’s the FY24 estimates all the way through, not a rolling “next year” estimate):

That’s not entirely uncommon for growth-sensitive stocks, but it’s more extreme with NVDA than for any other large companies I can think of. Usually, when you’ve got dozens of analysts covering a megacap stock, there will be periods when the analysts are ahead of the story in guessing what will happen, as well as periods when they’re behind, but the combined work of all those analysts usually gets pretty close to accurate, most of the time. When it comes to NVIDIA, it seems the analysts are always slow to catch up to changes in the company’s future prospects, during times of both pessimism and optimism. For whatever reason, analysts are able to do channel checks or get inside information or follow suppliers and industry sources and get to a pretty good picture of what’s happening inside the business for companies like Apple and Microsoft, but they just can’t do it for NVIDIA.

So at the risk of being a fool for paying attention to them, what do those analysts think now? The analyst expectation is still that this is largely a one-time reset, with growth getting back to something approximating normal again after this year’s anticipated surge (and this quarter’s dramatic move to more than double data center sales in just a few months). And although we know that NVDA analysts are almost certainly going to be wrong — they’ve proven that they have, as a group, no insight into NVDA’s business — we don’t know which direction they’ll be wrong this time.

And we also know that people are going to watch those forecasts, and use them in their valuation models, even though they’re going to be wrong. As of midday on Thursday, the expectations had been raised to the point that NVDA is now expected to post $7.80 in adjusted earnings this year, followed by $8.36 next year [July update: $10.07] and $10.90 [now $13.21] in FY26. They’re even expecting growth to be strong enough to swallow a fair amount of the stock-based compensation adjustments pretty well, so GAAP EPS numbers are forecast at $6.37 [$6.24], $6.63 [$8.01] and $8.65 [$13.21] for those same years. The revenue projections are now wildly higher, which is what drives everything, and those now stand at $42.7 billion [Jul: $42.9b], $43.5 billion [$52.4b], and $55.6 billion [$68.6b]for this year and the next two years after that. Analysts are still stuck on predicting that earnings and revenue will be pretty flat from this year to next year, it’s just that they’ll be flat at a much higher level than we expected a few months ago. [That’s not true anymore, analysts have caught the bug and dramatically ramped up their growth expectations for both revenue and earnings over the past six weeks.]

What does that mean for growth numbers? Well, it means that if we use last year as a starting point (that was the biggest down year for NVDA revenue and earnings in a long time, so it exaggerates the growth), then NVDA is in the midst of a run of revenue growth that will average out to about 27% a year, and adjusted earnings growth that will average about 48% per year. Most of that growth is happening right now, if you use this current year as the starting point, which is what we have to do in real life, then earnings growth going forward is forecast to average out at about 18%. But, again, that’s just the starting point for how to think about the future potential — the only thing we know for sure is that the analysts will be wrong.

[Growth estimates have bumped considerably higher as analysts get on board with the huge demand for AI chips and see that growing dramatically… so now, with the starting point of this fiscal year, the expectation is for 27% revenue growth and 30% annual earnings growth over the next couple years.]

And it’s all about the growth, of course, not about the earnings that they have actually recorded. At $380, NVDA shares are trading at a little over 110X the $3.56 in adjusted EPS the company earned over the past four quarters (or 200X the GAAP EPS)… but at only 43X the $8.72 in adjusted earnings they are expected to have over the next four quarters [now, at $437, the stock is at 48X the expected $9.02 in earnings over the next four quarters]. Or a hair over 50X the $7.25 in GAAP EPS analysts think they’ll have over the next four quarters [the GAAP forecast is still $7.25, so at $437 the GAAP forward PE is now 60].

That’s still a nutty valuation for a megacap company that’s nearing a trillion-dollar valuation, of course, but it’s a LOT better than the valuation looked a week ago… and human beings, in general, tend to be linear thinkers — we cannot help but expect, at least subliminally, that the way things are going right now is they way they will always go. When we saw that NVDA was in a flat patch of growth, with relatively low earnings, the expectation was that flatness would continue… now that NVDA is in a crazy and abrupt acceleration of revenue and earnings, the expectation will probably grow that this will continue. If NVDA sees earnings growth of 30-40% per year over the next five years, then it’s objectively cheap today — that’s a risky assumption, of course, that’s a wild growth rate for a company of this size, and that’s far faster than they’ve grown over the past five years… but we have to acknowledge that it’s a possibility.

