The latest teaser ad for The Crow’s Nest ($99) is focused on an area that I find fascinating, so I thought we’d dig into that one for you — Jimmy Mengel is pitching eSports as the next huge opportunity for investors, akin to getting in early as a team owner or investor in the NFL in its infancy, and in that tease he also hints at his favorite few stocks… so we’re going to throw those hints into the Thinkolator and see if we can get some answers today.

Here’s a bit from the ad:

“The time to get in early on eSports mania is right now before the massive growth takes off.

“And I have an opportunity to directly invest in eSports so you can capitalize.

“Meaning, you make money when eSports players and venues make money.

“No other major professional sport gives you this opportunity.

“Think about it.

“With the NFL, NHL, MLB, the NBA, you can’t directly invest in teams, players, venues… really nothing.”

That’s not quite true, there are a few publicly traded sports teams… but we’ll let that slide for the moment. Certainly eSports is growing quickly, with viewership of major events and tournaments that eclipses most regular sporting events (partly because video game streaming doesn’t necessarily have to be watched live, it’s not like you’re going to hear the results on the radio and spoil it, but they do also sell out big arenas for in-person viewing — or at least, they did before the coronavirus shutdown).

If you’re not familiar with eSports, it’s a blanket term that basically means “competitive video gaming” — either in-person or online contests and tournaments in popular video games, whether that’s the video game version of the FIFA World Cup in a soccer video game or a shootout between teams in a battle game, with the important (and surprising to most of us over 40) part being that some video games are extremely popular spectator sports, and spectators eventually bring money and sponsorship and advertising. This has quietly grown into a large business without getting much attention outside of the hardcore fan base, and the best players and teams are now getting million-dollar salaries and huge sponsorship deals that will sound familiar to any fan of traditional sports.

More from Mengel…

“… professional sports team owners are throwing serious money at eSports as we speak. They know how fast sports can make you money… they’ve already lived it once, and they’re looking for that big return again.

“You could invest like them to pursue the same returns as they are.

“Even professional leagues are trying to get in on this.

“23 of 30 NBA teams back an eSports team for professionals competing in NBA 2k, a basketball video game.”

So yes, there are a bunch of fairly high profile eSports teams in various games, and leagues sponsored by a couple of the largest publishers — and in several cases, new facilities are being built for these teams that are really junior high-tech arenas, often in the same complexes as the big NBA and NHL arenas and football or baseball stadiums, like the Fusion Arena in Philadelphia.

And the dream, of course, is “getting in early” so you could be like one of those early NFL or MLB families that turned their money-losing hobby from the 1940s and 50s into a legacy of generational wealth in the television era….

“You couldn’t invest in the NFL before it became the mainstay in American households like it is today…

“Couldn’t with baseball, basketball, or football…

“However, I’m about to show you an investment to give you a direct link to the eSports growth happening right now.

“Meaning, as the industry moves from $1 billion up to potentially $82 billion… you’ll have a chance at making a ton of money.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

And Mengel knows that the target market for most investment newsletters is ornery old guys, so he makes sure to address that reaction I’m sure some of you are having right now (something along the lines of, “this is stupid! Damn kids and their video games are ruining their lives!”)…

“I wouldn’t blame you if you hated the idea of eSports… or you thought those sitting around watching others play video games are lazy and need a job.

“I honestly thought that at first.

“But then I thought more about it.

“Look…

“If people will sit around and watch professionals play poker, play pool, bowl, even golf, all slow-paced games to watch…

“Is it really that much of a stretch to think millions and millions of folks would love to watch professionals play highly engaging, well-developed video games?”

And he thinks we’re on the cusp of something huge…

“Today, eSports is where the NFL was in the 80s… right when it claimed the throne as the #1 sport in America.”

I’d say that’s a pretty dramatic exaggeration in terms of money, though perhaps not in terms of viewership and participation hours — eSports is still quite small as a spectator sport compared to the major leagues by most measures, and is smaller still when it comes to sponsorship and advertising revenue, but it is fair to say that it’s growing really fast… and it’s not out of the question that it could grow up to be in the same neighborhood as the major sports someday. A lot of that really depends on how valuable those viewers are to sponsors, and outside of the core sponsors (like Intel or the game publishes) who are really directly peddling related products to their perfectly-selected audience, it’s not necessarily a slam dunk that sponsoring eSports will be effective for major consumer brands who fuel regular sports advertising and put their names on stadiums (beer companies, car companies, etc.) I’d guess that we’re heading that way, but it’s still fairly early.

