The first version of this article was published on May 25, 2023 — the ad has been updated with the new “December 10” date (now that the previous “September 10” date has passed), to go with the next expected dividend from the teased company, and I’ve re-checked the financial details below and made some minor updates, including a more thorough update following their recent earnings report at the bottom (scroll down to “October Update” if you remember the gist of the original story), but the basic spiel is largely unchanged since we first published.

This ad harkens back to some old pitches we saw in past years from different publishers, all about how there’s secret money flowing to those who just know how to get that “royalty” or that “income stream” from popular businesses (or even from the government). I’ve not written about Brad Thomas and his move to publishing and promoting newsletters, though (he has been a REIT-focused guy at Seeking Alpha for many years, I guess he’s trying to up his game), so this seemed like a good teaser pitch to jump on as he teases a secret “royalty” play as bait for subscribers to his Intelligent Income Investor ($49 “on sale” first year, renews at ?). We’ll see if this spiel turns out to be any different from the old “earn Amazon Prime profits” pitches we saw over many years from the Wealth Advisory folks.

Ready? Let’s jump right in… here’s the intro to the ad:

“SEC Filing Reveals Wall Street Billionaires Set to Collect $3.2 Billion Payout From:

“Amazon’s Secret Royalty Program

“Thanks to an IRS loophole , regular Americans can now collect $28,544 in “royalty” payouts (or more) — Starting June 13th December 10th…

“‘Enough money to live off of each year, without having any other retirement plan…’ —Business Insider“

Man, that headline has everything — a reference to obscure stuff that nobody reads (SEC filings), a huge number for the money billionaire are earning that makes you feel like there will be crumbs left for you, and even a specific payout that YOU can get ($28,544!) and an endorsement from someone who sounds like an outside expert and implies that this is the fix for the fact that you can’t afford to retire.

Not only that, but there’s also a deadline, June 13th, just a few weeks away… and we know that ads always work better if there’s a deadline (the last thing an ad copywriter wants you to do is think it over). Whoever wrote this one is earning his keep.

The basic idea, not unlike those “Prime Profits” pitches from years ago, is that this is a way for you to earn your little slice of the tidal wave of cash washing through Amazon’s business. Here’s a little taste from the “presentation”:

“… while most people know Amazon’s early backers got rich…

“And Jeff Bezos made out like a bandit…

“What few people realize is that a portion of Amazon’s massive profits — billions of dollars each year — gets paid out through what I call ‘Amazon’s secret royalty program’…

“I’m talking about an IRS loophole that allows regular Americans to collect ‘royalty’ payouts, every single year — without having to own a single share of Amazon stock.”

Which reminds us of another rule about investment newsletter teaser ads: If they put something in quotes, they’re “lying.” No, it’s not a “royalty.”

But what is it? He doubles down on that “royalty” term for a while…

“… like when a famous songwriter gets paid royalties whenever their music plays on the radio, a commercial, or online…

“Or a famous author gets paid every time a copy of their book gets sold….

“When you buy into ‘Amazon’s secret royalty program’…

“YOU gain the legal right to collect “royalty” payouts when people shop on Amazon…

“And you can do this:

“Without having to sell any products online…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Without having to become an Amazon Prime member…

“And without ever having to buy — or own — a single share of Amazon stock!”

And he also says it’s kind of like a dividend… which probably means we’re getting closer to the truth:

“It’s like getting paid a ‘secret dividend’ from Amazon… Even though the company has never paid a dividend, and most likely never will….

“… as the SEC states, this loophole is a way for ‘individual investors to earn a share of the income produced.'”

And we’re told about some of the huge institutions that are making bank on this…

“And Wall Street hedge funds and in-the-know billionaires have been raking up Amazon ‘royalties’ for years…

“Like BlackRock, who collected $449 million in Amazon ‘royalties’ last year …

“Vanguard, also received a huge $649 million payout…”

And he implies that Ray Dalio’s Bridgewater has bet on this “secret” program instead of owning Amazon…

“And even Ray Dalio’s Bridgewater Associates — the largest hedge fund in the world…

“They dumped every share of Amazon stock they owned…

“What did they do instead?

