Travis is out of town, so we’re re-posting a few older pieces so you don’t get bored — this article was originally published in the Friday File for the Irregulars on April 22, so free readers will have missed it… now you can check it out, though it has not been updated.

4/22/22: Not a lot of news to share about my Real Money Portfolio this week, so I thought I’d dig into a teaser solution for your Friday File… this one started running fairly recently as oil returned to “top of mind” status following Russia’s invasion of Ukraine.

The pitch is for Luke Burgess’ Junior Mining Trader ($1,999/yr, 90-day refund period), put out by the Outsider Club, and the order form sums up the pitch pretty well:

“We’re about to make a fortune off this oil discovery of the century… Argentina’s ‘Project Petrogonia.’

“Resource studies now prove it’s the second-largest shale basin in the world… second only to the Bakken in the U.S.

“And oil and gas industry insiders are calling it the world’s fastest-growing oil play — one that could dwarf the wealth created by the Bakken and Permian oil shale revolutions.”

We’ve seen several pitches over the years about little energy companies that were planning to mimic the success of the U.S. shale oil (or gas) industries, bringing horizontal drilling and hydraulic fracturing to new areas of the world. Most of them haven’t worked out, either because of local objection to “fracking” or to the vicissitudes of the oil markets — but I guess we’re primed to see more of these again, what with oil and energy security on the minds of so many people right now.

So what’s this particular company? Let’s dig some more clues out of the full “presentation” from Burgess…

He starts out with a bunch of satellite images, emphasizing the large scale of the drilling going in in this “Petrogonia” area…

“Nestled between the Andes Mountains and the Neuquen River in Argentina sits a shale gas and oil basin so large and prolific, NASA scientists have called it a ‘geologic wonder.’

“In fact, there are so many sites being cleared, NASA satellites can see it from space… and have been taking pictures of the formation and the drilling activity.”

And this is another, “the secret is in the hands of one tiny company” tease… from Burgess:

“There is a mostly unknown $5 energy company that’s been in ‘Petrogonia’ for years, perfecting its drilling technology.

“And now it has.

“In fact, the company is pumping out so much oil and gas now, its revenues have jumped from $669 million in 2020…

“To over $1 billion in 2021.

“That’s a 63% jump on oil and gas revenue in just one year!

“And it’s now exporting its oil and gas all over the world.

“That’s why I’m predicting the stock will be trading for $25 in the coming months.”

So… who is it? That sounds awfully similar to past teases we’ve covered about the Vaca Muerta area of Argentina, which would suggest that Argentine oil company YPF (YPF) is the match, since most of the juniors who were active in that area a decade ago didn’t survive the push for government oil reform and the oil crash of 2014 (some are penny-stock shells of their former glory, like Crown Point Energy or Centaurus, others are completely gone like Americas Petrogas), and YPF is a roughly $5-per-share company in US trading, though it’s revenues are far above a billion dollars. Other relatively large US-listed Argentine energy companies also fail to match the clues perfectly, including Pampa Energia (PAM), and there are some other Vaca Muerta-focused companies, including Vista Oil & Gas (VIST), which has had good growth recently in Mexico and has stuck it out in Argentina while a lot of global companies have left, but that also don’t match that particular clue.

So… let’s see what other clues we might get.

Burgess mentions another research report here…

“a recent report published by independent energy research firm Rystad Energy said the Petrogonia’ field is ‘breaking records left and right.'”

So we can consult the summary of that report for a little perspective, which is helpful — it’s not about any one of the particular operators in that area, but it confirms we’re talking about the Vaca Muerta field. And that, although I can’t say I was paying attention to this in recent years, production has boomed in that area, and there’s now enough activity and infrastructure in the area that costs are coming down to be comparable to some US shale fields.

Pan American Energy is a big player in the Vaca Muerta as well, though they’re essentially private (they do have some listed bonds and other instruments in Argentina, but not equity, and they’re not really accessible to small foreign investors, folks like you and I who subscribe to investment newsletters).

