I always try to take at least a quick look when one of the major publishers pushes a new newsletter — this time, it’s Matthew McCall, who has written some tradng books and is apparently a money manager and a bit of a Fox Business News personality, with what he’s calling the FUTR Stocks letter from Investorplace (the folks who bring us Louis Navellier, Hilary Kramer and Richard Band, among others).

That “FUTR” stands for “Flying Under The Radar”, and he says that he’s picking stocks that are fundamentally strong and inexpensive but not well-known, and that have growth catalysts in the foreseeable future and benefit from “mega trends.” Nothing too crazy about that strategy (or unique)…

He starts off with a pretty strong claim that all of his picks have an average return of 27%, including closed positions, and that he has a “win rate” of nearly 90%. I don’t have the info to verify that, it appears that he’s been putting the newsletter out for a while but that Investorplace started publishing/promoting it pretty recently, he’s not yet listed in many places on their website… but we’ll give him the benefit of the doubt, since we’re just interested in finding out what the stocks are that he’s teasing today.

The first “special report” he’s pitching to get subscribers interested is called 3 ‘Under the Radar’ Stocks for ANY Market… so we’ll start with those. He says the report is “a $79 value” (the newsletter retail price right now is $299).

Here are our hints:

“‘Under the Radar’ Stock #1: Flying the Cheap (Real Cheap!) Skies!

“What better time than a bad economy… to invest in a service that’s slashed prices below almost everyone else?

“Plus, they are growing fast. In 2014 alone, they opened 24 new international and 12 new domestic point-to-point flights.

“They’ve actually nearly doubled their share price in the last year… and it’s still shooting up like a rocket!

“This is a stock to own as quickly as you can buy it!”

Well, nothing equivocal about that — what’s the stock? There are actually two reasonable US solutions for this pitch, Alaska Air (ALK) and Spirit Airlines (SAVE) — both added substantial numbers of international and domestic point-to-point flights in 2014, and both are growing quite quickly this year as well — but Spirit is really the low cost provider among international airlines in the US (Allegiant and Frontier, which are sometimes cheaper, don’t have as many international flights… for low cost carriers, “international” mostly means “we fly to Mexico and the Caribbean, and a little bit to Canada”).

Alaska has actually been the better performer of those two low-cost carriers over the past year or two, and hasn’t slumped over the last couple months like SAVE has… so if you’re just going from the “nearly double in a year” hint, ALK is now actually a better match, though a couple months ago ALK and SAVE had similar growth profiles on the chart. But really, Alaska is the “expensive” low cost carrier — they don’t slash prices more aggressively than everyone else, that’s really Spirit’s bailiwick. I’d much rather fly on Alaska Airlines than on Spirit, since Spirit crams more seats into the same cabin and charges for water and carry-on space, but I suspect SAVE is probably the stock being teased here.

And it’s down quite a bit recently, so if you like the extreme no-frills airline it’s a good 20% cheaper now than it was when Louis Navellier was recommending it back in October. Personally, I’m not all that taken with the no-frills idea — all airlines have done very well over the last three years, and the low cost airlines have often been among the best performers (including SAVE for a while, particularly last year), but there’s nothing to indicate to me that SAVE is definitely a better buy than the others. The rising tide has lifted pretty much everyone over the past few years, but SAVE really faltered this year for reasons I don’t know. There’s nothing magical about the business — it’s all about filling your planes and running those planes as efficiently as possible and most of the airlines have gotten really good at that since the 2009 bottom. Perhaps SAVE will do better than the others if there’s a big downturn, I don’t know, but right now their profit margin is about the same as Alaska Air (the two best I looked at by that metric) and the stock carries a forward PE valuation quite similar to the stronger ALK, LUV and JBLU… growth expectations are slightly higher for SAVE than for the others, so maybe the stock could outperform if it gets back to its former valuation and gets credit for that anticipated growth again, but with lots of airlines that appear to me to be better run and to offer more sustainable models I don’t see any great reason to focus on SAVE. We’ll see. Maybe I’m just being critical because I hate hate hate every airline that tries to steal an extra two inches of legroom from me.

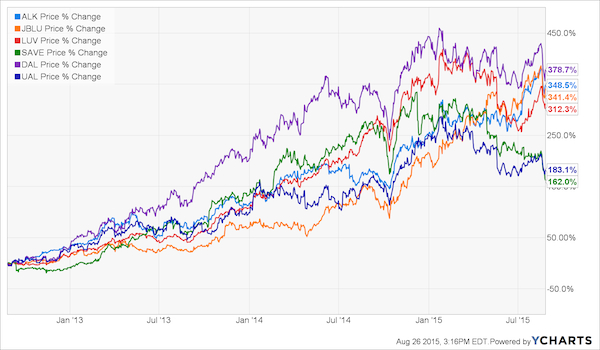

Here’s the chart for several of those airline stocks over the last three years — last year, SAVE was a growth darling for a while but is no longer… all have done well, and SAVE has been pretty average as an airline stock other than their big surge last year.

