Today we take a gander at a pitch from Mark Skousen, who has been a newsletter guy for decades with his Forecasts & Strategies newsletter (he’s also an itinerant economics professor, and runs the big “freedomfest” conference in Las Vegas each year, among other things).

And the headline of his latest “presentation” pretty well sums up the tease:

“I Made Millions in Pre-IPO Private Placements…

And Now I’ve Discovered a Way for You to Do the Same — Without All the Risks.”

So… what is he talking about? Well, essentially he’s doing something similar to what other newsletters have done many times over the years — promising you a seat at the table when the deals get made that helped folks like Peter Thiel become billionaires…

“Now, for those of you who don’t know, private equity investing involves getting in on companies BEFORE they go public.

“And it is without question the single, fastest (and most reliable) way to get rich in America today.

“No doubt, you’ve seen some of the stories…

“Like Chris Sacca, who invested $26,000 in Twitter back in 2006 through the private equity markets… a full 7 years before it went public.

“Those shares made him a billionaire.

“Or look at Max Levchin. He made 174 times his money on Yelp. Every $10,000 he put in turned into $1.7 million.”

So how does an ordinary person do this? Well, Skousen dangles out the promise…

“I’ve found perhaps the greatest private equity investment of all time.

- And this time, you DON’T have to be rich to get in.

- You DON’T need to be an accredited investor…

- You DON’T need any special connections… (other than me, of course.)

- And best of all, you DON’T need to take the risks that I had to take to make big money.”

These kinds of ads try to gloss over the separation of “risk” and “reward,” as if it’s just a formality — but we, of course, know quite well that buying Facebook a year or two before it goes public is not the same thing as buying Facebook when you’re taking a risk on Mark Zuckerberg when he was still living in a Harvard dorm room. The earlier or smaller or more unusual the investment, the greater the reward potential… and the greater the risk of a 100% loss.

That’s why traditional venture capital inveseting is restricted to accredited investors and institutions — they often lose money, and regulators want to make sure that only people who can afford to lose, invest. Those rules are becoming looser all the time now, but they also exist for good reasons — it’s a lot easier to scam investors when they think they’re in on a secret deal and when they don’t have all the information available that a publicly traded company has to reveal. You can lose on anything, of course, from a game of blackjack to a venture capital investment to a conservative mutual fund, but investing is a game of probabilities and it’s important to think about those distinctions — those who don’t risk everything are generally not shooting for the most dramatic returns, and also stand a better chance of not losing everything.

But anyway, what is this secret “back door” investment? In Skousen’s words:

“I’ve found a powerful private equity investment that allows you to get in on multiple great private equity deals — all at once.

“And the performance has been out of this world.

“Over the last two years alone, for instance, they closed out 7 private equity deals.

“Every single one made money… with the smallest gain coming in at 210%.

“Others were much larger.

“They haven’t exited a single losing position during that time.

“And the amount this private equity investment has paid out to investors has never dropped – not once — in 10 years.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“It’s only grown higher and higher.

“This year it will be $148 million.”

So this is some sort of investment pool or fund, no? Indeed, the Thinkolator says this is another tease of Main Street Capital (MAIN), a Business Development Company (BDC).

And Mark Skousen is, at the very least, consistent — he has pitched Main Street Capital as his favorite income stock (or one of his favorites, at least) many, many times over the years — he has called it a number of things, from the “SS-4 Income Plan” to the “Super 7 Annuity”.

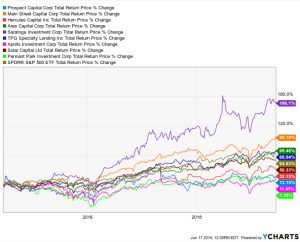

And he’s been right, so far. I’ve said nice things about MAIN over the years as I’ve covered it for Skousen teasers and other pitches, but I’ve never owned the stock — more’s the pity. It has indeed done better than the BDC Index and than almost any other BDC most of the time over the years, and the outperformance has really accelerated in the past two or three years. Here’s what the relative total return performance looks like since 2011 (when the UBS BDC ETN started trading):

Business Development Companies are primarily treated as income investments by individual investors, not so different from REITs or MLPs in that they get an advantage in the tax code — they distribute their earnings to shareholders in the form of dividends so that they don’t have to pay corporate taxes on that income. In this case, the motivation of the tax law is to provide financing for small business.

