This article was originally published on March 30, but we continue to get questions and are re-posting it here to supply some answers — the stocks teased are all down quite sharply since we first published, with drops ranging from 6% for the biggest of them (Freeport-McMoran (FCX), the “free” idea he shared) to a loss of 24% for one of the smaller battery ideas (Novonix (NVX)).

Here’s the lead-in to the latest teaser ad from Fry’s Investment Report ($49/yr)…

“From ‘America’s Top Trader’ – Brace Yourself For… ‘The Revenge of the Heartland’

“America’s surprising new “Epicenter of Wealth” could create a whole new class of American millionaires… even as millions more face shock and ruin..”

And alternate versions of the ad feature this intro:

“An Urgent Report From “America’s Top Trader”

“Ford is in for over $11.4 billion… Toyota, $3.8 billion… BMW, $1.7 billion… Hyundai, $5.5 billion… Mercedes, Volkswagen, Nissan…

“America’s New EV ‘Supercluster'”

This ad started circulating in February, actually… but the prices of pretty much every stock he teases were falling through March, and have fallen further still now, so maybe being late is good for us this time around.

What follows was last udpated on March 30, 2023.

And we can summarize the next half-hour of blather from him like so: Riches come from the “cluster effect,” when an industry grows up in a particular area, creates an ecosystem to support it, and builds something fantastic over a long time. His past examples are the automakers in Detroit, the chipmakers and later the tech companies in Silicon Valley, the financial firms around Wall Street in New York, oil in Houston, biotech in Boston, you get the idea.

And Eric Fry filmed his video “presentation” from the top of Lookout Mountain, which is in the northwest corner of Georgia and looks down on Chattanooga, Tennessee, which is where he sees this next “cluster” growing, all focused on building electric vehicles. Here’s a bit from the ad:

“… spread out on this horizon, you’re looking at America’s new technological heartland. And I’m not talking about Silicon Valley.

“Instead, I’m talking about the seven U.S. states you can see from this mountain…

“Tennessee… Kentucky… Virginia… Georgia… Alabama… and both Carolinas…

“Because in each of these states – especially in Kentucky and Tennessee – there’s a new economic ‘supercluster’ of innovation and investment taking shape .

“In fact, in the 300 square miles surrounding this mountain…

“You’ll find no fewer than 28 different companies, each dedicated to building out the future for electric vehicles and the batteries that power them.

“Collectively, they’re investing billions of dollars in kickstarting a new era of American ingenuity and prosperity – something I call ‘Made in America, 2.0.'”

I expect this is mostly driven by the fact that the automakers drifted into the Southeastern US over the past several decades already, fleeing the power of their unions in the midwest and looking for cheaper labor and lower taxes, so it’s no surprise that a lot of the big new EV-focused investments by Ford and GM and others are being made in Tennesee and Georgia and Alabama… and where the automakers go, their suppliers follow.

So Fry’s pitch seems to be that we’ll see a new super-cluster of EV-related companies springing up around the Southeast, reinforcing the growth of that sector, and that we’ll also see the push for more “made in America” supplies and components and raw materials to support this growth, which will create some stock market winners, from battery makers to miners to technology suppliers.

