Here’s the lead-in to the latest teaser ad from Nomi Prins…

“Obscure Midwest Firm Races to Unveil… The ‘EV Master Key’

“A resource snag is slamming the brakes on America’s EV rollout.

“But one firm using AI has unlocked a novel solution — and experts say it could unlock a $10 trillion windfall”

So what’s the story? Well, this is all in an ad for her entry-level Distortion Report newsletter ($49 first year, renews at $129), and it’s all about the transition to a less expensive battery chemistry… but we’ll dig through the clues, see how she sells the idea, and figure out what company she’s talking about. Ready?

Here’s how she builds the premise…

“We’ve been told EVs will soon take over.

“GM & Ford have even bet their whole futures on it…

“While smaller firms like Rivian and Fisker have invested billions of their own — all in an attempt to conquer this new market.

“Industry experts say Americans will buy 26 million EVs in the years ahead….

“There’s a fatal flaw that could prevent these high-tech cars from rolling out across the country as planned.

“And if this fatal flaw isn’t fixed…

“It could take years before the average American can afford one — and drive off silently into the sunset.”

So what’s that “major flaw?” Mostly just that the leading battery designs these days demand a lot of nickel, cobalt and other relatively expensive metals, and that limits our ability to produce enough batteries in time for the transition to electric vehicles to move as fast as most people would like. Here’s how she puts it:

“There’s a major flaw that needs to get fixed.

“That’s why giant auto firms have focused their attention on one Midwest company…

“With a new technology that’s critical to EVs going mainstream…

“And could soon reward early investors with a serious payday.

“My research indicates this firm could skyrocket in the days ahead…

“I’m so certain this battery breakthrough will save the day…

“That I call it the ‘EV Master Key’

“I’ll also share a 3-letter symbol critical to unlocking my top play.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

OK, so that’s our first clue, it’s got a three-letter stock symbol. We’re on our way.

More from the ad:

“EVs need hundreds of pounds of expensive raw materials that are in extremely short supply.

“Meanwhile… we’re in fierce competition with China, Russia, and Saudi Arabia who are all jockeying to secure their own raw battery minerals….

“One company that’s a fraction of the size of the big automakers…

“Has emerged with an ingenious solution.

“The entire trillion-dollar EV rollout hinges on a battery technology I call: The ‘EV Master Key.’

“It’s a miraculous battery innovation… powered by a NEW type of lithium…

“That promises to release the floodgates on EV adoption in America…

“And slash new car prices — practically overnight.”

OK, what other hints do we get about this company?

“Not only have they started securing lucrative contracts with auto giants like Chevrolet, Toyota, and even tractor-maker John Deere…

“They’ve penned over $1 billion in contract agreements with the U.S. Air Force, Army, Marine Corps, and Department of Defense.

“On his recent “Investing in America” tour, President Biden visited this firm’s facility to praise their $4.7 billion investment in the initiative behind the EV Master Key.

“And they boast an incredible 10,000+ patents protecting their cutting-edge tech…”

And she does some historical revisionism to get us juiced up for these kinds of “master key” investments…

First, by claiming that the “master key” for Toyota’s (TM) success with the Prius, the first commercially significant hybrid vehicle, was really Vale (VALE), the Brazilian miner, because she believes Toyota bought their nickel from Vale’s mine in Sudbury, Ontario, so therefore the huge move Vale made from 2001 to 2008 was due to the success of the Prius.

That’s an awfully big stretch — VALE didn’t even buy Inco, the owner of Sudbury, until late in 2006, and even in the peak year, 2007, before prices crashed in 2008, nickel was only about 30% of Vale’s revenues (it dropped to 15% in 2008). Vale was and is primarily an iron ore company, though nickel and copper have been of growing importance to them over the past 15 years… and nickel, at the time (and really, still today), was primarily a China story, just like copper and iron ore, since the most visible use of nickel was in stainless steel. I think it’s pretty safe to say that the Toyota Prius did not have a meaningful impact on the nickel market, not during the wild China-driven commodity bull market of the early 2000s.

But that’s not all, she also gets extra spurious with her next “master key” example, claiming that NVIDIA’s success from 2012 to 2023, with 14,000% returns, was because they sold GPUs to carmakers.

