Dan Ferris at Stansberry is pitching his “entry level” newsletter, The Ferris Report ($49/yr) by talking up what he calls the “Green Scare” — which is basically a spiel about how “climate alarmism” is being used by the government to “stretch its tentacles ever further into your home,” a new version of the “Red Scare” McCarthyism that provided us with the 1950s and 60s version of “cancel culture”… and that leads to teasing a few investment ideas that he thinks will protect you and let you profit from that “scare” — here’s a bit from his ad letter:

“… over the years, investors could also have done exceedingly well simply by taking the opposite side of political promises….

“… by using the Green Scare for their own selfish purposes, politicians have simultaneously created perhaps the biggest – and most inevitable – investment opportunity I have ever seen… by accident….

“I believe this opportunity they’ve created for you could jump 800%… 900%… or higher from here over the coming years.

“That’s simply because, the last time a similar situation occurred, this company jumped 1,214%.”

This is not new thinking from Ferris, he has pretty consistently been on the libertarian side of things and pushed against all things government… his stuff will probably make you mad and cringe a little if you’re a fan of either political party, he calls out a bunch of “scares” and hypocrisy coming from either side of the aisle in Congress, even if his marketing, like that of most newsletters, tends to appeal more to the government skeptics on the right than on the left (the right is generally where the money is, after all, newsletters have historically been marketed primarily to affluent men aged 50+, which is also the most reliably Republican-voting demographic). Suffice to say that Ferris’ headline is, “All Along, the U.S. Government’s Real War Has Been on YOU.”

But we’ll do you the favor of quickly skipping over all of that — if you want to be angry about the government’s COVID response, or the “wars” on drugs, terror, climate change, or whatever else, that’s your call… but we’re going to bump ahead to the “what to invest in” bit.

The backdrop here is that society is dependent on energy, of course, and the vast majority of that energy still comes — and will come, for a long time — from burning fossil fuels. Here’s how Ferris puts that:

“This drastic improvement in our quality of life grows hand-in-hand with the proliferation of cheap, efficient energy.

“What’s more…

“Without fossil fuels, we wouldn’t have cement, steel, plastic, or ammonia… the critical elements that build our cities, transportation systems, products, food supplies – and really, our entire standard of living.

“Yet a lot of our society forgets this… or never knew it to begin with.

“They flick a switch, and their kitchen light comes on… They swipe a credit card, and their money moves… They tap their phone, and an Uber pulls up outside their door….

“With such a lack of understanding of how the world and politicians actually work…

“You can be fearmongered, very easily, into acting against your own best interest… tricked into supporting self-harming energy policies… or rabble-roused into handing over your personal freedom.

“So, I urge you to be a rational student of history here… protect yourself from the alarmism…

“And try to get rich during the Green Scare.”

So that’s where we come in — how is it that we’ll get rich? More from the ad:

“I want to key you in on a clear-cut investing opportunity that’s just emerged.

“In fact, the more I investigate one company in particular, the more convinced I become…

Which is why I’ve started calling this company ‘The Linchpin.’

“I’d go as far as to say, if you miss out on this, you are going to regret it for the rest of your life.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“The fabric of reality can only be twisted for so long before it snaps back dramatically.

“And the way I see it, either the price of this company goes up or the lights go out.

“So, I urge you not to let this opportunity I’m handing you slip through your fingers. It might be the last situation like this, on this scale, that you ever see.”

What else does he tell us about this “Linchpin” company? Other than the fact that it’s the same one he referenced at the top with that “1,214%” gain during the “last time” this happened?

He name drops a few of the folks who have invested in this stock:

“This Company’s List of Investors Reads Like a ‘Mount Rushmore’ of the Best-Ever Investing Minds….

“… some of the greatest investors of all time just bought shares in “The Linchpin.”

“And these guys aren’t evil Bond villains who want to destroy the environment. The opposite. They are sharp, rational people who know how to seize a massive investing opportunity when it presents itself.

“Take Paul Tudor Jones…

“Apart from being so immune to fear that he was able to bank $100 million during the “Black Monday” hysteria of 1987, this wily billionaire is also an environmental conservationist….”

And he says Jim Simon and Ray Dalio have bought in, too, as has Larry Fink — though Jim Simon is a quant who uses math to trade positions, and Larry Fink primarily oversees a universe of index funds at Blackrock and isn’t making a lot of individual company judgements. Ferris knows all this, of course, but still implies that Fink “bought over $4 billion of ‘The Linchpin,'” despite the fact that he has also been outspoken about climate issues, and angered lots of folks by pushing “ESG” investing priorities through Blackrock…. which gives the reader the feeling that Fink is being a hypocrite just because this “Linchpin” stock is so compelling, and therefore entices us even more.