Part of that means there’s also a “funnel” for sports to develop these professional leagues, so you’ll be unsurprised to hear that there are high school and college “eSports” teams as well… from the ad:

“1,500 high schools are part of the High School eSports League… and the number of active eSports leagues in high schools has doubled recently.

“More than 475 colleges support eSports at a club level with teams traveling around to rival schools to compete much like a regular sport.

“The Big Ten league… home of the Ohio State Buckeyes and Penn State Nittany Lions… is launching its own eSports league.”

It does seem awfully interesting, and it’s fun to participate in and watch the birth of a new kind of business. Of course, the barriers to entry and monopoly power are different as well, so the economics of eSports are hard to predict — will it be TV ad revenue (or streaming rights revenue) that’s the big driver? Prize money? Player salaries? Will the video game publishers assert more control over how their games are used? (the sport of football itself, of course, is not owned by anyone, only the teams and the leagues have owners — but in eSports the actual games have to be made and maintained by someone). Or will the publishers and other major companies subsidize the leagues to get more spectators who will want to try and buy the games? Will it be the same half dozen popular games that remain the focus of eSports, or will there be major disruption every couple years as new hit games try to build their own leagues and teams? Will we see thousands of leagues and teams using dozens of different major games, with different rules, or will the industry consolidate?

All that stuff is very hard to know at this point, so my thinking is that it probably makes sense to invest across the theme if you’re interested — event promoters, publishers with different specialties and hits, streaming platforms, hardware makers, maybe even teams themselves.

So what, then is this “#1 eSports company” that Mengel is teasing? We finally get to the hints…

“If the industry has a runway from $1 billion to over $82 billion… stocks are going to move big time when that happens.

“And I believe I’ve found the next massive opportunity of the decade right now.

“It’s a little-known company that has its hands in every aspect of eSports that’s growing right now…

…the actual teams…

…the events and sold-out venues…

…the actual games being played…

…even getting its hands dirty working with local governments to expand influence globally.

“This company is based in the hottest area of the world right now for eSports… Asia.”

So apparently this company creates games, and has its own dedicated eSports tournaments and leagues. What else do we learn about them?

“My #1 eSports stock released a statement saying it’s taking a “long-term” approach to eSports.

“And it’s backing up its words.

“Recently, it launched an entire arm of its business dedicated strictly to eSports and media licensing of its games.”

And then some hints about which games this company makes:

“One of its franchises was a groundbreaking title when it released in the 90s. It introduced 1-on-1 combat games… and the proof is in the pudding. That franchise has shipped over 43 million units.

“And that’s only one title it’s created. It has also created 10 other franchises with many successful sequels to each.

“This company even built a collection of games for Disney that was released in the past few years.”

OK, and what’s the status of its eSports business? More from Mengel…

“Currently, it runs a global eSports tournament around its mega-famous fighting title. Over the past five years, this tournament has increased in popularity and fanfare every single year, according to its executives, with 18 events spread out across 11 competing countries.

“These events allow it to capitalize on ticket sales, sponsorships with companies like Sony, livestreaming on Twitch, advertising, and more.

“The prize pool for its competition has risen from a mere $36,000 to over $600,000 in under five years.

“Its biggest feat yet is partnering up with one of the top tech companies in the world to hold a tournament adjacent to the Olympics in Tokyo.”

Mengel says they’re also building “feeder” leagues for its games, for amateur and college players… and they also apparently have some more interest in their games and characters:

“It reported movie and licensed TV content around its titles is in the works.

“Two of these projects are set for release in 2020… and one of them will be one of the few video game-turned-movie titles to be distributed by Disney.”

And a quote from the company:

“…. it’s committed for the long-term, saying: ‘We are cooperating with local governments and businesses on regional revitalization efforts… we are focused on not only two or three year activities… but those that extend… ten and even twenty years out… in order to promote eSports well into the future.'”