“They moved their money into ‘Amazon’s secret royalty program,’ increasing their stake by over 500%…

“Why?

“Simple…

“Because with this ‘program’ you’re legally mandated to get paid — even if Amazon stock goes down!”

OK, so all of this is pointing at some kind of Real Estate Investment Trust (REIT) — “secret payouts” almost always means dividends, and “legally mandated” dividends almost always means REITs.

And yes, REITs do indeed have to pay out the vast majority of their income as dividends to their shareholders… though the caveat, of course, is income — they don’t have to pay dividends if they’re not making a profit, and most of them pay out far more than they are required to pay (diverting depreciation to shareholders instead of reinvesting it for maintenance or growth spending, for example, since they also count on their real estate appreciating in value over time), so even when they are required to pay a dividend, they usually pay a dividend that’s far higher than required… which means they could always reduce it if conditions warrant.

Brad Thomas wrote almost exclusively about REITs over at Seeking Alpha for years, so I imagine this won’t come as a big surprise to anyone who recognizes his name. He’s almost certainly recommending a REIT investment as a way to get indirect income from Amazon… probably because Amazon is a customer or tenant of that REIT.

But we’ve put the cart before the horse here, let’s hear it in Brad’s words:

“‘Amazon’s secret royalty program’ paid out $2.4 BILLION last year…

“Mandated by U.S. federal law!

“And get this…

“Over the last 20+ years…

“‘Amazon’s secret royalty program’ has NEVER missed a single ‘royalty’ payout.

“NOT ONCE.”

Well, that narrows it down quite a bit — there are not many gigantic REITs, and you’d have to be very large to have paid out $2.4 billion in dividends last year. Assuming a trailing dividend of something in the 5% range, at a minimum, and that would mean the REIT he’s referring to would have to be at a market cap of at least $50 billion. Perhaps much larger, if the yield is lower. He also says it was around back when the Nasdaq crashed in 2001, and when the whole market crashed in 2008, and that it paid out tons of dividends back then (over $219 million in 2001, $542 million in 2008)… so that narrows it down still more.

And I think he’s actually doing the math wrong with those, frankly, failing to realize that the share count ballooned in the interim (he must be using the per-share dividend in those years and multiplying it by the number of shares outstanding today, or perhaps combining all the companies that this REIT acquired over the years to get a total, because those dividend paid numbers are far higher than the teased company actually paid), but, again, we are getting awfully close to a certain answer here. Other clues, just to be sure?

“Wall Street’s most successful hedge funds and billionaires love this program so much…

“In fact, this year, they’re preparing to claim as much as 90% of ALL available payouts!

“It’s simply not fair!

“THIS ENDS NOW…

“There’s simply no reason why you shouldn’t collect your share of ‘royalties'”

Well, that’s not terribly surprising — most large companies are majority owned by institutional shareholders, particularly if you include the brokerage firms who hold your shares for you (I’m not listed in any “large holders” list, of course, but my shares held through Fidelity may well be included in the ownership by Fidelity).

And we get some examples of folks who get big “royalties” and seem like regular-guy folks like you or I:

“Buried on page 1,794, in Section 561, the code states the ‘Amazon secret royalty program’ must ‘distribute [payouts] to shareholders…’

“It MUST.

“And these mandated payouts can add up in a really big way…

“Just take a look at some of the earliest participants…

“I’m talking about the folks who helped launch Amazon’s ‘secret royalty’ program…

“Through public filings, I discovered these individuals are now collecting massive five- and six-figure “royalty” checks.

“Like Dr. Jeffery S., who actually retired back in 2009. He recently got a $49,730 ‘Amazon royalty’ check… And he’s set to collect at least 3 more ‘royalty’ payouts this year….

“And this is crazy but, Hamid M., is set to collect a massive $1.8 million Amazon “secret royalty” check — this year alone.

“Now, of course, that’s an exceptional amount of money… And you shouldn’t expect to see that kind of payout.

