Enrique Abeyta at Empire Financial has a new teaser pitch out, focusing on a new kind of EV battery and the best EV stock to buy… so we’ll take a moment today to dig through his clues, reveal his “secret” stock, and see what the story is.

The focus is first on the rise of EVs, which is a narrative that we all know is chugging along (even if it will probably be more gradual than the ambitious 2030 goals of a lot of automakers), but then he really digs in on that “perfect battery” idea — here’s the lead-in:

“Will This New “Perfect Battery” Supercharge the $858 Billion EV Boom?

“Experts call it ‘the next holy grail for EVs’ and predict that it will ‘go global’ and ‘take over as the standard EV battery.’

“Discover the only automaker that is both installing ‘perfect batteries’ in its

EVs and building a U.S. plant to provide them.”

The ad is for Empire Stock Investor ($49 first year, renews at $199), which is the flagship/entry level stock-picking newsletter from Abeyta and Whitney Tilson… it’s dated March 2023, and I first saw it running about two weeks ago, in the waning days of that month.

So… which automaker might this be? What is a “perfect battery?” More clues from the ad:

“… today I am going to tell you about a company that – according to Car and Driver – ‘is the sole U.S. automaker to have announced it will fit [‘perfect batteries’] to its EVs and build a U.S. plant to provide them’….

“… this project is being overseen by the MASTERMIND of the Tesla Model 3, the #1 bestselling electric car of all time.

“A man Elon Musk calls ‘one of the world’s most talented engineering execs.’

“For this reason – and numerous others – analysts believe it is the only automaker that could dethrone Tesla as the king of the EV market.”

Abeyta even says that he expects this company to outsell Tesla by 2025… and that you can buy the stock for $12 today.

And apparently a bunch of big names are buying the stock…

“The biggest trading houses on Wall Street are already snapping up shares.

“Goldman Sachs is investing $245 million.

“Charles Schwab is investing $280 million.

“Bank of America has put in $433 million.

“And many of America’s best investors are doing the same.

“I am talking about people like Jeremy Grantham, Paul Tudor Jones, Jim Simons (a man considered the world’s greatest investor with 66% annual returns), Ken Fisher, Steven Cohen, and Mario Gabelli.”

So that’s probably enough to get us our answer… and frankly, at this point it’s sounding a little bit familiar… but I was curious about this “perfect battery” bit. What else does he say on that point?

“I will explain why this battery is far superior to everything else on the market…

“And how the automaker behind it has locked in the first-mover advantage on this breakthrough tech.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

Abeyta does include a photo that he implies is of the “perfect battery,” though it’s just a stock image that he bought of a pretty generic EV battery module.

He also says we’re in a “master reset” of the automotive industry, akin to the huge changes that happened with computers and mobile phones in decades past…

“EVs are not just a gimmick or a fad – they are ushering in a true Master Reset of the auto industry.

“And it all hinges on ‘the perfect battery.’

“A battery that is safer… 61% cheaper… and nearly five times longer lasting… than the batteries you will find in most electric cars today.

“And while GM, Toyota, Volkswagen, Hyundai, and Tesla are ALL racing to add these batteries to their line-ups…

“Just one automaker is both installing ‘perfect batteries’ in their vehicles and building a U.S. plant to provide them.

“And you can pick up shares of this company for just $12 today.”

What is that perfect battery? Apparently it’s a change in chemistry from the standard lithium ion batteries that are used by most EVs today…

“You see, the reason EVs are relatively expensive is because of their lithium-ion batteries.

“These batteries make up about half the cost of electric cars.

“That is because they are made with nickel and cobalt.

“And – with EV sales rising – both of these materials have recently soared to multi-year highs.

“And they are only getting more expensive. Nickel and cobalt are expected to at least double in price by 2030.

“However… ‘the perfect battery’ contains neither nickel nor cobalt.

“Its cathode is made of iron and phosphorus, two materials that are far more affordable than nickel and cobalt.

“In fact, ‘perfect batteries’ are 61% cheaper than nickel-cobalt batteries….

“And the #1 EV stock of the 2020s is the ONLY automaker that is building these batteries in the states!”

But sadly, the further we get in the ad… the more of it sounds like a rerun. Like this…

“This company – which again trades for only $12 a share – just launched a vehicle that can provide full power to your home for three days.”

And this…

“It currently takes anywhere from 30 minutes to 12 hours to recharge an EV.

“If you try to charge an EV any faster than that, it will cause the batteries to overheat and then degrade over time.

“However, a team of engineers over at Purdue University has just invented a solution to this problem….

“It harnesses an alternative cooling method to deliver a fully charged battery in less than five minutes.

“That is roughly the same amount of time it takes to pump your gas!

“And here is the icing on the cake…

“This research was funded by the EV maker I am here to talk about.

