IPOs that are “Like Buying Apple in 1981?”

by Travis Johnson, Stock Gumshoe | October 17, 2018 4:14 pm

What are Jason Stutman's "3 Top IPOs of 2018 That Every Investor Needs to Know About?"

Everybody looooves IPOs, they bring with them the allure of “getting in early” and being a special first-mover who can brag about “buying the future” … so it’s not unusual to see newsletters teased because they have some secret idea for “getting in the back door” or buying BEFORE an IPO, but this new IPO Authority currently being promoted by Angel Publishing[1] is the first one that I’ve seen in a while that’s designed to get you revved up about buying after the IPO for selected stocks.

This is a fairly inexpensive newsletter ($49/year) from Jason Stutman[2], the hook is that he will give you his top IPO picks each month and update on the IPO market in general, but the immediate excitement he’s trying to generate is for three “IPO Tsunami” picks… they’re selling the subscription by promising a special report they call “IPO Tsunami: 3 Top IPOs of 2018 That Every Investor Needs to Know About.”

So let’s see if we can’t figure those out, shall we? I’m not such an enthusiast when it comes to investing in IPOs — it’s more fun to buy something that Wall Street isn’t trying desperately to sell to you — but I do occasionally find one that I like, so let’s dig through the clues and see which ones Stutman thinks we should have our eye on…

And yes, I’ll skip the few pages of promised blather that investing in these companies will be like “buying Apple in 1981,” since we all know that ie’s easy as pie to pick some old IPOs that would have been extraordinary investments (and, thanks to survivorship bias, to ignore the great many that fizzled or faltered).

Clues, please!

“IPO Pick No. 1: A Blockchain Solutions Superstar

“You know that investing in early-stage companies with leadership positions in today’s fastest-growing industries is the best way to generate huge returns.

“And that’s why, of the hundreds of IPOs that are coming out, we’re particularly excited about our first top IPO pick.

“This software and IT solutions company is less than a year old and has already lined up Microsoft, IBM, New York University, and health insurer Blue Cross Blue Shield as customers.”

And a few more details for the Thinkolator….

“This one-of-a-kind company has patented software solutions for today’s most demanding growth industries. This includes blockchain[3] development and e-tail conversion.

It is growing so fast that it already has…

* “650 highly skilled employees.

* “Unheard-of revenue growth, with over $85 million from its first year of operations.

* “Satellite offices in seven states and several foreign countries.”

This one seems very likely to be SharedLabs (SHLB), which is an IT service company that did indeed generate more than $85 million in its first year and filed for an IPO back in the Spring — I haven’t seen a firm date for the IPO yet, but you can see their latest update to the S-1 here[4]. Those details about number of employees and states are matches with some coverage of the company in the Jacksonville Business Journal[5], though the company is a little more than a year old now and has as its foundation several IT service companies that are several years older than that.

This is how they describe themselves:

SharedLABS is a global software and technology services company providing a broad range of software, digital, cloud, and security services to both commercial and government clients which enable businesses to innovate and compete in today’s competitive marketplaces. A respected partner to many of the largest technology companies in the world, SharedLABS creates, supports, implements, and manages the software, infrastructure, and e-commerce systems which drive today’s digital world.

That doesn’t tell me much of anything about how they’re differentiated or unique, and they’re not growing particularly fast, so I don’t know if the IPO will go through or be successful, but I’m no expert on that sector so yes, it’s absolutely possible.

This is a very low-profile IPO with one underwriter (ThinkEquity) and a low price and total valuation, which indicates that the market is not necessarily lusting for this stock — it has to be sold to them. It’s a very small company, so it could be quite volatile if anyone follows it, and the IPO range right now is $5-7, though that doesn’t really mean anything until they do the pricing.

