This article was originally published on February 10, 2022, but we continue to get questions about variations of this ad so we’re re-posting it here. What follows has not been updated or revised, other than the disclosures.

I always like reading the pitches from Dan Ferris, I guess partly because he cultivates the mien of the grumpy value-investing libertarian loner… and I certainly don’t always agree with him, but I often find his stock ideas interesting, usually more because of the limited risk than because of the mega-upside potential. A little bit of a nice reset from all the research I do into the high-growth ideas that more often get attention from newsletters.

And Stansberry is out with a new ad this week for Ferris’ Extreme Value newsletter (currently offered at $1,500 for two years, no refunds). The primary bait dangled to get you to sign up is a special 10-Stock Inflation Protection Portfolio, and Ferris argues that risk is high right now in the market, and everyone should have at least 10-20% of their portfolio in these kinds of stocks. So today, I’ll put the Thinkolator on the case and see if we can ID some of those picks for you.

First, the big picture spiel…

Ferris says his “spidey sense” indicates that we’re near major inflection points for five different trends — the end of this long-running bull market, the outperformance of growth over value, the outperformance of the US markets over the emerging markets, the weak commodities market, and inflation. He sees the market falling as much as 80%, inflation staying a substantial problem, commodities going through another bull cycle, and the US market doing worse than emerging markets.

So that colors his investment strategy… though he does, of course, also echo my sentiments when he says “prepare, don’t predict” — things have felt pretty risky for a while now, and were getting pretty close to valuation extremes even before COVID hit, but we shouldn’t rely overly much on those feelings in going “all in” or “all out” in the markets. We should be ready for cycles to change or for big upsets to the markets, but don’t bet on when it’s going to happen — mostly because you’re almost certainly going to be wrong. His basic recommendation is to hold a diversified portfolio, which includes stocks, a large cash position, and gold and silver (and he has come around to suggesting a little bitcoin as well).

The primal fear urge is probably what gets people to open this email, with the ad headlines that say “The Next Great Crash Has Likely Already Begun” — but, of course, the worrisome valuations have been present in the market many times over the past three or four years, and Ferris isn’t really planting a flag in the ground and saying, “this is the moment when we crash.” Nobody knows whether the market will shoot higher this year or collapse, or just muddle along.

The ad takes the format of a “prepare for the next great crash” interview with Ferris, hosted by Daniela Carbone, one of the Stansberry editors. Here’s the lead-in to that:

“The Next Great Crash Has Likely Already Begun

“This is one of the biggest bubbles in history. You can wait for disaster…

or take ONE simple step to prepare now.“Inside: The easy-to-use plan to stop worrying… crush inflation… and multiply the gains of every ‘defensive’ idea you’ve ever heard of.”

A little more flavor that we’ll pull out of the pitch for you, to give a sense of where Ferris is coming from… he sums up his lament about the current bubble state of the market:

“The attitude in the markets right now is that it’s impossible to lose. It’s a mania. Buy buy buy. You have stocks trading at hundreds, even thousands of times earnings….

“But stocks only go up, supposedly.

“Meme stocks like AMC whose core business is in steep decline that have gone up 2,000%? Buy buy buy!

“Digital assets like NFTs that just get conjured into existence with the click of a button? Buy buy buy. Put the rent money in. It’s guaranteed millions….

“When everyone is just desperately gaga to get in… to pour in their savings… to use leverage.

“That’s a bubble.”

Maybe so, it certainly feels a lot like a bubble and there are plenty of folks singing a similar tune over the past few months — and more still in the past month, especially, as the drop in the market to start this year has emboldened folks who are bearish to speak more publicly about how right they are.

More from Ferris…

“And just knowing intellectually that this is a bubble doesn’t mean crap if you don’t DO SOMETHING about it.

“So the first thing I want to say to your viewers is this: This is it. This is the moment when you must act. Now. Not when stocks are down 30% or 50% or even 70%.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“This is when you take action that saves you from having to feel the way you did in 2008.”

And he says you don’t have to pick the moment the market turns to make money from the next phase, or to be prepared for ugliness…

“There’s no magical thinking here. No B.S.-ing about how the market is going to turn on a certain day when this line crosses that line. And no shaming about anything you may have done in the market – good or bad – before in the last crisis or in this current bull market.

“There is a plan for this moment. It’s easy to implement. It’s backed up by history in a big, big way. The only part about it that’s hard is breaking out of the groupthink – the dangerous investor psychology that I mentioned that’s absolutely driving the bus right now.”

In the ad “interview,” Dan Ferris really highlights the challenge that inflation poses, since that can be a big negative for the economy even if there isn’t a moment when we have an identifiable and abrupt market crash:

“The kind of money printing that’s happening in the United States – and things like zero interest rates – it’s not just the U.S. anymore… and that’s markedly different from the last crash.

“It’s going to be worse.

“The safe bet – the rational bet – is for significant inflation for a long time.

“And I’d much rather expect that and be wrong than the other way around.

“Because here’s the key thing. If inflation over the next decade plays out the way I’m expecting… financial disaster even without a crash.”

So… with that said, he teases us about his solution — what are some of his recommendations in this crisis playbook? He gives the first one away for free…

“I think you should hold some gold bullion or gold through an ETF that’s backed by physical metal.

“There are some good ones out there and I’m not talking about G-L-D, which is the largest gold ETF, but based on complex engineering with futures contracts rather than real, physical gold.

“So let me mention a ticker symbol that you can go out today and take advantage of without ever spending a dime on my research.

“Even if you just did this and nothing else you’d be way ahead compared to most people. The ticker symbol is P-H-Y-S, as in ‘physical’ and it’s a much higher-quality way to own gold in my opinion.”

I think a lot of gold enthusiasts overthink that, which is why the larger ETFs have this reputation of being “paper gold” instead of “physical gold,” though I guess it doesn’t do much harm — The Sprott Physical Gold Trust (PHYS) tracks the spot price of gold almost as accurately as the much larger SPDR Gold Trust (GLD) or the iShares Gold Trust (IAU), the expenses are only a little higher, and it’s certainly easier than holding your own bullion personally.

