I’m going to be quick today… Luke Lango has a teaser ad that a lot of folks have been asking about, teasing his “Next NVIDIA: 7 AI Moonshots with 100X Upside” report about some possible smaller stocks that could surge higher, and I can offer a little bit of info, at least.

The ad presentation, which is a sales pitch for his Early Stage Investor ($2,199/yr, no cash refunds) is loooong and repetitive, of course, but most of them are these days (there’s a big psychological reason — the more time you commit to an ad, the more likely you are to buy, in part because it lets you convince your self, subconsciously, that you weren’t wasting your time)… and sadly, he doesn’t drop many clues about the “7 AI Moonshots” … but he does drop some clues about at least one of them, the one he calls his favorite idea, so we can at least get you one name. Maybe more, we’ll see.

The big argument is a familiar one… and even a sensible one, in many ways — Lango’s pitch is that NVIDIA is in a similar situation to Cisco in 1999 or 2000, atop a fast-growing business but about to see competition come in that will sap demand for their GPUs, and lead to a massive drop in their revenue growth and market share and earnings, which, in turn, will crush the stock price. That’s certainly possible, and I’ve shared similar concerns a few times throughout the year about NVDA in 2023 being eerily reminiscent of CSCO in 1999 or 2000, though that “eerily reminiscent” scenario, we should admit, is not exactly predictive — it’s extra hard to predict the future from a sample size of one.

So no, I don’t know how long NVIDIA’s “perfect storm” of massive demand and limited competition might persist. It might be that NVIDIA doubles again before the market starts to erode, or it might be that they share a disappointing forecast in their next earnings report and the stock falls in half overnight — both of those outcomes are definitely within the realm of reasonable possibility, and I’d hesitate to express any certainty about which is more likely. (I own NVIDIA, for full disclosure, but also sold half my position early this year at lower prices, and have a negative cost basis so I’ve tried to be relatively patient with my remaining stake and not overreact to the potential for doom. The sunnier perspective is that if things continue to boom for at least another year or two for NVIDIA, the stock is not that far from being rationally priced today.)

But anyway, that’s the basic backdrop — Lango expects big downside for NVIDIA, and he thinks they’ll lose share to the chips being developed by the big tech companies, as well as the non-GPU custom AI chips that are beginning to emerge as the industry grows, which will lead to big profits for his smaller “moonshot” companies.

And before we go any further, I should put in the reminder I’ve been noting about Lango every time his ads include that graphic about him being “Ranked #1 out of 7,889 Bloggers on TipRanks” (which he was, for at least a little while, in 2020): I don’t particularly endorse the methodology of TipRanks, but if you’re going to brag about that “#1 Stock Picker” success, I feel the need to remind readers that your current ranking is almost unimaginably poor — the latest TipRanks summary, for the past year, says Luke Lango is ranked #35,664 out of 36,127 experts.

But what are those moonshot ideas, you ask? Well, like I said, he pretty much only drops clues about one — here it is:

“… my favorite of the bunch has a market cap that’s 333 times smaller than Nvidia’s. Think about that.

“Everyone in the media is talking about whether or not Nvidia could double and become a $2 trillion company.

“Meanwhile, this tiny stock would have to explode 333-times just to reach Nvidia’s size today….”

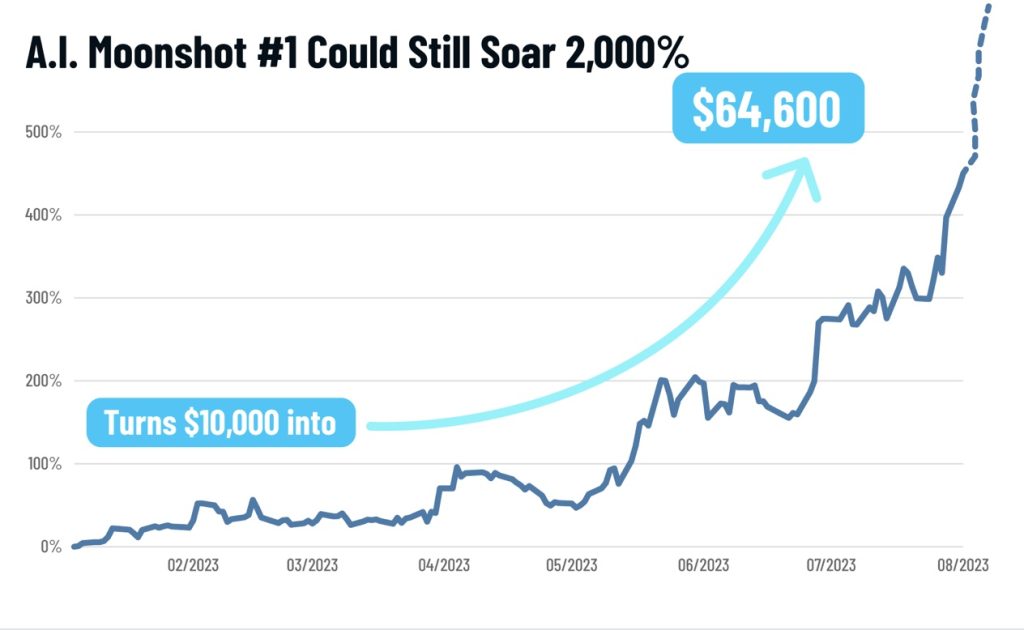

Other clues? The stock has already “soared as much as 546%” this year, though he thinks it could still “skyrocket another 2,000% higher or more.”

