Today, thanks to popular demand, we’re digging into a new teaser pitch from Christian DeHaemer’s Bull & Bust Report ($99/yr) — most of the pitch is really about how the government is going to “ban” Bitcoin starting on June 16, but the bigger picture spiel is about what that means for blockchain… and for the companies who enable it. Ready?

This is the headline that a lot of readers reacted to:

“WARNING: Shocking June 16 Announcement Could Spell the END OF BITCOIN

“And create a new chance for quadruple-digit gains that could turn every $1,000 into as much as $94,840… (Without ever owning a single cryptocurrency).”

PANIC PANIC PANIC! Oh, wait, it’s OK, it’s an ad. We can handle this. What’s the story? Here’s some more form the pitch:

“… the government is setting the stage for a “digital dollar.”

“It could be announced as soon as June 16.

“When this happens, one off-the-radar company providing vital technology for this massive shift could go through the roof.

“Remember, the first time blockchain technology took off, investors made combined gains of 10,280%.”

OK, we’re all delighted to get 10,000% gains, right? How is this related to Bitcoin then? More from DeHaemer:

“… this could be a much bigger millionaire-maker than Bitcoin ever was…

“The Economist calls it ‘the next big thing.’

“Fortune reported it will ‘change the world.’

“And the CEO of $2.5 trillion investment giant Fidelity said, ‘[This] will fundamentally change market structures.’

“Like I said, those who position themselves correctly now could have the opportunity to make 6,660% gains.”

Wait, which is it — 10,000% or 6,660%? Why is the number going down? I want my 10,000%!

The “End of Bitcoin” part of this is step one, it begins with this “war on cryptocurrencies” that DeHaemer sees coming from the government…

“You see, this war is not only about Bitcoin, or any one cryptocurrency.

“This war is about preserving the dollar’s dominance throughout our economy.

“That’s why the authorities are cracking down on any new form of money that isn’t issued by the government.

“And this war has already started…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“The Government’s Crackdown Is in Full Swing”

The examples he gives of this are Facebook, which was pilloried for floating the idea of its Libra cryptocurrency a couple years ago and more recently has talked about an updated strategy using a token they call Diem for on-Facebook transactions… and Ripple (XRP), which got sued by the SEC for doing illegal securities offerings.

And he compares this to gold…

“In fact, this current turn of events bears an uncanny resemblance to the last time Americans were banned from owning a potential new currency.

“It happened almost 90 years ago when, just like today, the government wanted to squash a rival currency.

“I’m talking about Franklin D. Roosevelt’s gold ban.

“In 1933, FDR feared that physical gold could replace the U.S. dollar.

“As the Fed explains, ‘Individuals and firms preferred holding metallic gold to bank deposits or paper currency.’

“That’s why, with a single act, FDR forced Americans to turn in their gold savings.”

I don’t think that’s a reasonable comparison, though I guess we could argue about it if we feel like getting bogged down in Depression-era politics. The US dollar was backed by gold back then, which constrained the government from creating too much money — that didn’t work for FDR, because he wanted to increase the currency supply coming out of the Great Depression and generate more capacity to stimulate the economy with the New Deal and build the first real “safety net” programs like Social Security. Essentially, as I see it, he wanted to slash rates, increase government spending, and boost economic activity, in part by reducing the value of the dollar, and (unlike the politicians and central bankers of today) he couldn’t do it easily because the dollar was backed by gold… so the government seized all the privately-held gold, reset the dollar’s gold backing at a new level for foreign exchange and trade purposes but distanced the dollar from gold in the eyes of regular folks by getting rid of the dollar coins, and therefore stimulated the economy with new money.

That’s not going to happen with cryptocurrencies — yes, they might (and probably will) face a lot more government regulation because of the craziness going on in the crypto space, and because the US doesn’t want to lose control of its currency by having people bypass it or build businesses that are harder to track and monitor. Governments and politicians absolutely do not want to lose control of their nation’s currency (which is why no government is genuinely interested in going back to a gold standard), and that means the Treasury will tax your Bitcoin trading but it won’t accept taxes paid in Bitcoins… but it’s not the same as the situation with gold in the 1930s.