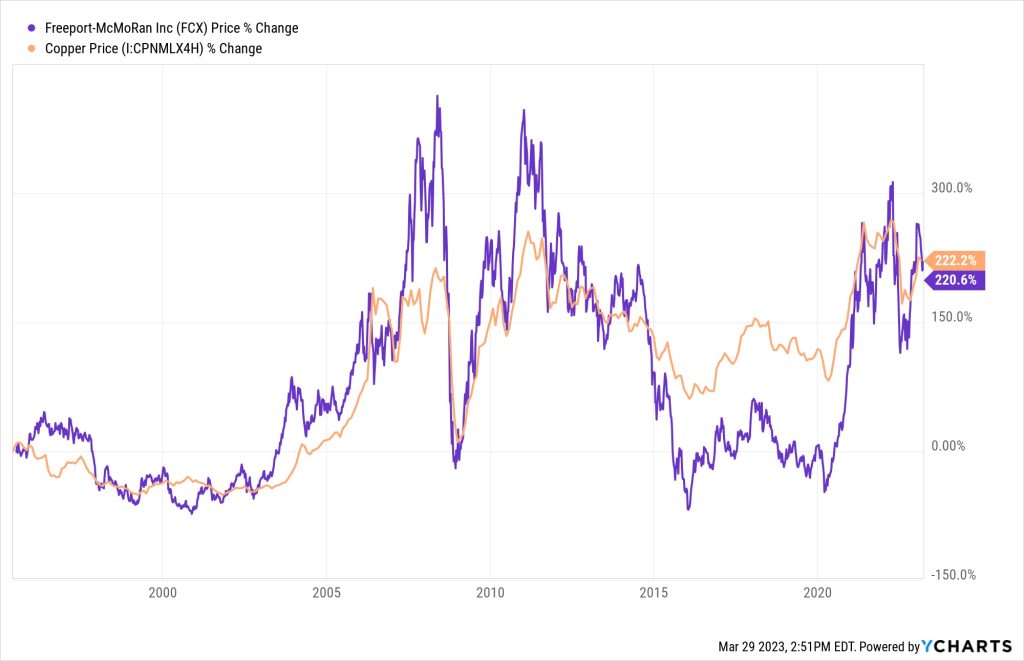

The first stock he pitches is a freebie, that’s Freeport-McMoran (FCX), and that’s basically just a “we’re going to have a copper shortage” pitch — Freeport is one of the world’s largest copper (and gold) miners, and they’ll be a beneficiary as electrification creates more and more demand for copper. Pretty reasonable, and copper is indeed in a precarious supply situation if the demand grows as many folks expect, though it’s not going up in price right at the moment. FCX shares do generally trade in line with copper prices, with some leverage, so like many miners they rise rapidly when copper prices are going up, and fall rapidly when copper prices are falling. Usually. Here’s what that looks like in chart form — that’s FCX in purple, and the monthly copper price in orange, over the past 25 years or so:

"reveal" emails? If not,

just click here...

Not cheap, but pretty reasonably valued, as long as they don’t have a major problem with a big mine. The other big copper play that has come up in teaser ads somewhat recently is Southern Copper (SCCO), if you want to check out alternatives… similarly valued, but more volatile, and pays a much higher dividend.

And how about the secret stocks Fry teases? He hints at five, so let’s put the Thinkolator to work…

“This first company uses AI to run “smart” EV-charging grids.

“With multiple energy sources hitting power grids these days…

“And with all that power getting stored until it’s needed…

“You need software that’s smart enough to manage that energy flow.

“This company has an AI-powered system that does exactly that.

“It’s already built the largest smart energy storage network in the world.

“It’s also already partnered with Fortune 500 companies across the US.

“And it’s machine-learning technology is tailor-made for streamlining operations for the vast EV-charging networks already being built across the US.

“Demand for this company’s product is booming, with an order backlog that’s already doubled year-over-year.

“This is the first pure smart-energy-network play to go public in the US.

“And you can still get shares for under $10.”

That’s very likely to be Stem (STEM), which has been pitched by many newsletters over the last year or so, since they went public through a SPAC merger. I dabbled a little in both STEM and it’s more grown-up competitor Fluence (FLNC) last year, though so far FLNC has far outclassed STEM… mostly because it seems to have gotten ahead of the curve in controlling its supply chain and making sure they can meet customer demand, which has been more of a challenge for STEM. They just announced a new capital raise yesterday, so the stock took quite a hit from that (they’re offering 2030 Convertible Senior Notes, so any dilution will be well off in the future, but still, people don’t seem to like it when their speculative growth companies need money… don’t know what the cost of those Notes will be).

No real direct connection to the buildout of EV production capacity in the Southeast, of course, but they are indirectly driven by the same things — their business is based on having access to relatively inexpensive batteries that they can package and sell to customers, and their future profit hopes stem from keeping those customers as long-term subscribers to their battery management software that helps balance charging and use cycles with the grid and with alternate energy inputs (like solar panels), reducing costs by storing cheap energy and giving power back to the grid when it’s more valuable. I’m still a lot more comfortable with Fluence than I am with Stem, which disappointed investors last quarter with weak results and pretty tepid guidance, but I continue to own a tiny bit of both.

What’s next?

“The second company I want to show you makes synthetic graphite…

“You can’t make lithium batteries without graphite. And this company cuts battery costs by making that graphite synthetically instead of mining it.

“As I’m sure you know, cutting battery costs is a huge EV priority.

“Already, this second company has partnered with Honda, Panasonic, Samsung, and Bosch, just to name a few.

“And it’s just won a huge $150 million grant from the U.S. government to build a brand-new plant right here in Chattanooga.”

