Here’s the lead-in to Whitney Tilson’s latest “presentation”:

“Whitney Tilson reveals the exciting true story behind:

‘Whisper Trades’

“The fastest, most reliable way for the average investor to make 10x profits in America today.”

And really, it’s a big presentation that’s all about “insider buying” — and in particular, about how following those insider signals can generate good returns for regular investors. It is, of course, horribly misleading to say that this is a fast or reliable way to generate 10X profits, but, well, it’s an ad, they’re always misleading.

What’s Tilson selling? A new service called Empire Insider Alert ($1,495/yr or $2,995 “VIP Lifetime” membership, 30-day refund offered).

And the bait he dangles is a set of “whisper” trades… here’s how he puts it on the order form:

“Insiders are piling into these stocks. The ‘whispers’ are clear to me. Chances are very good something BIG to happen with these stocks, and probably soon…

“Including a trade for an obscure resource ‘royalty’ company. No less than 9 of the top insiders are scooping up shares recently… It’s clear to me they are loading up their portfolios for one reason only… because they believe there’s an excellent chance their shares will soon skyrocket…

“This opportunity is so lucrative, I’m highlighting it in a free special report you can get instantly today, titled My #1 “Whisper Share” Trade for 2023.

“The time to get in this trade is right now…

“You can also access other immediate trades in another report I have for you, titled 4 More ‘Whisper Trades’ to Make a Killing in 12 Months.”

The big picture pitch here, of course, is that when insiders buy shares of their company, that’s a good indicator that the stock will do well. There have been a bunch of academic studies and back-tests done on this, and it is true — if insiders buy shares with their own money (meaning, they’re not given shares), the probability is that stock will outperform the market over the next year or two. Generally, from studies I’ve looked at, the best positive signal is if executives are buying, and if there’s more than one of them buying (it’s better if the CEO and CFO or some VPs buy than if Board Members or other large shareholders buy… and it’s better if there are at least three buyers, not just one).

And Tilson tries to introduce some urgency:

“But first, a warning…

“Though it’s true that these ‘inside whispers’ are 100% legal to use, laws can change overnight…

“Which means, if the U.S. government decides to shut down this completely legal loophole, we could be locked out of this secret for good.

“So I’m urging you to grab this knowledge while you still can.

“Because this is life-changing stuff you can’t afford to miss…”

That’s silly… I suppose it’s technically possible for laws to change overnight (though maybe not in this Congress), but the basic rules of insider trading and disclosure are pretty stable. If you are a big shareholder (5%+, and especially 10%+) or an insider at a company, you have to report your purchases and sales of company stock to the SEC… and the point of reporting this is so that it will be known to other investors, so the SEC makes those filings public. It is exceedingly unlikely that will change anytime soon.

And he makes it seem sexy and rebellious…

“But you’re probably wondering, if these ‘inside whispers’ really are so potentially profitable and straightforward to act upon…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Then why haven’t you heard of this secret before?

“Well, quite frankly, most people think trading on insider ‘whispers’ like this could send them to jail.

“That’s why people are too afraid to report on this secret.”

Here’s his rundown of the basic pitch for following insiders:

“The most lucrative ‘whispers’ are kept under lock and key thanks to the Securities and Exchange Commission.

“For example:

- What will earnings be in a company’s upcoming quarterly report?

- Is a company about to close a deal with a major new customer?

- Is a tech company on the verge of a new product breakthrough?

- Did a resource company just find a huge new deposit of oil, gas, or gold?

- Is there a merger or acquisition in the works?

“According to the SEC, there are significant restrictions on how this insider information can be released to the public.

“Of course, while the SEC restricts company insiders from spreading inside knowledge to their friends and families, the fact is – these insiders know about this big news… sometimes months in advance.

“And with such inside information, many insiders end up buying shares in their own company to profit when the good news is released publicly.”

And he includes a famous Peter Lynch quote that most folks who talk about insider trading use:

“Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.”

I think we need to actually expand that, now that some insiders clearly game the system to try to make small insider buys that get the attention of investors, but it’s still generally true — it’s just that they buy for maybe two reasons now: mostly because they think the price will rise, but partly because they’re hoping to get the attention of investors and make the price rise.