So what’s going to happen? DeHaemer implies that somehow Biden will crush Bitcoin by replacing it with a “digital dollar” …

“I expect him to usher in the biggest monetary transformation we’ll see in our lifetimes.

“I’m talking about the launch of a ‘digital dollar.’

“The Fed could announce it as soon as June 16.

“According to Fed Gov. Lael Brainard, a digital dollar will ensure government-issued money ‘[stays] at the center of [the U.S.] financial system.’

“And the transformation toward a digital dollar is the chance to turn every $1,000 into as much as $67,600 before the year ends.”

So we’re still on that 6,600% pitch, but now he says “before the year ends” — which makes it extra crazy.

Does that “June 16” date mean anything? Probably not really… that is when the next Fed meeting will take place (after today’s), and there will be a press conference and it could well be that a “digital dollar” will come up, or that talk of the risk of “stablecoins” as dollars substitutes in other countries is again part of the questioning, as has happened before, mostly because of Chinese talk about their own digital Yuan.

As for the timing of any big shift in the technological underpinning for the US$, though, whether that’s a real blockchain-powered ledger for dollars or something else, there are going to be Task Forces and Studies and White Papers, but I expect we’re nowhere near big changes… here’s how Powell reportedly summed up the idea of a Central Bank Digital Currency (CBDC) in January (this is from a posting at The Block):

“On the topic of CBDCs, Powell remarked that ‘[w]e’re going to look at it very, very carefully,’ reiterating that any potential creation by the Fed would constitute a years-long process. ‘We’re determined to do this right rather than quickly, and it will take some time — measured in years rather than months.'”

I obviously don’t know what’s in the minds of politicians or of Federal Reserve staffers and board members… but changes at that level tend to be very slow. And conceptually, I’d be careful about assuming any huge or abrupt change from a shift to a “digital dollar” or “crypto dollar” even if that does come over time — the US Dollar is effectively already a digital currency, most of it does not exist in paper form, it’s in the form of ones and zeros in computers in the banking system and at the Federal Reserve. That is not going to change, and if the government begins to shift to some kind of cryptocurrency or blockchain-powered system to track and control the dollar, instead of the existing computer networks, it won’t necessarily mean anything for the value of the dollar (or Bitcoin). A new blockchain-driven system could also pretty well destroy financial privacy over time, and I expect that will raise a lot of hackles, so expect lots of pushback on whatever they do in the ‘fedcoin’ or ‘digital dollar’ realm.

Yes, a shift to a more efficient digital dollar might mean that the government gets more effective in taxation enforcement, or that the banking system gets more efficient — that might be a major benefit, a modernization of the interbank transfer system and a more secure way to move money around without paying fees to various intermediaries in the banking system… but any change like that would also be extremely slow, and would depend on the participation of the mega-banks and other companies, like Visa and Mastercard, who effectively control the flow of money in the US on a daily basis and are not going to want to give up the little slice of frosting that they lick from the cake each time it passes through their computer networks (though they are, I bet, far more involved with researching blockchain applications than the Feds are). Changing the way that money moves and is tracked to cut out the middlemen, without involving companies like Visa or JP Morgan who effectively run much of the current infrastructure, would be like saying you’re going to invent a new internet without the participation of Google or the other tech giants. Yes, I suppose it could happen over time… but it ain’t gonna be easy or fast, there’s no flicking a switch to make it happen by fiat.

So yes, as usual, I’d say that “Biden’s going to ban Bitcoin!” bit seems mostly to be a way to get your attention… and the June 16 date is very likely just put in there to provide some artificial urgency (marketers are not dummies — if there’s no deadline, the probability that you’ll pull out your credit card drops considerably).

Political affinity is a common marketing tactic — any time a politician is mentioned in an ad and you start nodding your head and saying “Yeah!”, or anytime an ad throws out political talking points on either side (DeHaemer says “I’m talking about a drastic decision made behind closed doors… approved by Deep State cronies more than 74 million Americans didn’t vote for”), just remember that this is about selling you something. The copywriter is trying to get you to have a visceral emotional reaction, because that’s what keeps you reading and gets you engaged and lets them build up the sales pitch to the point where you’ll be begging for the opportunity to join the club and get the inside info — often in newsletter teases that primary emotional reaction is greed and the fear of missing out (FOMO), but political sentiment works really well to build a connection between the newsletter and the potential subscribe, too. If you pound your desk and say “that’s what I’ve been telling everyone” when you read stuff like that, then try to step back and remember that your emotional response or your perceived rapport with the person spinning this tale, is being used to manipulate you to buy something.