I’m serious, it’s ridiculous — here’s her assertion:

“Smart Vehicle ‘Master Key’ Minted Thousands of New Millionaires

“Cars are different these days. They’re smarter.

“But until about 2012, features like GPS, music streaming, lane control, assisted parking… were either nonexistent or very limited.

“But then carmakers started asking, ‘Why not turn our cars into smartphones?’

“Now nearly every new car has a giant TV in the dashboard…

“And 3,000 microchips powering 70+ sensors.

“Again, the automakers weren’t the biggest winners in the smart car revolution.

“The ‘Master Key’ was actually something called a GPU…

“Or ‘general processing unit.’

“And it was made by a partner to Audi, Ford, Volkswagen, Hyundai, Volvo, Mercedes, BMW, and many others.

“I’m talking about the chipmaker NVIDIA….

“Which would you rather have?

“Gains of up to 14,000%… 140 times your money from the chipmaker…

“Or roughly 50% — at best — from America’s top auto firms?

“It’s a no-brainer.

“That’s 280 times more profit from the ‘Smart Car Master Key.'”

Well, duh, of course NVIDIA (NVDA) has been a much better investment than the automakers over the past decade… but the two have essentially nothing in common. And no, the GPU is not a “general processing unit,” it’s a graphics processing unit, a chipset made to do parallel processing and dramatically speed up computer graphics.

NVIDIA does sell chipsets to carmakers, including some centralized computers now like the DRIVE Thor “superchip”, which can handle all the infotainment and driver assistance systems, but in the automotive space they’re primarily known for the chipsets they’ve designed to enable autonomous driving, and a decade ago that was the Tegra K1 processor. Automotive was never much more than 10% of NVIDIA’s business, usually much less — the company in that decade was dominated by the persistent growth in high-end video gaming and, to a growing extent later in that decade, by the rapid growth in demand for NVIDIA GPU chips for data center acceleration and AI projects. Automotive has always been part of the story, and it has often been meaningful, but it has never been the meat on NVIDIA’s bones.

But that leads us to more clues…

“Today’s firm has entered a partnership with a company that has leveraged NVIDIA’s chips since 2017…

“Long before AI was on anyone’s radar.”

That’s not really true… maybe 2017 was before AI was in the headlines like it is now, but it was certainly “on the radar” of many companies and investors. NVIDIA has been focused on AI for more than a decade, for example, and Alphabet made its most visible “OpenAI-like” big investment in AI in 2014, when they acquired DeepMind.

But anyway, what else are we told about this “Master Key” company? It is, as we noted up top, all about batteries…

“Despite all the hype around EV…

“It cannot become a reality without the ‘EV Master Key.’

“What this company has achieved is incredible.

“They’ve developed a proprietary battery technology known as lithium iron phosphate…

“A form of lithium experts simply called ‘LFP.'”

So why LFP? Apparently it’s better on cost, because it reduces the need for expensive minerals like nickel, cobalt and manganese.

And that’s basically the answer, when Prins says “forever lithium,” she just means, “lithium iron phosphate batteries”… and she thinks the automakers who are currently adopting LFP batteries in greater scale will ramp up the demand quickly, even though LFP batteries are only in something like 10-15% of EVs right now… not just because they’re cheaper, but because they’re also longer-lived (5X more recharge cycles before they degrade) and safer (they don’t catch fire as easily), though they also generally have a lower energy density and lower driving range for the same weight, which has mostly kept them out of the premium-priced EVs. That “longer-lived” part, particularly the fact that these batteries can recharge more fully than lithium ion batteries, is where she gets the “forever” part of the tease.

“Tesla, GM, Volkswagen, and Ford Are Desperate for This EV ‘Master Key’

“With resource prices on the rise, the world’s biggest carmakers are switching their battery chemistry to LFP.

“That includes Ford, Rivian, and Volkswagen….

“Tesla just announced a global initiative to switch their batteries to the EV Master Key.

“CEO Elon Musk said LFP will ’emerge as the dominant chemistry for Tesla’….

“These mega firms are preparing to spend $188 billion… over the next 8 years to make the switch.

“And my research indicates a large portion of that cash could flow into this firm’s coffers….

“I believe a mass-market adoption of LFP — ‘forever lithium’ — will send this company’s shares soaring.”

