Jeff Brown’s “Timed Stocks” pitch is essentially just another spiel about “buying biotech stocks before a catalyst event,” but it’s wrapped up in one of those video “summit” meetings that implies it’s something beyond a newsletter ad… and it’s so filled with massive promises of potential 1,000%+ gains that it’s driving a lot of Gumshoe reader interest.

They even hired a woman with an English accent to introduce the “presentation,” along with some strange techno music… kind of reminds me of the 1980s, when everyone on Wall Street listened to horrific music and hired secretaries and receptionists with aristocratic-sounding English accents to make them seem like they were hoity-toity upper class folks.

But anyway, what can I tell you about the presentation? It’s an ad for Jeff Brown’s Early Stage Trader, which they say is “devoted to delivering fast returns from small tech stocks”, and it’s “on sale” — they’re peddling it for $1,997 for years with several guarantees (“list price” is $4,000 a year).

Those guarantees are that the average pick will at least double, and that one pick will rise by 1,000% or more… so what’s the meat? What if those guarantees aren’t fulfilled? In that case, you get a third year for free.

Which is fairly typical, most publishers offer a guarantee similar to that for their higher-cost letters — they won’t give you your money back, but they will give you something else that doesn’t cost them anything instead. That’s a riskless guarantee for them, of course, since adding another subscriber to an electronic newsletter costs roughly $0… and extending your subscription if you’re unhappy enough to demand that they fulfill their guarantee is also unlikely to cost them anything, since your other option was likely to cancel your subscription. And, of course, after that free year I’m sure they’ll have their autorenew in there to catch your renewal payment for year four (they don’t say what the eventual renewal price will be, other than to note that it may be more or less than your initial subscription price).

And I sat through the whole “presentation,” so never doubt that I love you… and I pulled out some tidbits along the way.

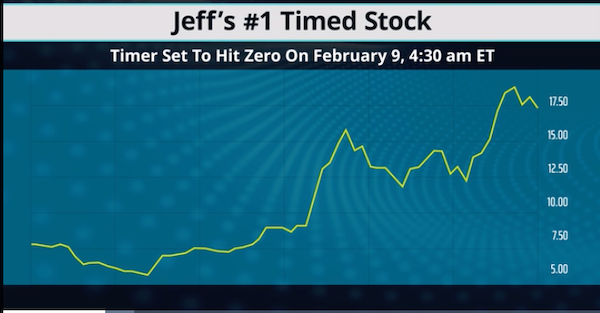

Much of the “presentation” is about the general idea of “Timed Stocks” and the certainty with which Brown claims he can identify the winners in that category with 100% success… but what caught the eye of most Gumshoe readers, of course, was the idea that there’s one of these coming up soon, with “Jeff’s #1 Timed Stock” set to hit zero on its “timer” on February 9.

And we all know that newsletter teaser ads require a deadline — if they just say, “we’ll identify 12 stocks with great potential over the next year,” you’ll probably yawn and move on… but if they say “we’ve got a secret stock that could rise by 1,000% or more in two or three weeks, hurry and type in your credit card numbers before the deadline,” well, suddenly the response rate for that ad surges higher. We all crave immediate certainty and fast gains, because, well, we’re not very smart only human.

The first half of the presentation is all about this mystical notion of “timed stocks” — Jeff Brown says he has identified more than 100 “timed stocks” that have posted massive gains, with 100% winners… though, of course, I’ll remind you that finding past winners is just a data mining exercise that requires only that you tweak your criteria until everything comes up roses, it’s pretty easy (it’s finding future ones that’s hard).

“Timed Stocks” are just stocks that, thanks to the federal government, have a preset timer attached to their share price — when the timer ticks down, the stock surges as it gets to zero. Whatever could that mean?

We get a bunch of examples… here are a few, in case you’re interested:

Emisphere (EMIS) presented a “timed stock” opportunity on February 22, 2018. Went from a few pennies to $2+, then later to almost $10.

Amarin (AMRN) had a December 15, 2011 “timed stock” moment Monday, september 21 at 8am — a 314% gain in three days, which he says is on the “lower end” of “timed stock” gains.

