The price of gold has been surging in recent months, setting new records, and that has Stansberry blanketing the world with this “#1 Gold Stock” pitch again, so we’re re-checking the details of that tease and re-sharing the solution with you to help answer questions.

Gold hasn’t been a smooth ride, for sure, partly because the gold price tends to be weak when interest rates are rising, so some of the recent strength has come from the fact that inflation is (arguably) getting under control and the Fed has been widely expected to cut interest rates in 2024 (gold competes with cash and T-bills for that “flight to safety” money… so when cash suddenly started earning a 4-5% yield, after years of 0% returns for cash, gold suffered a bit because the “yield” for gold is always negative — it pays no interest, and it costs something to store it or buy it in an easy and transferable form like a gold coin)… but gold has actually held up very well since rates bumped higher again over the past month, with persistent inflation increasing the likelihood that the Fed won’t cut rates this year, so I guess we’re also seeing some of the other typical drivers of gold raise their heads — fear, global instability, and currency uncertainty — as well as a big push, from the central banks in places like China and Russia, to boost their holdings of gold and therefore hopefully reduce their reliance on the US dollar over time, particularly because dollar-based sanctions regimes, led by the US, have essentially frozen out companies like Iran and Russia.

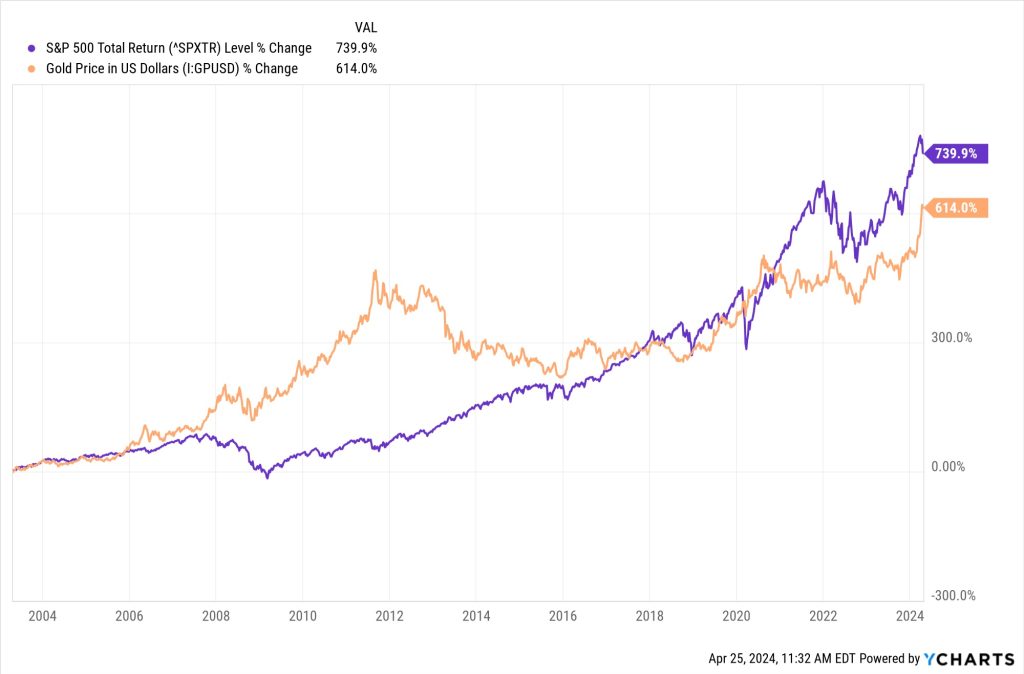

This is what the gold price has looked like in US$ over the past twenty years, just to give you some context (that’s the S&P 500 in purple, gold in orange — gold has gained, on average, about 10% a year):

Part of the long-term gain in gold is “dollar weakness,” since inflation means that the US Dollar (like all “fiat” currencies) loses purchasing power and value over time. It’s not just inflation, though — if gold were to just keep up with dollar inflation over the past 20 years, it would only be a hair over $1,000 an ounce today. The big years for gold of late have tended to come when people are losing confidence in their local currency — so during the global financial crisis, gold rose because we all thought ATMs might stop working and we’d be back in the dark ages for a while… and then it kicked into a new gear during the Euro crisis that followed, when investors were freaking out about Greece and Cyprus (we were also all quite sure, around 2012 or 2013, that Germany and France and Italy would be pulling out of the common currency and scrapping the euro “experiment”).