I have to keep myself on a fairly even keel with companies that have this much real volatility in their operations, going through massive surges and collapses in large parts of their business every few years. Roughly 40X earnings is about the highest valuation I can justify for a large company that can consistently grow earnings at close to 20% a year, and that has generally been a rational valuation level for NVDA, for patient investors — that’s about the valuation NVDA carried in early 2022, when shares were at $280 and trading at the time at 42X the expected “one year out” earnings forecast, so after that you had to stomach a 50%+ drawdown… but it still worked out, one year later. With this company, to keep yourself sane, you have to keep your position at a size where you can stomach massive moves, and that’s very much a personal choice. Little did we know, 15 months ago, that those forward earnings expectations would be cut in half over the next six months as we hit the interest rate and inflation fears of the summer of 2022, flounder for a while, and then more than double this week.

If we use my previous valuation methodology, effectively paying a PEG ratio of 2.0 for NVDA and penciling in that future earnings growth rate at 18-20% (smoothing out those big moves up and down in the growth rate, like this year’s near-100% earnings growth and last year’s decline in earnings), that would mean, still, that paying something like 36-40X forward earnings would be my “max buy” level for the shares.

Last week, that would have given us a max buy range of $160-180. Today, with the higher reset for forward earnings, now that NVIDIA has given us some numbers that were dramatically higher than anticipated, that would put us at about $350 if we max that out at 40X forecasted adjusted earnings… or about $260 if we shade down a little more conservatively, to use forecasted GAAP earnings and a forward PE of 36. [with higher estimates now in July, that could scooch my price range up to $360 or so, though I’m being a bit more conservative at the moment]

It’s just math: earnings double, PE stays the same, the price we can pay roughly doubles… and it still makes sense, as long as you think that NVDA can continue to grow earnings at close to 20% per year going into the future. I think they can, but it won’t be a straight line.

For the nine years going into the peak in 2022, NVIDA grew its GAAP earnings per share by about 38% per year, fueled by gaming and cryptocurrency mining chip demand, so growth is nothing new… but we’ve also seen, NVDA earnings decline sometimes, in 2019 and in 2022. Over the past five years, because of those two periods when earnings actually dropped from one year to the next, NVDA has had GAAP earnings growth that averages out to about 5% per year. You can’t pay 40X earnings for 5% growth… but you can for 20% growth.

So as an investor, it’s pretty simple: You have to choose what future growth rate you’ll bet on, and take your chances. I’ll bet that NVDA can keep growing earnings at 18% per year over many years, from this new, much higher, starting point.

Over time, it’s been a mistake to underestimate NVIDIA as a new trend emerges… they’ve consistently established leadership in almost every new high-performance-computing trend.

But on the other hand, it’s also been a mistake to pay high valuations for very large companies when investor interest is peaking and the analyst estimates are just catching up with the share price.

Investors, as a group, saw this wild growth coming for 2024, and analysts didn’t believe it… but now that both investors and analysts are believers, we may spend some months trying to find an equilibrium (or who knows, maybe we’re just halfway to inflating a massive “AI” bubble, and NVDA will be the most valuable company in the world in six months… crazier things have happened). I’ll reset my buy prices to be consistent with the way I’ve modeled NVDA’s valuation in the past. I’m holding the balance of my shares, we’re close enough to a rational valuation based on new expectations, and we’ll see what the future brings.

My lingering worry for NVDA can really be summed up with one word: Cisco.

