I’ve written about a bunch of “pre-IPO” investments in the past, but Ian Wyatt has probably been more relentless than anyone else in promoting this idea of “buying in before it’s public” … particularly when it comes to the hot “brand names” that excite investors.

Wyatt’s latest pitch is for a “webinar” that will air tomorrow at noon, so we obviously haven’t heard the hard sales pitch yet, but we can make some educated guesses for you. We don’t even know what newsletter he’ll be pitching, but in the past he has used these “pre-IPO” ideas to sell his Million-Dollar Portfolio.

His latest email subject line is that “The Next Tesla is Going Public — Get Shares Today,” but when you click through to the signup page for his webinar presentation about “The Pre-IPO Profit Secret”, the initial headline is about buying Palantir before the IPO.

So we’ll look into both of those quickly for you. They’re also good examples of the two basic kinds of publicly-traded “pre-IPO” investments that most investors can easily make.

The first one, the “next Tesla,” is teased thus:

“Electric vehicles are red hot …

“And that recently sent Tesla Motors (NASDAQ: TSLA) shares to a record high of $498.

“One new company is being dubbed “the next Tesla.” And it’s getting ready to go public in a historic IPO.

“Don’t wait! You can grab Pre-IPO shares BEFORE this next electric vehicle stock starts trading in November.”

I’m sure he’ll drop more hints in the “webinar” tomorrow, but those sessions always feel like the timeshare sales presentations you get sucked into at vacation resorts — so we’ll just jump the line a bit and tell you what I’m pretty sure he’s pitching here: This is very likely to be Fisker that he’s talking about, a name that will be familiar to folks who follow the auto industry.

Fisker Automotive was founded in 2007 by Henrik Fisker, a well-known automotive designer associated who was behind a few well-known cars for Aston Martin and BMW. He produced a couple thousand Fisker Karmas, a luxury plug-in hybrid, but they only produced for a couple years before first their battery supplier, then Fisker Automotive, itself went bankrupt (or nearly so, I don’t know if Fisker Automotive technically liquidated — but they sold everything other than the Fisker name to a Chinese company). They were reborn in 2016 as Fisker, Inc., with a new lineup of ambitious plans for electric vehicles and solid state batteries… including their first planned product, the Fisker Ocean. They’re taking reservations for that one now, and say they’ll be delivering this car, with an intro price similar to a low-end Tesla, in 2022.

So how is it that we can buy “pre-IPO” with this one? Well, Fisker has agreed to merge with a special purpose acquisition company (a SPAC, also often called a “blank check” company), and that will result in Fisker being a public company. The SPAC that they’re planning to merge into is managed by an arm of Apollo Global Management, a big private equity company, and is called Spartan Energy Acquisition Corp (SPAQ), and the deal is expected to be finalized before the end of the year (November is a good guess, though I haven’t seen any final dates yet).

Henrik Fisker is a bit of a showman, though not quite in the Elon Musk mold… and his overpromising might have even made Elon blush from 2010-2013 or so, which would give me ample reason to be cautious about this one, but I haven’t looked at it very closely in recent years. I have no idea whether or not Fisker 2.0 will work out, but I’d probably go in with some healthy skepticism. If you want to give yourself room to become a true believer in Fisker, the interview Henrik Fisker did with Barron’s might get you excited — you can listen to that here.

Here’s the comment from Car and Driver about the Fisker Ocean, in case you’re curious:

“The tide is turning for electric vehicles as more and more new models flood the market, and Fisker Automotive looks to capitalize on that sentiment with its aptly named Ocean SUV. While it’s still a couple of years away—or potentially more based on the company’s history of broken promises—the Ocean has a low starting price ($37,499) and long driving range (up to 300 miles). It also could benefit from the brand’s partnership with Electrify America, which might include some complimentary charging for customers. With a design similar to the handsome Range Rover Evoque, the 2022 Fisker Ocean could prove a compelling entry among the burgeoning EV SUV segment.”