“That means they will get first dibs on this charging cable when it is ready for commercial use.”

So yes, as he did several times last year, Enrique Abeyta is again pitching Ford (F) as the “#1 EV Stock of the 2020s” — we covered that pitch a couple times during 2022, though the urgency of his ads over the past year was all about his certainty that Ford would be splitting the company in two, separating out the EV business from the legacy automotive business to try to earn a Tesla-like valuation for their growing electric vehicle business. That always seemed unlikely, but Ford is one of the more successful automakers in the EV business so far, with legitimate hits on their hands in the form of the Mustang Mach-E and F-150 Lightning electric vehicles.

What’s up with that “perfect battery” business, though? Well, it’s not yet real, they aren’t yet producing the batteries in the US… but Ford has announced that it will open a new battery plant in Michigan to produce lithium-iron-phosphate (LFP) batteries for its electric vehicles — probably initially for the Mustang Mach-E, and later for the base-level F-150 Lightning. They have licensed that battery technology from CATL, the Chinese battery leader, and expect to begin producing the batteries in 2026, so it’s not going to have an instant impact on Ford’s bottom line… but it is real. They’re using that same battery technology now in some models, too, it’s just that they’re currently importing the batteries.

There isn’t necessarily any magic to these different batteries — they should provide similar range at somewhat lower cost, just because the materials are currently less expensive, but they do have somewhat worse performance in cold weather, and they are less energy-dense than the nickel-cobalt-manganese (NCM) formulations of lithium ion batteries, but they are expected to last longer (LFP batteries have to be heavier to get similar range, which is why they’re primarily planned lower-cost vehicles with slightly lower driving range, but they can also recharge many more times). Many automakers are incorporating LFP batteries, including the Tesla Model 3 (and yes, the engineer who drove the Model 3 launch, Doug Field, does now work at Ford).

While all those LFP batteries are currently being imported, we should expect that a bunch of other plants will also be built in the US over the next five or six years — the inflation reduction act (IRA) incentives passed into law last year will heavily incentivize EV battery manufacturing in the US, and the dramatic production goals of all the automakers will mean a lot of new plants should get built. Probably at least some of them will also be LFP battery plants, if only because the industry is not sure that miners can increase production of cobalt and nickel fast enough to meet their needs by 2030 or 2035, but the regular nickel-cobalt-manganese (NCM) batteries that are more standard right now are not necessarily going away — a lot of cars designs still depend on the higher-energy-density NCM batteries or other designs. Ford is building three other battery plants as part of its big BlueOval City in Kentucky over the next few years, too, in partnership with the Korean company SK Innovation, and we don’t know what kinds of batteries they’ll make there (SK is working on LFP battery designs, too, as interest in them has heated up among automakers looking to reduce costs, but that hasn’t been their specialty in the past).

Sadly, though, the videos that Enrique Abeyta shared in the ad, showing the dramatic safety difference between a “traditional lithium-ion battery” and a “perfect battery”, don’t tell us much about Ford’s lithium phosphate batteries… he stole those images from BYD, which posted this “nail penetration safety” video of their new Blade battery back in 2021. This video does compare a nickel-cobalt-manganese battery, which catches fire, with the BYD Blade battery, which hardly reacts at all to the nail penetration…

But Ford won’t be licensing those Blade batteries from BYD, they’re licensing a different lithium-iron-phosphate design from CATL, which is the only Chinese battery maker that’s bigger than BYD (roughly speaking, CATL has about 50% EV battery market share in China, BYD roughly 25%, though BYD also makes its own EVs so it’s a bigger company in other ways). No idea what the nail penetration tests on those other designs look like — CATL’s latest designs, like the Qilin Battery, are available in both NCM and LFP chemistries, so presumably that’s something like what Ford is licensing for its new Michigan plant, but we haven’t seen any flashy videos about those.

In general, lithium-iron-phosphate batteries are more stable and less likely to catch fire than the lithium-ion battery cells in your laptop or in the first generation Teslas, though if you’re using a liquid lithium electrolyte, which as far as I understand is inherently highly flammable, I imagine there’s always some risk if the battery is punctured (solid state batteries, using a thin metal film or even a gel instead of a liquid electrolyte, seem to be the safer hope for future generations of batteries, though they’re not ready for EVs yet). Of course, we’ll also get used to that over time as human beings become accustomed to a different risk profile — we’ve been seeing gasoline cars catch fire on the side of the road for generations, and gasoline is probably the most volatile and dangerous substance most people interact with every day, but because EVs are new we find that fire risk to be somehow more surprising and newsworthy.