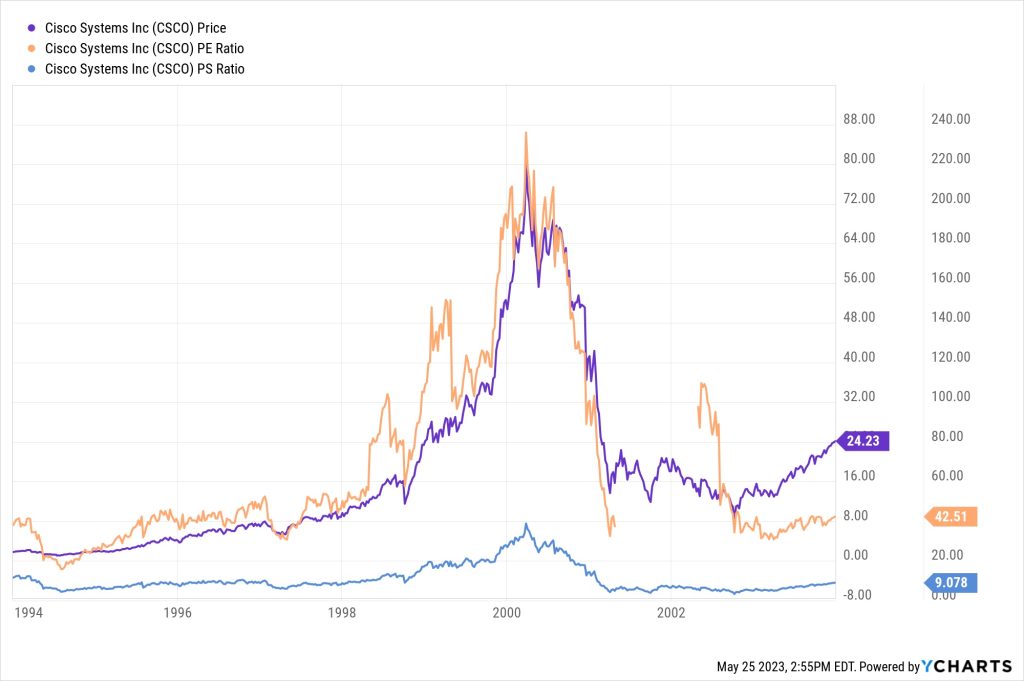

Cisco Systems (CSCO) was the “must own” stock for the growth of the internet in the year 2000, and it was a lot more “real” than all those fly-by-night dot-com companies of that day: Cisco was the hardware provider that made the internet’s growth possible, and the “picks and shovels” name that would work no matter which of the internet companies became the leader, because the internet would be built on Cisco routers and growth was inevitable and huge. There were other companies making switches and routers, but Cisco was the clear leader, to the point that it was almost seen as a monopoly. Every pundit acknowledged that the stock was expensive, but said that it was also a “must own” company if you wanted to bet on the internet, and they were actually making real profits and growing revenue quite dramatically, it was clearly a lot safer than the junk companies that were trading at some multiple of “price per eyeball” or other made up metrics.

The echoes of that are what shake my confidence in NVIDIA, and why I spent the first few months of this year selling covered calls on NVDA (and as I noted last week, eventually having half of my shares called away).

Why? Mostly because we human beings are primed to identify patterns and look for narratives, and the path NVDA is treading is so similar to the CSCO pattern from 1999-2000, both in terms of narrative and in terms of valuation, that we have to have some fear of a similar outcome.

NVIDIA is the consensus must-have “picks and shovels” play for the AI revolution, demand for its products is through the roof, growth is exploding, and everyone feels like it’s the safest play on AI, at a time when there are plenty of high profile junk AI stories (though not nearly as many as there were dot-com stories 23 years ago — part of the interest in NVDA comes from the fact that there aren’t many “real” AI story stocks to choose from).

And how did things work out for Cisco, for those of you who weren’t investors 23 years ago? CSCO revenue exploded higher, and roughly doubled, from 1999 through 2000. They deserved a premium valuation, and they got one… but then they had a drop in earnings and revenue as the dot com balloon popped in 2001 and 2002. And even though the business did recover pretty nicely, they were back to revenue and earnings growth within a year or two of the collapse, that offered little solace for patient investors, because the high valuation never returned.

In a fall from grace, the valuation doesn’t necessarily go back to “average” overnight and then recover later, CSCO shares were still trading at a rich premium, about 50X earnings in 2024, when the growth was just getting back underway… but if you bought anytime in the buildup of the bubble, in 1999, then you didn’t show a return on your investment until about 2015, you had to wait 15 years for the share price to recover and begin to grow from the price you paid. And if you bought during the year or so when the bubble peaked in 2000, when Cisco was the most bulletproof company in America and traded at 150-200X trailing earnings and around 30X revenues, you had to wait until 2021 to show a positive return, including dividends… and the stock has fallen since then, so you would actually be back down to a negative return now in 2023, after holding the stock for 23 years.