Fisker’s “Investors” page is essentially the press release about the SPAC merger, and it sounds like the money from the SPAC and from the additional private financing they’re going at the same time, a total of about a billion dollars, will go to funding initial development of the Ocean… which is being outsourced to Magna International (MGA, MG.TO), the big Canadian auto parts company.

The deal values Fisker at about $2.9 billion, but that’s at $10 a share — at the current price if about $14 a share, the market cap of the company after the merger would be about $4 billion, and from what I can tell it will essentially consist of the Fisker brand, their current car designs and plans, and a billion dollars in cash. Whether or not that’s worth $4 billion, you’ll have to decide… auto startups are really tough, and, as we’ve seen with Tesla, they don’t generally make money for a very long time — so if the CEO isn’t able to light a fire under investors and keep the excitement level (and trust) eleveated, there’s every chance it could be the next Delorean or Tucker. Or the next Fisker Automotive.

Once the deal goes through, as is expected (though never guaranteed), SPAQ will become FSR, and the warrants associated with this SPAQ, now at SPAQ.WS or SPAQW depending on your broker (or something similar) will become FSR.WS. Each warrant gives the holder the right to buy SPAQ (or FSR, once the deal is done) at $11.50 for a period of five years after the deal consummates (subject to an “early redemption” or “forced exercise” if the shares trade over $18 a share for 20 days in a 30-day period). That would provide a bit of leverage if the shares surge in excitement following the deal’s completion, but the fact that SPACs are already adored and followed by traders this year means that the warrants are already pricing in some excitement (they’re trading about $4.50 right now, which still gives warrantholders a bit of leverage compared to the common stock, but would mean the stock has to exceed $16 for you to be “in the money” with those warrants — and, as always, in the unlikely event that the deal falls apart, the SPAQ shareholders can still get their redemption price back, lately that’s about $10.30, but the warrants could expire worthless).

So yes, it’s sort of like buying Fisker “pre-IPO” if you buy Spartan Energy Acquisition — but it’s not a secret, SPACs are well-followed now and everyone knows Fisker is coming back to the public markets through that merger. The stock certainly could catch the imagination of investors, that’s what happened with the other “next Tesla” shares we saw come public through a SPAC merger recently, Nikola (NKLA), but nothing is guaranteed. The shares of SPAQ jumped by about 50% on the day the Fisker merger deal was announced, and that might be all the IPO “pop” they get.

That’s one way of buying into pre-IPO companies — SPACs are getting a little crazy now, since there are so many of them and they’re chasing deals like crazy (SPAC sponsors are very motivated to get a deal done — if they don’t agree to a merger within two years, they have to give back the money, which sometimes leads to a “sellers market” for the companies that SPACs are targeting), but they’re sometimes interesting stories and they do let companies come public at lower cost and without quite as much scrutiny as they’d have in an underwritten offering with a big investment bank that includes a road show where the CEO is trotted around the country in an attempt to impress institutional investors. SPACs in general have historically not had a great track record, but we also haven’t ever seen this kind of surge in SPAC deals, and investors are still giddy over IPOs in general, so maybe the excitement will stay hot for a while.

And what’s the other deal, the one where Wyatt says you can buy into Palantir “pre-IPO?”

Palantir is the “big data” company that controversially (to some) does a lot of work for the government — they’ve been rumored as the next hot IPO for four or five years now, but have finally filed to come public this fall, and that does have people a little excited. They will likely start trading tomorrow, the word is that trading will begin at $10 a share and give them a $22 billion IPO, but it’s not really an IPO, it’s a direct listing.

"reveal" emails? If not,

just click here...