We’ll probably see all kinds of battery technologies improve over the next decade, too, leaving the current state-of-the-art behind… maybe including new entrants from the solid state battery world (folks like Quantumscape (QS) and Solid Power (SLDP)). None of this innovation is standing still… but it does take many years to prove out new technologies, test them for safety and long-term efficacy on the road, and make automakers confident enough to roll out huge numbers of cars that they will have to support for a decade or more. Having plants in development right now for 2026 that will feed substantial increases in vehicle production by 2028 or 2030 is pretty standard — EVs are coming, and sales are growing fast from an extremely small base, but massive change and building factories and ramping up production in a big way still happens pretty slowly.

Ford’s goal is to have at least 40% of its global production be EVs by 2030, and they’re planning to invest something like $30 billion by 2025, mostly in those new plants, to get to that point… but that will also be heavily swayed by Europe, where Ford should be close to 100% EVs by 2030, the US will likely still be well under 40% at that point. That’s still a HUGE change, Ford was the second-largest seller of electric vehicles in the US in 2022 (a little over 60,000 vehicles sold, way behind the almost 500,000 vehicles sold in the US by first-place Tesla, which sold about 1.3 million EVs globally), but that 60,000 was only about 3% of Ford’s total vehicle sales in the year. It’s growing fast, it was 1% the year before, but it’s still going to take a long time.

It’s also a challenging revamp of a very old business — that $30 billion in new EV investments that Ford is planning to make is more than the ~$20 billion in total retained earnings Ford has had in the past ~40 years as a public company (they’ve already done probably at least a quarter of that spending, to be fair). It’s a big company, with $40+ billion in cash, $140 billion or so in debt, and almost $160 billion in revenue last year, so they can certainly absorb a lot of capital investment… but they have not exactly rewarded long-term shareholders very well in the past, so to some degree it requires a leap of faith. The stock looks cheap right now, as pretty much all big automakers look cheap (other than Tesla), but a lot is riding on whether they can invest their capital wisely for this EV transition… and whether they can come out of that transition with meaningful revenue growth and better margins.

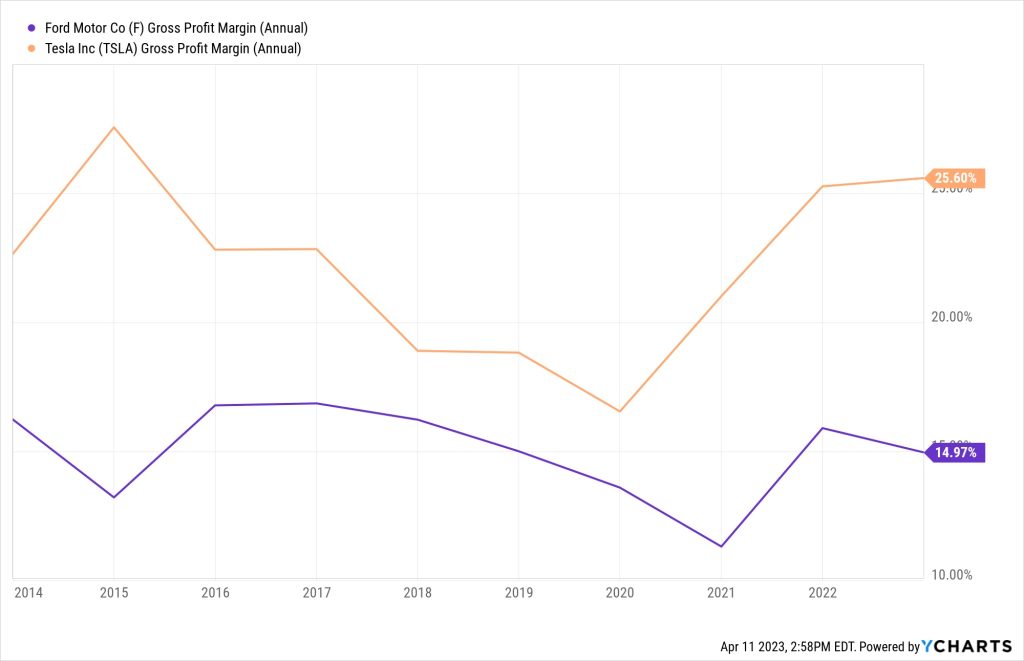

The hope is that going electric will improve their gross margins, though I guess it will be a long time before we really know how that plays out — the target everyone is shooting for is Tesla, with its 25% gross margins, but Tesla also doesn’t have the baggage (or benefit) of hundred-year supplier relationships, wide offerings of less-popular products, vast dealer networks, dozens of manufacturing locations that need to be retooled or closed, and massive entrenched bureaucracies at headquarters. This shows what those margins look like over the past five years… that’s Tesla in orange, Ford in purple, and this is exactly the opposite of how it should work — Ford’s massively larger scale should make them more efficient, in theory, but it’s the disruptor in the auto business that has been able to operate much more efficiently:

And, of course, that gets reflected in stock prices… I’ve never been able to justify Tesla’s valuation (though I could have started to come close at the lows a few months ago), but it has certainly been the winner in this space, thanks to high growth rates, popular vehicles, and highly promotional work from everyone’s favorite CEO, P.T. Barnum Elon Musk. Here’s the total return for investors over the past ten years, which gives us one more reason why all the other automakers are trying to go full-EV (I added Stellantis (STLA), in green, and GM (GM), in blue — both have outperformed Ford over the past decade, too, though that’s largely because they were much bigger disasters in the previous decade, when all the major US automakers except Ford went through bankruptcy… adding other global players, like BMW or Volkswagen, wouldn’t make much difference, they’d all be clumped down near the bottom with Ford):

And it’s probably still reasonable to use GM and Stellantis as the main comparisons for Ford — both are meaningfully cheaper than Ford on an earnings basis (Ford is at about 8X forward earnings, GM about 5X, Stellantis, which is essentially Chrysler, Fiat, Peugeot and Renault, about 3X), and those competitors carry a lot less debt than Ford, thanks to their bankruptcies a dozen years ago… though they’re also more complex, with more brands and more global exposure, and they may not be as strategically nimble as Ford in this EV transition. That’s a judgement call.

I do have some sympathy with this idea of Ford being the most aggressive of the legacy automakers to really invest in EVs, and there is huge potential if they can really ramp up production of the F-150 Lightning, since the conventional F-150 remains the top-selling vehicle in the US, and since Ford has a good chance to take the lead in commercial fleets of EVs with the Transit and the F-150 (the LFP batteries may make more sense in those commercial fleets, since businesses are more price-focused and less range-obsessed than consumers). And Ford is reasonably valued if you believe that they’re going to be able to improve their margins and eventually generate some growth over the next 5-10 years as they push electrification of their fleet, though that level of disruption brings in lots of uncertainty.

I can certainly justify buying Ford more easily than buying Tesla here, since I do think that eventually the old-world manufacturing might of the major automakers will catch up with Tesla and probably squeeze out most of the younger EV startups, particularly as prices come down (Tesla cutting prices recently is a sign of those rising competitive pressures)… but the failure of almost all of the car companies to generate any real long-term shareholder returns does make me hesitate to make big bets in that business (yes, Tesla is the big exception, they’ve amply rewarded shareholders, especially over the past five years, but Tesla is unique — I imagine it will remain the exception).

So that’s where I’m coming from. I think Ford is doing a good job of aggressively pushing the transition to EVs, and they are taking full advantage of the big government subsidies that are available over the next few years for battery plants and EV projects… it may work out well, and they pay a solid dividend (a 5% yield at $12 per share), so you do get compensated to wait it out, but I don’t have any plans to buy this one, personally.

Disclosure: I own Stellantis indirectly, through Exor, and a bit of BYD indirectly, through Berkshire Hathaway… and I am a Detroit Lions fan, so I have alternated between love and hate for the Ford family over the past 30 years, which I’m sure colors my perceptions of their company (the family only owns about 2% of the company, but that’s through super-voting Class B shares, so they still control Ford and dominate the Board of Directors). I will not trade in any covered shares for at least three days, per Stock Gumshoe’s trading rules.

Certainly not a pure play battery stock…so the Tease is misleading to a degree I would think. Ford – a tough call….maybe they have some things going for them, but still not a great margin business.

I agree… and Ford does have a lead among the legacy automakers, I think, but it’s so early in the transition, and the scale so tiny at this point, that I don’t know if the lead will be persistent.

Ohms law on electricity generation and use:

When you generate electricity, half is generation, half is heat., (50%) generation loss from heat.;

Then you use that electric to charge a battery, half is generation, half is heat. Half of half is 25% efficiency.

Then you use that battery. half is generation, half is heat. Half of the 25% is 12.5% efficiency that gets to the road.

This does not include any of the line losses, generator friction losses, and motor and gear losses in the electric car.

Gasoline cars now are approximately 50% efficient in the use of gasoline.

Unless heavy subsidization of electricity is given, electric cars cost more to run than gas.

There’s a lot of truth to that, though some of it is because we have a massive infrastructure to support the production and movement of oil and gas around the country.

Doesn’t mean we’re likely to stop pushing for electrification, though, especially as storage improves to make solar (and wind) more reliable and available. We’re not going to stop using oil in the next 25 years… but it’s pretty likely that we’re going to use a lot more “clean” energy.

Maybe that will be hydrogen, too, but I’m skeptical — hydrogen requires a massive infrastructure investment, while EVs already can count on a pretty strong electricity distribution network. I think the most likely outcome is that batteries and charging improve dramatically over the next 10-20 years to support the EV transition… but we’ll see, the future is inherently unknowable.