And we’re told that one of the biggest “timed stocks” in history was Alterity (ATHE), a nanocap valued at under $10 million… and Brown says that…

“They didn’t know this was a “timed stock” that was set Monday, July 29, at 8am. Had we gotten in ahead of time, our reward could have been 23,200% in one day.”

Note that he says “could have been” — which almost certainly means “wasn’t”… when investors make gains like that, they talk about it.

And I was curious about that one, actually, since I think it was the hugest winner he mentioned, so I went to check it out — it turns out that this is almost entirely a made-up bit of foofaraw, created by somebody mining past “big winner” stock charts without actually looking at the company or the numbers.

Alterity Therapeutics is an Australian biotech, it is indeed very tiny (market cap is still around US$10 million, and on average it trades less than about A$8,000 worth worth of shares in any given day). There’s also a Nasdaq listing at ATHE for an ADR, and, perhaps more importantly for our purposes, there’s a legacy OTC listing at ticker PRNAF that essentially never trades.

But when they released their Phase 1 clinical trial results for their drug (so yes, there was really a “timed stock” catalyst), the shares of the OTC symbol PRNAF did indeed rise by 23,000% in one day. But that’s just because of the trick of charting software insisting on a starting point that isn’t zero, the stock actually went from trading no shares and quoting a $0.00 share price on the days leading up to July 29, to trading 700 shares for 2.3 cents each on July 29. Which charts show as a 23,000% gain, even though the stock had been at a similar level just a few weeks previously, when it last traded.

The catch? That was a single trade in a symbol that essentially never trades, and it was for — get this — a total of 700 shares. Which means that someone, somewhere, completed a trade using this mostly defunct OTC ticker for a total of $16.10. That’s where the 23,000% gain chart comes from.

Now, to be fair, the real company in its real home market did respond positively as well — on the Australian exchange, Alterity briefly spiked from about three cents a share to four cents a share on the 29th, on the strength of 1.6 million shares trading in the wake of the Phase 1 trial results (so yes, that’s a total of about $50,000 worth of trading in the stock that day), though it was back down below three cents quite quickly a day or two later. There was a real catalyst response to the clinical trial results, but it wasn’t even 100% let alone 23,000%… and if you blinked, you missed it.

There are a bunch of others that he cites in the ad, should you wish to go check them… hopefully they’re more “real”…

"reveal" emails? If not,

just click here...

Clovis on January 2, at 4:05pm on Wednesday afternoon, got a $1.6 billion windfall, shares shot up 524%, from the $30-40 range. So that must be a reference to 2017.

Matinas had its “Timer” event on February 8 at 7:05am, went from a microcap at about a dollar to $7 or so, thanks to a $190 million windfall.

Amicus had a timer that was supposed to hit zero on April 29 at 8am, so if you bought before that around $10, it went down to $5 and then rose 721% when the “timer” hit zero.

I didn’t look at all of them, and there were at least a dozen more… and sorry, digging into each example is not really the point here — the point is that we should always question those kinds of ludicrous past returns that are cited… not only are they usually the result of data mining and backtesting, not historical stock pick ideas from the particular service being advertised (remember, you can make a backtest say ANYTHING about the success of your strategy, since of course you tinker with the criteria until your results are great, the whole point is to look for things that worked in the past), but sometimes they’re also just hooey. Certainly we should not imbue them with any predictive power, or let them ignite our daydreams.

So we’re moving on… and yes, that “timed stocks” notion is clearly a reference to FDA calendars and guidelines. They even cite the “federal government rules” that tell us that these stocks have this predictable timing…

Brown says that Title 21, Part 312 of CFR is the government document that each stock filed before their shares spiked up. And yes, 21 CFR 312 is, of course, the section of the Code of Federal Regulations that covers the rules for Investigational New Drug Applications to the FDA. Most of that is not specifically timed, though there are some guidelines for review times and transparency of the review timeline that primarily came about as a result of PDUFA and its various updates (that’s the Prescription Drug User Fee Act, which was first enacted in 1992 and was basically designed to get the FDA more funding, in the form of fees paid by drug developers, and in exchange for that funding to speed up and streamline the new drug approval process).