We have a hard time foreseeing that kind of multiple expansion and contraction, because it’s hard for us, in the heat of the moment, to imagine that someday CSCO (or NVDA) will be less adored and will trade at a below-average multiple (by “multiple” I just mean the conventional valuation ratios, like Price/Earnings or Price/Sales). Here’s what that multiple expansion and contraction looks like in a chart, to try to help you visualize — this is CSCO from 1994 to 2004, encompassing the buildup of excitement through the the collapse and initial attempts to figure out a “normal” valuation for the shares. In effect, over the course of about five yeras the stock went from a pretty average valuation, roughly 5X sales and 16X earnings, to 40X sales and 230X earnings (these are all trailing actual earnings, not forecasted adjusted earnings — remember, in the real numbers, which are the only things we can call fact in this exercise, NVDA trades at more than 200X trailing GAAP earnings today). And even though it was still trading at a pretty rich valuation in early 2004, people still remembered that the internet was real and they were selling a lot of routers and would probably grow, the dramatic multiple compression did it’s damage. Here’s what that multiple expansion and then contraction looks like:

And here’s what that looks like if we throw in the share price, to help us imagine what it actually felt like for investors during the mania and the comedown — this is the actual share price, not the percentage gain and loss, but the runup was a gain of about 900% from 1998 into the peak in 2000, and then the shares dropped about 85% from 2000 into the trough in 2002:

But the key is that earnings multiple — it’s true that over long periods of time, earnings drive share prices, but they do so with the leverage, in both directions, of the earnings multiple.

Companies that are pretty steady might usually have a pretty consistent multiple — nobody ever gets super excited or super panicked, so they almost always trade at 15-20X earnings. But companies that get to wild multiples can take a very long time to reset, and usually a company that goes through a bubble valuation and experiences the explosion of that bubble fails to ever get back to anything close to that kind of valuation multiple in the future.

This is probably the most telling chart, when it comes to Cisco — earnings per share did drive the share price over the long run, but they also served as an underlying magnet when multiples collapsed, pulling the price down to match the level of earnings and new expectations about growth rates. This is CSCSO EPS from 1994 to 2004, shown next to the share price. Both the earnings and the share price, in the end, went up about 1,000% during that decade, it’s just that if you bought anytime during that bubble period, you paid way too much for the earnings:

Which is why, even if you avoided buying right at the peak and only bought halfway up (or halfway down) that multiple expansion rampup, at, say, 100X earnings, the long term picture was pretty murky.

Here’s what we saw for earnings per share growth, revenue growth, and stock price for CSCO if you bought in May of 1999, at 10X sales and 95X trailing earnings… you felt pretty smart, because you bought at about $26 and the shares reached $80 at the peak a year later, with everyone in the financial media reminding you that this was the leading company that would build the internet, a must-own stock, and a brilliant purchase… but here’s what that would have looked like if you held on through today. The earnings have grown almost 900% from where they were when you bought the stock 24 years ago (it really WAS a great company! Still is!), but your return was only 165%, dramatically less than the 400% you would have gotten from buying the S&P 500 at the same time:

And that’s even with the company doing most of the right things — they made some dumb acquisitions along the way, sure, but they also bought back about 40% of their shares, and they eventually started to pay out a large and growing dividend (without the dividend, your 24-year return would have been only 88%, not 165%), the company grew and remained the market leader and even today it’s a giant, a $200 billion company… but today it trades at 13X forward earnings, and that multiple compression meant that owners of the stock ended up losing money, relative to holding an index fund, over a very long period of time. Over time, that matters — if you put $10,000 into CSCO in 1999, getting in at an exciting time, just when the stock was about to triple in less than a year, you would now have $27,000. If you had instead put that $10,000 into the S&P 500, you’d have a little over $50,000.

This is not a prediction of what will happen with NVDA… but that’s just because these stories are so unique, there are precious few examples of big companies trading at these valuations, ever. I’m just trying to hammer in the understanding that paying a very steep price matters in the long run, even if it really is a great stock.

We don’t know, and in fact we can’t know what will happen with NVDA shares. There is no obvious fundamental or operational reason to really dislike the company (other, perhaps, than their dependence on Taiwan Semiconductor, or your assessment of perceived competition from other chip designers, including AMD and projects inside Alphabet (Tensor AI chips) and others who will come in the years ahead). They’ve been a leader for a long time, like Cisco, and that leadership might persist, as it did for Cisco. We could also use Intel as a comparison, from the same time period, though the results are a little less extreme in terms of both valuation and returns.

There is currently a bit of a shock reset in demand for NVIDIA’s chips — and we don’t and can’t know whether it will be a reset that then fades away, like the surge in demand for NVDA chips for cryptocurrency mining suddenly evaporated a few years ago, or will be just the beginning of a long period of demand growth for AI chips that is huge enough to allow both for NVDAs continuing growth and for the rise of several strong competitors.

There are two facts we’re faced with, and we face them with the knowledge that we don’t have a big enough data set to say that past experience will be predictive… this just hasn’t happened many times before. Here are those two basic facts:

- NVIDIA is killing it right now.

