Here’s the lead-in for the latest ad from Tim Plaehn’s Dividend Hunter ($79/yr):

“In the summer of 2014, I quietly recommended 3 no-name dividend stocks to a small group of retired folks…

“A decade later… these 3 stocks generated $671,727 of dividends inside an average IRA portfolio

“TODAY — I’m releasing a new set of 3 stocks to buy and hold for the next “Decade of Dividends” (and the payouts could be BIGGER)”

Just so we know what his “starting point” is, he says an average retirement account in America is “around $603,000”, so if you received a cumulative $617,727 in dividends over ten years that’s a pretty good return, (if the stock prices at least held steady you’d double your money, and the stocks probably also went up, even if they might not have kept up with the broad market).

Just buying the S&P 500 would have turned $603,000 into about $1.85 million during the last ten years, roughly tripling your money, so you might even have done as well as that with those past high-dividend picks he touts, or even a bit better (high-yield stocks rarely have a share price that goes up as fast as the market, usually a good chunk of the return comes from the dividend… though that’s not always true).

I confess that what caught my eye was his email introducing the ad, which came with the subject line, “[LEAKED] – Private letter to Warren Buffett reveals ‘next Coca-Cola'” — here’s what he said in this email:

“When it comes to dividends, Warren Buffett knows best.

“In 2022, Berkshire Hathaway received $704 million in dividend income from Coca-Cola…

“They’ve collected over $10 Billion in dividends from Coca-Cola over the last 3 decades.

“But even Buffett is missing this hidden gem dividend stock…

“I can almost guarantee it!

“And I am this close 🤏 to writing a private letter to the Oracle of Omaha himself that reads:

“Dear Warren,

“You might not have heard of these 3 companies, but according to my extensive research…

“These 3 no-name stocks could pay you more dividends in the next decade than Coca Cola!”

I’ve been a Berkshire shareholder for close to 20 years, and I feel like I know Warren Buffett, but we have, of course, never actually met… and I think I’d go with a “Dear Mr. Buffett,” personally, but that’s neither here nor there.

And to be clear, Coca Cola was not a high-dividend stock when Berkshire Hathaway first acquired shares in the late 1980s. Buffett’s shares were bought in 1988 and 1989, when the dividend yield was below 3%, as it has almost always been. He has never sold a share, though, and the dividend has gone up by about 2,000% during that time (as has the share price), so Berkshire’s yield on their initial investment is absurd at this point. The cost of that initial position, which hasn’t changed in more than 30 years, was about $1.3 billion. In the early years, that was earning Berkshire about $50 million per year in dividends. As of the latest dividend payment, that stake earned a dividend of $728 million for Berkshire over the past four quarters. It was obviously a great investment, even if Buffett has publicly noted that he was distressed that he didn’t take the opportunity to sell some shares of KO in the late 1990s, when it traded up to a ludicrous valuation for a few years (it tuned out he was probably right to hold on, holding worked out spectacularly well… but it didn’t feel that way 15 or 20 years ago).

That’s without compounding, too — Buffett doesn’t reinvest his dividends, he takes them in cash and uses them to make other investments. If he had compounded his dividends into buying more shares of KO, Berkshire would likely have about a $65 billion stake and own roughly a quarter of the Coca Cola company right now. His other decisions at the time might have been better than just compounding KO shares, of course, but that’s a reminder that for most of us mere mortals, dividend compounding can be a truly stupendous force for growing a portfolio, if given enough time. As it stands Berkshire’s in fine shape, and they own close to 10% of KO anyway, having not bought or sold a single share in three decades (the ownership percentage has grown during that time, but only because KO has bought back so many shares over the years).

But anyway, my point is that Buffett has actually almost never bought a “high yield” stock, and certainly no high-yielder has become a very large portion of the Berkshire portfolio. The companies which pay Berkshire very large dividends right now do so because the companies grew dramatically over time, and grew those dividends. So I don’t know whether or not Buffett would be excited to get Tim Plaehn’s “leak,” but, well, I’m curious about it… so let’s see what he’s recommending for this next wave of “huge gains for the coming decade” stocks. Here’s how he describes them:

“DECADE STOCK #1: Pays a 9% yield and has raised dividends the past 20 years

“DECADE STOCK #2: Pays an 11% yield… and I expect 9-10% bumps every year to that payout. Their revenue has soared 50X over the past few years and growing like a weed.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“DECADE STOCK #3: A value-buy in the cash cow vessel space and has a potential 50% upward move in its dividend coming.

