Whitney Tilson is predicting that the market will boom later this year, and says he has identified some sectors (and stocks) that will be big winners… so let’s see what information we can sift out of that ad for you.

The teaser pitch is an advertisement for his Empire Investment Report ($2,500/yr, no cash refunds) — I don’t think we’ve ever covered a teaser pitch from this particular letter, that’s his “upgrade” letter (Empire is part-owned by MarketWise and follows the basic strategy of all those publishers — their profits come almost entirely from upgrading people to high-end services or lifetime subscriptions, all the “entry level” newsletters primarily exist to feed new people into that upgrade “funnel”).

And the basic spiel is that Tilson is making a contrarian prediction about a coming “peace dividend” … here’s a little of the hype from the ad:

“I’ll tell you upfront — while I’ve predicted some pretty controversial things in the past…

“Today I’ll make a prediction that almost no one expects to happen…

“My guess is, when I lay out my case for you, you might think I’m crazy.

“You see, after issuing nine major stock market predictions…

“*** I’m going public with my 10th and most urgent warning for all U.S. investors right now.

“So if you have any money in the markets… no matter if it’s $500 or $5 million… it’s critical you listen up….

“We’ll see a once-in-a-lifetime buying opportunity unfold in the days ahead.

“When this happens I’m urging you to back up the truck and buy the stocks we’ll cover tonight…

“Because I haven’t been as bullish about a situation like this since March 2020, when I said I was trembling with greed at the bottom of the market…

“Right before investors saw the sharpest and fastest rally of all time.”

Most of this stems from Tilson’s visits to Ukraine and his opinion about how the “Operation Iron Fist” counter-offensive from the Ukrainians is going to push back Russia and force a peace settlement, and soon…

“While I’m in the minority in this prediction…

“I’m certain I’m the ONLY one who expects it to play out by October 2023.

“Which means you have a short window of time to get in position for a massively “asymmetrical bet” here today….

“But thanks to how closely I’ve been following this story, how passionate I am about it, and my firsthand, boots-on-the-ground experience with this situation…

“I’m 100% certain “Operation IRON FIST” will come true.

“And when it does, the impact on the stock market (and the entire world) will be massive…”

Most of his argument is just a pretty rational-sounding judgement that the unraveling of the Ukraine war will have the reverse impact that the start of the Ukraine war had — while Russia’s invasion caused energy and agricultural commodity prices to spike, he thinks peace will cause those prices to collapse, which will benefit consumers and bring a stock market boom. Many of those prices are already back below where they were before the invasion, so I don’t know how immediate it will be, but the general idea of “peace with Russia means lower oil and grain prices” makes sense. It will certainly impact investor sentiment.

"reveal" emails? If not,

just click here...

Here’s how Tilson puts it:

“In the same way that the U.S. stock markets were jolted by Russia’s invasion of Ukraine…

“I believe the markets will be upended again by this new sudden, unexpected event.

“In short, my latest prediction, which I call ‘Operation Iron Fist,’ all has to do with the war in Ukraine.

“You see, in a recent survey by JPMorgan Chase, they asked investors when they expected the war to end…

“The majority of investors expect Russia and Ukraine to be tied up for a very long time…

“About a third of those surveyed expect the war to last beyond 2024…

“20% of those who responded said they anticipated the war to end sometime in 2024…

“But a tiny minority, just 5.6% of investors, believe the Ukraine war will end this year.

“I am one of those 5.6%….

“Not only do I believe the war will end this year…

“I believe there’s a good chance the war will end by this October.

“And when it does, it will send shockwaves across the globe and the markets.

“Upending global politics, literally reshaping nations…

“While at the same time changing how you fill up your car’s gas tank and the food you buy in the grocery store.”

So most of this investment opportunity, it seems, comes from the fact that Tilson thinks the war will end a lot sooner than most investors, and folks who are early with their contrarian bets can sometimes reap the best rewards. In his words…

“The abrupt end of this war will reset asset prices again…

“And because most people expect this war to last for a long, long time…

“You have a very rare chance to profit from this very out of favor prediction by moving your money ahead of the war’s end.”

I do not have any great insight into the situation on the ground in Ukraine, but Tilson says that his visits and his contacts give him confidence that he’s right about this… mostly because he thinks Ukraine’s counter-offensive (“iron fist”) is in much better shape than the media reports:

“The picture they’re painting (or rather, the story they’re feeding you) is that Ukraine’s counteroffensive has failed.