It happens on both extremes of the political spectrum, to be clear — it’s just that in the investment newsletter business the audience, while it has been shifting over the years, tends to be relatively affluent older men, approaching retirement age… and that also happens to be the core demographic for conservative politics, so the crossover is a lot stronger on the right side of the political divide. But really, you can be pretty sure that any time a politician’s name or a hot-button political issue comes up in an ad, whether you vehemently agree or disagree… you’re being played by a marketer who knows how to poke you to get a strong response.

So yes, we want to try to short-circuit some of that marketing power before it moves from our brain to our wallet… but we’re still interested in the meat of the pitch. What exactly is being teased, and does it interest us as an investment once we try to wash a little of the emotional sludge off of it? That’s the heart of what we try to do here at Stock Gumshoe, so let’s move away from the “throwing red meat to the hounds” portion of the ad and see what he’s actually pitching… and yes, I heard you in the back of the room, muttering “finally” under your breath (sorry, sometimes the blatheration gets the beset of me).

“Why Bitcoin’s Downturn Is a 94X Investment Opportunity

“What I believe to be Biden’s plan to dismantle Bitcoin can be found in this 110-page document you saw earlier.

“In his “Task Force Recommendations,” Biden pledges to achieve ‘net-zero carbon emissions across our economy’ …

“Companies that contribute to carbon emissions will be facing huge fines under Biden’s plans….

“And that’s a huge problem, because Bitcoin has a massive carbon footprint….

“The Bitcoin network consumes more power than 159 of all 195 countries in the world.”

And what happens when Biden supposedly “Bans Bitcoin?”

“While Biden starts to dismantle Bitcoin, I expect a digital dollar to take center stage…

“For investors who understand that the war against Bitcoin goes hand in hand with this huge shift toward a digital dollar, it adds up to an opportunity to generate immeasurable wealth in a short period of time.

“To give you an idea of how big this opportunity is, consider that about 6 billion paper notes are printed annually.

“The cost to print these notes amounted to $843 million in 2020.

“That’s almost $1 billion the U.S. Bureau of Engraving and Printing has to spend each year just to produce our paper money.

“Imagine tapping into this stream of money… because that’s the kind of opportunity that presents itself today.

“You see, just like paper notes require a printing press, the digital dollar needs to run on specialized technology.”

Ah, so there we finally get into it — this isn’t a pitch for some competing cryptocurrency, or for something that will benefit from the supposed overnight collapse of Bitcoin when the feds ban it… it’s a technology company that sells what the Feds will need for this “digital dollar.”

So what’s the story? More hints:

“It’s the same kind of technology that’s behind Bitcoin and other cryptocurrencies.

“Getting behind this technology could give you the chance to make 6,660% gains in the coming years…

“This technology is called the blockchain.

“You might’ve heard about it already. And if you’re like most people, it might seem hard to understand at first.

“However, it’s quite simple.

“Blockchain technology is the foundation of all digital currencies.

“You can think of the blockchain as a digital record that can never be manipulated….

“If you’ve received a FedEx package lately, chances are it was processed through the blockchain.

“The delivery giant started using the blockchain to record vital information concerning your shipment and live updates… “

So we’re dealing with some kind of company that makes money from the adoption of blockchain technologies. Here’s some more from the pitch:

“The amount of cash at stake when it comes to a digital dollar is staggering.

“You see, the value of noncash dollar payments in the U.S. totals more than $94 TRILLION annually.

“This kind of volume is 134 times bigger than what PayPal processes each year.

“Now imagine getting in on a little-known tech supplier to PayPal before this kind of explosion.

“That’s the size of the opportunity you’re facing.”

So what’s our stock? Do we finally, for pete’s sake, gets some actual clues? Indeed, though they’re still limited…

“Inside, I’ve documented every detail necessary to help you strike it rich off one little-known company that’s at the heart of the impending blockchain gold rush.