And a pointless hint, since share price doesn’t really mean anything, but we’ll share it anyway:

“Its share price is over one-tenth what other eSport stocks are trading for, giving you an opportunity to grab shares for cheap.”

Mengel also says the company is buying back stock, and recently “doubled its normal repurchase amount” by buying back stock at a premium (which is stupid, though Mengel says its “even better”). So what is this “#1 eSports company?”

Thinkolator says those clues all point at the Japanese video game publisher Capcom (CCOEY CCOEF), which produces Street Fighter and Resident Evil (among other titles) — Street Figher is the game that they’ve pushed into eSports, with their Capcom Pro Tour, and while it’s nowhere near as popular as a spectator sport as some larger scale and multiplayer games (sports games, battle royale stuff, newer titles and shooting games like Fortnite or Overwatch), it has still been pretty successful.

They’re profitable and have been for a decade or more, earnings have recently been growing (though revenue has not, and results have been quite lumpy), and they do buy back shares and pay a dividend (roughly a 1% yield at this point). They just reported their earnings last week for the past fiscal year, and posted a new presentation for investors.

Capcom is an old company, with established brands and with some legacy businesses that are kind of interesting, though they’re much smaller than the digital publishing business (they own arcades in Japan and continue to open new ones, and sell token slot machines (pachislo) that remain popular in Japan, in part because “real” gambling remains illegal — those two businesses are in gradual decline and together bring in about 23% of sales as of last year, though at much lower margin than the digital publishing business).

And it looks like the reason for lower revenue of late is twofold — not as many new games last year, and the move to digital publishing which has cut into their overall sales (downloading a game at a lower price than you’d pay for the packaged game in a store), but that has also improved margins for that segment, so the operating income still grew 3.6% even with a 27% drop in sales.

They’ve even got another new movie coming out — their biggest recent hit game, Monster Hunter, is apparently being turned into a feature film by the same folks who built the Resident Evil film franchise, it’s currently planned for release later this year (not sure if COVID is going to mess with that)…. though this isn’t a new thing either, there have been a bunch of films based on Capcom titles, particularly several different Street Fighter and Resident Evil films over the past 25 years.

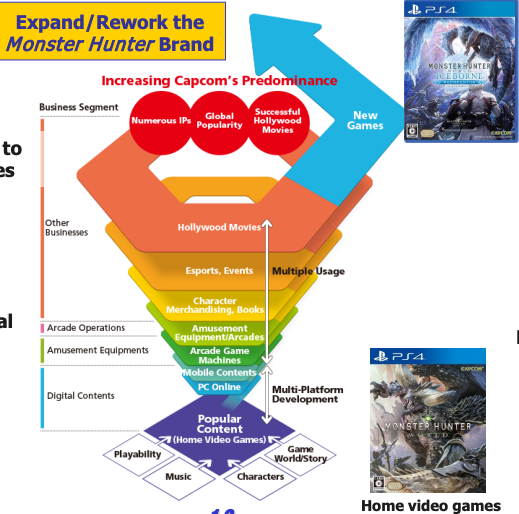

eSports is definitely part of their growth strategy, but, just like for the big US publishers, it will not be the primary driver of results… and given the games that Capcom publishers, it might not even make a meaningful impact as a marketing vehicle right away (except, perhaps, in Japan). Here’s a image from their presentation slides about how they leverage their gaming brands and the characters they’ve built in the games:

Interesting idea, I’d have to know a lot more about the trends for their games to want to bet on this particular publisher, which is a steady producer but is far smaller than the big guys and therefore much more of a “bet on hits” as we see how their new games do in the market place. I’d hesitate to really focus on this as an eSports idea, but that is at least part of their focus… and they’re pretty small and relatively cheap compared to the big US publishers, with some decent licensing revenue based on 20-30 years of video game characters who are pretty popular, particularly in Japan, so maybe worth a look if you like the sector and want a relatively undervalued name that’s still pretty low-profile outside of Japan.

