Investigating Casey’s “Cobalt Blueprint” that teases “86,900% Gains From America’s Next ‘Super Metal'”

by Travis Johnson, Stock Gumshoe | May 29, 2018 4:33 pm

What's being teased in Casey's "Biggest gain in penny stock history" ad?

Sometimes it seems like investment newsletter teasers run in trends… last week we were inundated with “smart metal” pitches, this week the questions are pouring in about Doug Casey[1]’s “Super Metal.”

I guess we shouldn’t be surprised, so many newsletter ads try to implant a short little phrase in your head that harnesses their investing idea… smart metal, super metal, liquid metal, whatever, as long as it’s short and sweet and sounds a little big mysterious and exciting, maybe someone will bite the hook.

This time, it’s all about cobalt[2]… which has been one of the hotter “niche” stories in resource investing over the past year or so, mostly because the blue metal is an important component in most lithium[3]-ion batteries, and the demand surge that’s predicted from electric vehicle adoption is driving demand for everything that goes into those batteries.

So we’ve seen the electric car pitches for lithium, to be sure, and even for graphite[4], which accounts for most of the weight of a battery[5]… but it’s arguably cobalt that’s got the best story.

How so? Well, not only is cobalt genuinely rare when it comes to finding highly concentrated deposits, and not only is the world almost bereft of “pure” cobalt mines (it’s almost all mined as a by-product in copper[6] and nickel[7] mines, which means that no one expands cobalt production if copper or nickel prices are low), but there’s also a “guns and corruption” aspect… almost 2/3 of all the cobalt currently produced comes from the highly un-democratic Democratic Republic of the Congo (DRC), and so prices and supply fluctuate pretty dramatically whenever Apple pushes to avoid cobalt mined by children[8] and slave labor or the London Metals Exchange pushes “principles for responsible sourcing”[9] … or when the DRC’s “leadership” cracks down and raises mining royalties and taxes[10], as has also been done this year.

So even as the DRC’s huge and very concentrated deposits of copper and cobalt continue to generate interest from the big mining houses, led by giant Glencore, the world has also been looking for non-DRC cobalt sources to meet the demand spike that everyone thinks is coming from the next wave of battery “gigafactories” around the world.

And, to be fair, I should note that the world is trying awfully hard to use less cobalt, too — there are other battery chemistries and improvements that are being used or tested that require less cobalt, or no cobalt… the highest profile attention to those advances came, as you might guess, from Elon Musk[11], who generated headlines[12] when he said that as part of reducing battery costs for the Model 3 and future vehicles, “we think we can get cobalt to almost nothing.”

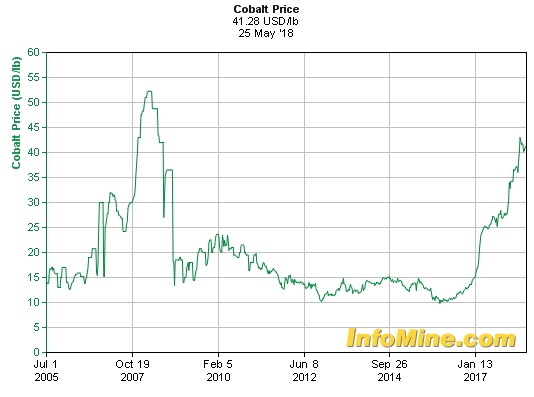

Of course, “almost nothing” and “nothing” are very different concepts, and Tesla still buys a lot of cobalt, but we should assume that any metal that rockets higher in price will send its customers looking for alternatives — even as we acknowledge that “next generation” battery technologies and advancements tend to get adopted pretty slowly. And cobalt has certainly surged, going from about $12 to $42 in just two years — though Musk’s comments and other sober sentiment did flatten out the curve a bit over the past month or two (the recent peak was around $45 in mid-March, though Cobalt had a somewhat similar run from $15 to nearly $55 back in 2006-2007).

[13]

[13]

So that’s the back story — what is it that Doug Casey[14] is pitching?

The ad is actually signed by Justin Spittler[15], who helms the International Speculator[16] newsletter for Casey, and the headline “86,900%” number when it comes to potential gains is from Casey’s history — that’s his all-time best investment and luckiest trade from one of the uranium[17] bull markets about 20 years ago, when Paladin went from a penny to $8+, the same trade that Rick Rule[18] also often refers to as his all-time best bull market bonanza.

