Today we’ve got a new teaser from Ray Blanco to check out, he’s peddling his Breakthrough Technology Alert ($1,995, 90 day refund window) with the promise that you can get a pre-IPO stake in a $100 billion Tech Venture Fund… and that it could triple in its first day of trading, which he says will be “as soon as August 29th” — which is tomorrow, so I guess we’d better figger it out!

Here’s the first part of the email:

“If you’ve ever wanted to own a single stock that could fund a worry-free retirement many times over…

“Stop what you’re doing and read this message now.

“Because I predict we could be on the verge of the biggest IPO in history…

“Followed by the largest one-day spike ever recorded on a stock’s first trading day…

“Capped off with a multi-year climb that could turn a small sum into a $2.5 million payday.”

And it is apparently easy and cheap to get this “pre-IPO stake”…

“It takes just 10 minutes and a minimum of $50 to secure your very own pre-IPO stake.

This simple move sets you up to claim a full ownership stake whenever the fund goes public, without racing to buy shares at inflated prices after it begins trading.”

And the outlandish promises…

“If you put your money behind Warren Buffett at the beginning, you could have turned $100 into $2.4 million.

“So how much could you make if you put your money behind the visionary I’m talking about today?

“My research says your total gains could handily beat these extraordinary benchmarks.

“I estimate this stock could soar 5,000 times higher than its IPO price over time.”

Of course, “at the beginning” for Warren Buffet was more than 50 years ago, so you do have to keep in mind whether you’re interested in that kind of “hold through thick and thin” investment in a venture capital company… or if you’re more like most investors these days, and think of six months as a “long term” holding.

Of course, “at the beginning” for Warren Buffet was more than 50 years ago, so you do have to keep in mind whether you’re interested in that kind of “hold through thick and thin” investment in a venture capital company… or if you’re more like most investors these days, and think of six months as a “long term” holding.

And Blanco says this fund is already profitable, though it hasn’t IPO’d yet and is only two years old:

“This Tech Venture Fund has already paid out $6 billion to its private investors to date.

“That means, averaged out to the day…

“This Tech Venture Fund has paid out an average of $7.9 million in profits per day.”

So what is this fund? Who is this “legendary” person? More clues:

“… this IPO would give you direct ownership in these 69 companies.

“Companies hand-selected by the same man who has historically made 114 times… 714 times… and 4,500 times his money on previous similar investments.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“The Economist says this technology venture fund will soon be: ‘The world’s biggest collection of young tech firms.'”

So what is this “get in early” pitch all about? Apparently there’s something you can buy that gets you a slice of this Tech Venture Fund before it goes public…

“OK… Step by Step… Here’s Exactly How to ‘Jump the Line’ on What Could Be the World’s Biggest-Ever IPO

“Right now, I’ve uncovered a single move you can make today that would make you a shareholder with 48% interest in this Tech Venture Fund…

“This is currently the ONLY way in existence for average investors to get access to the hundreds of billions at stake right now…

“If and when the Tech Venture Fund goes public on the stock exchange, you will either:

“Benefit from an estimated multibillion-dollar windfall that would be distributed to everyone with equity in the fund (that would be you if you act on my simple recommendation today)…

“Or…

“You will automatically receive shares of the newly public venture fund directly deposited into your account…

“… without you needing to lift a finger.

“That would take you from 48% exposure to 100% exposure.”

So what Blanco is talking about here is Softbank’s Vision Fund, which has been rumored to possibly consider going public in the past few months… which means that he is actually teasing shares in Softbank Group, the parent, as a way to get “back door” access to the Vision Fund (parent Softbank owns about a quarter of the Fund, and is more levered to it than that due to fees and debt… and is listed in Japan, at ticker 9984, and trades OTC in the US at SFTBY and SFTBF.)

The visionary behind Softbank and the Vision Fund is CEO Masayoshi Son, who has been an investor and entrepreneur in the tech space for decades but is probably best known for being a very early backer of Alibaba and Yahoo Japan, huge winners that have generated the lion’s share of his incredible returns (he says his annual rate of return is 44% over 18 years).

Softbank’s Venture Fund is an amazing symbol for these late-stage times of plentiful unicorns, it has done venture investing in a very different way — fast investments, paying crazy-sounding prices for startups and bringing huge inflation to the venture world, leverage through debt, huge bets from Middle Eastern oil states (60% of the fund comes from just Saudi Arabia and Abu Dhabi), massive ownership stakes in ridiculous companies like WeWork — and it has worked fairly well so far, but it is still practically brand new (the fund was launched in 2017, and has distributed some returns to shareholders as a result of their timely bet on NVIDIA and the sale of Flipkart to Walmart).