More from Ferris:

“When it comes to billionaire investors, don’t listen to what they say… watch what they do with their money, instead…

“Because if there’s one thing Fink knows how to do, it’s make money.

“All right, I don’t want to go on and on.

“Just keep in mind, these guys are modern-day investing legends.

“Brilliant, rational – and mega-wealthy – people. And when it comes to investing, they are who you should aim to rub shoulders with.”

So what on earth is this “Linchpin” that apparently every smart investor is buying? We finally get into some more clues…

“How to Profit From America’s Green Scare….

“What material is in all the following items:

“Wind turbines, power grids, solar panels, electric vehicles, and batteries?

“It’s not lithium.

“It’s not silicon.

“And it’s not even silver.

“But without this one material, none of the promises made to save us during this Green Scare can even begin.

“As you probably guessed…

“All these items use ‘the metal of electrification’: Copper.”

So that’s the “linchpin” investing idea: Buy copper. Ferris is certain that the price of copper will surge…

“Copper Stands at the Epicenter of Humanity’s Next Big Chapter

“Meaning its price is right on the verge of a ‘generational shift’ upward…

“Whether politicians like it or not.

“Saxo Bank Head of Commodity Strategy Ole Hansen said copper will undoubtedly benefit from the ‘enormous political capital’ invested in achieving the green transformation.

“The Wall Street Journal believes this shortage threatens politicians’ much-hyped green transition…”

So this “get rich” idea is to buy into something copper related, because the “Green Scare” is going to cause demand for copper to go bonkers:

“Remember, the Inflation Reduction Act promised to tackle the climate crisis using solar panels, wind turbines, and electric vehicles.

“It also promised:

‘the largest federal investments ever in upgrading the power grid, (…) and installing a nationwide EV charging network.’

“But when I read this, you know what I hear?

“Copper, copper… and more copper.

“See, solar and wind-power technology is absurdly metals-intensive…

“Up to 37 times more copper intensive, actually.

“Or take electric vehicles…

“Joe Biden wants half of all cars sold in 2030 to be electric.

“And EVs use up to 4 TIMES more copper than internal combustion engines.”

This is not new, either — newsletters and pundits have talked up copper many times in the past 25 years — first it was a play on emerging markets, as China in particular modernized and began to consumer dramatic amounts of copper in the early 2000s, then about a decade ago when the first enthusiasm for “electrification” took hold as the first mass market electric car caught our attention. The Tesla Model S started ramping up sales from 2012-2014, and the projections for electric cars were crazily optimistic at the time, driving some interest in lithium miners, in particular, but also leaking over into the much larger copper market.

There’s a pretty clear logic to the “we’re going to need more copper” argument, and prices have failed to get high enough to inspire any really aggressive mining expansion or exploration work, so it might well be that we’ll see a surge of copper prices over the coming decade or so as the demand growth really materializes… but getting the timing right is not exactly easy in the commodities space.

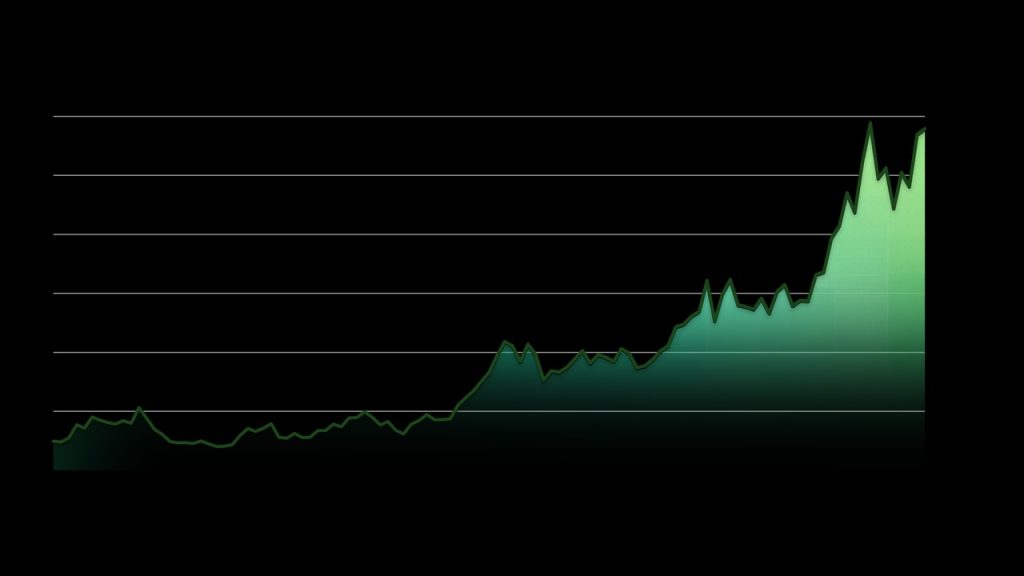

Here’s what the price of copper has looked like over the past 35 years or so… the emergence of China as an economic force from 2003-2007 or so has been by far the most important driver of copper prices (and of many other commodities)…