And Sprott does promise shareholders a redemption option to turn their PHYS shares into gold bars if they have a large enough position, and their redemption process is at least a little clearer than the SPDR GLD redemption process… though these are all essentially institutional promises, unavailable to small investors (you’d have to own enough to redeem in the form of London Good Delivery bars, which are about 400 ounces of gold — so you can effectively redeem in ~$750,000 increments, and be mindful that you’ll probably have to hire your own armored transport if you want to bring it home or drop it at another vault).

So sure, you can buy gold coins or buy through an ETF, and we’ve probably already overthought the differences among the various ETFs. What else?

“Consider a commodities ETF. Own some land or equities that are backed by things like land in a big, big way – which it’s 100% possible to find but is rarely obvious, by the way.”

The Stansberry folks have several times pushed the idea of owning your own farmland as the best hedge against catastrophe, and lots of folks have recommended timber stocks as a hedge against inflation in the past… but here I expect Ferris is referring to the many companies who own “hidden” exposure to massive tracts of land. Those holdings aren’t generally as hidden as they were 10 or 20 years ago, accounting and disclosures have caught up with the under-reported land values on a lot of balance sheets, but there are still plenty of companies out there with very large land holdings, from developers and timber companies to large agriculture firms.

He doesn’t drop any specific hints there, just talks up the general idea of commodities, energy and land as inflation hedges… which is historically reasonable, and not particularly a contrarian idea (Ferris’ colleague Dr. David Eifrig was talking up land as an inflation hedge last year, and I share some thoughts at the time)… more from Ferris:

“… my point isn’t just that these things will be a lot more durable investments in an economic crisis. It’s that we know what happens to their prices in times of inflation. They skyrocket. If it takes five times more dollars to buy a movie ticket, you just don’t go. But if it takes five times more dollars to buy a barrel of oil, the world still needs that. So I sure hope you own the oil company and not the movie theater chain.”

What he seems most excited about is commodities…

“This is the kind of moment that you wait an entire lifetime for. Because it’s the very, very rare chance to catch the beginning of a 10- or 15-year cycle….

“Commodities are the cheapest they’ve been relative to stocks since the lows of the dot-com bubble. Not the housing crisis… the dot-com bubble.

“They’re in almost exactly the same place as they were 20 years ago!

“And the last time we had this setup they went on a 500% run.”

That’s true, though the risk is that the surge from 2000 to 2008 was also caused by the explosion of China industrializing and becoming an urban country almost overnight — the cycles before that for things like copper and iron ore were a lot more subdued than the commodity price runup to 2007-2008. Is China going to step on the gas again? Well mega-cities continue to sprout up in other emerging markets? Will the mass electrification of homes and cars lead to much higher copper consumption? Maybe, but we should probably step a little bit back from the prediction that we’ll see commodities trend that mirrors the initial emergence of China.

So what does he recommend as a way to invest in these kinds of commodities? What are those other nine investments, once you’ve got your allocation to physical gold? He thinks he has some investments that are levered to these commodity prices and other trends, and he introduces them this way:

“Dan: Here’s the thing. For every commodity… for every hard asset… and frankly for every anything… there’s always the easy and obvious way to play it… and then there’s the way that the smartest guys in the room do it. A way with the same risk, or in many cases LESS risk, but with 5x-10x higher upside.

“Dani: Are you talking about using leverage? Buying call options, for example?

“Dan: Heck no. No way. That’s what the Robinhood bozos are doing today and they’re going to get burned. But you can get something like leverage baked in to an ultra-high quality business that owns world class hard assets… makes or sells something that’s going to skyrocket in times of inflation… and absolutely gushes cash with little or no debt.”

Sounds reasonable. Can we finally get to the stocks, please?

Indeed, this is how Ferris describes the ten-stock portfolio:

“I’m really excited because right now I’ve assembled an entire recommended portfolio of them. It’s 10 stocks and every one of them is inflation protection… it’s crash protection… it’s the stuff that’s going to soar in the next great market cycle. And every one is the kind of overlooked or backdoor play that most people will never find, that gives you potentially 5x-10x more upside than the obvious thing that people will buy, if they’re smart enough even to use this strategy at all….

“I highly recommend you set aside at least 10% or 20% of your investing dollars today and buy this entire portfolio. All 10 stocks.”

OK, so finally we get to some of the specifics — can we name some of the ten for you? I know for sure that we can at least name the first one, because it’s a stock he’s been teasing for years. I won’t spoil the surprise, though I’ll spare you the long spiel — here’s the basic pitch:

“I’ve said over and over in public that I consider it the single best stock I’ve EVER found in more than 20 years in the markets, researching thousands of stocks. I call it the best gold business on earth, and I’m sure that’s what it is….

“It’s a royalty-like business. A royalty on a huge portion of the gold market itself. As long as people want to own gold, this business makes money. And when demand for gold skyrockets – which I have ZERO doubt is going to happen in this environment – well you can guess what happens – the potential for this company is off the charts.”

OK, so that’s yet another re-recommendation of Sprott (SII), the Canadian asset manager that specializes in gold and natural resources investing. He’s been pitching Sprott for about four years now as his “If I had to put every penny into one stock, this would be it” idea, mostly pointing at the “royalties” they earn on the gold market without doing any mining themselves — which is a veiled reference to the pretty high management fees they earn for managing ETFs that hold physical precious metals.

We first covered a teaser for that pick in February of 2018, but it has been re-teased with similar language many times since then — and the stock has done quite well, partly because gold has generally drifted higher and partly because the profile of the company has been lifted by getting listed in New York (they’re still listed in Toronto, too, but there’s a lot more money and liquidity on the NYSE).