And that it’s backed by Bill Gates, among other notable tech guys, and has a “war chest of patents” in its industry.

A few more tidbits:

“Google’s CEO Sundar Pichai even said…

“this industry could ‘propel AI forward.’

“And yet this tiny AI stock’s market cap is 580-times smaller than Google and 813-times smaller than Microsoft.”

So that narrows it down quite a bit, and then we get a chart of the stock’s performance in 2023 (up to August or so), which will help us confirm the match — here’s the image:

So that, dear friends, is the quantum computing company IonQ (IONQ), which was indeed up 546% from the 52-week low to the 52-week high, though that low was actually a couple days into 2022, if you want to be nitpicky. After Lango’s data was pulled, with those dotted lines suggesting a surge much higher from early August into the future, the stock actually dropped quite a bit, so the chart looks a little different if you extend it here to November… but certainly still up quite a bit this year:

This isn’t a new teaser idea from Lango, he has talked up IonQ and quantum computing in the past, though he didn’t do so specifically with an “AI” theme until that really became the narrative du jour earlier this year.

Here’s what I said when he pitched IONQ in ads for his cheaper newsletter, back in March (he called it his “Area 52 stock”):

"reveal" emails? If not,

just click here...

“This ad from Luke Lango is largely a big picture pitch about how critical quantum computing will be to the world, bringing lots of 1,000% opportunities in every industry you can imagine, and maybe that’s all true… but that’s not happening in 2023, quantum computing is still a large-scale global R&D project (hundreds of different big R&D projects, actually), and from what I can tell there’s not much consensus yet about how or when it might become useful at tackling the big data processing tasks that are too complex for conventional computers. What Lango is teasing is an investment in IonQ (IONQ), which is trying to commercialize its trapped ion quantum computing technology, and beginning to build a facility that they hope can manufacture their trapped ion “chips” at scale in the future. In real financial terms this is a story that’s a long way from being something you can justify or analyze using the income statement, but probably the best thing IONQ has going for them now is that they’re the only quantum “pure play” stock that’s not a complete disaster (Rigetti (RGTI) and D-Wave (QBTS) are the other stocks in this space, both are now below $1 per share and $100 million in market cap, and have been written off by Wall Street almost completely), so IONQ right now is probably in the best position IF there’s another hype cycle for quantum stocks anytime soon. I’ll pass, I don’t understand this technology nearly well enough to be betting on it, but if I were forced to speculate on a quantum stock I’d also pick IONQ, if only by default.”

They’ve made some progress this year, with the bookings that have been steadily growing slowly turning into actual revenue, as companies buy their trapped ion systems — they had an analyst day in mid-September which provides a good backdrop of the business, if you’d like to catch up, and they will be reporting earnings tomorrow, on November 8, so that could certainly cause a move in the share price. They have enough cash to get them through another couple years of building up the business, though on the current trajectory it’s probably not enough to get them to profitability (which probably won’t come until 2026 or 2027, I’d guess), so this will mostly be a story-driven and future-driven idea for at least a few more years. They have had a good acceleration in their bookings this year, which is impressive, and they believe they’ll be the “first mover” in providing enterprise quantum computing at scale, and will keep that advantage and reap most of the rewards as the business really explodes in the 2025-2030 timeframe.

Are they right? Beats me, my big-picture thinking about quantum computing hasn’t changed since I wrote in more detail about it six months ago, and I’m by no means an expert on this technology. They’re not going to drive AI investment or acceleration this year or next year, but maybe their quantum systems will provide a better option in a few years. The company got sucked into a wild “overpromise” surge in 2021 as they completed their SPAC merger, then collapsed like all the SPACs when the revenue didn’t come through as quickly as investors had dreamted, and they probably got ahead of themselves again this year thanks to the AI mania… but certainly lots of really smart folks are excited about using quantum computing to solve really big problems, and right now they’re the small cap “survivor” in the quantum space, so perhaps they’ll still be the leader in a few years, so it is possible that all this bouncing around from $30 to $3 to $20 and now back to about $11 will be meaningless when we look back in 2027 or 2030… but that’s the nature of betting on emerging technologies that aren’t really commercially viable yet, you have to have both optimism and the ability to accept a near-100% loss if your optimism was misplaced.