It’s all made up, of course, “money” is whatever enough people agree it is, and gold is not automatically better than paper certificates or silver or seashells — but it is shiny, rare, portable, and easily divided (and expensive to find and mine, so, unlike government currencies, production is limited and it can’t be created on a whim). That has helped gold to embed itself in human culture as being “valuable,” for a couple thousand years now, and it has had more staying power on that “store of value” front than any other type of currency I can think of.

That doesn’t mean it will always be so, many are convinced that Bitcoin will be the “next gold,” a store of value for the digital age, and maybe that’s how it will evolve… but Bitcoin has only been around for 20 years or so and is extremely volatile, so it’s got a ways to go in developing a “store of value” brand. There’s always something new and rare that catches our eye, especially if it’s shiny (like aluminum in the 1850s, when it was more valuable than gold… until we figured out how to make it more cheaply), but gold has had real staying power.

And there is at least one thing you always know for sure: When gold prices go up, like they have in recent months, the gold pitches from investment newsletters will start filling up your inbox. We actually haven’t seen nearly as many “junior gold discovery” pitches as we usually do during a gold bull market, so maybe too many of those old gold bugs have gone out of business or retired, but I bet the interest will keep growing as gold lingers near these all-time highs in the $2,300s. We’ll see.

And we at least know that Stansberry is enthusiastically embracing gold, again. The latest version of this ad we’re looking at is from Daniela Cambone, for Stansberry’s Commodity Supercycles ($49 first year, renews at $199), so she is now the third Stansberry “face” to repeat essentially these same words over the years… and this is how the ad gets us started:

“Today, I’m going to show you the No. 1 gold play you can use this year.

“We think you could use this to turn a $5 investment into a substantial gain as gold soars higher.

“That’s because, after what feels like nearly a decade of disappointing performance, we believe gold is on the cusp of a major bull market….

“Today, we are at the beginning of a brand-new bull market.

“And we strongly believe we’re about to see spectacular gains.

“If you want to capture the biggest gains, you absolutely must get into this brand-new bull market as early as possible.

“I’m going to show you exactly what to buy today.

“It’s by far the No. 1 way to get rich in gold today, and you can get started for less than $10.”

You can tell that the ad is not exactly brand new, because they pricing they’re using is out of date:

“Not only do we expect gold to hit $2,000 by the end of 2024…

“We think it’ll likely keep going, soaring far beyond $3,000… possibly reaching $5,000 or higher in this new bull market.”

(Gold hit $2,000 a couple times in 2023, and is currently above $2,300)

"reveal" emails? If not,

just click here...

Cambone has hosted several presentations for Stansberry in the past, including some of Dan Ferris’ commodity-focused pitches in recent years, and she doesn’t name the actual editor of the newsletter in this pitch, or the person whose idea it is… Bill Shaw launched that entry-level Commodity Supercycles newsletter as well as Stansberry’s Gold and Silver Investor a few years ago, but he is no longer at Stansberry, and for a couple years the only “name” associated with that letter was Bryan Tycango, an analyst who has mostly focused on Asia and growth stocks… but now I see from Stansberry’s website that good ol’ Whitney Tilson is actually at the helm of Commodity Supercycles these days, though Bryan Tycango and Bill McGilton also seem to work on that letter.

So we don’t really know who at Stansberry is really embracing this investment today, since the originator of the pick isn’t around anymore… but we can at least tell you what the idea is. Here’s how Cambone teases the investment:

“Don’t Buy Gold, Bullion, or Mining Stocks… Do THIS Instead

“The virtually unknown gold investment I want to tell you about was pioneered by a Canadian named Pierre Lassonde.

“If you haven’t heard of Lassonde, don’t be surprised. Most Americans haven’t. He was born in Montreal and came to the United States to work as an engineer.

“While working in the U.S., he fell in love with the state of Nevada for its skiing and vast mineral resource potential.

“Lassonde knew Nevada held huge amounts of untapped gold wealth waiting to be exploited for millions of dollars.

“But the genius behind Lassonde’s unique investment has absolutely nothing to do with the risky, expensive, and complicated mining business.

“If you know the ‘secret’ of Lassonde’s business, you could use it to make huge gains over the next few years.”

So that’s a big waving flag which says, “this is a gold royalty company.” Pierre Lassonde was the founder of Franco-Nevada (FNV), which was the first successful gold royalty firm and has become the largest player in the space… and has usually traded at a premium valuation to its near-peers. Gamper goes on to highlight both Franco-Nevada and the almost-as-old Royal Gold (RGLD), which followed in FNV’s footsteps to build something quite similar, and those are indeed the easiest starting point if you’re going to start looking at precious metals royalty companies. They’ve both been solid investments over the very long term, though FNV is still the clear long-term winner in this segment of the market. Even with its recent challenges (more on that in a moment).