Even if we ignore the point that this was a hugely fortunate once-in-a-lifetime trade, and you should never go in looking for 10,000% gains (a sentiment that even Casey and Rule would agree with, I’m sure), that obviously doesn’t teach us much about our current situation — Paladin in the late 1990s was about bottom fishing in a completely hated commodity, uranium, that had done nothing but go down for 20 years… cobalt was arguably bottoming out a few years ago, but is one of the hottest commodities around right now and is pretty close to historical highs.

But it serves its purpose, which is to get us to start drooling. Mmmm, mmmm, 86,900% gains… that would be so delicious… where can I get some?

So, without further ado, and assuming that you’re not eager to spend $1,995 for the “free” report that comes with your International Speculator subscription, let’s jump right to the clues….

“Right now, there’s one cobalt company that’s our hands-down favorite. Our research shows that it’s entirely possible to see this company’s share price soar 10- to 30-fold. But the key is getting in early—while most of the money is still on the table.

“In my brand-new report, The Cobalt Blueprint: How to Earn 86,900% Gains From America’s Next ‘Super Metal,’ I lay out the full details on this company, including how much I think it will be worth, when to buy, and what to look for as this cobalt story unwinds.

“But again, the time to act is now. This company is expected to make an important announcement before the end of June.”

There’s quite a bit of talk about June in the ad, which is typical — if you don’t include a fairly close deadline, people won’t panic into subscribing… copywriters know that if you don’t make a decision RIGHT NOW, then you’re probably going to think it over for a while and maybe even talk to someone before you enter your credit card numbers, and that’s terrible news for them. So they’ve got a “deadline” of June 15 for getting your “blueprint” from Casey about the idea that could be poised, they say, for a “massive windfall.”

Which gets us started, but it doesn’t quite get us a name — what other clues do they drop?

“Like Paladin, this tiny overlooked company is trading for practically nothing…

“… but what most investors don’t know is that this same company is sitting on a massive pile of a rare and special metal called CO-27…

“CO-27 is a metallic super-element so powerful that just a swimming pool of it could power an entire city for 10 years….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“And because CO-27 is still generally only known to energy and mining insiders, shares are still trading under $2…

“It won’t stay that way…in fact, we may be just weeks from a big announcement that will likely send shares sky high…”

And he goes on to talk up the fact that Casey looks in the “incredibly secretive” filings that resource companies make with the Canadian government to find the hidden stuff….

“… these companies are incredibly secretive. They don’t say a word more than legally required.

“But Doug knows the special clues to look for—the words that hint at big, big discoveries and stockpiles.”

Which, if you’ve been around junior resource companies for any length of time, sure doesn’t sound true… every mining company I’ve ever looked at is quite desperately trying to convince us of the vast riches they’ve found (or are about to find) — exploration and mine development, after all, is a horrible and expensive business, all of these companies are raising capital or about to raise capital almost all the time. If they’re keeping secrets, they aren’t about how great the deposit is.

But anyway, that gets to more clues….

“… one specific CO-27 company just filed a special document with the Canadian government at the end of last year…

“And on page 229 of that document Doug’s team found a few short magic words…

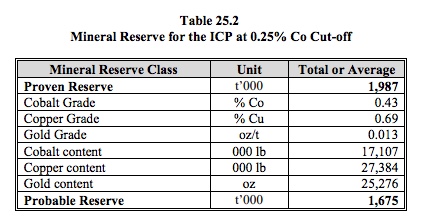

“Probable Reserve t’000 1,675”

“To you and me, this short phrase means almost nothing.”

Well, it means something if you look at the actual table and don’t take it out of context… here’s the table they’re talking about…

[19]

[19]

That’s actually just the top part of the mineral reserves table from that technical report, you can read the whole thing here[20], if you’re not feeling too sleepy, and see that the proven and probable reserves of cobalt are estimated at 34.5 million pounds in total.

And it’s a pretty reasonable-sounding project, certainly with cobalt at $40/lb — they did the cash flow summary for the life of the mine and concluded that net cash flow after tax would be about $10.43 per pound of cobalt… and that’s using a price of $26.66 per pound, so it would likely be more than double that with $40+ cobalt (capital costs and operating costs per tonne wouldn’t rise much, by-product credits would fluctuate as copper and gold[21] prices move up and down… it’s really only the taxes that would be guaranteed to rise with cobalt prices).

But I’ve skipped a step, haven’t I? What is this super-secret stock? It is, dear friends, the oft-teased eCobalt (ECS.TO, ECSIF), a stock I used to own and which is developing what is now called the Idaho Cobalt Project — soon, they hope, to be the only cobalt mine in the United States.