At first glance, I can’t see why this little IT services company that’s not growing very fast (that might be charitable, from the S-1 it doesn’t look like they’re currently growing at all), is particularly interesting… but maybe I’m missing whatever their “special sauce” is. We’ll see — they could go public essentially any time now if they and their bankers decide to pull the trigger and the SEC approves their application, and they seem like they’ll probably need the cash if their accounts receivable don’t get paid down quickly (partly because they still have some big promissory note liabilities on the books that came from acquiring iTech and ExoiS, two of the companies they’ve rolled up), but that’s all I can tell from a quick look at the filing.

The “risks” section is always a little frightening, and sometimes illuminating… here’s just a little bit of it from last week’s S-1[6] that I’ll leave you with:

“Our ability to continue as a going concern is dependent upon our ability to generate profitable business operations in the future and/or obtaining the necessary financing to meet our obligations and repay our liabilities. To date, we have operated at a loss and remained in business through the issuance of shares of our common stock and warrants[7], stockholder capital contributions and entering into a short-term loan facility. Management’s plan to continue as a going concern is based on us obtaining additional capital resources through the sale of our securities and/or loans on an as needed basis. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described above and eventually attaining profitable operations.”

Next?

“IPO Pick No. 2: The Next Social Media Breakout….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“A lot of companies have tried to replicate its success. But this next pick has grown faster than both Facebook and Twitter.

“Our second upcoming IPO pick is a “search engine for ideas” and recently passed the 200 million mark for active users. That was at a faster rate than practically any other social media company.”

Being the “next big Social Media star” is perhaps as much a curse as a blessing, given the tailspin that Snapchat owner Snap (SNAP)[8] has been in since its IPO a year and a half ago (the stock is down 70%, thanks largely to slowing revenue growth)… but who knows when the next great company will emerge?

Any more clues on this one? Here’s what Stutman provides:

“Its recent 200-million-user milestone was reached 2.5X faster than how long it took to reach 100 million users.

“Revenue for 2017 surged by 65% year over year.

“It’s even potential competition for Google because users have used it to process over 600 million searches within the last month alone.”

This one you might have to wait on a little bit, those hints point to Pinterest, which fell behind projections on revenue growth in 2017 and decided to postpone their IPO to 2019 (they’ve been touted as a possible IPO candidate for years, so no promises).

The company has some obvious appeal — they have meaningful revenue and good revenue growth, despite the fact that they’ve grown more slowly than they expected over the psat three or four years… and the visual “bulletin board” of the Pinterest page is a natural fit for all kinds of lucrative targeted advertising to actual future buyers, the folks that advertisers love most (Pinterest is used in lots of different ways, but it was designed to collect images of many different things of interest — like furniture or clothing, for example — while pondering a decision, renovation or makeover). It’s a natural fit for lots of big e-commerce categories, including home decor, fashion, travel, food and recipes, etc.

I’d be interested in Pinterest, depending on the valuation, but we probably won’t see it for at least a little while. Here’s a useful primer on Pinterest’s IPO story from Crunchbase[9], in case you’re curious. Pinterest is actually a small holding in the SharesPost 100 Fund as well, and I think a pretty recent one — probably not surprising, in that SharesPost often gets their shares from employees who need liquidity and are sick of waiting around for an IPO.

They have not yet filed an S-1, so there aren’t a lot of specific financial metrics floating around other than the basic revenue and user growth numbers that lead us to expect an IPO at something like 10-15X sales ($13-15 billion). CNBC thinks it will be “mid-2019.”[10]

And one more…

“IPO Pick No. 3: Billions off Big Data

“What if you could own a company that was founded by a founding investor in PayPal, Facebook, and Airbnb?

“Our third IPO pick is extremely secretive. It barely lets anything leak to the public. But the little information has managed to escape the lips of employees, industry insiders, and customers has made everyday investors extremely excited.

Founded just over a decade ago, this practically unknown tech company is already a billion-dollar data giant….“This hidden company is quietly gearing up to sell shares to the public for the first time. It’s even helped to expose secret Chinese espionage networks GhostNet and Shadow Network.

“It’s also rumored to have helped to find and kill Osama bin Laden!

“The Guardian calls it Minority Report come to life.”