So yes, what Tilson is calling “whispers” is just, “read the SEC filings”… here’s how he puts it:

“You see, in exchange for the luxury of being able to buy their own stock, these insiders do have to do one big thing in return…

“The SEC requires those insiders to file a simple 1-page form that tells us very, very important pieces of info. This 1-page, official government document must tell us:

- How many shares the insider has bought

- When they bought those shares

- And what price they paid.

“These forms must be filled by all company insiders who buy or sell their own stock within two days of the transaction.

“***Tracking these forms, which, again, is 100% legal and ethical, is what I call the ‘inside whispers.'”

The challenge, of course, is that there are hundreds of SEC insider transaction forms (it’s called Form 4) published most days… sometimes thousands. And the value is not in reading each one, the value is in knowing the patterns, and playing the odds. And of course, reading the actual filings when you’ve narrowed it down to a specific company (people hate reading — reading a company’s actual filings, not just the press releases, gives you superpowers relative to regular investors… it’s just that the superpower is most likely to be the ability to bore people at cocktail parties, and maybe get rich very slowly).

Personally, I do like to check on insider buying when researching a stock, and particularly when I’m looking at a company where the share price has collapsed or there’s been some bad news — that’s where the story often becomes interesting, because buying a stock that is down sharply is a lot easier to do if you see that the CEO or some other executives are buying, too. The absence of insider buying isn’t necessarily a negative, it’s just the absence of a positive, but I do like to see it — sadly, there are many companies where the stock-based compensation is so dramatic that it makes no sense at all for insiders to buy shares with their own money, even if they love the price, their financial advisors would be yelling at them to diversify and put some of their assets into something other than their company’s stock. Insider trades don’t usually tell a particularly compelling story, good or bad, but every once in a while they do catch your eye.

More from Tilson…

“Now look, I want to be very clear about this — as good as the strategy can be about following insiders into trades…

“Nothing in investing works 100% of the time.

“The insider’s we’ll be following could get their next product launch wrong. We could be run over by a dip in the economy itself, which causes a stock to drop despite the insider’s buying.

“The only certainty in investing is this — despite all our due diligence on the ‘whisper trade’ ideas we’ll be recommending, we’re sure to see a losing play here and there.”

Can’t argue with that!

OK, so finally we start to get into the clues and hints he drops about his specific “Whisper Trade” recommendations… so let’s see what the Thinkolator can tell us:

“My #1 ‘Whisper Trade’ For 2023

“I’ve just uncovered some ‘whispers’ about a stock that I believe could make you 10 times your money back in the next 12 months.

“It’s a small resource royalty company based in Houston.

“What’s a ‘resource royalty’ company? It’s truly an amazing business.

“It works similar to how royalties work with songs, books, or other intellectual property.

“The resource company only has to set up a deal once — and then it can get paid royalties on the deal without having to do much else.”

OK, my ears are perked up now… I do love royalty companies. Which one is this? What are the “whispers” Tilson is picking up on?

More:

“No fewer than NINE big-time insiders have already gotten into this stock over the past 2 months…

“Including the Chairman, CEO, President, Chief Financial Officer, Vice President, and several key members of the board of directors…

“Based on my estimate, we could have only 60 days to get into these shares before the chance is gone…

“Could these shares turn a $5,000 stake into $50,000, in a matter of months?

“Only time will tell. But based on what’s happened before – I certainly wouldn’t bet against it.”

He even shows a redacted and blurry copy of a Form 4 filing from this company… so what are we dealing with here?

Thinkolator sez this is almost certainly Black Stone Minerals (BSM), which is a diversified owner of mineral rights in many of the oil and gas producing areas in the US. And that’s almost certainly a blurred-out copy of the Form 4 filed by Jerry Kyle, Jr., one of the directors, who sort of bought shares on April 6, along with several insiders.