And no, they are not “virtually unknown,” not unless you’re really new to precious metals investing — people love speculating on gold miners when the price of gold is moving, but gold royalty companies have generally been the best performing gold stocks for decades now, while the big gold miners have mostly been terrible investments, on average… and, as you might expect, investors have noticed.

She goes on…

“Not only did Pierre Lassonde make a ton of money and make a lot of people very rich – he and his business partners and investors didn’t have to lift a finger.

“They didn’t have to own or operate expensive drill rigs or $5 million dump trucks.

“They didn’t have to pay drill and dig crews, the Bureau of Land Management, or anyone else for that matter.

“A mining company is on the hook for all these expenses and hurdles, before it can even begin to produce gold.

“But Lassonde didn’t have to worry about any of that.

“He simply wrote a check for $2 million to buy 4% of the gold produced by Goldstrike Mine in Nevada. And the mining company took care of the rest.

“The entire process to build a mine and produce gold can take 10 years or more, and cost hundreds of millions or billions of dollars.

“Royalty companies, on the other hand, are a cash cow business because they have little overhead and require very few employees.

“In fact, Franco-Nevada has only 35 full-time employees and it’s a $27 billion company.

“Yet most investors have no idea it exists.

“Which is unfortunate… because royalty companies are also the lowest-risk way for you to take a lucrative stake in the gold market.”

So… what is the appeal of royalty companies? Why do people seek those out, and pay premium prices for them. Wouldn’t the actual big gold miners do better?

Well, sometimes — gold miners, especially small miners, have more leverage to rising gold prices when everything is going great with their projects… but gold royalty companies are also nicely levered to rising gold prices, and they’re much, much more consistent.

Why so?

Well, mostly just because mining is a terrible business.

Yes, you have the excitement of turning dirt and rocks into gold… but it’s a really difficult thing to do, it’s expensive and dirty and it (almost) always costs much more and takes much longer than you think. And once you’ve got the mine operating and can finally generate some revenue, which often takes more than ten years from the point of initial discovery of a mineral deposit, you have to deal with changing local taxes or regulations, or inflated costs for diesel fuel or employees, or repairing broken equipment, or dealing with floods in the mine, or labor strikes, and it’s sometimes the case that you spent tons of money building up the project just at the same point that gold prices peaked, or, for the bigger miners, that they buy up little projects during bull markets and pay high prices, and the dreamed-of profits from turning dirt and rocks into gold end up evaporating.