- Historically, the only other times that a $100+ billion company reached this kind of valuation, it led to a decade or more of hugely disappointing investor returns.

Leadership matters, and huge new markets do get formed, creating huge new growth companies that lead those markets… but even with those huge new growth companies, valuation also matters, eventually. Or at least, it always has in the past, eventually. Pay too much, expect to be disappointed.

I don’t know if NVDA will follow the CSCO path, and I don’t want my littany of charts above to indicate that it is preordained. I also don’t know if this is the beginning of an “AI” bubble that will build over the next two years, or if we’re near the peak already. Just because we know that extreme valuations increase the probability of poor future returns, doesn’t mean we can know when “extreme” becomes “too extreme” and the price and valuation will start going down. It’s just a reason for caution.

So I’m still in camp wishy-washy, happy to own the shares and also happy that it’s not a larger position (though thanks to this week’s nuttiness, it has snuck back into my top ten holdings).

I’ll set my “buy” prices to reflect my expectation that they can continue to grow, though I’m using 18% as my long term earnings growth estimate, to be a little more cautious given the massive spike in estimates this year. That puts my “max buy” at $315 (roughly 36X what NVDA is likely to report in adjusted earnings over the next four quarters) [we could bump that up to $325 now, given the higher earnings estimates], and my “preferred buy”, using 36X GAAP earnings estimates, at $260 [unchanged](why GAAP earnings? Because at some point we have to expect NVDA to report real earnings, like all their mega-cap peers… GOOG, AAPL, AMZN, META, etc. have outgrown the insistence on reporting “adjusted” earnings or pretending that stock-based compensation doesn’t exist, NVIDIA and its analysts and investors should, too, though I don’t know when that might happen).

Those are huge increases over my buy prices from earlier in the year, so we do have to be ready to change our mind when the business changes, even if it makes us feel dumb in retrospect… but I can’t say that it’s easy to stomach that rapid shift in a company where I expected changes to be a lot more gradual than they proved to be this week. If I were maxing out optimism for NVDA, that would now let me justify a price of about $350, roughly 40X the adjusted earnings forecast [that would now be a little over $360]. I’d have to close my eyes to hit that “buy” button, but it’s not completely irrational. If you push that out a year, to the 2025 fiscal year that starts next February, then analysts are now predicting $9.51 in earnings for that year [now up to $10.07], and 40X that number, for those who really want to buy in to optimism in a big way, would be $380 [now $403]. Which is just about where the shares stand today, telling me that at the moment, the stock is reflecting about as much optimism as we can possibly conjure up — though as we learned this week, even optimists can underestimate sometimes. [I wrote these words when the stock was at $385 or so on May 27, the price is now $437 on July 12]

So don’t get too worried about the extremes, and don’t expect 2001 Cisco, that’s probably too pessimistic and nobody knows the future… but certainly remember 2001 Cisco. Earnings, on average, is what drives share prices over the long run (10+ years), and NVDA earnings are probably going to double and set new records this year, and may well keep growing nicely beyond that… but at speculative peaks, the impact of multiple expansion (and then on the way down, multiple contraction), is what mostly drives share prices over shorter periods of time (a year or two). Cisco’s earnings peaked in 2020, but it’s not like they declined forever after that bubble formed — they were at new highs again by 2022, and mostly kept growing from there, but they were no longer exciting for investors, and the crazy multiple never returned.

We’ve been climbing a speculative peak in NVIDIA, and it’s built on both dramatic growth in earnings expectations and a willingness to pay a higher multiple of those earnings… but the nature of peaks is that they can only be identified if you look backward. Unlike Mount Everest, nobody has been to this same peak before… you’ve heard the stories about past bubbles and peaks, and maybe this peak looks a little like the CSCO peak in 2000, so maybe you know to be a little nervous, but nobody left a bunch of flags and souvenirs at the summit, you just can’t know for sure when you’ve reached the actual peak. You know that there is a peak, even Mt. Everest doesn’t reach the moon, and you know that you’ll find yourself walking down the mountain eventually, if you keep walking… but even during that walk down, you can’t know whether you’re walking down a ridge or a foothill and are about to go uphill again, to a higher peak that’s not visible above the clouds (or if you’re about to fall off a cliff that you couldn’t see beneath your feet). Being an investor in these kinds of stocks means living with a high degree of uncertainty.