This one must be our old friend Palantir, Peter Thiel[11]’s big data[12] firm that’s probably most famous for being secretive and working with the government. That’s another longtime “next big IPO” rumor stock, and has been teased as a compelling private company since at least 2015[13].

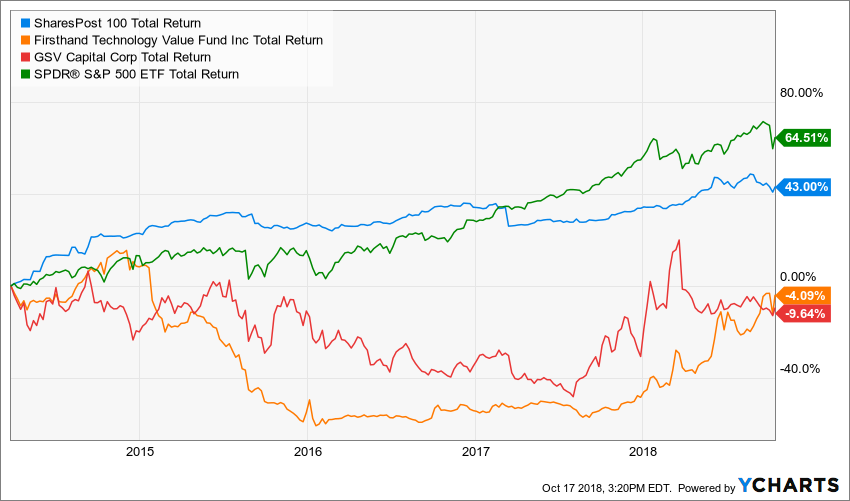

Palantir has formed the basis for several different teaser campaigns that were hinting at “pre-IPO riches” by “getting in the back door” — in most cases, by buying one of the few publicly traded companies who invest in private companies, so GSV Capital (GSVC)[14] has often been cited as a way to buy into Palantir early (Palantir is the second biggest holding in the GSVC portfolio, about 16% of the fund — the largest holding is Spotify (SPOT)[15], which went public earlier this year). GSVC has likely done pretty well with the Palantir investment, but that hasn’t helped GSVC shareholders much — here’s the chart of the three oft-cited “pre-IPO” investment vehicles (the others are Firsthand Technology Value Fund and the SharesPost 100 Fund) that are available to individual investors, and their performance over the past few years:

[16]

[16]

PRIVX Total Return Price (Forward Adjusted)[17] data by YCharts[18]

You can see that they’ve all failed to keep up with the S&P 500, despite the fact that most of these funds focus on technology stocks, and those have been well-received by the market over the past couple years. These funds own high-profile names like Uber[19] and Lyft and Coursera[20] and SoFi[21] and 23andMe, so I share that chart just to remind you that you don’t always have to be jealous of folks who “got in early” on private companies, even the best private companies (to be fair, these funds are not early-stage venture investors — they buy when a company is showing promise and has a real revenue-growth business with somewhat limited risk, not when it’s an idea in a dorm room).

I got a bit off track there, though — Palantir could indeed go public at some point over the next year or two, though I guess that will depend on valuation and the state of the markets — the rumor a couple years ago was that they would carry a $20 billion valuation, making it a truly massive IPO, but it sounds like the expectations are quite a bit lower than that now.

Palantir is reportedly profitable now and has raised a couple billion dollars over the years, with plenty of willing private market investors, so there’s been no real impetus to go public — though eventually you get so big that your employees really want liquidity and you want to be able to do big mergers and acquisitions or otherwise raise your corporate profile, which is harder if you’re private. Bloomberg[22] estimated 2019 or 2020 in a recent article, which also quoted Morgan Stanley in estimating an implied value for Palantir of $4.4 billion, 75% below where folks thought it might be a few years ago.

So… valuation is always hard for an IPO, even for big and established companies like Palantir who have been around for years, and there’s an art to going public at just the right time, when your growth and investor appeal is near a peak. I don’t know what these three stocks will look like if and when they actually hit the public markets in a couple months (or years), but they’re all impressive companies that would probably be worth considering at the right price.