We also get some tantalizing comparisons to the US shale winners of booms gone by…

“I think shares will easily gain several hundred percent, just like many of the small producers did during the American shale revolution.

“Just like Abraxas Petroleum jumped more than 800%…

“And just like Continental Resources increased over 1,000%…

“And just like Northern Oil and Gas soared more than 1,300%….

“If this small company performs anything like those, its tiny $5 stock could easily balloon into $25 a share.

“But with $100 as the new price floor for oil, I think shares could even go over $50 a share… $60 per share… $70 per share or even higher.”

So we have to do a little more snooping to be sure… what other little tidbits get dropped in as hints for us?

“… currently the biggest producer working on Argentina’s Project Petrogonia….

“… this $5 company has been meticulously developing and testing this shale basin for over 10 years….

“It owns over 1.8 million acres in Project Petrogonia….

“In the past 12 months, it’s seen revenue grow 56% and it’s increased shale production from Project Petrogonia by more than 80% in the past three years.”

So that does actually confirm it — yes, Burgess is hinting at YPF (YPF), which is the largest energy company in Argentina… YPF does indeed control over 1.8 million net acres, which means, by that measure at least, that it’s the biggest shale producer outside the US. Where he got the $669 million in revenue growing to $1 billion I don’t know, but it doesn’t match any of the smaller players, either, and nobody else controls nearly as much Vaca Muerta acreage as YPF.

And yes, Argentina has long had some of the biggest shale oil and gas potential in the world, it was touted and poked at by hedge fund guys and Canadian junior energy companies for years before oil prices collapsed in 2014 (even Kent Moors, who was the most vocal energy newsletter dude for a while, though he seems to have retired from that now, pitched the huge opportunity in YPF and Argentina back in 2013), and there has been little patience outside of Argentina for the very slow pace of reform of the energy business in that country… but YPF stuck it out, no surprise since it’s a state-controlled company, and they invested heavily in refining and drilling capacity, and as of December they finally got their daily oil production back up to where it was in 2012, around 550,000 barrels a day (during the reform talks in 2013 and 2014, the hope was to spur investment to drive production to 1.8 million barrels a day by 2035, perhaps they’ll get there and the current global panics over resource self-sufficiency might help speed it up, but building a big oil industry in Argentina is apparently a very slow slog).

YPF is a state-controlled oil company, and some investors don’t like to get into such investments. The government of Argentina owns 51%, and about 40% of the shares trade in New York (the rest trades in Buenos Aires). That’s not unique in the energy space, governments often have a strong strategic interest in controlling their energy reserves (Equinor (EQNR, formerly called Statoil), for example, is 2/3 owned by the Norwegian government, and coincidentally has also invested a little bit in Argentina, PetroBras (PBR) is always a political football in Brazil because the government has 50.1% voting rights), and energy companies are always pretty closely regulated even if they are private, but it does mean that state-owned oil companies might be less shareholder-driven than truly independent ones. That’s probably less of an issue for investors than the price controls, capital controls, and relatively slow pace of infrastructure investment in Argentina, which effect all the players in the space (there’s a good S&P Global article about that here), but some people avoid state-controlled companies entirely.

The revenue has not actually grown 56% over the past 12 months, right now it’s around 40%… though in a quarter ago, in 3Q2021, the total revenue growth was 56% quarter-over-quarter, so that’s a match if they were using data that’s a little bit old, as newsletter pitches often do. That higher growth was primarily because we’re comparing to the sharp downturn in 2020 (revenue in 2021 was actually a little below 2019 levels, which in turn were lower than in 2017 or 2018).