The difference? An IPO is an Initial Public Offering, and Palantir isn’t actually offering up new shares for sale — they’re just applying to list their shares directly without selling a huge chunk of them right off the bat. This isn’t unheard of, but it’s pretty unusual and generally has been done only with pretty big brand-name tech stocks — the ones that most famously followed this path were Slack Technologies (WORK) and Spotify (SPOT). Palantir is only allowing about 10% of its shares to trade, the rest (mostly held by venture capital companies and employees) is subject to a six-month lockup, so the price might act somewhat like a traditional “hot” IPO, with that initial pop due to a limited amount of supply, and then a drop in six months when insider selling is allowed to kick in.

How, then, to buy in before the shares trade tomorrow, if you should wish? In this case, I expect Wyatt is teasing SuRo Capital (SSSS), which is a publicly traded venture capital firm (used to be called GSV Capital, then Sutter Rock Capital). Palantir is a large holding of that firm, and the stock of SuRo jumped higher on the expectation that Palantir will go public and give SSSS holders a little windfall. Incidentally, Wyatt pitched Spotify pretty much exactly the same way back in 2018.

I’ve written about this a bunch of times for the Irregulars, since I also speculated on SSSS options once it started to look like Palantir would really move forward with its IPO, but there is some limit to the positive impact this IPO is likely to have on SSSS shares. Here’s the commentary I shares in a Friday File a couple months ago on this point, just illustrating how it worked with SSSS (at the time, GSV Capital) performed around the time that two of its previous large holdings went public (Facebook and Twitter).

(From the July 17, 2020 Friday File): The highest valuation SuRo has ever carried was back in March of 2012 (it was GSV Capital back then, ticker GSVC, but it’s the same company — just a name and ticker change), and that was entirely because they held a meaningful chunk of Facebook (FB) shares, which drove interest in the months leading up to the Facebook IPO (which ended up being in May of that year).

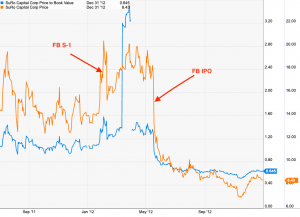

This is what that looks like, this is the chart from June of 2011 to January of 2013, with the Facebook S-1 filing (on February 1) and the IPO date (May 18) marked. The blue line is the price/book valuation, which got briefly up over 3 but was at mostly about 1.3X book until just the moment Facebook went public — at which time the folks who were buying shares because of Facebook could buy FB directly if they wanted. The next year after that IPO, with no real excitement building, the shares dropped down to a valuation of about 0.7X book value (they still held some FB for part of that time, and you might also recall that Facebook had a rough first year as a public company).

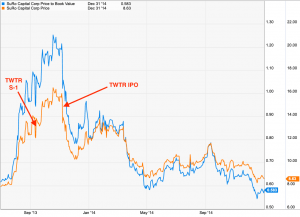

That was the most dramatic catalyst in SuRo’s history, but then for much of the next several years the shares were valued primarily based on the value of SuRo’s large private stake in Twitter, some of which they held for a while after the TWTR IPO. Here’s what the impact on the SuRo share price and valuation was during that IPO process a year or so later… Twitter filed its confidential S-1 on September 12, 2013 (and announced it on Twitter), and went public on November 7, 2013.

There have been some lesser periods of enthusiasm for GSV Capital and Sutter Rock (now SuRo) Capital, but those were the two biggies. And the biggie this time is Palantir, of course, which is one of SuRo’s largest holdings and could be one of the biggest IPOs of recent years… Palantir filed its confidential “draft” S-1 on July 6, a few weeks after Bloomberg reported (on June 11) that they were working with bankers with plans for a Fall IPO, and this is what that did to the SSSS share price…

So that’s a pretty clear indication that I should probably sell the balance of my position before the Palantir IPO, which could be anytime but will probably be in the next couple months if the market remains amenable. In the absence of other good news, it doesn’t seem terribly likely that the shares will soar a lot higher, since SuRo is right now trading at a price/book valuation of 1.3… which rivals the peak they reached right before the TWTR IPO. Indeed, this is the first time SuRo has traded above book value since that Twitter IPO, almost seven years ago.