Softbank Group is the only backer of the Venture Fund that is investing only equity, though part of that was done by contributing Softbank’s existing investments to the fund (like Arm Holdings, the chip designer that Softbank bought a few years ago) — Saudi Arabia and other big backers are getting a combination of preferred debt and equity — and it also charges a substantial private equity fee (roughly 1% management fee, plus 20% of returns over the 8% threshold)… so Softbank is indeed more levered to the Vision Fund than its investors are.

And yes, at the same time that rumors of a Venture Fund IPO started swirling earlier this year, they also started planning for Softbank Venture Fund 2, which will be even larger ($108 billion, they expect), and will help them to invest yet more into whatever Masayoshi Son and the fund’s hundreds of employees decide are the industries of tomorrow.

So yes, you might someday be invited to buy shares of the Venture Fund, part of the way they’re considering raising more money is by taking the Vision Fund public — though that might mean that they’re then selling some of the Vision Fund in order to help fund Vision Fund 2, and this quickly gets dizzying for those of us who are trying to figure out where the long-term opportunities lie. They have not filed an S-1 for the Vision Fund, and it’s not entirely clear that they would get SEC approval if they tried, given the structure of the fund, but perhaps they will.

Softbank does not have a lot of extra capital to throw into the next Vision Fund, the company already carries a LOT of debt, but that hasn’t slowed down Masayoshi Son very much in the past. I’ve long been skeptical of Softbank, largely because of the massive and rapid venture investments they’ve made and the big acquisitions they overpaid for (Arm holdings and Sprint), and the huge amount of debt they’ve taken on to make those bets (Softbank Group has about $160 billion in debt on its balance sheet, on a $90 billion market cap, and has been a huge beneficiary of easy debt and low interest rates… which might continue, but perhaps not forever). Despite my skepticism, it has still worked out reasonably well in recent years, and has certainly changed the way private companies raise money. The Venture Fund has completely turned venture capital upside down, it is 100X larger than most of the other funds who are raising money and has been a big reason why a lot of these unprofitable unicorns have been able to grow massive for years before they face the scrutiny of the public markets (Uber, WeWork, etc.).

But my skepticism might, of course, be too much — Masayoshi Son is a remarkable guy, with incredible vision and persistence and a willingness to make massive bets on the future. You can get a taste of where they think they’re going from their latest quarterly results briefing from a few weeks ago, both video and presentation files are available on their website.

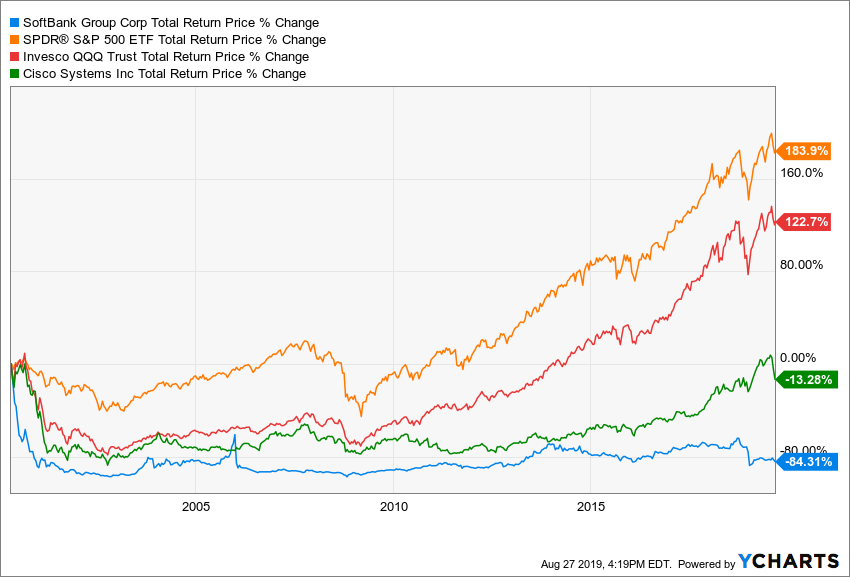

If you’d like a more optimistic take on Softbank, you need look no further than Fast Company, which had a long piece calling Son “the most powerful person in Silicon Valley” back in January… but I recommend the older article “Buying Warren Buffett, Richard Branson and Steve Jobs at a Discount” from Vitaliy Katsenelsen, who I know is a smart and thoughtful investor. Softbank shares have appreciated about 50% since he wrote that, but he still owns it and that’s pretty much just exactly mimicking the performance of the S&P 500 — so if there’s some huge outperformance to come by being involved with Son and Softbank, you haven’t missed it yet. This is what the stock looks like since Katsenelsen’s article was published (Softbank in blue, S&P 500 in orange):