The catch? The “sort of” means that he didn’t buy shares with his own money — he just elected, at some point in the past, to take his compensation for serving on the Board of Directors as shares in the company, instead of in cash. Which means, we can’t infer from this buy that he necessarily expects that something will happen in the near future that makes the company more valuable. It still looks like an insider buy, but it’s not really — and the same applies to several other board members who filed with the SEC on that day, including William Randall, Stuart Alexander and William Mathis. We can infer that they are “all in,” to some degree, since they take their compensation in the form of shares rather than cash, but we can’t infer that they were especially optimistic about the share price on April 6, 2023. They’ve been getting paid in shares for a long time, this is not a brand new thing.

And, in fact, those Board Members are all pretty large shareholders, the compensation that day was 1,00-1,500 shares for each of them… but they each own hundreds of thousands of shares, either because they represent large ownership interests (some of them are actually fund managers, it’s not necessarily all their money) or because they bought bigger chunks at some point in the past.

The good news? There has been some real insider buying recently as well. Director Mark DeWalch and his family increased their holdings by 15% or so with open-market purchases in early March, as did CEO Thomas Carter.

There were also some performance incentives for executives that were settled in shares in February, including a couple VPs and SVPs, with the net impact being that they chose to take their bonus compensation in the form of shares (though they also effectively sold some of those shares, to cover the withholding taxes on that compensation). So there was a little bit of real insider buying, at public market prices and with their own money… but there are caveats with most of the nine insiders who added shares in recent months.

In general, if you’re looking at a Form 4 filing, you want to see that the person acquired shares (A in box 4, as opposed to D for “disposed of” shares), and you want to see a price that’s not $0.00 — otherwise it’s effectively just part or all of the compensation they’re getting from the company. The best Form 4 filing to see, in my opinion, is one that includes code P in box 3, which means a purchase (code A in that box can be OK, too, and there are other codes that can sometimes indicate a “bullish” decision by that insider, but most of the time those other codes are part of either their compensation or of a pre-filed plan to acquire shares on a regular basis — the SEC describes the codes on the form here).

My conclusion? I actually like Black Stone Minerals (BSM), and have a call option position on those shares at the moment, and there is at least a mild bullishness to the insider behavior, but I wouldn’t say there’s a lot of insider buying just now. There is some buying that signals good days ahead, the CEO was continuing to buy shares in February and one Director was buying shares in March, and there is an admirable willingness of insiders to take their compensation in shares and NOT SELL those shares, which is at least mildly positive news. The insiders are on board, it’s just that they’re not necessarily making a big bet that now is the time to load up and buy lots of shares.

Which is fine, the normal state for insiders is that they’re selling, because they usually get part of their compensation in the form of shares… so any buying, even if it’s fairly mild, is positive. And they do also get directly rewarded for owning the shares, to some degree, because Black Stone Minerals currently pays a high dividend.

So what’s the story with this company? Well, it’s not actually a corporation — Black Stone Minerals is a limited partnership, and therefore you’re not buying shares of stock, you’re buying units of a partnership. As a tax pass-through (like a MLP or a REIT), they essentially just pass through the partnership’s income and tax obligations to you, the unitholders.

There are lot of corporate structures like this in the energy business, both in passive trusts of various kinds and in the midstream and pipeline businesses that are often structured as master limited partnerships. In essence, that means these often trade as income investments, so they’re sensitive to both interest rates and to the price of oil and gas (since the dividend depends on both how much oil and gas is produced on their lands, and on the price of that energy). The yield is high right now, the next dividend payment will be 47.5 cents for the second quarter (you get that next distribution as long as you own the units before May 11), and that’s been moving in the right direction lately, it was 45 cents a couple quarters ago and 40 cents a year ago… though it also drops sometimes, like when oil prices collapsed in the early days of COVID (the second quarter 2020 dividend was only eight cents). If the payment stays at this level, that would be $1.90 for a full year, which would provide a very nice yield of 11.5% at the current $16.50 share price.