And… that’s about all we get from the “7 Moonshots” pitch — Lango does give away a “free recommendation” in the presentation, which is the chip design software maker Synopsys (SNPS), which I suppose is a logical way to play the theme that “everyone’s designing their own AI chips now” — here’s what he says about it:

“This company is a market leader in electronic design automation software, or software that chip makers use to design chips and electronics.

“This software will become increasingly important and valuable as more firms like Tesla and Microsoft create their own custom AI chips.

“SNPS is a perfect play for the AI Turning Point.”

That has definitely been a popular story stock this year, as their earnings have surged higher for several years, even defying some of the headwinds that the broader semiconductor space has recently been facing. Right now, SNPS is trading at about 40X forward earnings and analysts expect that they’re in the midst of several years of roughly 20% annual earnings growth, so they’re right at the top end of what I’d consider a reasonable valuation for a “growth at a reasonable price” stock. My understanding is that the two leaders in this market are Synpopsys and Cadence Design Systems (CDNS), and they’re extremely similarly valued right now (and similarly sized, they’re both in the $70 billion market cap neighborhood). Analysts think CDNS will grow a little more slowly, and it’s a hair more expensive, so I can see why you might choose SNPS — but I certainly don’t know the businesses in any detail, or know in what ways they are meaningfully different. Both good, both growing very nicely as more and more companies want to bring chip design in-house, and investors know all this, which is why they’re both expensive.

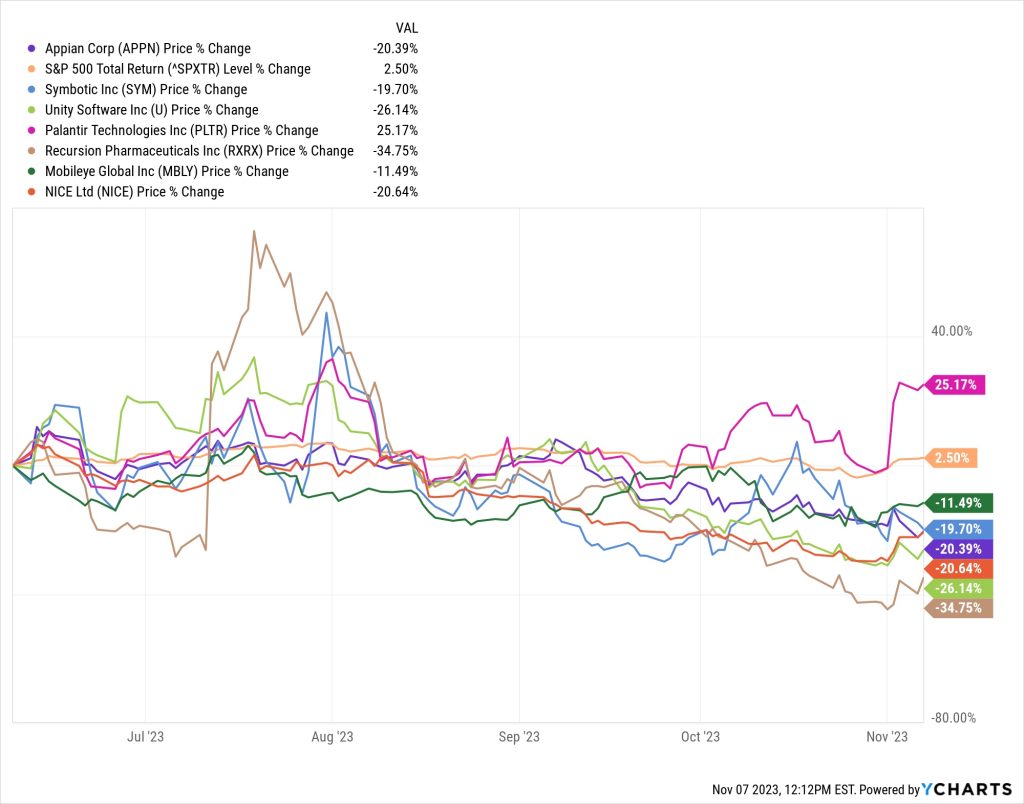

He also throws in, as a second “bonus” for subscribers, his “SUPRMAN Stocks” special report — and we’ve covered that before, back in June… the combination of my clue-sniffing and some later confirmation from other readers tells us that those seven stocks are Symbotic (SYM), Unity Software (U), Palantir (PLTR), Recursion Pharmaceuticals (RXRX), Mobileye (MBLY), Appian (APPN) and NICE (NICE). Just FYI, here’s how those seven have done since early June — Palantir is the only one that’s currently outperforming the broader market (that’s the S&P 500 in orange):

None of these are pitched as “gonna triple in a month” stories, really, and logically we should know that high-risk, high-growth potential story stocks in hot sectors of the market are likely to require patience if a “100X” moonshot is ever going to happen (you never get to 100X if you sell after a 50% rise or fall, of course), but hopefully that chart is a little bit of a reminder that you don’t have to sprint full speed into every new investment theme… it’s OK to take your time, think it over, and understand what you’re buying and how patient you’re willing to be before you risk your money (or, of course, before you pony up $2,000 for a nonrefundable newsletter subscription).