It’s been a troubled project, in some ways — they started building this mine many years ago, when they were still called Formation Capital[22], but then the collapse in cobalt prices meant they ran out of money and enthusiasm, and the site sat idle for years. With electric vehicle sales picking up, and cobalt prices rising, they started to push forward more aggressively with more exploration and development work over the past year or two, leading to that latest updated technical report (feasibility study) last Fall[23].

And if you go by that feasibility study, which was fairly conservative (it still has the old 34% tax rate, for example, and uses $26 cobalt for the modeling), the estimate was that the net present value of the mine, using a 7.5% discount rate, is about $136 million. The estimate is that the initial capital cost of about $187 million will be paid back in less than three years.

So that sounds like a viable project, though I decided to sell my shares about a month ago[24] because I prefer the valuation of another cobalt developer (Clean TeQ, in Australia[25]). That’s mostly because eCobalt is a fairly small project, and the stock’s gains since I bought a while back [26]already reflect a lot of the potential of the Idaho Cobalt Project — assuming, of course, that you stay fairly conservative and don’t assume that cobalt will be at $50 a pound for the next ten years.

The current NPV for the project is still well below eCobalt’s market cap of $160 million, and they will presumably still need to raise more money for development (they did already raise some money, selling about $30 million of equity in February, and presumably can use debt or off-take agreements with customers for a lot of the rest, but I haven’t seen any updates on the financing recently). The project is, of course, quite sensitive to those cobalt prices — if they realize cobalt prices of $34.50 a pound instead of $26.65, for example, then they calculate their net present value as being about $246 million… so trading above the “official” NPV is not necessarily irrational, not when cobalt is so far above their base-case price right now.

eCobalt’s mine is pretty small when compared to other global cobalt mines that are producing or in development, but it is a strategic project, being the only US cobalt mine that’s anywhere near development, and it should be able to ramp up to production fairly quickly — they already have permits and a mine plan and a lot of the equipment on site, and should have no trouble finding customers to do off-take deals to raise additional capital. The project could also get more attractive as they target improvements in the mine plan or extend those reserves (the deposit is still “open at depth and along strike,” which just means that they don’t think they’ve found the edge of it yet).

And, unlike most projects, they do have a pretty tight development timeline — all that work they did during the last cobalt bull market helped, and they are already doing a lot of the critical work on things like water[27] management even though they haven’t formally made the “production decision” and begun mine development.

It would be pretty shocking if they don’t give the project a green light and go forward at this point, so I don’t know if that “production decision” will really end up being a catalyst for the stock or not — but that production decision is expected to come right around the end of the second quarter, and that would be June, so that’s presumably the big news that they’re hinting at in the ad.

If they do start official mine development in the third quarter, as they’re planning, they think they can have their initial production by late 2019 and start “full production” in 2020. That may well end up being critical, since high cobalt prices are bringing more projects into the pipeline and it might well be that pricing is a lot better for folks who can begin production in 2020 than for folks who might require another five years for exploration and development and permitting, but, of course, that all depends on where cobalt prices go.

So there you have it, dear friends — Spittler and Doug Casey are promoting little eCobalt as a big potential winner. It’s not particularly beaten-down at this point, so there’s no way it can possibly generate 80,000% returns from here… but they do have a well-advanced and appealing smallish cobalt mine that could be producing in Idaho within just a couple years and keep going for more than a decade, and they should be making their final “start development” decision in the next month or so. You can pretty easily conjure up a model that has the share price doubling or tripling from here if cobalt prices stay strong, they get some good offtake agreements and don’t need to raise more capital, and the development process goes well over the next year or so, so it’s not a ridiculous speculation (and it has been touted by other newsletters a few times in the past year[28]), it’s just not a potential 10,000%+ gainer in my book.

With that, I’ll leave you to your cogitation and thinkifyin’ — sound like the kind of stock you’d like a piece of? Prefer other electric vehicle or cobalt plays? Let us know with a comment below.

Disclosure: As noted above, I own shares of Clean TeQ, and I also own shares of Apple among the companies mentioned in this article. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

- Casey: https://www.stockgumshoe.com/tag/casey/

- cobalt: https://www.stockgumshoe.com/tag/cobalt/

- lithium: https://www.stockgumshoe.com/tag/lithium/

- graphite: https://www.stockgumshoe.com/tag/graphite/

- battery: https://www.stockgumshoe.com/tag/battery/

- copper: https://www.stockgumshoe.com/tag/copper/

- nickel: https://www.stockgumshoe.com/tag/nickel/

- Apple pushes to avoid cobalt mined by children: http://www.newsweek.com/apple-faces-child-labor-scrutiny-it-looks-take-charge-cobalt-mines-815981