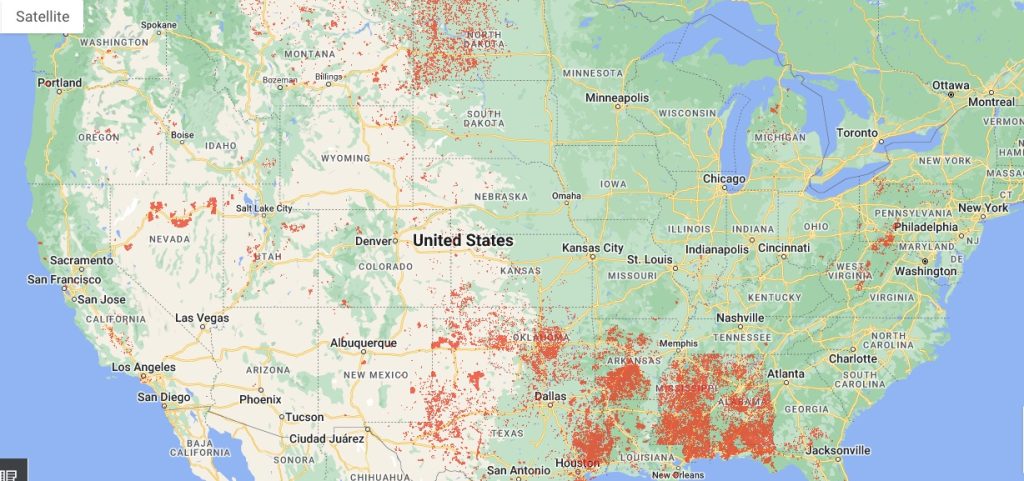

I mostly like BSM because of the geographic diversity of the mineral rights they own, with exposure to many of the big energy producing areas in the country, but, as you might guess when you see that there’s a big concentration in the Haynesville Shale in Louisiana, they do have substantially more reserves in natural gas than in oil… the red dots are their mineral interests, so there’s some Austin Chalk, some Permian Basin, some Marcellus, some Bakken, etc.

The company will provide its next update for unitholders today, as it so happens, they will release their first quarter update after the market closes, so their guidance might change for the year to come… but back in February, CEO Thomas Carter, Jr. had this to say in their quarterly update press release:

“Our record fourth quarter results capped a very successful year for Black Stone Minerals. Without issuing additional equity, we reduced our total debt and increased royalty production through our organic growth efforts to attract additional operator capital to our existing acreage positions. The development programs on our Haynesville and Bossier Shelby Trough acreage continues to ramp up with Aethon as our operating partner. In addition, new drilling activity is continuing to increase across numerous operators on our East Texas Austin Chalk acreage. We enter 2023 well positioned to drive further royalty production growth while maintaining our very healthy balance sheet.”

Other good news? They’ve done a fair amount of hedging for the next two years, to help make sure they get good cash flow from both oil and gas production, and they do have partners actively drilling on their lands to increase future production… they expect production to grow on their royalty lands by about 5% this year.

And I like that they have also been pulling back from the net profits interest (NPI) deals they have with operators, so it’s going to be almost entirely (94%) “real” royalties that generate their revenue this year. A “real” royalty, to me, is a passive one, they just collect income and don’t have to do anything — with NPI deals, something a lot of mineral rights owners do to try to increase production, they would generally be responsible for their portion of the capital spending (drilling costs, etc.). NPI deals are a challenge that’s hurting Permian Basin Trust (PBT) right now, for example, since they have to pay their share of the capital investment before they get to collect the revenue, which is why their dividend is starting the year so low, but BSM has worked recently to offload those NPI deals to partners and remain more passive. They’re still more active than some royalty owners in other ways, since they actively try to recruit producers and make their land more attractive for drilling, and unlike Trusts they are able to actively buy and sell mineral rights, so they do some work… but they’re trying to avoid participating in the actual capital spending.

(That’s why I effectively bet against PBT when I was analyzing them following Marc Lichtenfeld’s pitch for PBT as his #1 Oil Royalty play a while back, and I hedged against that by buying call options on BSM — that trade hasn’t worked to this point, by the way, PBT and BSM have both held up quite well, but that’s where I’m coming from).

The challenge is that while Black Stone Minerals gets royalties from both oil and gas, their reserves are gas-heavy (70%), and a little more than half their revenue (about 56% last quarter) comes from dry gas, which has been doing much worse than oil and natural gas liquids of late. They expect about 72% of their production to be natural gas (including some natural gas liquids) in 2023.