Things are similarly unimpressive if you go back a bit further — if you had bought back in 2011 (when the data for SFTBY starts) you would have also roughly matched the S&P… and done markedly worse than the Nasdaq Composite (QQQ, in red), which is weighted toward the technology sectors that are expected to be Masayoshi Son’s strength.

And this last one is arguably unfair, but if you had bought Softbank during its first iteration as a lusty dot-com Japan trailblazer in 2000, you would have seen your portfolio clobbered and haven’t gotten close to getting your money back in the subsequent 19 years (it’s down 84% since it started trading OTC in the US near the peak of the dot com bubble, in May of 2000, while the S&P is up 185%). That was a very different company than the Softbank of today, of course, and was insanely overvalued in 2000… but so was Cisco, just to provide one well-known dot-com bubble example, and CSCO has now almost come back to even.

None of that means that Softbank can’t do well from here, it might. It just means that you should remember that you’re investing in the company because of Masayoshi Son’s investing acumen… and that has so far produced two huge winners in the post-crisis era, but not yet any great returns for shareholders who have held the shares for a long time. Part of the investment thesis is based on belief, both in Son’s acumen and in the next wave of breakthrough technologies that he is gobbling up at a record pace, so you can’t really expect great results if you go into a Softbank investment with a strict financial mindset: You have to believe that the Vision Fund and, soon, the Vision Fund 2, will generate great returns over the next decade by backing the startups who will be the leading companies of 2030 or 2040. If that happens, then Softbank will do well and could generate great levered returns from the success of the two funds… if it doesn’t, well, leverage works both ways and the promises made to Saudi Arabia and Abu Dhabi and the other limited partners will eat into the funds and significantly reduce Softbank’s value.

If Softbank does take the Vision Fund public, which is a huge “if,” I suppose it’s possible that they might do so by spinning out their stake in the Fund to Softbank shareholders — it’s also possible that they might just sell a small stake to raise some cash or create liquidity for existing fund investors. I would be surprised if this is the path they take, particularly since having a meaningful public shareholder base can create challenges for venture capital funds given the long time commitment they generally require… but Masayoshi Son has done plenty of things that are way more surprising than that.

I have not done any detailed valuation work on Softbank shares, but I do think Vitaliy’s work has been worth reading over the years, I’ve seen him speak a few times, and I trust that his valuation work is reasonable and rigorous (he might not come to the same conclusions I would, but he’s not making stuff up). Here’s what he noted in a more recent free article:

“Here’s our view: By buying Softbank’s shares we effectively hired Son — a brilliant investor, a visionary — on the cheap (we are paying a 50% discount for Softbank’s shares relative to our estimate of their value) to make capital allocation decisions for us. Do we agree (or even understand) every capital allocation decision he makes? Absolutely not. He has a unique view of the world and has built an enormously successful company from scratch by getting a lot more things right than wrong.”

That’s hard to argue with, though your estimate of the current value of Softbank’s shares might be differen… so if you go in with that expectation it really just comes down to trusting a money manager in Masayoshi Son, and either picking at his ideas or just letting it ride. I am not inclined to do that in this case, but I can see why a reasonable person might. And thanks to the fees and the controlling stake, I would definitely buy Softbank itself before investing in the Softbank Venture Fund (or Venture Fund 2), assuming either of those funds really does go public someday.

This is also an idea that Blanco has trotted out before — Softbank is the most likely investment idea behind his “Halo-Fi” teasers for satellite-based internet that we’ve seen, since OneWeb is one of Softbank’s portfolio companies… but OneWeb is not going to be a positive contributor to Softbank’s results anytime soon, and indeed Softbank had to write down the value of its large OneWeb stake by half a billion dollars this year (I don’t remember whether OneWeb is a Softbank direct investment, or part of the Vision Fund, but it doesn’t really matter at this point).

That’s just what I think, though, and when it comes to your money it’s your thinking that counts — interested in Softbank or possibly getting exposure to the Venture Fund if it ever goes public? Let us know with a comment below.

Ray recommended SFTBY a buy up to $30 on August 5th. It has dropped ever since.