- London Metals Exchange pushes “principles for responsible sourcing”: https://www.reuters.com/article/us-lme-sourcing-exclusive/exclusive-london-metal-exchange-aims-to-ban-metal-sourced-with-child-labor-idUSKCN1FX1WY

- raises mining royalties and taxes: http://www.bbc.com/news/world-africa-43355678

- Elon Musk: https://www.stockgumshoe.com/tag/elon-musk/

- generated headlines: https://www.bloomberg.com/news/articles/2018-05-02/tesla-supercharging-its-model-3-means-less-cobalt-more-nickel

- [Image]: http://www.infomine.com/investment/metal-prices/cobalt/all/

- Doug Casey: https://www.stockgumshoe.com/tag/doug-casey/

- Justin Spittler: https://www.stockgumshoe.com/tag/justin-spittler/

- International Speculator: https://www.stockgumshoe.com/tag/international-speculator/

- uranium: https://www.stockgumshoe.com/tag/uranium/

- Rick Rule: https://www.stockgumshoe.com/tag/rick-rule/

- [Image]: http://www.ecobalt.com/assets/docs/170927_ECS-Technical-Report.pdf

- read the whole thing here: http://www.ecobalt.com/assets/docs/170927_ECS-Technical-Report.pdf

- gold: https://www.stockgumshoe.com/tag/gold/

- Formation Capital: https://www.stockgumshoe.com/tag/formation-capital/

- updated technical report (feasibility study) last Fall: http://www.ecobalt.com/projects/overview/technical-reports

- I decided to sell my shares about a month ago: https://www.stockgumshoe.com/2018/05/friday-file-two-sellbuy-simplifications-in-mining-plus-more-buffett-a-dating-trade-and-thoughts-on-a-dozen-other-holdings/

- Australia: https://www.stockgumshoe.com/tag/australia/

- since I bought a while back : https://www.stockgumshoe.com/2016/10/a-new-dumb-and-tiny-personal-speculation/

- water: https://www.stockgumshoe.com/tag/water/

- it has been touted by other newsletters a few times in the past year: https://www.stockgumshoe.com/reviews/pure-energy-trader-2/keith-kohls-blue-gold-pitch-to-turn-1-into-10-or-more/

Source URL: https://www.stockgumshoe.com/reviews/international-speculator/investigating-caseys-cobalt-blueprint-that-teases-86900-gains-from-americas-next-super-metal/

Dear Mr. Gumshoe,

Where do we stand in owning the Lithium stocks. Since the Cobalt is lot cheaper than is Lithium going to be replaced by Cobalt?

I haven’t owned any recently, but the big companies are pretty strong — major hiccup recently is the big increase in production approved by Chile, which might keep prices under control.

After I wrote my comment, I compared a few Cobalt and Lithium stocks. it appears that the Lithium stocks are doing better. But in general, the growth in Lithium stocks is not crazy as it was before.

Usually these stocks have already been moving higher even before Travis writes about them, but this one is heading lower. Is that an omen?

No ones been all that excited about the cobalt story in recent months, despite the still-elevated prices. I’d say it’s a combination of DRC uncertainty (if they get their act together, they could produce a lot more at very low cost eventually) and Elon Musk’s “we’re gonna use a lot less cobalt” sentiment, but there are a lot of moving parts.

eCobalt, Clean Teq are in the US, but also in a politically stable area is First Cobalt in Ontario, Canada. I own some, it’s up and down, but could be in production in one to two years. Anybody have any thoughts on that?

I own a few thousand shares of First Cobalt FTSSF last fall, and it blew up for a 125% POP at the turn of the year in early 2018. Now, it has been spanked down to $.53 and I am up only 5-6% as 95% of my gains were given back bc I didn’t sell and take profit. I love Ontario’s jurisdiction, but do think there will be huge value for eCobalt from Idaho because once GESARA (global economic security and reformation act) is enacted later this year, we will be on the gold/silver/platinum sound money standard and each countries currency value will be based on in situ resources, population size, and intellectual property. I will be shaving half of my position in First Mining in order to get a position in eCobalt. The auditing process has been completed by China and GESARA will change everything-namely KILL the corrupt FIAT petrodollar, as well as the Euro, bc each country will go back to having their OWN Currencies. I’ve sppoken to some international bankers about this so I am 100% CERTAIN that the Jr Au/Ag/PGM Miners will see superb appreciation as the venal futures market will not be able to naked short invisible hauls of gold and silver. ESP. Silver will see anywhere from 500-2500% spot price appreciation OVER the next year as the GSR is insane based on the actual production of 8.9 oz Ag for each ounce of gold mined-making Silver undervalued to gold by a factor of MORE THAN 7, and we all know how undervalued GOLD is. THANKS, TRAVIS!