“What you get out depends on what you put in.

“However…

“Can you imagine what you could do with even just a fraction of this kind of income?”

Well, sure. Who can’t imagine getting free money? Heck, sometimes it’s all we dream about!

And Thomas says that there’s something big and exciting coming, a “mega project” to boost payouts:

“I’m going to share with you the details on a massive project that Amazon is about to launch…

“A new mega project, which I believe could lead to the single biggest “royalty” that’s ever been paid…

“A massive $3.2 billion payout.”

So what is it that’s being teased here? Thomas continues to insist on referring to it as a “royalty,” but here’s how he gets into the details of where your “royalty” money comes from:

“You Can Own the ‘Rights’ to a Critical Asset for Amazon’s Business

“You see, in the United States alone, Amazon ships over 1.6 million packages per day! ….

“What critical asset?

“It’s the starting point for every Amazon order…

“The great Amazon warehouse….

“As Amazon has expanded its warehouse empire across America… Amassing more than 319 million square-feet of space…

“… what few people realize is that Amazon DOES NOT own all of its warehouses….

“Instead, Amazon pays to rent a large portion of the warehouse space it needs from a smaller partner company.”

So yes, Thomas is hinting at a recommendation to buy a warehouse REIT, a publicly traded company that owns and leases warehouse space to other businesses… yes, like Amazon. He finally fesses up on that part…

“Not like a traditional royalty. Instead, these payouts are tied directly to the fees Amazon pays to use YOUR warehouses…

“It’s like collecting a fee every time Amazon ships a package from its warehouses…”

Well, no, it’s like collecting a fee every time Amazon pays their rent. That’s a LOT less interesting, of course, because it’s not nearly so scalable — Amazon isn’t going to pay twice the rent in a month when they ship more stuff from that warehouse. The plus side of that is that it’s more reliable — Amazon is a good credit risk, so they’ll probably pay the rent, and the rent will probably go up a little bit each year.

What’s that “mega project” stuff about?

“I believe we could see the single biggest ever…

“A one-time $3.2 billion ‘royalty’ payout,

“Why?

“Because Amazon is set to launch its most ambitious project yet…

“A New MEGA Warehouse…

“It will be the single, largest Amazon warehouse in the world.

“We’re talking about a five-story, state-of-the-art facility that will be over 4 million square-feet in total…”

So that is being completed, not sure whether it’s actually operational right now or not (it was supposed to be done back in 2022), but that’s the massive new fulfillment center in the Inland Empire, often referred to as the largest warehouse in the world. And yes, it is a project that’s being built by a real estate investment trust, and it is leased to Amazon. There are a few other Amazon warehouses either open or under development that are almost that large, in Colorado Springs and Northern Virginia, but I think this is still the biggest.

And the landlord, of course, is our old friend Prologis (PLD), the largest publicly traded REIT in the world.

And yes, sadly, that means this is really just an homage to the old Wealth Advisory pitch for Prologis as a “Prime profits” income investment. The Wealth Advisory liked to promise that payouts of $48,000 were available, and Thomas is bumping that down to $28,544, but pretty much the same idea.

How does this work? Well, Prologis is a massive global owner of logistics and warehouse space, and they lease that space out to tenants who need to store goods and move them around the world, including giants like Walmart and Amazon who need to have big warehouses in every city, as well as plenty of smaller companies who need less space, or even just a single location. A lot of these, especially for the high-end Amazon warehouses that have to work with Amazon’s Kiva robotics systems, are essentially purpose-built for that client, with a lease deal promised before the building starts construction, and that’s certainly the case with that “mega project” Thomas talks about, but many others are much more generic.