And while it only becomes really clear when you look at shorter periods of time, part of what is striking is how much copper mimics the moves of the global stock market and serves as a signal of GDP growth — this is why folks often refer to “Dr. Copper”, calling it the only metal that has a “doctorate in economics”… here’s the chart of copper (blue) vs. the S&P 500 (green) over the past five years:

(both charts are from TradingEconomics)

Here’s how Ferris describes the current situation:

“Over the past 11,000 years, all the copper ever mined in history comes to about 700 million metric tons. That’s about three and a half million Statues of Liberty all standing in a line.

“But today – because of the skyrocketing demand – the world needs to mine another 700 million metric tons all over again…

“But instead of having 11,000 years to do it, it has just twenty-two!

“It’s hard to even get your head around the immensity of the task at hand….

“A supercycle is a sustained spell of abnormally strong demand growth that producers struggle to match, sparking a rally in prices that can last years or, in some cases, a decade or more.

“Since 1899, there have only been four distinct supercycles. And they are a dream come true for anyone who is in the right place at the right time…

“Like you are, right now.

“The last time a copper supercycle took place, ‘The Linchpin’ surged 1,214%.”

What else does he say about this “Linchpin?” A few other clues…

“‘The Linchpin’ can produce copper for decades to come without making new discoveries, keeping it far ahead of the competition.

“Very exciting.

“This company’s financial performance is impressive… as is its unusually strong balance sheet.

“Take it from me: That is not common in this industry.

“Put simply…

“This well-respected company can give you exposure to a low-risk, high-quality mining stock as the whole world begins its copper bidding frenzy.”

I’ll agree with that “this is not common” statement — the global mining industry is generally a consumer of capital, not a generator. Mining is dirty, expensive, difficult, and often highly regulated, and no matter how much you spend to build a great mine, you don’t get to decide what price to charge for your product — the curse of the commodity producer.

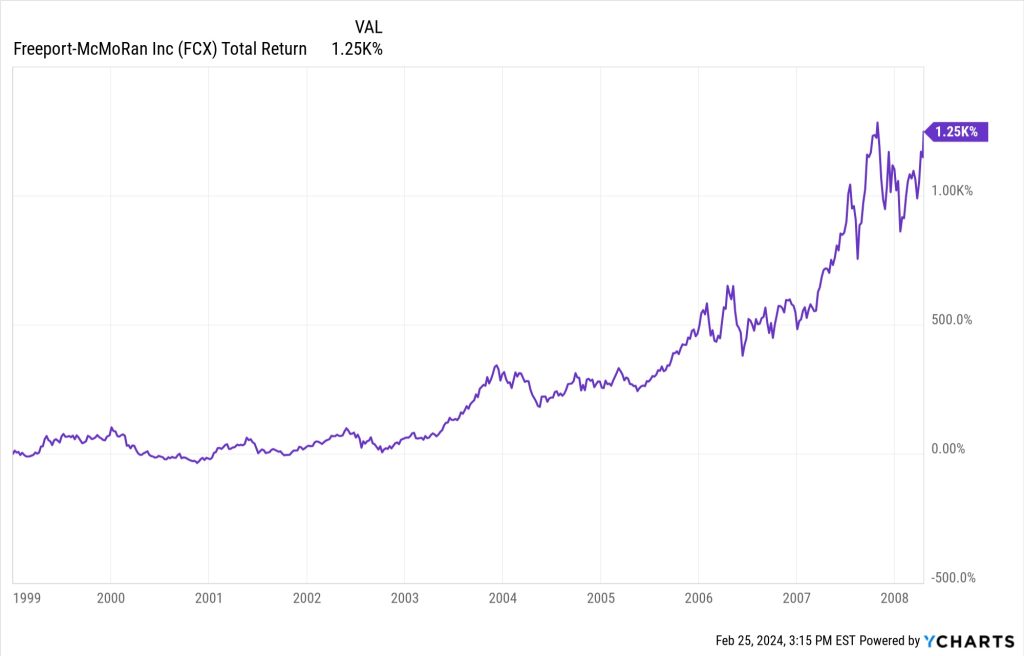

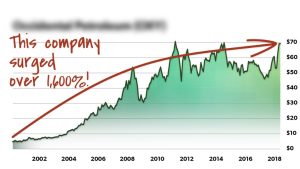

What Ferris doesn’t do, though, is drop many other clues… so we can be thankful that he at least shows a chart of that 1,214% gain from the last “supercycle” for this “Linchpin” stock, so we can match that to our answer… here’s the one he shows:

And here’s the total return chart for that same time period, though not precise to the day since Ferris doesn’t get that detailed, of Freeport-McMoRan (FCX)

It’s true that most copper miners will have similar-looking charts… but that’s a very precise match, enough for me to be pretty sure that the Thinkolator’s answer is correct: Dan’s “Linchpin” stock is Freeport-McMoRan (FCX), which, far from being “secret,” is the largest copper miner in the world, and has usually been the go-to investment on Wall Street whenever big institutional investors get the “I wanna own copper” feeling. Or sometimes the second-largest, depending on where production comes in at Codelco (the state-owned miner in Chile).

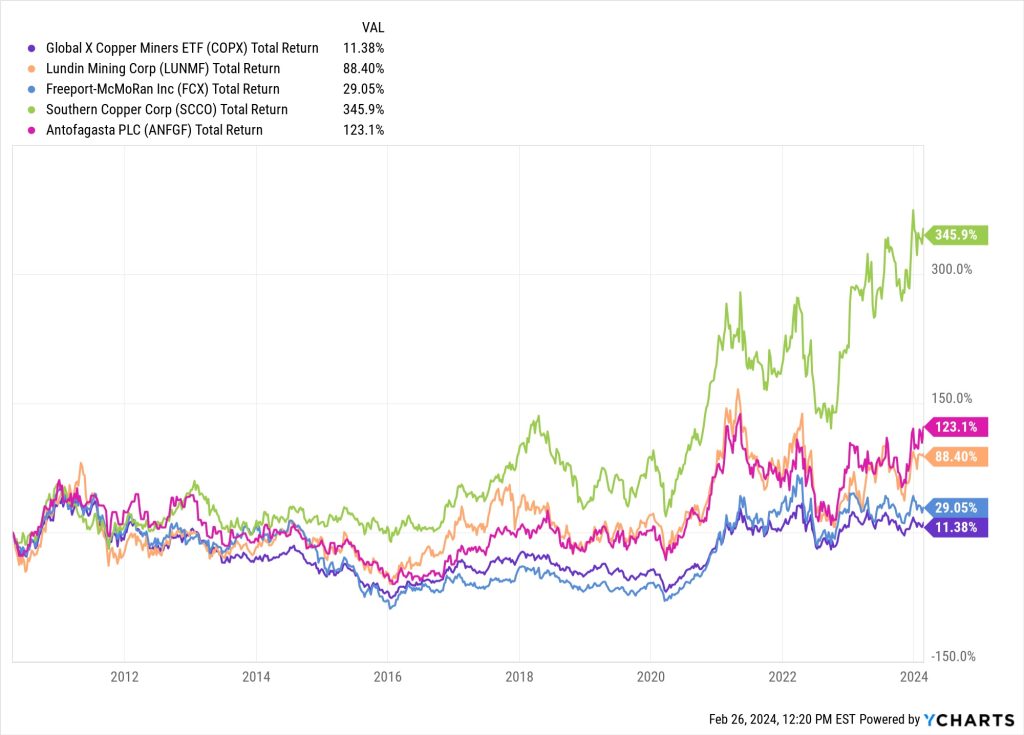

Freeport’s largest asset is their joint venture with the government of Indonesia to operate the Grasberg mine, which is, at least by some measures, the second-largest copper mine in the world (and, like many copper mines, also produces a lot of gold)… though they own and operate plenty of other mining assets as well. This is a huge company, with a market cap of about $50 billion, so FCX and Southern Copper (SCCO, about $60 billion) are the largest copper-dependent mining companies… though there are plenty of other large operators in this space, too, including Antofogasta (ANFGF) and Lundin Mining (LUN.TO, LUNMF), and some of the larger diversified miners like BHP (BHP), which owns Escondida, also get a meaningful amount of revenue from mining copper.

Most of the copper-focused miners trade at pretty similar valuations, at a quick glance, roughly 25-30X trailing earnings, and that’s well above the historical average valuation for mining companies… but that’s because these are mostly terrible companies, and you really only want to own them during times when there’s a favorable price cycle in the commodity they produce. Most forecasts are for rising copper prices, so valuations, at least on the superficial level of the PE ratio, are fairly high.