“But based on what I’ve seen, the contacts I’ve made, and all the research I’ve done…

“The media has got it all wrong again.

“Because, unlike most reporters who are covering the war from their cozy offices in the U.S…

“I’ve actually been to Ukraine personally, on the ground, twice now in the past few months…

“The media is telling you that Ukraine is on the brink of failure.

“But the truth is the opposite: Ukraine has Russia on the ropes.

“And by October 2023, I believe it will all come to an end with Ukraine as the victor.

“Because recently, Ukraine began its long-awaited counteroffensive…

“A move that Ukraine’s Defense Minister Oleskii Reznikov called striking back with an ‘iron fist.'”

Tilson lays out a bunch of reasons for his “war will end soon” argument…

“Russia’s Lost WAY More Troops Than Is Being Reported By the Mainstream Media…

“While The Russian Military’s Been Depleted, the Ukraine Military is Arming Up….

“Ukraine hasn’t even used the BEST of its military forces!

“Information Advantage…

“Relative Economic Strength…. Let’s be clear: this isn’t a war between Russia and Ukraine. It’s between Russia, which accounts for a mere 3% of the world’s GDP , and all of NATO, which accounts for 46%!”

He even gets very specific:

“Sometime in October, after Ukraine has successfully thrashed Russian forces…

“I believe we’ll see the two sides call an Emergency Peace Summit.

“To ensure a complete end to the fighting, I believe Ukraine will throw Russia two small bones:

“1) Russia will withdraw from Crimea and it will be returned to Ukraine, but no Ukrainian forces will enter the territory. Instead, it will become a demilitarized United Nations ‘protectorate’ zone.

“2) Ukraine will agree not to join NATO, but will instead receive security guarantees that will be the equivalent.

“Once these points are hammered out, and we finally see peace in Ukraine, the biggest effects, for you, are the financial ramifications that will take place…”

Sounds awfully nice… will it happen?

Beats me.

So what does one do to make some money from Tilson’s prediction? He calls it “Peace Profiteering” …

“Step #1 to “Peace Profiteering”:

“Buy these THREE major beneficiaries of lower energy prices….

“Any high-energy consumption businesses will be great buys…

“As energy prices dip, the company profits could soar.

“I’ve identified TWO low-cost airline companies that will see the most direct benefit to these lower energy prices.

“Both of these companies have recently had their profits chipped away by high energy prices…

“But as those costs come down, profits will soar, and so will the share prices.

“Both of these together could easily be a double your money play over time.”

Well, he’s not really dropping any great clues here — we can throw out some guesses, I’d say that Southwest (LUV) and Spirit (SAVE) have had the weakest earnings of late, and certainly part of that is from high oil costs… but it could as easily be JetBlue (JBLU) or Allegiant (ALGT) or a couple others. Southwest has had a strong fuel hedging program in the past, though most of the airlines say they don’t do as much hedging these days, and if you’re expecting a big drop in oil prices then the biggest beneficiaries would presumably be the airlines who are worst at hedging or get unlucky with their timing. The biggest US airlines tend to say that they don’t hedge their fuel prices (American, Delta and United), but their stocks have also all been significantly outperforming the “discount” airlines over the past 18 months.

I’ll pencil in Southwest and Spirit as my guesses, but not with any great certainty. When in doubt, you can also just go with the sector — the JETS ETF from US Global includes most of the airline stocks, with a lower allocation to the major aircraft manufacturers and travel agencies. Airlines are a tough business, though with planes full and prices solid over the past year things have been pretty good.

And there’s another one…

“The same goes for my third airline pick…

“I’ve identified one airline maintenance company that indirectly stands to benefit from this sudden drop in energy costs.

“Because while airlines have been facing rising costs, this company is steeply cutting its engine maintenance costs, which will soon become very attractive for airlines.

“At its current share price of around $30, I believe it could skyrocket to near $100 per share before long or more than triple your money on this one pick.”

There are not actually very many companies who do airline maintenance and are publicly traded, and are also near $30 per share. The best guess here would be Spirit Aerosystems (SPR), but that’s actually a pretty troubled company right now — mostly because the lion’s share of their revenue doesn’t come from aircraft maintenance, but from building major airframe components for Boeing and Airbus. And they’ve had trouble with that lately, in large part because inflation has boosted their costs while they’re also seeing demand for airframes drop a bit and customer pushback from Boeing for some quality control problems. I’d be really surprised if Whitney Tilson has this down as a favorite stock at the moment, but it’s our best guess from the very limited clues supplied… and if aircraft orders surge because of falling oil prices, it’s certainly possible that could juice Spirit at just the time when they really need a tailwind.