They are primarily a domestic producer of oil and gas (they own about half of the refining capacity in the country, and sell more than half the gasoline, largely from their own gas stations), and have faced varying regimes of price controls for their gasoline and natural gas over the years, though a small portion (~5%) of their production is exported, mostly in the form of refined oil products (jet fuel, etc.), and they’re also affiliated with a bunch of other related businesses, including stakes in refineries, distribution and fertilizer producers. They are the largest energy company in Argentina, and the largest producer in the Vaca Muerta (which is now by far the most productive hydrocarbon production area in Argentina, though it’s also gas-heavy, with production about half gas, half liquids).

And though revenue growth has not been consistent, and indeed overall production has declined steadily over the past five years, it is true that their fairly dramatic ramp-up in shale and “unconventional” productionover the past few years, especially with a big surge of drilling in 2021, is finally, years after it was expected, helping to right the ship and stop that decline. And 2021 was the first year in a long time that they actually grew their reserves, “discovering” more than they produced, so that’s a positive sign — half of their reserves are now in shale/unconventional fields.

Financially, at first pass they look pretty decent for an oil company — growing production, early on in production from a large new oil basin that should grow more efficient, improving free cash flow (though they’re guiding for a break-even year on cash flow, despite an 8% increase in production — probably, in part, because they don’t really control the consumer price), debt that is fairly large but seems manageable. It’s not a crazy idea, if you can tolerate the geopolitical risk that Argentina has historically represented for outside investors, and the fact that they don’t really get full exposure to global oil prices because they’re primarily selling into the price-regulated local market — their 2021 investor presentation is here, if you’d like more of an overview.

When it comes to valuation, it’s tough to understand what analysts are expecting — there is some analyst coverage, and they anticipate $3.7 billion in EBITDA this year, leading to $2.11 in earnings per share… so that’s fairly close to the “adjusted EBITDA” of $3.8 billion that YPF reported last year on $13.2 million in revenue, with no real profit. The plan is to produce 8% more oil and gas (with the growth coming from shale, as last year), and to spend about a billion dollars more ($3.7 billion) on capex, so they don’t think they’ll have free cash flow in 2022… but presumably they’ll get at least some price bump from higher oil and gas prices, either from the smallish portion of their production that they’re allowed to export or charge “international prices” for, or from higher prices at the pump in Argentina, and they have reduced their debt a little, so I suppose it makes sense to expect both revenue and EBITDA to grow.

Where the analysts come up with their earnings per share forecasts, I don’t know, YPF doesn’t offer guidance on that bottom line number, but the estimates are very high — $2.11 in adjusted EPS in 2022, on roughly $14.9 billion in revenue… so that would be 12% revenue growth, and a return to the earnings per share range they were in from 2011-2015 or so, which would be a pretty strong bounceback from the money-losing year of 2020.

Investors are not convinced, to put it mildly. That means YPF is trading at a forward PE of about 2.5 — it has usually been relatively inexpensive, probably mostly because investors haven’t consistently trusted the Argentine currency or government over the past 20 years (though there have been moments of enthusiasm), but a PE of 2.5 is very low even for them, that multiple has generally been in the range of 6-12 over the past couple decades.

So yes, YPF is a really cheap oil company, in part because it faces regulatory and currency risks that investors haven’t really been excited about taking, it has some massive shale oil and gas reserves in Argentina that are finally beginning to be produced in meaningful scale, and, well, if that sounds at all appealing to you, it may well be a decent contrarian play (and that’s not necessarily a bad thing, particularly in commodity markets — Rick Rule has thrived for decades as a commodity investor and broker, and he famously likes to say that when it comes to mining and energy stocks, “you’re either a contrarian, or you’re dead.”)

Which means, yes, that there are also plenty of reasons why the stock might stay cheap. Vaca Muerta has huge potential, and has grown some as production has begun to kick in over the past decade, but in addition to the Argentinian companies like YPF (which don’t have as much choice), and foreign companies like Shell, Equinor or Vista who are still investing in the potential, there are also big and well-run companies, like Schlumberger (SLB), that have given up their leases or businesses in Argentina, along with lots of global companies outside of the energy business who’ve decided, particularly with some of the changes following the las election, that Argentina’s opportunities are not worth the risk.