Then, as a REIT, Prologis has to cover its operating costs and provide services to tenants, finance new projects, deal with vacancies and lease renewals, and pay its own overhead and cover its debt payments, and then is required to distribute the income that’s left over to shareholders in the form of dividends. In practice, most REITs report a version of cash flow that’s called Funds From Operations (FFO), and it’s meant to represent the sustainable cash flow from their existing properties, without deducting for depreciation and generally ignoring the costs of building new properties or the profits from selling any of their real estate that they decide to get rid of. Investors generally assume that REITs will pay out most of their FFO as dividends, leaving a little margin of safety, even if the legal requirement for the dividend is much lower, because non-cash depreciation charges on commercial real estate are quite high (REIT managers know that the reason investors buy REITs is because they provide a steady and usually growing dividend, so they try to pay out as much as they can — some are more aggressive than others).

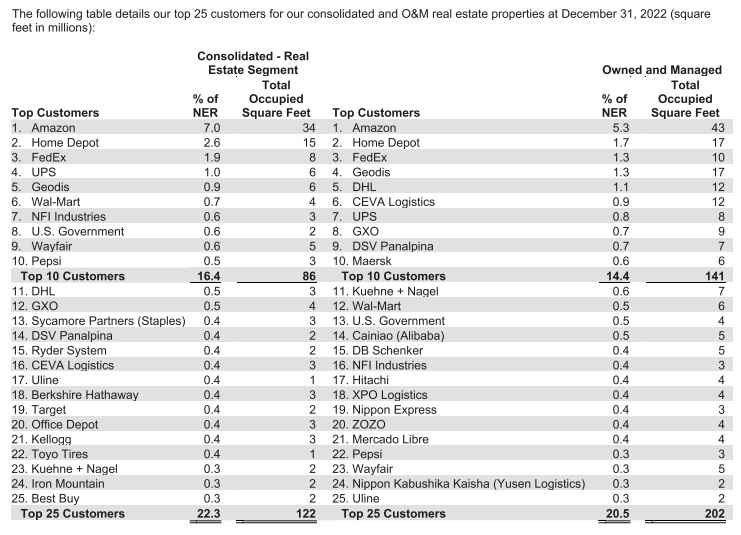

Right now, Prologis pays out a dividend of 87 cents per share, per quarter, and they have consistently grown that dividend over time… most years the growth has been right around 10% per year, though there was a big one-time increase of 25% in 2022 (it was not repeated, this year’s increase was back to 10%). And yes, Amazon is by far the largest customer for Prologis, at roughly 7% of their expected future revenues, but even the top 25 customers of Prologis only account for 22% of revenue, so this isn’t exactly a “pure play” on Amazon’s warehouse needs or spending. Here’s that customer list from their latest 10K:

That big new “Mega Project” warehouse in the Inland Empire will presumably boost this number a bit, adding another four million square feet, though I don’t know whether that’s included in the 34 million or 43 million occupied square feet for Amazon as of December 31. Those numbers did jump by 10 million square feet in just the past year, so they’ve been building like mad, and also making acquisitions (they bought about $3 billion worth of warehouses from Blackstone recently) — though last year, like now, Amazon was only 7% of the portfolio at Prologis, so everything else has also grown, and at the same average pace, and Amazon is not necessarily becoming more important to Prologis. The percentage of Prologis revenue coming from Amazon has been in this same general neighborhood for at least 5-10 years, I think it was a little bit higher in the past but not dramatically so.

So if you do the math… that means, at an annualized dividend of $3.48, you would have to own a little over 8,200 shares of Prologis in order to earn $28,544 in annual dividend income from Prologis shares. They’re changing hands for about $120 right now, so in order to buy that many shares you’d have to cough up just shy of one million dollars ($984,000, if you want to be precise). People who spend that much to buy shares of their favorite REIT are not necessarily the folks who usually get sucked in to reading a long pitch for a $199 newsletter, but I guess it takes all kinds.

Will this “Mega project” in California result in a dramatic shift in the payout from Prologis? Probably not. They’ve got more than 500 million square feet of property in their portfolio, and adding a few million more is good, from this and other projects as they grow each year, but it’s not going to dramatically shift the company’s prospects. More likely, they’ll find their FFO under a little more pressure as their financing costs go up a bit and they have to issue more shares to keep funding their growth (most REITs, to grow, end up using about half debt and half new shares to finance new projects or acquisitions — the focus on distributing cash to shareholders means they don’t typically have a lot of excess cash flow to use to fund their own growth).