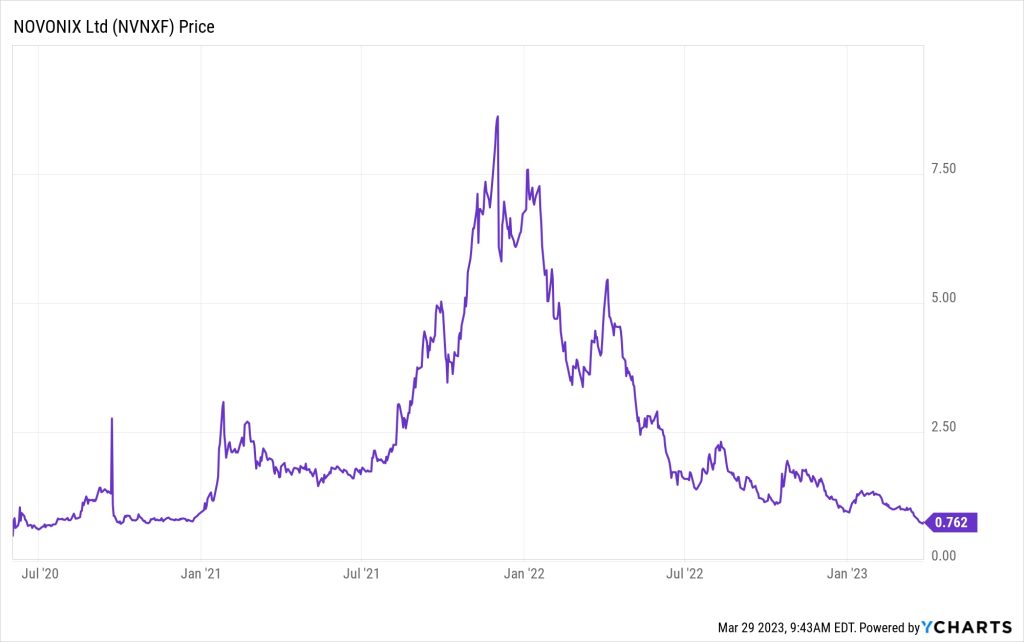

That’s Novonix (NVX), which has been listed in the US for about a year but, before that, was heavily teased by a few newsletters for their connections to Tesla and next-gen battery technologies. Ray Blanco, in particular, claimed with great certainty that Elon Musk would be mentioning Novonix by name at Tesla’s big “battery day” a couple years ago, and that never happened… but it is still chugging along with its business of building up synthetic graphite capacity for battery anodes. And the hype cycle has now left them behind, here’s the chart of Novonix shares starting during the hype buildup in 2020 (that first spike on the left of the chart is Blanco’s hype for Tesla’s September 2020 “battery day” event, which washed away almost instantly when it turned out that Novonix had nothing to do with that event, then he and others promoted it into oblivion over the next 18 months as it moved to get a US listing):

It’s pretty wild, a 1,000% gain and then a 90% loss, but that’s also a pretty familiar-looking chart, that’s what hype cycles and bubbles often look like.

So now, we get to start fresh… is Novonix worth a gander? Here’s what I said about them a couple years ago, when Michael Robinson was pitching the stock:

“… they’re all about building up their synthetic graphite anode business, and presumably using their base of battery testing customers to try to make sales connection for these new anodes… and also continuing to develop new battery materials and technologies, largely through their research sponsorship of the Dalhousie University battery lab that originally created Novonix (Novonix was spun out of a research project at Dalhousie in 2013). That lab has been working with both Tesla and Novonix on new battery materials under Dr. Jeff Dahn, who also, a couple weeks before that contract was renewed for five years, signed on to be Chief Scientific Advisor at Novonix (he’s also still working with Tesla, which is the connection Ray Blanco was trying to turn into a commercialization deal and a Tesla endorsement of Novonix last year).

“That next-generation work at the Dalhousie University lab is not what is likely to move the revenue needle anytime soon, but there’s plenty of hope that they might eventually turn their patents in new anode technologies or other battery materials into a real business in Nova Scotia. The larger scale for now, and the real potential for revenue in the next few years, is in Tennessee, where Novonix has the PUREgraphite anode plant in Chattanooga that’s “ramping up” to supply 2,000 tons/year of synthetic graphite for battery anodes.

“That’s mostly going to Samsung at first, they’ve got the initial order for 500 tons, but Novonix also has a non-binding agreement with Sanyo/Panasonic to evaluate the production for possible use. There are a wide variety of price quotes for synthetic graphite, and nobody’s talking about what Samsung will pay, but if we assume a pretty high-end price of $20,000/ton (I don’t know if that’s rational or not, I’ve just seen the number used), perhaps that could bring in as much as $10 million from the Samsung deal and $40 million in annual revenue when the plant reaches capacity. That would still be very small, and an inconsequential part of the global graphite anode business (which consumes roughly 400,000 tons/year)… but Novonix is currently almost entirely an R&D operation, with just a couple million dollars in revenue from their battery testing business, so that would still be a big deal. I should note that they’re also at a US$800 million market cap in anticipation of the value of this pilot project and their future possibilities beyond that in other battery materials and designs, so it’s a small company but not really an unknown microcap — even a huge success from this initial plant would mean they’re already trading at an optimistic and future-focused valuation.”

The shares were around $2 at that point, where today we’re pretty close to a 52-week low at about 75 cents, and the market cap is down to $375 million. They still have about $100 million in cash left from the fundraising they did in 2021, and they got a $150 million grant from the Department of Energy for building out their synthetic graphite production, with a goal of building that production to 30,000 tonnes. They are just beginning site selection for that, so that’s extremely early days.

And their actual pilot plant that’s producing some synthetic graphite anodes in Chattanooga? Well, the key partner there is now KorePower, which will be buying most of the production for their Arizona battery plant starting in 2024, and ramping up over the next few years after that. Revenue doesn’t really reflect any meaningful anode sales yet at this point, the roughly $8-10 million in annual revenue they’re generating these days is mostly from testing and R&D work, and is supremely unprofitable. The earliest that production could really ramp up and provide meaningful revenue for Novonix is probably 2024.

Next?

“Speaking of graphite…

“You also need to compress and coat it so it can be packed into the anode post of EV batteries.

“This company will do exactly that when its new plant in Louisiana goes into production later this year.

“It’s the first plant of its kind outside of China and the only one in the U.S.

“What’s more, the company’s initial graphite output is nearly sold out already…

“Thanks to a four-year purchase contract with a major U.S. EV manufacturer.”