Will FCX soar higher? If gold and copper prices go up, almost definitely. If those prices fall, then probably not. Ferris is confident that copper is going into a supercycle thanks to rising demand for green energy and electrification, and that strikes me as a reasonable argument, but just know that because copper is a huge commodity that touches almost everything, it’s also generally very sensitive to falling economic growth… so if there’s some kind of global recession, copper prices will probably fall, even if demand for electric vehicles or new power grid investments remain fairly strong. Soft growth in China has arguably kept a lid on copper for the past few years, so that could change… but it could change for the worse as well as for the better. I’d put the probability of copper prices rising over the next decade at “pretty high”, but that’s no guarantee that copper will move in a straight line.

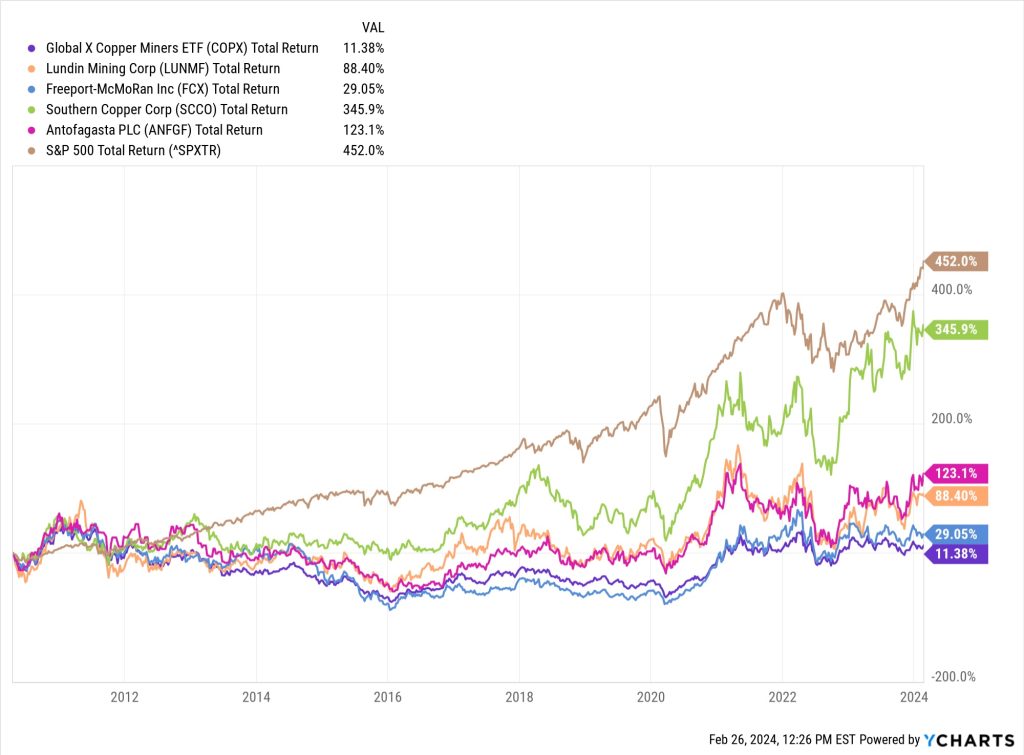

Will Freeport be the best copper miner to own over the next few years? Maybe, but it hasn’t been over the past decade — it has been above average for its sector, but only barely. This is the chart for FCX (blue), Lundin Mining (orange), Antofagasta (pink), and Southern Copper (green), compared to the biggest ETF in this space, the Global X Copper Miners ETF (COPX, purple), over the past dozen years:

To be fair, a lot of that relative weakness is because of some challenges Freeport-McMoran had with the Indonesian government in the 20-teens, which seems to have been settled and resolved — here’s what that same chart looks like over just the past three years:

But, just as a reminder, mining is a tough business, and it tends to stink as a long-term investment if you don’t figure out how to trade the cycles in prices well… here’s that longer-term chart with the addition of the S&P 500, in brown, which highlights how deeply negative the returns from many miners have been for long periods of time:

Doesn’t mean you shouldn’t buy mining companies, they can be great if you own them during times of rising commodity prices, and some people make lots of money from mining stocks… just know what you’re getting into. If commodity prices don’t do what you think they’ll do, you might be very disappointed.

If I were interested in getting more exposure to copper, I might well look at Freeport first, too… if only because it’s also got unusually meaningful exposure to gold, which can give them a little more stability than some big copper miners. I generally prefer royalty companies when investing in mining, and there aren’t any great copper-focused royalty companies at this point — though there are some small hopefuls in that area with some meaningful copper exposure, including EMX (EMX) and Metalla (MTA), and the royalty companies I do own shares of, including Altius Minerals (ALS.TO, ATUSF), Sandstorm Gold (SAND) and Royal Gold (RGLD) are also more reliant on copper than many folks might guess — SAND gets about 15-20% of its revenue from copper, RGLD about 10%, Altius about 25%.