These are my go-to picks to buy and hold and collect over the next 10 years.”

And he throws a bunch of clues on the pile to entice us, so let’s dig in and see if we can name these investments for you…

“NEW “DECADE OF DIVIDEND” PICK #1:

“Markets pounded utilities in 2023 for its worst performance in over 15 years. I’m always pounding the table to my readers… ‘Buy the Dip in great opportunities.’

“This is one of the best out there.

“A closed-end fund in an essential service sector. The fund isn’t one specific bet on one utility company.

“Formed in 1961, a $3.5 billion dollar fund manages the closed end fund.

“$2.4 billion of that funnels into my ‘Decade of Dividend’ utility fund. The fund invests in over a dozen utility companies like Duke Energy, The Southern Co. and others that provide you electricity, gas… essentially everything you must buy each month.

“Imagine getting a check every time someone pays the bills to keep the lights on? You can rely on that one every month for life. It’s never going away unless we stop using electricity as a country!

“Paying a 9%+ yield… this fund has increased dividends for the past 20 years and the payouts have doubled in that timeframe.

“This closed-end fund ticks all the boxes I look for:

“#1. Utilities will be around for 100+ more years. Everyone needs energy to power their home. Now, you can benefit.

“#2. The competitive advantage is this fund focuses on regulated utilities. Meaning, a business with high barriers to entry, little competition, and historically low chances of bankruptcy. They can raise prices as much as they want.

“#3. Their dividend comes from free cash flow and has increased for the past 20 years. As the world consumes more energy each year than the prior, I expect this dividend to keep going up steadily.

“Buy this ‘Decade of Dividends’ pick today and start collecting this month!

“Because this utility opportunity pays out monthly dividends. Every 30 days, you get a check.”

There are a half dozen or so utility-focused closed-end funds, but given the 1961 reference, the 9% yield and the other clues, the Thinkolator sez this is almost certainly Reaves Utility Income Fund (UTG). That’s been a popular one with newsletters in the past, particularly when it’s trading at a discount to net asset value (as most closed-end funds typically do), though it’s right now trading right around fair value.

(If that concept is new to you, the basic difference with closed-end funds is that they have a set number of shares like a corporation, they don’t create and redeem shares every day like an ETF or open-ended mutual fund does, so the share price is subject to supply and demand — when people really love a closed-end fund, it might get bid up to a premium price, worth more than the fund owns, but more typically they trade at a discount, usually in the 5-15% range but varying dramatically).

Closed-end funds almost all use leverage, borrowing money or issuing preferred shares to try to enhance their performance, so many of them have been under pressure as interest rates have risen, since it’s therefore more expensive to “lever up” … and Reaves has gotten hit perhaps even worse than some, because utility stocks themselves have gotten clobbered by rising rates. Regulated utilities are in the “widows and orphans” category when it comes to income stocks, they’re generally very stable and safe, and they’re usually bought for the dividend… but when the “risk free” income from cash suddenly jolts to 5%, as happened this year, the safety of utility stocks gets quickly less attractive. The unlevered ETF which owns a lot of these same kinds of companies, the Utilities Select Sector SPDR (XLU), has dropped quite a bit over the past year, though it has recovered form the October lows as interest rates have fallen a bit again, and XLU has a trailing dividend yield of only 2.43%. That’s similar to the UTG official dividend yield of 1.9%, though that’s just the regulatory yield… they pay out far more than that in distributions, largely by booking capital gains, so they actually pay a dividend that is just shy of 9% right now. (Last year, 90% of the dividend came out of long-term capital gains, and they’ve relied more and more on capital gains each year… only about 10% was from qualified dividends that were effectively passed through from the utility-type stocks they own).