That’s Syrah Resources (SYR.AX, SYAAF), which produces natural graphite at a mine in Mozambique and aims to process that flake graphite into high-end anodes for EV batteries at a plant they’re building in Vidalia, which is supposed to begin production of about 11ktpa later in 2023 (ktpa is thousand tonnes per year). The Mozambique mine, Balama, is sustainable and large but not super-profitable at the moment, with cash costs pretty close to their average sales prices last quarter, though they do say that production and margins should improve… but the real profit would come from vertical integration, they hope, once the Vidalia plant is operational and they can sell.

Tesla has an offtake agreement to buy about 70% of Vidalia’s production, at an undisclosed fixed price, and to buy in for more than half of the expanded production when they quadruple the Vidalia operation in a few years (or plan to, at least — Tesla is the key customer, taking a total of 25ktpa of the planned 45ktpa of graphite anode). We don’t know what the economics of that plant will look like as it gets going this year, but it should at least show a more meaningful revenue line. They’re under construction right now, with production expected to start in the third quarter, though they won’t really be producing at their full run-rate of 11ktpa until probably sometime in mid-2025. Ford and LG are also evaluating the product, and considering offtake agreements. Syrah is taking advantage of DOE grand and loan funding to help with the project, one of many “bring battery material production back to the US” investments made by the government, and they say the current construction work is fully funded, but for the next couple years the money might be a little tight, so it will probably be important that Balama keeps up production and generates some profit.

Next?

“Of course, you also need lithium to make batteries…

“But so far, here in the US, that’s easier said than done.

“Because right now, 80% of the lithium worldwide comes from China.

“However, this fourth company I want to reveal to you is building a world-class lithium facility that could change all that.

“And it’s building that factory 55 miles from Chattanooga.

“When it’s finished, this single plant is expected to double U.S.-based lithium production.”

I guess we can see why Fry was in Chattanooga, lots of focus on that part of Tennesee … and yes, this is a hint about the Tennessee Lithium project, which is a processing plant for lithium that Piedmont Lithium (PLL) is planning to build in Etowah, TN, which, yes, is about 55 miles northeast of Chattanooga.

Piedmont was one of those penny stock stories that keeps the hope alive, it went from being a $50 million Australian penny stock a few years ago to getting a Tesla offtake deal for a potential lithium mine in North Carolina and spiking up in price, then, perhaps partly because of local opposition to permitting that project, moved on to invest in a spodumene project in Ghana to secure raw materials, and planned this Tennessee Lithium facility to process the spodumene into lithium for batteries. That, plus a joint venture with Sayona’s North American Lithium project in Quebec, which is expected to restart production this year and supply some spodumene, gave Piedmont investors hope and drove the company up to a billion-dollar valuation, where it still stands now (they also own 25% of Sayona, which at current prices would be worth about $300 million).

You can get a picture of the company’s plans from their recent Investor Presentation, but with the exception of the Quebec joint venture, which if it begins production is pretty much earmarked to be passed right through to Tesla and LG to satisfy offtake agreements over the next few years (LG Chem also bought a million new Piedmont shares as part of their latest offtake deal), this is really early-stage stuff — they are just in the early engineering planning at Tennessee Lithium, which could be operating in 2025 or 2026 at the earliest; Atlantic Lithium’s Ghana project, which is what they hope will supply the Tennessee plant, is not yet under construction and is hoping to be mining in 2025; and the Carolina project may be stuck in permitting and doesn’t seem to be a major focus right now (they say that if the permits come through, and presuming that financing is available, they could begin production in 2027).

They’re also the focus of a bear attack at the moment, Blue Orca published a critical short report a few weeks ago, alleging that the Ghana project won its permit through corruption and won’t supply the spodumene the Tennessee plant will need, with the corruption possibly bouncing back on Piedmont and hurting its US government grants. No idea how much of that is a real risk and how much is short-seller exaggeration, the cynic in me will note that corruption is rampant in mining projects in many parts of the world, and we shouldn’t be at all surprised if they had to bribe a general’s son to get their permit in Ghana (or if, now that the General is out of power, they have to bribe someone from a different party)… but even if everything is kosher in Ghana, there’s a lot of “going to be built over the next couple years” uncertainty in everything at Piedmont Lithium, and the hope and expectation seems to be, at least at this valuation, that they’ll become a vertically integrated US lithium producer on a pretty meaningful scale within a few years, so any additional risk is reason to be a little wary. Here’s a little excerpt from Blue Orca’s short report, which at least provides a more bearish perspective to balance out the company’s optimism:

“We are short Piedmont because without Atlantic’s Ghana supply, Piedmont and any promise of near-term revenue from its much-hyped

Tennessee facility are dead on arrival. Without Ghana, industry experts and even a former Piedmont senior executive have confirmed that

Piedmont is unlikely to find a source of replacement spodumene. Additionally, FOIA requests we obtained from the Department of

Energy (“DOE”) suggest that the spodumene from Ghana was important to Piedmont’s grant proposal, meaning that the loss of the offtake

agreement, and questions surrounding Piedmont’s own potential liability under the FCPA and other anti-corruption statutes, raise doubt

about whether Piedmont will ultimately receive the conditional government funding.“Ultimately, the premise of Piedmont’s valuation is the Company’s claim that it will soon leverage spodumene from Ghana to become a

fully integrated lithium hydroxide producer. We think not.”

