I always feel a swell of optimism when I read a teaser ad from Patrick Cox — something about his relentless happy-facing about the teensy tiny technology and biotech companies he loves just stirs me up a little bit, reminds me that the reason many of us dabble in microcap stocks, little mining companies, new technology ideas and the like is that we believe in breakthroughs. We want to see a company come from nowhere to become the next Apple or Genentech.

And just because it almost never happens … well, that’s no reason not to hope a little bit, is it?

Frankly, these Cox teasers also always float to the top of my pile because so very many of you, the great Gumshoe readers, ask about them — we are, after all, slavishly devoted to our legion of fans (and if you’ve got a teaser ad that you really want to see covered, you can help us by sending it along for consideration — just use our Contact Form, easy peasy).

So this particular pitch comes in the good ol’ “presentation” format from Patrick Cox, and he’s trying to get us to subscribe to his Breakthrough Technology Alert with a pitch for three different companies — and yes, thankfully his publisher, Agora Financial, has recently made a little transcript available for his ads so it’s not quite as much of a nightmare to sift through them anymore in our hunt for clues.

From what we can tell as we get started with our sifting, the two picks that are getting the most play here are an antiviral company that has recently gotten some sort of patent approved for polymer-based virus targeting doodads, and a company that has an Alzheimer’s drug that has already made it through one Phase 1 human trial and could skyrocket if it makes it to Phase II (they have a second Phase 1 trial apparently coming this Fall).

Cox opens with the Alzheimer’s one, since Alzheimer’s Disease hits pretty much every family in some way and since investors know that this is probably the largest potential market that remains almost completely un-addressed by effective pharmaceuticals (there are treatments for the symptoms, but none for the disease — and, frankly, there’s still a lot of debate about what causes the disease). So the first little biotech to develop an effective Alzheimer’s drug can pretty much count on creating some billionaires … assuming, of course, that one of them gets there (there are lots of folks trying, and they’ve been trying for decades — the brain is tricky business).

But we’re going to flip the story around and start with the Virus one, since that’s what folks are asking about (and I think I already know what the Alzheimer’s one is, so I’m following my curiosity). What does Cox tell us about that one?

The first clues come in the free Agora email that linked us to the ad:

“The U.S. Patent and Trademark Office has issued a broad and sweeping patent to a company that’s combining biotechnology and nanotechnology to wipe out viruses.

“But it’s bigger than that, Patrick says: The firm “has become the owner of an entire new field of science — the use of polymers for drug delivery far, far beyond the field of viruses.”

“The polymers essentially lure viruses to their demise. The viruses attach themselves to the polymers and they die. This treatment has the potential to treat bird flu, swine flu, even garden-variety seasonal flu.

“But that’s not what the polymers were designed to do in the first place. “They were designed to contain a drug payload that would kill diseases without endangering the patient,” Patrick explains. The newly awarded patent encompasses this purpose.

“It’s great news coming on the heels of a successful meeting with the FDA — in which the regulators gave every signal that they’d approve human trials for flu treatment soon.

“The market for flu drugs already tops $7 billion. ‘This company could be close to eliminating scores of dangerous viruses,’ says Patrick. ‘Someday…down the road this is…when it could be an industry leader… potentially raking in profits… potentially saving lives… long after it could have made forward thinkers like you very wealthy.'”

Well, after that it turns out we don’t need to get the few additional clues that were shared in the ad itself … this one must be teasing … Nanoviricides (NNVC, trades over the counter)

NNVC is a tiny company, with a market cap of about $100 million, and it is not going to become profitable in the near future. But that’s true of pretty much all of the early-stage biotechs. It’s also a stock that Cox has been touting for more than two years — I don’t know if he has recommended trading in or out of it at all along the way, but we first got wind of it from an earlier teaser of his back in early 2010. It has been a wild ride for the stock for many years, with a big spike in the mid-2000s when the bird flu story had everyone searching for virus killers and again in early 2010 (perhaps because of the Cox recommendation, though they had other developments going on as well).

Since then the stock has been relatively quiet — over the last year there’s been no big positive news to drive the shares higher, so it’s been drifting gradually lower and, in recent months, bouncing around between 50-70 cents most of the time.