Is it just me or is all advertising becoming more desperate? You’ve mentioned it before, but if all these gurus are so great, why would they want money for their newsletters? It’s getting to the point for me that if something is advertised, if don’t want it.

Probably a good basic feeling to start with… a lot of very wise investors try very hard to avoid investing in anything that folks are trying to “sell” to them.

Completely agree. Worst investment advice I ever bought was Stansberry’s CREDIT OPPORTUNITIES; highly hyped, highly advertised and expensive. I’ve lost on 70% of the recommended bonds and 80% of their Golden Triangle stock picks that I was able to find at or below their “buy up to” price. Simple rule of thumb to always remember: If the sob’s were so smart, why the hell aren’t they buying long calls and shares instead of peddling newsletters.

Remember years ago, my grandfather getting a sales call — vacuum cleaners I think — and after listening for several long minutes he said, “ Sounds damn good to me, I think you ought to go ahead and buy one” and he promptly hung up. I should have used his example.

You must have been extremely unlucky in the bonds you were able to get into. They quote their overall success rate at 80+%. Bummer…

Can always buy puts!

I don’t know why your SFTBF data doesn’t go back as far as it should. I bought it at $30/share before 2000 and it went to $1900 before collapsing. (No, I did not sell anywhere near the top; sigh.)

For what it’s worth, Alex Green in The Oxford Communique is hyping SFTBY. He believes it’s selling for just about half of the value of its current assets.

Did Green give up on his “only one stock to own” Hon Hai Precision (HNHPF)? Best to flush your money down the Softbank toilet instead?

Different person. Ray Blanco is the editor of this newsletter from 7-figure publishing, Alexander Green’s touts are for his Oxford Club (though both are affiliated with Agora). And yes, Green is still pitching that Hon Hai tease for “one stock retirement.”

Oh, just saw you were referring to another commenter… sorry! Haven’t seen Green tease Softbank, FWIW, so they haven’t been promoting that position.

Joe,

It’s almost about a year now that I took the bait for Hon Precision (HNHPF) and invested through Fidelity’s Foreign Stocks.

I lost over $1,000 when it did a reverse split….very disappointed to say the least. Recently, I almost fell for another pitch only to find it was Alex Green pitching a year old play 0f Hon Hai (again), in his book! I believe he must have too many of his books left over from last year and needs to get rid of them!

I esp like this “Gumshoe” site, so much that I stopped being a guest and joined tonight!

Thanks Sara, welcome aboard!

Smart move joining, I almost signed up for a couple different subscriptions and remembered the GUMSHOE and I found both were covered by GUMSHOE and I did not fall for either after looking at what he discovered. Saved me a great deal of money.

I have sftby on my watchlist as a buy at 55-60% below it’s current value. Every time Ray recommends the stock it falls, but quite a few analysts recommend this stock and most of them I call balloon analysts. They blow things out of proportion and have no credible evidence of the timing. I believe the market can be timed and larger bumps can be had when the stock is really undervalued.

I like the picks it potentially adds new aspects/fields to consider or weigh against the ones you like..even if you would avoid them. Also makes for a good read…

Me thinks that Softbank’s financials depends upon the Sprint/TMobile merger as it owns a majority stake in Sprint and has for some time.

I switched from Sprint to ATT, as Sprint has been terrible….

On the California. 50 marijuania stock mentioned elsewhere….I own several MJ stocks which are moving very slow….so no more of those stocks for me! TTD is doing fine….Hon hai…Foxconn is slow moving but I will hang on….

We own 1200 shares . The jury is out but we are holding long term. Hopefully they see 1900 again in some remote future.

We own 1200 shares. Like BABA and the vision fund. We are praying his vision fund is not out of focus.

Ya, I think Ray is a Dope! Trying to hang on to a paycheck!

Sorry Ray, ya dope!

Excellent article. I’m actually going to look into this. I like the “Buying The Man” theme. Its what drives Tesla. If you look at the industries Tesla competes in, the company is extremely overvalued. But people are buying “The Man”.

On the bright side, SFTBY has a very bullish 9.8 rating by Fidelity, and has a book value 23% higher than the current stock price. They also have great earnings 33% of the current stock price. On the down side, they don’;t offer options and their current ration is less than 1 at .89.

Katsenelsen has sold his SoftBank. He is disappointed in the huge debt being rung up, the sinking more $ into WeWork, and the pouring more $ into the Vision Fund 2.

Don’t blame him!