Prologis is one of the safer commercial real estate companies out there, their warehouses have much better occupancy rates than office buildings right now (97%, and consistently well over 95% for a decade now)… but that’s not guaranteed to be the case forever, and there is some risk, so lenders will be charging them a little more as they have to refinance a little chunk of their debt each year. It’s not a huge deal, their profitability is not being squeezed out entirely, but the business is getting a little harder than it was when interest rates were at zero… though on the flip side, they’re also seeing a fairly large number of big tenants rolling off of their leases in the coming years, and Prologis believes they will be able to re-lease those properties at substantially higher rates, given strong demand in many of their markets (and the fact that interest rates are climbing means that new building projects are slowing down in this space, reducing competition) — they see that lease rollover as providing an 8-10% annual boost to their net operating income over the next few years, which is better than I would have expected. The rising cost of debt is actually less of a big deal for Prologis than I would have guessed, at least for now, because their average interest rate is only 2.9% right now, and has an average term to maturity of almost nine years, with only 15% of their debt being at floating rates… but yes, their debt costs will almost certainly rise, it will just happen pretty gradually (they’re up from about 2.5% to 2.9% over the past six months… and their latest refinancing was at 4.9%, but they don’t have any big maturities until 2026).

And this year will probably look quite impressive when it comes to year-over-year growth — even if that’s primarily because of a big acquisition. Prologis bought out their largest competitor, Duke Realty, in a deal that went through surprisingly quietly but closed back in October, and that’s going to boost the growth rate pretty sharply this year (it will boost the per-share numbers a little bit, too, since Duke traded at a lower valuation, but they used stock for the $23 billion acquisition, so the share count also jumped sharply at Prologis last year).

The rising interest rates have hurt Prologis, like they have most REITs, and that’s both because of higher borrowing costs for them and because their REIT shares have to compete with other income investments, to at least some degree. Prologis got very popular, and traded up to the point where it had a dividend yield of 1% or so near the peak of the market in 2021, but investors started demanding a higher payout as interest rates and risk climbed over the past year or so, and the dividend yield is now back up to roughly where it was in 2018, just about 3%. The stock has pretty much always paid a below-average REIT dividend yield, since it’s very large and perceived as very safe and well-managed, and that’s still true (Vanguard Real Estate ETF (VNQ) has a dividend yield of 4.8% now, that’s a pretty good proxy for the sector average), but it has also been more than a decade since PLD shares have had to compete with a much safer 4% or 5% T-bill or Government Bond (or savings account, even). It’s likely still more appealing to many people than T-Bills, particularly because the history of dividend growth has been so steady and solid, but when inflation and real interest rates are high, even a growing 3% dividend fades into the background a bit.

So what do we end up with? Prologis is the safest large REIT I can think of, and it has an admirable track record of consistently growing their funds from operations and dividend by more than 10% per year, well above average for a REIT (and above average for the S&P 500, actually). They are still subject to interest rate risk, since investors have to come in each day and choose to buy these shares with a 3% yield, but they are a global titan and have far more flexibility and access to capital than anyone else in their industry, and they also have plenty of growth potential in the form of available land in key logistics areas, so there’s no reason to expect the growth to drop off dramatically.

There’s no indication that any of their new properties under construction, including that largest-ever Amazon warehouse, will provide a big one time “royalty payout” for any reason, as Brad Thomas says in his ad, but the reasonably steady growth seems quite likely to continue. My best guess is that Prologis will keep raising the dividend by roughly 10% per year, maybe slowing slightly as they grow, and that the FFO growth will be more than enough to cover that dividend, as long as their logistics and warehouses properties remain in enough demand that they can release existing properties at gradually higher rents. None of that is guaranteed, but it is fairly safe, on balance. And they can easily cover the dividend, with a lot of cash to spare (their most conservative estimate for “core FFO” for this year is $5.10 per share, which easily covers the current $3.48 dividend for the year).