Finally, just to square the circle here, I should note that Bridgewater (Ray Dalio), Tudor (Paul Tudor Jones), Blackrock (Larry Fink) and Renaissance (Jim Simons) have all owned shares of Freeport McMoran in the past, and some of them still do, but in no case does any of those major investors have even 1% of their portfolio in FCX shares or in any other specific copper investment. Those “managers” each typically report owning at least a few hundred positions with each of their quarterly portfolio updates, including the latest 13Fs that report their December 31, 2023 holdings.

And Ferris doubles down on the “profit from the green scare” stuff by betting on the fossil fuels industry, too… here’s how he teases that:

“Fossil fuels are the foundation of modern life.

“If copper is the backbone, fossil fuels are the lifeblood.

“It shouldn’t be controversial to say that. It’s physics. And yet, our own government is on a war path to end fossil fuels without having a dependable replacement.

“Aside from the 900,000 or so Americans working in the industry their public servants promise to kill, imagine you are CEO of one of these companies…

“With all the political promises to gut your industry, what do you do?

“Well, I can tell you. Because it’s already started.

“You quit making long-term investments.

“Because the capital spending of major oil companies has plummeted over the past 10 years…”

Continuing demand and lower investments in production should make for a pretty rosy picture for oil producers, one assumes, and I agree that it’s hard to imagine demand for oil and gas actually falling anytime soon, even with all the investments in electrification. Here’s how Ferris puts it:

“It’s worth noting that the average person in dozens of countries consumes less electricity in a year than the average American refrigerator.

“Do you think developing nations will sacrifice their own chance at prosperity because of a promise some Washington bureaucrat made to win an election? ….

“Scarce materials get expensive, fast. And along with copper, right now, fossil fuels represent the financial opportunity of a lifetime.

“As we speak, commodities such as copper, oil, and gasoline have never looked so favorable when compared to common stocks….

“I have another special report for you, featuring the names of my three favorite fossil fuel companies in the stock market.

“Obviously, we both know there are zero guarantees in investing, but let me just tell you, the moves upward during supercycles are dramatic.

“And the gains can be almost cartoonishly large.

“However, during the last run-up, one of these companies skyrocketed 1,600% between the turn of the millennium and 2018.”

Here’s the example stock chart he provides for one of those companies he likes:

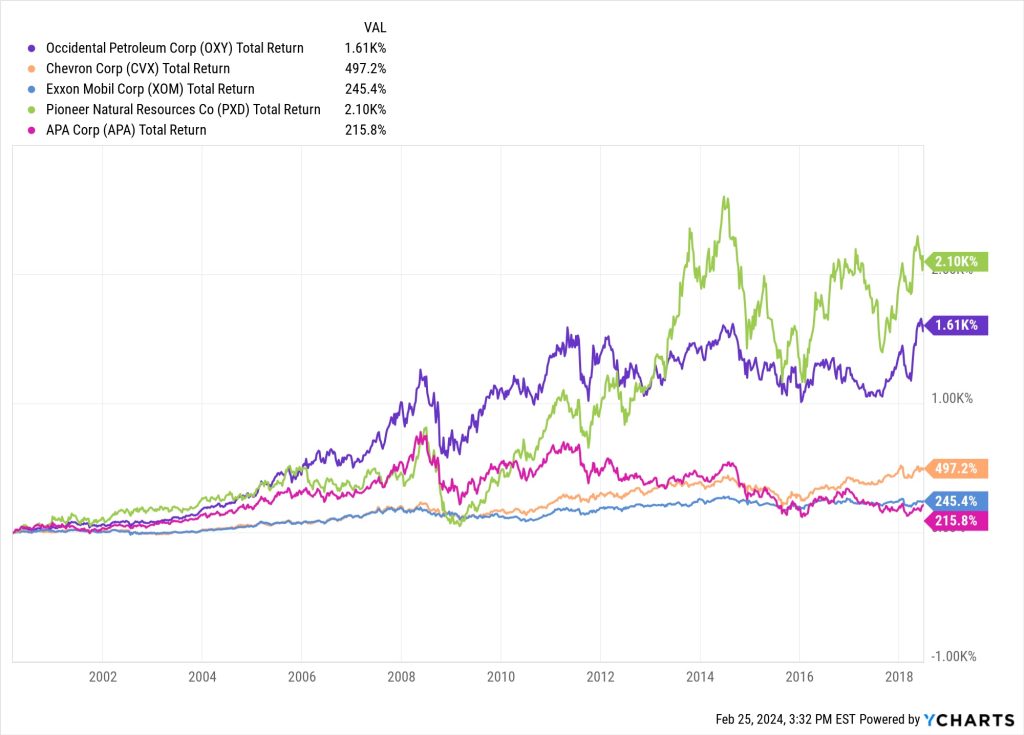

And here’s the chart for roughly that time period of Occidental Petroleum (OXY)…

So that’s a pretty clear indication that Occidental is at least one of the fossil fuel stocks Ferris is pitching here.