The ad says that of the 119 “timed stocks” Jeff Brown has tracked, 100% of them have gone up the second their timer hit zero. He could have made money on all 119 using his criteria, for a 100% win rate.

So is he saying that 100% of stocks that are on a timeline for FDA approval or a clinical trial data release will go up? Of course not, though that’s the initial impression the ad gives.

What he’s really saying is that the stocks that meet the criteria he has chosen always go up when they report their critical news… because the news in those cases is always good — which is a crazy enough claim to make in its own right.

And he says that there’s information anyone can get in what he calls a

“timed stock request form” — the company files this form, and when it’s approved by the government the stock then has a timer attached to the share price. It ticks down literally minute by minute, second by second.

(which isn’t actually true, by the way, the FDA has timing guidelines and goals, and each clinical trial that the FDA approves does have a schedule and a requirement that they report the results of the trial… but there is no hard rule that they must announce decisions on a precise day even for the most constrained schedules like the PDUFA date review deadline for final new drug approval — sometimes they’re earlier than the goal, sometimes later).

And yes, he does go on to explain that these events, which are at least loosely predictable in the calendar, cause stock price movement because they are effectively major announcements about being one step closer to bringing a brand new drug to market (and therefore making money on it).

So it could be positive preclinical results (like, something that works great in the lab), positive clinical trial results (meaning it’s working well in human trials), the filing of an IND application or actual FDA approval… any of these announcements pour money into that “timed stock” and the share price goes up. A timed stock is a company that makes an announcement of any of those kinds… which means that a lot of those future catalysts are not really specifically tied to particular dates (let alone times), but are really more narrowed down to a quarter or a month or two (as in, “we’ll report top line data from this clinical trial in Q3”).

Though obviously, biotech stocks also announce bad news with some regularity — and, in case you’re unaware, that usually tends to drive the stock down. Sometimes dramatically.

So it’s certainly more fair to say that “When this announcement is positive, investors pour money into the stock.”

Which means you have to pick the stocks that are going to release good news — preferably news that’s even better than investors anticipate. Which comes as an “um, duh” statement — every stock rises when it reports news that is better than expected, and falls when it reports news that is worse than expected. That’s the nature of a market, what moves stocks is a change in investor perception… and on a single-stock basis, that’s usually because the news is different than investors expected.

So the trick is, how do you know it’s going to be positive news, and preferably surprisingly positive? Isn’t that impossible?

Jeff says no, that his work (backtesting, I presume) tells him that he has a predictable, reliable way to determine these outcomes.

Essentially, his key criteria, as I read it, is that the stock has to have gone public recently, and to have done so without really needing to go public. He thinks this gives him the edge, because biotech company leaders are incentivized to go public before they release good clinical data or reach milestones, since they know that these good news releases will increase the value of the company.

Which I guess makes a certain amount of logical sense, though I would be shocked if it is clear or predictable that a newly public biotech reports good results the first time out. And on the flip side, of course, we have the truth that biotech leaders don’t know what the results of their clinical trials are going to be six months or a year out… and as stewards of the company, they might also be incentivized to go public later, after good news, because that would get a better price for the new shares they’re selling.

And he further emphasizes two things — that not all biotech events are equal, with phase two or three results carrying more weight than phase one… which is certain true… and that drugs that have large potential markets will have a bigger financial impact on their owner than niche drugs. Which is also fine and logical, though it’s hard to take seriously someone who takes these logical statements and says those three or four criteria make for 100% successful stock picks around near-term catalyst dates.

Brown did say that he looked for exceptions to this theory — stocks with with good VC funding that went public earlier than they had to, and then released a negative announcement and saw their share price fall. He didn’t find any, which is where he gets that 100% success rate… though most biotech stocks release data with some regularity, and with more than one data event in any given year that moves the stock up or down, so how he decided which was the key event to monitor I don’t know. Certainly some biotech stocks go down in the year after they go public.