A lot of nonesense here, gas cars are nowhere near 50% efficient, when you use a battery at least in teslas closer to 98+ % efficient. Also trust me I live in -40 winters, they don’t produce much of any heat, or we wouldnt lose 30% range in winter (new teslas using the heat pumps lose about 10% now so it’s not such a big deal anymore) You don’t lose 50% charging your battery, maybe up to 15% to switch from AC to DC. If you did lose all the crazy 50% everywhere, we STILL wouldn’t have bothered with electrics.

Also, that wasn’t Ohm’s Law.

Try I = E/R.

Hey, Travis, Honolulu Blue and Silver division champs this year. Gonna bite some kneecaps. GO LIONS

I’m always optimistic from April to September, but things look good… do love a tasty kneecap!

Hydrogen is a disaster, our gvmnt is going to waste a huge amount of $ on it. It is very inefficient to produce, it requires massive infrastructure (as Gumshoe says), it has major problems storing in a car, since either cryogenic or under high pressure. It makes metals brittle, so you get ruptures. Plus H2 flames are almost invisible, you can walk into. The gvmnt will be sued along with manufs. What could possibly go wrong?

Travis, thank you for your very good work…. I am interested in Hydrogen cars or blue gas vehicles. They discharge only water and can be charged in minutes but give for long driving distances between charges. Any thoughts on this technology? It can obsolete all ev battery vehicles.

What are the stock plays for Hydrogen fuel, Toyota has an improved fuel and motor and may be aiming at Tesla

I noted a while ago that Altech Chemicals Ltd (Now renamed Altech Batteries Ltd (ASX and also European

Exchanges) have a new Solid State Battery in JV with a German organisation. A good deal by looks of it, for

Altech. It is called CERENERGY(tm) and is to replace Lithium Grid Storage. I hope they will at some point also produce EV batteries of same type. Uses Salt, not Lithium.

Ford loses money on every EV they produce. There is no “perfect battery” unless it can be produced at scale. Let’s see how Ford does if/when they actually produce them.

“(folks like Quantumscape (QS) and Solid Power (SPWR))”. Note that Solid Power symbol is SLDP. SPWR is SunPower a solar panel maker spun out of the old Cypress Semi when retired CEO TJ Rodgers was running things. TJ also financed and turned around ENPH a few years back. I bring this up because there IS a battery technology that may make a huge technological advance, and that is Enovix, TJ’s current project. They use a silicon anode in their battery which provides power density. They also patented brakeflow which stops thermal runaway fires. TJ demonstrates this via the nail test video on the Enovix website. While Enovix is not targeting the EV sector currently, it will be explored after they ramp up batteries for wearables and mobile devices n 2024-2025.

Oops, sorry about the ticker typo

What do you know about ENVX that Louis and matt mention?

Heck, I’d be happy to get notification they actually started building the Maverick Hybrid I ordered 7 months ago…. Seems like Ford production is paralyzed.

I thought this add might be about #ENVX. Enovix is way ahead of everyone.

I like Renewable Innovations, Inc. (stock ticker symbol REII). They do a lot with hydrogen fuel cells, but I think the one product that could set them apart from everyone else is their Green EV Rapid Charger (https://www.renewable-innovations.com/ev-rapid-charge-system). The stock is currently trading around $1 per share, and they have 6.09 million common shares.

New one for me — what on earth happened on November 30? The chart looks like a penny stock promotion (three cents to $2.50).

A reverse merger took place between Nestbuilder.com Corp. (NLBD) and Renewable Innovations, Inc. (REII). Here’s a link to an article about the reverse merger: https://microcapdaily.com/renewable-innovations-inc-ri-rm-the-rise-of-nestbuilder-com-corp-otcmkts-nbld/

Take a look at AMPX their new battery

AMPX, ENVX and lots of others seem to be focusing on silicon anodes as a way to improve efficiency (and extend the battery life), can’t say I really understand the science of it, but it all sounds fascinating. That’s the focus of Sila Nanotechnologies, too, which was teased as a “gonna be great when they eventually go public” idea years ago (and still hasn’t gone public).

WHAT COMPANY IS DOING GRAPHENE BATTERIES?

On that same topic, last week’s Angel Research Podcast was an in-depth conversation between Jason Stutman and Alex Koyfman about new Battery Technologies coming online. Is Lithium still king? Or should we be looking at new materials like Graphene?

THE COMMENTATOR SAID THAT GRAPHENE HAS NONE OF THE SHORTCOMINGS OF LITHIUM FOR BATTERIES! A graphene battery would last a million car miles (could be resold/transferred); very safe!; very fast charging, for over a thousand recharges; high energy density/less weight; etc. I’m sold on them, just need a company in which to invest! Pete

My advice? Take a breath. Last I checked, their battery work was still extremely early-stage stuff, most of their graphene material goes into paint and lubricants… and they don’t sell much of that yet, either. It’s easy for a podcast discussion between a penny stock pitchman and his editor to sound awfully exciting.