And Mengel hints at a second stock as well…

“A Recently IPO’d eSports Company That Could Become the Most Trafficked Website on the Planet

“I showed you how Twitch in the U.S. is doing 100 million views per month…

“Well, a recently IPO’d company… its stock went live in 2018… is prepared to take over the eSports streaming trend in Asia.”

And while eSports is a global phenomenon, it certainly has its biggest fan base and user base in China…

“China is the #1 eSports market in the world after the U.S. According to iResearch Consulting Group, there are more eSports players in China than there are people in the UK.

“That makes up 57% of the global eSports audience.

“And I’ve found a company that plans to be the ‘eSports broadcasting hub of China’ to cash in on the 170 million people in China viewing eSports….

“At the pace of eSports growth, the “eSports broadcasting hub of China” could easily become a top 5 trafficked site in the world.

“Its viewership grew 48% just the last year. Analysts expect earnings to skyrocket over 80% in the next 12 months.

“And the company is only a couple years old… I expect massive investment to be around the corner, which could easily propel this stock 500% if not 1,000% in the next couple years.”

Thinkolator sez this one is Huya (HUYA), though Douyu (DOYU) is pretty similar — both are often referred to as the “Twitch of China” as they try to build market leadership in online video game streaming (which is critical to eSports — most people don’t go to live events, they watch eSports over streaming platforms… and in case you’re curious, Amazon owns Twitch… Microsoft has built the fast-growing Twitch competitor Mixer to try to compete, and Facebook, Twitter and Alphabet’s YouTube, among many others, are also fighting for market share in video game streaming/spectating). Huya and Douyu are both growing very fast, and both are tied in with the most important video game publisher in China (and arguably the most important consumer-facing company), Tencent.

And it’s clearly Huya that’s the better match for the clues — it went public in NY in 2018, while DouYu started trading in 2019. And to be fair, both have been terrible investments over the past year or so, they’ve each lost about a third of their value while China stocks in general (up 5%) and the tech-focused Nasdaq (up 14%) have been quite solid. I don’t know how the competition between the two (and others) will shake out in China and elsewhere, but at this point HUYA is growing revenues very fast (expected to double the top line between 2019 and 2022), they are already profitable, and they trade at a pretty reasonable forward valuation if analysts are at all right about their near-term prospects (the forward PE is about 22, and that doesn’t account for the fact that they have $1.4 billion in “extra” cash on their balance sheet).

I like Huya, and I think they’re pretty admirably undervalued given their growth rate, but there’s also a wild card in the deck here — Tencent just became the controlling shareholder, with a 50.1% stake, and that means Tencent has put a new Chairman on the board of Huya and, in the end, can do almost whatever they want with the company.

It’s probably still worthy of some further research, HUYA is an interesting speculation that’s quite cheap relative to its growth rate, and even the call options trading indicates that investors have pretty limited growth expectations given the fact that HUYA is still growing revenue at better than 60% (though, to be fair, that’s a lot lower than the growth rate was a year ago)… but they report their first quarter in a week (on May 20), so we’ll know more soon. I’ll be curious to see what they say, if anything, about Tencent’s plans when they report… but I’d guess that the biggest concern for Chinese streaming platforms is competition, and it could be that having Tencent on their side could really help (Tencent controls Fortnite and is the biggest gaming company in China, among other businesses). If I were taking a stake in HUYA (I’m not, at least right now), I’d be tempted to do a small nibble on the longer-term call options.

And there is one more stock hinted at…

“As a secret bonus, inside this eSports streaming report, I’m adding my #1 ‘picks and shovels’ play that I believe will see the most growth from eSports.

“It’s a well-known company already sponsoring multiple eSports events… but without its product, there wouldn’t be an actual game to play.

“I’ll leave it at that because the company is already known… but it’s a perfect conservative play to add to your portfolio to ride this wave.”

That could be just about anybody, frankly. Intel (INTC), NVIDIA (NVDA), Activision (ATVI), Electronic Arts (EA) (or one of the other publishers). I’d bet that NVIDIA fits best here with their high-end gaming GPUs that are used by a lot of PC gamers (eSports is still overwhelmingly PC-based — they’re using expensive desktop computer rigs… and what the pros use, the amateurs want to buy), but that’s just a guess on my part.