There is a lot of schadenfreude floating around when it comes to NVIDIA, to be sure, and this is one of those situations where institutional investors are almost all going to be wildly underweight NVDA, which is now about 2.2% of the S&P 500 [now 2.8% in July] (so yes, if 1% of your portfolio is NVDA, you are dramatically “underweight” … which means that this quarter you’ll have to make up for that with some very successful large investments, or you’re going to trail the S&P 500 and get yelled at by your investors for lagging the index and missing an “obvious” growth giant like NVDA).

Maybe that will drive more buying, keeping the shares at these levels or pushing them up even higher, one never knows — there is money rushing toward AI, and there are precious few places where serious people could honestly put that money to work, so we could see money continue to flow into NVIDIA, especially if the growth continues to expand beyond this one-quarter surge, as it very well might. There could be more surprises on the upside, even if we tend to fear the downside surprises more viscerally. Usually, a sharp drop requires some kind of reset or event or catalyst, whether that’s something company-specific or a broader market crash… but these days, for what is now the most popular stock in the country, that catalyst could be a couple negative analyst reports, a Tweet from Taiwan, or even a Jim Cramer tirade on CNBC, so good luck predicting when a “reset” might come.

Can I rant about the analysts for a moment?

Part of the challenge is just that investors have almost always been smarter than analysts, at least when it comes to NVIIDA. Investors knew growth was coming, and analysts had not yet included that growth in their forecasts. Analysts are a cautious lot, by and large, and they don’t like to really “forecast” so much as they like to take the guidance numbers that company executives give them, put them into the model that they’ve always used for that stock, and use it to spit out expectations. If they all stick together, and all have similar forecasts like that, then nobody gets fired. NVIDIA hadn’t offered any new guidance since they started to see a surge in demand for their chips, and analysts, apparently no longer interested in doing the actual work of researching the business and talking to suppliers and customers in between quarters, essentially decided to wait until NVIDIA management told them what to forecast.

That led to a pretty extreme failure for NVDA analysts, actually, but they come by it honestly, and the problem is that fools like me routinely pay attention to those forecasts, even though they’re terrible. We can’t help it — numbers exist, generated by thoughtful MBAs, so we can’t just ignore them, even if maybe we should. The analysts got NVDA wrong when their chip demand collapsed with the drop in cryptocurrencies in years past, and they got it very wrong when NVDA gaming chips proved to be in much more consistent demand than anyone expected over the past decade (six or seven years ago, analysts were expecting NVDA’s gaming chipsets to be in perpetual decline as demand softened and they lost pricing power, which was a big deal because that has been NVDA’s largest business… until last year, when data center finally lapped gaming for the first time). Analysts have pretty persistently missed the mark in both directions for NVIDIA, underestimating their exposure to big and long-running growth trends… and overestimating their resilience when demand drops for their chips.

And now NVIDIA joins the ranks of the best all-time teaser stock picks, for several pundits. The leader continues to be David Gardner at the Motley Fool, who was teasing NVIDIA because of its leadership in self-driving car processors back in the Summer of 2014, at a split-adjusted $4 or so. Probably more importantly, because of the Motley Fool’s philosophy of holding on through massive upheaval, and not just holding your winning stocks but buying more of them, that would have been a real 9,000% return if you bought on his advice, and held on his advice (NVDA has been one of those rare 100-Baggers if you bought just a little lower than that — though it’s worth reminding you that it was also a pretty complete dud for 15 years along the way, generating not much in real returns from about 2000 to 2015). I don’t know if other pundits would have recommending holding or buying more, like David Gardner did over the years, or if most investors would have followed that “hold your winners forever” strategy, that’s extremely hard to do in real life, for most people, but others certainly recommended it in the teens many times over the next few years, including Michael Robinson, and would have gains in the 4,000% range if held to today.

That’s not quite the best teaser in the history of Stock Gumshoe, or even the best Motley Fool teaser pick, but it’s getting close. That title still goes to Netflix, which David’s brother Tom was touting in the summer of 2007 at a split-adjusted price of about $2.50, leading to 15,000% gains if held to today… and there are a couple others in that rarefied air, including probably the best “penny stock” speculative pick, Enphase Energy (ENPH) back in 2016, which could have led to 14,000% returns as of today, though that newsletter (Casey’s Extraordinary Technology) no longer exists, and I don’t know if they would have pushed a “buy and hold forever” philosophy with that pick. Of the 32 stock picks that would have led to 1,000% or greater gains if held to today (at my last count), going back to when I launched Stock Gumshoe in the Spring of 2007, four of them have been picks of NVIDIA at different times, which also has a few 700-900% past recommendations from various pundits that don’t quite hit the 1,000% mark today, but might soon.