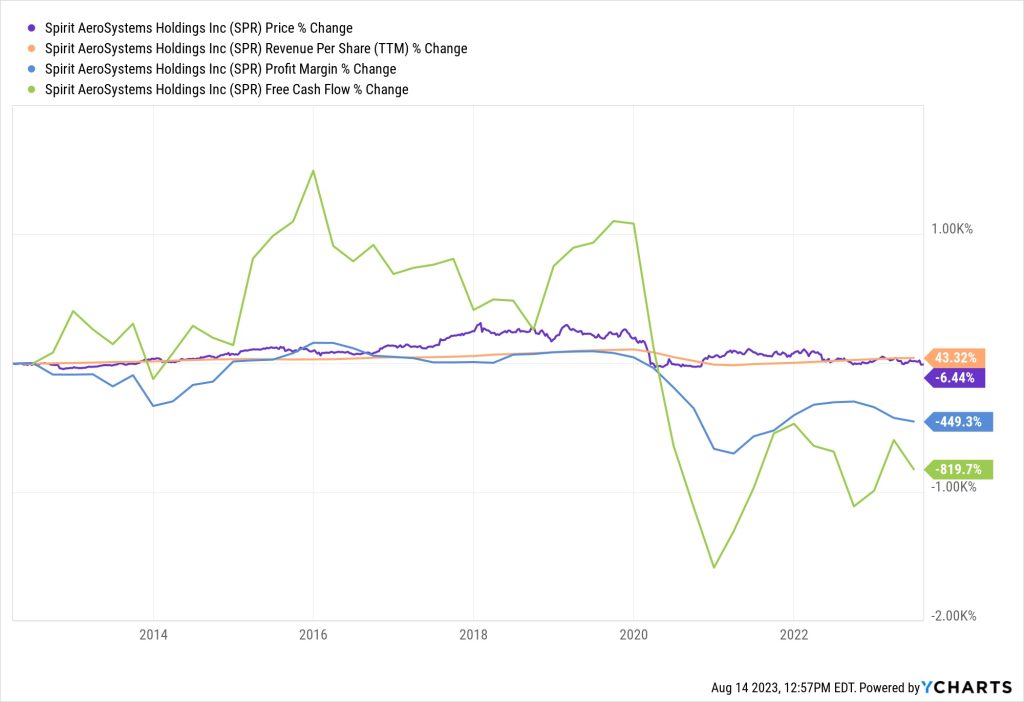

Over the longer run, you can see the challenge of being a major system provider to airlines — they don’t have much pricing power, but they also get less revenue from the key aftermarket parts and maintenance business than a lot of other suppliers to the airline industry (HEICO, TransDigm, etc.). They’ve been public for about a decade, and this is the chart of their share price (in purple) as well as their revenue per share (orange), profit margin (blue) and free cash flow (green). A huge collapse and recovery with the airline shutdown in 2020, of course, but not much else that’s really clearly building toward greatness:

Spirit doesn’t really fit the “engine maintenance costs” part of the tease, to be clear — they do some engine work and related aftermarket maintenance, but don’t really make or service jet engines. I’d be more inclined to invest in AAR Corp (AIR) for a more aftermarket-focused maintenance company, or in Rolls-Royce (RR.L, RYCEF) for their engine sales and maintenance, than I would be to buy into Spirit Aerosystems these days, but, well, they’re not priced near $30, as Tilson teases. So that’s our guess, weak though it may be.

Update: A reader called my attention to FTAI Aviation (FTAI) after we published as a better match and Tilson’s likely recommendation — sorry I missed that one, but it’s probably the right answer and FTAI is a much more appealing business than SPR (though it’s also pretty small, and has surged on the recommendation so it’s not exactly cheap).

But don’t worry, the guesses get even weaker as the clues remain almost useless…

“Step #2 to “Peace Profiteering”:

“Buy these THREE stocks to prepare for a massive consumer spending boom

“Not only will energy prices drop for big transportation companies…

“But we’ll likely see a drop in prices at the pump for you and the cost to heat your home.

“That means we’re all about to see our energy bills plunge.

“What will folks do with all this money they’ll be saving at the pump? ….

“… the next three stocks I’ve identified benefit directly from a rise in consumer spending.