And that’s pretty much what MAIN does — here’s how they describe themselves:

“Main Street is a principal investment firm that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street’s portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides “one stop” financing alternatives within its lower middle market portfolio. Main Street’s lower middle market companies generally have annual revenues between $10 million and $150 million. Main Street’s middle market debt investments are made in businesses that are generally larger in size than its lower middle market portfolio companies.”

A lot of what they do is help family owned companies grow or transition ownership, like when a few executives might want to buy out a founder or a midsize industrial company might want to expand but isn’t big enough for Wall Street bond financing. These are private equity and debt deals, with equity more likely part of the financing for their smaller customers, but they are not the kind of “venture capital” private equity deals that make you daydream of instant billionaire status — most of these companies are not ever going to go public, let alone with a splashy IPO, and in the rare times that these kinds of companies do end up going public they’re not the kind of sexy growth stocks that rise 500% in six months.

Which doesn’t mean MAIN is a bad investment, just that your expectations should be in line with the business — they are bankers, really, they lend money to riskier but unglamorous smaller companies and get a pretty good return because of that, and since they pay a steady monthly dividend they are able to get pretty cheap equity and debt financing on Wall Street from investors like you and I. They also get access to federally-subsidized small business lending funds (many other BDCs get this same access), so they enjoy some cheap, long-term fixed-rate leverage from the government.

You can see MAIN’s most recent investor presentation here — they’ve done very well and have grown the dividend nicely over time, including with special dividends paid twice per year that boost the overall return (the monthly dividend has grown steadily, the semi-annual special dividend has recently shrunk). If they keep the special dividend steady for the next year, and maintain the monthly dividend, that would lead to income of $2.96 per share for current shareholders (20.5 cents per month regular dividend, 25 cent special dividend paid in June and December — the June one went ex-div today), and those are from real income… they have not paid “return of capital” dividends, so this cash comes from the loans and equity investments they make. So that’s roughly a 7.2% yield. Not bad.

Like most BDC’s, MAIN will probably see its returns (and share price) drop in a recession — some of their investee companies will presumably run into trouble during a slowing economy and have trouble paying their debt service or repaying loans, and the equity investments would probably lose money. Diversification across customers and sectors would help to reduce the impact, but that’s a risk you take.

But the real risk, I guess, is that the optimism has risen considerably over time — if you use MAIN’s own metrics, their calculation of Net Asset Value per share (NAV), then the company has gone from A NAV of about $21 in 2014 to a NAV of about $25 today… which is good growth, and is supported by the high dividend payouts they’ve been able to make, and the stock has shown a levered return relative to that NAV growth (the NAV has grown 20%, the stock has risen 30%). That doesn’t seem too dramatic, but it’s important to keep in mind that the NAV is what investors will probably look at as a “fundamental” value for the company if they hit hard times, when the NAV will also probably be falling, and the stock could at some point trade down to a substantial discount to NAV (the NAV per share at the bottom in 2009 was $12-13 per share, but the stock price bottomed out around $9).

If the company keeps doing things the right way, and manages through the next downturn well as they did in 2009 (though it took a few years to recover and grow), then that might not matter for the patient investor — but since you’re paying about a 60% premium over the NAV, it’s worth noting that there could be a long way down if sentiment shifts. The stock has enjoyed nice leverage since 2011 as the share price has outgrown the NAV, and sometimes that bites back on the downside.

But as for today, well, all I can say is that this would have been a good income investment to buy pretty much all the times that I wrote about it or Mark Skousen teased it from 2013 to 2016, and, at least compared to most other BDCs, it continues to look pretty impressive.

Here’s a chart of all the BDCs I came up with off the top of my head (I’m sure there are several others of interest) — it helps to illustrate both the long-term strength of MAIN, which has been the second best performer (after Saratoga Investment Corp, SAR) over the past five years, but also the downside. These companies have all paid similarly high dividend yields for years, most of them with growing dividends, and have been, at times, beloved by investors… but even with those large dividends, MAIN and SAR are the only two have have meaningfully outperformed the S&P 500.

So… is Main Street Capital going to continue to be better than most other BDCs over time? Do they deserve their current premium valuation? Does a 7% dividend interest you enough to pay a premium price to get it? Those are questions only you can answer… but do mind the fact that this is not going to be a “get rich quick” idea — it may well beat the market again, as it has for the past five years, and the returns can be strong when you let those dividends compound every month, but it’s not going to get you “I was an early Uber investor before anyone had ever heard of it” returns… think smaller.

