The world of psychedelics was briefly exciting for investors, mostly back around 2019-2020 or so, when everyone was looking for the next version of the cannabis bull market (remember that?)… and as potential for legalization of some drugs, like psilocybin (“magic mushrooms”), seemed to be in the wind, and old hallucinogenic or psychedelic compounds were beginning to be tested by a bunch of little biotech companies as treatments for PTSD, depression, addiction disorders and a bunch of other stuff.

That enthusiasm was pretty short-lived, but at the time a few stocks really did soar as the story took hold. So I was curious to see that Jeff Siegel, who was selling his Green Chip Stocks newsletter by teasing a few psychedelic drugmakers back then, is back at it. Last time around he was talking up the “Magic Molecule” that was going to bring riches raining down on a few select companies, and the results were thrilling for a hot minute — particularly for Mind Medicine, often called MindMed (MNMD), which was also backed by Kevin O’Leary (the Shark Tank celebrity, whose “brand” certainly took a beating after he enthusiastically endorsed Sam Bankman-Fried at FTX).

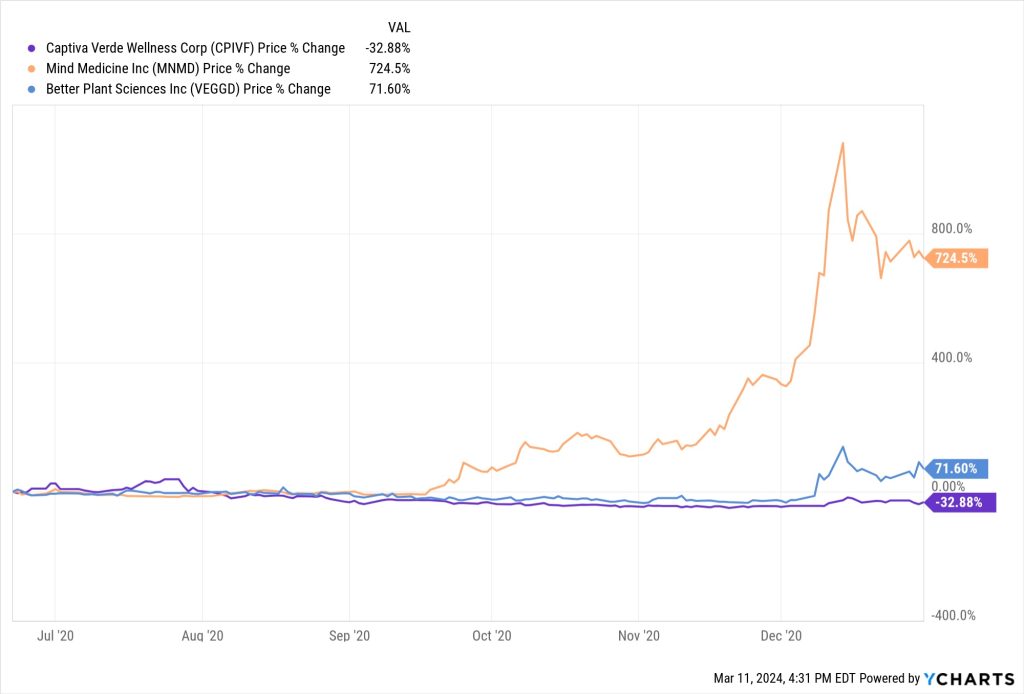

This is what the charts look like if you go back to 2020-2021, with the three stocks we wrote about following Siegel’s tease of the “Magic Molecule” which mostly pointed at MindMed, and when Oregon was pushing to start the decriminalization of psilocybin — that’s MindMed in orange, with the 1,000% gain at one point in late 2020, though the other two were less fortunate, for a brief while MindMed was one of the “top teasers of the year” as it soared higher:

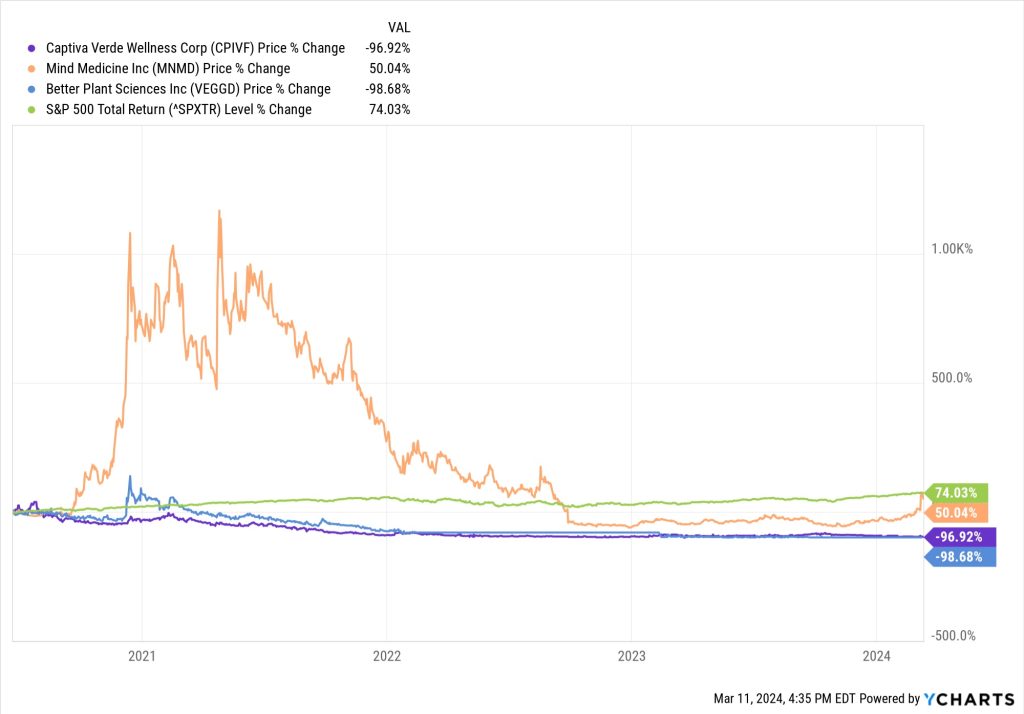

The crazy thing is that when Siegel writes about the stocks this time around, he says that at Green Chip Stocks, which is the newsletter he’s again selling today ($299 for the first year, renews at ?), they closed out their MindMed position with only a 105.13% gain… so either they sold quite early on the way up, in the Fall of 2020, or very late on the way down in 2022, when the psychedelics story was in freefall… here’s what that same chart looks like if you extend it out to this month (I added the S&P 500, in green, just for some context):

And if you look closely at the far end of that chart, you can see where MindMed has gotten some attention again recently. It bottomed out last fall around $2, and lately has gotten up to $10 or so, rising a bit even since I pulled that chart and giving it a market cap of more than $700 million again. This was a billion-dollar company for much of 2021… though there are also twice as many shares outstanding as there were three years ago, since this is still a years-from-generating-revenue biotech startup that has to sell shares to keep the lights on. As of December they were down to probably a year’s worth of cash, though a week or so ago they did a large equity offering to raise another $175 million at $6 per share, so they have “reloaded” a bit.

And the reason they were able to raise money at $6 a share is that they made a bit of clinical progress — and received “breakthrough therapy” designation from the FDA for their MM120 compound, after releasing their Phase 2B results, and announced they would plan to initiate Phase 3 trials in the second half of this year. That’s when things start to get real for biotechs… and also when they start to get expensive, because Phase 3 trials usually need to dose many more patients to convince the FDA of the safety and efficacy of the treatment. MM120 is their version of LSD, being tested in this trial as a treatment for Generalized Anxiety Disorder. They’re testing the same or similar variations on LSD for palliative care, cluster headaches and ADHD, and are also testing versions of MDMA in early stage trials (mostly to test dosing and safety on healthy subjects — MDMA, if you’re not caught up on all these things, is the chemical stimulant and “minor psychedelic” that is the active ingredient in the recreational drugs Molly and Ecstasy).

But it seems like the rising interest in hallucinogens and psychoactive drugs is mostly being driven by the expectation that another version of MDMA, from another company, is likely to get FDA approval later this year, perhaps as soon as August (the PDUFA date, by which the FDA is supposed to provide a response, is August 11). That came out of a decade of work by the Multidisciplinary Association for Psychedelic Studies (MAPS), which is a public benefit corporation (not publicly traded), though the organization has changed its name — MAPS Public Benefit Corp has now been rebranded Lykos Therapeutics PBC. The thinking seems to be that this first approval of a psychedelic for a mental illness will let loose the floodgates, maybe specifically for MindMed since they also have MDMA products in development, but for hallucinogens and pschedelics in general as people seek better and non-addictive treatments for depression, anxiety, addiction and lots of other ailments and illnesses.

So that’s the back story, as I see it… what is Siegel selling this time? Here’s a bit from the ad:

“Elon Musk, Sergey Brin, Bill Gates, and Joe Rogan ALL take this ‘Limitless Pill’.