That’s almost certainly a repeat of the ongoing pitch from Koyfman about Graphite Mfg Group out of Australia — the ads started in early 2022 for that one, I last updated my coverage last summer here: https://www.stockgumshoe.com/reviews/penny-stock-millionaire/solution-this-sub-5-stock-is-destined-to-win-the-battery-arms-race/

Thanks for proving access to company name. They have 7 times in cash as loss last year. Concept is good, seems worth a modest speculation. Insiders own a good %. Pete

5 April, 2023 [from a comment on Yahoo Finance] GMG continues to make good, steady progress, but too slowly for some people, who are panicking and dumping their shares. I’ve just picked up 10,000 more, at $1.54 CDN. A reasonable price target would be $10.00 a share in one to two years. They don’t disclose which large companies they are talking to, but when they do enter into an initial agreement with one such company, just watch the GMG stock price skyrocket.

Pete

Graphene Manufacturing Group Ltd (GMGMF)

Other OTC – Other OTC Delayed Price. Currency in USD

1.4900+0.0388 (+2.67%) At close: 03:32PM EDT

Current

12/31/2022 9/30/2022 6/30/2022 3/31/2022

Market Cap (intraday)

118.10M 143.00M 173.53M 166.88M 251.78M

Enterprise Value

110.71M 138.32M 166.22M 157.86M 241.26M

Trailing P/E

N/A N/A N/A N/A N/A

Forward P/E

N/A N/A N/A N/A N/A

PEG Ratio (5 yr expected)

N/A N/A N/A N/A N/A

Price/Sales (ttm)

1.48k 1.59k 4.74k 3.22k 1.83k

Price/Book (mrq)

15.36 26.95 26.59 34.51 128.02

Enterprise Value/Revenue

956.41 39.41k 1.94k 9.14k 26.56k

Enterprise Value/EBITDA

-126.00 -93.53 -50.05 82.37 120.45

Trading Information

Stock Price History

Beta (5Y Monthly) N/A

52-Week Change 3 -60.36%

S&P500 52-Week Change 3 -7.59%

52 Week High 3 3.8300

52 Week Low 3 1.0940

50-Day Moving Average 3 1.7290

200-Day Moving Average 3 2.1887

Share Statistics

Avg Vol (3 month) 3 46.94k

Avg Vol (10 day) 3 76.37k

Shares Outstanding 5 81.79M

Implied Shares Outstanding 6 N/A

Float 8 67.8M

% Held by Insiders 1 17.19%

% Held by Institutions 1 0.29%

Shares Short 4 N/A

Short Ratio 4 N/A

Short % of Float 4 N/A

Short % of Shares Outstanding 4 N/A

Shares Short (prior month ) 4 N/A

Dividends & Splits

Forward Annual Dividend Rate 4 N/A

Forward Annual Dividend Yield 4 N/A

Trailing Annual Dividend Rate 3 0.00

Trailing Annual Dividend Yield 3 0.00%

5 Year Average Dividend Yield 4 N/A

Payout Ratio 4 0.00%

Dividend Date 3 N/A

Ex-Dividend Date 4 N/A

Last Split Factor 2 N/A

Last Split Date 3 N/A

Financial HighlightsCurrency in AUD.

Fiscal Year

Fiscal Year Ends Jun 30, 2022

Most Recent Quarter (mrq) Dec 31, 2022

Profitability

Profit Margin 0.00%

Operating Margin (ttm) -8,925.11%

Management Effectiveness

Return on Assets (ttm) -35.71%

Return on Equity (ttm) -23.97%

Income Statement

Revenue (ttm) 115.76k

Revenue Per Share (ttm) 0.00

Quarterly Revenue Growth (yoy) -76.70%

Gross Profit (ttm) 19.18k

EBITDA -9.6M

Net Income Avi to Common (ttm) -1.7M

Diluted EPS (ttm) -0.0100

Quarterly Earnings Growth (yoy) N/A

Balance Sheet

Total Cash (mrq) 12.55M

Total Cash Per Share (mrq) 0.15

Total Debt (mrq) 1.43M

Total Debt/Equity (mrq) 12.34

Current Ratio (mrq) 2.31

Book Value Per Share (mrq) 0.14

Cash Flow Statement

Operating Cash Flow (ttm) -7.85M

Levered Free Cash Flow (ttm) -15.27M

See Statistics Help for definitions of terms used.

Abbreviation Guide:

mrq = Most Recent Quarter

ttm = Trailing Twelve Months

yoy = Year Over Year

lfy = Last Fiscal Year

fye = Fiscal Year Ending

Footnotes

1 Data provided by Refinitiv.

2 Data provided by EDGAR Online.

3 Data derived from multiple sources or calculated by Yahoo Finance.

4 Data provided by Morningstar, Inc.

5 Shares outstanding is taken from the most recently filed quarterly or annual report and Market Cap is calculated using shares outstanding.