Other things to keep in mind? Because this is a partnership, you’ll have to deal with K-1 forms when it comes time to do your taxes — they’ll let you know what your share of the net income of the partnership is, which is usually a much smaller number than the distributions you received, and the forms often come in pretty late and can make tax prep a little more complicated (one of the reasons to like these partnerships is that they often provide tax-deferred income — usually a lot of the distribution you receive is actually a return of capital, so you don’t pay taxes on it until you sell the shares and get the capital gain).

So yes, there’s a little insider buying… but that picture may not be quite as clear as Tilson implied. And I agree, it’s a reasonably attractive investment and would probably be my first go-to if I were buying into energy royalties today. Just be mindful that it is an oil and gas royalty partnership, which means, over the long term, that your returns will probably be driven more by commodity prices than by whether or not the CEO is optimistic.

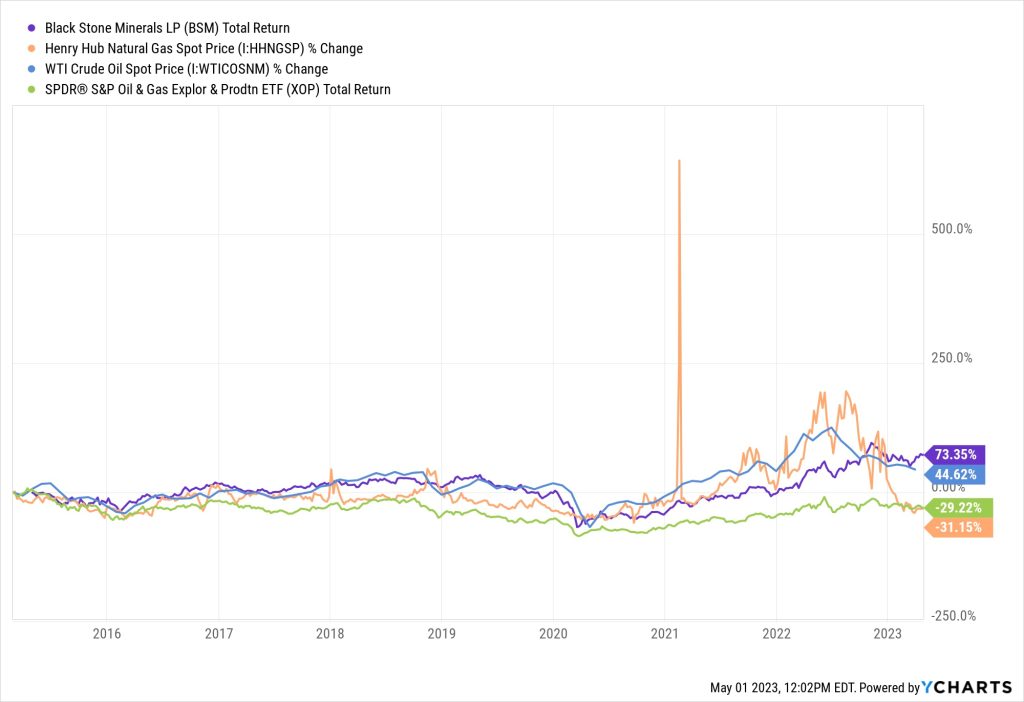

For some perspective, and a reminder of why I prefer royalty owners to actual commodity producers, as a general rule, here’s the chart going back to BSM’s 2015 IPO — this shows the total return for Black Stone Minerals (in purple) compared to the price of oil (blue) and natural gas (orange), so it has held up quite well… and BSM has done much better than the average oil & gas producer (that’s the S&P Oil & Gas Exploration and Production ETF (XOP) in green):