“Now, With FDA Clearances Right Around the Corner…

“This New Class of Medicine Could Earn You an Absolute Fortune

“It can make you smarter, make you stronger, and extend your life span by as much as 20 years…

“And in less than a year, not only will you be able to get your hands on it, but early investors could make a legendary fortune in the process.”

Those references are generally to the trend of “microdosing” among folks in Silicon Valley over the years, not specifically to one drug, but we’ll see which specific junior biotechs might be getting the nod from Siegel this time… what hints does he drop?

“EN-23 is a truly unique substance.

“Some folks have even called it the “limitless” pill.

“If you’re unfamiliar, this is a direct reference to the movie Limitless, in which a fictional drug called NZT-48 turns a failed writer into a wealthy Wall Street guru who can process information at incredible speeds… learn foreign languages almost instantly… win over beautiful women with little effort… and eventually become a United States senator.

“Now, I’m not suggesting you can take EN-23 and do all that. After all, Limitless was just a movie. It was fiction. But EN-23 is not.

“You see, in the summer of 2023, Phase III trials for EN-23 were successfully completed, and now not only is EN-23 expected to be approved by the FDA, but it could actually be available to the public in less than 12 months.”

So that’s specifically about the MDMA trials I mentioned above, from what is now Lykos Therapeutics PBC, and we can’t invest in that… but he does finally get into some hints about the things we can buy.

"reveal" emails? If not,

just click here...

Starting with some of the big investors… though again, a lot of this references back to MindMed and investments that were made 3-5 years ago by these folks:

“… the Big Boys Are Racing to Claim Their Share Now

“Kevin O’Leary of Shark Tank fame invested $6 million in EN-23.

“PayPal co-founder and legendary venture capitalist Peter Thiel is in, too. He led a $125 million funding round for a company producing one of many versions of EN-23. That particular company was valued at more than $3 billion shortly after Thiel made his investment.

“Sam Altman, the CEO of OpenAI, is in for a few million dollars.

“And then there’s Bruce Linton, founder of cannabis company Canopy Growth Corporation. Linton made 70,000% on cannabis when his company’s stock price went from $0.10 to $70 a share.

“He’s betting big money that EN-23 will be far more profitable than cannabis ever was — or ever will be.”

So… Kevin O’Leary is MindMed, Peter Thiel’s big funding round was for Atai Life Sciences (ATAI) back in 2020, Sam Altman is funding a small private rehab startup that’s working on psychedelics, Bruce Linton has been involved with several firms in the space (he was on the board of MindMed for a while, and also invested in Red Light Holland (TRIP.CX, TRUFF), which has evaporated down to almost nothing these days, though I don’t know whether he’s currently involved with either).

And he does finally come out and say that this “EN-23” is just a made-up word for a class of drugs, not a specific pill itself:

“I should clarify that EN-23 isn’t just a single pill or treatment.

“Instead, it’s a valuable class of molecules that drastically improves brain function.

“To be more specific, these molecules bind to the serotonin 2a receptor, which is one of 15 specialized receptor molecules the serotonin system uses to coordinate brain activity.

“When administered orally, EN-23 molecules can not only lead to extreme changes in perception, cognition, and mood, but also promote neuroplasticity.”

The truth is there are dozens of EN-23 clinical trials being backed by the FDA right now and even more in preclinical stages, where early research is already showing success in the treatment of everything from mental illness and addiction to Alzheimer’s and erectile dysfunction.

And some of these companies conducting this research are not only public, but trading at huge discounts right now….

Once the FDA announces approval of EN-23, every trend chaser on Wall Street will be loading up the boat. And they’ll be paying a hefty premium for those EN-23 stocks compared to what you can buy them for right now.

So what about specific stocks? Can we hazard some guesses, at least, about which ones Jeff Siegel is pitching this time around?

Here are the clues…

“… there are three EN-23 companies in particular that stand to get a sizable chunk of this action.

“One is developing EN-23 treatments for major depressive disorder, anxiety, and alcoholism. The value of those three treatments alone exceeds $300 billion.”

The best match for those specific treatments, among the “reasonably sized” biotechs working on psychedelics, is probably Cybin (CYBN)… you can check out their recent presentation to some healthcare analysts here. Cybin went through the same boom and bust as MindMed in 2021, but, also like MindMed, has managed to keep raising money to move their clinical trials along… and they should have a fair amount of news flow this year for CYB003 (plan to initiate phase 3 study “midyear” in major depressive disorder, also in preclinical testing for alcohol use disorder) and CYB004 (cleared to start phase 2 study in generalized anxiety disorder). They just raised $150 million in a private placement at 43 cents/share, so they’re in pretty good shape to keep the clinical work going.