Whether you need a subscription to tell you that, well, that’s your call — I generally find that newly public companies are more appealing 6-12 months after they go public, when some of the enthusiasm might have burned off and the insider selling has had a chance to resume.

Any thoughts on those three? Other favorite IPOs you’d like to see, or are planning to try to invest in? Let us know with comment below.

- Angel Publishing: https://www.stockgumshoe.com/tag/angel-publishing/

- Jason Stutman: https://www.stockgumshoe.com/tag/jason-stutman/

- blockchain: https://www.stockgumshoe.com/tag/blockchain/

- latest update to the S-1 here: https://www.nasdaq.com/markets/ipos/filing.ashx?filingid=13004004

- Jacksonville Business Journal: https://www.bizjournals.com/jacksonville/news/2017/10/02/shared-labs-a-jacksonville-giant-is-emerging-on.html

- from last week’s S-1: https://www.nasdaq.com/markets/ipos/filing.ashx?filingid=13004004

- warrants: https://www.stockgumshoe.com/tag/warrants/

- Snap (SNAP): https://www.stockgumshoe.com/tag/snap/

- useful primer on Pinterest’s IPO story from Crunchbase: https://news.crunchbase.com/news/tracking-pinterests-path-to-a-ten-figure-revenue-and-an-ipo/

- CNBC thinks it will be “mid-2019.”: https://www.cnbc.com/2018/07/20/pinterest-nearing-1-billion-in-ad-revenue-as-it-plans-to-ipo-mid-2019.html

- Peter Thiel: https://www.stockgumshoe.com/tag/peter-thiel/

- big data: https://www.stockgumshoe.com/tag/big-data/

- since at least 2015: https://www.stockgumshoe.com/reviews/true-alpha/secret-loophole-into-silicon-valleys-most-valuable-private-company/

- GSV Capital (GSVC): https://www.stockgumshoe.com/tag/gsvc/

- Spotify (SPOT): https://www.stockgumshoe.com/tag/spotify/

- [Image]: http://ycharts.com/mutual_funds/M:PRIVX/chart/#/?recessions=&format=indexed"es=true¬e=&securityGroup=&displayTicker=false&maxPoints=850&title=&source=&calcs=id:total_return_forward_adjusted_price,include:true,,id:price,include:false&scaleType=&zoom=&partner=&useHttps=false&securitylistSecurityId=&startDate=&units=&legendOnChart=&securities=id:M:PRIVX,include:true,,id:SVVC,include:true,,id:GSVC,include:true,,id:SPY,include:true&endDate=&useEstimates=false&securitylistName="eLegend=&splitType=single&correlations=

- PRIVX Total Return Price (Forward Adjusted): http://ycharts.com/mutual_funds/M:PRIVX/total_return_forward_adjusted_price

- YCharts: http://ycharts.com

- Uber: https://www.stockgumshoe.com/tag/uber/

- Coursera: https://www.stockgumshoe.com/tag/coursera/

- SoFi: https://www.stockgumshoe.com/tag/sofi/

- Bloomberg: https://www.bloomberg.com/news/articles/2018-09-04/morgan-stanley-s-long-romance-of-palantir-pays-off-as-ipo-nears

Source URL: https://www.stockgumshoe.com/reviews/ipo-authority/ipos-that-are-like-buying-apple-in-1981/

Travis,

At the end of today’s article, you write: “Whether you need a subscription to tell you that, well, that’s your call — I generally find that newly public companies are more appealing 6-12 months after they go public, when some of the enthusiasm might have burned off and the insider selling has had a chance to resume.” Why do you find a company more appealing after the insider selling has had a chance to resume? Doesn’t the price usually drop once the insiders start selling again? Wouldn’t you want to wait until after they have been selling again for awhile?

JayBee is exactly right. We’ve been focused on the IPO market for about a decade now. There are rare times when you want to buy an IPO at the open (typically in a weak market where the deal barely gets done.) Generally waiting until the six-month lockup comes off is a much better idea. You have time to see how the company executes in public and those lockups can really push down the price in the short-term.