6 Implied Shares Outstanding of common equity, assuming the conversion of all convertible subsidiary equity into common.

7 EBITDA is calculated by S&P Global Market Intelligence using methodology that may differ from that used by a company in its reporting.

8 A company’s float is a measure of the number of shares available for trading by the public. It’s calculated by taking the number of issued and outstanding shares minus any restricted stock, which may not be publicly traded.

© 2023 Yahoo. All rights reserved.

Data DisclaimerHelpSuggestions

TermsandPrivacy Policy

Your Privacy Choices

ju

Best of luck with your speculation, I hope they’re able to come up with a prototype this year to begin testing.

Gmgmf is the company making a graphene battery. Very promising

Yes I’m waiting for Sila…so I’m guessing funding is no problem for them, which would be a good sign

Been following ENVX and own a position in AMPX. AMPX just expanded their contract with AVAV to provide batteries for their Switchblade missile. The AMPX battery will increase the flight time by 50%. Not sure who wins the race for the dominant EV battery, but it’s damn interesting to follow the competition!

I’ve been following Sila for years and I’m getting sooo frustrated! The big money has probably already been taken by the BIG co’s but I know the founder was Elon’s employee #7 and may not care about the huge payout? I thought they were listed on the London exchange, ticker OJXL? I can’t figure it out? Guess I need to call Schwab…and, I’m not sure if it starts with an “OH” or a zero?

Thanks!

The Sila Holdings listed in London has no connection to the battery startup Sila Nanotechnologies.

Companies generally go public when they need the money, or are mature enough that their employees really want liquidity. I’m a bit surprised that Sila didn’t take the wild cash and go the SPAC route in 2021, when they could have been awash in cash with little scrutiny, but perhaps they’ve got a different plan. Or don’t want to deal with the “you say it’s a secret, but you gotta prove something” drama that plagued Quantumscape.

I’ve been keeping my eye on Sila since the huge tease about Tesla Employee #7 from 2019, or earlier. Gene at Sila was #7 but their “magic powder”, or whatever they call it, should have been monetized by now. I hear QS is still the best hope for the battery breakthrough the world is waiting for. We need to drill baby drill and stop ripping up the earth.

All this mal-investment in the transition will last just as long as the U.S. government does. Musk took an old technology and upgraded it some, but the result has been largely the same. Miracle batteries don’t exist. Lead-acid batteries still work fine , though there have been very few recent advances. Other battery designs have hit the technological wall already. BTW – actual tests of the Lightning have shown it to be non-useful in the real world.

I guess it depends on what “real world” use you’re testing — I haven’t driven a Lightning, but I imagine lots of heavy-duty pickup folks would be disappointed with the range, particularly if they have to tow something or carry a heavy load… but, of course, most people just drive their pickup around town and don’t really do “work” with it. Demand for the trucks seems to be quite strong, they should hit a production rate of 150,000/yr by later in 2023, and they can’t come close to delivering all the Lightnings that have been ordered.

Like a lot of people, my concern about EVs is mostly just about range and the hassle of charging on the go — I wouldn’t want to take a long road trip in one, particularly in the winter, but they are a fine match for the driving that almost everyone in the US does, almost all the time (20-50 miles a day commuting or driving around town, plug in at home) — if we’re at “the wall” with battery development now, I would imagine that current EVs would actually work well for most, but I find it hard to believe that the solid state battery R&D, and higher-capacity charging projects, won’t make some progress in the next decade.

Strange evolution we’re living through, it will be interesting to see how it plays out.

Then there’s NNOMF which is doing some specialized work with Mn [manganese] esp. in cathode production — bunch of patents, etc.

I wish I had more understanding of how it will all fit together.

I’ve been watching NNOMF since 2019 and several other Canadian companies. I really like EXROF. These guys have developed what they call a “Coil Driver” which is supposed to make ANY EV more efficient. It’s something every EV maker should be installing in their cars or be required by some oppressive government agency. I still don’t like what EV’s do to the ripping up of earth. I think we should be drilling, and once they use up all the Rare Earth’s, they’ll have to go back to good old oil eventually.

God I love (you) Travis! Straight up. Thanks also with your patience with the ‘gas is more efficient than batteries’ people. When you charge an electric vehicle with a solar array, with slightly used solar panels for $50 per 350 watts, the sheer economic idiocy of propigating an already dead means for getting around is “driven home” so to speak.