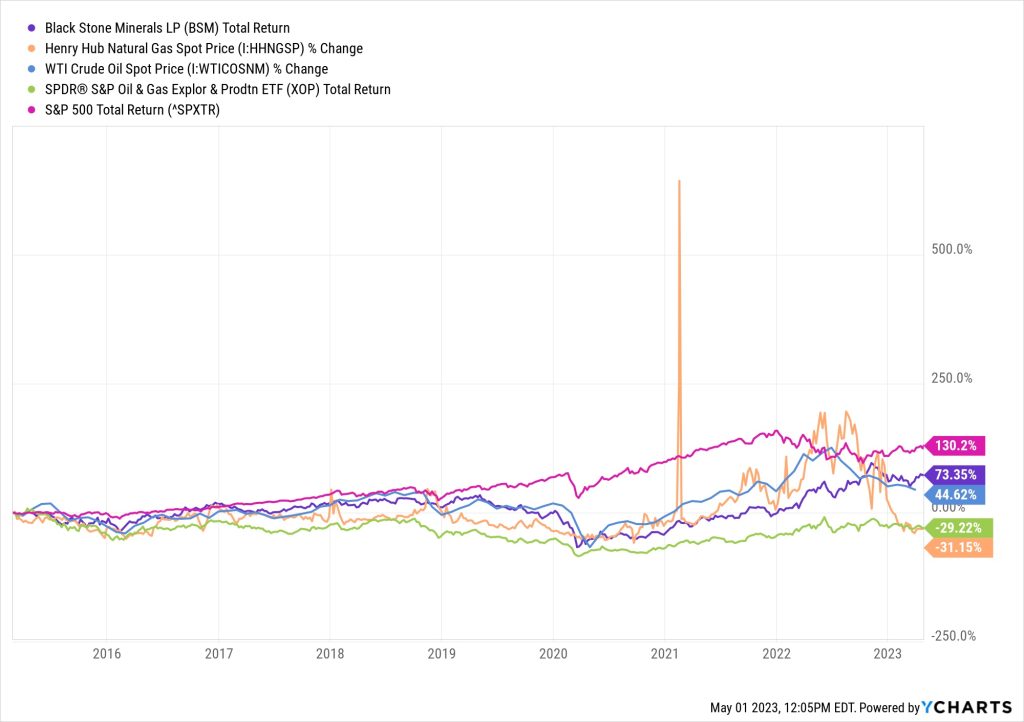

Of course, you’d generally have been better off under-weighting energy over the past eight years, so that’s a consideration, too — this is the same chart if you add in the S&P 500 as a comparison (in pink):

I don’t know what the future holds when it comes to commodity prices, sadly, but certainly a lot of newsletter folks are yelling about how super-bullish they are on oil and gas these days.

Tilson also throws in a couple of his other favorite “whisper trades,” and I have a few minutes left so I’ll see if we can get some quick answers for you, I won’t dig as deep into these:

“A ‘whisper trade’ on a small Las Vegas-based energy company whose shares are being bought by Carl Icahn, the 53rd richest man in America. (Icahn now controls 12% of shares of this small company… surely he must know something!)”

That’s almost certainly Southwest Gas (SWX), though I think Icahn’s ownership is more like 10%. They are based in Las Vegas… though it’s not really an energy company in the way BSM is, it’s more of a utility company — they are a big provider of natural gas for residential and business customers in Arizona and Nevada. They also get a lot of their revenue from contracting to do gas pipe installation, which I guess would probably be closely associated with the level of new home construction in those areas. Don’t know a lot else about them, they pay a decent dividend and they look pretty cheap compared to a lot of traditional utility companies, though utilities often struggle to do well when interest rates are rising (since they use a lot of debt, and since they’re mostly owned as a “safe income” play, so the competition for investors is tougher when T-Bills are at 5%).

Next?

“A ‘second chance’ to get into a history-making trade with Bill Ackman, very similar to the one which made me 15 times my money back. (With this ‘sequel’ trade, Bill is again buying up shares like crazy, just like he did with the original trade for General Growth Properties. You couldn’t ask for a stronger ‘whisper’ than this! And unlike General Growth Properties, this stock is on extremely solid footing, making it an even better bet…)”

OK, sure, but we should point out that you usually can’t have it both ways: if it’s on “extremely solid footing,” it’s not going to give you a 15X return like Tilson/Ackman’s GGP trade — they got those massive returns because GGP was going into bankruptcy, and Ackman had the contrarian view that there was enough asset value that shareholders wouldn’t be wiped out despite the bankruptcy.