“One is looking at an easy 20% profit growth, translating to a full doubling of the share price over time.

“The other is a massively overlooked retailer I believe could double on the heels of this consumer spending boom as well.

“And the third is an alcohol company that I believe will climb higher as American consumer spending ramps up.”

There are no real clues there, sadly, so we’d just be guessing. If I had to choose in those categories, I’d pick Booking Holdings (BKNG) for the “easy 20% profit growth, Target (TGT) for “overlooked retailer,” Diageo (DEO) for the alcohol company, given its relatively appealing valuation and strong long-term history in building liquor brands (you could also choose Anheuser Busch (BUD) if you think they’ll recover from the fact that Bud Light was bizarrely spotlighted by “culture warriors”… or Molson Coors (TAP) or Constellation Brands (STZ) if you think Bud Light will keep losing share to Miller and Modelo — I think TAP is the cheapest beverage company out there on a forward PE basis).

All pretty much wild guesses, but you get the idea. You probably have some idea of where you think money will flow if we see more energy and food deflation.

What else?

“Step #3 to “Peace Profiteering”:

“Buy this “All in One” Portfolio of stocks at a massive discount….

“a sudden end to this conflict will rapidly remove that uncertainty from the future, giving people confidence in the global economy and stocks as a whole again.

“Leading to a massive upswing in the overall market throughout the end of the year.

“By positioning yourself ahead of this upward move, you could stand to make a fortune as peace breaks out in Ukraine….

“I’ve identified the perfect investment to take advantage of this rare situation.

“You can buy shares at a massive discount right now ahead of any potential peace deal between Russia and Ukraine.

“This is a fund made up of outstanding businesses all rolled up in one ticker.”

OK, so some kind of investment fund… and since it’s trading at a discount, presumably it’s a closed-end fund. Which one?

A couple more clues…

“The best part, this fund is managed by one of the greatest investors in the world.

“To give you an idea of just how great…

“I give this investor full credit for three of the biggest wins of my nearly two decades running a fund, a 100% gain, an over 600% gain, and one investment which handed me more than 17 times my money in under a year!

“In short, it literally pays to follow this man.

“Which is why buying his fund right now, before this upcoming boom in stocks, is a no-brainer.”

OK, so that’s enough for a real answer, finally — that’s Pershing Square Holdings (PSH in Amsterdam, PSHZF OTC in the US), the closed-end hedge fund managed by Tilson’s friend Bill Ackman. I’ve been invested in Pershing Square Holdings off and on over the years, including through part of Ackman’s Valeant debacle about seven years ago, but went heavily “on” again during the COVID crash in 2020, when Pershing reaped a massive dividend from their hedging (and did so again last year, profiting from the spike in interest rates). I’ve been very impressed with Ackman’s strategic shift after the high-profile Valeant and Herbalife fights, and have written about the fund a few times (most recently after their annual report, back in April), but here’s my basic take:

Pershing Square is a levered hedge fund that enjoys cheap leverage (they issue bonds to boost the investment portfolio by about 20%, with an average maturity of about nine years and cost of 3.1%), and is very concentrated, with some inexpensive “tail risk” hedging and large positions in usually only 8-10 stocks — the largest holding of the fund is Universal Music (UMG.AS UMGNF), followed by Chipotle (CMG), Restaurant Brands (QSR), and Lowe’s (LOW), and they generally add and subtract a couple positions per year, often pretty gradually. The most recent additions have been Canadian Pacific (CP) last year and Alphabet (GOOG, GOOGL) this year, and this last quarter the most meaningful shifts were a sale of more than 20% of the LOW position and an add-on buy of more GOOG.

They report their net asset value once a week, and as of last week the shares were trading at about a 35% discount to the value of the portfolio, which has been pretty typical over the last year or so. I think it’s a pretty easy buy at this steep a discount, and would be inclined to reduce my position if the discount closed to something more “normal” for a closed-end fund (10%ish)… the average, in the decade or so the fund has been publicly traded, has been about 20%. They have talked endlessly about the many ways they could try to reduce the discount, but none of them have worked so far (buybacks, dividend, etc.), and the Board seems more accepting of the fact that they just have to wait for investors to recognize the value, after several years of strong performance.

I think that the discount and the hedging that Pershing Square does make it worthwhile to pay the relatively high hedge fund management fees (1.5% of assets plus a performance fee of 16% of returns above the benchmark, roughly, though there are some adjustments to the performance fee — Pershing Square earned a big $464 million performance fee in 2021, but no such fee in 2022 because the fund lost value).