Will it make you rich like “Dr. Jeffery S.” or “Hamid M.” Well, sorry, but no… not anytime soon, anyway. That’s almost certainly Jeffrey Skelton, who has been on the Prologis Board of Directors for more than 25 years, and has accumulated about 59,000 shares (worth a little over $7 million, and yes, paying out a nice dividend of a bit over $50,000/quarter), and Hamid Moghadam, who co-founded the company that became Prologis 40 years ago and still serves as CEO and Board Chair. He and his various trusts own about two million shares now, so that’s generating a truly nutty amount of income, but, well, that’s what happens when you found and build a $100 billion company.

How about compared to an Amazon investment? Well, that’s tough to say… here’s the long-term history, and there’s no contest on that front… since the moment when investors could have had a choice between these two companies (Prologis’ predecessor company AMB and Amazon actually went public within about a year of each other in the late 1990s), the total return has not been close — AMZN has returned about 50,000% and Prologis, including dividends, about 1,400%… though Prologis did beat the S&P 500 quite handily over those 25 years:

Over the past five years, however, Prologis has held its own quite nicely, getting a COVID boost and a zero-interest boost just like Amazon did, but not giving back as much of it over the past year or so — here’s that same chart going back to 2018, instead of 1998:

What will the next five years bring? I don’t know. I do own Amazon shares, and think they’re probably a more compelling long-term investment than Prologis at today’s prices… but Prologis is a great company, it will probably be a much steadier investment than Amazon, and it has come back to a pretty rational valuation again.

And your October update?

Prologis reported its latest earnings update this week, and the numbers for the quarter were a mild “beat” of analyst estimates, but they talked pretty cautiously about supply and demand in the fulfillment warehouse space, and their core FFO shrunk year-over-year for the first time in a couple years (you can get a sense of management’s cautious “tone” from the call transcript). The stock dropped about 5% on the week, and is down close to 20% since we first solved this teaser pitch back in May — thanks mostly to the much sharper move higher in interest rates that finally kicked in (most clearly, with the 10 Year Note jumping from 4% to 5% in the past couple months).

The company is still very large and stable, and they can still borrow pretty cheap, their preferred shares are still trading at a premium (for a 7.7% dividend yield) and their 5-10 year bonds are trading with a 5-6% yield these days… but those bonds had initial coupons in many cases of 2, 3 or 4%, some even as low as 1.25%, so it seems almost inevitable that their cash costs will go up — they will have to pay a bit more to borrow money, they have to pay a higher dividend to attract shareholders, and the buildings that they bought with only a 4% cash return (cap rate) have to get a lot better, without too much capital spending, in order to contribute to their profitability instead of detract from it.

Thankfully, they did do some planning for this, with a debt structure that goes out for a long period of time and a break of another couple years before large refinancings are necessary… and they bought and built hundreds of warehouses around the country (and the world) which have much higher current cash yields than the recent investments, since they were acquired at more rational cap rates of 6-8% or higher before the zero interest rate era, and have enjoyed many years of rent increases to keep up with inflation… but the current squeeze is real, and it won’t necessarily ease up anytime soon, not when the company is saying that they’re seeing overbuilt conditions in some markets and are being cautious with their balance sheet.

My knee-jerk reaction is that PLD with a 3%+ yield is starting to look appealing, but that’s probably because I remember looking at it for so long when it had a 1-2% yield… so I have to remind myself that the only time I’ve owned Prologis, back in the early 2000s, it had a dividend yield of close to 6% (the 10-year Treasury Note was in the 4-5% range at the time then, too — though it was falling, not rising).

But really, I think the world has changed, at least for the moment, and their business has gotten harder, and 3% is no longer particularly appealing. That could change, and a lot of investors expect it to change next year, with the hope that interest rates will fall again — if that happens, it would probably be very good for Prologis, but I would hesitate to really count on that outcome.