If you’re curious about which games are gathering the most attention and viewership, I ran across someone’s assessment of the top tournaments in 2019, with their viewership numbers… what stands out is the still-dominant nature of League of Legends, a battle game that was first introduced in 2009, as well as the general focus on battle games, here’s the table from that article:

That list includes representation from a bunch of different publishers and companies, so we should probably remember that we’re a long way from finding one clear financial winner in eSports.

There are plenty of others who I haven’t named in this space, too — I held shares of Modern Times Group (MTG-B or -A in Stockholm), which owns some of the larger brands in eSports events and tournaments (Dreamhack and ESL), but let my shares be stopped out in March because of their heavy reliance on large, physical in-person events (that’s not all they do, they’re also a small game publisher and those games have done well during the lockdown, and their pro eSports leagues and events have largely moved online, but losing the arena and theater events changes the financial picture pretty dramatically, and they came into that poorly positioned for such a change). The most positive news out of MTG lately is their partnership with PUBG and Tencent, which was a nice beacon of hope after their deal with Huya fell apart earlier this year.

Allied Esports (AESE) is a smaller US company, a speculative penny stock I’ve run across a few times that’s doing similar things in hosting eSports tournaments, though they’re a little more focused on running the physical facilities and, with their Las Vegas base, have some actual gambling in their DNA as well.

And there are larger companies as well, there’s the Garena business in gaming and eSports that’s the major asset owned by Sea Limited (SE), which is a Southeast Asian tech conglomerate that some folks see maybe becoming the next Amazon or next Mercado Libre out of Singapore. That one’s been on a tear, but even with 175% revenue growth it’s “only” at 12X sales — more speculative, and not profitable, but also a more established business than many despite the fact that most of us in North America don’t know the name. The biggest risk there is probably that they’re extremely reliant on one huge hit video game, Free Fire, which is a mobile-optimized take (shorter games, less complex) on the “survival” battle royale games (there are a lot of these games, many inspired by or hoping to compete with the Fortnite craze, but the most popular are probably still Fortnite and PUBG). Free Fire, by the way, is on that list of top tournaments above even though most of us in North America and Europe have probably never seen the game. (Sea Limited is priced at a really challenging valuation at this point, but it’s the one that also stands out the most to me as having high growth potential, so despite the fact that it’s hitting new all-time highs recently I did actually put a small flier on that one (both calls and options) as I was doing this research).

And you can even buy shares of an eSports team directly — or a group of teams, at least, Astralis went public in Scandinavia (ASTGRP in Copenhagen, ASGRF OTC in the US) and owns teams in several different eSports leagues (Future FC in FIFA, Origen in League of Legends, etc.). I have no idea how to even begin to value something like that, but it’s more like owning a pro sports team than these other holdings, and there are also a bunch of even smaller publicly traded penny stocks that are trying to build eSports teams (including Simplicity Esports and Gaming (WINR), and probably others that I haven’t run across yet). Just remember that the families who bought pro sports teams early in the last century weren’t necessarily doing so to make a quick fortune, and could never have imagined the massive business that would emerge… they certainly tried to make money, but to a large extent they were successful businessmen or wealthy people who were also getting into sports for fun, or to build a promotional vehicle for their other products (beer, especially) or give them something to cover in their newspapers and TV stations. A lot of those teams either lost money or were marginally profitable for decades, particularly before the big television contracts began to explode in value in the 1980s and 90s.

Or, of course, you could buy some real pro sports teams — sports leagues are having a rough year so far with the coronavirus shutdowns, and can’t go entirely online like eSports teams can, but they have become the plaything of choice for billionaires, so the values keep going up (if you’ve already got all the yachts and private islands you can handle, the only logical next step to impress your friends is buying a NBA or NFL team in the US, or a soccer team in Europe). You can buy shares of MSG Sports (MSGS) and own a piece of the NBA’s New York Knicks and the NHL’s New York Rangers, two of the most valuable teams in their respective leagues, at a “discount” to those crazy team valuations (and you get a few smaller teams and some eSports assets, too)…. or Liberty Braves Group (BATRA, BATRB, BATRK), which owns the Atlanta Braves in Major League Baseball. Or for the football/soccer fans among you, Manchester United (MANU), for a long time the most popular team in the most popular league in the world (the Premier League in the UK) is also publicly traded (I don’t know if it’s still the most popular team, their results on the pitch have not been as strong lately, and the stock has been more or less flat for seven years.)