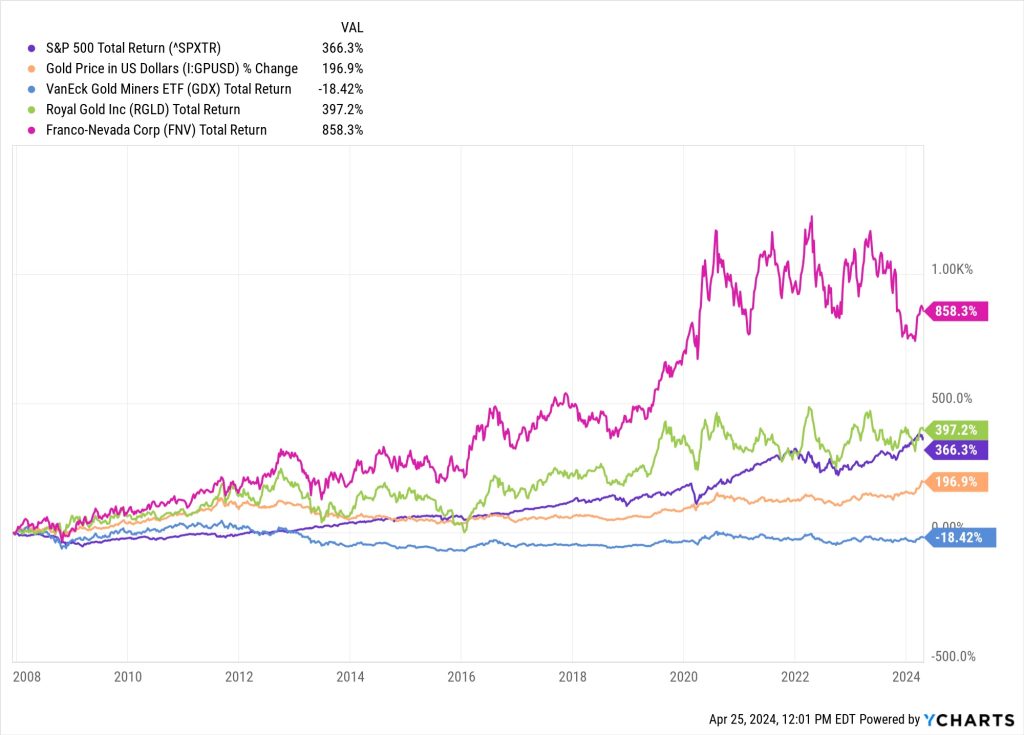

There are always some successes, but the average big miner is a lousy business, and has been so for a long time — since the first big gold mining ETF was created in 2006 (the VanEck Gold Miners ETF (GDX)), you would have been better off just buying an ounce of gold and sitting on it than trying to profit from the average performance of the companies who create those ounces… here we see the total return of the GDX ETF, in blue, compared to the price of gold, in orange… and, for comparison, Royal Gold (in green) and the S&P 500 (purple):

Franco-Nevada has done about twice as well as RGLD over the past 15 years, incidentally, but I didn’t put it in this chart because I wanted to go back as far as possible — FNV went private for a few years, and didn’t come back to the public markets until late 2007, more than a year after the GDX ETF started trading… here’s how that chart looks if we throw in FNV, it’s in pink:

And that chart, really, is why investors tend to love royalty companies… and why they put Franco-Nevada on a bit of a pedestal, and usually give it the highest valuation in the space (because of a shutdown of Franco-Nevada’s most expensive royalty asset, the Cobre Panama mine, Wheaton Precious Metals (WPM), which earlier in its life was called Silver Wheaton, has taken the “most expensive” slot among the royalty companies… but usually it’s Franco-Nevada).

In general, royalty owners have a much smoother ride than operators in the natural resources space, getting upside from higher prices but not so much downside from higher operating costs or other operating challenges. Most royalty and streaming deals come about either from some initial right that a landowner or an explorer had on the property or initial discovery, or, more commonly these days, from the explorer or mine developer selling royalties and streaming deals in order to finance the development of the mine.

There are generally two kinds of “royalties” that we see regularly in the mining space — the first are actual royalties, usually for a small percentage of the metal output from the mine (sometimes all the metals they produce, sometimes just one of them). Most common is probably something like a 3% Net Smelter Return (NSR) royalty, which means that the royalty owner has no ongoing financial obligation, and they get to receive 3% of the gold that is produced from the operation. Royalties are often initially created very early on, well before the mine is built, so they don’t often cost very much — but they also often end up sitting there and gathering dust for decades if the project is explored slowly or changes hands a bunch of times or the mine is never built (most discoveries, of course, never become mines… too small, too expensive, too low-grade, wrong regulatory regime, bad owners, location too far from infrastructure, low gold prices, high financing costs, there are endless reasons to not build a mine). Royalty owners are passive, they collect their share if the mine is built and operating… but if the mine never gets built, or if it shuts down for a while, they’re out of luck. And usually have no recourse, they can’t force the miner to build or operate a mine.

The second kind of royalty we see is the “streaming” deal, which is more often made for a pretty mature project — a mine that is either under construction or at least close to reaching that point, or sometimes even for a producing mine. A streaming deal will usually be larger and more expensive than a royalty (since the project is usually “de-risked” and more likely to be built in the relatively near future), and will entitle the buyer to a larger percentage of the mine output, but it often also comes at an ongoing cost to provide some cash flow to the miner — a streaming financier will buy the right to receive a big percentage of the gold output of a mine, for example, but also commit to paying the miner on an ongoing basis, usually at steep discount (maybe $500/ounce for the gold, for example, or an ongoing 50% of the spot price of gold per ounce).

Every deal and contract is different when it comes to royalties and streaming, but the basic idea is that you are getting a gross profit share of the operation… and will face no ongoing responsibility for problems or costs that arise at the mine, you are just a passive top-line partner. That’s a great business, in almost any sector of the economy — in some ways, companies like McDonald’s (MCD) and Universal Music Group (UMG.AS, UMGNF) are also in the business of building large gross-sales royalties on long-term growth businesses, but the model is particularly clean and easy to understand in the mining business.

What makes royalties so incredible, particularly in mining, is that even though you’re a passive participant, and even though most discoveries don’t turn into operating mines (and sometimes even profitable mines are shut down, like Cobre Panama), there’s a double-leverage in having a share of the top line — the royalty financiers benefit from higher gold prices, but they also benefit from the fact that almost all mines that do get built, end up becoming much larger than initially envisioned. When you have a gold discovery, exploration work is expensive… so your incentive is to drill enough and “prove up” enough reserves to justify building a mine and getting financing, not to fully determine the extent of the deposit, so the initial royalty or streaming deal that’s created is often financed with those reserves and that initial mining plan in mind.