They also pay a dividend, which in the future will probably grow (they have said it will grow at the same pace as their net asset value), but it’s not a huge yielder — the dividend right now is 52.25 cents per year, paid quarterly, so that’s a hair over 13 cents per share per quarter, and a yield of a bit under 1.5%. Pershing Square is likely to be a passive foreign investment corporation (PFIC) under tax rules, so it can require a little annual work on your tax return, and the US OTC shares are not always particularly liquid (if you want to buy shares, check the price in Amsterdam (PSH.AS) and use a limit order to bid something near that on ticker PSHZF during the first hour of NY trading, when both exchanges are open — it trades in US$ on both exchanges). Ackman’s letters and presentations to shareholders are on their website here if you’d like to read up on this one.

Next?

“Step #4 to ‘Peace Profiteering’: Buy these two “Great American Resupply” Stocks….

“… as a result of sending so much ammunition to aid Ukraine, the U.S. is now low on supplies!

“This is important and will benefit two specific stocks for two main reasons…

“First, as the Ukraine counteroffensive marches on, more ammo and supplies will be needed…

“And two, once the war is over, we’ll need more ammunition and supplies here in the states.

“Which is why I’m pounding the table on two specific defense stocks you should buy right away as America resupplies its own forces and continues to support Ukraine.”

Well, you could pretty well pick most of the major defense contractors in the US for this “resupply” dynamic — Raytheon (RTX) is going to have a make a lot more Stinger missiles, Lockheed Martin (LMT) is going to need to produce a lot more HIMARS rockets and Javelin antitank missiles, and somebody is going to have to make a lot of artillery rounds — probably starting with General Dynamics (GD). Raytheon and Lockheed Martin are probably the safest picks for long-term defense spending and a surge of “resupply” demand for a lot of those consumables, even though replenishing those missiles is not going to be the largest driver of their income statements in the next few years (Lockheed’s revenue is dominated by the F-16 program, RTX is also heavily reliant on aerospace with their Pratt & Whitney engines, along with radar and avionics work, and 40%+ of their revenue is non-military). I wouldn’t argue against any of those three, but, again, not enough clues to do much more than guess.

“Step #5 to ‘Peace Profiteering’: Buy this one stock set to benefit as “The World’s Bread Basket” Reopens…

“Russia, of course, was well aware of how important Ukraine farmland was, which is why they stole $5 million farm vehicles upon invading.

“Now, as this war comes to a surprising end as I’m predicting…

“Those highly advanced farm vehicles will immediately head back to work.

“If you get in position on this one company providing the farm equipment to Ukraine, you could benefit enormously as profits surge.”

Everyone’s going to want to get back into Ukraine fast when the war is over, but, just as a gentle reminder, falling crop prices are generally terrible for farm equipment companies — farmers upgrade their equipment and buy new tractors when they have a boom year or two, not when wheat or corn prices are collapsing and they’re worried about paying off those new loans.

The biggest stories about advanced tractors in Ukraine have been about John Deere (DE), some of whose tractors were remotely disabled to keep them out of Russian hands, and it might be that some enthusiasm for US brands will follow the war and help boost Deere in the future in that market, but CNH Industrial (CNHI) has also long had strong market share in Ukraine, which was “undersupplied” with agricultural technology even before the invasion. There are other significant tractor and equipment companies in the world, of course, including AGCO (AGCO) and Kubota (KUBTF, KUBTY) and the German leaders CLAAS (private) and Fendt (owned by AGCO), who have “home field advantage” in selling to Ukraine. Given India’s delight at buying Russian oil over the past couple years, it would be surprising if a lot of Mahindra or Sonalika tractors made it into the Ukraine, but I guess one never knows.

Forced to pick one, I’d guess Deere (DE) for this Tilson tease, since they’re the technology leader in the space. Though I do indirectly own CNH Industrial, through my shares of the Exor conglomerate (EXO.AS, EXXRF), and both AGCO and CNHI trade at about half the valuation of Deere. There is no meaningful growth in earnings “priced in” for any of those three, analysts are pretty much expecting a flat year next year… so I guess if there is a big Ukraine-driven boom, that might provide some catalyst (even though, we should reiterate, falling wheat and corn prices might well mean fewer sales of tractors in the US and Canada)

Any of those sound appealing to you? Think Tilson will be right about a coming boom?

