Today we dig into a teaser pitch from Kent Moors for his Energy Inner Circle, which is one of his “high end” newsletters — currently being sold for $1,950/year with some possibility of a refund (they have terms, so you have to wait a year… but if he doesn’t get you a chance at a 5,000% gain in that year, they say they’ll authorize a refund).

I imagine that rule about waiting a year before you can request a refund cuts down on the requests, particularly since you’d be having your automatic renewal kick in right around then, but at least they’re not doing a blanket “no refunds” deal like so many of the larger publishers do with their high priced services.

But anyway, what’s the tease about? A natural resource that’s “about to vanish” and make us all rich. Here’s a little taste of the intro:

“20% of this critical natural resource is about to vanish.

“It creates 12,096x more energy than oil… produces 16,000x more electricity than coal…

And 20% of the world’s supply of this critical resource is about to vanish into thin air.“Every major country will soon pay whatever it takes to get this stuff… otherwise, their economies will collapse.”

Can you guess what it is? Don’t worry, he eventually “reveals” that he’s talking about uranium… which we’ve seen teased in waves, every couple years.

“… two of the largest uranium miners in the world are taking 20% of the global supply off the market.

“This has unleashed a perfect-storm scenario that could be 2X bigger than what happened in 2006.

“Back then, prices exploded from $36 to $140 a pound.

“And for the tiny miners who had high-grade uranium ready to sell, their share prices shot to the moon.”

And he’s right, the supply is dropping by about 20%… though that’s not because supply is “vanishing,” that’s because the two biggest uranium miners in the world, Cameco and Kazatomprom, have cut their output by closing mines or otherwise slowing down production in a fairly desperate attempt to support uranium prices, which have been falling pretty steadily since the Fukushima disaster took Japan’s nuclear plant fleet offline in 2011.

So far it looks like that’s starting to work a little bit… but it’s very early days, and this exact same supply/demand imbalance and “too low” uranium price has been trumpeted by newsletters and other industry pundits for at least three or four years. Prices, we’ve been told, aren’t high enough to make uranium mining profitable in most places, or to incentivize future mine development that will be needed, and there are hundreds of nuclear power plants that require refueling and, more importantly, hundreds more being built that will require much larger amounts of the stuff to start operations.

Of course, we’ve also seen some declining demand in the US — the new nuclear power plant being built by Southern in Georgia is at least a billion dollars over budget and way behind on construction, and probably won’t inspire many new plants to be built… even as half a dozen reactors have been shut down in recent years because their old age and high costs made them uncompetitive, and more seem destined for shutdown soon given local unease with nuclear power or the cost of maintaining and upgrading 40-year-old facilities. Nuclear is doing better outside of the US, Germany and Japan, and remains a hugely critical power source for much of the developed world (and China and a few other places), but if there’s going to be meaningful growth in nuclear power generation it will have to be led by China.

Which is unfortunate, because nuclear power is probably our best hope as a planet to reduce pollution and greenhouse gas emissions without significantly reducing electricity consumption, but that seems to be the path we’re on. I do hope that the world agrees to push forward with much more use of cleaner, safer, new reactor designs, but I’m skeptical that it will happen.

And, frankly, I’m a little skeptical about uranium prices, too — not because I disagree with the basic premise that there will be new plants built and that uranium prices need to be higher to support the cost of exploration and extraction, but because I’ve agreed with that basic premise for four or five years, and uranium has not yet risen in price.

Partly that’s because of the surplus uranium that was no longer needed after Japan shut down most of its reactors (they’ve restarted some of them, but nowhere near all… and they had contracts to buy refueling uranium for all those reactors, so the “extra” uranium was just piling up), and after Germany suddenly shut down all of its reactors as well, but uranium doesn’t trade on commodity exchanges and is a hugely strategic mineral, too, so the supply and demand picture is not nearly as obvious as it first appears… even to experts like Moors, who was himself convinced in 2014 that we were on the verge of a major imbalance that would drive the price skyward.

The spot price and long-term price have just barely started to turn up now, which is probably a positive thing, but they have turned up before — particularly in 2014-2015 when the latest round of uranium bullish sentiment from the newsletter crowd really got “refueled” — and those price increases have not “stuck.”

So it’s fine to bet on uranium because you see that initial rise in the spot price and the first inkling of a rising long-term price (most power plants buy uranium on long-term contracts, which is why the long-term price really matters), but remind yourself that you’re speculating on something that has seemed likely for four or five years without really coming true… it might be that uranium has another price spike that makes speculators millions, you can see those past price spikes in 2007 and 2011 that are what every uranium speculator points to as the proof that a speculation can work, but it might not happen… or it might not happen on your timeframe.