Thank god our service has never resorted to this kind of newsletter hype to get people to sign up. It’s repugnant.

Thanks, Travis as always for the shining the light!

Your picture made me smile. Willy Wonka and the Chocolate Factory is one of my favorite movies, and Gene Wilder was the perfect person to play Willy Wonka.

What is your service?

Often there’s a stock price reaction both to the resumption of insider selling after the lockup expiration, particularly if big insiders file for big sales after six months… and it’s also good to see some initial response to being a public company, since companies often go public with the rosiest possible earnings reported in their S-1 or first quarter.

There’s often a dip in the share price around then, and buying that dip is sometimes appealing if the company has a good trajectory operationally. It’s not mechanically predictable, but it’s worth looking for. Buying a dip is a more rational thing to try to do than predicting where the bottom of the dip will be.

W hat do you know about hi hat or foxtron

Big electronics Chinese…company….now in Wisconsin….google Foxconn….I own shares in it….long term…

Hin haf

It is traded on the Taiwan exchange it has over 50000 patents. It has contracts with apple,etc. it is moving it’s operations to Wisconsin,penn, Illinois.

We covered Oxford Club’s tease of Foxconn here: https://www.stockgumshoe.com/reviews/oxford-club/alex-greens-single-stock-retirement-plan/

Man, all this red on legalization day. Think I should hold on to Aurora, or just walk away with 60%?

Hold i say – they have some things coming down the pipe – like a NYSE listing.

I would hold on….it’s just started. I own Aurora.

Some guidance on investing in companies after they have newly become publicly traded may be found at the following link.

https://www.investopedia.com/university/ipo/ipo2.asp

I was interested in Anaplan that became publicly traded earlier this week on the NYSE under the ticker PLAN. Opened 43% above its IPO price of $17 and is now at 25. Sounds like I should wait 6 to 12 months to invest when hopefully the volatility will have settled down.

Are any of you Gumshoe people interested in or following this stock? I would be interested in your comments.

I like this one. Have a small position at $22.

Here is our post: https://ipocandy.com/2018/10/weaponized-analytics/

I worked for this company for some time. My own experiences were we tried using our own Anaplan software internally but there were so many problems with the software that we reverted to using spreadsheets.

I’m bullish on Acreage Holdings, which is RTOing soon. I noticed they even have product in the official government website right now on opening day in Canada.

Palantir is not the market leader they once were. They are overpriced, proprietary and need a lot of technical assistance to implement. The government sector is not as enamored with them as they used to be. There are competitors that have taken away market share and will continue to do so.

Thanks for the perspective… interestingly, I had seen a lot of pessimistic coverage recently about Palantir and its drop in value, but then, coincidentally, this morning came a new wave of reports that they’ve been talking to bankers about a late-2019 IPO that might value them at as much as $41 billion, far higher than other recent estimates. It will be interesting to see how it shakes out.

Maybe my favorite quote from that article: “Investment bankers often provide a rosy outlook for a company’s future finances to earn business in an IPO.”

Also, the sky is blue. And gravity pulls things down.

I am always kind of “suspicious ” when already wealthy people are letting their IT companies go IPO. Is it they want to squeeze out the last ill-gotten dollar from the populous before they are over taken by new innovations?that they know are coming ? and this “IPO” isn’t really so “I” after all? buying on the way down and staying there?

Most companies are not just owned by the founder, they’re owned by other early investors and employees… all of whom want “liquidity” — which means they want to be able to sell all those shares they have, and to sell easily and at good prices the stock has to be publicly traded.

IPOs also give companies a “currency” that they can use for acquisitions — so companies that plan to grow by acquiring other companies find a public listing very helpful, since they can use their stock to buy firms. That’s a lot harder to do for a private company, they usually have to borrow money or use cash to make acquisitions, and that’s not nearly as fun or sexy.

Any guess on IPO date for Acerage Holding

Any idea how to get into the PRE IPO for Airbnb?