I have owned a few hundred shares of eCobalt and made no money at all. Will do some DD on Clean Teq, thanks for the insight Travis. As a former purchasing agent in the aerospace industry, I understand the need for cobalt in nickel based alloys for the hot section of aircraft engines. And now we have EV’s with requirements there too.

Hi Travis , there is really no substitute country for DRC when it comes to cobalt

they simply own the biggest deposits and can mine them the most cost effective. Then China is the number 1 country too in the world as they process all this cobalt coming from DRC in their plants. To me Katanga mining is the best play still especially as their stockprice got hit very hard. They are the real market the other players are niche players they can,t compete with teh saudi arabia of Cobalt.

You’ve got to decide ethically where you stand on children mining cobalt if your investing in any coming out of DRC. Apparently this is still going on:

https://www.cbsnews.com/news/cobalt-children-mining-democratic-republic-congo-cbs-news-investigation/

Great write up Travis. I find your research and insight quite valuable.

I took some profits from ECS off the table. I think another somewhat compelling fact for Cobalt is that is very hard to replace in a battery. It keeps the battery cool and stable. They had a few batteries catch fire and kinda blow up a little. I remember a backup B that caught fire on an airplane. They realised that Cobalt kept it from heating up. In any case the reports that I have been reading say that it will take a few years to get rid of Cobalt completely.

That’s my guess as well… though it does mean that I place a much higher value on likely cobalt production in the next two or three years than I do on cobalt exploration for a mine that might be built in ten years or more. I’m not particularly interested in folks who are just starting to explore for cobalt, though if the price resumes its rise those might be good short-term speculations as the stories get revved up and investors freak out.

FCC is a good stock in my mind. They have bought up a ton of property with past silver mines on it with a large amount of COBALT at the town of COBALT. As the name suggests it was a place that has a large deposit of Cobalt but when Silver was no longer economical they closed all the mines leaving behind a lot of visible Cobalt. The exploration they are doing is showing some #s of untouched Cobalt. But caution is warranted.

I do not see a stock with the ticker symbol FCC, can you provide the full ticker symbol

thxs

I am invested in FCC, ECS, FT, CLQ,KAT plus other battery metals juniors. Up on one or two at present. Was up 50% earlier 2018 including a double on FCC so cashed in half in one of my SIPPs but left it running in another which is now showing a loss. I was up 180% on KAT before the big dispute between Glencore and a former investor (which I don’t begin to understand) but Katanga are not users of child labour and do have the richest current cobalt mine in the world, I believe.

AUZ, SYA, BPL,XMG,LGO are worth a look. I have been a subscriber to Doug Casey with gold and the Int Speculator a couple of times in the past eight years but hit the downturns so exited while I had some winners. I only have a relatively small investing pot so Doug’s $1995 sub would buy me shares in four of the above. If there is a money-back offer I might get it for the report but will probably stick with SeekingAlpha Trend Investing with Matt Bohlsen – also expensive but has a valuable chat forum and sound research, and a monthly sub if you just want to sample it for a while.

Do you mean “FCX” instead of “FCC”? I can’t find FCC myself. What’s the full name of FCC? Maybe its a ticker symbol for a company traded outside of US? Thanks.

$FCC.asx FIRSTCOBAL/IDR UNRESTR 0.76AUD atm

TSX.V: FCC $0.68 (-0.04) | OTCQX: FTSSF $0.53 (-0.02) | ASX: FCC $0.76 (0.05) The largest cobalt exploration company in the world. https://www.firstcobalt.com/

🙂 #Best2ALL! 🙂

Thanks gr8full

FCC.V

what does anyone think about cameo cobalt

Cameo (CRUUF in the US) quadrupled in price in the last month, but has fallen back to a mere double or so.

I cannot buy either one of these–CTEQF or ECSIF–through my broker, Merrill Lynch, because there is not enough research. They say they are too volatile.

.

So far, they’re saving you from some losses — might want to send them a thank-you note 🙂

If you want to trade riskier or OTC stocks, many “full service” brokers will try to counsel you against it — they are more risk averse, and more likely to feel like they have a fiduciary obligation (whether they do legally or not) to protect you from yourself. Discount brokers will generally provide more access to this kind of trading, though it varies by broker and by account. If you want to trade regularly in Canada-listed stocks (or those in other countries), you’re better off having direct access to those exchanges — many brokers offer an international account for that, I personally usually use Interactive Brokers to trade on overseas exchanges and in Canada.

What about Nickel Sulfate or 118