But I think we might actually be getting something a bit sneakier here, and that Matt might be teasing the fast-growing Mexican low-cost carrier Volaris (VLRS)… the stock for that one has indeed been strong recently, and has just about doubled over the past year… and they did report that they added exactly 36 flights last year, including 24 domestic (within Mexico) and 12 international. So on those clues, it matches much better.

VLRS is a significantly smaller stock, market cap around $2 billion, and is growing fast particularly with its hub in Guadalajara and growing service to US cities — though it’s expanding in Central America as well. Mexico is actually a fairly appealing economy to consider now, as everyone’s worried about China and trying to keep their emerging markets investment exposure a bit closer and a bit more closely tied to the US. I don’t know much about VLRS, other than that they’re profitable, they’re growing quickly, and the stock has done nicely since it had a big post-IPO swoon about 18 months ago, but if you’re looking for international airline exposure there’s one idea for you to consider. My impression is that there’s been some concern on this one in the past because of the presence of other low cost competitors in Mexico, including Viva, which was backed by and is partially owned by the family behind Ireland’s Ryan Air (the “charge for oxygen and bathrooms” European airline that Spirit is emulating), and because Aeromexico apparently has some flexibility to push the low cost carriers in a price war, but that may be misinterpreting the market — I really don’t know much about Mexican airlines (I usually hear more about the Mexican airport stocks, actually, OMAB, PAC and ASR).

How about another?

“‘Under the Radar’ Stock #2: The Entertainment Superstar

“In an exotic Asian country, a new middle class is emerging.

“They have money. They have influence. And they want entertainment

“And this film company is in the middle of it all, and growing like crazy. Over 105% in the last year alone… which I fully expect a repeat performance of during the next 12 months, too.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“But this is another stock to get into quickly. Many news outlets report it is going to go private soon, meaning it could pay a nice premium on outstanding shares.

“Now, even though this company is foreign, you can buy it on the NASDAQ, as easily as if it was Apple or Netflix.

“You could make a pile of cash from this. It’s hitting on all cylinders, and churning out the gains… and as a privatization target, it could make you rich quickly!”

This one, sez the Thinkolator, must be Bona Film Group (BONA), which did have a one-year 105% gain as of late June or early July… it has come back down a bit, as you probably would have guessed would happen to a Chinese company in this market environment. BONA is a small cap stock, with a market capitalization around $700 million, and they are both a film distributor and a theater owner in China, where the film business seems like it has been doing very well in recent years as urban Chinese have a bit more disposable income and as the Chinese domestic film industry has matured and created more popular content.

And yes, like some other Chinese companies over the last six months or so, BONA’s CEO is trying to take the company private — he has a go-private offer under consideration by the board to buy out public shareholders at $13.70 per US share, so if that deal goes through you could buy it today and get about a 16% return. The deal is not binding, and the board might reject it, so there’s certainly no guarantee… and that fairly large price gap probably indicates that the chances are decent that the deal won’t happen anytime soon.

Other than that, I’ve never heard of this one before and it doesn’t strike me as an idea that’s exciting enough for me to go digging through financials and trying to guess whether this is a fraudulent or a real Chinese operation… film distribution is a shady enough business in the US, with numbers that don’t really mean anything, so I’m a long way from understanding what the numbers would mean for a Chinese theater owner and distributor. As trends go, it’s an appealing social trend as the Chinese seem to be watching more movies in theaters, and the stock is reasonably priced if the analysts are at all correct about their growth potential — they’re probably almost entirely doing business in Chinese Yuan, so the devaluation will hurt their results slightly in US Dollar terms, but if they can really earn 35 cents a share this year and 50 cents next year, then you can certainly argue that the CEO is trying to buy a strong growth company on the cheap. I actually might end up with some exposure to this one, since I own shares of Fosun International and Fosun is one of the investors (along with Sequoia Capital) backing the CEO’s go-private offer, but I’m not likely to dig much deeper into the Chinese theater business.

And one more…

“‘Under the Radar’ Stock #3: The Global Tech Supplier

“As you’ve seen earlier…

“Everyone loves a high-flying tech stock.

“However, the next company I’m about to tell you about is a biopharmaceutical pioneer. This company is currently in FDA trials for a leading drug to treat eye diseases.

“Their money-making appeal? Instead of replacing existing eye treatments, this new drug complements the existing drugs on the market.

“The future of the company is coming down to their Phase 3 trial results. If they’re positive, this could be a multi-billion dollar opportunity for this company.

“In view of their explosive growth potential ahead, you should take a position in this company now.”

This one I can’t be 100% certain about, but the Thinkolator’s best guess is Ophthotech (OPHT), which is now a $1.5 billion company just starting phase III trials for their lead drug, Fovista, in combination therapy for Wet AMD with Lucentis (they’ve already partnered with Lucentis’ owner, Novartis) and, a bit further behind, with Regeneron’s Eylea. Looks kind of interesting, but there won’t be results until next year sometime, maybe late next year. There’s a decent short article from the Motley Fool on this one here, and OPHT has been discussed off and on by our readers on some of the biotech threads (like here, for example) — though not much recently.