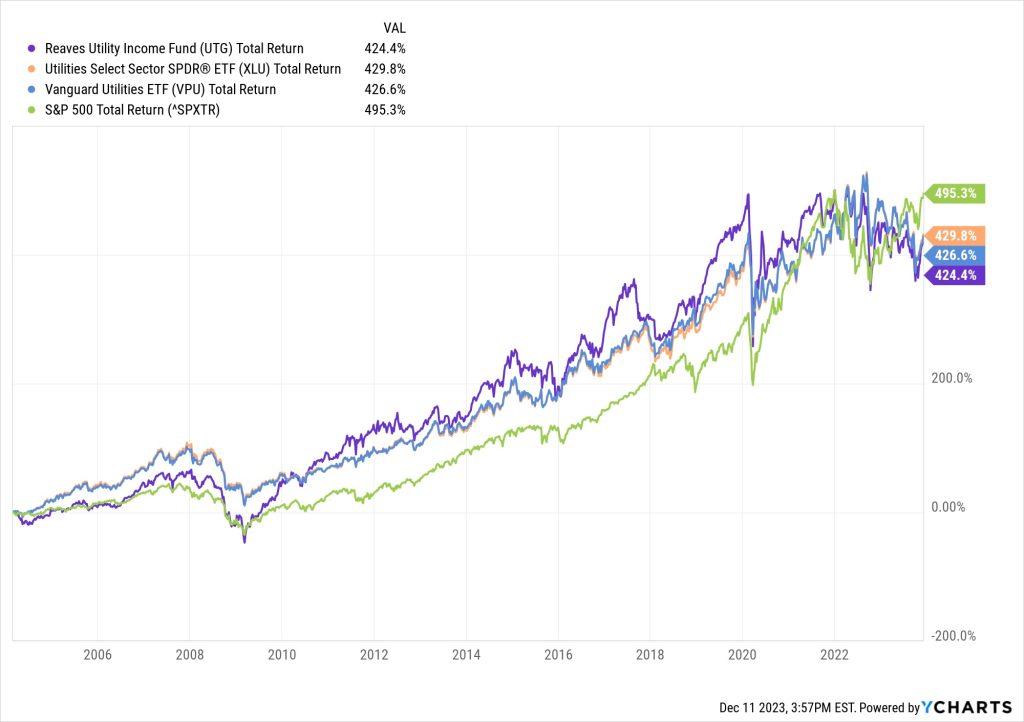

UTG does expand the definition of “utilities” a bit, so they own a couple railroads, and some telecom stocks like Comcast and Verizon, and they do also expand internationally a little bit… so it’s not quite as focused on “regulated utilities” as the ETFs like XLU or Vanguard Utilities (VPU). Here’s what the total return on all three of those looks like if we got back ten years, just FYI — that’s UTG in purple, more volatile than the utilities ETFs in blue and orange, and the S&P 500 in green:

Over the longer term, the appeal of utilities has been pretty clear — at least, it has been pretty clear during 20 years of mostly-falling interest rates, during which the utilities stocks often outperformed the braod market (though not over the past couple years) — but it’s also clear that utilities don’t really save you from short, sharp moves during bear markets — the utilities fall along with the broad market in 2009 and 2009, and during the 2020 COVID collapse, so you still have to be ready for some volatility.

What’s next?

“NEW ‘DECADE OF DIVIDEND’ PICK #2:

“Introducing a new business development company, (a “BDC” as they’re known). BDCs provide capital to small businesses, especially those who can’t get funds from a traditional bank.

“The firm who owns the BDC manages over $170 billion in assets… so they’re no small potatoes.

“They’ve grown at breakneck pace.

“Following a recent merger internally, the company has seen its dividend 2X over the past three years.

“Revenue has grown 50X over the last seven years…

“And they’ve posted profits through Covid and rapidly rising interest rates.

“I expect their dividend to grow 9-10% each year… which should entice more attention and drive the stock price up.

“This BDC follows all 3 of my dividend investing criteria:

“#1. Small business financing will be around for the next 100+ years. Businesses start daily. With $170B+ in assets under management (and climbing), this BDC has the equity to weather high interest rates.

“#2. Their competitive advantage is the diversity of their strategies. This BDC is different because they don’t pigeon-hole themselves into only the health of the small business. They provide credit, buy equity, but also purchase real assets like real estate and even ‘dip buy’ public stocks on the market. By diversifying, they can weather a recession better than other BDCs who will see more small business defaults.

“#3. Dividend just doubled and paid despite economic headwinds. Many dividend payers slashed dividends during Covid. This BDC has doubled them since. Profits are strong which helps with the cashflow to keep paying us our checks.

“This is my dividend growth bet over the next decade… and you can buy it now.