Any thoughts about what some other “moonshot” AI plays might be, whether or not they’re in Lango’s latest list of seven hopefuls? Please let us know with a comment below. We’ve been compiling all the AI picks that everyone has been teasing so far this year — as of last month, that totaled up to 25 in our “All the AI Picks from Everybody” update, but if we keep getting these teasers we might have to post another update soon. Thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of and/or options on Alphabet, NVIDIA, Symbotic and Unity Software. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

My best guess is that IONQ is delusion.

SNPS, and to a lesser extent CDNS seem like reasonable choices for a small stake.

In my opinion, it’s still hard to bet against GOOG, MSFT, an NVDA.

The latest tease by Brownstone research…any idea? “Brownstone Research Near Future Report by Colin Tedards – Google’s Code Red, Project Gemini, to Rival ChatGPT”

Thanks a million Travis. You are the best stock detective.

Best of success to you and the fellows here.

Amen!

what about Elon Musk,Xai

Lango misses a few but 16 out of 20 recommendations from 10X I used generated over 52% overall in one year. His constant bombardment of NEW get rich quick schemes can be annoying but I invested in several of his schemes and every one of them made me big money. Some I didn’t invest in but tracked for a year and was disappointed I didn’t invest in them because they all would have generated huge returns in a short time. The average of 20 investment recommendations had some flops, big, but still those 20 would make money when owning all 20.

Was that in 2020-2021? He certainly rode that wild bull market with a lot of enthusiasm.

Great work Travis! I own a piece of IONQ so we’ll see, but you have given us many others to investigate, much appreciated!

I don’t know if it’s allowed in here or not, but there’s an Investorplace Subreddit available about these and other Analysts services too, perhaps there’s more info available there?

https://www.reddit.com/r/InvestorPlace/

Thanks Travis, excellent analysis.

I found this via Mr. Google:

https://investorplace.com/2023/10/7-quantum-computing-stocks-that-ai-will-send-soaring/

Thanks Travis, I was one of the first questioners about Lango’s latest pitch, so appreciate your careful and helpful response. Gumshoe is my most valuable subscription!

Now …. I’m wondering about the three “sneak peeks” from Motley Fool on their latest AI micro-cap teaser offering. I know you like putting thinkolater to work on those guys and, based on form, I’ll bet that at least one, maybe two of those have already been promoted previously. Looking forward to your shot at these.

Thanks in advance 🙂

A

Is that the one from Motley Fool Canada? Haven’t seen the US Foolies run a “microcap” AI teaser lately, though I might have missed it.

The basic “AI Disruption Playbook” stocks from the Fool have generally been NVIDIA (NVDA), Alphabet (GOOG) and Meta Platforms (META), no surprise, but that “special report” has been around for years, it’s just been revived by the interest in AI. I’ll look for that “microcap” one to see if I can add anything.

Yes, Motley Fool Canada selling a micro-cap AI service with a tease (peek) to uncover three “micro-cap AI sleeper stocks, with lots of clues the Thinkolator would love.

A

The name of the service is , “AI Holy Grail: Top Microcap Sleeper Stocks to Buy Right Now.”

i subscribe to Lango’s Basic Service, but not his expensive Early Stage Investor. I have bought some, not all, his reco’s – with mixed results. I bought IONQ in February 2023, sold the basis when it was +147%, but them the remainder sold in late September for a 30% loss.

Thanks Travis, great article.

Own PLTR, hanging on through ups and downs with (gulp) optimism. Same story with IONQ. Doing well with SNPS so far. Many thanks, Travis, for your insights on these and other stocks.

“Luke Lango is ranked #35,664 out of 36,127 experts.”

Too funny! Thank you, Travis.

It appears to me that almost 100% of most stock pickers energy is directed to getting our money from our pocketbook to theirs!

Lukes Latest AI tease for AI Startups gave a freebee of AtomBeam

https://click.exct.investorplace.com/?qs=6eaef8cf1f38067817c8b4218ca622f44e15f7a8f38573ce70f54707a7edff9b629b33fe148b23667dbfb46b5a18354f5087ffe12762ce8f

He also teased a Robotic Building Company. Google gave me

https://zennihome.com/ available on WeFunder.

There is also an Automatic Coffee Dispenser teased, but there are heaps out there, so cant pick which it is.

I Bottom fished for IONQ and bought 100 shares at $12.70 last week.