Prins says her special report includes discussion of…

“Their state-of-the-art $3 billion LFP battery facility

“The 10,525 patents protecting their incredible technology

“And how they’re leveraging AI to dominate the domestic battery sector”

So that’s a few more details to throw into the Thiknolator. What else?

“… with 85% of the company held by big-money managers, very few regular Americans even know this firm exists…

“Much less what’s at stake for those who get in on the ground floor.

“Without the help of today’s firm, the $10 trillion EV revolution could stop dead in its tracks.”

As you’ll see in a moment, this is not really an “unknown” company, there’s certainly a good swathe of the country that knows their brand… but yes, they do have a somewhat above-average institutional shareholder base. Most companies are majority owned by large institutions, of course, but 85% is on the high side. Probably means they’re not attracting a lot of day traders or retail investors with sexy growth or a splashy dividend.

Other clues?

“The company I reveal in my report is about to roll out America’s first & most critical LFP battery factory…

“And that’s why you can’t afford to hesitate.

“For those who move early, this could become our biggest win yet….

“This is the #1 Stock for 2023…

“And it Could Mint More EV Millionaires Than the Rise of Tesla.”

So who’s that? Thinkolator sez Prins is teasing Cummins (CMI), which you may know as one of the largest manufacturers of diesel engines in the world. They build most of the engines for heavy trucks and similar equipment in the US, as well as some other drivetrain components (boosted by their acquisition of Meritor last year), and also make the guts of lots of diesel locomotives, large diesel generators and similar equipment… and they also have some pretty ambitious “clean” goals in the form of industrial batteries and hydrogen technology, though those aren’t really a meaningful part of the profit picture at Cummins just yet.

How do we match our clues? Well, Cummins is a partner in a big LFP battery facility that’s going to be built to make heavy truck batteries — that’s a joint venture between Cummins’ Accelera brand, Daimler Trucks and PACCAR, they’ll each pony up about a third of the capital, though there’s also a small 10% partner in there who brings LFP battery technology to the deal (that’s EVE Energy, a Chinese firm). It’s roughly a $3 billion project, so it’s going to be something like a $1 billion drag on Cummins capital over the next couple years (partly subsidized by government help, I expect), with commercial production hoped for as early as 2027, but it could turn into a profitable contributor to the business eventually.

And it’s a pretty big plant in the context of the heavy-duty truck business — here’s an interesting quote from an article about this project (which was announced in early September of this year):

“Twenty-one gigawatt-hour is a very big number in the context of trucks and buses,” Jamie Fox, principal analyst at Interact Analysis, commented on the announcement. “A 21-GWh plant, operating at full capacity in 2026, would provide enough batteries for the entire North American market for all battery-electric buses and medium- and heavy-duty trucks combined, assuming about 10% of trucks are electric in that year.”

Right now, though, Cummins is pretty much all about trucks and generators, and the key driver for the foreseeable future will probably be the global market for new on-highway trucks… though developing and advancing technologies that can help transition heavy industrial engines to “net zero” is certainly one of their big growth drivers for the future, and one of their major challenges. The Accelera business, their “zero emissions” brand with lots of ongoing work in hydrogen fuel cells and electrolyzers and batteries, is the only one of their five segments that loses money. Some of the business is very steady, in part because they’re an established leader and have more than 10,000 dealers and a big distribution network for parts and services, but over the past four quarters about 60% of revenue and 70% of EBITDA came from their engines and components business, and most of the rest came from distribution. Power systems (mostly large generators) is the next biggest component, and even that’s pretty small still.

And as luck would have it, we’re on the cusp of learning more about how things are going at Cummins — they’ll report their third quarter earnings tomorrow morning. Analysts expect $4.69 in earnings per share and $8.2 billion in revenue for this $30 billion company, which would mean they’re continuing to shrink just a little bit from their all-time highs following the Meritor acquisition, but they are still expected to have their best earnings year ever in 2023, the estimate is now $19.89 for full-year earnings — so at $215 or so, this is a dominant industrial leader that’s valued at about 11X current-year earnings.

Analysts think that they’ll have roughly flat earnings next year, which is a pretty typical forecast for a big industrial company right now, but that earnings growth will pick back up to ~10% in 2025. So as long as you don’t see demand collapsing for highway trucks over the next decade, it’s probably a reasonable investment — established market leader, some proprietary technology and brands, consistent profitability, investing some into future potential, and growing more slowly than the market but also priced at a discount to the market.