On the other hand, we’re also in a truly nutty IPO environment right now, where SPAC conversions soar crazy high sometimes and “hot” tech IPOs shoot higher immediately, embraced by the latest generation of stuck-at-home day traders, with not much attention paid to valuations when it comes to newly public companies. So maybe SSSS will surge up to a 2X or 3X book value price as the details of the expected Palantir IPO emerge, getting to $20 or $30 before the next collapse… particularly if their second most-followed holding, the online education company Coursera, decides to jump while their sector is hot and file for an IPO as well (that’s been rumored for years, but I haven’t seen anything specific about even tentative plans for a filing anytime soon — Coursera’s last private fundraise was over $100 million, about a year ago). Given the limited history, it’s really just a question of whether we think the near-term performance will be more like during the FB IPO, in which case SSSS could double again, or the TWTR IPO, in which case we’re probably seeing the highs right now.

The last data point we might reasonably consider is what will the book value of SSSS be if Palantir is meaningfully revalued at the IPO? And that’s a wild card as well, because Palantir’s value as a private company has dropped some over the past few years but has actually been pretty stable (at least in SuRo’s estimation) over the past year.

Palantir has reportedly had more than a billion dollars worth of shares trade hands privately in recent years, with employees looking to cash in some of their compensation or early backers like Tiger Global taking their profits as the firm remained stubbornly private (and unprofitable), but the move to offering more automated and higher-margin services in the past couple years has apparently created a more predictable and profitable business. Valuations for the company over the past five years have fluctuated widely, from $20 billion in 2015 to less than half of that in some recent transactions, and fund manager Bailie Gifford, for example, disclosed that their stake in Palantir had lost about 3.5% a year from 2014-2020. Palantir was rumored as pursuing a valuation of $26 billion last year with some additional fundraising, but it didn’t happen.

SuRo reported a couple of weeks ago that they expect their net asset value (NAV) per share to have rebounded nicely from March to June, it was reported at $10.22 on March 31, and they now estimate that it will be between $11.70 and $12 as of June 30 (they report in early August, so we’ll get the full detail then). That does not reflect any adjustment to the value at which they carry their Palantir shares, it mostly just reflects the bounce-back from the coronavirus valuatios — the NAV was $11.38 on December 31.

In SuRo’s books, the Palantir investment was valued at $30.5 million as of March 31, a hair lower than the $31.6 million they estimated on December 31 and up slightly from $30.1 million a year ago. So it has been relatively steady… but that does change the calculus a little bit, it means that instead of trading at about 1.3X book value right now at $13 and change, SuRo is actually trading at about 1.1X book. If the value of Palantir jumps by 50% going into the IPO, which would be ridiculous (ridiculous happens every day now, so who knows), then that would likely boost SuRo’s book value by another 10% or so, perhaps getting it back above $200 million and over $13 in NAV per share. I think that’s the somewhat reasonable bull case, and if we assume that Palantir is Twitter-esque in its impact on investor enthusiasm for SuRo, we could easily see SuRo trade for 1.25X book going into the IPO. At $13 in book value, again just estimating a boost for Palantir, that could be a $16.25 share price for SuRo.

That seems to me to be a reasonable ceiling for Palantir hype’s impact on SuRo shares in a rational world, though I can’t promise the world will be rational. And absent any Coursera hype (that’s SuRo’s largest holding, though it’s roughly the same size as Palantir), we should probably expect the stock to be back under book value by a few days after the Palantir IPO, again matching that pattern from the Facebook and Twitter IPOs… so if we’re holding for that “peak hype” moment, watching that IPO date will be important. Of course, if the manic traders get ahold of Palantir and drive it up by 200% on the IPO day, who knows what might happen (we also don’t know whether Palantir will do a direct listing or actually offer up new shares, or, if it is an actual IPO, whether SuRo might sell some of their position as part of the offering).