He does toss in a second prediction, which is that this “peace profiteering” will be further amped up by the Fed cutting interest rates later this year…

“… in order to fight inflation, the Fed has been slowly and carefully raising rates.

“But soon, I believe that will all change…

“And by the end of this year, the Fed will begin to cut rates, kicking off a stock market bull run.

“Combined with the surprising end of the Russian war in Ukraine, we could be looking at a massive SUPERBOOM in the markets the likes of which we may never see again.

“At the very least, this sets us up for a BIG opportunity today.”

Could happen, I suppose, and both would probably be good for the market, though I do think it’s fair to say that a fast end to the war and the Fed cutting interest rates this year would both be surprises to most people.

So we’ll turn it back to you, dear friends — I’ve come back from vacation with a pile of guesses for you (and one or two certain picks), and with an idea for you to ponder… who will benefit if energy and agricultural commodities come back down further? Might the Fed also back off on interest rates and become less restrictive, helping to fuel another “superboom?” Have better matches for those limited clues than I’ve been able to provide? Do let us know with a comment below. Thanks for reading!

Disclosure: Of the companied mentioned above, I own shares of Alphabet and of Pershing Square Holdings. I will not buy or sell any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thank you very much for tackling Whitney Tilson’s 10th prediction. Also called Prediction X. That’s the way Roman’s labeled the number 10. I bet your mostly right on. Excpt for the airlines I think international airlines might have been a better choice. May be some one paid to find out and will share the list in the comments that follow. Keep up the good work.

“Those REALLY in power” (Larry Fink, Michael Bloomberg, and others) have done all they could to suppress the economy & stock market in 2022 & up to now in 2023, so that toward the end of this year and especially in Q1, Q2 & Q3 of next year (as the 2024 election nears) there will be a “miraculous recovery”, and they will claim it’s because of the Democrat’s (Biden) policies and actions. That is my (unprovable) belief.

Stocks will “soar” by Q3 2024 because of this…. that is my prediction.

Are you betting on that belief, or is it just what you expect to happen politically?

The average over the last 100 years or so is that the year of an election, and the first year of a new president’s term, are both a little below average. Though there haven’t been many environments when partisanship was as poisonous as it is now (some eras were almost as vitriolic, like FDR and Nixon, but not many — and sentiment shifter more slowly back then).

I an unconvinced the War in Ukraine will end this year; even if it does, I believe recovery will take years.

The US must begin rebuilding it’s arsenels, and LMT is probably a good way to go…and, if you’re making that bet, GFS and SKYT are also interesting.

Although speculative, I see DE and RYCEF as both interesting plays.

But none of the above reflects belief in a peace dividend any time soon.

Sure after decades and trillions of dollars spent protecting what our politicians have done in their worldly agendas, no reason at all the military should actually have a fleet of thousands of fire fighting, water carrying aircraft. It’s not like their stated goal is to protect the people from actual deadly dangers!

Interestingly, at the same time he is running his “Prediction X” video he is also pushing “Energy Supercycle” which predicts HIGHER oil prices for the foreseeable future.

Nice to be right either way! Makes having several newsletters more comforting… at least one is likely to be on a good run most of the time.

I guess with no refunds, you can predict any fantasy you want to sell.

Possibly Useful Advice but the Timing is OFF!

Simply put, if I were to gamble on the end of the war in Ukraine I would peg it on late next Spring (of 2024). Why? Because the Ukrainian offensive is a grind. Because Russia is willing to sacrifice more sons and brothers. Because Ukrainians are bitter and vengeful. Because Russians cannot bear to exit without something to show. Because both Ukraine and Russia may be willing to give Winter a chance to mix things up after a slow Summer and Fall campaign.

I am surprised at the lack of strategic surprise effected by Ukraine. I predicted a series of jabs and feints by Ukraine, using their very useful interior lines, to keep Russia off balance. Nope (unless everything so far is just one big distraction from the real attack).

I’m not surprised by Russia’s willingness to sacrifice more and more of its future for the sake of the present ill-advised adventure.

I am taken aback by the level of bitterness on the part of Ukrainians I talk to. I expected ALOT of bad feelings but the level of ferocious anger among folks with a usually detached intellectual view is going to make it hard for Ukraine to make peace very soon.

It’s not only Putin who needs to feel vindicated by war results; the Russian military too is hungry for something, anything to prove that Russia is still a military power.