So that’s a long-winded way of saying that the rule is that he wants to look for biotech companies that have some sort of data or FDA-related catalyst, look for when they are scheduled to report an announcement (sometimes it’s not a specific date, but a general time period), then narrow it down to only companies that recently IPO’d and had solid VC funding before the IPO, because that gives a 100% certainty of a positive announcement.

And, as I suppose I’ve made clear, I’m super skeptical that the actual results will be anywhere near 100% predictive of positive stock price moves… but we’ll leave that aside for now and focus on what the first stock might be.

I’ll leave you with a visual clue, since that’s one of the key criteria used to check the Thinkolator’s results. Here’s a screenshot from the presentation of the stock that he’s teasing:

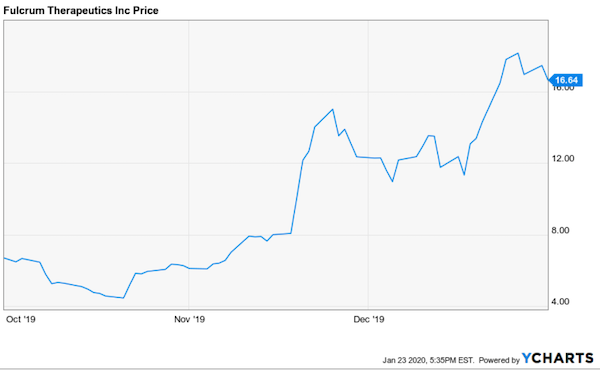

Going by the stock chart, and the fact that the company raised $140 million in venture capital and went public fairly recently, arguably before they had to go public, the stock is clearly Fulcrum Therapeutics (FULC)… they did raise $140 million in funding in their venture rounds, and they went public in July — though whether or not they “needed” to go public is, I suppose, debatable. They were ramping up spending for clinical trials, but they also pushed it to go public at what was a slightly weak time, with their IPO having to shrink a bit to get finalized, and it ended up being a “busted” IPO that didn’t get back up to the offering price until December and, in fact, fell by about 2/3 in the few months after the IPO.

And heres that matching stock chart for you from YCharts, in case you’re curious — both this and Brown’s chart omit the first three months or so of weakness after the July IPO:

But as far as the “February 9 at 4:30am?” I’ve had no luck achieving any certainty about what that February 9 date means with this one — it’s certainly not the anticipated date for Phase 2 results for their lead drug. The Phase 2 study of their lead drug, losmapimod for facioscapulohumeral muscular dystrophy (FSHD) did start on August 9 and it does have a 24-week dosing period, so I suppose you could just add six months to that date and guess that the first patients might have been dosed and had their data collected by February 9, but that’s a bit of a stretch — more likely it will take longer than that before any of the results from this Phase 2 trial are made public unless there’s some shocking news (there have been no updates from the study thus far, at least as far as I can tell)… and the estimated “top line data” release is in the second half of 2020, with the study completion date expected to be in August.

This is the company’s “vision,” if you want to get into the story a bit:

“Thousands of genetically defined diseases have a known root cause. Our product engine enables us to systematically approach drug discovery in genetically defined diseases. We aim to discover and develop disease modifying therapies that result in meaningful outcomes for patients and families.

“Our vision is to treat genetically defined diseases by addressing their root cause.”

And this is the basic info about their lead program:

“Facioscapulohumeral muscular dystrophy (FSHD) is a rare, progressive and disabling disease for which there are no approved treatments. The disease is characterized by progressive skeletal muscle loss that initially causes weakness in muscles in the face, shoulders, arms and trunk, and progresses to weakness throughout the lower body. Skeletal muscle weakness results in significant physical limitations, including an inability to smile and difficulty using arms for activities, with many patients ultimately becoming dependent upon the use of a wheelchair for daily mobility.

“FSHD is caused by aberrant expression of DUX4 in skeletal muscle, resulting in the inappropriate presence of DUX4 protein. Normally, DUX4-driven gene expression is limited to early embryonic development, after which time the DUX4 gene is silenced. In patients with FSHD, the DUX4 gene is unsilenced as a result of a genetic mutation. The result is death of muscle and its replacement by fat, resulting in skeletal muscle weakness and progressive disability.