But yes, this is one of the companies that came out of that GGP restructuring, actually, the property owner and master planned community developer Howard Hughes (HHC), where Ackman is still Chairman of the Board. Ackman’s Pershing Square is by far the biggest owner of HHC (~32%), and bought more recently (including last week’s $4 million purchase, Pershing has bought about $175 million worth of HHC shares in the past six months or so), and he often comments on how undervalued he believes it is. There have been rumors that Pershing Square Holdings, Ackman’s publicly traded closed-end hedge fund, might even try to do a reverse merger with HHC, as a way to take that hedge fund public in the US, though I wouldn’t say that seems likely to me. (I own a big chunk of Pershing Square Holdings (PSH.AS, PSHZF), just FYI.) HHC reports next week.

“A $2.4 billion life sciences company working on blood tests for cancer screening. (I’m sure you’ve heard hundreds of ‘stock pitches’ in the past about companies with cures for cancer and other wild medical claims. And yet the two co-CEOs just bought $5 million shares of stock. If they know something big is coming, and they are putting their money on the line, then surely this is an opportunity worth checking out, right?)”

That’s almost certainly Guardant Health (GH), which has been getting destroyed over the past two years. I owned that stock for a while, selling in 2021 and early 2022, so I haven’t followed it that closely since, but they do sell cancer blood tests, including tests to genotype specific cancers to help select the best treatment. And they are trying to eventually push into more early-stage cancer screening blood tests, which could be a vastly larger market someday, though I don’t know what the timeline for that is right now.

Their two co-CEOs, Amirali Talasaz and Helmy Eltoukhy, did indeed buy roughly $2.5 million worth of shares each last month, at about $26 per share (it’s around $21 right now), so they may well be feeling very optimistic about the company’s prospects… but it only feels fair to note that they each also bought about $10 million worth of shares in late 2021, when the price was about $95, and following those earlier insider purchases wouldn’t have done any investors any favors.

And one more…

“A “turnaround” situation at a $1.6 billion food distributor which could pay off 10x over the next 3-6 months. This company recently reported a bad quarter. Of course, Wall Street punished the stock and it tumbled 33% in a day. Could it be over for this company? I suspect not. In fact, I’m expecting BLOCKBUSTER results in the next quarter. Why am I so certain? Because the CEO of the company just “whispered” his enthusiasm in the future prospects by dropping $1 million of his own cash into his company. This CEO is working hard behind the scenes to right the ship – and you can get in with him right now with a ‘whisper trade.'”

That one is United Natural Foods (UNFI), and yes, CEO James Douglas, Jr. has been a pretty steady buyer of shares in recent years… and he did buy $1 million worth of back in March at about $22 per share, after the shares collapsed following their “bad quarter” (interestingly, I see that the company’s President, CFO and some other officers sold a total of roughly $2 million worth of shares in the months before they reported that bad quarter). Don’t know anything about UNFI or why their earnings are in the process of falling so sharply from the high levels of 2022, but it wouldn’t be surprising if inflation was a primary culprit. They mostly distribute natural and organic food to grocery stores and other retailers, and right now they’re valued at about 8X earnings, with analysts expecting growth to pick up after a fairly soft 2023.

So there you have it, some insider “whispers” and a few ideas to chew on… have any favorites in that bunch? Other insider buying catch your eye anywhere? Do let us know with a comment below.

Disclosure: of the companies mentioned above, I own call options on Black Stone Minerals and Icahn Enterprises, and put options on Permian Basin Trust, and I own shares of Pershing Square Holdings. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

5 for 5

Travis, the call options for BSM in your portfolio are now going for 67.5 cents. Would you recommend buying them at the current price or is that too high? Also, the Icahn Enterprises call options info isn’t on the portfolio. Could you list those or put the info here?

I don’t make recommendations about buying or selling options, I just share what I do — I do like BSM, but those options are primarily a hedge against my put options on PBT. I’d be more likely to buy BSM shares than build a meaningful option position in that name, since the partnership units have some tax advantages and a nice yield, but I don’t own them right now.

The IEP options are still on the Real Money Portfolio page — Jan 2025 LEAP call options at $55 strike price, my cost is about $1.20 and IEP just got CLOBBERED by a short report from Hindenburg (down 20% on the day), so I’m sure they’re worth a lot less at the moment. Haven’t looked into that short report yet, but Icahn is a fighter so it might be interesting to see how that confrontation unfolds.