It’s still a good company, and is amazingly dominant in its space, and the need for smart warehouses and industrial space is not going to disappear… I just don’t know when to get comfortable with the interest rate reset. PLD has growth its revenue per share by 140% in ten years, and its funds from operations (FFO) per share by almost 200%, which is clearly what has supported the share price (which has also gone up about 200% during that decade — total debt has gone up about 160%), but it might be challenging for them to keep up their 10% dividend growth of recent years or invest in growth, which means it might not grow fast enough to make it feel appealing compared to risk-free government debt. (The dividend did jump by about 25% in 2022, but that was the outlier — every other year recently, including 2023, has seen roughly 10% dividend growth.) Here’s the dividend yield for PLD over the past decade (purple), compared to the 10-year note rate (blue) and the Fed Funds Rate (orange):

You can see that the last time we had a little panic about interest rates finally going up and becoming “real,” in 2016, PLD shares dropped to give the stock a yield of over 4%, but the stock held up pretty well through that rate-hiking cycle and the dividend yield on PLD dropped to about 2.5% when the Fed Funds rate got to its high (at the time) of about 2% in 2019, before the COVID panic brought back zero rates. So far, though, the leap higher in the Fed Funds Rate in 2022 and 2023 has impacted the 10-year note a LOT more than it has the PLD dividend. I expect that to change — if the 10-year note stays up near 5% for a while, or drifts even higher, that PLD dividend is going to have to climb much closer to that level to attract a lot of attention, particularly because they’re likely to see their profitability squeezed by higher rates, and that makes it unlikely that they’ll be able to grow the dividend at a fast enough rate to make a 3% yield look attractive.

A recession that doesn’t destroy demand for fulfillment infrastructure and industrial real estate would probably be the “goldilocks” scenario for Prologis. If we do hit a recession but PLD’s tenants keep paying their rent, and the Fed has to slash rates in a year or two, then PLD’s dividend yield at these levels will probably look attractive again. Assuming the bond vigilantes surrender, or the foreign buyers come back into the market, and everyone goes back to buying 10-year notes at 3% coupons (or, alternatively, assuming the Fed does “quantitative easing” again and just buys the bonds itself — which is obviously just another shell game, but worked fine and pleased investors last time around).

That’s the same squeeze impacting so many levered low-growth companies right now, including most of the big REITs, it’s not just Prologis, but that’s how I’m thinking about it today.

It’s your money, of course, so in the end it’s your call — does Prologis deliver for you at $100, with a 3% yield? Prefer Amazon’s future growth potential and more beaten-down price? Have other investments you like much more than others? Let us know with a comment below… we’ve kept all the original comments attached below, too, in case you’re wondering what folks thought back in May when we first published. Thanks for reading!

P.S. If you’ve ever subscribed to Thomas’ Intelligent Income Investor or have experience following his stock picks, please visit our Intelligent Income Investor reviews page to let your fellow Gumshoe readers know what you think. Thanks again!

P.P.S. In case you’re ever tempted to believe the crazy promises of newsletter ads, and particularly the urgency of buying RIGHT NOW, here’s what the total return for Prologis (PLD) since we covered the first version of this ad, on May 25, 2023 — that’s PLD in purple, the S&P 500 in orange, and the Vanguard Real Estate ETF (VNQ) in blue (including dividends)… and just for grins, Amazon in green:

Disclosure: Of the companies mentioned above, I own shares of Amazon. I will not trade in any covered shares for at least three days after publication, per Stock Gumshoe’s trading rules.

Hey Travis, thanks for the leg work.

I own PLD at around $104. I think $131.50 is fairly priced. $104 is an excellent buy price, not because its my cost basis, but it is at the lower range of the 10 year, 2 sigma price range. An excellent price point is $92 which is the 10 year, 3 sigma lower limit.

If we don’t have a wild further acceleration in inflation and interest rates in the next few years, I agree, pretty appealing here. We don’t really know how these kinds of companies will perform in an environment that’s different from the past 40 years, though — during the last real Fed rate hike cycle, from 2004-2006 or so, PLD was valued at about 10X cash flow, and when rates went briefly up from 2015-2016 it was valued at about 15X cash flow for a while, those are the recent valuation lows. Valuation is at a little over 20X expected 2023 cash flow now. (Just looked quickly, so I’m using EV/EBITDA as a stand-in for price/cash flow since it’s easier and similar, particularly since interest and depreciation should rise pretty similarly for them if rates have an impact, though that hasn’t been the case for the past decade of low interest rates)

Where do you find (or how do you calculate) the 2 and 3 sigma prices?