“Its technology is the vital component for almost all blockchain hardware.

“Nasdaq says this company is at “The Top of the [Digital Currency] Food Chain.”

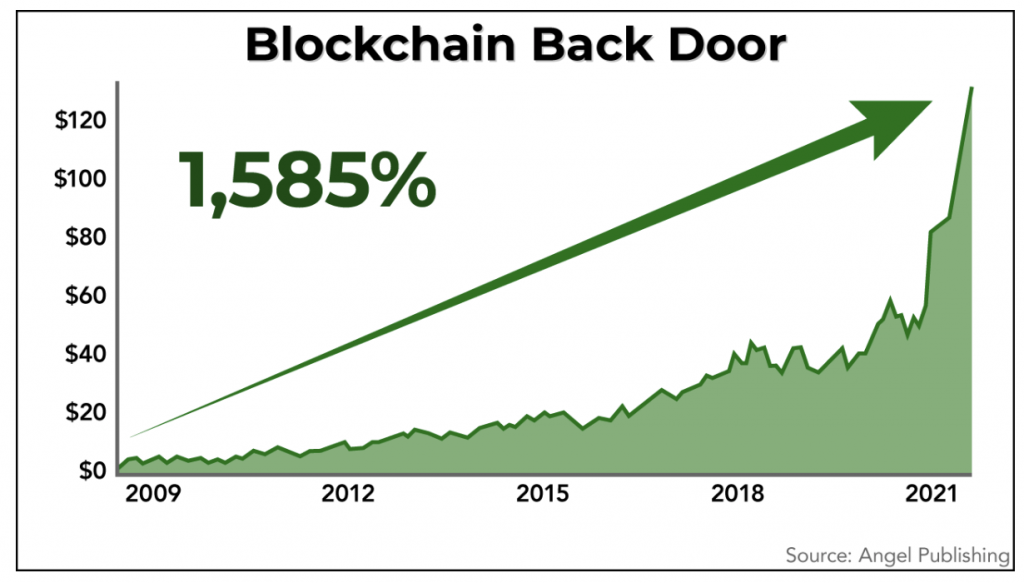

“Since the first blockchain went operational with Bitcoin’s launch on January 3, 2009, this company’s shares soared by 1,585%….

“This company owns the technology making both the digital dollar and the blockchain possible.”

And we get a handy-dandy stock chart for this secret company, so that will help with our confirmation if the Thinkolator can track down some good candidates…

Is there more to come? While this stock has already gone up by 1,500% since Bitcoin was introduced, DeHaemer points to some other tech suppliers who rose far more dramatically during that time period…

“The last time we were in a situation like this was on January 3, 2009.

“On that day, the first blockchain went online. It’s the date Bitcoin was launched.

“Of course, no one except hardcore computer nerds knew how to acquire Bitcoins back then. Crypto exchanges didn’t exist.

“But you could’ve easily bought shares of Nvidia and AMD.

“Both companies made the blockchain hardware the Bitcoin network used to run on until a few years ago.

“Did you cash in on their combined 10,280% run?”

So that’s the real possibility he’s hinting at — a second chance at a blockchain tech supplier>…

“Here’s your second chance.

“Based on my research, today we’re almost exactly where we were in 2009.

“Only we’re talking about a far BIGGER $400 trillion opportunity…

“And things are happening far FASTER this time.

“I expect share prices to go ballistic around June 16…

“When the Fed announces the digital dollar.

“This is precisely why you need to build up your investment position in this company dominating the blockchain sector today.”

So if we go with that “1,585% returns since January 2009” clue, and the matching chart that DeHaemer drops as a hint, we do start to see some potential but not quite matches… including Inphi (IPHI) and AMD (AMD)… but the one perfect match comes from a little bit of a surprising place, a much, much larger and more diversified company — the Thinkolator sez DeHaemer is pitching the biggest chipmaker in the world, Taiwan Semiconductor (TSM).

