Whitney Tilson has rejuvenated an old teaser theme with his pitch about a “Chaffee Royalty” investment — way back in 2008 (and again in 2013) Chris Mayer used that “Chaffee Royalty” name in his newsletter ads, to pitch some of his favorite mining royalty stocks…. so, which one does Tilson like? Let’s dig into the ad and see…

The pitch is similar to many of the other “royalties” teaser ads we’ve seen over the years — and for good reason, it’s an inherently delightful business model, appealing to exactly what all of us want to do: Make money without doing anything. Of course, in order to earn that royalty stream in the first place you have to do some work — either create something that earns you royalties, like writing a book or song or inventing something or, if you’re a celebrity, licensing some part of your image or likeness, or you have to buy the royalty. In the case of the kinds of royalties we talk about as investors, which are usually mining and mineral rights royalties, it’s almost always the case that you’re investing in a company which itself buys and manages a portfolio of royalties on mines or oil & gas projects.

Here’s a taste of the ad from Tilson, it’s a pitch for his Empire Insider Alert ($1,495/yr or $2,995 “VIP Lifetime” membership, 30-day refund offered):

“… the legendary investor Warren Buffett said, “The best business is a royalty on the growth of others, requiring little capital itself.”

“Royalties are one of the only ways in the world to do nothing and make money while you sleep…

“What might shock you is there actually IS a way for anybody to tap into a pool of “royalties” which is similar to what I just described… wealth that piles up by itself…

“And the incredible thing is you don’t have to write a song or novel, invent something, or do anything creative…

“That’s because what I’m describing is not traditional royalties.

“Instead you can make one simple investment to capture some of wealth that is already now worth more than the entire Beatles catalog…

“More than the commercial rights to “Happy Birthday” and…

“And more than the net worth of Harry Potter author J.K. Rowling, combined.”

The “Chaffee Royalty” name comes from James Chaffee, who was one of the first to invest in royalties on the gold mining claims in Colorado, about 150 years ago, though there are tons of names of people who grew rich from financing those early gold miners or, later, the oil explorers, in exchange for a small slice of the mineral rights. Chafee used his wealth to became Senator Chaffee, and had a hand in cementing the notion of transferable mineral rights into law.

So what’s the royalty stock that Tilson likes? Here’s a bit more from the ad…

“Right now, I’ve discovered a “Chaffee Royalty” opportunity you can get into for around $16 per share….

“…. resource producers are lining up to swap some of their gross profits for these “royalty programs”. Why would they do that?

“It’s simple.

“See, right now, American resources like natural gas, oil and other commodities are needed because of shortages from the war in the Ukraine.

“That’s great for everyone who produces or sells those materials.

“Trouble is, usually this money comes from the banks. But right now, according to Natural Gas World, the crisis across the bank sector has caused banks to pull back on lending, including loans to resource producers.

“And the resource companies themselves – companies like ConocoPhillips and Barrick Gold – want to avoid spending their precious cash to make up the slack.

“So they turn to the royalty companies instead… taking in cash they need today in exchange for a stream of future profits on the huge piles of resources they are drawing out of the ground.

“It’s win-win for the royalty rights holder and for the operators and drillers.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“And as long as the oil, gas, or minerals keep coming out of the ground… royalty companies and their shareholders get rich, without owning a single well or worrying about doing any actual drilling or mining.

“It’s that simple. And right now may be one of the best times in history to be part of the “Chaffee Royalty” trend.”

And then we get into some details:

“The “Chaffee Royalty Program” with this other company has nothing to do with gold, silver, or precious metals in fact.

“Instead, this company collects royalties on one of the most important resources on Planet Earth… energy from oil and natural gas.

“Without energy, there wouldn’t be electricity to power any gold or silver mines.

“Without energy, civilization itself would likely stop…

“And this small company, based in Texas, has one of the best business models in the world to collect from the world’s unstoppable demand for oil and gas….

“‘Royalties’ on 20 Million Acres of Energy Wealth… For Around $16 a Share”

Until we get to really an embarrassment of clues…

“… this company has eerie parallels to the Franco-Nevada story.

“What do I mean?

“Well, for starters, this company’s origin story is very similar to Pierre’s story…

“In 1987, a man named Tom took over his father’s lumber company…

“What Tom did was genius…

“Tom sold off all the timber assets and focused exclusively on getting mineral rights to oil and gas interests.

“Today, Tom runs his royalty company with only 98 employees.”

Franco-Nevada (FNV) is the all-time most fantastically successful mining royalty story in the world, thanks to Pierre Lassonde’s leadership and their early move to acquire royalties on a huge number of gold mines… including some mega mines, like Goldstrike, which eventually turned tiny investments into billion-dollar windfalls.