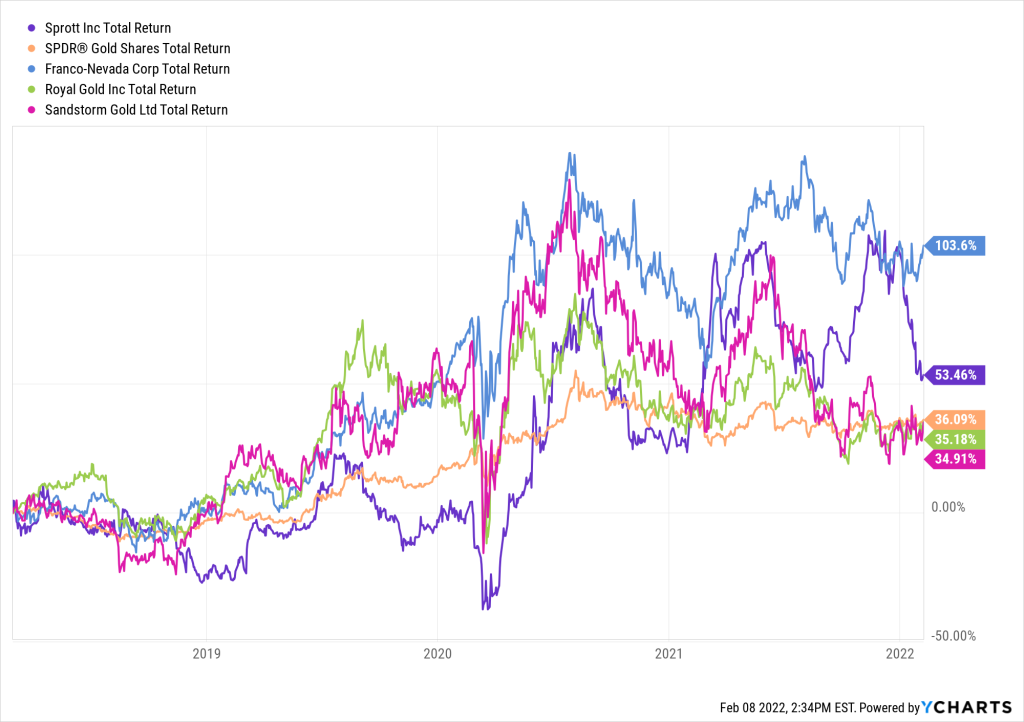

Here’s how Sprott has done since we covered that first Ferris tease in February of 2018, just for some context — Sprott is that purple line, they have done better than gold (in orange) and the average gold mining stock (the GDX ETF of large miners, in blue), but with more volatility:

And they’ve been a pretty decent investment if you compare them to royalty stocks, too — they’ve done better than my favorite gold royalty company, which has been pretty weak in recent years thanks in part to two major bets that haven’t paid off (that’s Sandstorm Gold (SAND)), and better than the cheapest big gold royalty company Royal Gold (RGLD), but have not done anywhere near as well as perennial gold royalty leader Franco-Nevada (FNV), which usually, as it does now, trades at a premium valuation to its peers.

So what will happen with Sprott? It’s still a decent secondary play on the commodities businesses and on precious meals, so if gold, silver and other commodities soar it should do well, and it’s a pretty nimble asset management business, with solid cash flow and a steady dividend (it’s been five quarters since they raised the dividend, but the current yield is about 2.75%). What Sprott really needs to do is grow their assets under management, since management fees are charged as a percentage of assets, so if they can do that without cutting their management fee to attract capital, they’ll do well — and they’ve been doing better than I expected on that front in the past couple years.

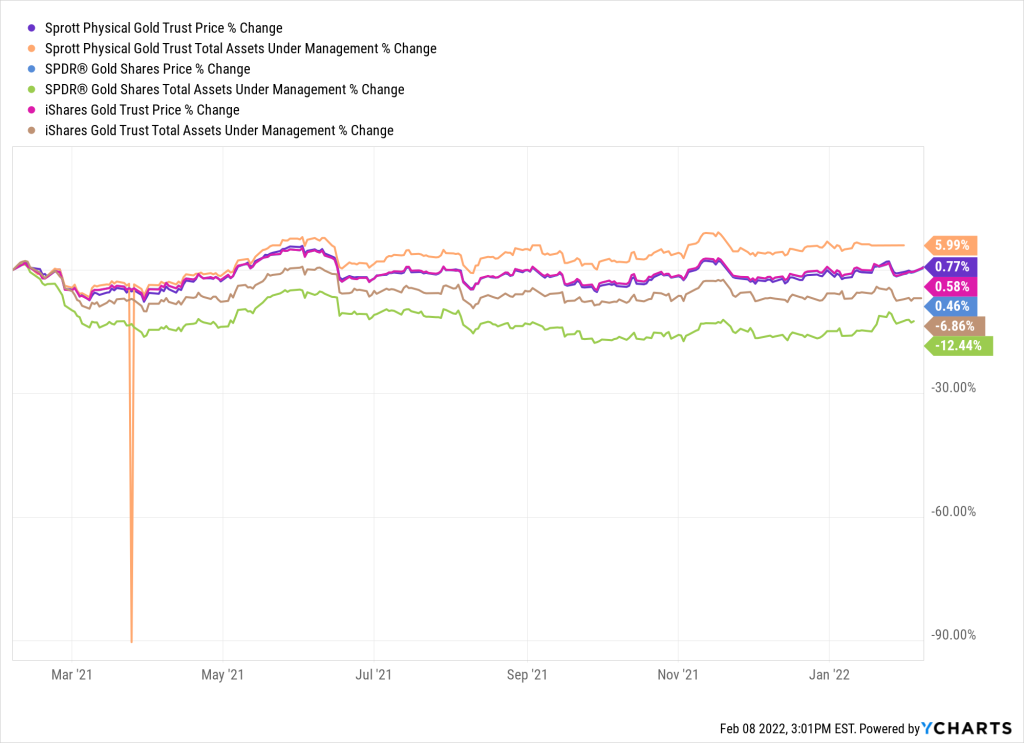

There are a few much larger ETF operators who offer gold/silver ETFs, and Sprott’s Physical Gold Trust (PHYS), which is their most important fund and also the gold ETF Ferris recommended as his “free” pick, has held up pretty well — the biggest gold ETFs are SPDR Gold (GLD) and iShares Gold Trust (IAU), and IAU has taken share in the past couple years, probably both because they’re tied in with Blackrock’s massive management platform and because they have lowered their management fee to be a little smaller than GLD, so we see assets dropping for GLD and rising for IAU… but we also see that PHYS is holding its own. The Assets Under Management (AUM) at both PHYS and IAU went up sharply after the COVID panic as more people put money into gold, and then it flattened out… but they didn’t lose shareholders after that, like GLD did.