Where does that leave us with SSSS at about $13 and the December $10 call options I own at about $4.50? It means that I could sell now for gains of about 1,800%… or hold out for possible gains of about 2,800% if I’m right about that likely ~$16.50 ceiling on the shares and the options go to $6.50-7 each. Since we also live with the risk that the market might get ugly at any moment, causing Palantir to pull back and postpone their IPO for another six months and quite possibly sending those option prices down by 90%, I’ll take the rest of that profit now. Your decision might easily differ, and indeed my decision might be different if I made it on a different day, when I had eaten a better lunch, but I thought I’d at least share my thinking with you.

(Incidentally, in case you’re wondering, the name change from Sutter Rock to SuRo was because of a lawsuit — apparently Sutter Hill Ventures, a VC company in Palo Alto, thought they were infringing because of the similar business focus, so they settled with a name change. Neither of them seems to have any real connection to pioneer/settler John Sutter who has left a legacy of Sutter-named things across the State. He built what became Sutter’s Fort in what is now Sacramento… and owned Sutter’s Mill, where gold was discovered in a moment that became the starting gun for the California gold rush).

I haven’t dug further into SuRo in the couple months since then, but unless Palantir rises by a couple hundred percent tomorrow morning — which is possible but, I think, pretty unlikely — then SuRo’s Palantir excitement might have already peaked. You never know for sure, of course, but I won’t personally try to jump on the last few moments of that ride. In August, SuRo did report that their NAV had risen to $11.84, with that Palantir position still valued by them at $30.5 million. I don’t know if they’ll be selling any Palantir shares into this direct listing tomorrow or not. Barron’s covered this one on Friday, nothing that the shares are expected to open at $10, giving Palantir an opening valuation of $22 billion, roughly 16X their revenue.

That’s roughly twice the valuation SuRo carries on its books for Palantir (SuRo apparently values its Palantir shares at ~$5), so it’s possible for the stock to pop higher still if Palantir goes bonkers tomorrow, but the ~$16 price I was speculating about in July still sounds like the most optimistic price a rational person could hope for… and while there’s possible upside from $13 here, it’s also becoming a high-wire act to some degree, given the tendency of SuRo to drop pretty sharply once the “pre-IPO” story has run its course and investors are able to buy the stock they actually want on their own.

So there you have it — two ways to buy into a company before it’s formally public, both of them pretty well-known and with the excitement of that “IPO” at least partially priced in. Does either sound exciting to you? Worthy a bet? Think they might be more appealing at some future date if the excitement cools? Let us know with a comment below.

Disclosure: of the companies mentioned above, I own call options on Slack and Twitter. I will not buy or sell any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thanks for the timely heads up, Travis! I have been getting bombarded with Wyatt’s emails this morning (say 10 or so). Certainly won’t be listening to tomorrow’s webinar!!

Travis, I think you’re spot on with SSSS. As a matter of normal due diligence, everyone should go to its web page and take a look at the backgrounds of its officers and its holdings. When you go to SSSS’ website and click on Palantir, a statement simply comes up that says, “Palantir prohibits the communication of company information. You can learn about Palantir by visiting their website.” Also, in its 10-Q dated June 30, 2020, SSSS reported it owned 5,773,690 common shares of Palantir which represented 15.85% of the value of its Net Assets. So, if Palantir common shares rise 200% (for example) from its IPO price, that does not mean the price of SSSS ‘ common shares would go up 200%. Incidentally, SSSS states that its Date of Initial Investment in Palantir was 5/7/2012 at a Cost of $16,189,935 which equates to about $2.80 per common share. SSSS shows the “Fair Value” of that total investment on June 30, 2020 at $30,542,820 or about $5.29 per common share (i.e., a gain of roughly $2.49 per common share or 88.9%). I’ll let Travis go further with more comments, should he choose to do so. As always, CAVEAT EMPTOR.