If you’re considering an investment in eSports, then the challenging truth is that unless you’re going super-risky your investment will mostly be pretty indirect — there’s a massive amount of overlap between video gaming and eSports, and investing in one means you’re investing in the other. A focused eSports investment that’s not more reliant on the publisher of a hit video game or sales of hardware is pretty hard to find unless you go way out into riskier territory (like buying into a publicly traded eSports team or a smaller startup). If you buy into a video game publisher (like Capcom, or Sea Ltd, or Activision) because of its eSports potential, you are certainly playing that trend but you’re still going to mostly be relying on them to develop, package and sell profitable videogames to regular at-home non-professional gamers… and that’s becoming, like Hollywood movies, ever more a business that’s driven by massive hits and multibillion-dollar franchises and sequels, which means there are also a lot of expensive flops and an ongoing competition to speedily spend your way into building the next hit game franchise.

If you just want a taste of the industry in general, there are many video gaming ETFs out there, all of which have some eSports exposure but are really more of a bet on video game publishing and the sale of gaming hardware. The tickers for the ETFs I’m aware of are HERO, GAMR, ESPO and NERD, and they all have quite different weightings and holdings, with some more international than others, but you’ll see major equipment makers like NVIDIA and AMD and the game console makers in most of them, along with a large number of video game publishers from around the world (that last one, NERD, is probably the most levered to video game streaming and eSports, but it’s also the smallest and most illiquid).

So that’s my take on eSports for you, and a couple tickers that the Thinkolator says are being teased as recommendations by The Crow’s Nest… have a favorite way to play eSports? Think it’s stupid? Share your feedback with a comment below.

P.S. Have you ever subscribed to The Crow’s Nest? If so, our readers want to know whether or not you liked it — please click here to share your experience with your fellow investors.

Disclosure: Of the companies mentioned above I am currently invested through either equity or call options in Amazon, Alphabet, Activision Blizzard, Electronic Arts, Sea Limited, Intel and NVIDIA. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Interested to follow the SE moves, didn’t see them in the RMP yet

I’ll update the portfolio on Friday.

Any thoughts on GAN yet?

Nothing new this week, just bouncing around in volatility since the IPO — continuation of strong growth this year mostly depends on whether the NFL is in business in September.

I’ll add a few comments about SE.. Not that they are needed!

I am quite confident you have found an eSports player and probably a good one.

Back in January, I listened to a Stansberry Dog and Pony show by Porter Stansberry and 3 other individuals.

Steve, Doc, Austin, Porter – each of them gave out a single stock that the were bullish on.

Steve was gung ho on Sea Limited and I think was roughly $39-$40 or thereabouts.

I was fortunate to get in at about $40 middle of March and saw it go into the 30s and back in the 40s.

I have recently seen Motley Fool recommending this in 1 of their services.

So I believe you have arrived at a winner.

Now, as part of my coronavirus demise, I got out of SE at $55, anticipating the market was headed south.

Not a good plan in April. And now at $61.50, I’m not getting back in. And that will probably burn me further.

Thanks for the heads up on the May 18 earnings report.

I think the other guys selected: CVS, MSFT, SHAK

Thanks for all your advice and direction. Best money I’ve ever spent!

The other components of SE’s business are e-commerce and fintech, with the former being the largest one. It can be pictured as a combination of SHOP,/PYPL/ATVI or BABA/TCEHY to the South East region.

I got in earlier in the year and has done very well. Incredibly, it is not as volatile as most international tech companies. That quality also signals that it probably has a lot of room to run. Furthermore, its EV/S is also much lower than both MELI and SHOP despite delivering a much higher revenue growth rate.

btjossem You may be able to cure your seller’s remorse by taking some of the profits and buying for example , the 1/21/2022 out of the money call options with a strike price of $75.00 for around $12.00

Motley Fool also has SE as a recommendation

It’s an interesting space. I own GAN in decent size. We did a report on the company and plan to cover them going forward. I like their SaaS model. Also I think DraftKings is a valid way to play the betting angle although that one is now too expensive for me. I think there is another eSports play as well that came public not long ago. I need to scour my notes for it.