Here’s a chart that gives you a visual of that trend — those lines at the bottom are the price per share of the ETF, which just follows the gold price, and we know that went up for about six months in the beginning of the pandemic and has since been pretty flat. That means, all else being equal, assets under management for those ETFs, if they didn’t have to create new shares or destroy shares because of rising or falling investor interest, would have also matched the gold price almost perfectly (if they had the same number of shares two years ago as they have today, their AUM would go up as much as the gold price went up). So you can see that those AUM numbers are rising, which means that people are buying more gold ETFs than they’re selling… and on a relative basis, IAU and PHYS are doing better at attracting new shareholders than GLD.

Over the past year, when gold has essentially been unchanged, the story is not as dramatic — but you can see that Sprott’s PHYS ETF did grow its assets a little bit faster than the gold price… and the larger ETFs I mentioned, IAU and GLD, both actually shrunk a little. Again, a pretty good sign, though not a super dramatic one.

Why does that matter? Because the larger the fund gets, the better Sprott’s earnings will be — it doesn’t cost them more to manage the physical gold holdings of more shares (the actual physical storage costs are absorbed by the fund before the management fee is taken out), and in fact the cost probably falls a little as they grow on a per-ounce basis, so if the gold price goes up AND the number of shares of the ETF goes up, that creates positive leverage for their management fee.

The tendency in the marketplace is for those ETF fees to go down with competition, so that’s a risk, and PHYS and Sprott’s other ETFs are still tiny compared to IAU and GLD, so there’s certainly a risk that the business could be more commoditized and returns could fall, but there’s also a subset of the gold market — call them “gold bugs” if you like — where Sprott is a powerful brand name, and where the slightly clearer promise that PHYS makes about being able to redeem your ETF shares for bars and coins is very attractive.

They have a higher effective management fee/expense ratio than other gold ETFs (GLD charges 0.4%, IAU has taken share by charging 0.25%, and PHYS says its management fee is now 0.42%), and these are not actually ETFs in the standard sense, they’re Trusts that own physical metals, so the tax treatment and tracking to the index are not as clear and perfect as standard ETFs, but they basically act the same.

And Sprott does have other assets under management, it’s not just their physical gold and physical silver ETFs — part of Ferris’ original argument, four years ago, was that Sprott was transforming their business by buying the Central Fund of Canada, one of the oldest closed-end funds that holds gold and silver, and ballooning their AUM. They do still own that fund, it’s now called the Sprott Physical Gold and Silver Trust (CEF), and it’s still big. CEF has about $4 billion in AUM, Sprott Physical Gold (PHYS) about $5 billion, Sprott Physical Silver (PSLV) about $3.5 billion — those are the three biggies that matter for Sprott, their other ETFs, including Sprott Gold Miners (SGDM), are relatively tiny. Those still pale in comparison to the big ETFs, GLD manages about $60 billion and IAU about $40 billion, but it looks like Sprott is very slowly gaining ground of late.

What does all of that mean? Mostly, “if gold goes up, they’ll do well” — like any of the larger mining royalty businesses, Sprott is levered to gold prices, though it’s true that for this core of their business it’s gold itself, not gold production, that matters, and that means the risk is lower (a gold royalty company is much less risky than a miner, it doesn’t have to incur the inflated costs of running a mine or deal with day-to-day problems at any individual mine, but they do get hurt if a mine has to shut down or has other operational problems… no production, no royalty).

Sprott also has other levers to push, like their other investment banking activity in the mining business and the other funds they manage for mining investors, so they might do better than the big royalty companies… but they also have risks, in that their ETF shareholders could all leave en masse and provide negative leverage to their operating results, and they don’t really own underlying assets (like mines or royalties on mines) that could protect the business over the longer term if other peoples money begins to leave. Their assets are really their managers and their brand name. That’s not necessarily a worse risk to take, but it is a different one.

Right now, Sprott trades at about 30X free cash flow, which is on the high end for their valuation over the years, and the analysts say they’re valued right now, at about $37, at 23X 2021 earnings and about 18X 2022 earnings. Growth depends on either higher gold (and silver) prices or on higher investor interest in precious metals, and those two tend to go hand in hand, so we should probably expect leverage in both directions.

What does that mean? Well, it looks like Sprott pretty typically is a 2:1 levered bet on gold. Last time gold fell substantially, from 2013 to 2016, we saw gold drop about 30% and the revenue per share at Sprott dropped by roughly 60% (the share price dropped about 80% — as is typical, leverage means investors are likely to overreact in both directions). During the most recent climb in gold prices, from the Fall of 2018 to the present (gold actually peaked in August of 2020, but we’ll give it some extra time to absorb that quick rise in gold), gold rose about 50%, and Sprott’s revenue per share went up by 113%… though interestingly, Sprott shares themselves only kept up with gold curing that particular time period, also returning about 50%. Maybe that means there’s more leverage to run into Sprott shares and they’ll pop up further, we’ll see, they’ll probably report their fourth quarter results in about two weeks and give us a little more data to work with.

I don’t own this one, but it’s a reasonable idea as a play on gold — asset management is a pretty fantastic business, and typically a very scalable one because the same person can manage $10 million as easily as he manages $1 million (especially when all you’re doing is buying gold bars).

What else? More hints from Ferris as we work through the other recommendations in the 10-Stock Inflation Protection Portfolio…

“There are 10 stocks in total. And besides “the Best Gold Business on Earth” there’s two more royalty plays.

“Again I’m not talking about Royal Gold, Franco-Nevada, or anything you’ve likely heard of.