“We initiated a Phase 2b clinical trial of losmapimod, our product candidate for FSHD, in August 2019.”

The primary outcome measure for this trial is DUX4 activity, with a measure of the gene suppression (or lack thereof) of DUX4 at week 16, so it’s not necessarily impossible that some partial news could come out in February or otherwise before the official release of top-line results in the second half of this year, but nor is it particularly likely — I haven’t seen any indication from the company that we should expect news or any kind of scientific presentation on February 9 or at any other time in the near future. The US study locations all say that they’re currently “enrolling by invitation” and some of the European sites are not yet even recruiting.

Other events that could include this information Brown hints at, or give a reason for some initial data readout from the trial? Well, they are likely to report their fourth quarter earnings in mid-February… though earnings releases don’t generally mean much for biotechs.

And there are other reasons to consider Fulcrum, though they’re not likely to generate big news in the next few weeks. They announced a new collaboration agreement with Acceleron at the end of December that will bring in some funding, and could lead to milestone payments and royalties on any products that result… and they expect to submit IND applications to begin clinical trials in their treatments for Sickle Cell Disease and Beta-Thalassemia in the middle of the year.

There has been one other real “catalyst” event as well, the release of Phase 1 results back in October… which were good enough to further support the Phase 2 decisions they had already made, since the Phase 2 trial started a couple months before the Phase 1 data was released, but the share price also fell to its lowest price a few weeks later.

As is typical, I have no idea what will happen with Fulcrum Therapeutics — I rarely get involved with clinical stage biotech stocks, partly because the economics are so murky and so reliant on an entirely uncertain future, but mostly because the only thing I can be pretty sure of is that the person selling their shares to me probably understands the science better than I do. This one seems like it’s probably a decent bet as clinical stage orphan drug treatments go, if only because they seem to be the company that’s most advanced in this space at the moment.

If you want a comparison, probably the most apt one is Acceleron (XLRN — yes, the same company they’ve more recently collaborated with on other stuff), which recently had a Phase 2 trial for a drug also targeting FSHD — and they surprisingly announced on September 16 that the drug had failed to meet its endpoints, and they were canceling the program. The comparison is certainly not perfect, because XLRN also has several other drugs in their pipeline and they’re a much larger company… but in the couple weeks that the stock was most likely reacting primarily to this FSHD news, before other news came out, the market cap did fall by about $300 million. Before roaring back on good news in some other programs, but still, perhaps that $300 million provides some indication of what a successful Phase 2 trial might convey in terms of market capitalization. For Fulcrum, which is a $400 million company right now and probably isn’t granted a lot of value for their much earlier-stage operations, that kind of swing might indicate that a disastrous Phase 2 trial could mean a loss of 75%, and a solid one could mean a similar gain. That’s very squishy thinking, but perhaps it will provide some context.

As for me, I’ll sit this one out… and remain skeptical of anyone using a 100% successful backtest to imply they’re guaranteed to be 100% successful in the future. But for all the folks suffering from FSHD, well, I certainly wish them the best, and I hope Fulcrum’s treatment works miracles.

Those of you who are biotech-minded, feel free to jump in and share your thoughts — do you like the setup here for this orphan drug maker and target developer? Think they’re primed for good news in this first year post-IPO? See any reason to expect movement or news in February? Let us know with a comment below. And thanks for putting up with a bit of extra blatheration this time.

I really think Jeff is on to something with CRISPR technology. He just signaled a sell signal on one and a buy signal on another. Surprised he is going down another path.

Which one did he mention to sell? I have a few Crispr companies but don’t have that report. I have the near future report

He advised his readers to take profits on Crisper Therapeutics (CRSP), which, admittedly, has been going sideways for quite a while now. Brown doesn’t anticipate anything new from this company for the foreseeable future.

10/4 I knew I haven’t got anything about sell for Edit and I knew FULC was the one he was talking about last night. Thanks for your insight

Lee, to be clear, Brown is NOT advising to sell Editas (EDIT). In fact, this is a buy right now. He advised his readers to sell Crisper (CRSP).

It’s not FULC.

If it isn’t FULC, what is it?