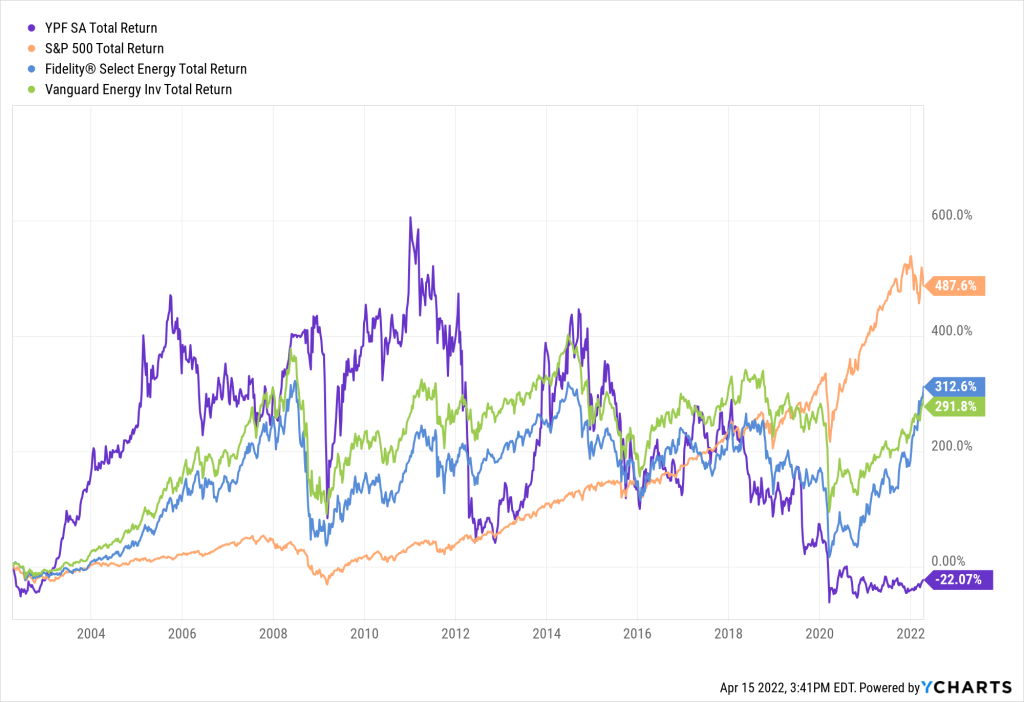

If YPF is to have another renaissance as an investment, it will probably have to prove it with numbers before investors are convinced to pile in again… we can be slow to get excited about a country or a stock once we’ve been burned a few times, so that’s probably the reason to think of YPF as a potential contrarian opportunity here, and at the same time the reason to realize that it’s quite risky, despite the very low valuation — investors who’ve lived through this history haven’t been clamoring for another taste:

What’s in that chart? It covers 20 years (through last week), and that’s the total return for YPF shares in purple, compared to the S&P 500 (orange) and, since ETFs for the sector don’t go back that far, a couple broad energy mutual funds (Vanguard Energy in Green, Fidelity Select Energy in blue). So you can see that there have been periods of high returns, particularly back when Chinese commodity demand was first exploding in the early 2000s (the all-time high in crude prices is still $147/barrel for West Texas Intermediate, hit in 2008)… but with political and regulatory changes and currency crises over the years (sovereign debt default in 2001, crisis-driven austerity in 2012, currency crisis in 2018, inflation remaining wildly high today at close to 50%, etc.), they have also been very volatile.

For some context, as we fret about inflation of 8% in the US, Argentina is hoping to get inflation under control and slow it down to 35% or so by the end of next year (it’s been above 50% for almost a year now), which much make it a really hard environment in which to run a business. Particularly with the government using price controls to limit what you can charge for oil, I think the current price in Argentina is about half what most of the rest of the world is paying.