They did get a patent award about three weeks ago, you can see that notification here — and it does sound pretty impressive in the press release as regards the broad potential scope of the patent, though obviously all press releases sound impressive and I’m in no way an expert on patents or the science behind their gizmos. They have a brief “fact sheet” style explanation of their technology and their strategy here if you want a quick run-through. Polymers that are used to track viruses are fairly common and it’s a strategy being tried by many other virus researchers from what I can tell (and there are a lot of polymer-related patents out there for drug delivery or antiviral stuff), but Nanoviricides seems to have as their key proprietary technology a “nanomachine” that mimics a cell’s surface (biomimetic, they call it) and allows the nanomaterial/polymer to latch on to the virus, prevent it from attaching to other cells, and effectively smother it to death.

That explanation is probably wrong in some technical way (or several), but that’s the basic idea — they make nano-scale materials that are designed to target specific viruses. Their most advanced project is called FluCide, which targets the flu (particularly the threatening pandemic-potential flues like avian flu, but it sounds like it can target any influenza virus), and they also have a program that might potentially reach the clinic fairly soon for HIV (HIVCide), as well as several others that are still at investigational/animal testing stages for Dengue Fever, various viruses that attack the eye, Herpes, Rabies, and some biodefense programs — one to build a base stockpile of “generic” nanoviricide base material that can be modified in the field to fight emerging pandemic viruses, and one for the real nasties (Ebola and Marburg). The company’s goal is to get external funding for their RabiCide and for the biodefense programs, and to try to develop the others through the conventional FDA clinical trial route (which I’d guess will mean getting in bed with deep-pocketed partners at some point — these would be mega-scale trials if they get to Phase II and III).

They have been burning through cash at the rate of roughly a million dollars a month, and that’s with quite a bit of their compensation being in the form of preferred stock, so their roughly $12 million in cash should get them through the year if they don’t start a large-scale trial — they say they have enough cash to last two years at their projected burn rate, so the reality is probably somewhere between those two guesses, and it seems very likely that they’ll continue selling shares to raise funding whenever the market seems receptive.

So … it’s interesting, they have a patented approach that seems to be working in flu studies so far, and so far — before human trials, which get crazy expensive — they’re burning through money at a reasonable rate in relation to the amount of cash they have on hand. Since this is a novel approach and a new class of nanomedicine, we can assume that the FDA will look at it very, very closely before it gets tested in humans in a Phase 1 clinical trial — which is why they had a “pre-meeting” with the FDA to exchange some questions and answers about what studies need to be done before they submit their IND (that’s the Investigational New Drug application, which is what you do before you can start a clinical trial). Their brief report from that “pre-IND meeting” is here, so it sounds like they have a “roadmap” of the path to a IND application but I haven’t seen any kind of timeline.

Cool technology, seems effective, not yet tried on humans and years away from the marketplace unless perhaps some emergency pandemic that thwarts all other drugs turns us all into guinea pigs (hopefully that will remain the stuff of thriller novels, and real life will remain more boring). Clearly some potential, though almost any biotech can say that — you’ll want to watch the science, watch their developments, and particularly keep an eye out for big pharmaceutical partners or deals with the defense department to restock their cash pile as they move down that “roadmap” toward potential future clinical trials. Beyond that, I bet a lot of Gumshoe readers know far more than I do about the science of attacking viruses (and I imagine several of you have nibbled on this stock in the past, either because of Cox and his past recommendations or because of other positive news items like this founder interview last year), so if that number includes you feel free to chime in.

"reveal" emails? If not,

just click here...

With companies like this, it seems ridiculous to get granular in your analysis and say that it is worth 50 cents but it’s not worth a dollar — the science is the value, and the science is years off and massive in potential scope, so the future value will be determined not by incremental cash flow but by broad brush strokes, with the most likely result being either a gradual decline in the share price if there’s no news or progress toward a clinical trial, or a binary event sometime in the next few years, which would probably be either a big partnership deal or an effective rejection of their technology. These kinds of investments, in very early stage companies, usually require a strong stomach and the ability to be patient and accept a total loss on your investment if the patience doesn’t pay off — you can sometimes get an edge if you’re expert on the technology or follow a largely-ignored company more closely than most, but it’s still a crapshoot. It’s like venture capital investing — they know that most of the companies will fail, but occasionally one will come through as a 10,000% winner that makes all the failures worthwhile.