They have kept up with the S&P 500 over the past five years, despite growing their net income by only about 18% (total) during that time period, and that’s partly because they’ve bought back about 10% of their shares to boost per-share earnings growth (which has averaged out to about 20% a year over the past five years, fueled by revenue growth of 6-7%), and have gotten a bit of multiple expansion (the trailing PE ratio is a bit higher now than it was five years ago). They’re not quite a Dividend Achiever, but they’re pretty close — other than a little pause in 2009, they’ve increased the dividend every year for about 18 years now, and the dividend yield is currently a little over 3%.

Decent stock to consider, I’d say, though the Prins pitch about a “master key” and the urgency of this “rolling out now” battery tech are pretty ridiculous — Cummins does not own the idea of LFP batteries, almost all of which are made in China right now, they’re just a partner in what might be one of the first large LFP battery plants to open in the US, and even that will take three or four years to build (there are others in the works, too, as automakers have drifted toward LFP batteries as a way to build lower-cost cars that could more reasonably appeal to the mass market — check out this useful article about the evolution of LFP batteries for a little context). Just among big-name companies, Ford is planning to open a $3.5 billion LFP battery plant in Michigan in 2026, and LG intends to spend about half that much building LFP capacity as they expand an existing battery plant in Michigan this year… Tesla talks a lot about building LFP capacity, but I don’t know if they have a specific public plan yet.

Cummins does hope to become more of a “clean energy” leader over time, and they did host President Biden at an event in Minnesota back in the Spring, highlighting some of their work on hydrogen electrolyzers, but those parts of the business are consuming capital right now, not generating it, and will need a lot of time to develop.

And no, Cummins is almost certainly not going to provide any abrupt riches or skyrocketing growth to match the early days of Tesla, this is a solid industrial company that’s growing a little slower than the market, and getting a little better and more efficient over time, and it’s trading at a discount to the market — it will also be at least somewhat cyclical, since much of the business depends on the steady demand for heavy duty trucks (and the growing usage of those trucks, which results in more demand for parts and replacements).

Reasonable idea, but you’d have to go into it with reasonable expectations — not Tesla expectations. Of course, it probably won’t fall 90%, either, and Tesla could (I’m not saying it will, of course, but TSLA trades at more than 10X the valuation of all the other large car companies, and expectations are obviously extremely high).

But wait, there’s more!

The tease doesn’t stop there, Prins also promises some other big winners in the electric truck space as she teases a “special report” called “The 2EV Trucking Titans.”

Here’s how she hints at the first one:

“I predict that one of the biggest winners won’t be another Tesla, but a transmission manufacturer.

“… the founder of this firm was an original member of the Indy Motor Speedway.

“Now more than a century later, his legacy lives on as America’s leading producer of EV transmissions for eighteen wheelers.

“You’ve no doubt heard rumors about self-driving trucks replacing drivers.

“But have you ever actually seen one?

“The technology is still years away — so here’s where you can make money now.

“A nationwide shortage of truck drivers has sent big rig trucking companies scrambling to hire and train new drivers…

“And with this firm’s industry leading automatic transmissions, it’s much faster to get new drivers safely on the roads, compared to manual transmissions.

“Their customers include GM and the U.S. Army, plus the biggest names in the freighting business.”

So… hoodat? She’s talking about James Allison, who was one of the founders of the Indianapolis Motor Speedway but also advanced automotive technology in the first half of the 20th century, building several companies that pushed innovation forward, including in batteries in the very early days… but he’s probably best known now for his remaining namesake corporation, Allison Transmission (ALSN), which is indeed a big seller of transmissions and propulsion systems for heavy-duty trucks. Including some hybrid and electric systems, though that’s not currently the biggest part of the business, and, yes, lots of fully automatic transmissions for highway trucks. He also founded Allison Gas Turbine, incidentally, which is part of the technology foundation that went into the Rolls-Royce turbines and jet engines.

And the second company is somewhat related, a customer of Allison…

“For truck makers, the writing is on the wall.

“The EV trucking sector is set to grow 15-fold in the years to come.

“That’s why some of America’s most revered big rig brands like Peterbilt, Kenworth, and DAF are gearing up.