And yes, Taiwan Semiconductor is an extraordinary company, with a stock that roared to life a year or so ago after being a super-boring investment for a decade or more (and one that I looked at many times as an undervalued play on global chip demand… but never bought, more’s the pity). It’s not overlooked or undervalued anymore, that’s for sure… indeed, I’d go so far as to say that if there’s one company that could spark the next global war it’s probably Taiwan Semiconductor.

Taiwan Semiconductor is essentially the world’s foundry — outside of Intel, most of the big chipmakers would rather pay someone else to do the challenging and relatively low-margin work of manufacturing microchips, so when NVIDIA or AMD or Apple wants to build a new chip that they’ve designed, TSM is the first call… and for any high-volume company, they may be the only supplier who can meet demand for tens of millions of high-end chips. When we talk about “fabless” semiconductor companies, we really mean that those companies design computer chips and outsource the “fab” (fabrication) to a manufacturing plant, or foundry, owned by somebody else… and most of the time, that’s Taiwan Semiconductor, which built the first foundry for this outsourcing almost 35 years ago and remains the largest foundry operator. Almost 2/3 of the world’s fab capacity is in Taiwan, and Taiwan Semiconductor dominates production and capacity in its home country — their share of the global contract manufacturing business in chips is now reportedly 54%. Most of their foundries are in Taiwan, which has been a global flashpoint for decades (even before Mao’s revolution drove Chiang Kai-Shek’s Kuomintang to Taiwan in 1949, though things have certainly heated up during recent bouts of “independence” talk in Taiwan and fears following China’s crackdown on Hong Kong), but they do also have a little capacity in both mainland China and in the US.

Ten years ago, maybe even five years ago, it was probably still fair to say that Intel (ITC) was both the largest and most advanced chipmaker in the world. In recent years, Taiwan Semiconductor has arguably taken both of those crowns, partly because they invested heavily and successfully in the next-generation processes and technologies that continue to make chips smaller, faster and better… particularly the 7nm and 5nm processes that now make up roughly half of their revenue. 7nm has been the next-generation commercialized wafer tech for about three years now, since it was used to make Apple’s A12 chips for the iPhone that was introduced in 2018 (as well as the latest chips from Qualcomm, AMD and others that year), 5nm really started to come online late last year.

To some degree the sizes of these chips have become so small, and the other details of those design platforms so similar, that reaching the next breakthrough foundry node is as much a matter of bragging rights as it is actual functional improvement… but still, TSM and Samsung (to a lesser degree) have stolen quite a bit of the thunder from Intel over the past five years (Intel’s 7nm process was famously delayed and problematic, which meant that it at least looked like it was as much as five years behind TSM… that’s probably an exaggeration, but the impression has clearly been that TSM is the new bully on the block, they stole Intel’s lunch money and left them crying by the loading dock).

So what’s the connection to blockchain? Well Taiwan Semiconductor does work with big bitcoin miners to make chips for mining… and it’s not just the mining-specific ASIC chips that TSM makes (and sometimes designs, too) for folks like Bitmain or Canaan. Taiwan Semiconductor makes GPUs for both NVIDIA and AMD, the two leaders in that space, and those GPUs have been widely used by cryptocurrency miners. It’s not entirely clear how cryptocurrency mining or blockchain projects will impact future chip demand, but we should be a little careful in guessing at huge gains — Taiwan Semiconductor is a huge company, with a market cap of $600 billion and profits last year of $46 billion. Mining chips are not going to suddenly become a bigger deal for Taiwan Semiconductor (or Intel, or Samsung, or the other foundry operators) than are big high-volume chips for consumer products, like Apple’s latest chips for iPhones or Mac computers.

Increasing blockchain use probably means more business for TSM, that’s true… but we’re talking about the world’s biggest chipmaker, and everything uses chips, the world continuing to spin on its access probably means more business for TSM. It’s hard to argue that blockchain specifically will move the needle in a big way for Taiwan Semiconductor over the next few years, but it will probably help — and you don’t get huge exposure to stuff like Bitcoin without huge risk… so the fact that TSM only fell 5% during the mining crash of 2018, when Bitcoin fell 80%, is both a comfort and a reminder that this is not a particularly levered “blockchain” play. They have made chips for many of the mining rig companies, including Chinese giant Bitmain, and at least one report assesses the total mining chip-related income for TSM as being roughly equivalent to their income from GPU maker NVIDIA.