Meanwhile, we move on to the Alzheimer’s teaser — who is Cox talking about that has an Alzheimer’s Phase I trial ready to go for this Fall?

He starts with the story of a guy named “Robert” who has Alzheimer’s, putting a human face on the disease and the desperate need for effective treatments and a cure — but you probably already know someone with Alzheimer’s already, so we don’t need that spiel. Here’s the promise:

“But due to recent research I will share with you today, there is hope…

“As MSNBC quoted a professor from King’s College London as saying… ‘The care of people with [Alzheimer’s] is not just a health issue, it is a massive social issue.’

“This higher awareness comes just in time too. Because as one researcher told Bloomberg BusinessWeek…

“‘The new understanding [is] that Alzheimer’s starts years before symptoms are apparent… The earlier the disease can be identified, the better are the chances to slow its development…’

“Now what if there was a way to not only find out about Alzheimer’s sooner, but also slow it down and eventually destroy it?

“Due to shocking new research, this is the HOPE I want to share with you today…”

And he mentions a few of the big, failed projects to fight Alzheimer’s that have ended up squandering millions of big pharma dollars over the years, reiterates the massive size of the potential market (he says we spend $172 billion a year on Alzheimer’s treatment — which presumably includes a lot of nursing home costs) and tells us how he thinks it will be a little guy with a breakthrough that discovers or develops a real cure …

“…. my research leads me to believe that in the case of Alzheimer’s – it isn’t one of the big, powerful pharma companies that have the best possible solution for Alzheimer’s.

“In fact, as my research will show you – big pharma has dropped the ball on Alzheimer’s.

“In the case of Alzheimer’s research, I’ve uncovered yet another classic case of the biggest potential breakthroughs coming from the smallest companies.

“What I’ll show you is like how 25 years ago two unknown Australian researchers discovered the true cause of peptic ulcers was a bacteria, not stress or spicy foods.

“Despite millions spent in ulcer research by the big pharmaceutical companies…

“This is just one example of a research David slaying Goliath in the past few decades…

“Today it could be happening again. Not with ulcers – but with Alzheimer’s.”

And some specifics to help out the Mighty, Mighty Thinkolator? Of course!

“CEO Reveals: Shocking New Alzheimer’s Treatment to Hit Phase I Trials in September…

“Phase I trials are the first official step to finding out if new drugs and treatments are safe and if they work. Merely getting a hopeful new drug to Phase I is a big story…

“The story of the tiny company that could offer real hope for Robert is a double-big story because this company’s research is so unique. In fact, it’s completely novel. It’s new.

“Plus – this company’s best Alzheimer’s treatment has already completed Phase I trials.

“This is a matter of public record.

“If the evidence the company has so far holds up, we could be very near the end for Alzheimer’s….

“A Barclay’s analyst recently reported that a drug on the market that could reduce memory loss would immediately be worth $5 billion a year.

“If the tiny company I want to tell you about today is RIGHT – they’ll be right by themselves. That market could BELONG to this tiny firm.

“When you compare $5 billion to the current market cap of the company I want to tell you about – you’re looking at the potential for a 100x price explosion.

“This is exactly what further clinical trials could begin to make clear. To analysts. To the press. To the scientific community. To every researcher in the world….”

And then Cox starts to share some excerpts of interviews that he conducted with the CEO of the company …

“In validated standard approach animal models, which everybody does, we’ve seen an efficacy that far exceeds Aricept (Eisai/Pfizer), and at very low doses. We also have seen actual disease modification. Aricept is the market leader and is a symptomatic treatment only — there is no disease modification.

“…The other interesting thing is affinity of these compounds… is very strong at very low doses. So our thinking is we may be able to get significant efficacy without having to make the trade-off between tolerability and adverse event profile.”

Aricept, despite the fact that it only treats the symptoms and doesn’t “cure,” reverse or prevent Alzheimer’s, generated revenues of several billion dollars a year before it went off patent a couple years ago (it is now available as a generic called donepezil), so that kind of mega-drug status (or better) is what researchers are striving for.