Once the mine is in operation for a little while and generates some cash flow, then the incentive is to keep drilling and find more gold, because you’ve already built up the infrastructure and have the staff and the sunk costs, and you want to keep the mine running as long as possible… so if you bought your royalty with the idea that the mine, if it is built, would produce 100,000 ounces and repay your investment in, say, five years, then that might well happen, but a higher gold price or a longer mine life, with many more ounces eventually produced, can also exponentially increase your total returns.

That’s what happened to Pierre Lassonde’s first royalty purchase — his Franco-Nevada bought a royalty on what was then a small project called Goldstrike, on the Carlin Trend in Nevada, for $2 million in 1986. Within a few years, new operators came in and discovered more gold at depth, and it eventually became one of the largest gold mines in the world… there have been further deals after that first purchase, but the last time I checked Franco-Nevada still, almost 40 years later, gets more than $25 million in annual revenue from Goldstrike, which has produced close to 50 million ounces of gold and still has at least another 50 million ounces of reserves and resources to mine in the decades to come.

That Goldstrike mine was a key driver for building both Franco-Nevada and operator Barrick Gold (GOLD) into the giants they are today… but, to expand a bit on the theme, even if you have a great mine, miners still usually stink as investments… to lay it on a bit thicker, this is the chart since FNV’s IPO, that’s Barrick in purple, badly trailing the actual price of gold (in orange), and Franco-Nevada, in blue, soaring above it all:

That’s what people dream about when they buy royalty companies.

Since we’re in an inflationary period that mimics the late 1970s and early 1980s, to some degree, seeing royalty investments teased here reminded me of an old Warren Buffett profile from Financial World in 1979 — someone posted scans of the article, and this is the quote that caught my attention:

“The few businesses that Buffett thinks are worth owning often fall into the category he calls ‘gross profits royalty’ companies, perhaps better called ‘gross revenues royalty’ companies: TV Stations, institutional advertising agencies, iron-ore landowning companies, newspapers. Benefitting directly from the large capital investments of the companies they serve, they require little working capital to operate and, in fact, pour off cash to their owners. The unfortunate capital-intensive producer — Chrysler, Monsanto or International Harvester — can’t bring its wares to its customers’ notice without paying tribute to the ‘royalty’ holder: The Wall Street Journal, J. Walter Thompson, the local TV station, or all three.”

It’s not quite the same, of course, and we’ve all seen how the advertising world has changed and the newspapers and TV stations have lost that monopoly in the last 20 years or so… but participating at the top line of the income statement, and not worrying about all the capital-intensive work that goes into generating a profit on the bottom line, is inherently appealing. And I generally love royalty companies, and usually own several of them.

So… which gold royalty stock are they now touting as their #1 for 2024? Here’s the general idea…

“… there’s actually a much better (and newer) way to take advantage of gold royalties than Royal Gold or Franco-Nevada.

“You can invest in either company and you’ll probably do OK, but if you want to grow wealthy during this gold boom, THIS is the royalty company you want to own….

“The #1 Way to Invest in Gold in 2024.”

And then some specifics…

“Franco-Nevada and Royal Gold are great companies, BUT…

“They’ve both been around for nearly 40 years.

“Yes, they can still make investors decent money. But the days of 1,000% gains are probably long gone.

“After all, Franco-Nevada is worth $28 billion. And Royal Gold is valued at $7 billion.

“But there’s another company that, we believe, is BY FAR the best gold royalty investment you could make in the world right now.

“And that’s why this company gives you a realistic chance to make astonishing gains thanks to this incredible business model.

“It’s led by a man who grew the world’s largest silver royalty outfit into a multibillion-dollar company.

“This experienced team helped form a brand-new royalty company – which uses the same investor-friendly business model as Franco-Nevada and Royal Gold. They now own royalties on mines in Brazil, Turkey, Mongolia, Argentina, Canada, and the United States, just to name a few. “

So yes, we’ve got a rerun here. The Stansberry folks took those old Bill Shaw ads about his favorite gold royalty company, and they’re just re-running the pitch with a new spokesperson saying the words, for now the fifth year in a row. This is a repeat of what Bill Shaw first called his “#1 gold pick” back in 2019.. these Commodity Supercycle ads are again teasing an investment in Sandstorm Gold (SAND, SSL.TO).