And do not discount the possibility that Russia is hoping for a cold Winter. Keep in mind that a very cold winter will also be on Ukraine’s mind – it may actually be easier to campaign across a frozen landscape than many think.

There is not a chance, not even a hint of a chance, that Russia will give up Crimea. In the event of a very successful Ukrainian offensive – and I mean very, very successful, the geographical sticking point is going to be Mariupol.

So, late Spring. . . if I were going to bet on peace between Ukraine and Russia.

And by the way, I have always like Diageo.

I have to disagree. For Russia this is an existential fight they cannot afford to lose. Historically, there’s hardly a family that didn’t lose someone of have someone fighting during WWII. Russia will destroy Ukraine and NATO if need be if the West gets the war they so desperately seek. Everyone in the West is bewitched by the propaganda. Russia’s there for the taking, Putin is sick etc, their army is weak, full of criminals, running out of ammo etc etc blah, blah. Don’t you believe it.

Groups within the West have their own reasons to have Ukraine fight to the last man: ex Ukrainian neocons in the US govt want to settle ancient scores with Russia. Bankers/financiers want to return to the rape and pillage of Russia and its raw materials of the Yeltsin days. Administrations want to use war to delay/cancel elections/ introduce CB digital currencies/default on the debt and on….

But what if Tilson is wrong? Poof, his prognostications are a waste of time. And if not, the big companies that know how to bribe have already sown up all the deals.

So dude you really can’t see that putin is the biggest thief in Russian history and he knows that when he gets dragged out of his, wherever he will spend the rest of his life in Siberia! It won’t come to that of course. The Russian military has proven more than once that they will disobey insane orders! The Russian people have gotten rid of insane greedy bastards before they can do it again!

Check Putin’s popularity versus the morons we have running the West. The only way he’s ousted is the Russian Neocons persuade the populous that he’s not destroying Ukraine fast enough. If you think Putin is bad, you don’t want to see what could take over.

It is hard to debate your arguments based on unprovable mostly-fantastic assertions. It is not clear – to me at least – if this is an existential war for Putin. He will survive this. It may be an existential fight for the Russian military as it is presently organized , armed and trained. But one thing is clear: Russia is not going to be destroying anybody with any significant ability to defend itself. Right now Russia could not defeat Poland in a stand-up war (let alone all of NATO).

Who have NASA used to get into space these last few years? Russia rockets and engines. In technology, manufacturing, raw materials R is far above the West. It’s our smug and condescending attitude in the West caused by this anti-R propaganda that’ll destroy us. Where’s all the info we get for the war. Ukrainian sources. Oh my! They are much better paragons of virtue in truth telling that R. We were told R’s out of ammo/Bucha massacre/Mariupol will hold blah, blah. All those military geniuses on the MSM are all bought and paid for by the MIC. They need the destruction to keep going (cha ching).

Re: Poland – don’t stand a chance. They just want to grab their old lands when Ukraine folds.

R put 40K soldiers in at the beginning of their SMO and destroyed the first Ukrainian army that NATO had built up since 2014. What was it the world’s third largest army. Poof and it’s gone. R’s forces are now putting the third iteration of Ukie army through the meat grinder.

Do yourself a favor, suspend disbelief and check sources you have sneering opinion of. They just might have a point.

OFF TOPIC – How did the PanMass Challenge go both for you and the charity?

Thanks for asking! It was a wonderful weekend with perfect weather. I crashed on my last training ride a week before, but healed up enough to ride, and it felt great. My butt was sore for an extra long time, but sitting on a bag of ice helped 🙂

Thanks in large part to the generosity of Stock Gumshoe readers, my total fundraising for Dana Farber is now just shy of $250,000 for the seven times I’ve done the ride, and they’re likely to meet their $70 million goal for this year. It’s a little extra poignant because I have a friend being treated at Dana Farber right now, but she’s doing great and the prognosis is optimistic.

Thanks again!

A better airline might be the London-listed Hungarian WIZZAIR. They are the dominant low-cost airline in Central Europe and with routes to the Ukraine would get a real boost if peace broke out.

Surprised at your choice of Pershing Square as I assumed it was Berkshire Hathaway which Tilson is very keen on but I do agree it is not trading at a massive discount although there are those who say its various units-the transportation network etc- are undervalued.

Whitney pretty consistently says that Berkshire Hathaway is his favorite retirement stock, and a company everyone ought to own, but yes, this particular pitch is for his friend’s closed-end hedge fund. He has recommended both in the past, too.