So what’s this energy company that Tilson thinks is following a similar path? Well, it turns out that he’s repeating this one — this is Black Stone Minerals (BSM), which he also teased as one of his “insider whisper trades” stocks a couple months ago (he also still hints at the other stocks we wrote about back in May as “4 More ‘Insider Buying’ Trades To Make a Killing in 12 Months,” though the focus is much more on the “royalties” aspect).

And this has actually been a favorite of the “insider trading” newsletter guys of late, so it turns out that I also wrote about Black Stone Minerals last week, in response to an ad from Alexander Green’s Insider Alert newsletter (he called it the “#1 Royalty Investment in America”)… my opinion hasn’t changed, and there’s been no changes from the company in the last week (and the stock price is about the same), so I’ll mostly just re-share what I wrote then:

So what’s the story with this company? Well, it’s not actually a corporation — Black Stone Minerals is a limited partnership, and therefore you’re not buying shares of stock, you’re buying units of a partnership. As a tax pass-through (like a MLP or a REIT), they essentially just pass through the partnership’s income and tax obligations to you, the unitholders.

There are lot of corporate structures like this in the energy business, both in passive trusts of various kinds and in the midstream and pipeline businesses that are often structured as master limited partnerships.

In essence, that means these often trade as income investments, so they’re sensitive to both interest rates and to the price of oil and gas (since the dividend depends on both how much oil and gas is produced on their lands, and on the price of that energy). The yield is high right now, the last dividend payment was 47.5 cents for the second quarter, and that’s been moving in the right direction lately, it was 45 cents a couple quarters ago and 40 cents a year ago… though it also drops sometimes, like when oil prices collapsed in the early days of COVID (the second quarter 2020 dividend was only eight cents). If the payment stays at this level, that would be $1.90 for a full year, which would provide a very nice yield of 12% at the current $16 share price. There is clearly some risk of the distribution having to be reset lower, however, that was a question on the last conference call and they’re right at the point where they’re already distributing essentially all of their cash flow. That means they need production to kick up in some of their royalty areas, which is expected later this year, or they need oil and gas prices to bump higher, but things are obviously tight with oil prices down 12% this year and natural gas prices down 36%, and with the rig counts on their royalty lands dropped considerably from last year as producers cut back in the wake of falling prices.

Still, oil and gas prices are pretty steady over the last two months… and the company was fairly confident that they would be able to keep the distribution steady when they reported in early May… so it’s possible things will work out OK.

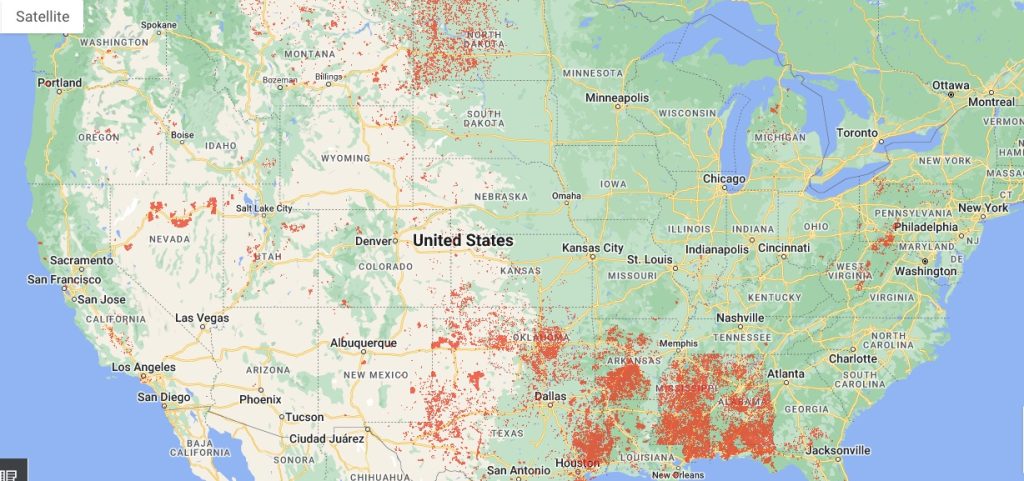

I mostly like BSM because of the geographic diversity of the mineral rights they own, with exposure to many of the big energy producing areas in the country, but, as you might guess when you see that there’s a big concentration in the Haynesville Shale in Louisiana, they do have substantially more reserves in natural gas than in oil… the red dots are their mineral interests, so there’s some Austin Chalk, some Permian Basin, some Marcellus, some Bakken, etc.