And while I have also had Sandstorm Gold as one of my largest gold investments most of the time over the past dozen years or so, having first bought it when it was a little penny stock startup, and I do like the company… I should also point out here that it has rarely been the best performer among the gold royalty companies (it was in its first few years, but not in the last decade), and it has also tended to be more volatile than the others. In retrospect, I would have been better off just owning Franco-Nevada — despite the fact that it is much bigger, should have a harder time growing, and almost always trades at too-high a premium price, Pierre Lassonde’s original gold royalty titan has handily outperformed most of its smaller competitors, most of the time.

How is Sandstorm doing now?

Sandstorm made two big strategic moves in recent years: They roughly doubled in size with the acquisition of Nomad Royalty (NSR.TO) and some other royalty assets in 2022, which they paid for with a big stock offering and some debt, and they spun out some of their oddball investments (including their 30% ownership of the Hod Maden project in Turkey, as well as their 25% shareholding in Entree Resources (ETG.TO)), to try to simplify the business for investors, essentially turning those harder-to-value equity stakes into more conveintional royalties that they hoped would be more palatable to investors.

That expansion created roughly 50% dilution for existing Sandstorm shareholders… though it also added a lot of producing and near-producing assets to Sandstorm’s portfolio, and boosted their growth and should boost their revenue pretty meaningfully in time. That’s been the heart of the challenge for the stock in the last couple years, the premium price they paid for Nomad, and the dilution that was part of the deal, mean that the immediate growth in “ounces” was not enough to bring substantial per-share growth in earnings or cash flow right away. It makes them a better and more diversified company, with probably steadier growth over the next five years, but it was also a big and transformative bet, and it was expensive.

The blue line on this chart is the recent sign of hope for SAND — that’s their cash flow from operations per share, which fell and flattened out after the dilution but has finally now started to grow a bit, even before we get results that should begin to highlight the impact of a higher gold price in 2024:

The Hod Maden solution was to spin off that junior equity stake and some of their other odd projects (including some they bought in another transaction, which included a royalty on the giant Antamina copper mine in Chile), to another company, which is effectively a spinout that they’re calling Horizon Copper (HCU.V, RYTTF), and have Horizon Copper create royalties/streams from those assets for Sandstorm to own (Sandstorm will also continue to own at least a third of Horizon Copper). If it works well, and investors are finally cheered that they’ve turned their 30% Hod Maden ownership into a royalty they’re hoping that they’ll be able to continue to use this structure to create additional royalties in the future.

So Sandstorm has been simplified to some degree, but the Hod Maden mine remains Sandstorm’s single largest growth engine (by itself, it could increase gross profit by 20-30% or so from today’s level), and it was finally making progress toward development — a new operator had been brought in, SSR Mining (SSRM), and they already have an operating mine in Turkey so that inspired some confidence. Word from the company was that they were well underway with “early works” infrastructure (power lines, road building, etc.), and it’s a shallow and high-grade deposit that could be fairly quick to build, so for a while Sandstorm was still hoping for production as soon as 2025. That’s several years behind the initial estimates that were made for the timeline when Sandstorm acquired their piece of Hod Maden, but we’ve been patiently griping about those delays for years, and more delay would not be surprising (if you invest in miners at all, you know that their management teams always overpromise and underdeliver — mining CEOs are pathological optimists, partly because they have to spend most of their time trying to convince people to invest in their projects).

But wait… encouragement has now turned to frustration again. Early this year SSR Mining had an accident at their other mine in Turkey, a tailings spill/accident that killed some miners and might have made an environmental mess, and that essentially froze their Turkish operations. Sandstorm doesn’t know exactly what will happen, or when — again, that’s the risk of being a passive royalty owner — but their estimate is that this adds at least a year of delay to the Hod Maden project. And countries don’t like when you make a big mess and kill people, even if such accidents inevitably happen every now and then in the mining world, so there’s probably now an increased likelihood that Hod Maden gets put on the back burner for many years, or never gets developed.

So… how do we value Sandstorm Gold today? Mostly, we ignore that Hod Maden potential, and focus on the fairly steady growth they should have from other less-snakebitten projects, or mines that are actually in production or in construction.

The growth isn’t always consistent, though. The guidance that they offered for 2024 is “75-90,000 ounces” of production, using gold-equivalent ounces (some of their royalties include other metals, mostly copper). That’s well below last year’s 97,245, partly because they have sold some smaller assets and partly because some older mines are producing less at the moment.

So far they’re in that range, with first quarter production of 20,300 ounces and an average selling price of about $2,100 (“preliminary revenue” was $42.8 million, almost as high as a year ago even though production was 8,000 ounces lighter).