“They’re buying these transmissions by the truckload.

“Which means every time one is sold, you’re set up to profit from BOTH picks.

“How?

“Because I’ll also give you the name & ticker of the company behind these truck brands.

“Their financials are solid as granite.”

That’s almost too easy, here she’s talking about PACCAR (PCAR), which is primarily known as the owner of the Peterbilt and Kenworth truck brands. Those two nameplates together have roughly a third of the US market for Class 8 trucks, though they do also sell DAF trucks in Europe and South America, a meaningful but smaller business (probably 15-20% of the European heavy truck market).

Class 8 is the largest class of conventional trucks, in case that term is new to you — it’s mostly tractor trailers for highway use. They also sell a lot of Class 6-7 trucks, things like dump trucks and garbage trucks and local delivery trucks, though below that a lot of vehicles are based on a standard commercial truck chassis from one of the big automakers (Ford, GM, etc.).

Prins sums up…

“I believe these 2 stocks are the next big winners in the EV trucking space.

“Add them to your portfolio now, and you could make out with a healthy profit.”

It’s awfully early to claim that long-haul trucking will ever really be electrified, but there are certainly hybrid and more electrified and other more efficient drive trains and transmissions being advanced every year, including engines and fuel cells that use alternative inputs like hydrogen, and both of those companies are pushing that, even as they mostly profit from the ongoing refresh of the regular ol’ diesel trucking fleet.

And like Cummins and most of the companies involved in auto or truck or similar heavy equipment manufacturing in the US, and indeed like the automakers themselves, they’re capital-intensive businesses (lots of expensive factories that require constant reinvestment, and lots of debt), and they’re generally valued at a pretty steep discount to the broader stock market.

Allison has a market cap of about $4.5 billion, has enjoyed roughly 10% earnings growth over the past five years (~4% revenue growth), and is trading at about 7X earnings, with an EV/EBITDA multiple of about 6. It pays a dividend of a little under 2%.

PACCAR is much larger, with a market cap of about $42 billion. Earnings growth has been about 12-13% per year over the past five years (~8% revenue growth), and they’re valued at about 9-10X earnings, with an EV/EBITDA multiple of about 8. The regular dividend is about 1.25%, though they also typically announce a special dividend in December (last year’s was big, so the total trailing dividend now is about 3.6% — no idea what they’ll pay this year, but that announcement is about a month away).

PCAR is estimated to be at peak earnings in 2023, with a dropdown coming next year before they get back to something like 10% earnings growth… ALSN is seen as a bit more predictable, and the expectation is that they’ll keep growing every year, but at a slower pace, more like 5% earnings growth. Allison has also been a pretty impressive cannibal, so that and the much smaller size make the story quite a bit more compelling, though they don’t really have an external brand like PACCAR does.