Back in February, CEO Thomas Carter, Jr. had this to say in their quarterly update press release:

“Our record fourth quarter results capped a very successful year for Black Stone Minerals. Without issuing additional equity, we reduced our total debt and increased royalty production through our organic growth efforts to attract additional operator capital to our existing acreage positions. The development programs on our Haynesville and Bossier Shelby Trough acreage continues to ramp up with Aethon as our operating partner. In addition, new drilling activity is continuing to increase across numerous operators on our East Texas Austin Chalk acreage. We enter 2023 well positioned to drive further royalty production growth while maintaining our very healthy balance sheet.”

And on May 1, in the first quarter press release, he didn’t moderate that too much despite the falling prices…

“We had a strong start to the year despite headwinds from weaker natural gas prices. We remain constructive on our long-term outlook and are encouraged by our development agreements with Aethon in the Shelby Trough and various operators in the Austin Chalk. As we continue to focus on growth in our existing assets, Black Stone is able to maintain the highest distribution level since going public.”

Other good news? They’ve done a fair amount of hedging for the next two years, to help make sure they get good cash flow from both oil and gas production even if prices slip, and they do have partners actively drilling on their lands to increase future production… they still expect production to grow on their royalty lands by about 5% this year, though it’s not growing yet.

And I like that they have also been pulling back from the net profits interest (NPI) deals they have with operators, so it’s going to be almost entirely (94%) “real” royalties that generate their revenue this year. A “real” royalty, to me, is a passive one, they just collect income and don’t have to do anything — with NPI deals, something a lot of mineral rights owners do to try to increase production, they would become more active partners, and would generally be responsible for their portion of the capital spending (drilling costs, etc.). NPI deals are a challenge that’s hurting Permian Basin Trust (PBT) right now, for example, since they have to pay their share of the capital investment before they get to collect the revenue, which is why their dividend started the year so low, but BSM has worked recently to offload those NPI deals to partners and remain more passive. They’re still more active than some royalty owners in other ways, since they actively try to recruit producers and make their land more attractive for drilling, and unlike Trusts they are able to actively buy and sell mineral rights, so they do some work… but they’re trying to avoid participating in the actual capital spending.

(That’s why I effectively bet against PBT when I was analyzing them following Marc Lichtenfeld’s pitch for PBT as his #1 Oil Royalty play a while back, and I hedged against that, in part by buying call options on BSM — that trade hasn’t worked to this point, by the way, neither PBT nor BSM have moved dramatically enough for me to make money, but that’s where I’m coming from).

The challenge is that while Black Stone Minerals gets royalties from both oil and gas, their reserves are gas-heavy (70%), and a little more than half their revenue (about 56% last quarter) comes from dry gas, which has been doing much worse than oil and natural gas liquids of late. They expect about 72% of their production to be natural gas (including some natural gas liquids) in 2023. Pricing for natural gas might improve again in the years to come if liquefied natural gas (LNG) exports really grow, since the Haynesville is expected to be a big feeder of LNG projects (due to proximity to the gulf coast), but those projects are taking a long time to get permitted and built, and there’s not a lot of optimism that we’re going to see natural gas prices move higher in short order.

Other things to keep in mind? Because this is a partnership, you’ll have to deal with K-1 forms when it comes time to do your taxes — they’ll let you know what your share of the net income of the partnership is, which is usually a much smaller number than the distributions you received, and the forms often come in pretty late and can make tax prep a little more complicated (one of the reasons to like these partnerships is that they often provide tax-deferred income — usually a lot of the distribution you receive is actually a return of capital, so you don’t pay taxes on it until you sell the shares and get the capital gain).

And yes, there’s been a little insider buying… CEO Thomas Carter has bought as recently as May 5 (about half a million dollars worth), and Director Mark DeWalch bought a similar amount in March. Most of the insider holdings are from stock-based compensation for directors and executives, and outside of those two individuals most of the insiders are net sellers as a result, but Carter, at least, has been buying pretty steadily over the past year. And I agree, it’s a reasonably attractive investment and would probably be my first go-to if I were buying into energy royalties today. Just be mindful that it is an oil and gas royalty partnership, which means, over the long term, that your returns will probably be driven more by commodity prices than by whether or not the CEO is optimistic.