I feel it’s a good idea to have a cluster around the gene editing companies, those based around the Jennifer Doudna and her colleagues research and then those like Bluebird Bio who use Mega tals as the editing pathway. That way we are covered by possible very promising outcomes in this sector of biotechnology from the different btrearments and paths being pursued.

Udayan

He has several newsletters and has to churn out at least a few new stocks a month to his subscribers — can’t just linger on CRISPR 🙂

I knew he was pounding the table for EDIT for the last few months pretty hard .

Years, not months on that one.

True ! Well I missed it if he put a sell on it . I’ll be looking for me a exit soon

BEAM will be one of the best ipo stocks this year!

I watched the presentation as well, so yes, I get that you love me. Thank you. It didn’t take me very long last night to figure out that the mysterious stock chart was FULC. I watched it like a hawk all day today. I’m a subscriber to Early Stage Trader and I’ve been expecting a buy alert. I’d like to think that FULC will come out as a buy alert in the near future (following from the presentation) but I figured in the meantime it could easily slip down from 18 to 16 or even 15. So I didn’t load the boat today.

For what it’s worth, I could see myself buying this stock and holding it for a good return; but I’d want to think that I bought it right. It’s technically strong, but very likely could touch support in the 15-16 range before going on to new heights.

I do like their mission statements, their approach, and it has a decent chunk of insider ownership.

Yes, the presentations are painful to watch; and I have no problem missing most of them. But, I’m on board with Jeff Brown and have to follow his work.

Jeff also mentioned option plays and I went through all of the options today, and most of them have over 100% implied volatility. So, no easy money there either.

Thanks for watching and covering the event and revealing the mysterious stock. It traded on low volume all day, so no one who was watching the presentation last night bought it today. The funny thing is, if this stock gets lit up, it will be in the all time high range, and none of the stocks have done that. They usually come in low and off the radar. But a lot of people must have joined E.S.T. because the portfolio went up about 7% today (which was fantastic).

FULC has No options !

I was referring to the other holdings in Early Stage Trader. Not FULC.

I do not follow the biotech sector that closely. Just a question to those who follow Jeff Brown’s work . Is it reasonable to consider his recent offer as legitimate and not just hype?

thought this was related to blackout period, apparently not

how 4:30 am arrived at?

Must be HI time 😉 =9:30 in NYC

Greetings, thanks to Doc Gumshoe and his thinkolator. Well, since I’m invited to share my thoughts on biotech, here it is then : I found

there are 2 ways to play the sector +/- successfully :

1) to “play” to pre-PDUFA and binary events run-ups using the biopharmcatalyst. com calendar of binary events,

2) trading, swing trading the real post-approval winners.

This is a viable system in a very tiny nutshell but needs explanations and fine-tuning from case to case.

EG consider the cases of PFNX, XERS, NKTR, KALA

PFNX which had a potential blockbuster drug approved ran higher post approval, whereas XERS with a commercially insignificant product tanked and NKTR is currently consolidating, down 30% post approval as I write…KALA had a comeback 6 months after a CRL, complete response letter, and is now up 100%+ from is lows in anticipation of a renewed application.

Bottom line : take the profits, or losses, but do NOT run away, do not write off neither winners nor losers, by closing cases, win or lose, too quickly, but keep both on your radar.

May The Force be with U.

Dang, I was hoping it was Forty Seven (FTSV) which I bought for under $8 about three months ago. Looking for one more good pop, then bail…

I used to set time aside to”learn the secrets” and get the stock names from these presentations. I learned they’re just sales pitches and reveal nothing of real value to me. They also tell me I have to listen to it on their schedule. It’s all BS! I’ll be getting chances to listen to his pitch for at least the next 5 days. Just more messages to send to trash. Plus all these pitches have prices far beyond what I’m willing to pay for their expertise. I’m not wasting my time on these.

I just want to thank you Travis for your insight. It makes my think twice about what all the hype really means and helps me make the decision not to be a sucker, because it sounded pretty good to me when I listened to the presentation.

The stock is (ALEC) Alector.