(The Motley Fool has more of those 1,000%+ win teaser stocks than any other publisher, in case you’re curious, including NFLX in 2007 and 2010, TTD in 2018, NVDA a couple times, and one or two others… I believe only one letter or publisher, that same defunct Casey’s Extraordinary Technology, has two picks that ring that 1,000% bell today).

Personally, I didn’t buy my first NVDA shares until 2017, around the same time that folks like Michael Robinson and Ray Blanco and, yes, Louis Navellier were teasing the stock (mostly pitched as a play on “virtual reality” or on cryptocurrencies at that time)… and it was clearly pretty richly valued then, and it was hard to buy (the stock was around $30 at the time). I haven’t handled this position very well, letting some shares get stopped out at bad times when I overreacted to their cryptocurrency challenges in 2019, but it still has been a very profitable relationship. NVDA is one of three current long-term holdings where I’m sitting on returns of more than 1,000% above my first purchase price (though with all of those, including Alphabet and The Trade Desk (TTD), I’ve added to that position over the years and my total return is lower). Some stocks are spectacular enough that you can be human and screw it up along the edges, and still have it work out nicely. Dealing with a stock that has moved like NVIDIA depends a lot more on psychology than on math… these are the investments that help you learn the real answer to “what’s your risk tolerance?”

*****

So that’s what I think about NVIDIA, which really is a “master key” kind of stock for A.I., with their expensive chips used for most of the big AI processing projects out there right now. There’s risk that may change, for sure, Alphabet has developed its own chips and AMD is nipping on NVIDIA’s heels and there may be breakthroughs to come from them or someone else, but Jensen Huang’s NVIDIA is right now reaping the rewards of investing in developing the best GPU processors and establishing the operating system for that hardware over the past decade, their technological lead in the marketplace is proving to be pretty durable, at least for the moment, and it’s been fun to watch… even if the valuation sends shareholders on an emotional roller coaster.

I don’t know if it’s the way to ride the AI trend with the “least possible risk,” given the valuation, probably Microsoft or Alphabet are a bit safer at these levels… but they won’t be as dramatically driven by AI in the near term, since they’re much larger and more diversified. In many ways, NVIDIA is earning all this attention because it’s the only “real” stock which is close to a “pure play” investment to ride the dramatic revenue growth from all the companies who are investing in A.I. projects right now, and it’s at least a lot less risky than some of the junk AI names that don’t yet have real businesses but have been thrown in the blender by enthusiastic speculators.

So we’ll turn it back over to you, dear readers — can you justify the valuation and buy NVIDIA today, with the expectation that the growth will really re-accelerate from here? Or are you afraid of the risk of being in the hottest stock, in the hottest technology trend, the next time investors panic? It’s personal, so only you can decide what to do with your money and judge how much you’ll risk in the name of optimism… let us know with a comment below.

Disclosure: Of the companies mentioned above, I own shares of NVIDIA, Alphabet, Amazon and Berkshire Hathaway, and my stock holdings are updated most weeks in the Real Money Portfolio. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

At some point the law of large numbers will matter.

Probably so, though the perception of that “law” has changed a lot with the advent of the mega-cap tech stocks in the last

Five years.

Travis

You should be aware that subscribers to the Navellier Growth Investor were told recently to Sell part of their NVDA Investment. It is Odd that this would be considered the #1 A/I Buy.

Sometimes the trading advice doesn’t match up with the “best story to sell” — thanks for the info!

Yes, I was just going to post that subscribers were told to sell that stock. it seemed odd to me at the time and I didn’t do it. So was surprised when I read Travis’ analysis.

Navellier has had some good FREE picks in the past —-most notably SMCI when it was around $70 last year – it’s over 200 now. But glad I didn’t pay him any money just to find out that his top pic is NVDA. that’s like my saying my toptip on how to get from Pittsburgh to Los Angeles to take an interstate highway. as in yes, you should already be planning to take an interstate and planning to be invested in NVDA.

Im in Growth Investor and can confirm that it is NVDA.

Excellent article. Thx very much Travis

It is a bit strange lately when Investor Place and the team are using high market cap shares, NVDA could be the “mater key” but they are not stocks of cents with strong potential, all depend on the goal of each investors, but in may case, Nvda, is the most important supplier, but not the next google, apple, etc… what about Heydr over the article how participate in OPenAI before teh IPO? any info over it? thanks very much for sharing.