Remember, if the price spikes up, huge producers like Cameco and Kazatomprom can also jump in and restart or increase production. It might take a year, and perhaps some of the small in-situ miners can ramp up production faster to take advantage of higher prices, but there is a lot of potential supply that can likely come back to the market as soon as it’s needed.

I’ll leave you with the note that I shared about uranium just last week in the Friday File for the irregulars, just so you have a little of my skepticism to balance out Moors’ optimism, and then we’ll get in and name those two stocks for you. Fair enough?

Here’s what I wrote:

"reveal" emails? If not,

just click here...

“Speaking of commodities, uranium continues to be an interesting story in the stock market and generate some teaser ad campaigns from newsletters… but I’m still not biting — we’ve now seen that September long-term price get reported by Cameco (CCJ), and it is an improvement over the last month (from $31.25 to $31.75), but that kind of improvement has happened many times over the past couple years without being sustainable. It’s the spot price that has people more excited, with that jumping up to $27.50 from the spring lows around $21, and reporting now three months in a row of substantial price increases on that spot market.

“That, too, has happened before, though — this period has been better than most in recent years, but we’ve seen multi-month climbs in the spot price before without that filtering through to long-term pricing (it’s the long-term contract price that really matters to the miners). The spot price and the long term price are now closer than they’ve been at any point in the past five years, so perhaps that’s a good sign, and some of the uranium stocks have reacted positively over the past month or two (though they’ve mostly come back down), so perhaps we are at the beginning. I’m stubbornly resisting that speculative urge when it comes to uranium, though, just because I’ve misinterpreted the “logic” of the situation for so many years now. Uranium remains a “show me” sector, and it’s the long-term contract price that has to show me something, not the stock prices.”

But maybe I’m just being too stubborn because of my past frustration with the uranium sector… so now let’s get to the two stocks being teased.

One final bit of red-meat waving from Moors:

“My sources have identified two tiny miners that hold all the cards in this uranium shortage.

“Either of them could make you a millionaire.

“And locking up stakes in both of them could set you and your family up for generations.”

And then our clues:

“Payday #1: A Potential 7,490% Windfall from ‘The Saudi Arabia of Uranium’

“That’s the nickname CNBC coined for the Athabasca Basin, located in Saskatchewan, Canada….

“20% of the world’s supply comes from right here.

“And that includes Cameco’s famous deposits at McArthur River and Cigar Lake.

“The same deposits behind both the 2006 shortage and today’s.”

More clues:

“Our first explorer is led by an all-star team of innovators who weren’t afraid to think outside the box.

“They developed a complex airborne survey system to search for uranium west of Cigar Lake, in a region where nobody had bothered to look.

“Using their powerful invention, they discovered 141 million pounds of high-grade uranium!

“That means their deposit could soon be worth an eye-popping $20 billion.

“Yet, this renegade explorer is absolutely tiny. They’re trading at just around $0.50 a share.”

We’re told that they’ve “locked up” over 31,000 acres in the region, that the market cap is only about $250 million, and that they’ve got a management team with great connections (the CEO helped develop Roca Honda, the Chief Geologist worked at Cameco, Areva, and BHP Billiton, etc.)

And that they have high-grade uranium that’s much purer than most (not a surprise, since Cameco’s got the highest grade uranium deposits in the world, and they’re also mining in this same region), and that they can produce uranium for just $14 a pound… with the potential to extract 141 million pounds of uranium from “their current drilling operations.”

We’re also told that they’re some insider enthusiasm:

“Over the last year, the CEO and President have quietly scooped up 283,000 additional shares of their company for themselves.

“And the board of directors have added another 350,000 shares to their already impressive holdings.”

So… hoodat? This is Fission Uranium (FCU.TO in Canada, FCUUF OTC in the US), with the primary asset teased being their Patterson Lake South (PLS) project in Saskatchewan, starting with that project’s Triple R Deposit. That project was indeed assessed as having a $14/lb operating cost, though that was back in 2015 when the preliminary economic analysis (PEA) was done, and we have not yet heard what the pre-feasibility numbers might look like (the PFS is a much more detailed analysis that will give updated estimates about the resources/reserves, production, costs and pricing — all of which has probably changed pretty dramatically in 3+ years, partly because we know the PEA was done with an assumption that $65/lb would be the long-term uranium price).

You can see the basics of that old PEA in their latest investor presentation here — that presentation also talks a lot about the big picture “prices will have to rise” sentiment that is shared by all the uranium juniors.