Piedmont disputes that, of course, and says that they’d be able to find alternate spodumene supplies if the Ghana project isn’t producing in a couple years. The one or two analysts who provide estimates say to expect Piedmont to be profitable this year, earning about 50 cents per share, presumably because they’ll sell a little bit of spodumene from Canada (ramping revenue to $166 million, from a starting point of zero), and to grow rapidly to $14 in earnings per share in 2024 and $31 in 2025, so from that perspective it looks downright cheap at $57. They do have about $100 million in cash still, and they spent about $60 million last year (roughly half on overhead and operating costs, half on capex and investing in affiliates, including the Ghana project), so they don’t have to raise money right now… but they probably will before too long, if they want to keep the Tennessee Lithium development moving forward, depending on how much government largesse comes their way (and when).

It’s a good big-picture story, North American lithium and domestic lithium processing, which is what the government and their customers want… but it’s going to take a while, and sounds to me like there’s some reason to be wary about costs and timelines, even if you’re not particularly concerned about the Ghana corruption stuff.

That’s not just these three materials companies who are going to struggle with timelines and construction and financing, of course, these kinds of industrial projects always take a lot of time — building a mine comes with extra struggles, too, since permitting can often take years (and might fail), but even the processing plants take years to design and build, whether your a multibillion-dollar behemoth or a little startup. And though we all know that demand for almost all of these raw materials is climbing right now, largely because of electric vehicles, we also know that lots of companies are trying to meet that rising demand, and it’s still a commodity business — nobody really knows what the price of lithium or graphite anodes or whatever else will be in 2025 or 2026 or 2030.

Next?

“Finally, the last company I want to show you specializes in microsensors…

“Why microsensors? Here’s why…

“EV batteries need all kinds of monitoring to keep your vehicle running smoothly.

“This company specializes in a fiber-optic technology, that’s ideal for the job.

“It also makes 5G network solutions that help make autonomous driving possible.

“This company is already an industry leader and has an impressive list of partners…

“Including not just car companies but NASA, ConocoPhilips, and Lockheed-Martin.

That’s not enough clues for any real certainty here, but the Thinkolator’s best answer was Luna Innovations (LUNA), so we’ll toss that on the pile as our guess. Luna is actually an interesting little story in the fiber-optic space… this used to be a strange little R&D shop, with its curious fingers in lots of unprofitable pies, and it has been promoted by newsletters before (including way back in 2008, when they were expected to cure baldness. Seriously).

Now, thankfully, they’ve spent a few years reorganizing and strategically restructuring, have jettisoned some of their R&D projects and acquired a few more companies in the fiber-optic sensing and testing space, and they’re beginning to build something meaningful in that little segment of the market. They’re still small, and compete with some giants in this space (including Keysight (KEYS), which I own, and National Instruments (NATI)), but they have at least a coherent package of products and services now, and it is growing, both organically and through acquisitions. They provide fiber optic sensors and testing equipment, and according to their latest investor presentation they’re expecting to grow sales at about 15% and adjusted EBITDA at 15-30% this year, which is pretty solid (earnings are way less steady, partly because of some big line items for “discontinued operations” following their restructuring), and the current valuation, with a market cap of about $215 million, is about 15X that 2023 adjusted EBITDA number.

There’s clearly some risk here, while they’re forecasting that earnings will really grow and stabilize and haven’t really become very consistent with their cash flow and earnings just yet, but I do have a soft spot for aspirational little industrial conglomerates, companies with a few specialized products who are acquiring small bolt-on companies and growing their platform, especially if they can show that they’re consistently generating positive cash flow. Their last quarter, announced in mid-March, was clearly a bit of a disappointment (the stock fell from about $9 to $6), but volatility is also part of the price of admission for these tiny stocks (LUNA was at about $4 six months ago, for example).

Luna is not especially focused on the automotive sector, though they do highlight some EV applications for fiber optic sensing — I’d guess that their defense and aerospace work with similar kinds of sensors is a larger business, as is their communications testing business (which is the fastest-growing segment at the moment), and many of the named projects they mention are infrastructure-related (sensors for dikes, for example, or pipelines), but they do keep signing new customers, including some pretty large OEM deals (they’ve mentioned OEM deals with Northrop Grumman, Lockheed and Intuitive Surgical recently). I expect I’ll come back to this one, I like the trajectory the business is on but I need to dig into this restructuring they’ve been doing for the past five years before I get too excited. There is one analyst providing estimates for LUNA, he says to look for 30 cents in earnings per share this year and 40 cents next year… if that’s reasonable, then the current $6.50 share price is perhaps a “full” valuation at ~20X earnings, but it’s not ridiculous.

So there you have it, dear friends — five potential beneficiaries of the big “cluster” of EV and battery development in the Southeastern US, and of the “reshoring” of battery materials in general… three of them certain matches for Eric Fry’s pitch, and two a bit more “guessy”. Any of them sound like profitable ventures to you? Have other favorites that follow similar stories? Let us know with a comment below.