Taiwan Semiconductor, like NVIDIA, has also done some work to minimize the volatility that cryptocurrency mining demand has caused — NVIDIA announced recently that they’re releasing special mining chips to help even out the rollercoaster of demand that crypto prices caused for their core GPU gaming chipsets, and demand immediately jumped for those, and Taiwan Semiconductor has been throttling back the access that they give mining rig operators like Bitmain.

But really, Taiwan Semiconductor is not a bet specifically on blockchain or “dollar digitization” … it’s a bet on the continuing advancement of semiconductors, the increased demand for chips of all kinds, and the fact that both of those trends seem completely unstoppable and Taiwan Semiconductor is clearly the most dominant company in the space.

And, of course, it’s a bet on the semiconductor space in general, since so much of the growth in demand is from new fabless companies and new products. It might get complicated for a while, since the chip industry is just about guaranteed to be in a supply crisis for at least another year or so, thanks to rising demand for chips for automobiles and other products tied to the supply chain crisis that has been building over years, starting with the trade war but coming really to a head with the pandemic shutdowns of fabs and factories and the bottlenecks in the movement of goods around the world… and God knows what happens if China actually invades Taiwan… but so far things are looking quite strong in TSM’s fundamentals. In their first quarter report, they included some reassurances about revenue rising more quickly and the bottlenecks, particularly for automotive chips, beginning to ease within the next few months (though everyone expects shortages to last into 2022… and they also talked about investing more heavily in expansion and CapEx, cutting into margins a bit, so the stock did not react particularly ebulliently to the top-line optimism).

The challenge, for those who take a historical perspective, is that Taiwan Semiconductor has never been this richly valued — it was for a long time a boring outsourcer who kept its slice of the business but was never as sexy, in the eyes of investors, as the brands who hired them to make chips… not unlike Hon Hai/Foxconn (2317.TW HNHPF) or, for that matter, the automotive supplier/assembler we looked at yesterday (Magna International (MGA)). That changed over the past year, and a jump in earnings growth and the perception that TSM had lapped Intel and was the core provider for the hottest chipmakers, from NVIDIA to AMD to Apple, led investors to begin to pay more for the company. That’s arguably rational, it’s certainly one of the more strategically important companies in the world (though that brings regulatory and political risk, as well), but it’s pretty new… and it’s hard to adjust your thinking about valuation all that quickly if, like me, you’ve watched TSM for years.

Does that mean we can’t buy it now? No, not necessarily — you can still make a good case that a strategically critical (and almost unique) supplier like TSM, with gradually improving gross margins over time, is worth a premium price. But still, it’s important to note that TSM’s advance over the past couple years has been driven by sentiment, not performance — the shares have been going up mostly because investors are willing to pay a lot more for a dollar of TSM revenue or earnings than was the case a few years ago.

That’s true of a lot of companies, to be fair, “multiple expansion” is one of the major drivers of stocks over the past couple years (the S&P 500 traded at about 13X forward earnings ten years ago, and 17X forward earnings five years ago, but is now up to 22X), but it’s particularly obvious with TSM — here’s what that looks like in chart form, this is TSM’s share price (in blue) compared to the growth in revenue (orange) and earnings per share (red) and the rise in the gross margin (green). The increased profitability in 2020 was clearly a factor, with earnings growing much faster than revenues for the first time in a while, but for the most recent five year period the earnings doubled… and the share price went up by 450% at the peak.

There’s no rule that says this has to stop — TSM’s forward PE went from about 18 at the beginning of 2020 to about 30 now, but that’s because the company’s net income grew by almost 70% during that time, making it look, at least on the surface, like a much more appealing company to invest in. Maybe TSM is just getting started on squeezing out more profit from its operations and taking advantage of their relationships with huge technology leaders and their leadership in the sector, and if you ignore the past valuations at which TSM traded you can certainly still justify buying the shares. Really, judging the prospects for TSM depends on whether you think the Taiwan Semiconductor of 2014-2019 is the story you’re buying, with steady but very slow growth, or you think they’ve really turned a corner with their advanced node processing and new capacity expansions and the growth of 2019 and 2020 is what’s setting the stage for the years to come.