And then we get the bit that makes you want to start browsing Ferrari catalogues:

“Right now this tiny research company I want to tell you all about trades for around $.70 a share….

“As it enters more trials as I expect it could in the coming weeks, the increased exposure alone could shoot it to $10-$15. This is a conservative projection.

“In time, if this new way of possibly treating Alzheimer’s is successful, $30-$50 a share is reasonable. This is also a conservative guess.

“Then, if all goes well – by the time folks like Robert can receive this treatment – by the time this tiny company is RESTORING lives… well, the sky’s the limit.”

Of course, there are lots of “coulds” and “ifs” in there, but the lizard brain’s lust for an Italian sports car doesn’t listen to qualifiers.

We then get a little bit more detail about how this company’s approach and drug might be different …

“Plaque in the brain can contribute to Alzheimer’s, according to how the New York Times described Alzheimer’s.

“At least, that’s the common wisdom.

“New science, pioneered by the first company I reveal to you in Breakthrough Profits Today From Tiny Companies Working to End The Great Plagues of Our Time, says that common wisdom could be wrong….

“Remember that major drug backed by Pfizer that recently failed? The research behind this drug was based on the “plaque model” of Alzheimer’s.

“So was a recent failed drug from Eli Lilly. The Associated Press carried the story just a few days ago…

“Still, big pharma’s insistence on researching the ‘plaque model’ continues.

“The tiny company I want to share with you today flat-out rejects the “plaque model”. All of this company’s research is focused on another possible Alzheimer’s cause…

“In fact, here’s what this tiny company’s CEO told me in our recent interview about where big pharma’s work is headed…

‘The field is thinning out…And you need to define the mechanism, which is probably best addressed via multiple pathways. The ideal drug would be one that is a small molecule, orally available, with an ability to combine with other oral therapies, that is a disease-modifying {…} compound. With those qualifiers, there are very few companies.'”

Ironically enough, it turns out that this must be a stock that I had forgotten about completely (but that Cox has teased in the past): Anavex Life Sciences (AVXL, trades over the counter).

Which was indeed around 70 cents a few weeks ago when it bottomed out … but it’s now just over a dollar, perhaps partly due to Cox’s renewed enthusiasm for the shares. This is another pick that has come far, far down from the enthusiastic pricing it enjoyed in recent years, it hit $4 in 2011 and was around $5 back in 2008, though it’s been all downhill over the past year or so, even with their completion of the first Phase I clinical trial late last year.

Anavex explains itself pretty well, so if you want the story of their lead Alzheimer’s drug (Anavex 2-73) you can get the basics here on their website. They are continuing to test dosages, and hope to get into a Phase 2 trial (or Phase 2a, whatever that means, as a preliminary step) to start testing efficacy and safety in humans — Phase 1 was for making sure the drug gets into the system, making sure there’s no dangerous reaction, and seeing what kind of dose is tolerated; Phase 2 is where we start to really learn whether it might work.

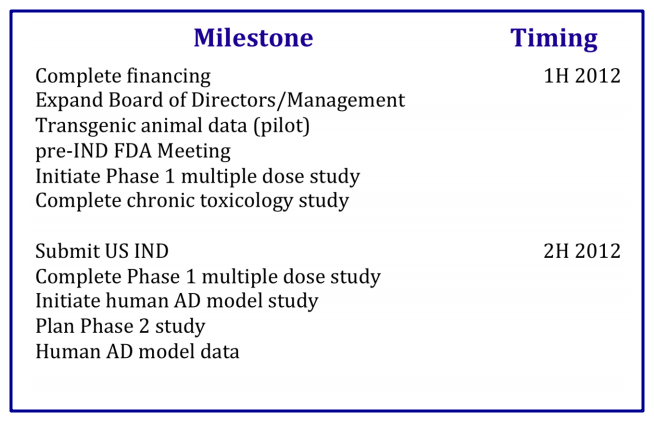

Anavex is teensy even compared to the other companies Cox likes to tout and tease, it has a market cap of only $30 million and they are currently broke — they need cash to get through this year and to get Anavex 2-73 far enough along in development to get a good partnership deal — their goal is to bring on a partner to fund the drug through to Phase 3 trials, and presumably they’ll get a better deal if they have some stronger Phase 1 or Phase 2a data first. Here are the catalysts they described as upcoming when they gave a corporate presentation back in February:

I haven’t seen any word of the financing deal that they hoped to have in place in the first half of this year, so that still ought to be coming — one would presume that the shares would fall on any big capital raising event (this is a $30 million company, so even raising the few million that they absolutely need would be big). That might not happen, of course, since they might raise the money on good terms or folks might be more comfortable with the stock once they’ve built a bit of a cash cushion to fund their R&D for a little while, or perhaps that “dilution” is already built into the price … but my bet would be that if they announce they’re raising $5-10 million, the stock would fall sharply … and if they were going to get great terms on that capital raising, it seems a little odd that they haven’t done it yet, more time only makes the need sharper and presumably gives their funders more leverage.

That’s all just my guessing, though — I haven’t combed through the SEC filings other than to quickly check that yes, they really do need cash, and to confirm that this is a match for Cox’s clues. The first time Cox teased this one was in the Fall of 2010, and it was also pitched similarly as an “end the grey plague” stock by Brian Hicks back earlier in that same year. So in the leadup to the first Phase 1 trial the stock doubled, then during the year that the trial was completed and reported it was halved … what will happen over the next year or two as (if) Phase II trials move forward? Well as I said, it’s tiny so pretty much anything can happen, and it’s arguable whether the stock even needs a reason to double or get cut in half, so you can make your own guesses on that.

And a bonus? Cox did throw in a couple hints about the other company he’s teasing, in addition to Anavex and Nanoviricides:

“The 2nd company in Breakthrough Profits Today From Tiny Companies Working to End The Great Plagues of Our Time has a product on the market right now that could help rid the body of inflammation.

“You can buy this breakthrough treatment online, or in a major national retailer.

“This research is very new. Not many people outside the scientific community even know about it yet. It could have huge potential for arthritis, diseases of organs like the thyroid and liver, even cancer. The best part is, scientists at a famous institute in Florida want to study it for Alzheimer’s too.

“The potential is endless. There’s also a study underway to see if this substance helps people who have Multiple Sclerosis.

“And you can currently snap up shares for as little as $3.35.”

Well, Jiminy Crickets if this isn’t his old favorite “The Last Stock You’ll Ever Need” pick — Star Scientific (CIGX) and their Anatabloc anti-inflammatory nutraceutical (which is also in early clinical trials and studies to see if it can help with Multiple Sclerosis and Alzheimer’s, among other things). I’ve tried the actual supplement and it hasn’t changed my life, but perhaps it’s helping a little bit (and I didn’t have any debilitating inflammation problems to begin with). I’ve written about Star Scientific a jillion times, almost always as a result of various Patrick Cox teasers over the years, so I won’t bore you with more here nd) — it’s a tobacco curing technology company that has become (though it’s still in patent/licensing disputes with some tobacco companies) a broad bet that Anatabine, and their specific formulation thereof, will turn out to be a hot supplement and eventually, perhaps, the kind of preventive that people take just like they take vitamins. The latest news was that they’ve rolled the product out in all GNC stores, and have received a patent for their synthetic formulation of anatabine. I’m not at all convinced that this is the “Last Stock You’ll Ever Need,” or even that their Anatabloc will take off, but I do have some small positions in CIGX call options just in case some near term news causes it to spike over the next year or so.

NNVC’s human trials will be much less expensive that typical trials, because their first drug to be tested will be the anti-flu drug. It will be inexpensive to administer and results will be available very quickly, since the normal course of flu is measured in weeks, not months as it is for expensive anti-cancer drugs. NNVC’s CEO has stated that they may be pursuing initial human trials in other countries, so there may be news relatively quickly if they decide to have “Flu-cide” trials in the southern hemisphere’s flu season (summer for us Northern hemisphere residents).

Will the leaders of these countries be willing to run human trials before they know if the drug will kill people or not?

I have a subscription to Breakthrough Technology Alert and today’s teasers were about AVXL and GALT and NNVC. I did not see anything about CIGX but may have just glossed over it.