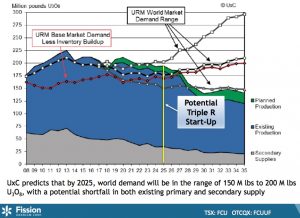

Interestingly, though, the chart that Fission shares in their presentation that estimates the potential start-up date for Triple R (2025) also helps to explain why prices are not yet rising — they include something called “base market demand less inventory buildup”, which I guess is an estimate of the impact of all that unused Japanese and German uranium that helped supply other demand, and they predict that existing and planned production will meet that demand until about 2028. That’s still not a lot of leeway, not for projects that take this long to permit and build, but it’s a better assessment than I’ve seen of the “real” reason that prices have stayed soft despite what clearly looked from the outside like a top-line supply-demand imbalance.

So… does that mean the pressure is building now and must be released with big new production and spikes in the price of uranium? Maybe… though you can also note that they use a pretty wide range for annual demand (150-200M lbs), so if demand is at the low end of that there might not be all that much pricing pressure until well into the 2030s. That’s not what I’d consider the most likely scenario, but since I’ve been wrong for quite a while now on uranium it’s probably important to keep that in the back of your mind as a possibility.

And yes, Fission is priced right around 50 cents, with a $250 million market cap — both US$. The price has risen slightly in the few months since Cameco and Kazatomprom announced their cutbacks and the uranium price showed a little life, but it’s still down on the year and down about 50% from the exciting discovery days in 2014 when they were first talking up the potentially massive size of Patterson Lake South.

They haven’t spent all that much on exploration in recent years, so they do still have about $20 million left of the $100 million they raised from 2014-2016, but this will probably be an expensive project to permit and begin to develop, I imagine, so they’ll have to sell a bunch more stock before they get to the point where they can get meaningful bank financing for actual construction of the $1+ billion project. I wouldn’t be surprised if they take advantage of any upturn in uranium prices to do a secondary offering, though they might want to wait until they complete their prefeasibility study… if they raise money before they publish the PFS, I’d worry that the project might have higher capital costs than the $1.1 billion the PEA anticipated, but that’s just a guess — their latest press release indicated that the PFS will be coming in the fourth quarter of 2018, which means anytime between now and New Year’s Eve.

And what’s the other stock?

“Deal Dossier #2: A Potential 22,377% Payday from ‘America’s Secret Uranium Stash!’

“… Our second explorer owns what is arguably the most valuable intelligence in the entire uranium industry.

“Their CEO quietly acquired 50 years of critical data from senior miners across the United States.

“And they’ve used this 871-mile uranium ‘treasure map’ to lock up 14 separate properties for pennies on the dollar!

“But they’ve got another ace up their sleeve.

“Their management team is dialed in to the Trump administration.

“They’ve already met with Energy Secretary, Rick Perry.

“That means they stand to be a major benefactor from upcoming legislation that could be coming down the pike, meant to address the supply shortage in the United States.

“Currently, you can lock up shares of this small miner at only $1.50 apiece.”

Other clues?

“… their flagship property, located on over 8,000 acres in the historic Texas Uranium Belt….

“So far, they’re projecting at least two million pounds of uranium for this location.

“And they can get it out of the ground for $22 a pound.

“But this isn’t the only mine where they’re using this technology.

“They’re also implementing it at their Wyoming deposit, which covers 21,600 acres.

“It’s near Cameco’s now abandoned Smith Ranch-Highland mine, which produced 23 million pounds over 14 years of operation….

“… when our explorer rolled out their technology, they discovered an estimated 29 million pounds of uranium.”

And a few hints about the management team…

“… his Chairman is a former energy secretary. And he’s dialed into the current administration.

“But the CEO himself is an accomplished resource explorer.

“He previously founded a gold mining company that gave ground-floor investors the chance to pocket a 662% windfall.

“And the firm’s Executive Vice President has held leadership positions at Cameco.”

We also get a list of those “treasure map” deposits:

“Fourteen in this country alone, including…

- Five properties in the South Texas Uranium Belt…

- Two properties in New Mexico…

- Two properties in Colorado…

- Two properties in Wyoming, and…

- Three properties in Arizona.

“Across all of their deposits, this miner is sitting on a combined 109 million pounds of uranium.”

And more of that insider buying:

“Over the last six months, they’ve bought up nearly 1.1 million shares for themselves.

“And you should join them.

“Right now, shares are trading for around $1.50 apiece.”

So this, dear friends, is our old buddy Uranium Energy Corp (UEC), which I speculated on once or twice a few years back, when I too was convinced of the potential uranium spike coming down the pike. Moors touted this one off and on from 2014 to 2016, too, and was part of that wave of enthusiasm that drove UEC shares up to about $3 back in 2015.