If we assume that they end up with 83,000 ounces in 2024, to be in the middle of their guidance range, then cash from operations if gold stays near $2,400 per ounce for the next three quarters ought to be about $160 million (a little higher than last year’s $153 million, even with the lower gold production)… if gold drops back to $2,000 for that period of time, it should be about $135-140 million… and if gold keeps rising and averages, say, $2,800/oz for the remainder of 2024, cash from operations should be about $180 million. They have 297 million shares outstanding, so if SAND continues to be valued at the bottom-of-the-barrel multiple of close to 10X cash flow from operations (CFO), as it has been recently, then the shares in those scenarios would likely stall out in the current $5-6 range, even at $2,800 an ounce… but if the rising tide lifts all the boats, and the valuation multiple moves back up to 15X CFO, or 20X, and shareholders begin to treat SAND like they treat the other royalty companies, inspired by enthusiasm about rising gold prices, then we could easily be in the $8-12 range if gold doesn’t drop back down. And if we get an actual mania in gold prices, and people bid the gold royalty prices up to crazier valuations, then you can start to use your imagination about more dramatic returns. 20X CFO for SAND, assuming $160 million in cash flow from operations, would be about $10.75, all else being equal.

I use cash flow from operations just to make it easier to compare all the gold royalty companies, by the way — some have much higher margins if they primarily own royalties, others have tighter margins for streaming deals, but what matters is the net cash that the royalties or streams produce for the company, which is captured by that cash flow from operations. Using “earnings” is pretty pointless for these companies, because they all have massive depletion charges that reduce their GAAP earnings dramatically (similar to depreciation, but accounting for the value of the metal that’s produced and therefore has been “depleted” and can’t be produced again).

I’m generally willing to pay up to 20X operating cash flow for a gold royalty company with a lot of potential growth (lots of non-producing royalties, some of which are on territory being actively explored or for mines that are currently being developed) — that’s often a premium valuation compared to other kinds of companies, and I’m willing to go that high just because I think gold exposure is valuable, and portfolios of good gold royalties have huge upside potential if gold rises dramatically, and they are generally solid enough companies that they can hunker down and survive even if the market turns against them for a while. But to be clear, paying that valuation does mean you have to be patient — that’s just a 5% cash flow yield, and if you want something close to that in any given year, with a lot less risk but also no possibility of growth, you can just buy a T-bill.

I’ve been patient with Sandstorm Gold, perhaps too patient given their long-term underperformance versus leaders like Franco-Nevada, but I still like the strategy and expect it to work out over time… and by some measures, Sandstorm is still the cheapest of the large or midsize gold royalty companies, and should have the best potential growth, even if big chunks of that growth keep getting pushed off into the future.

There are challenges, new and old, but every meaningful royalty company has one or two big mines that present a challenge these days, even the unbreakable Pierre Lassonde — Franco-Nevada’s biggest ever investment was spending roughly a billion dollars for several royalties and streams on the Cobre Panama mine a few years ago, and that just disappeared last year, as the government shut down the mine… perhaps permanently, perhaps to be renegotiated in the future, nobody really knows — but Cobre Panama accounted for about 20% of Franco-Nevada’s revenue right before it was shut down, so it’s a very big deal and is the primary reason FNV shares have fallen roughly 20% over the past year, doing much worse than their near peers.

I already have a meaningful position in Sandstorm, however, so I am not likely to buy much more in the near future. Among the larger and slower-growing royalty companies, my second favorite these days is Royal Gold (RGLD), which is not growing as fast, and also brought on some debt recently, but is the only other large royalty company trading below my 20X CFO “line in the sand” valuation, and also does have decent “ounces” growth that should give good exposure to rising gold prices.

Here’s the chart of the price/CFO valuation of the major gold royalty companies, and two things should be clear from this: First, that FNV historically was considered the “blue chip” in this group, and now, after Cobre Panama, that’s arguably Wheaton Precious Metals (WPM)… and that Sandstorm Gold has usually been the cheapest; and second, that valuations tend to rise substantially in a gold bull market. The last big surges in gold were in the first half of 2016, and in mid-2020 after COVID, and during both of those periods the valuation multiples of the big royalty companies rose pretty dramatically (SAND went from a valuation of 10X CFO to more than 20X in less than a year back in 2016, for example). Gold has moved up 15% just this year, and the valuations haven’t shifted meaningfully yet… maybe that’s a warning that gold’s quick run was a flash in the pan, and will lead to nothing, or maybe it’s a buying opportunity.