Here’s the basic valuation outlook: TSM is expected to grow revenues by close to 15% a year going forward, maybe a little more depending on who you ask. Analysts believe that will lead to earnings growth of 15-20% a year. The current expectation for 2021 is that TSM will earn $3.97 per share on revenue of $56 billion, so at $120 a share you’re effectively paying 30X earnings for a company that you think can generate 15-20% earnings growth. That’s perfectly reasonable. Maybe TSM is not a slow-growth company that is valued for its 3% dividend yield anymore, as was the case for many years… maybe it’s really a “growth at a reasonable price” industry leader, with the small kicker of a 1.5% yield that will probably continue to rise over time. You could talk me into that.

But no, it’s not because the Treasury Department or the Fed is going to somehow ban Bitcoin on June 16 and create a digital dollar that depends on some massive new supply of computer chips. The growth of the semiconductor industry, the strength of Taiwan Semiconductor, and the likelihood of increased demand for chips over time because of new blockchain applications are real… the panic over “Ban Bitcoin” or some mythical change that’s going to come down the pike on June 16 are just there to provide false urgency and sell newsletters.

That’s what I think, anyway… but it’s your money we’re talking about, so you get to make the call — interested in Taiwan Semiconductor as a play on blockchain (or, perhaps just “more technology” in general)? Think it’s overvalued here, or have better ideas for that space? Let us know with a comment below.

P.S. as always, readers always want to know what real subscribers to these newsletters think — have you ever subscribed to DeHaemer’s Bull & Bust Report? If so, please click here to share your experiences with your fellow investors. Thanks!

Disclosure: Of the stocks mentioned above, I own shares of NVIDIA and Google parent Alphabet, and I also own some Bitcoin. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

enlightening,to say the least.ty

Once again, nicely done Travis. Great industry report delivered with a touch of Dave Barry:)

Just your read on the socialist shenanigans of FDR and the elites of the era makes this article worth gold.

Maybe ‘ol Joe will talk( subsidies, Tax breaks) TSM into building part of the $100 BB capital expansion in the US. It would be safe from China and we would get our National Security concerns alleviated along with a lot of jobs. Has anyone heard any rumors on who, when and where Joe wants to put our major chipmaker yet?

The big push for increasing US semiconductor production will include subsidies and breaks for big projects, most likely, with Taiwan Semiconductor’s large and growing campus in Arizona a likely beneficiary, and probably Intel and Samsung will be the next big companies in line to invest meaningfully in US chip production if things work out.

Digital Dollar Backdoor by Christian DeHaemer is back again today. inperpetuity,

September 28, 2021 comment does deserve an answer. “Try again. Look for a tech company in crypto that has a much smaller valuation , and a 10 times from closer to its launch.”

Dear Travis, wonderful to read your thorough report on the possible new Fed Coin and its ramifications. I’ve been looking for some commentary on this matter, and finally have found a level-headed, nuanced approach to the subject, and truly it has set my mind at ease. Again, you’re the best!

A fantastic indepth input, research and read. Saved a lot of people from paying out for this information. I had written down this particular company very early this year. Found it then by just googling, “crypto currency mining stocks publicly traded”. Keep up your incredible work.

Yes it is likely to be a tech company but I highly doubt that Christian DeHaemer is referring to Taiwan Semiconductor given if he is continually referencing an opportunity that can of 66 X your money – and that is the key of his pitch. $600B x 66 = puts TSM at a market cap of $39.6 trillion – no-one thinks that possible.

Try again. Look for a tech company in crypto that has a much smaller valuation , and a 10 times from closer to its launch.

Hi there, Travis,

Posted a comment back in April, 21. Now Chris DFeHaemer is repitching the exact same spiel again that the Fed will announce the ”Digital Dollar” revolution to take place on January 26 ’22. This latest new pitch made by DeHaemer on Jan 9, ’22. So much for his pitch to be announced by the Fed on June 16, 21. DeHaemer must be “RUNNING OUT OF CASH” & wants to rope in more people to buy into is subs.

Again, Travis, thanking you very much & keep up the great work in finding out these spiels with your incredible research.

R.S.