And while all oil companies tend to be driven by the same thing, since they all produce the same commodity, their charts are never exact matches — here are a few others, for comparison, so this is Chevron (CVX, orange), Exxon Mobil (XOM, blue), Apache parent APA Corp (APA, pink), and Pioneer Natural Resources (PXD, green), all compared to Occidental (OXY, purple):

Of course, it doesn’t hurt that our favorite nonagenarian investing legend, Warren Buffett, has been buying up OXY shares pretty much every month for several years now, and controls close to a third of the company at this point (Berkshire Hathaway also owns a lot of Chevron, incidentally — the two are Berkshire’s fifth and sixth largest equity investments, each roughly 5% of the portfolio that Buffett oversees).

What other oil stocks might Ferris like? No idea. He doesn’t drop any hints about the others. He might like stalwarts like ExxonMobil (XOM), growth stories like Hess (HES), or something smaller… though for the Ferris Report I’d guess that he mostly recommends very large name-brand companies (he saves the more obscure stuff for his pricer Extreme Value newsletter).

And this ad also promises two other special reports, both of which seem to be recycled from past “crisis” investments recommended by Steve Sjuggerud and David Eifrig at Stansberry…

“A Unique Way to Protect Your Wealth (The Government Doesn’t Even Have to Know About It).

“This report details a strategy long used by the world’s mega-wealthy to protect themselves. It may be the best way to legally get serious money outside of the U.S. dollar, which you don’t even have to report to the government.”

There’s no way to be certain about this, but the wording here is very similar to Sjuggerud’s past pitches for collectible gold coins, so that would be my best guess. His favorite has generally been the graded St. Gaudens $20 gold coins, which were the standard US gold coin before FDR’s gold seizure in the 1930s and remain beloved by collectors and quite common, which makes them pretty easy to buy or sell. Those coins contain about 0.9 ounces of gold, so they’re ‘backed’ by the gold price, but generally also earn a collectible premium during times of gold enthusiasm. And yes, they’re collectibles, so you don’t “report them” to the government, though you do, of course, owe capital gains taxes if you sell them at a profit in the future.

Again, that’s just a guess. And this is the other teased “special report” that Ferris throws in:

“The World’s Two Most Valuable Assets in a Time of Crisis

“It’s critical you learn about two assets that go up the most (with the least amount of risk) during a crisis. It’s not bonds, gold… or anything else like that. In fact, some even call it ‘gold with yield.’

“The first of these assets is up 1,900% over the long term, without a single down year in decades. And the second has consistently delivered returns of around 10% per year for the last 35 years.”

That first one is just “farmland”, as teased by other Stansberry folks from time to time over the past decade or two as a “never goes down” asset. The returns have been generally good and stable over the long term for farmland, but there aren’t any great publicly-traded investments that are direct plays on that, the two options are small and have been pretty mediocre investments, this is the 10-year performance of Gladstone Land (LAND, purple) and Farmland Partners (FPI, blue) compared to the S&P 500 (orange) — they both pay a dividend, roughly 2% for FPI and 4% for LAND, and in the past investors were well-advised to expect that to be their total annual return from these investments:

It might well be that the second tease there, “10% per year for the last 35 years,” is a reference to what has been a much more investor-friendly “farming” asset: Timberland. That’s roughly the return you would have gotten from owning one of the two major timber REITs, Rayonier (RYN) or Weyerhauser (WY) over the past 30+ years.

And that’s all anyone should have to read on a Monday, so we’ll leave it there — have any enthusiasm for investing in copper miners, oil companies, farmland or timber, or perhaps gold coins? Do let us know with a comment below…

P.S. I’ve written quite a lot about Dan Ferris’ Extreme Value over the years, but we haven’t covered his newer Ferris Report. and I’m sure readers are curious about it… so please, if you’ve subscribed to The Ferris Report, click here to visit our Reviews page and share your opinion with your fellow investors. Thanks!

Disclosure: Of the companies mentioned above, I own shares of Berkshire Hathaway, Altius Minerals, Sandstorm Gold and Royal Gold. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I went with Teck.

Also a pretty popular one among newsletter guys over the past couple years.