“The yield is strong at 11.3%. If they keep raising the dividend, more shareholders will push the price up.

“I’d get in now while it’s under $30.”

That’s a little trickier, but here the Thinkolator sez Plaehn is almost certainly teasing Oaktree Specialty Lending (OCSL), which did indeed merge with a different Oaktree fund back in January. OCSL is a BDC that does primarily private lending, so the “almost” is because I’m not sure where he got that “dip buy public stocks” flexibility he talks about, but otherwise it’s a perfect match… and the chart Plaehn shows when he says “the firm who owns the BDC managers over $170 billion in assets” is lifted from Oaktree’s website.

OCSL itself manages a much smaller amount of money, to be clear — Oaktree is a large credit-focused asset management company, majority owned by Brookfield Corp (BN), OCSL is a smaller BDC that is managed by Oaktree. Oaktree Specialty Lending says the current value of the portfolio is $2.9 billion, and they get an average yield of 12.7% from their investments… which gets turned into dividends, leading to the nearly 11% yield. They use roughly 1:1 leverage, so that helps to cover the management fee, though it also means there’s some risk of a squeeze if their cost of capital rises at the same time they get a bunch of defaults from their borrowers. That’s ameliorated somewhat by the connection to the much larger Oaktree/Brookfield, they’ve been able to borrow at good rates so far, but the risk persists to at least some degree.

And yes, the dividend has roughly doubled over the past 40 months or so, from the COVID lows to the most recent payment… and you can sort of claim that they had a “50X growth” in revenue over seven years, though revenue is very uneven for most BDCs and that claim can only be made because there happened to be one very low-revenue quarter in 2016. There have also been plenty of years when “revenue” was negative, probably because of non-cash writedowns of their portfolio. Here’s what the longer term performance has looked like for OCSL during the past decade, relative to a couple other BDCs — that’s OCSL in purple, the Van Eck BDC Income ETF (BIZD) in blue, Main Street Capital (MAIN) in green, Ares Capital (ARCC, by far the largest BDC) in pink… there are others, but that gives a little taste, and I included the S&P 500, in orange, for context, you can see that OCSL has been pretty average for a BDC so far, but also that the above-average BDCs have kept up with the broader market much better:

I can see being attracted to this one, I think Oaktree’s focus on distressed debt might surface some real opportunities for them as companies fall into refinancing trouble after the recent reset of interest rates, and the post-COVID period has been pretty good for them so far… but it hasn’t been an obviously fantastic outlier in the past. OCSL currently has roughly the same dividend yield as the BIZD ETF, so in that way, at least, it slots in as an “average” pick among that group of specialty lending companies… which means that if you aren’t convinced of Oaktree’s specific excellence or unusual growth potential, you can get roughly the same amount of income from the much more diversified ETF. I like Oaktree’s management, and I wish OCSL was more obviously unique or fantastic, but I confess that I’d rather settle for the ETF than study the different strategies of a dozen different BDCs. Sometimes settling for average, and doing a lot less work, is A-OK — you can’t be an expert at everything.

One more…

“NEW ‘DECADE OF DIVIDEND’ PICK #3:

“Final pick is a 20-year old dividend payer in the vessel space.

“Think crude oil tankers… car vessels… container ships hauling goods from overseas.

“Their business runs on long-term contracts with companies needing their product moved. Meaning, they’re the Netflix of the oceans.

“Money coming in from contracts each month… and companies paying them month after month… year after year.

“The average contract is six years. This stability allows them to build more ships to then lease out.

“Record revenue poured in during 2022…along with record profits.

“And their accumulated dividends should keep marching upwards.

“Due to Covid, they slashed dividends in 2020…

“And they’re still 50% below the payouts of 2019. Which gives you yet another “Buy the Dip” opportunity in the high-yield dividend space….

“Like the other two “Decade of Dividend” payers, this stock receives an A+ in my book:

“#1. As much as more information goes online, physical goods STILL need transferring over the next 100+ years. You can’t email oil. Those new golf clubs still need manufacturing and shipping.

“#2. This vessel stock’s competitive advantage is they’re global and involved in five major industries: Tanker ships, Dry Bulk, Liners, Energy, Car Carriers. A high barrier to entry business requiring 8-10 figures just for building the ships.