Very accurate. I confirm these are all correct.

Thank you for your research and sharing with the community.

Thanks valerb! Glad the couple guesstimates among them hit the mark… do you like any of these stocks?

I can also confirm (Fry’s subscriber) that you nailed it.

I have small out-of-the-money call-options positions in FLNC and STEM. I also have a basket of 15 junior/exploratory miners (focused on lithium and uranium with a few gold/silver options), and I added PLL to the basket after the short-report-driven price drop. I own FCX via sizable positions in the PICK & XME ETFs.

Syrah is intriguing, but I try to avoid jurisdictional risk, and Mozambique certainly poses that. No position in Novonix or LUNA.

Most recently I’ve started a position in Syrah Resources. It’s appealing to know that graphite represents 28% of batteries composition. And Syrah is running world’s largest mine, as well as building a US base with production expected later this year.

By the way, the report including the names you uncovered changed name to “The New 1,000% Portfolio”

Now that’san ambitious name! Thanks… hope it works out well for you.

I am still bullish on Rolls Royce which I suggested a few months ago: watch for progress on small nuclear reactors. Now, for mining royalties, you could look at Trident Royalties in UK (TRR) could be very interesting.

Thanks Brian… a lot riding on that lithium deal for Trident Royalties (TRR.L, pink sheets symbol is TDTRF but there’s no trading volume in US), but if it works out as hoped then the current valuation at ~6X 2024 royalty revenue might turn out to have been a nice entry point. Don’t know much about the details on that one, looks likethey’re trying to transition from “mostly gold” to copper and lithium over the next five years, reliant on two big projects under construction that should kick in revenues from 2024-2026.

Thanks, Travis. On 5 April, shares of Trident Royalties started to trade on the OTCQX market (‘TDTRF’). The company announcement states:

Trident Royalties Plc (AIM:TRR, OTCQX: TDTRF), the diversified mining royalty company, is pleased to announce that its Ordinary Shares have been approved to trade on the OTCQX Market (“OTCQX”) in the United States of America (the “US”) and will commence trading at the market open today under the ticker symbol “TDTRF”.

The cross-trading of Trident’s ordinary shares on the OTCQX will provide enhanced investor benefits, including easier trading access for investors located in the US, and greater liquidity due to a broader geographic pool of potential investors. Through trading on the OTCQX, the Company will be able to engage with a network of US investors, ensuring that they have the same level of information and disclosure available to investors in the United Kingdom, but through U.S.-facing platforms and portals. In addition, the OTCQX cross-trading facility will provide US based investors with the ability to access Trident’s Ordinary Shares in US dollars during US market hours.

Adam Davidson, Chief Executive Officer of Trident commented:

“Trading on OTCQX opens Trident to a new pool of potential investors in the US with an appetite for exposure to a diverse mix of commodities – an offering quite different to the traditional mining royalty companies that have dominated the North American markets to date. This is particularly timely given the recent developments at the Thacker Pass Lithium Project in Nevada, being a key asset within Trident’s portfolio, as well as developments at Trident’s North American gold offtake assets. The quotation supports our vision of Trident being the leading royalty company for global investors to obtain exposure to a diversified portfolio of mining commodities.”

I think there could be good times ahead, Travis.

Regards.

Brian

I am also BIG on RYCEY. It’s a sleeper as most people think it’s just a car company like Tesla, which is more energy storage. Their small reactors will need to pass the Greenies smell test and if they pass RYCEY could go to $20. They have their hands in many industries, and I believe in their future. Blessings

As you probably know, Rolls-Royce (RYCEY) has nothing to do with the car brand these days, other than the shared name and similar logo… $20 would mean they’d be back above their 2013 high in terms of market cap, reaching about $160 billion, which seems optimistic but could certainly come if this long-running turnaround eventually gets some traction (I’d guess it would be driven by some revival in their large engine business rather than the work on small nuclear plants, since it’s the aircraft engines that generate all their profit these days, but one never knows).

Yes, it would come from the Small Reactors if they can get the greenies to accept nuclear NRG.

You are on the money with respect to the 5 EV stocks. I currently have positions in all except PLL. I also like VWAGY for the largest potential future in production of electric vehicles. FCX is only active as a 1/3 position from the original recommendation that I discarded a while ago.

Hello everyone. I purchased “Fry’s Investment Report “ subscription, and so, below i will list all of his stocks he talked about and recommended in that publication:

A. “Three Building Blocks Companies”:

1. Albemarle Corp (Ticker: ALB)

2. Alcoa Corp (Ticker: AA)

3. Freeport-McMoRan Inc. (Ticker: FCX)

B. “The New 1,000% Portfolio”, (Five Stocks):

1. Stem Inc. (Ticker: STEM)

2. Syrah Resources Ltd. (Ticker: SYAAF)

3. Piedmont Lithium Inc. (Ticker: PLL)

4. Novonix Ltd. (Ticker: NVX)

5. Luna Innovations Inc. (Ticker: LUNA)

C. “Made In America…Again”, (Three Stocks):

1. Corning Inc. (Ticker: GLW)

2. Intel Corp (Ticker: INTC)

3. Ivanhoe Electric (Ticker: IE)

Good investing to everyone, and enjoy 🙂

Kaz

Ifuel teaser. TTE. TOTAL ENERGIES SE

Any update on the 3 AI that are going to grow in Project Omega and 3 AI that are losers?