I hear the Madden Bowl is now a much bigger deal since here are no “real sports” to watch or bet on. I wonder how much will fall off post-COVID?

I am a total rookie trying to increase my small retirement money so I can finally retire. In one of the video teasers I had heard of SE and somehow I went along and put $3000 on it ($45/share). Now it is at $5000 (461/share). Naturally I am very happy. Now that Travis invested in it, I’ll try to increase my investment a little bit . I have a son (27) and two grandsons (like uncle like nephews), all gamers. This is why I have some ATVI and EA and they are doing well too 🙂

However I have had some bad results too, with some high dividend stocks (BRX, ARI, PTY, SAR, WDR, AJX, +) that are all down 🙁 I still need good dividend payers for income but I am yet to find them and decide to invest. I had thought CVS and VZ were good, but they too are down.

Oops! SE at $61 now (not 461)

You may want to consider diversifying and some of Travis’ more conservative investments if you’re using needed retirement funds, especially if prices of the big names drop with another down leg in the market this year.

Hi Travis, I’m a relatively new Irregular and really enjoy the service and value your comments. I’m long HUYA since it was in the mid-30s a while back. I’ve held my position waiting for this alleged E Sports stock boom. So far, stock has been flat. Curious to hear if and when you decide to take a position. I also recently bought a small position in DOYO and bought SE on Motley Fool’s reco a couple months ago, and I’ve been in Tencent for a couple of years. So I’ve got the space well-covered. Just waiting for the biotech-like boom. Thanks again for your hard work.

BILI is worth taking a look at too.

If this is about grand kids and sons then get out ! Buy some physical gold and keep it in a safe at home . The stock market is a crap shoot even for “pros” .

Hey what do you think about enthusiast gaming comapany they also own a bunch of teams. ??

I seem to be in a very small minority of out of touch clingers-to-the-past. Paying to watch strangers play video games is, in my opinion, a major milestone in the further demise of civilization as conventionally defined. Even watching for free seems pointless and boring. I cannot bring myself to invest in this sector, but if any of you can talk me into the 21st century, I might reconsider.

I’m with you! I can’t relate to watching anybody play anything. I don’t understand why people watch the NFL, golf, chess matches, any of it. It’s probably due to this herd mentality and the need to belong, which is just missing in me. I prefer to play the games myself, you know, enjoy the competition. But watching somebody else do it… boring! Maybe people watch this stuff because they are too chicken to stick their own necks out and possibly lose? I dunno? And yes, I know, I’m just a grouchy, old man. I’ll continue to invest in the game makers though, but not the game watchers. My loss, I’m sure.

I am one of those grumpy old guys who hates this stuff. However e-everything is a growing business as the youth of today transition into becoming androids. So if you can’t beat’em – join’em. Although they will never actually want an old model like me who actually watches live baseball and football games with real old school humans. I’m in for buying an e-sports ETF. So maybe Travis can dig into that a bit more. Thanks for a great article.

https://www.google.com/search?q=e-sports+ETF&rlz=1C1CHWL_enUS772US772&oq=e-sports+ETF&aqs=chrome..69i57&sourceid=chrome&ie=UTF-8

Just read this about a small, new Florida Company in this field (eSports) and would like to learn what you think (if at all) about BTHR. Thanks!

https://www.moneynewsnation.com/the-lock-make-investors-huge-gains/?msclkid=56643b9a984e16e8d985652434e85f72&utm_source=bing&utm_medium=cpc&utm_campaign=MN%20NATION%20BT&utm_term=no%201%20stock%20buy&utm_content=Stock

“With the NFL, NHL, MLB, the NBA, you can’t directly invest in teams, players, venues… really nothing.”

Not true. MSGS you are buying shares with ownership in the NY Knicks and NY Rangers and some minor league teams too. Recently spun off of MSG.

Why not just buy ESPO & buy all of the good players in eSports?

Travis: Off topic, but I wanted to congratulate you on your FSLY investment. I’m very happy for you . You deserve it.