Incidentally, my personal positions in Pershing Square Holdings and Berkshire Hathaway are very similar in size right now, they’re my two largest “diversify away from yourself” positions in my Real Money Portfolio… though I consider Berkshire to be almost a “never sell” stock, and don’t think that way about Pershing Square, mostly because of the fees (and lingering memories of a couple major Ackman blunders before his strategic reset, when his hubris ran away with lots of shareholder $$ — I don’t think that’s as likely to happen again in the future, but never say never).

I suggested some time ago that your readers may like to watch Rolls Royce. Those who bought will be enjoying strong profits. More to come: a contract for small nuclear reactors is likely to be awarded to RR by the UK government.

Yep, we’ve been covering some Karim Rahemtulla pitches for Rolls Royce for about a year and a half now — their new CEO this year seems to be breaking stuff in the boardroom to get everyone’s attention about how moribund the company had gotten, and investors like it.

It is FTAI aviation ltd.

It is FTAI Aviation Ltd. they make aircraft engines. Been up 43% since his call

Thanks, that one’s new to me. Interesting company.

If there is one expression that makes me gag it is “WallStreet Legend.” If I’m not mistaken the reason Tilson is a “former” hedge fund manager is because he ultimately lost so much money for his clients he felt guilty and decided to close up shop. Apparently, however, he retained is “legendary” status.

I can’t think of any newsletter pundit who doesn’t call himself a “Wall Street legend” or “America’s best trader” or something along those lines. Chutzpah is a pretty big part of marketing 🙂

Sincerely,

Travis Johnson

Legendary Ice-Cream Scooper

1.Russia is wiping out Ukraine’s ‘forces’ (which means men, and is sad for everyone, even the Russians). 2. Oil will not collapse in price, Saudis will ensure that. 3. Gas will not collapse in price as Nord Stream unlikely to be restarted by defeated EU (US masters won’t allow it) so LNG stays in high demand and price). 4.World dynamics have been shattered, and when Russia wins on battlefield (probably mid 2024) the rebuilding ‘peace dividend’ goes to the BRICS nations, not the USA or EU, who will be exposed to the Global South as yesterday’s men. 5. All in all, this guy is either deluded or a shyster.

Tilson’s analysis of the Russia/Ukraine war is so weak and nonsensical that one must wonder whether it is deliberate military industrial complex propaganda.

And anyone who genuinely believes that Putin will give up Crimea is genuinely stupid. Russia will NEVER give up Crimea and if we keep pushing Crimea as a concession, The West is more naïve than we originally thought. And we are in trouble. Crimea is the tipping point into a nuclear war with Russia, if the West does not tame its arrogance.

As a reader mentions below, Tilson is promoting higher gas prices on the one hand and lower gas prices on the other.

This is classic con-artist behavior. I used to pay for his entry-level letter just to take a peek behind the curtain. Not much there one cannot figure out on their own, plus Stock Gumshoe’s help.

My membership had expired before his latest laughable comment on the Ukrainian war. If not, this would have ended it anyway. I have lost all respect for him.

By the way he could not have returned to Wall Street and his “friends” or “contacts” he brags about constantly without following the company line anyway. Remember this is a guy who claims to travel to discover opportunities no one else knows about. Do you remember his trip to Houston Texas last year to review a company with breakthrough technology when he was pushing his Taas scam?

The fact of the matter is: Ukraine CANNOT defeat Russia without DIRECT involvement of NATO troops. That’s reality! And Biden will never go down that road.

Comparing Russia’s economy against Nato Countries’ economy is no way to measure or discover the eventual winner of a war.

If so, America would have won in Iraq, Vietnam and Afghanistan- all wars America lost after wasting trillions.

Our country is in trouble with mentality similar to Tilson’s in our leadership. Oh, didn’t he brag about his Harvard credentials too?

Tilson is in a business that depends on suckers…and fortunately for him, one sucker is born every minute. Shame on him!

Its is amazing to see such thesis. The weak China economy has far bigger risks midterm ( 12-30 months)

and we need to see where it goes and what bottom fishing is possible

Politically despite what the western media projects Ukraine is not doing well. Several corruption cases have been highlighted. A significant number of Ukraine residents are evading the conscription due to martial law and fatigue is settling in the Rest of World .

The likely endgame will be Korea type ceasefire where North backed by China ( Russia did not get involved ) and South Korea ( USA went fully in but failed to ‘win’) as the Ukraine army and militia imported from NATO run short