I’ll wait until it splits again

Im in Growth Investor, its been fairly good to me but I cant and dont want to buy all the stocks he recommends. My biggest complaint is that he waits too long to get out of a stock if it starts to tank and sometimes you will see a different buy below price between the high growth and elite dividend stock portfolios. I do like his commentary regarding government events as it relates to financial matters, which you wont hear on the mainstream media.

Travis – an absolutely great discussion on NVDA. as a subscriber, I seldom buy Navellier’s top stocks, and sometimes I buy before he does. His commentary and watching Portofolio Grader changes seem to be my interest – although changes for the worst do seem often to come only after the horse is out of the gate. Your parallel to CSCO is brilliant – and worrisome. I bought NVDA and ENPH 2019. Never sold any ENPH – but in 2020 I followed another strategy – sold enough NVDA to recoup my capital investment. So, playing just on the “house’s money” I’ve let NVDA ride, ignoring Navellier’s “sell half” suggestion. Indeed, the time will come to sell – ah, good luck, everyone, in trying to figure out when?

Let’s not forget that Nvidia itself needs a “master key” to provide those deep learning chips, which for now is Taiwan Semiconductor (TSM). What could go wrong there?

True, like Apple and AMD and many others, NVDA is dependent on Taiwan Semi. They make more than half of the world’s high-end chips,

And Taiwan in general is close to 80%.

If Taiwan Semi gets cut off from the world, that will be hugely bad news for everybody. NVDA will probably not be our biggest concern at that point, but the future is quite unknowable.

And TSM itself relies on a master key, ASML!

Speaking of holding on…I held AAPL from 1997 to 2015. Sold some along the way and ditched the rest by 2015. Went back in late last year.

Another one is ADBE; purchased in 2000 and held ALL of it right up until now. I like to give my picks at least about three years or so to deliver something.

Patience and conviction are certainly important, and it often takes years to get to the point where you “trust” a business (and management team) enough to be patient through both good and bad years. Sadly, it’s easy to fool yourself into “conviction” about companies that turn out to be in the early stages of a long decline, too, we need the humility to acknowledge when we’re wrong… or, if we’re looking exclusively at the long term, to accept that being wrong about some ideas is the price for being right sometimes, since nobody is truly prescient, and holding on to a few 1,000% winners more than makes up for a few 100% losers.

TRAVIS, you keep me thinking in the A.I Master Key, surely it ´d be NVDA, but not sound like too fast too growth? in SYM, PLTR, IONQ, BBAI, RIGETTI, U, PATH, SOUND, etc, they are paying how many time the P/S? how are you managing it? A.I will need a time, faster than internet, for sure, but… They are paying future, without correction, not sure your opinion, but I wish it // By other side, the Luke Lango and the Investor Place team, in the last meeting insisting in BUY IN PRIVATE SALES, before IPOs, reading now the last report over the meeting of yesterday they had. Called “AI IMPACT” any idea over it?? or you can open a new thread for debate over it. I think something more exists before the “buy CHATGPT before IPO” I don´t believe it will be only MSFT. Happy to hear your comments thank…for all your work.

https://www.bitchute.com/channel/HBBwqdoMy7Gz/ Nothing Artificial nor Intelligent

Just Code. There is NO Mastery of the Technology today.

Reminds me of the Dot Com Bust.

In its most recent webinar entitled “AI Impact Event”, Investor Place gurus Fry, Navellier and Lango have combined efforts to identify 9 stocks as future AI winners. Any idea what these 9 AI innovators and suppliers are?

Hey, Bunion132, trying to read carefully over the transcription of this webinar, but I couldn´t find now the 9 AI stocks, it would be great, if TRAVIS can open a disucssion thread for debate it. If I find something I share it for sure. Today I receive an email where they come back over the AREA 52 article, when IONQ was $ 5 dollars, he talks that the shares is below $ 10 yet, but I think it is wrong, it closed $ 18 yesterday. strange …

I was researching carefully the 9 AI innovator stocks, they mentioned several stocks that they like as BIGBEAR.AI, C3.AI, IONQ, SYM, INNODATA, BIOXCEL, and SCHRODINGER, but they mention over quantum computers related for A.I will reach goals, as microchips shares, but really, not find much more in the last report of the 9 AI IMPACT meeting they are talking. Somebody any idea? or a possible new thread? Anyway, Luke was talking over the next month in the market correction, it would be the last possiblity to buy them “cheap”. Hope comments guys.