Thanks for your reply. I saw an article on the short report. That will be interesting to follow. I put in a limit order yesterday at 45 cents on BSM and it filled this morning. One bright side to a declining market. I may look at adding a small position too.

I have a ROTH IRA that is paid dividends. If I bought BSM in my ROTH with those dividends would the BSM distributions have to be declared and taxed as income despite BSM being in my ROTH? The BSM yield is so attractive but I’m 84 and SO CONFUSED!!!

There’s a good piece here on how these kinds of publicly traded partnerships work in a Roth IRA. I think it’s generally not great to hold these in a Roth, all else being equal, since they’re at least partly tax-deferred anyway, but it is possible and might work out for some situations.

Thank you Travis. I’ll read the article but I’ll probably just take the cash from the ROTH and buy outside. Our income is so low we don’t usually even have to file a tax return!!!

I read the tease by Tilson. I thought NGL fit his narrative. A $3 stock that could see $30+. Huge build out of their pipeline infrastructure over past 5 years. Took on huge debt. Now paying it off by truck load. The faucet is on and they are printing money. If oil an gas demand continues higher this will follow. P/FCF is 8.08. Market Cap is $372mil…..Sales are 9.18bil. Management is on a mission!!

I don’t remember every looking at that MLP — have you followed it for a while? Curious how the company blew up so much worse than the average infrastructure play in the 2014 oil collapse and struggled to recover. I assume it’s more tied in to oil production than just midstream stuff? Has been wildly more volatile than the MLP index, and, unlike almost everything else in the space, didn’t react positively to the Russian embargo last year, sounds like maybe there’s an interesting story behind that:

NGL Total Return Level data by YCharts

Joel Litman has been bashing Blackstone of late calling it an overleveraged accident waiting to happen. I am not sure this applies to BSM (he sees the trouble mostly in their real estate activities), but guilt by association is always a problem when things turn bad (see First Republic).

Any comment?

Gernot Reiners in CT

Just from the name, you mean? The companies have no connection that I’m aware of, other than the similar name.

Wouldn’t worry me, but I guess you can never know what will drive a mania.

Certainly commercial real estate is a sector a lot of folks are very worried about, primarily empty office buildings and the debt that supports them, and that’s hitting BX now. BSM’s price and performance should be driven by oil and gas prices, mostly.

ENOUGH about whispers! What about Chinese SHOUTS about invading Taiwan???!!! What happens to the stock market and especially semiconductor related investments?

Is now a good time to sell Apple stock?

Nobody really knows, which is why Buffett sold most of his Taiwan Semiconductor shares shortly after buying them. The rest of the world is trying to catch up and diversify the chip supply chain with onshoring or “safer shoring”, but Taiwan still has ~75% of the most capacity and market for the most advanced chips, and those new fabs (including TSM’s US facilities that are in development) can’t be built overnight. Apple’s been diversifying and developing their own chips, and moving some assembly to India, but if there’s a real war with China that shuts down Chinese exports to the US in any major way, then the global economy probably grinds into a deep depression.

Seems unthinkable, and I can’t imagine it’s what any world leaders really want, but I guess it’s not impossible. What happens to the stock market depends on how investors feel about more major shakeups in global trade — I can imagine a wide range of possible outcomes (from a quick boost to defense stocks, to a depression among tech hardware companies), but, in general, it’s pretty safe to say that war is bad for trade and economic growth.

Interesting in that BSM over the last couple of days, including the publishing date of this one on May 1. it has dropped a couple of dollars, and after hours trading, now at 5PM May 4th, it is at $14.92, down from a high on Monday of $16.92.

This market is so unpredictable !

Indeed, crude oil prices plummeting will sure do that to oil stocks — WTI is down about 10% in less than a week.

What’s the deal with Nomi Prins and her SMR? (small modular reactor)

That’s NuScale — covered a while back here: https://www.stockgumshoe.com/reviews/rogue-strategic-trader/answers-smr-tease-by-nomi-prins-whats-the-next-exxon/