It’s certainly a huge market, growing by the day with our aging population, and there’s plenty of demand for better treatments — I try not to invest in single biotech stocks very often, mostly because I can’t get at any kind of reasonable financial scenario for most of the companies who are a long way from a commercial product (and also because I don’t want to be in conflict of interest with the active biotech discussions that Dr. KSS leads here at Stock Gumshoe… and, frankly, because I don’t have a passion for or great understanding of the science like most good biotech investors do), but this is a generally fairly clean company to look at — they have a good website that explains their drugs, they are tightly focused on AMD (both dry and wet), they’re already well advanced into clinical trials, and they have a strong partner for their lead drug.

And, for whatever reason, the company is $900 million dollars cheaper than it was three weeks ago at the peak, down from about $70 a share to $45 — I don’t know if that’s because there’s reason for concern with the drug (there’s been no announcement, but I don’t track rumors), or because some competing drug has had great news… or just because pre-commercial biotech in general just sold off, or because of the “risk off” selloff of so many volatile stocks. Maybe that drop is an opportunity, maybe it’s a red flag — I’ll have to leave that call up to you.

So there you have it… three probably, not quite 100%-certain picks from a relatively new newsletter… anything tickle your fancy among OPHT, BONA or VLRS? Let us know with a comment below.

With all do respect why play the Airlines? The time to buy Alaskan Air was two years ago. And instead of a Mexican Airline how about GRUPO AEROPORTUPARIO ( OMAB ).

Its Airport Concessions cover 31 Mexican States, seven Regional Airports mostly in northern and central Mexico and almost 1MM Sq. Kilometers ( 13 Airports Total ). In addition it serves International Routes and the popular Tourist Destinations,

When I bought it earlier this year it was the dividend that interested me and the International Exposure. Currently 7.67% and after the gyrations this week I’m still up 58% today. It corrected less than my Carbon Holdings.

Maybe the earnings need improvement to retain the dividend at current levels but I believe it’s a better investment than airlines. See if this is suitable for your tolerance level and your International Investments Diversity.

P.S. Since Solar and Battery Powered Planes may never be economical or expeditious this strikes me as a SUSTAINABLE CARBON FUEL INVESTMENT!! ( sarc on )

The story behind the growth in profits in the airline industry is due to a number of factors that may continue and some that will not.

Everyone can see the effect of lower fuel cost.

It was not that long ago that this industry was in trouble, thus they got good labor agreements. As these expire, labor cost will rise.

It was not that long ago that due to a number of bankruptcies, the industry was allowed to consolidate into fewer players such that some carriers virtually own all the gates at certain airports. With the current level of profitability, anti-trust may again become a concern.

Airport expansion has not kept up with demand, thus each gate an airline occupies guarantees a level of economic rent. A lack of competition is responsible for some of the increase in profitability. Will an increase in public infrastructure create a more competitive environment?

The industry has learned the lessons from the past and thus has chosen to expand seats rather than planes. Lower levels of growth have led to higher levels of profitability.

These factors have run their course and the only new thing on the horizon is increased U.S. to Cuba tourism. But those tourists will most likely not fly to another destination thus cancelling any growth out.

Two years ago was when to hop on. Not so much now.

I look forward to your news letter thanks

would you please comment on James Dale Davidson,s book The Age of Deception Thanks

Fred:

I started a thread that has 12 responses so far. Check under stocks section labeled James Dale Davidson Age of Deception. Don’t have anything new to add other than the fact he has been very accurate in his predictions. It gives us all great cause of concern.

Don’t feel too bad. I started a thread with ZERO responses, Gene Therapy for Potatoes.

Not anymore! (I couldn’t resist.)

How to become a millionaire in aviation?

Start as a billionaire… 😉

I wouldn’t buy airlines stocks. If you saw the news recently, American Airlines refused to allow a war veteran on board because of his service dog. They, along with other airlines, also allow free baggage to active duty personnel, but war veterans that are military ID card carrying retired personnel are excluded. Only Southwest and Jet Blue don’t discriminate when they allow free baggage with certain restrictions.

He’s doing ice tea now http://profitsintea.com/. Very small Yahoo says BV is .10.

Net loss $ (3,180,269 ) . Small float Float: 2.13M

http://ih.advfn.com/p.php?pid=nmona&article=70862675

The flyer I got in the mail says “Global CR Holdings paid $TBD 471,600 for the creation of various elements of this campaign in an effort to build investor awareness. This report does not provide an analysis of a company’s financial position, operations or prospects and this is not to be construed as a recommendation by Global CR Holdings or an offer to buy or sell any security, or investment advice”

Travis, Once again you’re hard work has saved me from investing with another slick talking, scam artist. This is the third person who has promised me profits beyond human comprehension. I got a flyer singing the praises of an special type of tea that has no GMOs, cashes in on the well known name of the product to reduce or even eliminate shelf space costs and retail in the mass market price range ($1.25-$1.39) while offering a Super/Ultra Premium product.

I thank my good fortune for discovering the Stock Gumshoe. If I have a question I simply go to this site. It is well worth the annual subscription price. Thanks.