“One of them is a I LOVE. It was my favorite stock in the world for years, until I found ‘the Best Gold Business on Earth,’ which just slightly edged it out. It’s not a gold play. It’s a royalty on a metals market that’s way, way bigger than gold or any precious metal. A huge royalty on iron, for example, which the world needs desperately every day. This infrastructure push is going to be fueled by iron, which goes into everything. A royalty on potash, the fertilizer component that we need to make food. A royalty on energy production….

“All in one company, run by the best capital allocators I’ve ever seen. These are THE guys you want on your team in the next supercycle because they buy assets at the bottom, they buy them at pennies on the dollar essentially, when nobody want them. Then they collect royalties for years, sometimes decades. That’s money that flows through with basically no marginal cost – no further investment in anything. Remember royalty companies don’t do the work of extracting or producing anything. If they buy a royalty on a particular mine, all they do is sit back and collect a percentage of everything that mine produces.

“And then they sell at the top. They sell – if they sell at all – for often way more than they paid to acquire the royalty to begin with. It’s unbelievable.

“It’s a stock by the way that you could liquidate – take the company apart and sell off every asset – and you’d end up with about 40% more than it’s trading for today. That gives you an incredible margin of safety.”

That will probably ring some bells for longtime Gumshoe readers, this is another long-time Ferris favorite called Altius Minerals (ALS.TO, ATUSF), and it’s also one of my larger holdings and a stock I’ve been very stubborn with over the past dozen years (I first bought shares after ID’ing it as a Ferris teaser pick in 2009, and have only added since — though the story has gone through some huge ups and downs). I just shared my Annual Review of Altius with the Irregulars a few weeks ago and updated my valuation work, so I’ll just paste some of that commentary in here for you:

1/21/22: Altius Minerals (ALS.TO, ATUSF) is the very definition of a commodity business, they buy or develop royalty streams, mostly on natural resources — base metals like iron ore and copper, commodities like coal and potash, and recently a little exposure to renewable energy through a portfolio of royalties on wind farms. And they just reported their preliminary numbers, so it’s time to update my thinking. They had their best year yet in terms of sales, thanks to strong iron ore prices early in 2021 and strong copper and potash prices for much of the year, so they reported attributable royalty revenue of about C$84 million, which means the company, though it is now at new highs, is still trading at a lower valuation than at previous peaks — they’re valued now at about 8-9X royalty revenue.

This is what I wrote in my Annual Review two years ago, when Altius was trading at about US$9, for some context:

“So where does that leave us? Well, it leaves me still stubbornly pleased with Altius as my primary base metals/commodity exposure investment — they pay a small and growing dividend, and they trade at a huge discount to the long-term value of their royalty streams if we assume that potash and copper and iron ore will continue to be in demand for decades to come. And it’s pretty cheap right now, with the company valued at roughly 6X their royalty revenue and with enough cash flow to pay down debt relatively fast and continue to invest in prospecting to create the next generation of royalties. I don’t know whether Altius will ever get the sky-high valuations afforded to precious metals royalty companies (Sandstorm Gold, my favorite in that group, trades at about 15X sales — the others are generally more richly valued, topped by blue chip Franco-Nevada’s 27X sales), or even close that gap, but I’d stubbornly argue that they should. Potash and copper and iron ore are more important to the growth and development of the world than gold or silver. So I’ll keep waiting and nibbling a bit on Altius from time to time as my portfolio grows — it will probably be a drag on the portfolio overall unless we have another strong commodity pricing cycle, but such cycles do tend to come around every now and then.”

So what’s the take now, as we start the Annual Review for 2022?

The shares have risen 50% or so in those two years, as commodity prices have recovered and they grew the dividend a bit, and they’ve also done a little bit of buying back shares with some of their excess cash flow. Margins remain very high, as expected for a royalty business (that’s why you can pay 15-25X sales for some of these companies with a straight face, they are not generally nosebleed growth “story stocks,” but their cash operating margins are very high), and they have continued to feed their long-term growth potential by building more potential future royalties through their prospect generation portfolio.

That’s VERY long term in most cases, they’ve only really seen one prospect turn into a meaningful operating mine and begin to pay royalties in the last ten years, but the cost and risk of development is generally all pushed off to their partners, so they can afford to be patient. Altius retains that potential top-line growth if and when discoveries and staked properties turn into actual mines, and their partners do make progress from time to time in drilling and mine development, so I imagine some of them will become cash flowing royalties to supplement they many royalty streams they’ve bought for cash, eventually.

The stock is more appealing when it gets genuinely cheap, like when it was trading below what I’ve carried as a “buy below” level of $10 for much of the past couple years, we should not fool ourselves into believing that they’re suddenly going to report massive growth… but it’s also true that it has become a meaningfully better company as it has grown — more diversified, with stronger cash flow and earnings, though still, of course, subject to the vicissitudes of shifting commodity prices in any given year. As more of their revenue comes from royalties and less from milestone payments and equity gains from their junior mining portfolio, and as their troubled coal royalties in Alberta shrink in significance as the rest of the portfolio grows, with little bits of “clean energy” and “battery metals” exposure sneaking in gradually, probably the cash flow will be steadier in the future. And hopefully they’ll be able to continue to reinvest that cash flow into new royalties to compound that cash flow and build the business, as various commodities hit “down” cycles and present them with buying opportunities… we’ll see.

The EBITDA number for Altius has grown a bit more meaningful as their royalty portfolio has gotten steadier, as well, and that’s also at a new record of $68 million for the trailing year — so the EV/EBITDA ratio has dropped to pretty much an all-time low at about 10X lately. That makes it still a decent value in the mining royalty space, with the lower-cost gold royalty companies trading at EV/EBITDA ratios of about 13X lately (Sandstorm Gold (SAND) and Royal Gold (RGLD), both of which I also own), and with industry leader Franco-Nevada (FNV) at 23X (down from 60X) and Altius’ closest peer, Anglo Pacific (APF.L, APY.TO, AGPIF), way up at 27X.