Travis, always appreciate your commentary. I will be a paying member soon any thoughts on these warrants I know its not actively followed by many, but this looks to be a new trading platform. Any thoughts . https://www.marketwatch.com/press-release/triterras-fintech-reports-5-billion-in-total-transaction-volume-on-its-kratos-platform-in-the-first-six-months-of-fiscal-2020-reaffirms-its-full-year-projections-2020-09-16-8183053

Well, sometimes those patterns do repeat… a huge collapse for SuRo today as Palantir finally completed its

Direct listing and began trading. PLTR looks like it rose on the day, but that’s just because the entry “benchmark” price was $7.50, not the ~$10 some folks expected — the valuation ended up being around $20 billion in public trading, and insiders seemed pretty eager to begin selling some shares.

Now that this event is over and there’s not much to look forward to of PLTR isn’t going to double like Snowflake, and might not rise dramatically, SSSS shares are down sharply, by 18% or so, presumably on their way back to the discount to book value that they typically trade at when a “hot” IPO isn’t in the offing.

Hi Travis,

PLTR skyrocketed in the past 3 days and SSSS shares has gone back to 10 bucks after market. Do you think the run will continue. Their NAV also went up as per recent earnings. Care to share if you have any updates?

Thanks

AC

Haven’t looked at Palantir since I sold my SSSS speculation, sorry.

This was so amazingly predicted. I lost a bunch on SSSS on the PLTR IPO, wished I would’ve read this beforehand. Congrats on the option gains!

Good to see Ian Wyatt’s (or any other “hotshot” newsletter/investment promoter’s) name in the headline. Hopefully, that’s a huge, strong “red flag” to anyone even passively considering throwing some of their hard-earned money off that bridge. As always, CAVEAT EMPTOR!

Election Result Market Thoughts?

What happens if Trump loses and does not amicably pass the baton?

Travis…are stops enough?

The Old Man

I most recently shared my thoughts on the election here:

https://www.stockgumshoe.com/2020/10/friday-file-insurance-disruption-flat-rhythm-and-a-falling-par/

The world doesn’t offer 100% certainty in anything.

Pre IPOs

Has anyone had experience with SPACs?

Wyatt is on to AirBnB, pre-IPO and I confess to being interested in it as a long term investment. What’s the private equity firm most invested in this one? -Dave

I am interested to know that as well…

Ian Wyatt is at it again even more aggressively. I understand that he may be promoting to get in on AirBnB and the likes pre IPO. I have looked at buying preIPOs through sharespost.com, but their minimum investment in any of their offerings is $100K., way more than what I am willing to gamble with. Any ideas as to how to buy preIPOs with less money? (obviously I am asking how to buy shares from companies who do not let smaller private investors buy from them directly).

Thanks!!

I have looked at using equityzen.com for pre-IPO companies because the buy in is a lot less, but I have not pulled the trigger yet. Much more research to do still.

Thank you so much, Travis! You have been a godsend! I have used my Corona time at home to become more educated about investing, so my investment knowledge is rudimentary and spotty. However, I am the investment guru of my family and friends. Scary!! And scary to think how many people are absolutely clueless. Going through your writings, it is obvious one must possess a large dose of intelligence, curiosity and affinity to financial matters and math and a healthy dose of motivation combined with good old hard work. To achieve the American dream through investing seems largely unattainable for everyday folks, if they do not have the extra time, money and brain power to get behind it. Sad to say.

Having just looked at European news this morning, I also encountered Fisker Automotive. While Magna is a Canadian company, the founder, Frank Stronach, is Austrian, who, after becoming less active in his company, went back to Austria to become a politician around 2011/2012. It is reported that the Fisker Ocean will be built, starting 2022, in Graz, Austria as well as in Hoce, Slovenia. They are estimating that they will produce about 50,000 cars there per year. Would it be worth buying Magna?

They depend a lot more on general volume of automobile demand, so the recessionary worries are more of an issue for Magna than is Fisker… not particularly interested in owning either at this point, but I do at least like Magna a lot more than Fisker.