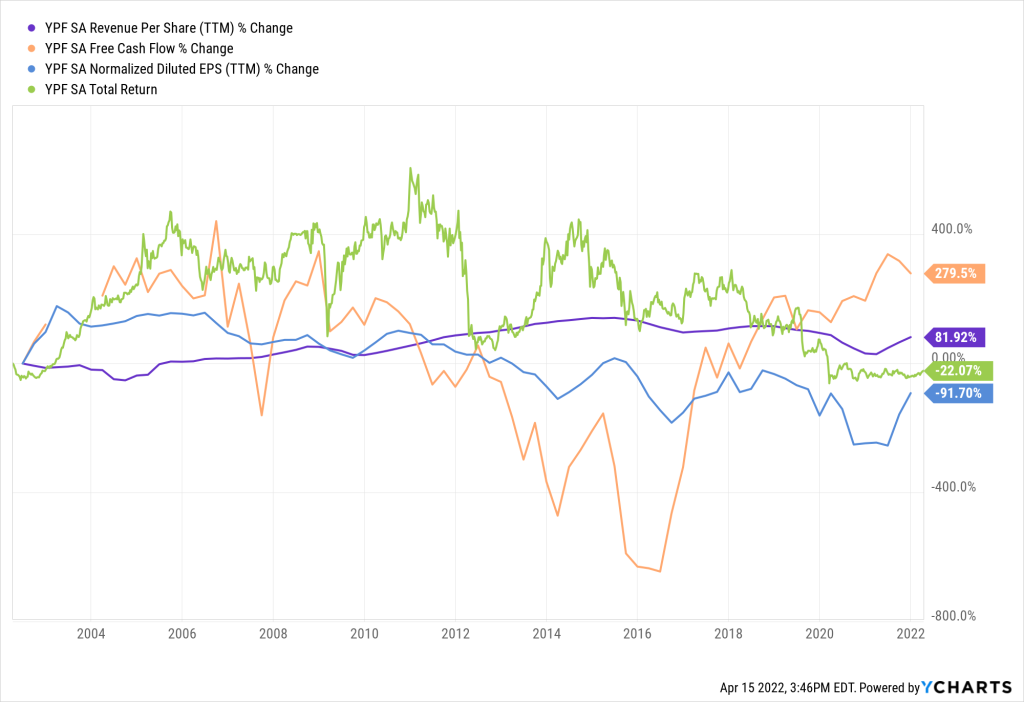

And if we look at the actual fundamentals for YPF, you can also visualize some of the reasons why enthusiasm never really stuck. For this second chart that’s YPF’s total return for investors in green, earnings per share (in blue) that never consistently grew, and the total revenue per share (purple), which grew only 82% in 20 years, at least in US$ terms. The sign of hope right now is that return to strong free cash flow in 2021 (in orange), but that might be as much a function of lower costs in the latter part of the pandemic as it is a sign of real operational leverage and profits, and they’ve already said they don’t expect to have positive free cash flow this year.

I can see reasons to be tempted, as a contrarian play with oil prices high and production growth returning for YPF, and maybe the economy finally improving in Argentina one day, but I see no reason to hurry that decision. It’s hard to imagine an oil and gas company with growing production trading at such a low valuation forever, and I hope Argentina is really getting its act together, both with growing energy self-sufficiency and a more stable currency and easing capital or export controls, but I’m not so sure I’d bet on that just yet. I’ll pass on investing in the stock right now, personally.

Sound like the kind of speculation you’d like to make? Have other favorite oil and gas stocks that make you more excited? Let us know with a comment below. Thanks for reading, and have a great weekend!

This is a discussion topic or guest posting submitted by a Stock Gumshoe reader. The content has not been edited or reviewed by Stock Gumshoe, and any opinions expressed are those of the author alone.

YPF 4-4-22 = $5.31. YPF 7-11-22 = $3.05 Another save by Gumshoe. Thank you !

Travis what do you think about Lou Basenese’s “area 52” claims?

tony cicoria