Interesting — FYI for other folks, GALT is Galectin Therapeutics (primary programs are mostly cancer-focused right now), and they used to be called Pro-Pharmaceuticals. Under their earlier name they were also teased by Cox early in 2011 when they were around $7-8, they’re back down to the $2 range now. I think the only time I’ve mentioned them is here: http://stockgumshoe.com/reviews/breakthrough-technology-alert/next-printing-press-part-two-five-breakthrough-companies-teased-by-patrick-cox/

Hi,

Just a comment on the Alzheimer disease. Since I run a biomedecine company and am working with some of the most famous scientists in Sweden I happen to know that the problem with interfering with a protein that causes Alzheimer is that this protein has 20-50 different functions so if you interfere with it you may have several not wanted sideeffects.

That´s the problem with all diseases where you want to change a function within a protein.

Peter R.

Just MSM 8000 mg per day and see how your hand pain is. works wonders and comes from food.

Yes Peter is right

cant change one thing without upsetting other things

Same with the hocus pocus with the AIDS/HIV – no one has pinned it down largely because it it has never been properly isolated and photographed and second it changes its shape all the time (over 30 years now) and third it can be attributed to now over 100 different things. I I think the latest HIV is to do with psoriasis – simply put its a immune deficiency but AIDS sounds so much better and worth of billions in grants

I bought Anatabloc to see if it would help ease the neuropathic pain I have in my hands as they claimed it would. It didn’t. If it had I would have bought the stock and made sure that everyone I know would have bought also. Needless to say, I am on the sidelines.

What if NanoViricides tests Flu-Cide in humans, soon, in a country more accommodating than the USA? And, what if in a few weeks of tests it is shown that Flu-Cide defeats flu? This could happen. This possibility puts all the doubts raised in the article in the shade, and it’s why I’m invested in NNVC. There is still a real world out there – in spite of bureaucratic mazes that make the real world appear secondary to books of rules.

“More ccommodating”? That bureaucratic maze and those books of rules exist to prevent the foisting of dangerous and/or ineffective drugs on the “real world”, i.e., PEOPLE , such as you and I and everyone else. This is not failure to accommodate. It is responsible governance.

Vic Bowman,

This is not about stocks but about something you might try for your pain. At all major pharmacies, there is a pain reliever named Cobroxin. It comes as a gel for external application or as a spray for ingestion. No side effects unless overdosed. Read up on it. It is an excellent pain blocker, not a cure. I use it, I have no financial interest in Cobroxin.

Travis please let this through or forward it to Vic Bowman.

Leif Smith, “Bureaucratic Rules” ! Dxxn right! They do try to protect us but let through the compounds that kill while holding up the ones that do not kill and actually have a chance of curing. Money and greed are often involved.

I have been using Anatabloc by Star Scientifics since March 1. This is the first spring that I have not suffered from all the pollen and sinus infections. I get sick every 2-3 months and I will stay on the product.

Travis, it appears you got suckered into NNVC dictating the terms of the argument here. For example, saying that NNVC was “awarded a patent” – it was not. The patent was awarded to the AllExcel, a shell company owned by NNVC president Anil Diwan, then transferred to another Diwan shell company. TheraCour, which is going to allow NNVC to use the technology.

I’ve never seen any good come from a web of shell companies like this. Warning bells also go off when the company kool-aid drinkers post statements saying that human trials are going to happen in a blink of an eye – and cheap, too! Hey folks, go look up how many years Tamiflu trials took if you actually believe that.

Oh, but some mystery South American country NNVC hasn’t even talked to yet is going to run human trials a few months from now? Of course,

Glad you pointed out that NNVC has about a year of cash left, as opposed to the two years it claims.

So it doesn’t have any patents, human trials are likely years away, and it’s running out of cash. Sounds like a $100 million valuation is overly optimistic.

Good dose of reality Doc, thanks. Hadn’t checked into the actual ownership of the patents, but if it’s as you say then yes, the “tangled webs” of cross-ownership and licensing seem often to be set up to benefit the insiders disproportionately (NNVC does have exclusive worldwide license, but I don’t know the details).