If you want some patient commodity exposure, Altius is still my favorite place to get it, and it’s still pretty reasonably valued given the recent strength in their most important commodities — though on some other metrics it is more expensive than up-and-coming royalty peer Anglo Pacific, which has greater appeal with some investors because it offers both a much higher dividend and a more assertive shift to focusing on “battery metals” in its portfolio, but did see its earnings reset considerably when they made that shift last year (it used to be pretty consistently the cheapest royalty name, mostly because it was overwhelmingly dependent on its coal royalty in Australia).

I typically use cash flow from operations as my metric for royalty companies, since things like depreciation and complicated structures of pass-through entities mean that sometimes the top and bottom lines on the income statement are not as clear as the cash flow. For the gold names, I have generally been comfortable going up to 20X operating cash flow, since those companies have historically traded at a premium to base metal companies… for Altius or Anglo Pacific, which have exposure to less-sexy commodities, it’s generally been best to use a lower multiple.

The easiest number to use is the P/CFO multiple, share price divided by cash flow from operations per share, and on that front Altius has essentially caught up with the lower-profile gold royalty companies I own, trading right in the range of 15X… but it’s also the one that has grown the most dramatically on that metric, since it really became a steady cash flowing company in just the past five years. Here’s that in a chart form going back just three years, since that’s a fairer comparison (otherwise Altius shows something like a 1,500% gain, since they were starting at just a couple cents per share in 2016) — that’s RGLD, SAND and FNV all chugging along with similar growth in cash flow from their relatively mature portfolios of (mostly) gold mining royalties, and Altius Minerals in purple with dramatic growth (in case you’re curious, gold has risen about 40% during those three years, and copper, Altius’ most important commodity, is up about 50%):

What will the future hold for Altius? Well, as soon as you tell me what copper, iron ore and potash prices are going to be, I’ll tell you. I assume they’ll be higher a decade from now, particularly copper as electrification and clean energy drive much higher demand for stronger grids and electric cars, and potash as the world continues to generate more mouths to feed, and commodities generally rise with inflation… but commodity pricing also often goes through volatile cycles, and it’s definitely possible that they’ll fall 70% first, they certainly have before.

Since Altius has been growing up a bit, with more consistent and diversified royalty streams, and still with potential growth in the decades to come, I’ll up my buy price a bit. For now, I’ll say that the improved portfolio at Altius is worth 15X cash flow — that gives them enough flexibility to service their debt and reinvest in growth and grow the dividend or buy back more shares, and the stock is also beginning to show up on “normal” financial screens as being about as cheap as it has ever been, with a trailing PE of about 15 (some of that is one-time earnings — the forward PE estimate is 25, also low for a mining royalty company). Analyst forecasts for 2022 are roughly in line with what they did in 2021, but one risk is that those same analysts see the numbers declining a bit in future years, presumably because they expect softer commodities prices, but I think we all probably know better than to try to predict what copper and potash prices will be in 2024. Right now, the CFO per share is C$1.07, so that would mean a “buy below” level of about C$16 (US$12.75), so it’s pretty close to buyable these days. I’d still hold out for a more obvious bargain if you’re making big buys, 10-12X CFO would inspire more confidence in the short term (roughly C$11-13, so below US$10.50), but if the solid commodity prices of recent years stay with us we may not see those lower levels anytime soon.

And if you’re looking for a reason to push those numbers a little bit higher, given the strength in iron ore prices and other commodities in just the past few months, then I should note that this CFO number doesn’t include the fourth quarter yet — Altius has released just the top line numbers, not their final 2021 financials, so it’s likely that CFO number will rise to at least $1.10-1.12 or so, probably driving that “max buy” number up to C$16.80 or so (US$13.35). Of course, there’s also a fair amount of soothsaying about China’s real estate crackdown leading to a lower demand for iron ore (since a lot of steel has been going to build those speculative skyscrapers), so we might be near a peak in that particular commodity. The people who are selling usually have just as good a reason as the people who are buying, at least in the short term, and sometimes they’re right.

Altius shares have risen 10-15% since I wrote those words about three weeks ago, so they’re a bit above the top of my “buy” range at the moment, but my opinion hasn’t changed.

What else? After hinting at Altius, Dan teases this:

“There’s a spinoff company that’s a play on renewables with the same world class management. It’s something you’re crazy not to own today. I don’t care a whit what you think about green energy, climate change, or any of that, personally. A lot of smart folks are saying that the shift to renewables is going to be THE biggest factor driving the next commodity supercycle. Because governments are pouring billions… potentially trillions… into it. So that’s another no-brainer that gets you a whole different set of hard assets with massive tailwinds.”

So that’s pretty easy, here he’s pitching Altius Renewable Royalties (ARR.TO, ATRWF), which is still controlled by Altius Minerals but was spun out last year to help them raise more capital to build this portfolio — which has as its genesis the strategy that Altius wants to put its cash flow from its coal royalties into building something more sustainable. They have $50 million in cash and about $100 million in investments made so far, and a big partnership with Apollo Global Management that has helped them scale up quickly, so it’s not exactly cheap at $215 million, given the youth of the portfolio, but it’s probably not very well known yet, since most of their assets aren’t yet generating revenue, so it might be worth owning to see what this management team can build.

So far, they’re mostly financing the construction of wind farms and solar farms by buying a “royalty” — a share of the energy those farms will produce over their lives. I don’t know how long it will take Altius Renewable Royalties to really scale up, but it could certainly attract investor attention if they do — they’ll start to have meaningful cash flow over the next year or so as more projects go online, they expect to be “cashflow positive” in 2022 and to grow their cash flow at 25% a year, but it’s early days still. So far they’ve just got the first few windmills and solar installations producing electricity (and cash, most of the royalties are top-line revenue shares on the power sold, in the range of 1-3%), and a bunch of projects under development.

Their investor presentation is here if you’d like to get an overview — I’m happy with my large Altius position giving me exposure here, Altius Minerals still owns 59% of Altius Renewable Royalties so I don’t feel the need to overdo it (Altius Minerals is still quite small, with a market cap of US$600 million or so, so that exposure to $100+ million of value in Altius Renewable Royalties is quite meaningful on the asset side, if not yet on the cash flow side). Perhaps I’ll change my mind in the future. If you think that renewables will be a hot item in the next few years, as seems likely, there’s certainly plenty of room for this stock to soar if it gets a lot of attention — if only because it’s quite small and pretty thinly traded (since Altius and some other large institutions own most of the shares).