That’s not an in-depth comparison, and if you want to confidently buy these kinds of companies and hold on for the long term you need to review their presentations and think about the key projects that will drive their portfolio (every big royalty company has a few “tentpole” projects that are much more important than the rest), but if gold averages well above $2,000 an ounce this year, these companies should all have substantial growth in cash flow through the year (even if FNV maybe doesn’t grow year-over year, necessarily, since they lost 20% of their production when Cobre Panama closed), and that is likely to lead to richer valuations for the stocks.

If gold falls back to something close to $1,000, roughly the lowest price of the past decade, then it gets much uglier — many mines will probably slow production if that happens, and new mines won’t be built, so the royalty companies will get fewer ounces of gold and will get less money for each ounce, but they should be able to keep the lights on while they wait for the sun to rise again, just like they did when gold collapsed from 2013 to 2015.

The main worry I’d have with Sandstorm these days is that IF a gold crash happens in the next year or so, before they have a chance to more meaningfully pay down their new debt, they won’t be as “anti-fragile” as I’d like. They’ve made a meaningful bet on growth in the past two years, and seen their share price punished as a result. They are very likely to have the cash flow to pay off that debt in the next few years, so it’s not exactly a crisis… but if they bet wrong and gold goes through another bear market very soon, they might continue to under-perform their peers.

That’s just what I think, though, and I’ve been too optimistic with Sandstorm Gold for a long time — stubbornness, I guess. I know we’ve got a bunch of royalty enthusiasts out there in the great Gumshoe universe, so if you’ve got other favorites to suggest, or want to remind me that I’ve been too patient with Nolan Watson, well, feel free to toss your thoughts into the friendly little comment box below. Thanks, as always, for reading.

P.S. As I told the Stock Gumshoe Irregulars a few weeks ago, I like owning gold coins for exposure to physical gold, too, but about a year ago I started to use the program at Vaulted as essentially an automated savings plan for previous metals, setting it up to buy a little gold and silver every couple weeks. That gives me specifically allocated gold that is stored in the vaults at the Royal Canadian Mint (the silver is in London, in the HSBC vaults), with a low cost of ownership.

I can’t promise that this is the absolute best deal around, but I trust them and I like the flexibility to have an automated purchase plan that I can ignore while the gold accumulates, and I particularly like that they make it available to folks who are starting out small, without charging higher fees to small investors — I think the minimum purchase level is $10 if you want to set up a Vaulted plan to buy a little gold every two weeks, or every month, and the fees are the same even at that low level. I’ve been allocating more to this than to coins over the past year, so I get a little surprise when I check in every few months to see how the total is growing — and as of now, about 10% of my physical gold is held at Vaulted. If you want to try it out, I have an affiliate deal with Vaulted that will throw me a few bucks if you decide to buy through them, just use this link (thanks, and no pressure! If you’ve come across a better gold accumulation program, feel free to let me know in the comments below.)

Disclosure: Of the companies mentioned above, I own call options on and/or shares of Royal Gold and Sandstorm Gold, as well as some bitcoin and physical gold and silver. I will not trade in any covered investment for at least three days after publication, per Stock Gumshoe’s trading rules.

FYI, a reader called attention to the fact that they’ve recomended a different gold stock recently at this newsletter, too — in their list of recent articles is a headline, “Buy This Beaten-Down Gold Producer Ahead of the Crowd”, which is, a reader says, a recommendation for Newmont (NEM). The “#1 Gold Stock” ad they’re running is still clearly teasing SAND, though, as it has been for years.

(We also covered Newmont a few weeks ago, when it was being teased as a dividend pick by Tim Plaehn, just FYI)

Was recently at an event and listen to a fella explain he got a “tip” he bought from newsletter (did not catch the name) on a royalty company Topaz Energy TPZEF maybe better then TPL? Has had a bit of a run since then as most in the space have #Royalty #OilandGas

Travis

Once again you have given us a lot of information to digest on a topic that keeps coming up when investors are uncertain as to the direction of the markets: Gold!

Looking at the charts on GLD, RGLD, FNV and SAND, we see stocks that have moved up, and could go to higher levels if more attention is place on the commodities sector in months to come.

My top pick is this space is HMY, which I picked up from its high rank with Bill Gunderson with “Best Stocks Now App,” a subscription I have held for years. I find Gunderson to be very entertaining and also using one of the best computational systems for momentum in the business. Check him out!

If you don’t hold it you don’t own it. MS70 gold & silver is what I recommend. Although I own Sprott Physical Gold ETF up 27% and Sprott Physical Gold & Silver also up 27% in 6 months. The operative word is PHYSICAL just like ONJ ‘ s LETS GET PHYSICAL, PHYSICAL…

Elemental Altus is worth a look

https://finance.yahoo.com/news/elemental-altus-royalties-2023-full-120000750.html