Checking this website, it’s true that Amazon is not in Bridgwater’s top 50 holdings but neither is Prologis. So I doubt that part about Dalio moving money into Prologis.

https://hedgefollow.com/funds/Bridgewater+Associates

I don’t think either was ever in their top 50 holdings, but Bridgewater has owned both in the recent past — and during some quarters you could have said that they sold AMZN and bought PLD, though to imply that this was some kind of big strategic shift by Dalio is, well, poppycock. The most recent moves from Bridgewater were selling most or all of their positions in both of those stocks (Amazon in Q3 last year, PLD in Q1 this year).

Should have included that in the article above, but I was afraid I was getting too long-winded as it was… thanks for pointing it out. Stockcircle is a good resource for tracking trades in and out of stocks by big investors like Bridgewater — see their page on Dalio’s Prologis trades, for example.

..was a ceo of a REIT for many years…to the readers of this excellent piece – Travis knows what he’s analyzing – spot on. Agree 100%

Thanks Hal, appreciate the generous feedback!

Thank you Travis! I read another article online that mentioned STAG. Any idea if they are also involved with Amazon?

Haven’t looked, they probably list their top tenants in their 10K… but STAG is very tiny in comparison, with less financial flexibility than PLD (the yield is higher, and they pay monthly, which some people love, though the dividend hasn’t been increased since the pandemic).

I’m just a lil fish so I’m looking to buy the PLDGP which is priced about $55 and pays a juicier divi at 7.8%. Every lil bit helps these days as I build my divi paying portfolio.

There are some tempting preferred shares out there these days, finally trading at compelling yields. PLD should be a safe credit risk, in my judgement, but keep in mind that if rates fall in the future and they can refinance cheaper than 8% or so, they can call back those preferreds for $50. There’s a reasonable probability of some capital loss there, depending on where rates go, albeit a relatively minor loss (that $5 loss would be a little over a year’s worth of dividends, so if they wait more than a year to call the preferreds you’re still in the green… if they wait for many years, it could work out great, though that would probably mean that rates stay high, which means there will probably be other relatively safe and compelling yield opportunities available, too). When the preferreds are callable, like these, often falling rates are better for the common shares of the REIT than they are for the preferreds.

I love your comment about marketing for financial newsletters – “If they put something in quotes, they’re “lying.” I never thought of it in those terms but your comment is so true. If they’re going to lie to you in their marketing material, why should you believe anything they say in their actual newsletter. It’s probably a good warning sign to avoid whatever they’re selling.

The marketing dance seems always to be a game of stretching the truth … making you believe something is true without really quite coming out and saying it, so you can’t quite get in trouble for lying.

Generally prefer Canadian REIT’s – decent and somewhat more stable returns

Thanks for a meaningful analysis of one of the lying advertisements by talking heads on the internet.

Another one I would appreciate advice for is ” a little known pharma company” who supposedly is coming our with an Alzheimer cure.

There have been a bunch of those over the years, I think the one that I’ve been asked most about is probably this from Behind the Markets: https://www.stockgumshoe.com/reviews/behind-the-markets/is-the-end-of-alzheimers-going-to-be-jeff-bezos-next-big-thing/

You are correct! He recommends Prologis and also Digital Realty.

Amazon and Intel just down the road from me, in Etna/Kirkersville Ohio

Travis,

Great article on PLD .

Last week you did a lot of AI, have you looked at James Altucher ” The AI Crown Jewel”

Not yet — trying to take a little break and not go all-AI, all the time, but I do have that and a few other AI pitches on my list to investigate.

Always superior drill down, Travis. I was hoping you’d compare PLD with IIPR.

What’s the next big stock play?