UEC is a similar size to Fission, with a market cap of about $235 million (the shares are at $1.47 right now), and they have a little less cash on hand (about $11 million), they raise cash by selling stock every couple years and are probably due to do so again within the next few months, so I’d guess they’ll be making the rounds to chat up investment newsletters and present at conferences… especially given the little uptick in uranium prices.

The company’s whole shtick under Amir Adnani has been that they are ready to produce at a moment’s notice, with their relatively small but ready-to-go Hobson, Texas processing facility for in-situ recovery (ISR — that means they pump water through uranium-bearing deposits and extract the uranium from that water, which is cheaper and faster than hard-rock mining), but that they’re not going to start producing until the money is better… so despite the fact that they say they can produce at $22/lb, and long-term contract prices for uranium have been well above that level for years, they haven’t really produced anything yet. In Adnani’s words from his January shareholder letter, “We are well prepared to ramp up operations when justified by reasonable uranium prices.”

So UEC is still quite small, with capacity at the Hobson plant of two million pounds a year representing all of the near-term potential cash flow and having a very limited potential impact on the market (McArthur Lake, to give you some context, is one of the largest uranium mines in the world and can produce about 14 million pounds a year… assuming Cameco restarts the mine at some point) — though they do have some larger projects in Wyoming and elsewhere that are at earlier stages. I don’t know what Adnani is looking for in terms of “reasonable uranium prices” that would inspire him to start production and begin to sell a bit into the spot market or sign some longer-term contracts, but the Hobson plant exists and can be put to work, and they have enough permitted projects surrounding the Hobson plant that they could probably be producing faster than any new hard-rock mine.

Finally, I’ll share with you Kent Moors’ own version of “cautionary” language, just to be fair:

“Both of the investment opportunities in these Deal Dossiers are speculative.

“They’re tiny companies, each trading for pennies a share.

“So you will not want to chase them. Make sure you follow my strict buy-in instructions for your stakes.

“And certainly, don’t invest what you can’t afford to lose.

“However, you don’t have to put a lot on the line when there is the potential for a total payout of 29,867%.”

Just can’t resist mentioning that 29,867% potential windfall, even in the same breath as the “don’t invest what you can’t afford to lose” comments.

Ah, well. I’ve done enough blathering on this one… time to turn it over to you, dear readers, are you convinced of the potential for another uranium windfall sometime soon? See prices spiking and sending “juniors” like these soaring higher? Let us know with a comment below.

P.S. We always want to know what investors think of the newsletters they’ve subscribed to — not the teaser pitches that are sometimes ridiculous, but the actual content shared with subscribers. Worth it? Not worth it? If you’ve subscribed to Energy Inner Circle, please click here to share your experience with your fellow investors. Thank you!

Disclosure: I do not own any of the stocks mentioned above, though I still do have a small (and very unprofitable) call option position on Cameco. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s rules.

Realisticly all the usa uranium miners will require years (5-10) before they can really start ramping up uranium production. In the mean time China is building till 2030 roughly 100 new nuclear plants, Saudi Arabia plans 16 nuclear plants and many more countries are joining. Both Fission and Nexgen have huge deposits but they will require a lot of capital to get in production. Have a look at the analyse at the bottom.

To make the case more positive for uranium many old uranium mines are reaching the end of their minelife which comes at a bad moment. Hardly any uranium miner can mine uranium at a profit these low prices. That is why the sentiment and are only a handfull uranium miners still alive.

My take is as a uranium speculator invest for now only in a few premium uranium mining companies in Africa who will be able to ramp up production when the price of uranium goes up and thus make a killing before their competetors in Canada are

ready to produce, just read what happened with Palledin Energy out of Namibia.

The uranium market is very small and we are now in a unique situation supply destruction and increasing demand = much higher prices.

https://sightlineu3o8.com/2018/10/ucomps-uranium-development-stage-projects-show-me-the-money/

I like UEC as a swing trade. I buy when at around $1.20 and sell when it hits $160.

I just hope that 132,00% trading range holds up 🙂

Which is unfortunate, because ‘nuclear power is probably our best hope as a planet to reduce pollution and greenhouse gas emissions without significantly reducing electricity consumption,” Travis, is this really your opinion? Solar and wind, and electricity management techniques allow renewables to be integrated easily, BUT utilities don’t want that, because the “return is too low, and it takes too much effort”. Peak loads can be reduced by 10 to 40% with off the shelf load management equipment, but it is no advantage to the traditional utility. They cannot charge for peak power without peaks. It is so much easier for them to go to PUC’s pleading increased costs at peak times.

Perhaps Thorium reactors will move into mainstream, but they do not need Uranium. My take? Like fossil fuels, now declining and long term continuing declines.