From the very, very worst days when it traded at a 30% discount to NAV, MAIN returned almost 1,000% to investors over 10-1/2 years (966% total return from November of 2008 to today) — that’s far better than AINV or PSEC, for example, similar companies who had returns of 80-130% during that same timeframe, but MAIN starting today is not at all likely to do that again, not if you’re buying at a 60% premium to NAV. That doesn’t mean it will be bad, but it does mean that “double in five years” is a more rational goal than the “$25,000 to $500,000” private investment successes Skousen shares in his ad.

And that’s about all I’ve got to share with you on this one today — I know we’ve had some MAIN investors here in the past, and that many of you are very interested in dividends… especially monthly dividends… so please do let us know your thinking with a comment below. Thanks for reading!

P.S. We try to collect investor opinions about newsletters, it’s a way to let investors help each other to sift out the disappointments from the delights — if you’ve ever subscribed to Forecasts and Strategies, please click here to share your experience and opinion with the group. Thanks!

What B.S. with the economy slowing and the last 10% of the bull market this is the last stock you want to buy !

Economy is just fine and should continue to be reflected in the markets. Proud and content owner of MAIN. Power of Compounding in action with 14 dividend payouts per year. Mushrooms!!! Check back in 3, 6 and 9 months and let’s compare notes. Should be fun.

OK it’s expensive but it’s the best in its class. It’s the AMZN or MSFT of BDCs. When or if the price drops, buy. You’ll not regret it.

Have owned MAIN since 2014 and HTGC since 2017. Admittedly MAIN has been buy and hibernate since I bought it. Cost basis is $20.71 with todays selling price of $41.43. HTGC keep a core position and buy on the scandal and sell on the high – wash, rinse, repeat.

Travis, thought you were going to mention that HTGC was the mystery stock. Shows how good I am at using clues to get a solution.

Have a great week.

An up and comer is CSWC

Adding MAIN and SAR to my watchlist. Will seriously look at buying during the next downturn. Thanks!

I am not among the MAIN investors, or any other BDC since the crash of 2008-9. Back then, I held Allied Capital, which was among my best investments for years. It then sank faster than the Titanic. I would tell anyone holding BDCs to set a tight stops, except for the fact that they tend to issue new shares from time to time (without warning, of course) which would likely trigger the stop. I’m with coolsoupy on this one.

It is risky to buy a stock that is selling above the 1 year analyst target as is MAIN.

MAIN is an excellent BDC with solid and steady returns. The MAIN difference, pun intended, is it’s COMPOUNDING INTEREST ability i.e that it pays a monthly dividend and 2 semi-annual special dividends. With dividends reinvested it outshines just about any other stock, ETF or mutual fund over any time frame especially at 5, 7 and 10 yr. It went public on 10/9/07. You can see the power of compounding at

https://www.dividendchannel.com/drip-returns-calculator/

travis, thanks for your ‘eyes opened’ discussion.

the conclusions are objective, rare things these days. i kept MAIN under observation on my desk. my conclusions brought to prefer MLP over MAIN and similar. their NAV more consistent and the yield attractive (not the valuation). and never mind the economic trends, the people need to heat houses, the coal is in regress thus the gas goes up. the wind and solar still far from supplying the energy needs at least 5-10 years.

MLP Maui Land & Pineapple Company is not a BDC and it pales in comparison to MAIN. Not sure how you concluded as such.

See https://www.bdcinvestor.com/business-development-company-list/

Comparison Tool: https://www.dividendchannel.com/drip-returns-calculator/

I assume you mean MLPs in general, which are mostly oil and gas pipeline/midstream companies, yes? Not the actual ticker MLP (which is Maui Land & Pineapple, an old Hawaii plantation owner that is now more of a real estate development company). Have any favorite MLPs?

Mark likes dividends, always has! 6% is mouth watering to him. (Even if we correct here, there is always that divvy Mark will tell us you’re getting!)

Mark has been a huge supporter of MAIN for years. Was on a call today where he highlighted the continued success and well managed MAIN but did warn that if interest rates were to move higher MAIN would be hit hard…as others in the category.