The car makers are not going there, and owning their own battery companies because it’s not better in every way. It’s not because they don’t remember Texaco buying Ovonics back with the EV-1 and killing that for 20 years.. and oil companies bankrupting them with $4 per gallon run up in 2008 killing the bigger SUV = more-margin cash cow. The car makers remember all of that. The masses not so much. Gas prices go down, and another Jeep Grand Wagoneer …L… rolls off the lot. (Max Carnot efficiency for a gasloline engine is 28%, btw; to the wheels, less)

But yes, the first perfect battery.. cheap, light, infinitely rechargeable, non-toxic, doesn’t-explode,, that you see.. ring that ‘buy’ bell early and often. It’s like the cure for alzheimers though… easy to say hard to do.

I bought a new 2018 Ford Escape SE Ecoboost 4WD for $23,500 + LTT in June 2018. It rides well, handles well, is quiet, has plenty of room, accelerates well from a stop, easily goes 70 OR MORE on the highway, gets 25 mpg and can be refueled ANYWHERE! What must I pay for an electric equivalent that has everything this has INCLUDING range? A tax credit does me no good because my income is too low to owe tax!

Engine repairs are expensive but AT LEAST AN ENGINE CAN BE REPAIRED! A failed battery MUST BE REPLACED at a cost PROBABLY MORE THAN the used car is worth! NO, I will drive this car until the gov’t makes it a jailable offense!

Tens of millions in the US drive cars more than the average of 11 years-old because that’s all they can afford. Just HOW CAN they afford to pay $30-40,000 (MY GUESS) for a family size electric?

OMG, Travis, you are a LIONS fan???!!! How did that happen? Came natural to me since I spent my 1st 74 years in the Detroit area. I’m still ALL THEIRS although I’ve lived 15 miles east of Sioux City, Iowa since Dec. 1st, 2012.

I’d guess that there will be plenty of gasoline powered cars and gas stations in the US for at least thirty or forty years. Evolution and technological progress is sometimes slow, and cars last a long time. The most ambitious big car companies are hoping to be all-electric by 2035, but that is hugely ambitious… and I hope it’s painfully obvious that the government is all about supply side pressure — politicians hate to tell anyone they can’t do something, or that they have to pay for things, they would prefer to try to make it appear that there’s a solution which doesn’t cost anything (Example: Instead of the obvious and incentive-driven solution of increasing gas taxes to reduce gasoline consumption, improve road safety and infrastructure, and make more efficient cars more attractive, the government uses fleet CAFE standards and forces companies to make efficient cars that nobody wants to buy, and gas consumption does not decline).

As with all innovation, from smart phones to a antilock brakes, it starts with the expensive and flashy stuff, and with high profit margins and early adopters and luxury brands… but in the end, as batteries rapidly get cheaper (and they almost certainly will, the past 20 years of rapid technological change should at least teach us that), an EV ought to eventually be a lot cheaper to buy and maintain than a conventional car. Cars have gotten amazingly better and more reliable in my lifetime, and I imagine that will continue.

As for the curse of Lions fandom… well, more than half of my family is from Michigan, so I grew up with the Lions in the background… and just when I had plenty of time to watch lots of games in high school and college, Barry Sanders came along and I was really hooked. I’m not sure I’m ready for them to really good for a long time, the Patriots fans in my neck of the woods were certainly insufferable for 15 years when they expected to win all the time 🙂

They just need to find another Barry Sanders, or two. Of all of the ball carriers I’ve watched…and I’ve been watching them since the days of Lenny Moore…I think Barry was the very best.

Lenny Moore? No. Jim Brown was the best, but he made more in Hollywood and kept his health by quitting when he did. Stocks? Don’t ask me. My IRA is down about 40% over the last 3 or 4 years.

I give you that Jim Brown was great, but the catch is I was never able to watch him. My IRA is also down severely. Now I’m watching it more and football less.

.. understand the regional/family influence on NFL fave .. like when I was near the home stadium of the team that won 4 SuperBowls in 6 years .. what?

Those were fun years for the Steelers!

Travis, any comments on Quantumscape QS?

Haven’t checked in on their progress for several months… so, not really. Still an R&D story, I gather.

How about Sodium Ion technology? Relatively low cost of production and certainly far more abundant required raw materials and also reduced environmental risk. Energy density is OK but requires improvement (which is ongoing). The current real problem with Sodium Ion battery technology is that it cannot yet compete head-to-head with Lithium or lead acid in terms of recharge cycles. And by the way, the largest concentrations of the best quality raw material for Sodium Ion batteries is in . . . Wyoming.

Today, the Outsider Club headlines screamed “BAD NEWS (for Tesla)” and Jason Williams pitched “Blue Gas.”

NEW “Blue Gas”… say what?

2nd day in a row now we hear this from the same source:

OUTSIDER Club

“New “Blue Gas” Poses a MAJOR Threat to EV-Makers“

Sounds like yet another repeat of this one: https://www.stockgumshoe.com/reviews/crows-nest-the/will-blue-gas-be-the-tesla-killer/