Thank you for sharing! Fry has been recommending GLW for years. He also was pushing ERIC & NOK for a long time but now I see he is high on mining. The problem today is that the American Public does NOT WANT EV’s, and car companies are stuck with millions in unmovable inventory, especially Ford and their Lightening.

Hi again, everyone. Anyone knows what stock Eri Fry refers to as the “iFuel” , by any chance? What is your assessment of that stock? Really appreciate any one who could reveal this stock. Kaz

Do you have Fry,s 3 AI teasers. 1. Revolutionize energy, 2. Find gold, oil etc without drilling 3. $5 stock

Don’t think I’ve covered those, but I’ll look for the ads.

Hi, lalgulab12 and everyone else.

I have Eric Fry’s “Investment Report” subscription.

Here are his AI Teasers:

A. “The Top 3 Stocks for the AI Revolution” :

1. GE Healthcare Technologies, Inc. — ( Ticker: GEHC ) …. Buy up to $85.00

2. Intel Corp — (Ticker: INTC)…. Buy up to $35.00

3. Amazon — (Ticker: AMZN)…. Buy up to $120.00

B. “The AI Moonshots” : (Three Stocks here) :

1. Stem Inc —(Ticker: STEM)…. Buy up to $7.00

2. Sabre Corp — (Ticker: SABR)….. Buy up to $6.00

3. Ivanhoe Electric Inc. — (Ticker: IE)…. Buy up to $17.00

C. “Top 3 AI Losers” : AVOID these Stocks (OR, SELL them if you already have them) :

1. Manpower Group Inc . — (Ticker: MAN)

2. SL Green Realty Group — (Ticker: SLG)

3. The Brink’s Co. — (Ticker: BCO)

I’m not sure about Eric Fry’s following recommendations:

1. Revolutionize energy

2. Find gold, oil, etc. without drilling

3. $5 stock

Maybe these last three items are featured in another one of his publication which I don’t have a subscription to.

Best of luck to everyone, and happy investing.

Kaz

Hi Kazito, thank for sharing your reports, you have idea over the last report called ” Buy Open AI before the IPO? they launched it for investing in shares I guess related with Open AI befoer the public offer. thanks and great work done.

Hi AI.Futures.

Can you tell me who made that report for the stock recommendation before The OpenAI does an IPO ???

If you’re asking about Luke Lango’s recommendation for “ChatGPT loophole” , his recommendation is to buy Microsoft (Ticker: MSFT).

Kaz

One pick Mr. Fry had from 2020 was SLI, a Canadian lithium miner with an operation in Alabama. They had it going up 10X+ but it never took. I’m 65 and do not have 20 years to build wealth with buy and “hold forever’, which could make anyone look brilliant after 20 years. I need NOW gains and my crypto, option and small pharm stocks do that for me. Be wise, blessings. Hey Kaz, if I can ever return the favor of sharing with you just say so. Paul

Thank you so much, Paul. You’re very kind.

Best of luck with your investments.

Kaz

I believe that the ifuel he was referring to is from his following statement “Because green hydrogen results from combining renewable energy with water, it is the ultimate carbon-free fuel… at least in theory.” The referenced stock is PLUG. I picked some up about 3 weeks ago at 12.39 and today it is around 10.97. It was about 30 in September and had a high above 60 in January 2021. This stock has had its ups and downs over the years.

Thank you so much, Charlie1030. Really appreciate your sharing this knowledge

Kaz

Hey Charlie & Kaz, careful with PLUG. Yes, that is the stock, but the company has terrible leadership, and they can’t keep it on track. It should be a $30 stock but I’ve heard too much negative about its direction. Take care and THANKS Kaz for sharing your paid picks!

Thank you so much, Paul, and you are most welcome.

Kaz

Eric has been promoting FCX for years and his co-worker Louis Navellier has been promoting SQM. They all believe that investing in Lithium, Copper, Graphite and other Rare Earths is a good bet. I can’t fault that thinking as NUGT is up 60% YTD and GPHOF is up 38% YTD.

I also own STEM and FLNC which are both now being pushed by several others including Alex Green, Nomi Prins and more. I know there has been huge investment from the BIG boys in alternate energy. I have owned both FLNC and STEM since they were SPAC’s and do believe they will take off the more the Greenies push to dump Oil and ESG invades the Boardrooms. Just like EV’s are inevitable because the BIG Money has moved there, Alternate NRG will also skyrocket. I also did very well with NRGV which could be another big gainer, but it is not getting the recognition it did when it first came to the market. Blessings.

If there is anybody here who is interested in further information about Eric’s and the other InvestorPlace Services, there is a Subreddit here with access to more info and services

https://www.reddit.com/r/InvestorPlace/

Enjoy and Happy Investing 🙂

I am a subscriber of Eric Fryer, spot on on all five!