What else?

One more specific company is teased with some detail, further along in the “interview”…

“It’s not a commodity company of any kind. It actually involves insurance

“Insurance is an evergreen business. It’s not something you let go of in a recession. It has enormous pricing power – something we talked about. And even though insurance is a financial product, what is it really about? It’s about real estate. It’s about cars and boats. It’s about factories and power plants. You insure real physical assets.

“And when the value of those assets goes up, guess what also goes up? The premiums.

“So this business is like a royalty on the growth of hard assets, which is all but inevitable in the coming years. It’s the world’s most capital efficient way to play the hard asset boom. I’m incredibly bullish. I’ve gone on record saying I think the potential upside is around 1,500%.”

There’s no way to be 100% certain of a match with those limited clues, but I’ll go out on a limb and say that Dan Ferris might be teasing Brown & Brown (BRO) here — it could be almost any company that sells insurance to businesses, either actual insurers (underwriters) or brokers and agents like Brown & Brown, but the brokers are more of a real “royalty” on the rising price of insurance and the rising cost of insured property. The actual underwriters, the insurance companies, see their liabilities rise almost as quickly as those higher rates (inflation doesn’t just mean that more people have to buy more insurance to protect more valuable assets… it also means that in the event of a claim, replacing that asset is more expensive). To oversimplify: The insurance agent benefits from rising prices, because they live off commission… but they don’t face the cost of rising claims, because they really only participate on the front end (that’s not entirely true, but close enough).

And what ticks me over into calling out BRO here? Dan Ferris did indeed “go on the record” as saying the upside is “around 1,500%” — he actually used 1,550%, but when he teased BRO as an Extreme Value stock back in August of 2020, that number made it into the headline of my article about his pitch.

I’ve written a lot about BRO in the past 18 months or so since I first bought shares, just a couple months before Ferris first teased the stock, and it has worked its way up to be one of my larger holdings. It’s a hair above my “buy below” price these days, but not so much that I’d choke if you suggested you wanted to buy shares… it’s a great company, run by a third generation of Browns, with a long history of compounding value by reinvesting their free cash flow into buying more agencies and related businesses. It’s a fairly simple business of mostly selling insurance to both businesses and households, and it’s still almost entirely a US company, so it’s a bit easier to understand and smaller than the other large brokerage companies like Marsh and McLennan (MMC), Willis Towers Watson (WLTW), A.J. Gallagher (AJG) or AON (AON) — and by my measure, it’s also growing faster and is more appealingly valued right now than those companies.

Is this really Ferris’ pick for that top ten list? Can’t say for sure, but I agree that insurance brokers are generally a good play on rising insurance prices, which we’ve seen for a couple years now and may see more of if inflation stays high, and Brown & Brown is my favorite in the space.

And after that, I’m sad to say, it’s mostly guessing… but indulge me for a moment, and maybe we’ll come up with something interesting.

Dan shares some generic optimism for the energy sector…

“I think the opportunity in those sectors is off the charts right now. You’ve seen where energy prices are going. We’re nowhere near replacing hydrocarbons with renewables. The world absolutely must energy, period. That sector is way too cheap. But like everything else I’ve talked about, there’s a better way to play it. A play that’s levered to energy prices.”

He doesn’t get into any more detail than that, it could be anything from a pipeline company to a oil services provider to a oil & gas royalty company, no real hints. I’ll throw out Freehold Royalties (FRU.TO, FRHLF) as one possibility, just because it’s a not-very-well-known oil royalty company and it hasn’t recovered as much as some of the other oil royalty companies in recent years, but I don’t know it particularly well — their recent investor presentation is here, if you’re interested in digging deeper. And there’s always Texas Pacific Land (TPL), the big royalty owner in the Permian Basin, that’s more well-known and is often adored by value investors.

My guess would be that Ferris is probably picking one of the smaller oil services companies that’s levered to rising capital investment in the oil patch, there are often cheap stocks in that sector, but that’s just a guess. No other clues, and I don’t really own anything in this space at the moment.

He goes on…

“There are some great businesses out there with a certain amount of pricing power. But if your product isn’t a necessity, good luck when people are hurting financially. If your product keeps the lights on, or food in people’s bellies, or it’s the physical infrastructure of our world that we need to live and work – and you can raise prices? That’s who’s gonna win.”

So it’s not just commodity prices he likes, he sees some stability in hard assets, perhaps those that have some scarcity or other embedded value (brands? Customer relationships?) and can generate pricing power — do we get any other hints?

“There are actually four stocks in the portfolio that are plays on infrastructure. They have market leading competitive positions. They’re essential to housing, road construction, waterworks, Internet buildout – everything you’ve been hearing about in the news. And they own in many cases incredibly valuable facilities and equipment that’s not easy to make or replace… and significant real estate portfolios as well.

“One of them is a company you’ve heard of but I bet you’ve never thought about buying. I was recently thinking about putting together a portfolio with just four stocks – a so-called Coffee Can portfolio of stocks you can essentially stash away and hold forever, but the rule was four stocks maximum. And this was one of them. It’s what I call ‘a World Dominator.’ It’s raised its dividend in 31 of the last 33 years.”

And he leaves us frustratingly without many more hints on those four infrastructure-related plays… thisis what we get…

“They’re critical, direct links in the infrastructure chain.

“Without them, roads don’t get built.

“Power doesn’t get delivered to houses. Water and sewer systems don’t get maintained.

“Internet, including 5G wireless, doesn’t get built out into communities across America.

“Those are pipelines that are not going to get shut off in the next crisis. In fact, the opposite is true. The government is pouring trillions into infrastructure. In part because we need it, badly. But also in part because it’s a big, obvious place the government can spend to prop up the economy.

“That’s likely going to increase, not decrease, in the coming years.