And I would agree that new nanomedicines like this are going to face a long slog from the FDA, though it is good that they’ve at least had their pre-IND meeting to set the framework for potential hoops to jump through prior to clinical trials. It may not be as bad as Alzheimer’s drugs, since impacting brain chemistry always gets the FDA nervous and Alzheimer’s drugs have tended to have scary side effects (or lack of efficacy) in the past because of the complexity, but new types of drugs always face very long study periods and lots of trials before (if) the FDA gets comfortable … especially a drug like FluCide that would presumably have a huge potential patient pool. I think the best potential for getting something done quickly at Nanoviricides and generating any near-term revenue (near term being the next couple years) would be an end run around the FDA by the bioterrorism defense folks to sponsor the Ebola/Marburg or Bird Flu emergency treatment research, but that’s just my guess.

My Mom was diagnosed with Alzheimer’s so I’ve spent a lot of time reading about it in the past 6 years. I typically go to http://www.alzforum.org to read about the latest hypothesis. Given that, Anavex really is about tying up those nasty free radicals we always hear about. Nothing new about it. Then, the root cause of the free radical build up has to be determined. Is it proximity to a chemical plant, radiation and mercury fillings from your Dentist, Jack Daniels charcoal, Camel cigarettes, flu shots containing mercury or just sleep apnea? Reading through the latest hypothesis is interesting, because lot’s of odd molecules, chromosome defects as well as Vitamin B12 deficiency have been postulated. A researcher even thinks that the opposite > people who cannot forget anything and have very strong memories have just very low levels of amyloid proteins naturally. If so, Anavex doesn’t have anything to do with amyloid reduction. If it is tied to the Down Syndrome > Chromosone 21 trisomy, as well as chromosome 1, 14 and 19, defects, imagine what it will take to prevent the chromosome aberrations in the 1st place. So for me, NNVC is just bottling a vitamin supplement with a sexy name.

Sharon, I’ve been following an Alzheimer company for years that seems to actually be making progress. Prana (PRAN) successfully completed a phase 2(a) trial and has started the phase 2 trial in which they are imaging the brains of patients with and without Alzheimer’s. At least two labs (MIT, Max Planc) have investigated their claims and seem to support the efficacy of their approach. I suspect in a few months Prana will be reporting their interim results; we’ll know then if they really have something then or not. I hope to see some of those before and after brain images before I forget why!

I had been suffering from an inflamed bursal sac in my L elbow for 18 months, which resulted in my elbow swelling into a large bulbous lump that it required draining about 8 monthss ago. The elbow was & remained visibly inflamed and sore and began to fill with fluid again. A month ago I began taking anatabloc (2tabs/day) — and my elbow is now absolutely normal in feel and appearance.

Which may well have happened without the anatabloc. Your experiment lacked a control.

Google testimonials for Anatabloc and find much enthusiasm for the product. It attacks systemic inflammation, which is the common thread among most of the health problems of later life. Anatabloc shrank my prostate in a week and cured long-standing arthritis at the base of my thumbs in about four months. You have to stick with it for a while.

MRNA, another Cox pick took a 42% haircut yesterday when they announced they do not have funding to continue their Biz Plan, after a major haircut when they did a share consolidation.

ARNA has been a 3 bagger over the past month or so, betting on FDA approval later this month.

Travis – perhaps you should stock up on Anatabloc for next snowboarding lesson

I said Anatabloc didn’t work for me. I would hve ben happy if I had a placbo qeffect. I took 3 tabs per day and then upped it to 2 tabs 3 times a day. If it w

if it was going to work I would have felt some effect after 6 weeks. Thanks to szll for your suggestions. I will try each suggestion.

I hate to be the rain cloud at the parade, but in all good conscience, I have to say: Invest in a Patrick Cox-pumped stock, and pucker up; you’re about to kiss your money goodbye. Really, before you take Patrick Cox’s word for anything, first look at the performance of anything he’s ever pumped. That alone should open your eyes. Eventure Interactive Inc. (EVTI) is another Patrick Cox “Special”. The chart of that stock is pretty much representative of a Patrick Cox pumped stock. I wonder how this guy stays out of jail, or doesn’t have a couple hitmen trailing him.