For some perspective, and a reminder of why I prefer royalty owners to actual commodity producers, as a general rule, here’s the chart going back to BSM’s 2015 IPO — this shows the total return for Black Stone Minerals (in purple) compared to the price of oil (blue) and natural gas (orange), so it has held up quite well… and BSM has done much better than the average oil & gas producer (that’s the S&P Oil & Gas Exploration and Production ETF (XOP) in green):

Of course, you’d generally have been better off under-weighting energy over the past eight years, so that’s a consideration, too — this is the same chart if you add in the S&P 500 as a comparison (in pink):

I don’t know what the future holds when it comes to commodity prices, sadly, but certainly a lot of newsletter folks are still yelling about how super-bullish they are on oil and gas these days… and at least two of them, Whitney Tilson and Alexander Green, are highlighting Black Stone Minerals as their favorite energy play, both because of the magic of passive royalties and because of the signal sent by insider buying at the partnership.

Sound like your kind of investment? Already considered and passed on the idea when we’ve covered it before? Do let us know with a comment below.

Disclosure: Among the investments mentioned above, I still have a small position in call options on Black Stone Minerals (and a put option on Permian Basin Trust). I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

BSM is also on the oxford insider alert portfolio

The point here is if AI shares like C3.AI, SYM, U, PATH, PLTR, IONQ, are overvalued or not taking account the Price /Sales, or if they need a rest and later show any better incomes and continues flying? I wish to see some IPO´s…

Travis: Thank you for your review and analysis of BSM. Liked the graphic of the location of the BSM royalty interests. Wouldn’t it be interesting to have a talk with a Petroleum Geologist or paleo-geologist to understand why the continental US is blessed with such widespread oil bearing rock formations/basins?

I’ve owned shares of several MidStream Pipeline L.P.’s for years. Had better luck with them than with Oil Royalty Trusts. Difficult to evaluate the value of either one but especially the latter.

You likely know that MMP has received a recent acquisition offer from OKE at a small premium in price. The merger will combine the midcontient Refined gasoline storage, distribution and crude oil pipelines and Gulf coast port tanks of MMP with the natural gas and NGL liquids pipelines of OKE. The latter is a corporation not a LP. Reasonable idea.

Some of us folks living in Texas wish that the “unstoppable demand for oil and gas” would at least slow down a bit. It’s been rare day this summer that we don’t have a heat advisory/warning over much of the state. As for BSM, you won’t find it in the Zacks portfolios, as they have a strong sell rating on it. Yet, dry gas price futures are up, so I wouldn’t rush to drop the stock or options on BSM, as they should eventually benefit from any price rise if/when that comes to pass.

The last time I was involved with Zacks, it got to the point of having to buy in the opposite direction of what they recommended.Now, that is true with Nomi Prins who recently wrote how the housing market is going down and about as soon as she wrote that, XHB and LEN went way up.

Hey buddies, any idea over the luke lango article based on buy ChatGPT before IPO? I can´t find the way, I d´ appreciate your commets. thanks

The only way to buy ChatGPT before the IPO is to buy shares of Microsoft (MSFT), OpenAI’s largest investor.

It may not have a meaningful impact on Microsoft in terms of income or revenue anytime soon, of course, MSFT is a $2.5 trillion company and OpenAI is probably valued at about 2% of that (roughly $50 billion), but during a manic period like this, when there are so few “real” pure play AI stocks to get investor attention, that might not matter.

Hi Travis, thank for your answer but I ´m looking for butyin OpenAI before IPO and exactly as you mentioned MSFT seems to be the way. Right now last private sales gave a value $ 29 mill millions at OpenAI, I have reading once and other time the Luke Lango article but I can´t not discover the way he is talking over buying OpenAI before the IPO, he talks of other company not MSFT, but not sure if it could be a partner, or a supplier of Open AI, he is saying 100x after the IPO, really researching hours but not sure with the few info sharing in the article. Will it be possible open a new thread over it, perhaps in this case we could sharing information and perhaps reach where Luke is suggesting?

lost money on BSM badly.

In the COVID crash, or when oil came back down last year?

Do I understand this correctly, if I put 100k into BSM, right now I could get a 12% yearly return on that investment? And if that is correct, is it paid out monthly, every quarter, or yearly?

That’s the level of the dividend right now. Don’t recall, but I think it’s paid quarterly.

Whether it stays at this level depends on how much oil

And gas is produced on their mineral rights properties, and what oil and gas prices are in the future. There have certainly been points in the past when the dividend fell.

I assume that if I own BSM in a Roth IRA then I don’t have to deal with a K-1 form.

True, but owning MLPs in an IRA only makes sense for relatively small positions — once you have over $1,000 in income from the partnership, it’s taxed as income (UBTI) even though it’s in an IRA, so that short-circuits the tax benefit of the IRA. Don’t know the specifics beyond that, but that’s the general reason to not own MLPs in an IRA.