Wouldn’t be surprised if he likes that one, the reward potential of Alzheimer’s Disease drugs always tempts newsletter guys, even in Phase 1… but that’s not a match for the hints in this ad for that #1 stock —- could just be another of the recommendations or potential recommendations. They should have some Phase 2 clinical Results for their lead drug in the first half of this year.

If it is ALEC, it doesn’t inspire confidence in me, the fact that 4 insiders have been quietly selling off small stakes of their shares since Dec. 26th, and that another insider did a swap for their $22 shares for equal shares at $8. Makes me think the stock is overvalued at the least.

DNice is right- I’ve read the report, thanks to a lifetime membership in Bonner and Partners. Allah be praised I’m no longer stupid enough to buy lifetime memberships, but they do have occasional uses.

Hi. So what did the report say to do after 4:30?

Only $2. Stock increase.

i think he raised the buy price on it. I got ALEC, and the spike was okay, but I think it dropped a bit this morning.

You are correct DNice, I think Jeff B. used the chart of FULC just to throw people off!

Could be… if they lie in their ads, the answers will be wrong.

Thanks Travis: for another excellent review. I once had considerable respect for Jeff Brown, but my guileless faith is evaporating steadily. I lost on his breathless enthusiasm for Everspin (MRAM) but made it back on Synthorx (THOR). I guess he’s just another shill that I will have to plot on your incisive radar.

THOR was closed for a gain of 400%+ and MRAM is still in the portfolio. How did you lose money?

I believe PLX has a drug that is proven to work and approval should be in January. What do you think of PLX?

Thanks Travis, you are a real money saver!

Thank you Travis for yet another brilliant article. As always, I am amazed by your knowledge and skill at ferreting out the facts.

Hmm…I am wondering why FULC did not have the typical spike in price at opening today (1/23) if this was indeed the number one recommendation that was supposedly complimentary for sitting through the entire presentation last night (viewed by over 11,000 people). Some other small/micro cap biotechs did spike up today, e.g. KLDO.

Dear Travis Johnson

Many thanks for all your research. I like to read it.

Another aspect to be considered.

I have watched 2 bio stocks that were up more than 100% on good news. 3 hours later a new company information. The company sold millions new shares for almost the start price.

Of course the market shares were down to end at a lower price than the start price. (BTW I’m an Israeli person and not a long time or heavy investor on the US market).

AIM could continue to climb a lot higher. Has $ 9 Mill Market cap, supposedly.

Travis, nice piece of detective work here! I can only say that if this guy (Brown) used a chart from a company he wasn’t pitching to mislead anyone reading it, you have to wonder what kind of critter he is? I hope that he didn’t pitch ALEC but did pitch FULC, just to validate that he isn’t a seriously questionable guy. His subscribers, however, seem to indicate that he was pitching ALEC. So, I guess each will have to judge why they would listen to or acquire anything he’s pitching. Or Maybe he just doesn’t do his own work?

For the record, I am a Biotech skeptic and have watched hundreds of these wannabee companies take billions from wishful investors. I moderated a trading room with hundreds of traders where I watched the same lose lots of $$$ gambling on ‘hitting the big one’. My advice to the average investor is to stay grounded in buying the prospect of good earnings at reasonable prices. Biotechs are too often the domain of the rabid speculator — sorry to say so.

I do think that your work is balanced and thoughtful. You’re trying to hold onto reason and temper claims with a dose of objectivity and reality. In this case, the example of one of the fake micro-penny stocks cited popping for a day on $16 is really sick. I was sitting there LMOA and thinking how many years the same crap has been going on. In this case, the $16 trade is quite an indictment on this guy.

Best Regards,

Buck

Thank you, Travis.

FWIW: Here’s background on FULC’s only Phase 1-2 trial in progress: “Fulcrum acquired rights to losmapimod from GlaxoSmithKline (LSE: GSK) in April this year (2019), after it failed prove effective as a cardiovascular treatment, now repositioned as a potential FSHD treatment.”

The Phase 2 trial is supposed to finish in Fall2020. Seems that anyone who buys FULC may be in for a long bumpy ride before any significant uptrend might occur.

I’ll pass til some actual positive news post about this potential drug.