“#3. The dividend is on the rise as record revenues flow in. This dividend still has more room to run, meaning more potential cash in your pocket. Record profits means cashflow is safe.”

Well the dividend is no longer “50% below 2019,” but they did cut the dividend when demand collapsed for a few months during COVID, and they have been growing it recently. They’ve been around and paying dividends for almost 20 years, I remember owning shares of this one at one point in the pre-2008 crisis years… this is almost certainly Ship Finance Limited (SFL), which does own a nice variety of vessels that are under long-term contract to shippers and energy companies around the world (that “Energy” category is two drilling rigs they still own, a legacy of their earlier days when they were founded by John Fredriksen to help finance his oil tankers for Frontline (FRO) and his drilling rigs for Seadrill (SDRL)), but they mostly own container ships, with a few bulkers and tankers and a handful of new car carriers that they’ve been building in recent years, including some pretty cool LNG-fueled car carriers that will be moving Volkswagens from Europe to the US any day now. And they’ve proven to be a lot more stable than the operators of those vessels, which is a good reminder that sometimes it’s better to go with the financiers rather than the operators — they typically, though not always, have a lot less debt and more stability.

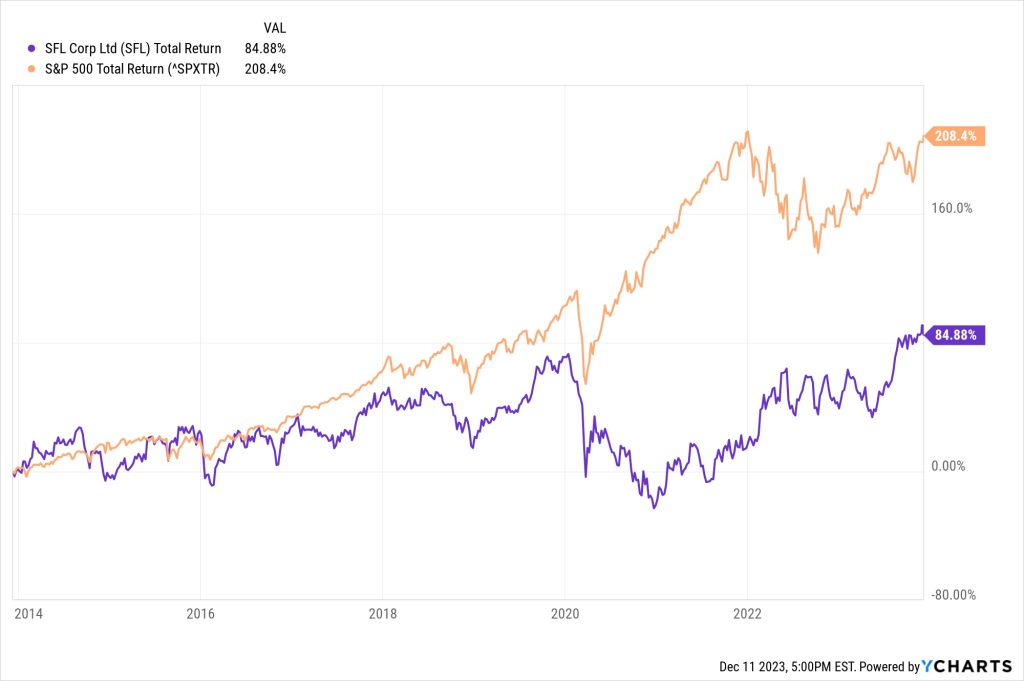

That said, it’s been a rocky road for SFL, too — lots of their operators went bankrupt during the financial crisis, and many others are struggling with high interest rates, and earlier struggled through changing trade patterns during COVID, even though, yes, most of their vessels are on pretty long-term contracts (that still means at least a few are rolling over every year). Here’s what their since-inception total return chart looks like:

That’s surprisingly strong, at this point they’re roughly matching the S&P 500, and for some long stretches of time they’ve dramatically outperformed… just note that essentially all of that performance comes from the dividend, the share price is actually lower now than it was almost 20 years ago… and, as always, the starting point for the chart matters a lot. Here’s the 10-year version, for a little different picture:

Shipping isn’t an industry for the faint of heart, even if you’re just a financier like SFL… but it’s also an industry that has used lots of debt to create plenty of mega-fortunes, and, as Plaehn said, we still need to move heavy stuff around the world, and will probably always need to do so, and these ships are extremely expensive and valuable, so having a nicely-depreciated fleet that still churns out plenty of high lease payments can work out pretty well. Just don’t expect things to be stable or easy, shipping is known as a boom and bust sector precisely because people get excited and borrow lots of money to build lots of ships… and sometimes they build too many ships, and something surprising happens in the economy, and those ships lose half their value because the charter rates drop dramatically.