“And these companies own a lot of very valuable assets – factories… real estate… construction equipment. Assets that provide big time protection for the share price, because they don’t just evaporate in tough times, like the financially engineered so-called profits of a lot of companies.”

So, we’re not going to have enough detail to be certain about those names, but let’s throw out some guesses for you to ponder in those categories.

There are lots of companies that build roads, but one smallish pure play that might interest Ferris and is pretty reasonably valued is Construction Partners (ROAD), which has built a vertically integrated business that leads in a lot of markets in the Southeastern US, and is growing into its valuation pretty quickly as it makes bolt-on acquisitions that aren’t really reflected in the numbers yet… and one we know that he has probably recommended in the past is MasTec (MTZ), which is a larger construction company with an infrastructure focus. Those are possibilities, with Construction Partners the most directly linked to “road building” of any of the smaller infrastructure plays I’m aware of, and I suppose the Motley Fool’s pitch of Smith-Midland (SMID) might slot in there as well, though that’s a much smaller and more competitive business in concrete, particularly leasing Jersey barriers for road construction projects. Those will all benefit from the recent infrastructure bill’s bump-up in highway spending over the next five years, and those stocks all also probably overreacted on the high side to that spending bill… but have come back down a bit to look more appealing here.

And you could probably throw in some of the materials companies as well, since those assets are tough to replicate and tend to be local monopolies… maybe starting with Martin Marietta Materials (MLM), which Ferris’ colleague Steve Sjuggerud pitched last year, or Cemex (CX) or Vulcan Materials (VMC)… none of those are particularly small or unknown, however, and they tend to be among the first “go to” stocks Wall Street jumps on when there’s infrastructure spending afoot, so they’re not exactly cheap at the moment.

Power getting delivered to houses? I doubt Ferris is recommending an actual electrical utility here, those tend to be quite expensive and boring and not really in his wheelhouse. Maybe a company that makes or distributes electrical equipment? On the small side I might throw out Atkore (ATKR), which makes the conduit that electrical wires run through… or WESCO (WCC), which is a big distributor of electrical infrastructure equipment.

Atkore is actually unusually inexpensive, with very strong growth thanks partly to the surge in homebuilding, so they trade at only about 8X earnings, with very high returns on equity and assets and a manageable level of debt. That one jumps out at me a bit, though I haven’t dug deep enough to really look for skeletons.

And WESCO I already own, it’s a little larger and is a much lower-margin business, since they’re a distributor, and carry more debt, but they’re absorbing an appealing acquisition and are well-suited to supply wire and everything else that’s needed for communication and electrical infrastructure projects, everything from new power lines to new data centers.

We could maybe throw in MYR Group (MYRG) as well, that’s a construction company which specializes in electrical projects — they do big industrial projects as well, but the focus is things like transmission lines and electrical substations. Engineering and construction companies are often pretty cheap, partly because the business is volatile and goes through big swings, and MYRG is not currently all that cheap (about 15X free cash flow, it has mostly bottomed out around 10X in the past) — but it is probably reasonably valued, given the surge in spending that the electric grid is likely to see over the next five years.

No real idea whether Ferris is really interested in any of those, but they should do well as spending on electrical and communications infrastructure grow, and at first glance they look pretty reasonably valued. Think of them as guesses to start your thinking, there are a lot of companies in these businesses, many of them quite small.

Water? Among the somewhat lesser-known names that might tempt a value guy we might see Advanced Drainage Systems (WMS), Gorman-Rupp (GRC), or Mueller Water (MWA)… and there are a dozen or so water utilities that are publicly traded, the biggest of which (at least in the US) is American Water Works (AWK), though again, it’s hard to see Ferris getting super excited about a regulated utility (though the downside is limited, with the government typically guaranteeing a pretty good return on the capital those companies invest in their systems). You could also throw in big construction companies that sometimes do water projects, like Jacobs Engineering (J) or AECOM (ACM).

None of those jump out at me enough that I’d want to hazard a guess on what Ferris is picking in that water theme, there are a bunch of water ETFs if you’d like to browse around the industry (Invesco Global Water (PIO), First Trust Water (FIW), Invesco Water Resources (PHO) are a few of them — PIO has underperformed over the past decade, given its global bent in an era of US-led growth, but FIW has done better than the S&P 500, for whatever that’s worth).

****

So what do we end up with? Four pretty solid matches out of the teased 10-stock inflation protection portfolio in Sprott (SII), Altius Minerals (ALS.TO, ATUSF), Altius Renewable Royalties (ARR.TO, ATRWF), and Brown & Brown (BRO), three that are certain matches and one (BRO) that is a reasonable match, and a stock I know Ferris has liked in the past.

And some ideas that we’d have to call pretty wild guesses for the infrastructure-related ideas that include Construction Partners (ROAD), Smith-Midland (SMID), MasTec (MTZ), Atkore (ATKR), WESCO (WCC) and MYR Group (MYRG). Along with some energy and water names that are even wilder guesses than those, so I won’t reinforce them here by mentioning them again.

So no, we’re not getting to the full 10-stock list, he didn’t drop enough hints for that… but four plus some guesses ain’t so bad, and there are some interesting ideas in there. Among those guesses I own WCC, and if you forced me to pick the others I’m initially most tempted by, those would be ROAD, ATKR and MYRG.

What we haven’t done is go to very small cap or really deep value ideas in many cases, though some of those are certainly relatively undervalued… and we also haven’t really addressed the “emerging markets will outgrow the US” theme with any of these ideas, but that’s what I can come up with for you, given the clues and themes Ferris shared in his ad.

If you have some stocks you think are a better match for the rest of that portfolio, or other ideas for how you think we can protect our portfolios against inflation, we’re all ears — just use the happy little comment box below. Thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of WESCO, Smith-Midland, Altius Minerals, and Brown & Brown. I will not trade in any covered stock for at least three days following publication, per Stock Gumshoe’s trading rules.

Ferris’s picks: ARR.TO, SII, ALS.TO, BRO, WM, BAH, ADP, ORLY, PHYS.TO, PSLV. He also likes COST