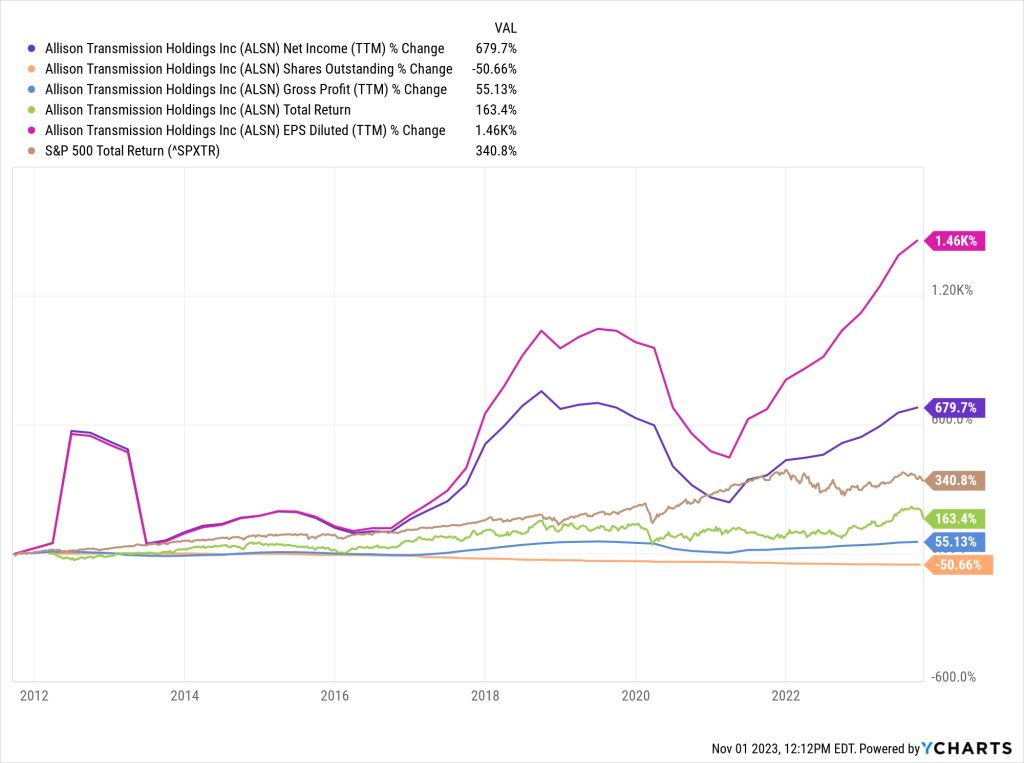

By “cannibal” I just mean they’re buying back a lot of stock — they refinanced most of their debt in 2019 and 2020, which put them in very good shape, and have been using more than 10% of their revenue to buy back shares for more than a decade, so this has been a relatively low-growth industry for a long time, but they’ve managed to run the business very efficiently… shareholder total return for Allison (green) has been far worse than the S&P 500 (brown), but still pretty impressive in some ways — this is what that looks like on a chart, the blue line is their gross profit, which has grown only 55% in ten years, but the net income (purple) has grown 680% as they’ve gotten more efficient and, thanks to the fact that they’ve bought back 50% of their shares, the earnings per share growth (pink) has been an incredible 1,460%.

The challenge has been, mostly, that because it’s not a high-growth business, and investors haven’t been that enthusiastic about it, the valuation multiple has dropped dramatically in a decade — ALSN traded at about 40X earnings in 2012, and now it’s about 7X earnings. I wouldn’t expect dramatic growth to pick up anytime soon, from EVs or anything else, but the nice thing about cheap is that a little bit of growth, and a little bit of multiple expansion, can go a long way — if they continue to hold up well and have a pretty consistent business, maybe the earnings grow 5% a year and investors decide they’re willing to pay 10X earnings for that in a 2024, which would drive the price up to something like $75. That may or may not happen, but it’s certainly feasible, and doesn’t require much magical thinking about breakthrough products or dramatic innovation or shocking growth.

So… any of the above rev your engine? Have another favorite play on the greening of the truck fleet or the push into lithium-iron phosphate batteries for electric vehicles? Do let us know with a comment below.

P.S. Nomi Prins has been one of the more heavily-marketed pundits in recent years, so readers always want to know how she’s really doing — if you’ve ever subscribed to her Distortion Report, please click here to visit our Reviews page and share your experience. Thanks!

No one wants EV except Biden and CA

I’d love to have an EV, the cheaper and simpler maintenance and fueling appeal to me, as does the dramatically better acceleration… but the ones I want would cost $80-100,000, and they’re still too slow to recharge, so I don’t want one that much. 🙂

I recall an interview last summer with a delivery company exec. in (of all places) Calgary Alberta. They had switched all of their van fleet to new electric ones and were really happy with the results. Apparently, they were able to earn back all of the extra $$ it cost to go electric in 3 years. No fuel and much lower maintenance costs were the big payback.

As the battery fleet improves, that payback time is sure to get shorter.

Look at the Chev Bolt. Less than half your low end (under $30,000) Time to recharge is a non-issue. You are sleeping while it charges. If you have solar panels, you can drive on sunshine. How far do you drive? What zero to 60 time would you really find useful? What top speed do you really need?

For me it’s not so much speed, it’s size — maybe a smaller EV is the solution for around-town driving, but I’m too big and arthritic to sit in a Bolt for long periods of time without being uncomfortable… and too old and grouchy to be uncomfortable for long 🙂

Right. That’s why Musk has sold so many cars, because nobody but Biden and CA want them. Were all those Teslas sold in CA? I didn’t think so.

Here in Japan I see more and more EVs on the roads.