“Another is developing an EN-23-derived treatment for neuroinflammation.”

That one’s a bit trickier… it could also match Cybin, since they have an early-stage program working on neuroinflammation, though it’s not a major focus at the moment… so that might bump that first solution over to one of the other larger psychedelics companies who have a pretty wide range of programs (perhaps MindMed itself). There are several other companies who have worked on the anti-inflammatory potential of psilocybin, in particular, though none seem to be especially focused on that in clinical trials right now. The companies who are known as psychedelic developers and are making some initial waves in anti-inflammatory stuff seem to be Atai Life Sciences (ATAI), Silo Pharma (SILO) and Seelos Therapeutics (SEEL), though the latter two are too small to take seriously (market cap under $10 million, so they’re micro-nanocaps), and in all three cases the neuroinflammation work is being done using their non-psychoactive compounds.

“And the third EN-23 company that’s a virtual gold mine is one that’s developing a new EN-23 derived treatment for chronic pain.”

That’s probably MindMed (MNMD), which is specifically targeting chronic pain with some earlier-stage work using their version of LSD… though chronic pain and “opiate alternative” are thrown around a lot as targets for most of the psychedelic drugs, including psilocybin and ketamine. This could also be several other companies who are working on chronic pain, including the above-mentioned Silo Pharma as well as NRX Pharmaceuticals (NRXP), which is spinning out part of a ketamine company called HOPE Therapeutics which is trying to commercialize its use of IV Ketamine as a treatment for suicidal depression, and it’s a long list after that.

So those are some possible guesses for you — no way to be really certain given the limited clues available. If you’re interested in exploring the broader universe of biotechs who are working on psychedelic compounds or on drugs derived from those compounds, whether they’re natural (psilocybin, ayahuasca, mescaline, peyote) or synthetic (MDMA, LSD, ketamine, etc.), there’s also still a tiny surviving ETF that tries to address this sector, the AdvisorShares Psychedelics ETF (PSIL)… but it’s really, really small and could easily be wound down at any time. The biggest companies I’m aware of in this space that are working mostly in psychedelic-derived drugs, and have some clinical work ongoing, with a market cap over $100 million, are…

Mind Medicine (MNMD) ~$700 million market cap

Compass Pathways (CMPS) $600m

GH Research (GHRS) ~$550m

Atai Life Sciences (ATAI) ~$300m

Cybin (CYBN) ~$175m

Relmada Therepeutics (RLMD) ~$150m

VistaGen Therapeutics (VTGN) ~$120m

Would I buy any of these stocks? Probably not, I’m not particularly interested in trying to ride another crazy market in psychedelics, and I’m not likely to become an expert on these drugs or on gaming which MDMA or psilocybin-derived treatment might get the best pricing or insurance coverage or big pharma partnership as they approach the finish line of FDA approval… but if you think any of them are particularly great or terrible, please do let us know with a comment below.

As someone whose wife believes my brain function needs drastic improvement, she can’t wait for the winner to emerge!

This space is just to high for me …

bah dump, tsst!

All jokes aside, though, I sincerely hope something comes out of this research to help those people that it can help.

I’m recommending Compass Pathways (CMPS) in Biotech Moonshots for their proprietary psilocybin drug for treatment-resistant depression. Very successful in Phase 2. The first Phase 3 reads out at the end of 2025 and the second in mid-2026. Should be approved in 2o27. Their key difference is it is given in a professional setting with several weeks of counseling follow-up.

I jumped on CMPS as a purely speculative move and hung with it as it dropped and then rebounded. I am selling covered calls on my position to generate some return while we wait to see if these stocks will take off when something promising comes out. Oddly enough MNMD popped onto my radar earlier this morning so I may place a small speculative bet through a cas put to try and catch it at a discount. I live close to Telluride, CO which is the psychodelic capital of the state and has alot of unsanctioned human trials underway 🙂

Kevin O’Leary’s backing is about as good as the Mooch’s or Chamath’s. Stay away!

I am really grateful to you for finding stocks for us so we don’t have to pay $300 or even $49 to find out. I had been finding my own clues till I found you. Now I’m just annoyed for them charging anything, but this is the info age. I could put that $300 into a stock when you find it. Just want to thank you!