Don’t want to make you too depressed, though, and it’s true that SFL is a lot more stable than many of the operators — here they are compared to Frontline (FRO), the big oil tanker operator that was once one of SFL’s biggest customers and operators… I don’t remember whether Frontline every quite went through bankruptcy, but it at least came close.

If I were forced to “buy and hold” one stock in the shipping industry for ten years, I guess Ship Finance would be one of the first ones I’d consider… but it’s not an easy sector for long-term investors, it tends to be the swashbucklers and contrarian traders who make money in these kinds of stocks. I can’t say I’ve got as much of a stomach for shipping as I did 15 years ago, but compared to the high-yield shipping stocks I was dabbling in back in 2007, enticed by what at the time were gargantuan yields from exciting companies like Frontline, it’s certainly true that SFL is the survivor.

P.S. Plaehn’s publisher, Investors Alley, was apparently acquired by Tifin, a conglomerate that owns a bunch of financial tools, including Magnifi, an app they call an “AI investing assistant”… so this subscription also includes access to Magnifi. Haven’t tried that one just yet, and don’t know if it’s particularly valuable, we’re seeing “AI assistants” crop up from a lot of different financial research companies, but it’s interesting to see a newsletter get bought by a financial research platform instead of by a fellow marketing-focused publisher.

Disclosure: Of the companies mentioned above, I own shares of Berkshire Hathaway. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

You are correct once again Travis! All 3 are included in Tim Plaehn’s “stable dividends” section of the portfolio.

Thanks for the confirmation, bob!

As a bit of an amateur sailor, I still love shipping. As the economy seems to be staying global we need more and newer ships. As long as Amazon exists we will be shipping stuff from China and the East. Backing the right shipper is always tough bet. This sort of “tools and plowshares” for the shipping industry is a good play for my investment style. Just got to keep that trailing stop set in case things go underwater.

A pick that I got from this very site (BWLLF) an LPG shipper has DOUBLED since I bought this year, plus an average 10% div. on top. My only complaint is from not going harder due to fear of a totally new company to my portfolio. I like to dip my toe in before diving head first.

Thanks BT — for other folks who are interested, I’m guessing you saw BWLLF when I covered it for a Robert Rapier tease back in September, so that article has some different high-yield ideas if you’re interested in exploring more (ET, Telenor, Carlyle among them).

What’s this 100+ years business? No one reading this will be alive then. The only dividend plays I will consider now are from unleveraged companies paying the dividends out of profits. None of the three qualify. Companies taking government subsidies don’t qualify either. That eliminates most utilities. Container ships are a no-go because that industry is consumer dependent. The longer I live the more I see that the best way to go is private investment where you and your few friends are in control. Your thoughts Travis?

As an alternative to UTG, I own DNP. For Oaktree, I own MAIN, both of which I have held for years. As for shippers, I’ve gotten burned too many times and won’t own another one.

My portfolio is stuffed full with dividend aristocrats. Food, drugs, manufacturers like KO, utilities and oil companies, and even a shipping line like SFL. Buy, hold and hope for capital gains, the dividends are a sweetener.

Sounds like a pretty comfortable situation to be in.

How I love reading about those AI (5) gang busing stock again every day. Now how come we aren’t being told what they are since we are paying to receive information on stock that people are teasing about – I can’t believe they are actually making money on ghost stocks.

Hi Kent… don’t think I understand your question — is there a particular AI teaser you’re curious about?

There are dozens of AI-themed ads circulating these days, I’m sure I haven’t covered them all but we do get to a lot of them, and many of them have been repeated for months. If you know the newsletter name or have a copy of the ad you can send us, we can take a look.

I’ve owned SFL for 15 years and have recommended it to numerous friends who have bought and are pleased. I guess it’s the many long term leases they have ( some 20 years) that have me sticking with them. Share price be damned…the dividend is healthy and fairly stable.

I think his latest tease is Newmont Mining?