I think FDRV is a good buy….knocked down to 14.00 possibly because new bill HR1435 which makes it a choice wether or not you have to buy electric (which i support as i like freedom of choice) but i think its still a good fund which includes foreign lithium and some chips which are also in the AI category

Thanks for the suggestion… that’s overwhelmingly an ETF for EV makers and their suppliers, including chip companies and component makers, though there is a tiny bit of lithium exposure in there (mostly through some Albemarle (ALB) shares).

The mandates in some states that they’re reacting to with this HR 1435 are probably not really attainable anyway, that bill is mostly punching back against the states which have followed California in saying that no new internal combustion cars can be sold in that state after 2035 — which matches a lot of the automakers’ promises or plans that they’ll only be producing EVs in 2035 or 2040 or 2050 (most of them have a goal like that, though not always the same year)… though the automakers, of course, are not making a legal commitment, they can always change their minds if the demand or profit isn’t there for EVs at some point.

No idea how it will shake out. Other than the pretty strong certainty that this Congress won’t get its act together to pass any real legislation of any kind over the next year, given the current divisions and the calendar’s inexorable turn toward an election year.

OK – then I will ask. What is the name of the $2,00, $3,00, or $4,00 IA stock stock(s) that everyone is teasing and that are going to make us all billionaires. These AI teasing have been going on for nearly a year. Is there any one stock they are teasing? Hey Look What I have found – NOTHING. but you see the same tease everywhere!!

There are several different pitches like that, though many do point at the same few low-price “story” stocks — I tried to collect them all here: https://www.stockgumshoe.com/2023/10/all-the-ai-stock-picks-from-everybody-25-different-stocks-that-have-been-teased-as-a-i-picks-this-year/

Candidly, if I was going to bet on something in the EV Battery space, if would definitely be IDKOY, the ADR for Idemitsu Kosan of Japan. In the first week of October, Toyota announced a partnership with them to develop Solid State Batteries, and stated that their early research suggested a range as much as 932 miles (with no danger of thermal overload or fire). It’s gone up 15 % since October 3, although if this pans out (big if as always), it could go up considerably more than that. Just sayin…

New one for me, thanks.

Lots of hopes for solid state batteries out there, of various chemistries and degrees of solidity (some are thin metal films, some gels, etc). I hope

Somebody gets it right at a commercial scale soon,

Lots of investors were burned by the hopeful (over)promises of Quantumscape, Solid Power, etc. from 2019

through 2021.

Apparently Prins has not heard about the new Tesla Semi that is outperforming any other EV truck in its class on range and performance. Check it out.

It will be interesting to see if Tesla can really scale up Semi manufacturing next year. Sounds like the first ~70 or so on the road got good reviews so far this year.

Tesla also has stated that LFP batteries make sense for lower-demand applications, to cut costs for small EVs, but probably high-spec batteries with lots of nickel, and maybe cobalt, will be more appropriate for the Semi. Can’t afford anything but maximum energy density if they’re going to haul heavy loads.

Just wanted to thank you. You reviewed NVIDIA years and years ago. I put in $120 total into my daughters custodial brokerage. Today, it’s at about $10k. I just really wanted to thank you for doing what you do.

Glad it worked out for your daughter, Tyson!

Coincidentally, Louis Navellier also spent a few years using a similar “master key” pitch for NVIDIA (he called it the “master key for crypto,” not as many folks were thinking of their dominant position in AI at the time, though it’s been building under the surface for a decade or so)

Maybe Nomi should have read the following article:

“The Edsel was one of the great flops of all time,” Mr. Moore told Fox News in an interview. “I’m here to tell you, if these trends continue, we’re going to see the EV market become the next big flop because car buyers don’t want them.”

https://www.zerohedge.com/energy/electric-vehicles-set-be-auto-markets-next-big-flop-says-freedomworks-economist

No government ever mandated that you own an Edsel or requred manufacturers to produce them. You can’t say the same thing about EV’s.

Ford is losing a fortune every month on lost EV sales. They have thousands of their Lightening E Truck no one wants. The Greenies are Globalists, and this is just another form of control. The Earth is not going to die anytime soon. The problem is over-fishing and the lack of blue-green algae. Watch “Seaspiracy” on Netflix. Explains the whole problem.