Current market conditions are sending contradictory signals, so I have added a dose of Ferris’ cynicism and recommendations to my portfolio. I, however, prefer an ETF (Blackrock) to individual commodity stocks. FCX was added to his portfolio last July, and CVX. OXY, and XOM were added last January. He did, however, reiterate the oil buys days ago.

Please adjust your charts for inflation. I can’t do that myself, but I’m pretty sure it can be done. I just checked the price of a postage stamp in 1970 ($0.06) with the current price ($0.68). That’s a 10 bagger! Most all the stocks featured here are recommended on a speculative basis. OK. Speculation equals gambling. What happened to fundamentals? Gambling requires constant attention in order to avoid losses. How about a low PE stock that pays a 5% dividend? Would that be attractive? FCX ain’t it kid.

I think the green energy stocks are going to stumble as more experts speak out about the amount of money these projects will cost. I like oil (and own oil stocks) but it looks to me like serious analysis points to natural gas, with nuclear a distant second.

If the bureaucracy – especially the dimwits in Europe and California – insist on expanding the electric grid the global cost will be in the trillions. That means a lot of copper, for one thing. Now if Sleepy Joe would only wake up to the low probability of converting to EVs in our lifetime . . .

Meanwhile Dubai is delving into natural gas exports.

Regarding timber, I have two timber properties, although I currently use one for hunting and fishing. Every month I get at least one offer from some dirtball offering me 65 cents on the dollar.

Speaking (or writing) of the Stansberry folks, the very next item in my inbox this evening was a pitch from Porter himself on his prediction of a looming AI Die-Up, being convinced that all the hot AI stocks will soon crash. Instead, he is pitching oil and LNG at current bargain prices. There is no “green scare” on his horizon, citing that at the current pace of the world countries’ action…as opposed to promises…to convert to renewables, we would not achieve 100% clean energy until the year 2207, almost 200 years from now. It looks like copper production would easily keep up with demand, a conclusion I came to recently and sold FCX . I also just sold my AI stuff and kept oil, so guess I’m sort of in Porter’s camp, even if I don’t like him.

I find it too easy to get sucked into projecting what will happen to the world on the macro level… and usually the fact that the narratives are too easy leads to jumping to the wrong conclusion about a complex economic future. Every time I have such thoughts, I try to bring it back to “why this company?”

I did cover Porter’s “A.I. Die Up” pitch last Fall, just FYI for anyone who didn’t see that, as well as his more recent “A.I. Keystone” pitch.

I had forgotten the pitch last fall, but after checking, I had dismissed his story out of hand at the time. He was a bit early on it, as my backchecking revealed the among two of the AI stocks I owned and/or followed, NVIDIA is up about 80% since then and SMCI more than 200%. Guess if Porter keeps at it, he may eventually get it right. As the late Alan Abelson was fond of writing, if you make a prediction, don’t give a date…and if you give a date, don’t make a prediction.

My two (maybe) three portfolio stalwarts i.e., energy ( oil) , minerals and collectables. In the 80s Doug Casey (Mr. Nugget) taught be a valuable lesson. He opined that over the entire stock market history the average stock price multiple at that time was a P.E of 12— and he claimed that was the limit of what he was willing to pay. Tough to do that today. But you can and normally those stocks pay a handsome dividend as well. No I’m not going to tell you what they are but Ferris has touched upon some. I’m going to give you some homework about the Mining Industry from one the Nations Genius’, Dr. Mark Mills, Manhattan Institute. https://docs.house.gov/meetings/IF/IF18/20211116/114231/HHRG-117-IF18-20211116-SD014.pdf.

After reading this can you tell what the price for carbon-base (proper term) fuels and copper will be it we continue on this Green Fraud Scam of EVs and Un-renewables.

If someone gets the right answer I’ll give you one of my stock selections.

I’m a novice at EFTs I buy mainly stocks under $30. I held 8 stocks for 3 weeks then sold them. I made just over $600. Would this be considered a good return? Is this day trading? Any insight is appreciated. Thanx

Whether it’s a great return depends on how much you put at risk to get the return, and what the percentage return was.

Being in and out of a position in three weeks is certainly “trading,” though most “day traders” are in and out more rapidly than that. Doesn’t matter what you call yourself, what matters is if you know what you’re doing, have some discipline that you’re following, and can repeat those good results over and over.

I can’t reliably trade like that in the short term, I prefer to look for companies that I’d like to own for decades and let the market give me opportunities to buy them at less than I think they’re worth. The more actively I trade, the more likely I am to get emotionally wrapped up in it and make a mistake.

But there are a million ways to invest in the market, there’s no one right way.

Thanx Travis. I haven’t got a lot of discretionary cash to use. I risked $3K for my $600. I have 4 sources for my recommendations and I check daily I get no fee transactions thru Fidelity because of a (401)K.