They have been in the Fry’s portfolio as a EV basket for a few months. Down significantly since recommended but he has confirmed confidence in them in his latest issue.

Thank you so much, Kaziti. Really appreciate your sharing this knowledge Johnmut!

You’re most welcome, Johnmut.

Kaz

Eric has been big on FCX for a few years. He also has TTE in his picks but I’m not sure if is in this video. Yes, FLNC is a great pick, I bought it as a SPAC and added to it when it dropped and I’m up 30% on it today. STEM is not getting the same attention as FLNC, but I believe it could be a triple digit stock in five years. Energy storage is the future with the Greenies in charge and the BIG money has already moved there. Look at all of Elon’s Gig Factories, energy storage will be HUGE! Blessings

Hi Everyone.

Anyone can share Nomi Pins’ Warrant recommendations in her webinar of tonight, Wednesday 6/20/2023? I am really interested to know the warrant recommendations in “The FedNow Survival Guide”, as well as the other warrant recommendations she talked about in the webinar tonight. Really appreciate it if anyone can share those recommendations here.

Thanks.

Kaz

Hi Kaz, wondering if I can be added to the email list

rada44 at hotmail.com

Good morning, RADA44. Yes, I just added your email to the list. Thanks.

Kaz

Hi Kaz, Could I also be added to the email list please? It would be most appreciated.

njbacon1 at gmail.com.

Hi cornucopia. I have added your email to my “Email List”.

Thank you

Kaz

Can you please add me to ravirana28 at gmail.com

Hi rv2smile.

Sure, I have just added your email address to my “Email List”.

Thanks.

Kaz

Hi Kaz.

Can u please add me to yr email list

Heydr.dr at gmail

Thank u for all yr great work.

Hi Heydr.

I have just added you to the “Email List”. Thanks.

Kaz

Hi Kaz,

Thank u muchly.

Hi Kaz, thanks for your info on Fry’s suggestions. can you add me, richbochmd at gmail to your email list as well? Richard

Hi Richard.

I have just added your email address to my “Email List”.

Thanks.

Kaz

Hi Kazito, I always follow you, first thank for sharing the reports and shares, you have idea over the shares related with the Luke Lango report ” BUY OPEN AI BEFORE THE OPA? I read carefully the report but I can not obtain so information? thank for all your work.

Hi AI.Futures.

I only have a subscription to Luke Lango’s Innovation Investor. Do you know if the report you’re referring to is in his Innovation Investor? Or, perhaps in any of his other subscriptions (which I don’t have).

I do know that his most recent pitch of how to benefit from ChatGPT’s pre-IPO is Microsoft (Ticker: MSFT). Hopefully that’s what you’re asking about. I actually bought some MSFT shares today.

Kaz

By the way, you’re most welcome. I hold a lot of satisfaction for sharing recommendations in any of my subscription packages with different gurus. If you like to be placed in my “Email List”, you can provide me with your email address, and you will receive all sorts of recommendations, updates of different gurus’ recommended stocks & cryptos, buy and sell alerts, etc. I have over 110 members in my “Email List” and many of them share whatever recommendations they get from their own subscription packages with different gurus. It’s, of course, all for free, and it’s a very friendly crowd of like-minded individuals. It’s a “give and/or take mentality . You, too, can share recommendations from whatever subscriptions you may have.

This invitation is open to ANYONE who is interested to be placed on my “Email List”. All I need is your email address, so I can add you to the list, and you’ll be a member of this big family.

Thanks.

Katz

Katz,please add me to your email list.

Thanks.

Regards,

Frank

Franklin, I will need your email address to add to my “Email List”.

Kaz

Katz, please add me to your email list. Best regards.

Need your email address to add it to the Email List.

Kaz

Katz, please add me to your email list: bmbjamn at yahoo dot com

Hi Jinxed. I just added you to the Email List. Thanks.

Kaz

Hi Kaz, I would like to be involved on your email list. I have a few subscriptions to share with the group. Thanks for what you are doing. 4jvanas at airosurf.com

Hi Kaz-can you add me to the email list? mmrice412@gmail.com

You’re added.

Thanks.

Kaz

Hi Everyone.

Does anyone know what are Eric Wade’s crypto recommendations in this Special Report :

FedNow… How the “Crypto Dollar” Could Make You Thousands of Percent This Year ???

Also, Eric Wade’s 12+ Crypto recommendations for FedNow.

He recommends to buy these cryptos BEFORE the July 1st 2023 rollout of FedNow.

Here’s his video pitch:

https://orders.stansberryresearch.com/?cid=MKT742804&eid=MKT745662&step=start&plcid=PLC182956&SNAID=SAC0017243433&encryptedSnaid=G2fuxwoa3luqTnJcXhBb4LLFBEHrF0OjxMT6gCITLAM%3D&emailjobid=5364548&emailname=20230625-205545-DIG-MASTERS_Sun&assetId=AST303235&page=1

Really appreciate anyone’s sharing these recommendations.

Kaz

Stellar Lumens (XLM) is the freebie

I already got the freebie. Thanks.

Do you know the 12+ crypto recommendations for the FedNow?