Yes, those that we used to call Reds decided to label themselves as Greens, since the Reds became so unpopular with their disastrous economic policies. Also ‘Progressives’ are the least progressive, they are actually regressing back the early 20th century disastrous European policy mess..

A lot of hype and no substance. The author a female doesn’t know anything about the subject, the chemistry, the lack of supply change due to mining capacity and the most important mineral is copper. There have been no new copper mines built in years. The single exception is Rio Tinto in the land down under and that is just starting. It takes 16 years to bring a new mine on-line.

Nobody wants these fire starters for a hundred reasons including the GRID overload.

Mining Trucks use diesel engines that power four electric engines, one for each wheel. No chance for anything else to power these behemoths.

Our State is concerned about the country bridges that battery powered pick-ups gross weight exceeds bridges load carrying capacity. Many are rated structurally deficient. And many have only 6000 lbs ratings. Ford Lightning is 9000+ pounds. We have 44,000 miles of paved roads and thousands of bridges.

Have you looked at ABAT seem to have done very compelling tech and opportunities for recycling batteries

Haven’t looked recently, but that’s been an “overpromise” story stock without revenue for several years.

Might be worth looking into they have the largest lithium claim in US and have received grants from US govt as well as a partnership with BASF to produce black mass in a circular production batteries to black mass

When I worked for Eaton they had like 90% of the market for class 8 truck transmissions. Now ALSN did have the class 6 & 7 sewed up. So I think this lady is kinda blowing bubbles so she can get you to sign up for her letter. We did some work for CMI and I can tell you they are a “classy outfit” Eaton spon off the transmisson divison and sold the drive train divison and bought Cooper Electric and now they are big in

electric . Cooper was based in Ireland so Eaton moved their base. there.

Apparently Volt has a faster process for producing lithium. Anyone know about this?

Try insuring an EV…. Try repairing an EV after an accident…. Try to locate remains of your EV after its battery explodes, either standing alone or parked next to other EVs in a parking garage….

Have you had trouble with repairs or insurance for EVs? Haven’t looked into that at all, personally, but nobody I know with an EV has mentioned insurance being an issue… though the fact that you have to rely on the manufacturer for most repairs outside of stuff like tires and glass is certainly a potential hassle. Even though the indication is that there may not be as many repairs needed, given the smaller number of moving parts.

At age 74+, my 2015 JEEP Cherokee runs Great! Unleaded gas, 30+MPG, stations all over north America. So why should I spend $80,000 to use less gas? Ask me again in 10 years.

Similarly with my 2017 Subaru Forester. Mostly get around 30 MPG. Currently it has around 60,000 miles on the odometer and an expected life of 250,000 miles. It is a little underpowered by American standards with a 2.5 liter non turbo engine. Currently put on approximately 10,000 miles/yr. At rate, it should last another 19 years. Given those numbers, this car will likely out live me. Don’t believe that lower maintenance costs and right now little or no fuel cost will overcome the high initial acquisition of EV cars for some time.

Another Lango tease about an under the radar company that will be the “eyes” of self driving cars.

Any ideas?

This report claims to give THE REAL COST of EVs to the United States:

Overcharged Expectations: Unmasking the True Costs of Electric Vehicles

By The Honorable Jason Isaac, Brent Bennett, Ph.D. October 25, 2023

Federal and state subsidies and regulatory credits for EVs totaled nearly $22 billion in 2021, or nearly $50,000 per EV, socializing the true cost of these vehicles to taxpayers, utility ratepayers, and owners of gasoline vehicles.

Allison Transmission (ALSN) is one of her picks. It has a solid balance sheet. It also has a new “swap out” EV drive shaft system for existing medium and large delivery vehicles.

https://www.youtube.com/watch?v=NXPZlRklJ58

Cummins and Allison, yawn. Been in my portfolio for years. I love these articles for the suspense of finding out these “super secret” picks are boring old everyday companies that have been around for decades. There is nothing new in investing. Just fancy talking sales people.

I can tell you when and where Nomi Prinz and Bill Bonner’s Agora publishing gets its information from.

The when is 1-6 years after all the buzz on the internet (the when and where). When Prinz says she is getting on an airplane and flying all over God’s creation to dig into different companies, she actually means that she is rolling out of bed to see what load of baloney she can feed to raise her readership over 100.